Harry S. Dent Jr.'s Blog, page 51

June 4, 2018

Social Unrest in China

Anyone who has listened to me in the past decade knows that I think China’s going to take the greatest economic fall of any major country.

They’re the only emerging country that has continually declining demographics. The top-down Chinese mafia-like government has overbuilt everything (decades ahead) in the name of job growth in cities to leverage steroid-like GDP growth.

But I’ve also considered another proven principle: it’s younger people that move and migrate, but they also revolt and drive unrest, much more than older people.

And China is an aging society with rapidly falling birth rates.

There’s a great concentration of younger migrant workers in cities that move from rural areas yet are not official citizens with normal access to education and social programs. They’re looked upon and treated like second-class citizens, similar to illegal immigrants in the U.S. – needed for their low-wage labor yet shunned otherwise. Urban citizens often don’t want such lowly migrant children going to school with their own kids, and the government doesn’t allow them.

These people have the lowest wages, zero benefits (and often have to leave their kids with their grandparents in the rural areas for schooling), are least able to afford the sky-high and rising real estate prices, all while having to choke on the smog and fight traffic like everyone else.

In China, most men buy a condo and a car before they get married, otherwise they have no chance of even getting a date! Chinese women are very discriminating about that. The two sectors that have the hardest time getting married are poorer men and richer women – as these men don’t like women who’re smarter, more affluent or more powerful than them.

Migrant male workers outnumber women due to the one-child policy that favors boys!

And the majority of them are young and ripe for revolting.

These migrant workers are significant in numbers at 280 million, making up just over 20% of the population, and likely closer to 30% of the adult population.

However, since 2014 the number of migrant workers has been declining, with more going back to rural areas where they’re better treated.

And since 2015, migrant worker wages have been rising slower than urban citizens after rising faster previously, adding insult to injury.

It’s important to note that there are two groups of such migrant workers.

The older workers came from the Mao Era of the Cultural Revolution. They were born 1960 through 1980, and came in the 1980s and 1990s when the great migration was first pushed by the government. They were just happy to make more money, despite the sacrifices, and knew they could always go back to the farm if need be – and they’re old farts now.

The younger generation – those born after 1980 – grew up during the Deng reforms. They’ve never worked the land, and don’t want to go back to the rural areas, making them far more likely to stay in the cities.

It’s the older migrants that’re starting to move back to rural areas and causing the migrant population to decline for the first time since 2014.

When this reverse migration back to rural areas started, it was a “shock” to China’s policy of over-building to over-stimulate urbanization beyond natural growth rates.

China’s four-decade strategy has finally failed… Only no one has announced it yet!

So, where does that leave the cities of China: with about 150 million-plus younger migrant workers that’re pissed off, with two-thirds of men 18 to 25 unmarried (or three-fourths by some estimates) and unlikely to be, as they can’t afford housing.

When this so-called “miracle” of Chinese growth and urbanization finally falls apart between 2019 and 2020, these men will revolt.

The next Tiananmen Square protests will come, and they will be much greater and more powerful. With workers, not students, rioting in much higher numbers from much greater desperation!

I want to see what the economists that constantly praise the new Chinese model of state-driven capitalism say then…

Harry

Follow me on Twitter @harrydentjr

The post Social Unrest in China appeared first on Economy and Markets.

June 1, 2018

The Coming Financial Detox

The economy has been over-stimulated for too long!

And now Trump is issuing more tax cuts. This does nothing except delay the inevitable meltdown that helps to clean out and reset the economy.

Every bubble must burst. It destroys money, and causes businesses and investors to suffer. But this is a natural process of just about every aspect of life. It’s a way to keep balanced. When we run ourselves ragged, we get sick, then get better.

With Trump’s tax cuts, it isn’t going to keep the boat afloat. Rather it merely slows the sinking process.

But we’ll see the damage of this patchwork job done to the economy sooner rather than later.

You can hear more what I have to say about this in today’s video. Watch it now.

[Signature]

Harry

Follow Me on Twitter @harrydentjr

The post The Coming Financial Detox appeared first on Economy and Markets.

May 31, 2018

Yields Are Crashing!

When long-term Treasury yields started to climb mid-month and closed at a high of 3.24%, I didn’t see fundamental evidence to suggest that higher inflation was on the way.

Recent economic and market developments haven’t changed my view.

The 10-year Treasury yield rose to more than 3.11% early last week, while long-term yields ticked above 3.2%.

Yields didn’t reverse until April new-home sales came in 15,000 below expectations on Wednesday. March sales were revised lower by 20,000, a hefty adjustment.

Existing home sales were also down 2.5% month over month and 1.4% year over year. Existing sales aren’t as important to the overall economy, but these numbers show that the real estate market has started to feel the pain of higher rates.

The Federal Open Market Committee (FOMC) released the minutes from its May meeting on Wednesday afternoon; the contents likely contributed to the sharp fall in yields.

The voting members of the central bank’s policy-making arm are led by Federal Reserve Chair Jay Powell. But they all have their own opinions about the direction of inflation, wages, employment, and, ultimately, the necessary policy prescriptions.

Last Wednesday’s minutes reveal that most Fed officials expect the next rate hike to happen very soon.

In fact, a hike is pretty much a certainty at the FOMC’s June meeting.

Policymakers seem to agree that it’s OK if inflation moves above the Fed’s 2% target for a bit. In the minutes, some officials noted that if “oil prices remained high or moved higher, inflation would be boosted by the direct effects and pass-through of energy costs.”

That makes sense.

The minutes also revealed some disagreement concerning the yield curve, which is the difference between short-term and long-term yields.

Some members noted that hikes in the overnight federal funds rate (affecting short-term rates) and the gradual shrinking of the Fed’s balance sheet make “the slope of the yield curve a less reliable signal of future economic activity.”

But several participants said “it would be important to continue to monitor the slope of the yield curve, emphasizing the historical regularity that an inverted yield curve has indicated an increased risk of recession.”

So far, the yield curve hasn’t inverted, which is what happens when long-term rates move lower than shorter-term rates. An inverted yield curve often signals a recession may be coming down the pike.

However, the yield curve has flattened.

A recession is worrisome, of course, and several Fed officials are paying attention to the yield curve.

Recession fears may have caught the attention of bond traders, as long-term rates fell sharply Wednesday through Friday. The 30-year Treasury bond moved well off of its recent high and is approaching its six-week low of just under 3%.

That’s quite a reversal from all the worries about inflation less than two weeks ago.

My system recognized the market’s overreaction and subsequent rise in Treasury yields. Readers who followed my trade alert booked a tidy 36% gain when rates fell last week.

I’m eyeing another opportunity this week to play the decline in Treasury yields.

You can prepare for and profit from surprises in the financial markets with Treasury Profits Accelerator.

Good trading,

Lance

The post Yields Are Crashing! appeared first on Economy and Markets.

May 30, 2018

The Market’s Finally Getting Serious About Italy

Over the years I’ve spent much time talking about Italy as the next ticking time bomb for Europe and the global banking system.

It’s government debt is the third highest in the world at 132% of GDP, coming only after Japan and Greece.

Its private debt is 23% of the Eurozone versus Greece’s 3%.

But here’s the bigger issue: Italy’s bad loans are 40% of the Eurozone.

Just one country comprises 40%… That’s crazy!

So, you can see how the euro and Eurozone can’t afford to bail out Italy. This has been obvious from the beginning. We’ve been saying so for years.

Italy’s already bankrupt. It’s just that no one has announced it yet.

Its banks keep propping up zombie companies with just enough credit for them to meet their debt obligations.

In other words: lend them just enough to pay you back and stay current on their debt obligations, but not enough to grow or get into more trouble.

It’s a form of denial. Nothing more than false hope that the economy will magically get better down the road.

The paradox in Italy is that the banks can’t get healthier without economic growth… and the economy can’t grow without healthy banks to lend money.

Now that the government’s divided, and the rising populist parties are calling for higher spending and even breaking away from the euro, the stock market and Italy’s bond market are falling.

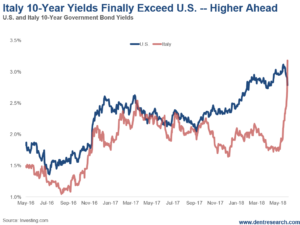

The markets are finally starting to get serious about Italy and the imbalances in the entire euro system. Only Mario Draghi’s incessant stimulus, years after the U.S. tapered, has kept Italy’s 10-year bonds well below the much more solvent U.S. Treasurys. (We aren’t pretty either, just the best house in a bad neighborhood.)

Personally, I think it’s about time.

Italy’s yields spiked strongly on Tuesday, up to as high as 3.18%, while the U.S. 10-year fell sharply, down to as low as 2.97% from recent highs of 3.11%. But, more importantly, look at the most recent massive spike in Italy’s yields…

Italy’s bad debts had climbed to 14% of loans as of 2014, and now they are near 20%. Meanwhile, 10% is technically bankrupt…

Italy is the next Greece, and it’s too big to fail or bail out. Within the next six to 18 months the euro and Eurozone will be imploding in some fashion: one of many coming to the global economy.

And it couldn’t have happened to a nicer group of central bankers!

[Signature]

Harry

Follow Me on Twitter @harrydentjr

The post The Market’s Finally Getting Serious About Italy appeared first on Economy and Markets.

May 29, 2018

A Safer Way to Play Volatility

I’ve been preaching how this endless and desperate stimulus will (and must) come to an end. When it does, hell’s going to be a popping.

The markets keep going up despite one bad news event after another. Central banks keep printing money, and promise to do more if things weaken. Trump has cut taxes massively to offset the fact that the Fed isn’t printing money anymore. And now he’s proposing another tax cut.

All this points to DESPERATION!

After nearly 10 years, this economy is so weak it can’t stand up on its own without an endless supply of free money and stimulus.

If your kid couldn’t ride his bike without training wheels after three years, you would know something’s wrong, and likely sooner rather than later.

Mark my words: Volatility’s coming.

If you don’t want to be in cash – which would only be great if the crash starts soon, and even then it’s far from optimal – then you must have a proven system in place. One that can work in up and down markets. There’ll be violent bear market rallies, even in the great crash, and reset coming over the next several years.

So naturally, at Dent Research, we look for people who have such systems at different risk and return levels. People with different approaches that allow you to diversify. And we already have a cadre of successful ones – hence, we are careful with who we choose to add.

Well, we’ve found a new one from Lee Lowell, who’s quite an experienced trader.

He has a system for collecting predictable, upfront income during times like this. The best part: it gets better when markets get more volatile, meaning the income goes up, not down.

Lee has been doing this on record for almost 10 years, and has not had one losing play. That’s a proven system. In fact, that’s one hell of a track record.

I’m not going to try to explain this system to you. But I strongly suggest you .

Lee gave a presentation earlier today, at 1 p.m. ET. If you missed the live viewing, you can tonight at 7 p.m.

His is certainly a unique and safe way to play volatility for the income side of your portfolio.

I think you’ll like what you hear.

[Signature]

Harry

Follow me on Twitter @harrydentjr

The post A Safer Way to Play Volatility appeared first on Economy and Markets.

May 28, 2018

Thanks to Them, We Have Choices Today

I was scared to death when my first child was born.

I had no idea how to raise, or pay for, a kid. Concerned for his health, my wife pureed vegetables and froze them in old-fashioned ice trays so we would have healthy, correct serving sizes both at home and when he went to daycare.

By the time our third child came along, we were old pros. I forgot to strap in her car seat for the ride home from the hospital. At three months old, the pediatrician asked what we were feeding her. I told him bits of pizza, ribs, really anything we ate she got as well.

Typical parents.

But even though we grew more comfortable with the process, one thing remained constant. I have always been painfully aware of my limited time with my kids and my wife.

For some reason, I am wired to feel each passing day. Christmas is wonderful for me, but also a bit sad, because I can estimate how few I have left to celebrate with them.

At the website www.WaitButWhy.com, author Tim Urban created a series of visuals dedicated to this theme.

He notes how many days he spent with his parents, and how few he has left. He also determines how much pizza he will eat, and how many Chinese dumplings he’ll consume.

It’s humorous, but it also makes the point that we should prioritize what matters because we have only so much time.

Which brings me to Memorial Day.

We set aside this holiday to remember the millions of mostly young men who died in the service of our country.

I don’t know the breakdown, but some portion volunteered, others were conscripted.

Some passed heroically, some perished in training accidents, and some died in meaningless skirmishes that meant nothing to the outcome of the conflict.

But they all died.

Today, when I look at a graphic of the years, months, days, holidays, and even dumplings that I have left, or when I consider what I think to be the precious few years still in front of me to be spent with my wife and children, I can’t help but think of those soldiers I will never know who had their lives cut short.

They gave their most precious gift, time, so that ours could be spent in the manner of our choosing.

May you spend your time enjoying what is most important to you.

The post Thanks to Them, We Have Choices Today appeared first on Economy and Markets.

May 25, 2018

The Income Secret That Would Make a Hall of Famer Jealous

I’m not a particularly big risk-taker. In fact, I’m known around the office as “the income guy” for my work in Peak Income.

It’s baseball season, so I’ll use some baseball analogies here.

I don’t often swing for the fences looking for a homerun because I know I’m more likely to strike out.

Sure, hitting the ball out of the park is fun. But a steady stream of disciplined base hits will win you more ball games. That’s the way I view dividends.

I focus on finding durable income streams to help get you into – and through – retirement. The idea is to build wealth slowly… one dividend at a time.

But as I’ve learned in this business, there’s more than one way to skin a cat.

And my friend and new Dent Research colleague Lee Lowell has mastered an approach that’s exactly like mine — except totally different.

Like me, Lee’s not much of a homerun hitter. But he can drop base hits with a consistency that would make Hall of Famer Ty Cobb jealous.

For those of you that aren’t into baseball (and shame on you for that, by the way), Cobb had the highest career batting average in baseball history at .366 over 24 years.

Well, Lee’s batting average is a lot higher than that. It’s not quite 1.000, but it’s not far from it.

Enough about baseball for now. It’s making me want to order a beer and order a bag of peanuts, and it’s barely past lunch time as I’m writing this.

I can’t tell you exactly what Lee does because I don’t want to steal his thunder.

He’ll be revealing it next Tuesday, May 29, at 1 p.m. ET in his free presentation here, so if you want to know the nitty-gritty you’ll have to tune in.

But I can explain it like this: While my strategy focuses on the long term, Lee’s strategy is all about getting paid right now. As in immediately.

He calls his strategy his “instant income secret,” and it’s one of the only ones I’ve ever seen where you take your profit up front.

As with any strategy, there’s risk. But the nature of Lee’s strategy is that even when you lose, you don’t really lose.

You still collect your profit up front, and the “loss” is actually the opportunity to take a new trade that you likely already wanted to take.

And the beauty of it is that it can be repeated like clockwork month after month, year after year and with virtually any traded stock.

Lee’s been running this strategy for over a decade, and it’s been battle-tested by the worst bear market of our lifetimes in 2008. So, we know it works.

In his presentation, Lee will show you what he does, and he’ll even walk you through a trade and show you how to make anywhere from $200 to $2,000 (or more) show up in your bank account in the blink of an eye.

I’ll let you in on a little secret. I’m familiar with Lee’s strategy and have experimented with similar strategies myself over the years. But, frankly, I lacked Lee’s knowledge and experience, and my results were nowhere as good as his.

Lee’s the only guy I trust to run the instant income strategy successfully. So, I recommend you block off the time to hear him explain it.

Bond and CD yields are higher today than they were a year ago. But chances are, they’re still nowhere near high enough for you to retire on. You need alternative income streams, and Lee’s instant income strategy fits the bill.

The post The Income Secret That Would Make a Hall of Famer Jealous appeared first on Economy and Markets.

May 24, 2018

Sports Betting for Profit? The Odds Are Long

The Supreme Court recently ruled that states have the right to regulate sports betting, opening the door for such activity in every state.

Chances are, your state officials are burning the midnight oil developing regulations for sports betting because they want the tax revenue.

After all, Pew Trusts estimates the industry could become a $41 billion industry, contributing $3.4 billion to state and local taxes.

That sounds great, but we have to put it in perspective.

If sports betting contributed that much to tax revenue, it would still be less than half of one percent of tax revenue collected, which doesn’t sound like much of a victory for all the hassle that will go with it.

And who wins at sports betting, anyway? I’ll give you a hint: It’s not you.

Bookies, legal or illegal, are the winners, in much the same way that brokerage firms are the winners in the financial world.

On sports, gambling houses establish the line, or the point spread, that they believe will entice gamblers to place equal bets on both teams.

The bookie then charges a sort of interest or carry cost (think of it as a transaction fee) on losers.

If it works out, the gambling house doesn’t care who wins or loses. It still earns the fee.

As for individual sports gamblers, they have a better chance than people playing the slots, but the odds are still stacked against us. We only win 48% of our sports bets, which makes it a losing proposition.

Maybe it’s because we fall in love with our alma mater, or simply can’t stand an opposing quarterback. Or perhaps we don’t do enough research.

Whatever the reason, we shouldn’t count on the recent Supreme Court ruling as a way to increase our income.

For that we need smarter strategies, with much higher win rates, but recent trends in the financial markets have made this much harder.

For almost nine years you could win the investment game by owning stocks, bonds, or a combination.

Sure, the markets didn’t go straight up (remember the scare of the summer of 2011!), and bond yields didn’t go straight down (taper tantrum, anyone?).

But, in general, equities climbed as yields dipped, so bond prices also moved higher. As fixed income investors we didn’t earn much money, but we made a bit on capital appreciation.

The easy days are over.

The Dow is negative for the year as I write this, and the 10-year Treasury yield is sitting above 3%.

Today the markets feel like we could lose on both fronts as equities waver and bond prices slip. That could make investing harder than sports betting!

But there are ways to earn income without taking excessive risk. We have a number of such strategies in place at Dent Research already, and we’re excited to introduce one more featuring Lee Lowell.

For many years Lee has helped investors bank consistent income, all the while keeping a weather eye for risk.

Any investment includes the possibility of some loss. The key is how you manage that risk.

In a testament to his abilities, Lee has been able to generate consistent profits for almost a decade without a single losing position. It sounds crazy until you see how he did it.

If you’re looking for an income strategy, but you’re worried about the current markets – and don’t think you’ll make enough income betting on sports – then tune in to Lee’s Instant Income Secret presentation to see if his approach is right for you.

His presentation is next Tuesday, May 29, at 1 p.m. ET. Just go to www.instantincomesecret.com then to watch, no registration needed.

And, in the meantime, you can read and see more from Lee at the site right now about what to expect.

The post Sports Betting for Profit? The Odds Are Long appeared first on Economy and Markets.

May 23, 2018

The Makings of a Debt Crisis: Corporate Debt Soars While Credit Ratings Fall

Two big news items in the last 24 hours have grabbed my attention.

The first is Congress’s approving a bill to roll back the Dodd-Frank Act. If this passes, smaller financial institutions will find relief from the strict rules that have applied to Wall Street banks since after the 2008 crisis.

This is sheer idiocy! It will not end well.

The second is the U.S. corporate debt is suffering one of its worst sell-offs since 2000. This is another disaster in the making.

U.S. corporate debt has risen from $40 trillion to $70 trillion since the top of the last bubble in 2007. That’s 63% in 10 years. It’s risen 135% since 2000!

Only government debt has risen faster, from $35 to $64 trillion, or 83%.

China is the worst by far, going from $6 to $36 trillion or a 500% increase!

Of course, many of these bonds are simply financial engineering to buy back stock to increase earnings per share. Uber-low long-term interest rates thanks to QE have allowed companies to do this cheaply.

The problem is these long-term rates have been rising since just July 2016. They’ve gone from 1.38% to 3.10%. That’s an increase of 172 basis points in the risk-free 10-year Treasury bond. That naturally reverberates up through the risk spectrum from investment grade corporate bonds to junk bonds.

You see, here’s the thing…

Governments have artificially pushed down bond yields for so long that companies have embraced speculation rather than productive investment (i.e. they’re not spending money on productive assets that will serve them and the economy well in the long-term).

This mentality only creates financial asset bubbles that burst.

When companies buy back their own shares at historically high valuations, they’re speculating, just like an investor or hedge fund.

When stocks crash ahead, shareholders will demand to know why these corporations used the money they will need to survive the crisis to speculate in their own stock… at the highest prices in history!

Well, as the numbers are now showing, this corporate bond bubble is starting to burst, and of course that will ultimately hit junk bonds the worst… then stocks and real estate.

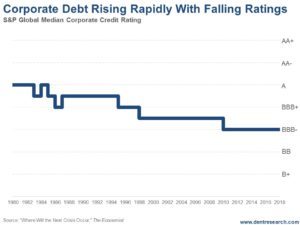

But the real story here is that we’ve been in this bond bubble since 1981. And the quality of this corporate debt has been falling for nearly 40 years now. QE has only accelerated the decline.

We’re now at the point where the median corporate bond rating is borderline junk…

Median ratings started at A in the early 1980s when this unprecedented boom began. Since then, it has steadily fallen to BBB-. The next step down is junk bonds.

And this is a global phenomenon. It’s not just isolated to U.S. corporations.

Forty-eight percent of investment grade bonds are rated BBB, just one notch above the median in this chart. The net leverage ratio for such BBB issuers has gone up from 1.7 in 2000 to 2.9 today.

All of this means that investors are getting rewarded less and less for lower quality bonds. Yet such investors are less worried than ever, as shown by a 40% drop in the cost of insuring such bonds (through credit default swaps) in the last two years. Continued tightening by the Fed only makes this worse.

This is a bond crash and debt crisis in the making and could end up being the biggest trigger for the stock crash. And it’s already in motion!

[Signature]

Harry

Follow me on Twitter @harrydentjr

P.S. You need to beware the crisis unfolding in corporate bonds, but that doesn’t mean you need to give up on finding income-generating investments or, even worse, turn to riskier alternatives. Lee Lowell, an ex-trader and income expert, recently joined our team. Next Tuesday, May 29, he’s providing free training on how to find a reliable source of instant income. The training starts at 1 p.m. so drop by www.instantincometraining.com to check it out.

The post The Makings of a Debt Crisis: Corporate Debt Soars While Credit Ratings Fall appeared first on Economy and Markets.

Don’t Let the Government Bankrupt You Too

I’ve spent the last few weeks diving deeper into the pension mess in the U.S. while researching for the June issue of Boom & Bust, due out to subscribers this week.

And I’ve come to a conclusion. We’re in deep trouble.

Some things are obvious. Puerto Rico, which I didn’t write about because it’s on display for the world to see, will NOT fix its pensions.

In exchange for a stay of execution from creditors, the commonwealth agreed to hand over financial management to an oversight board.

The board rejected the Puerto Rican government’s budget, and then laid out how bondholders could be trimmed, other creditors could be shortchanged, pension benefits could be cut, and work rules revised.

“Great!” the governor said, “except we won’t cut pensions or change work rules.”

Essentially, he’s all for telling creditors they won’t get their money, but he won’t do anything that weighs on his constituents. At least, he says he won’t.

In the end, he won’t have a choice. Pensions will be cut, taxes will go up, and services will dwindle.

That story will be repeated, although not in such a big and ugly way as Puerto Rico, around the U.S. over the next 15 years.

And it should all start about 2024. That’s when Detroit – yes, that Detroit, which already went through bankruptcy once – will have to face an ugly set of facts.

It’s easy to point to states with pension problems (cough, Illinois and New Jersey, cough), but the issues don’t stop there.

Cities, counties, school districts – any level of government entity that levies a tax, most likely has a pension. And many of them have legacy pension problems, where they promised awesome benefits but then didn’t put the money away to fund them.

There’s no free lunch.

We essentially spent years not paying the taxes necessary to fund the benefits that are now coming due.

As taxpayers, we’ll have to make up the difference, and it will cost us.

The price will be our standard of living. The worse off the pension funding is, the bigger the bite (higher taxes and lower services) from the pension sponsor such as a city or county.

And, remember, this is on top of whatever problems we have at the state level.

Oh yeah, and all of this nonsense is happening during the second longest bull market in history. What happens when the economy rolls over?

Which leads me to another conclusion.

I need money. Lots of it. Well, maybe not exactly like that. I need a steady flow of money that I control to carry me through my retirement years in the lifestyle I want to enjoy.

I don’t want to be beholden to any government agency, or be tied to any one state or region. I want to create a stream of income that’s flexible based on my needs, not based on what some other entity can provide.

Except for the very rich, I think that’s a goal we all share.

The financial press is centered on wealth, and a million different newsletters talk about earning a billion percent in just a few hours with no work. That’s nice. But I always wonder, if it’s so easy, why are they spending their days peddling that to me?

Creating streams of income takes time and diligence. It’s why we started some of the programs we have here at Dent Research, and why we continue to look for great investment approaches to add to the mix.

For instance, you’ll be hearing more about Lee Lowell’s Instant Income Secret training session over the next week. Lee’s a new addition to the team, and he’s excited to reveal his unique, consistent income-generating strategy to you for free next Tuesday, May 29.

All you have to do is head to www.instantincometraining.com then, no registration required. As a valued Network member, Lee’s new service will automatically be added to your membership when it goes live.

As you work on building your own streams of income, I highly recommend you investigate various sources, looking for programs and strategies that fit your personal risk tolerance. If you haven’t already, I also suggest you get started immediately.

Every day you wait is a day closer we get to widespread financial issues that will weigh on us for years to come.

The post Don’t Let the Government Bankrupt You Too appeared first on Economy and Markets.