Harry S. Dent Jr.'s Blog, page 45

August 28, 2018

The Pot Game Is Just Getting Started

I recently traveled to Toronto, Canada. My wife and I took a bicycle tour and traveled to the waterfront, the old Distillery District, over to the CN Tower, up to Chinatown, and then through Kensington.

You notice things as you ride around. The people are nice, almost to a fault. The streets aren’t as clean as I expected. The population is very diverse, and they speak many languages.

And there’s a lot of pot.

The Canadians voted to make recreational pot legal this year. It was supposed to happen in July, but was pushed back to October 17 because the provinces weren’t ready.

But that hasn’t stopped the people in Toronto from lighting up.

As a child of the ‘70s, I recognize the smell of pot. On the first day, when we’d pass people on the street that smelled like a head shop I’d quickly turn to see who’d been toking up.

By the third day, I didn’t care. It was so common that it didn’t matter.

Keep in mind, this is before pot is legal.

After the bike tour my wife and I returned to Kensington, which is an eclectic shopping district.

At one point I noticed a small tent between two townhouses.

A group was trailing under the tent toward the back yard. I followed (of course), and we found ourselves in a marijuana bazaar, with everything from the smokable buds to the edibles, oils, and topical creams.

A lot of Canadians are ready for legalization. They expect the industry to be worth several billion dollars.

That’s nice. But it’s small potatoes. The real prize is here in the U.S., and we’re only starting to scratch the surface.

Marijuana is legal for adult use in nine states, and for medical use in 30 states. But those numbers are terribly misleading.

Yes, marijuana is legal for adult use in California, but the laws governing licensing, inspection, and compliance are onerous, as are the taxes. And then there’s the little matter of how you run your business.

Because marijuana is still a Schedule 1 drug per the federal government, no business with a national charter or regulator, like banks, will touch the industry.

The pot industry runs on cash, using greenbacks to pay for everything from inventory to employees to taxes. This has created a cottage industry for security guards!

And when you file your business taxes, you can’t write off the cost of inventory as an expense. The IRS won’t allow you to deduct the price of illicit drugs.

It’s no wonder that, even though pot is legal in some states, it hasn’t destroyed the black market.

As for medical marijuana, it exists in name only in many places. I wrote about this last year in Boom & Bust.

In Texas, you can get a prescription for medical marijuana, but only if you have epilepsy. And you’ve tried at least two other drug regimens without success. And your doctor, who must spend at least 70% of his time on such diseases, prescribes the drug. And then you get a second opinion.

Right. That’s not access. That’s denial.

But we know something. The market is coming, because 9% of Americans over 18 years old say they have used marijuana in the last month, and 14% say they have used it in the last year.

The number of adults using marijuana regularly has grown dramatically since 2009, from 15 million to more than 22 million. And there are currently more than 2 million Americans registered to receive medical marijuana.

Both of these markets will grow (pun intended) dramatically over the next decade.

Attorney General Jeff Sessions threw cold water on the industry earlier this year when he rescinded the Cole Memo. That memorandum instructed the Justice Department to follow state law with regard to prosecuting marijuana crimes, which meant ignoring it in states where it is legal.

Sessions instructed his prosecutors to follow the law. So far, there hasn’t been an uptick in pot prosecutions in states where it is legal.

The market will grow, whether Jeff Sessions likes it or not.

And it won’t be because a bunch of Millennials – or Boomers for that matter – want to get high.

Instead, it will be aging Boomers, those with creaky knees, rheumatoid arthritis, and painful hips and shoulders who demand the change.

This group will want access to a pain reliever that won’t kill their kidneys like ibuprofen, and won’t destroy their lives like opioids. And is cheap.

Medical marijuana, and even over the counter pot, will fit the bill.

This industry is coming. It will be massive. And it’s just getting started.

I’ll talk more at our Irrational Economic Summit in Austin next month about the pot industry, how it’s developing, and the opportunities we have as investors to get in on the ground floor.

I hope to see you there! We’re holding a special Labor Day weekend sale on tickets, so keep an eye out for the details.

Rodney

The post The Pot Game Is Just Getting Started appeared first on Economy and Markets.

Capitalism Isn’t the Problem… and Neither Is Democracy

Many would assume that the Agricultural Revolution back near 10,000 BC was the greatest innovation and breakthrough in human history.

Or the invention of the wheel back around 3500 BC.

Or the creation of writing 300 years after.

Those were all milestones in human history.

But from an economics standpoint, it was the start of both free market capitalism and democracy in the late 1700s that was truly the greatest innovation and breakthrough.

The steam engine was perfected in 1776.

That same year the Declaration of Independence was signed, and Adam Smith published his breakthrough book on capitalism, The Wealth of Nations.

In my most recent book, Zero Hour, Andy Pancholi and I show how a 250-year Political Revolution, a 84-year Populist Revolution, and a 28-year Financial Crisis Cycle all came together back then – just like what’s happening NOW!

And I’ll be speaking more on this at our 2018 Irrational Economic Summit.

In the book, I predict we’ll continue to see the greatest political polarization since the Civil War, and it will only intensify.

The Democrats are leaning far left. They claim that capitalism has failed, and that we need to push towards socialism with guaranteed income and health care for all if conditions are to improve.

It’s ridiculous!

That’s a guarantee of national bankruptcy when we’re already up to our necks in debt at public and private levels. It’s far more now than any other time in history.

Capitalism has not failed.

It has merely been corrupted by Wall Street.

The goons have rigged the system for the financial elite to prosper, and made it to work against businesses and everyday interests. Glass-Steagall was repealed in 1994 just in time to allow the greatest debt and financial bubbles since the Roaring ’20s. It was passed precisely to prevent such collusion in financial institutions.

Central banks have now totally taken over free markets by setting short- and long-term interest rates to zero (adjusted for inflation).

That takes away free market pricing and accountability. It only rewards speculation and stock buybacks, creating unprecedented and unsustainable bubbles in everything. It certainly doesn’t support productive investments and wage gains for everyday people. Dr. Lacy Hunt, who is speaking at our Irrational Economic Summit, shows how low money velocity measures and reflects that.

Tax cuts when corporate profits are at the highest – compared to GDP – in history only serve to add to this whole debt and financial bubble environment, while wages continue to stagnate.

This endless and extreme economic tinkering is NOT free market capitalism!

Bubbles are natural. They will always occur at some point in the economic cycle.

Left alone, capitalism would never have allowed such a bubble economy to get anywhere near this extreme and out of balance.

For the first time in history, we’ve had three major stock bubbles and two real estate bubbles in a row… that means an even more dramatic end to our “economy and markets on crack.”

The Republicans have not only allowed for such fiscal irresponsibility at all levels, but they have led the charge against democracy.

Wealthy corporations and billionaires – special interest groups made richer than ever by the bubble – have taken over.

Are you aware that the two Koch brothers single-handedly vetoed Mitt Romney to run for president in the 2016 primary? Two douchebag billionaires did this.

It’s not about whether that was a good thing or a bad thing…

That’s NOT democracy…

The Supreme Court voted to allow corporations to be treated like individuals and have unlimited ability to contribute to political campaigns…

That’s NOT democracy.

The Republicans now seem hell bent on stepping back every advance in social progress made over the past several decades, from civil rights to pollution. They are seemingly aiming against public interest or common good. They’re simply supporting anything that makes prioritizes profits.

That is NOT democracy!

Democracy and the chance to vote despite financial standing was designed to be a natural counterbalance to capitalism, which rewards the people who contribute and innovate the most.

It was designed to be more inclusive and to align the troops with the generals.

The secret is that democracy and capitalism are actually opposite principles that balance each other like men and women, boom and bust, inflation and deflation.

Clueless economists and politicians want an economy that grows at 3%-plus with no recessions or cycles of inflation and deflation.

They all went nuts when the S&P 500 reached all-time highs last week, which is a side effect of QE and continual artificial stimulus. .

The problem is that it’s those very dynamics and play of opposites that actually drive innovation and a standard of living that has grown nine times since 1900!

Find a time in history when that has happened…

Lobbying by special interests should be outlawed or severely limited.

Political contributions should be capped at something like a $1,000 per household per candidate.

Corporations, at best, get the same $1,000 cap, if anything at all.

Central banks should not be able to artificially stimulate the economy with money printing or interest rate manipulation.

And if they do, it should only be allowed for brief periods during times of defined emergencies, like recessions with unemployment over 10%, or stock crashes over 50%, etc.

The Fed should simply grow the money supply in line with GDP growth and only provide injections of liquidity when needed to keep the banking system from getting overwhelmed and melting down unnecessarily…

NOT to prevent recessions and natural rebalancing that keeps the economy healthy and innovation moving forward. That is free market capitalism with consequences for failure.

We are on the verge of the greatest political, social, and economic revolution since the advent of democracy itself.

Our newfound information technologies make capitalism more innovative than ever through bottom-up network systems, rather than top down.

It’s more competitive than ever.

They make democracy more robust since everyday individuals can be much more informed and participate in many more ways.

It’s more inclusive than ever.

This revolution is about the revitalization of the two most important principles in history, not about the failure or destruction of them.

Our greed, our shortsightedness, and our political system is what has failed here.

I’m afraid that the system is going to have to break down further than any previous time in history for us to understand and restore these simple principles.

One of the things my father told me stuck with me: “People are not realistic. Hence, they are irresponsible.”

It’s not that people mean to be irresponsible, or in this case, want to kill democracy or capitalism.

The desire for an easy, risk-free life and economy kills these proven and successful principles without us even knowing or seeing it.

It’s time we listen to people that do understand capitalism and democracy. It’s time to start seeing the obvious here.

David Stockman is one of those people you should be listening to.

He’s the author of the bestselling book, The Deformation of Capitalism, and he’ll be speaking at our Irrational Economic Summit in Austin, Texas this October.

Seats are running out, and the Hilton Hotel is nearly booked full.

Be sure to reserve you seats now before there are none left.

If you’ve any faith in the system – the original untampered system – then you won’t want to miss out on the chance to hear some of the greatest minds come together and talk about the current state of our economy and markets.

Harry

Follow me on Twitter @harrydentjr

The post Capitalism Isn’t the Problem… and Neither Is Democracy appeared first on Economy and Markets.

August 24, 2018

A New Way to Lighten Our Health Care Load

The Bureau of Labor Statistics (BLS) recently reported that headline inflation rose 0.2% in July and is 2.9% higher than last year.

Core inflation, excluding food and energy, also rose 0.2% last month, and is 2.4% higher than last year.

That’s the highest growth for core inflation since September 2008.

The Federal Reserve might count this as progress, but to the average American family it spells pain.

Rising costs are eating up the meager wage gains over the past few years, and higher prices for medical services are part of the problem.

Health insurance costs are moving up, with premiums jumping 30% in Maryland and 24% in New York.

Some areas, like Vermont at a mere 7.5%, expect smaller increases, but with earnings creeping up at less than 3% per year, even “small” increases can be a burden on the family budget.

As a rank-and-file member of the self-employed, this topic is near and dear to my heart. I’ve done countless hours of research to find the best approach to health care.

As you might imagine, it’s not a one-size-fits-all.

My family gets coverage through a medical cost sharing program, Christian Heath Ministries.

For a mere $150 per month apiece, plus approximately $30 per quarter, we’ve got excellent, unlimited coverage.

It comes with caveats. No drunk driving, no drug abuse. We pledge to live responsibly and in return get great prices. I can live with that. No pun intended.

But there’s still the matter of the cost of care.

As a recent member of the 50-year-old-plus club, it was time for me to have the dreaded “procedure” to check my system.

I put it off for a couple of years, but then decided to be done with it.

When I began searching for a provider, I found the same old problem.

How did I know my list of potential providers was complete?

How could I avoid those pesky, after-the-procedure costs that simply show up in the mailbox unannounced?

I was determined to find an answer, but it was a repeat of similar adventures for MRIs, etc.

Then I found New Choice Health. I’d never heard of them.

The group develops a repository of cost information for many procedures by zip code. If you need something done, you plug it in and they give you the range of costs in your area and an estimated “savings” if you go to their preferred provider.

You get the actual procedure quote when you fill in their form.

But you aren’t committed to anything. It’s like Priceline (OK, Bookings.com, Nasdaq: BKNG) for medical procedures, only better.

The price they give you is all in. There are no extra fees, no attending doctors you didn’t know about, no facility fees, no labs, nothing. One price.

A friend of mine recently had a colonoscopy, so I had a frame of reference. The friend shopped around and had the procedure for $1,780. Mine cost $1,450.

It’s a great deal. But there’s a catch.

The company can offer this service by giving the providers peace of mind. This happens through pre-pay.

To go down this road, I had to pay up front and then request a reimbursement from my health cost sharing provider. I thought this was brilliant!

By requiring prepayment, the doctors can completely eliminate collections. They don’t need to assign any staff to my account for payables, insurance filing, or anything.

I show up, have my procedure, and we’re done.

This approach can’t work for everyone with every type of medical need, but it certainly works for things like MRIs, CT scans, knee repairs and shoulder injuries.

And it works because we cut out all the middlemen.

We know the procedure we need, we identify the costs in our area, find the provider willing to exchange a lower cost for guaranteed payment, and then we’re on our way.

That’s a deflationary trend I can support.

Yes, things cost more, but we should do our best to use technology and our access to information to cut out as much unnecessary bloat as possible.

Perhaps we’ll be able to drive costs down far enough to where our wage gains make a difference.

Here’s wishing you good health!

Rodney

The post A New Way to Lighten Our Health Care Load appeared first on Economy and Markets.

Beware of Greeks Bearing Bridges

OK, so I kind of mashed up this title.

The first part is obvious, something about Greeks and gifts. The second part is actually a double entendre.

I cobbled together the old line of, “If you believe that, then I’ve got a bridge to sell ya!” and a reference to one of the initiatives underway to save the Greek economy, namely selling infrastructure.

Both ideas have the same outcome. Investors get hoodwinked. When it comes to the Greek bailout and exit, we should all be wary.

Despite what you hear or read otherwise, nothing has been fixed. Nothing will get done. And the euro is still very much at risk.

Invest in the region at your peril.

Eight years ago, the Greeks were hemorrhaging cash. The country ran a 15% budget deficit in 2009, but nobody knew how bad it was because they were scared to run the numbers.

Greek officials begged the European Commission (EC), European Central Bank (ECB), and IMF for a helping hand.

The troika, as it became known, threw the country a financial lifeline, but attached conditions.

The Greeks had to get a handle on their budget, reform their pensions, taxes, and work rules, and start selling assets through privatization.

The Greeks readily agreed. And then screwed it up.

They reformed pensions a bit. They even raised taxes. And they cut spending. They started the process of selling assets. But they couldn’t quite get any of it done, at least not enough to keep the country afloat.

The country fell back into crisis and needed another bailout. Then another.

The population threw out the government and elected a far left party, then matched that by giving the far right party a few seats as well.

Pensions were cut again. And again.

Taxes were raised. A lot.

If you make more than 60,000 euros per year, you can expect to send 75% to the government. If they can catch you. Tax evasion remains a national past time.

They haven’t sold many assets. After identifying more than $60 billion that could be privatized, they’ve managed to sell $6 billion.

Things like the unused, empty Athens airport, which has been under contract for seven years, remains in limbo, bogged down by lawsuits and infinite red tape.

The government needed two more bailouts.

Private sector investors (PSI) were told they were going to get a haircut. They got crushed.

Now the official sector investors (OSI), such as central banks, are going to take a bath by lowering interest rates, extending maturities, and granting a multi-year grace period on bonds outstanding.

As for balancing the books, well, the Greeks hired a statistician, Andreas Georgiou, to help sort things out.

He reported that the country ran a 15% deficit in 2009, and his numbers were verified to be in accordance with European lending standards.

The EC, ECB, and IMF accepted his report and approved of his methodology. The Greek government sued him for treason and is trying to get him thrown in jail, all for reporting the truth.

The Greek government might have “exited” its bailout by promising even more pain in exchange for the latest round of cash, but that doesn’t mean this is the end.

Greece never got any of the bailout money. The country was “credited” with the payments, which were immediately sent to its lenders, such as the other central banks in Europe and big private banks like Deutsche Bank.

The GDP of Greece fell by 25%, unemployment sits at 20%, bureaucracy is still a mess, and the tax structure kills investment. And then there’s the little matter of the banks.

43% of the loans held by Greek banks are non-performing. That’s awful, but at least it’s down from 50% in 2016.

The country hopes to have non-performing loans down to 35% by the end of 2019.

Typically, banks hold a capital cushion of 7% to 10%. Let’s be generous and say the Greek banks have 10% in capital.

With 43% of their loans non-performing, that means the banks can’t repay 33% of their deposits!

On what planet is that “fixed?”

Sometime in the next couple of years, the Greek economy will suffer another blow.

They won’t be able to make payroll or pay their pensions without running the printing presses. But they can’t do that because they are part of the euro.

Something will have to give.

Either they will get yet another bailout, or they will “bail out” themselves, by leaving the euro zone.

Either way, the chaos will cause disruption across the euro zone, and it’s something we should avoid when possible.

Any investments you hold in euros could be at risk of devaluation as the common currency falls.

And if it’s not Greece that blows up, maybe it will be Italy, where non-performing loans make up 11% of bank assets, or Portugal, where the number is 16%.

Clearly the Europeans have not fixed the debt issues. Don’t let their next crisis drag down your portfolio.

Stay ahead of the trends instead.

Rodney

The post Beware of Greeks Bearing Bridges appeared first on Economy and Markets.

August 23, 2018

Overbuilding, Over-Borrowing, and the Autocracy

Read a great article in The New York Times on Sunday (August 19).

Erdoğan of Turkey made it into the West’s graces by pretending to bring democracy to Turkey. He was to be an example of a moderate, modernizing Muslim leader.

For 60 years Turkey has been a stalwart NATO ally, bridging together Europe and the volatile Middle East.

Its demographic and urbanization trends have been strong.

I thought that the eurozone made a mistake by not allowing Turkey into that economic alliance years ago.

Now it looks as though that was the better decision, as Erdoğan has clearly reversed his position and attitude dramatically, taking on a more autocratic rule and allying more with Gulf, African nations, and Russia.

You could argue that bringing Turkey into the eurozone might have prevented this direction change. And the U.S. could have been more supportive after its attempted coup.

But a dictator is a dictator, and Erdoğan fits the bill.

Erdoğan served as prime minister from 2003 through 2014 before becoming president. Despite some democratic reforms, he always claimed: “For us, democracy is a means to an end.”

Meaning great trade and financing…

Following the super-low interest rate environment of 2008 due to QE in developed countries, Turkey and other emerging countries were able to borrow aggressively and catch up to our debt bubble.

It’s been the unintentional impact of our desperate stimulus efforts…

Most of $60 trillion increase in global debt since the 2008 crisis came from the emerging world; the greater part of that from China.

But much of the non-China debt was borrowed largely in U.S. dollars at very low interest rates.

Erdoğan greatly expanded Turkey’s urbanization and public projects. He even encouraged crony corporate borrowing with implicit guarantees as his government got more and more autocratic…

Sounds a lot like another nation, doesn’t it? (Yup. China!)

As of now, Erdoğan’s government is one of the most oppressive in an autocratic region.

European banks – including Greece – are owed much of the Turkish debt.

Favorable relations with the U.S. have broken down since Trump began slapping tariffs on steel and aluminum from Turkey, hurting an already collapsing economy and currency.

And if you didn’t know it, David Stockman will be talking about where the U.S. stands during this politically and economically turbulent time at this years’

As the Fed continues to spur on rising U.S. short- and long-term rates – along with a rising dollar – it’s now harder to pay back any U.S.-denominated debt…

Turkey (on a smaller scale) and China (on the larger scale) are the symptoms of the emerging world crisis, which is very likely the trigger for this bubble’s crash.

It’s similar to how subprime loans were for the last bubble.

The biggest difference between Turkey and China is the sheer scale.

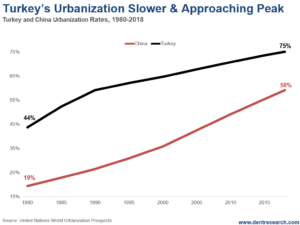

The fact that Turkey doesn’t have the same urbanization potential ahead as China does doesn’t do them any favors either.

China is at 59% urbanization after accelerating rapidly from 19% since 1980.

Turkey is already at 75% urban from 44% in 1980.

Such rates slow dramatically after 80%. It has added 31% of its population to cities since 1980 versus 40% for China, which is a bit slower as well.

But Turkey financed its growth largely on foreign debt, especially in the last decade.

It now has the highest percent of foreign debt to GDP out of any emerging country at 53.4% (China only comes in at 14.3%).

Though China has at least twice as much total debt as a percentage of GDP, it’s internally funded through government guarantees and its own banking system.

Yet it’s still the same strategy.

A country stimulates through excess borrowing and government guarantees to create outsized growth. Then, when the chickens start coming home to roost after such a leveraged and artificial strategy, they get more autocratic to deal with the social unrest and economic collapse.

Given that China has more control over its economy and less reliance on foreign credit, it’ll likely take more meltdowns in emerging countries like Turkey, Venezuela, and South Africa to highlight for the world the greater vulnerability of China.

China may have the most leveraged urbanization machine in the world, but its workforce demographics have already peaked. And its urban migration is slowing – reversing, even – due to the consequences of super-high real estate prices, pollution, and traffic from its steroid-like policies.

Emerging markets are on steroids with massive overexpansion.

Meanwhile, developed countries are on crack with massive money creation and ultra-low interest rates that create asset inflation and bubbles that will burst dramatically.

Turkey is the first significant sign of many to come for triggering debt problems and crashes in the coming crisis. As I said numerous times, it’s just like the subprime crisis that started to emerge in 2006 and 2007, but was not initially seen as a big problem…

This is a big problem!

Excessive debt and slowing demographics are a problem globally – now more so than in 2007.

And China should be the greatest loser before the next debt deleveraging is over.

I see that happening between 2019 and 2023, during the last phase of this predictable Winter Season of deflation.

It’s just a question of whether it starts sooner rather than later…

It’s something that I’ll be focusing on at our Irrational Economic Summit this year, which is happening October 25 through the 27 in Austin, Texas.

Harry

Follow me on Twitter @harrydentjr

The post Overbuilding, Over-Borrowing, and the Autocracy appeared first on Economy and Markets.

August 22, 2018

Will a Little Housing Bend Break Towards Big Trouble?

The Federal Reserve’s statement from its last meeting and policymakers’ subsequent comments sum up the current situation as follows: U.S. economic growth has been strong, unemployment is low, and inflation is running slightly above the central bank’s target.

That’s great news.

Against that backdrop, the Fed should increase interest rates at its next meeting.

However, could a deteriorating housing market put a damper on those plans?

Maybe.

The Fed wants as much “ammo” as possible to deal with the next downturn so that it won’t need to resort to quantitative easing and other extraordinary measures.

The more the central bank can increase interest rates without crashing the economy, the better.

I’m not calling for an imminent recession.

That happened before the financial crisis in 2008?

You got it… the housing crash.

I remember that bust quite clearly because I owned a few rental properties and suffered the consequence of not listening to Harry’s warnings!

Granted, I’d just met Harry and Rodney and was already trying to dump properties that were leveraged and barely profitable on a cash-flow basis.

Real estate is a lot harder to liquidate than stocks, so I couldn’t just put in a “sell” order.

But I learned a tough and expensive lesson: Real estate doesn’t always go up in value.

Housing Cracks?

You’d have thought lenders and buyers learned their lessons from the last real estate boom and bust… but here we are again: Zero-down loans are back.

No income? No job? No problem!

But the housing market is starting to show signs of weakness. And that’s even with historically low interest rates!

The July 27 issue of Treasury Profits Accelerator highlighted my heightened concerns about the housing market.

Existing-home sales have declined for two consecutive months and were flat prior to that. New-home sales, which are fewer in number but more important to the economy, also fell sharply.

Interest rates are moving higher, and the Fed has forecast two more hikes in 2018 and three in 2019.

The July data on housing starts and permits did little to dispel my fear.

After dropping by more than 12% in June, housing starts ticked up by less than 1% in July. The consensus estimate had called for a 7% increase.

Ouch.

Housing permits, on the other hand, were better.

Permits were up by 4.2% year over year. Filings to build single-family homes were up over 6%.

Permits are less reliable than starts because builders can change their plans if they don’t think they’ll have buyers.

Housing starts mean that a builder has begun excavation and that the home will likely be completed and then, hopefully, sold.

It’s still a little early to say housing is in a downturn, but these trends bear watching.

Spending Away!

Home purchases may have slowed, but retail spending remains healthy.

U.S. retail sales jumped 0.5% in July, handily beating expectations for a 0.1% bump. Excluding autos and gas, retail sales climbed 0.6% month over month, topping the consensus forecast for a 0.4% increase.

Here’s the bad news: The Commerce Department lowered its estimate of June sales growth to 0.2% from 0.5%. This revision also brought core retail sales, which exclude autos and gas, to 0.2% from 0.3%.

That means July’s strong retail sales in part reflect the downward revision to the June data. But, overall, consumers are still spending more.

Treasury Yields Drop

Long-term Treasury yields have declined from 3.12% to 3.02% over the last 10 days.

Aside from the latest trade war developments, the bond market seems to be focused on weaker housing data.

Tomorrow, we’ll get new-home sales data for July.

Preparing ahead of time for the types of surprises these reports often generate is what we do in Treasury Profits Accelerator.

(My publisher would appreciate it if I add that “Preparing ahead of time for…” is another way of saying “Profiting from…”)

To good trading,

Lance

The post Will a Little Housing Bend Break Towards Big Trouble? appeared first on Economy and Markets.

August 20, 2018

Nearing a Line in the Sand

Most of the classic technical indicators favor a continued rally in stocks into 2019.

And that’s still my preferred scenario for a final peak. One that happens in late 2019, coming off of this Trump rally that started in late 2016.

It could be near its peak growth rate after the 4.1% GDP report.

But it’s not likely to be sustainable for long given that we are running out of workers to rehire, and the real estate bubble seems to be finally be running out of steam due to such high prices making homes and rentals unaffordable.

So, do we peak just ahead, or could it sustain well into 2019 before peaking… and I see low chances of it sustaining past that point where our proven fundamental indicators are the lowest between 2020 and 2023.

The first warning sign for the near-term peak is the sharp collapse in the Smart Money Flow Index over this year’s rally after the late January 2018 peak.

But another warning sign is the collapse in China’s stock prices down 26% recently, after a second bubble peaked in late 2015, and crashed 49% into early 2016.

Such a continued crash would be a bad sign for the global economy, not just China. If it breaks much below its major support at 2,638, it’s due to crash to at least 2,000 in the next year, and more likely to 1,000 over the next few years. And it’s just a bit less than 1% from that level on Friday.

This has been a classic dead cat bounce scenario ever since that low in early 2016 – which is now failing again and approaching the lows of the last crash at 2,638.

The ultimate support level is 1,000, at the bottom in 2006 just before the first great bubble that peaked at 6,200 in late 2007 and crashed 72% to follow.

Emerging market stock indices are also down just over 20%, with a rising dollar and interest rates that they largely borrow in impacting them negatively…

This could be the next subprime crisis in debt, as most of global debt came from emerging countries since the 2008 debt crisis when the U.S. had lower interest rates and a lower dollar.

This is important.

It would come with an acceleration of the trade war which is already happening – and rising dollar and interest rates – which looks likely ahead by my longer-term forecast based off of chart patterns.

It’s a crucial trend for me and you to follow. If China’s second bubble heads down again, it would favor a top in late 2018 for the U.S. and global economy, since China has the second largest, fastest growing economy, and is the most leveraged.

China’s Shanghai has bounced a bit recently as we approach this critical level…

But a break much below 2,600 could be a curtain call for China.

And yet this is another indicator that stocks in the U.S. could peak earlier in late 2018 rather than late 2019, which is the final deadline for all of my indicators and cycles.

Cryptos like bitcoin are at critical levels, as is gold and Treasury bonds. These are all indicators of a coming crash if they move down much more.

I’ll keep you updated in this tricky and unprecedented period.

Either way, we’ll see a major crash by late 2019 into the early 2020s.

It’s already been determined by our most powerful Great Reset Cycle every 90 years.

It aligns with the Great Depression, which happened between late 1929 and early 1933.

And if the thought about crossed your mind about attending our Irrational Economics Summit, or you’re on the fence about the decision, the time to buy your ticket is now!

Seats are filling up quick this year. So don’t wait on it. There may not be much time left.

I’ve said it numerous times over the past few weeks, but Austin is the place to be. And Austin just happens to be where this years’ Irrational Economics Summit is being held, on October 25 through the 27.

With all the uncertainty in the market during this unprecedented time, you won’t want to miss out on the invaluable insight that’s to be gained from the many great minds speaking at this year’s event.

So, don’t wait any longer… The time is now!

Harry

Follow me on Twitter @harrydentjr

The post Nearing a Line in the Sand appeared first on Economy and Markets.

August 17, 2018

He Was Right…

Mainstream Media may criticize him.

But he was right about many things over the years.

Of course, when navigating the economy and markets, it’s impossible to be right every time.

Yet his track record over the years for predictions that matter is nothing short of impressive.

The situation that’s playing out in Turkey is merely a symptom of a larger issue that the emerging world is to face.

It’s difficult to say what’s to come, and where this will all lead the U.S., along with the global economy.

One thing that seems to be true, the greenback is a safe zone. As is the case for high-quality bonds, such as 10- and 30-year Treasury bonds.

Just as Harry predicted it would be.

Just as he urged people to get out of gold and silver before it plummeted.

Just as he warned against the crypto craze last December, stating that they were following a similar trend as internet stocks, which, ultimately, crashed.

These times, they’re turbulent. And Harry’s done his part to help you avoid the pitfalls in the system.

As have all of us here at Dent Research.

We have the necessary tools to help you earn profits through the worst of storms, so to speak.

Take Adam O’Dell, for instance. His Cycle 9 Alert has the ability to turn $50,000 into $1.2 million in just over five years, regardless of the state of the economy.

And, as always, Harry has more to say…

Click here, or the video below, to hear what he has to say.

The post He Was Right… appeared first on Economy and Markets.

August 16, 2018

The Sunbelt Dominates

I’ve never read so many good articles and rankings on cities by growth, affordability, and desirability. Especially during a time when the real estate market is crazy!

This is the last one I’ll bring you for now…

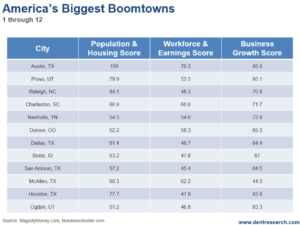

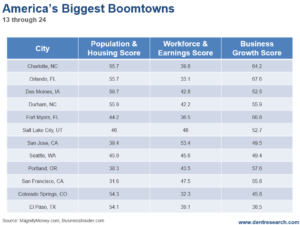

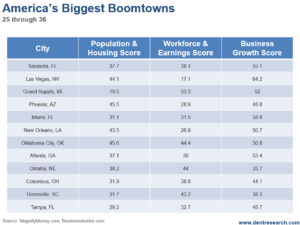

This study rates on three measures, population and housing, workforce and earnings, and business growth.

So, you can decide which of these are most important to you or your kids.

The only surprise in the top five is Provo, Utah.

Austin is on top with its hip culture and restaurant scene.

Then Provo comes in after Austin, with its dry, sunny weather. It’s less than an hour from Salt Lake City.

Raleigh’s third with its research triangle and universities, followed by Charleston with its booming restaurant scene and massive tourism.

Nashville, the country music capital, falls in right behind Charleston with strong tourism. Both of which are always bachelorette destinations, making them busy nearly year round with their mild climates.

We had our last Irrational Economic Summit in Nashville. This year it’s in Austin. Maybe in the future we’ll host it in Charleston.

Out of the top 12, five of the boomtowns are in Texas.

None of them are in Florida.

And 11 of those 12 are located in the sunbelt.

No surprise there!

Out of the top 36 boomtowns, 28 are tucked along the sunbelt.

The top boomtowns for population and housing are: Austin at 100, Raleigh 84.1, Provo 79.9, Houston 77.7 and Charleston at 66.9.

Those that lead in workforce and earnings are: Austin at 70.3, McAllen, Texas (a southern border town) 62.2, and Charleston at 66.9.

And the top areas for business growth are: Provo at 95.1, Austin 93.0, Nashville 72.9, Charleston 71.1, and Raleigh at 70.8.

The boomtowns that standout most to me: Austin, Charleston, and Raleigh.

These are some of the best places to consider moving to, especially for your kids.

But the best strategy is to rent for a few years to make sure you love it, and to look for better buy opportunities when the next real estate decline sets in.

Harry

Follow me on Twitter@harrydentjr

The post The Sunbelt Dominates appeared first on Economy and Markets.

August 14, 2018

Twisting the Constitution Hurts Us All

I’m not a fan of small spaces, and MRIs give me the willies.

I understand that there’s no way the giant machine could collapse, and no possibility that I’ll run low on air, but that doesn’t make me feel any better.

Maybe President Trump has a similar issue, although not with small spaces.

Instead, the smell of new car leather might make him sweat.

Or the sound of a revving precision engine could cause his blood pressure to spike.

Perhaps driving a well-appointed, great-handling, streak of lightning passenger car reduces him to a huddling mass.

I don’t know why this would be the case, but how else can you explain the president’s fear of BMWs, Porches, and Audis?

And he’s not content to live with his own fear, he’s projecting it to the rest of us, and now trying to defend the nation!

Our Commander-in-Chief wants to slap tariffs on foreign car imports because of national security, as if we’re in danger of foreign cars breaching our shores and enslaving us all.

The funny part is that the leading auto exporter from the U.S. isn’t GM (NYSE: GM) or Ford (NYSE: F), it’s BMW (ETR: BMW), which makes hundreds of thousands of cars in Spartanburg, South Carolina.

The plant employs thousands of workers, helping Americans grow their prosperity.

Obviously, the president doesn’t fear foreign cars, at least not in the sense that they pose a security risk.

Instead, he’s using the tariff as a bargaining tool. But the only way he can act without congressional approval is to claim this power as a matter of national security.

He’s twisting the U.S. constitution, trying to wring out new ways to get what he wants.

In doing so, he also weakens the power of the document, which is bad for everyone.

Parsing the constitution, looking for new federal government powers, isn’t new.

Generally, those wanting more expansive authority look to the “general Welfare” clause in the taxation section.

Presidents, congressmen, and judges have fought over this concept since the document was first ratified. But for the first 140 years of our nation’s history, we ebbed and flowed across a narrow band when determining what general Welfare meant.

This changed with the Social Security Act of 1934.

President Roosevelt used the term “welfare” in the act itself as a way to make relief for the poor appear constitutional.

He got his way, but in doing so he opened the door for many programs that came later, such as Johnson’s Great Society (Medicare).

I’m not suggesting these programs are bad, or that we shouldn’t have them, only that they do not fall under the purview of the national government as formed by the U.S. constitution.

We can add such things any time through the amendment process.

But who wants to go down that long, arduous path when you can simply claim a general power to spend anything you want and then dare someone to challenge it?

Today our president is stretching the notion of national security beyond recognition.

His cause might be correct, and the outcome might be beneficial. But that doesn’t mean we should allow him to assume the power.

If everything can be construed as part of the general Welfare, and anything can fall under the guise of national security, then there are zero limits on the powers of the national government.

This is the exact opposite of the U.S. constitution, which specifically limits the powers of the federal government to those listed and leaves all others to the states.

This issue might seem far removed from your daily life.

It isn’t.

The federal government isn’t an efficient machine that generates surplus revenue and spends without waste.

It’s a gargantuan enterprise that sucks in tax dollars by the trillions, runs 12-figure deficits, and blows billions on questionable pursuits.

Every time it gets bigger, we the taxpayers owe more.

As the Boomers age, we’ll see more proposals to spend out of the national coffers for the general Welfare for things like pension fund bailouts and healthcare.

Maybe we should address such things.

But before we do, we should ask if the U.S. constitution remains relevant, or have we decided simply to let the national government officials do whatever we want while we foot the bill?

Rodney Johnson

Follow me on Twitter @RJHSDent

The post Twisting the Constitution Hurts Us All appeared first on Economy and Markets.