Deborah Weir's Blog, page 8

September 6, 2012

Webinar Sept. 18 from 7-8:30pm

Do you want to learn how to profit from market volatility?

Join us after work on Tuesday, September 18th in the comfort of your own home for a webinar. We will gather free information on the Internet that will help you manage your own portfolio. Continuing education credits apply.

Join us after work on Tuesday, September 18th in the comfort of your own home for a webinar. We will gather free information on the Internet that will help you manage your own portfolio. Continuing education credits apply.

The NY Institute of Finance will host this webinar. For more information and registration: https://nyif.com/courses/inve_1059.htmlBuy Timing the Market at Amazon.com

Join us after work on Tuesday, September 18th in the comfort of your own home for a webinar. We will gather free information on the Internet that will help you manage your own portfolio. Continuing education credits apply.

Join us after work on Tuesday, September 18th in the comfort of your own home for a webinar. We will gather free information on the Internet that will help you manage your own portfolio. Continuing education credits apply. The NY Institute of Finance will host this webinar. For more information and registration: https://nyif.com/courses/inve_1059.htmlBuy Timing the Market at Amazon.com

Published on September 06, 2012 11:57

August 28, 2012

Is the summer rally losing steam? These charts from Yahoo...

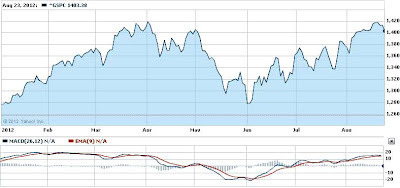

Is the summer rally losing steam?

These charts from Yahoo.com suggest, "Yes." The MACD line just crossed and turned negative. Money flows are seeping out of the S&P. Relative strength has dropped.

These charts from Yahoo.com suggest, "Yes." The MACD line just crossed and turned negative. Money flows are seeping out of the S&P. Relative strength has dropped.

Buy Timing the Market at Amazon.com

These charts from Yahoo.com suggest, "Yes." The MACD line just crossed and turned negative. Money flows are seeping out of the S&P. Relative strength has dropped.

These charts from Yahoo.com suggest, "Yes." The MACD line just crossed and turned negative. Money flows are seeping out of the S&P. Relative strength has dropped. Buy Timing the Market at Amazon.com

Published on August 28, 2012 14:46

August 23, 2012

Markets Crumbling?

When the S&P gains 10% in a few months, many portfolio managers seem to lock in those profits. They did it last spring...

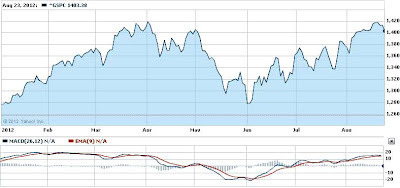

Here we go again. (Graph, courtesy Yahoo.com)

The market was +11% a few days ago, and it looks like there might be some profit-taking going on. You can join them for a few weeks, or use the coming decline as a buying opportunity.

As usual - wait until the VIX stops rising, the MACD line turns up, and/or credit spreads improve before commiting cash.Buy Timing the Market at Amazon.com

Here we go again. (Graph, courtesy Yahoo.com)

The market was +11% a few days ago, and it looks like there might be some profit-taking going on. You can join them for a few weeks, or use the coming decline as a buying opportunity.

As usual - wait until the VIX stops rising, the MACD line turns up, and/or credit spreads improve before commiting cash.Buy Timing the Market at Amazon.com

Published on August 23, 2012 12:57

August 9, 2012

The ten-year treasury yield has been rising for almost tw...

The ten-year treasury yield has been rising for almost two weeks - which means that the price has been falling.

http://stockcharts.com/h-sc/ui

Investors who bought at the highest recent price less than two weeks ago have lost about 1.5% of their principal. Their small coupons (1.62%) will not cover this loss if it contimues at this rate.

There may be more pain ahead for bondholders. Some of them may retreat into equities.Buy Timing the Market at Amazon.com

http://stockcharts.com/h-sc/ui

Investors who bought at the highest recent price less than two weeks ago have lost about 1.5% of their principal. Their small coupons (1.62%) will not cover this loss if it contimues at this rate.

There may be more pain ahead for bondholders. Some of them may retreat into equities.Buy Timing the Market at Amazon.com

Published on August 09, 2012 09:31

August 8, 2012

The outlook for the Euro and the EU is obvious to Ge...

The outlook for the Euro and the EU is obvious to George Friedman, analyst at Stratfor. Stratfor.com

His view that the Euro will survive is good news for equities. You can receive this free report each week.

His view that the Euro will survive is good news for equities. You can receive this free report each week.

http://join.stratfor.com/forms/get-free-reports?elq=56912b1aafe447309c50c3b068f7768fBuy Timing the Market at Amazon.com

His view that the Euro will survive is good news for equities. You can receive this free report each week.

His view that the Euro will survive is good news for equities. You can receive this free report each week. http://join.stratfor.com/forms/get-free-reports?elq=56912b1aafe447309c50c3b068f7768fBuy Timing the Market at Amazon.com

Published on August 08, 2012 10:34

August 1, 2012

The S&P may be fluctuating around 1350 - 1390,but the...

The S&P may be fluctuating around 1350 - 1390,

but the bond market is in a clear trend.

but the bond market is in a clear trend.

The bond market is signalling a return to the "risk-on" trade. Fixed-income investors have been moving out of safe US government securities and into high-yield corporates.

Quality spreads have been growing narrower for the past week. Soon this confidence should translate into a stronger equity market.

Buy Timing the Market at Amazon.com

but the bond market is in a clear trend.

but the bond market is in a clear trend.The bond market is signalling a return to the "risk-on" trade. Fixed-income investors have been moving out of safe US government securities and into high-yield corporates.

Quality spreads have been growing narrower for the past week. Soon this confidence should translate into a stronger equity market.

Buy Timing the Market at Amazon.com

Published on August 01, 2012 14:56

July 27, 2012

GDP rose 1.5% in Q-II. This was better than&nbs...

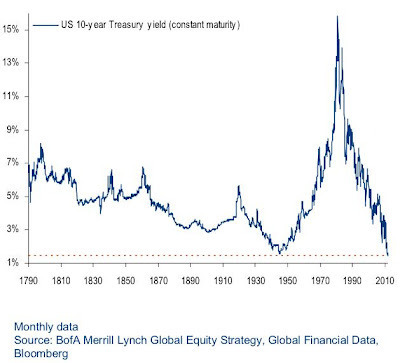

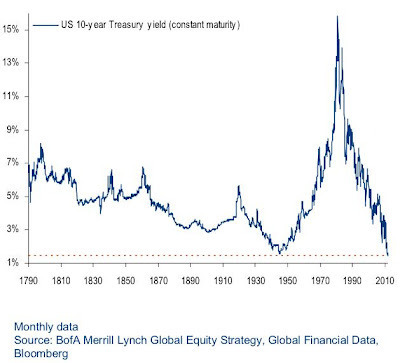

GDP rose 1.5% in Q-II. This was better than expected. The Bloomberg survey of 82 economists produced a median expectation of 1.4%. A small improvement to be sure, but enough to help keep this stock market rally on track.

http://www.bloomberg.com/news/2012-07-27/economy-in-u-s-grows-at-1-5-rate-as-consumer-spending-cooled.html

Several indicators suggest more strength in equities. This may continue to be an opportunity to add to stocks.

The VIX has started a downward trend.Quality spreads are narrowing.Interest rates are at a 300-year low. These low interest rates are good for business and the stock market.Buy Timing the Market at Amazon.com

These low interest rates are good for business and the stock market.Buy Timing the Market at Amazon.com

http://www.bloomberg.com/news/2012-07-27/economy-in-u-s-grows-at-1-5-rate-as-consumer-spending-cooled.html

Several indicators suggest more strength in equities. This may continue to be an opportunity to add to stocks.

The VIX has started a downward trend.Quality spreads are narrowing.Interest rates are at a 300-year low.

These low interest rates are good for business and the stock market.Buy Timing the Market at Amazon.com

These low interest rates are good for business and the stock market.Buy Timing the Market at Amazon.com

Published on July 27, 2012 07:13

July 24, 2012

More good news on housing that may add steam to our econo...

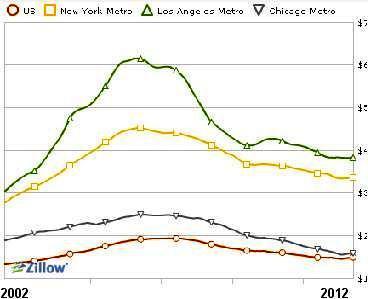

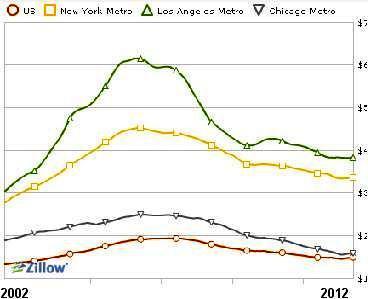

More good news on housing that may add steam to our economy. This is also good news for equities. Market declines such as we are experiencing may be good buying opportunities. Let the VIX start coming down before commiting funds.

In addition to the increase in the Case-Shiller Index, the real estate website Zillow sees improved home prices.

http://www.marketwatch.com/story/home-prices-reach-a-bottom-zillow-2012-07-24

Zillow economist, Stan Humphries, says that year-over-year prices rose 0.2% last spring. This was the first annual increase since 2007. He expects a 1.1% increase next year.

The Zillow Home Value Index measures 156 markets - or 3/4 of all US homes. Case-Shiller measures property values in ten major US cities. For more detail on the construction of these indices, see the Zillow website. http://www.zillow.com/wikipages/Zillow-Home-Value-Index-vs-FHFA-and-Case-Shiller/

Buy Timing the Market at Amazon.com

In addition to the increase in the Case-Shiller Index, the real estate website Zillow sees improved home prices.

http://www.marketwatch.com/story/home-prices-reach-a-bottom-zillow-2012-07-24

Zillow economist, Stan Humphries, says that year-over-year prices rose 0.2% last spring. This was the first annual increase since 2007. He expects a 1.1% increase next year.

The Zillow Home Value Index measures 156 markets - or 3/4 of all US homes. Case-Shiller measures property values in ten major US cities. For more detail on the construction of these indices, see the Zillow website. http://www.zillow.com/wikipages/Zillow-Home-Value-Index-vs-FHFA-and-Case-Shiller/

Buy Timing the Market at Amazon.com

Published on July 24, 2012 08:45

July 17, 2012

Investors have been waiting for the housing market to pic...

Investors have been waiting for the housing market to pick up in order to add one more driver to economic growth. New homes require new appliances and furnishings - to say nothing of the investment in higher insurance. Then there are the parties to celebrate the new status in life!

The Case-Shiller Housing Index should make investors happy.

This index shows a year-to-date increase; 19 of the 20 cities in this index had higher home prices. Here's the monthly data:

Date Index

April 30, 2012: 138.55

Mar. 31, 2012: 137.63

Feb. 29, 2012: 136.63

Jan. 31, 2012: 136.49

Source: http://ycharts.com/indicators/case_shiller_home_price_index_composite_20Buy Timing the Market at Amazon.com

The Case-Shiller Housing Index should make investors happy.

This index shows a year-to-date increase; 19 of the 20 cities in this index had higher home prices. Here's the monthly data:

Date Index

April 30, 2012: 138.55

Mar. 31, 2012: 137.63

Feb. 29, 2012: 136.63

Jan. 31, 2012: 136.49

Source: http://ycharts.com/indicators/case_shiller_home_price_index_composite_20Buy Timing the Market at Amazon.com

Published on July 17, 2012 12:06

July 11, 2012

The stock market is overlooking some good news in the eco...

The stock market is overlooking some good news in the economy:

Unemployment is a little lowerAutomobile sales are higherRail car loads are at a five-year peakLower oil prices should create more discretionary income [image error] This last item is a game-changer. As we unearth our shale gas and oil, energy prices will trend lower for many years. More domestic energy should reduce our dependence on the Middle East. We may become less involved in their politics - which may reduce our federal spending in that area.

This graph courtesy of InflationData.com http://inflationdata.com/inflation/inflation_rate/Historical_Oil_Prices_Chart.asp

This may be an opportunity to add stocks to your portfolio.Buy Timing the Market at Amazon.com

Unemployment is a little lowerAutomobile sales are higherRail car loads are at a five-year peakLower oil prices should create more discretionary income [image error] This last item is a game-changer. As we unearth our shale gas and oil, energy prices will trend lower for many years. More domestic energy should reduce our dependence on the Middle East. We may become less involved in their politics - which may reduce our federal spending in that area.

This graph courtesy of InflationData.com http://inflationdata.com/inflation/inflation_rate/Historical_Oil_Prices_Chart.asp

This may be an opportunity to add stocks to your portfolio.Buy Timing the Market at Amazon.com

Published on July 11, 2012 12:54