Deborah Weir's Blog, page 10

May 14, 2012

The yield on the US ten-year note keeps dropping. Today i...

The yield on the US ten-year note keeps dropping. Today it's trading around 1.74% - a new low for that number. In addition to the Fed's "operation twist" that buys these notes to keep mortgage rates low, investors are avoiding risk and buying these securities.

The intra-day spread of this instrument over the three-month bill is only 1.67%, or 167 basis points. Banks need a wider spread than this to make much money.

Jamie Dimon at JPMorgan and Ben Bernanke the Fed are probably having a little chat about the situation right now...

There's probably a great buying opportunity ahead for equities, we may want to keep our cash on the sidelines until it appears.Buy Timing the Market at Amazon.com

The intra-day spread of this instrument over the three-month bill is only 1.67%, or 167 basis points. Banks need a wider spread than this to make much money.

Jamie Dimon at JPMorgan and Ben Bernanke the Fed are probably having a little chat about the situation right now...

There's probably a great buying opportunity ahead for equities, we may want to keep our cash on the sidelines until it appears.Buy Timing the Market at Amazon.com

Published on May 14, 2012 09:29

May 8, 2012

The moving average convergence/divergence line (MACD) has...

The moving average convergence/divergence line (MACD) has turned down with a vengance.

The depth of this decline is usually the result of pent-up selling. Although some economic data is strong, investors may want to preserve cash until confidence returns to the markets.Buy Timing the Market at Amazon.com

The depth of this decline is usually the result of pent-up selling. Although some economic data is strong, investors may want to preserve cash until confidence returns to the markets.Buy Timing the Market at Amazon.com

Published on May 08, 2012 10:13

May 3, 2012

This equity market weakness shouldn't last too long. Sign...

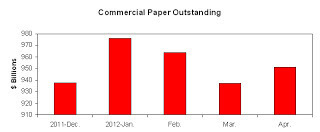

This equity market weakness shouldn't last too long. Signs of strength are building in the commercial paper market.

Not only is the volume of paper increasing, but the yield curve is positive. Businesses must have a good reason to add to their cash reserves...such as an optimistic outlook for increasing sales. Buy Timing the Market at Amazon.com

Not only is the volume of paper increasing, but the yield curve is positive. Businesses must have a good reason to add to their cash reserves...such as an optimistic outlook for increasing sales. Buy Timing the Market at Amazon.com

Not only is the volume of paper increasing, but the yield curve is positive. Businesses must have a good reason to add to their cash reserves...such as an optimistic outlook for increasing sales. Buy Timing the Market at Amazon.com

Not only is the volume of paper increasing, but the yield curve is positive. Businesses must have a good reason to add to their cash reserves...such as an optimistic outlook for increasing sales. Buy Timing the Market at Amazon.com

Published on May 03, 2012 11:29

May 1, 2012

Eurasia Group thinks that the "golden age of gas" energy ...

Eurasia Group thinks that the "golden age of gas" energy will come with "golden rules" that will limit the investment potential of this new era in energy production.

Another set of investment ideas is on the Internet at http://www.investorplace.com/2012/05/3-funds-riding-trends-you-can-bank-on/

The author, Kyle Woodley - Assistant Editor of InvestorPlace.com, likes the growing trends in computer chips (found in almost everything we buy), cloud computing (growing at 60+% annually) and gaming (addictive).

The author, Kyle Woodley - Assistant Editor of InvestorPlace.com, likes the growing trends in computer chips (found in almost everything we buy), cloud computing (growing at 60+% annually) and gaming (addictive).

Buy Timing the Market at Amazon.com

Another set of investment ideas is on the Internet at http://www.investorplace.com/2012/05/3-funds-riding-trends-you-can-bank-on/

The author, Kyle Woodley - Assistant Editor of InvestorPlace.com, likes the growing trends in computer chips (found in almost everything we buy), cloud computing (growing at 60+% annually) and gaming (addictive).

The author, Kyle Woodley - Assistant Editor of InvestorPlace.com, likes the growing trends in computer chips (found in almost everything we buy), cloud computing (growing at 60+% annually) and gaming (addictive).Buy Timing the Market at Amazon.com

Published on May 01, 2012 07:07

April 30, 2012

The yield curve is flatter than it has been since the end...

The yield curve is flatter than it has been since the end of February. The 3-mo./10-yr. spread is only 184 basis points. The VIX reflects investors' fear and is a little higher today at 17.

The markets are still worried about problems in the Eurozone. Investors should read the comforting outlook for the Euro on Eurasia Group's website - where the issue is considered a "red herring" and "the single most overrated risk of 2012."

http://www.eurasiagroup.net/media-center/view-press-release/Eurasia+Group+publishes+Top+Risks+for+2012

http://www.eurasiagroup.net/media-center/view-press-release/Eurasia+Group+publishes+Top+Risks+for+2012

Therefore, when this minor downturn in equities is behind us, the market should continue its plodding uptrend.

Buy Timing the Market at Amazon.com

The markets are still worried about problems in the Eurozone. Investors should read the comforting outlook for the Euro on Eurasia Group's website - where the issue is considered a "red herring" and "the single most overrated risk of 2012."

http://www.eurasiagroup.net/media-center/view-press-release/Eurasia+Group+publishes+Top+Risks+for+2012

http://www.eurasiagroup.net/media-center/view-press-release/Eurasia+Group+publishes+Top+Risks+for+2012Therefore, when this minor downturn in equities is behind us, the market should continue its plodding uptrend.

Buy Timing the Market at Amazon.com

Published on April 30, 2012 12:01

April 25, 2012

For a glimpse into the future, read the article in "The E...

For a glimpse into the future, read the article in "The Economist" magazine describing the next industrial revolution. http://www.economist.com/node/21553017

The future of manufacturing may increase US output by $20 billion - $55 billion annually, improve working conditions, and benefit society. Buy Timing the Market at Amazon.com

The future of manufacturing may increase US output by $20 billion - $55 billion annually, improve working conditions, and benefit society. Buy Timing the Market at Amazon.com

Published on April 25, 2012 09:06

April 23, 2012

This stock market volatility is reminiscent of last fall ...

This stock market volatility is reminiscent of last fall - even the issues are the same!

The bond market still points to lower S&P prices over the near term. The strengthening US economy may put an end to this volatility soon and allow the rally to continue.Buy Timing the Market at Amazon.com

The bond market still points to lower S&P prices over the near term. The strengthening US economy may put an end to this volatility soon and allow the rally to continue.Buy Timing the Market at Amazon.com

Published on April 23, 2012 14:57

April 13, 2012

Investors continue to take money out of equities and buy ...

Investors continue to take money out of equities and buy bonds. The US Treasury 10-year note yields less than 2% yet still attracts new money. Don't people know that these historically-low rates can't last forever?

As Dave Glen, CFP, CFA at Boston Private Bank and Trust writes, "... a tiny 25 basis point rise in interest rates (next year implies a) capital loss of 2% which will negate the coupon income for the entire year."

http://randomglenings.blogspot.com/

This asset re-allocation cannot last much longer. Have hope that this minor correction will be shallow and brief. Wait for bond quality spreads to narrow - and then buy equities like there's no tomorrow!

Buy Timing the Market at Amazon.com

As Dave Glen, CFP, CFA at Boston Private Bank and Trust writes, "... a tiny 25 basis point rise in interest rates (next year implies a) capital loss of 2% which will negate the coupon income for the entire year."

http://randomglenings.blogspot.com/

This asset re-allocation cannot last much longer. Have hope that this minor correction will be shallow and brief. Wait for bond quality spreads to narrow - and then buy equities like there's no tomorrow!

Buy Timing the Market at Amazon.com

Published on April 13, 2012 14:23

April 6, 2012

More signs of trouble...Reuters news flash: "Americans br...

More signs of trouble...

Reuters news flash: "Americans brace for next foreclosure wave"

Foreclosures were delayed during bank investigations. Now those old problems are ready to resurface.

This time, ordinary people with regular mortgages may be foreclosed. These folks are falling behind in payments as the slow economy puts pressure on their finances.

This article highlights problems in Ohio such as those of this trucker.

http://www.reuters.com/article/2012/04/04/us-foreclosure-idUSBRE83319E20120404Buy Timing the Market at Amazon.com

http://www.reuters.com/article/2012/04/04/us-foreclosure-idUSBRE83319E20120404Buy Timing the Market at Amazon.com

Reuters news flash: "Americans brace for next foreclosure wave"

Foreclosures were delayed during bank investigations. Now those old problems are ready to resurface.

This time, ordinary people with regular mortgages may be foreclosed. These folks are falling behind in payments as the slow economy puts pressure on their finances.

This article highlights problems in Ohio such as those of this trucker.

http://www.reuters.com/article/2012/04/04/us-foreclosure-idUSBRE83319E20120404Buy Timing the Market at Amazon.com

http://www.reuters.com/article/2012/04/04/us-foreclosure-idUSBRE83319E20120404Buy Timing the Market at Amazon.com

Published on April 06, 2012 10:56

April 3, 2012

The treasury yield curve, from three months to ten years,...

The treasury yield curve, from three months to ten years, continues to become flatter. Quality spreads continue to increase. Now the VIX, that measure of fear, is on the rise. All point to a bit of a correction in equities.

The strengthening economy, however, should put this stock market rally back on track before too long. Look for opportunities to buy.Buy Timing the Market at Amazon.com

The strengthening economy, however, should put this stock market rally back on track before too long. Look for opportunities to buy.Buy Timing the Market at Amazon.com

Published on April 03, 2012 09:11