Deborah Weir's Blog, page 5

October 15, 2013

The swap market has priced in a 2% probability of a gover...

The swap market has priced in a 2% probability of a government default. The market is lower today on no new news. Yet, 28 of the Dow 30 fell. This is a good indication of an overreaction to fear, and it is a signal to buy stocks.Buy Timing the Market at Amazon.com

Published on October 15, 2013 13:18

October 9, 2013

We may be near the bottom of the stock market decline.&nb...

We may be near the bottom of the stock market decline.

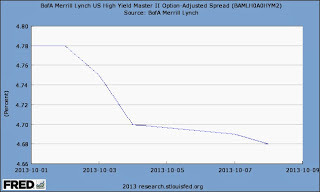

Credit spreads measure investors' risk tolerance. This indicator is particularly powerful when it differs from movements in the equity market. Over the last few days, the stock market has declined while credit spreads show investors taking on MORE risk. Narrower spreads, as in the graph below, are the result of fixed-income investors leaving the safety of US government ten-year notes and buying riskier junk bonds.

This may be a time to add risk in the form of equity exposure to your portfolio. Perhaps the conversation in Washington is moving toward re-opening the government and avoiding a default on our bonds.

Graph courtesy of the Federal Reserve Bank of St. Louis.

http://research.stlouisfed.org/fred2/graph/?id=BAMLH0A0HYM2Buy Timing the Market at Amazon.com

Credit spreads measure investors' risk tolerance. This indicator is particularly powerful when it differs from movements in the equity market. Over the last few days, the stock market has declined while credit spreads show investors taking on MORE risk. Narrower spreads, as in the graph below, are the result of fixed-income investors leaving the safety of US government ten-year notes and buying riskier junk bonds.

This may be a time to add risk in the form of equity exposure to your portfolio. Perhaps the conversation in Washington is moving toward re-opening the government and avoiding a default on our bonds.

Graph courtesy of the Federal Reserve Bank of St. Louis.

http://research.stlouisfed.org/fred2/graph/?id=BAMLH0A0HYM2Buy Timing the Market at Amazon.com

Published on October 09, 2013 11:40

September 18, 2013

Now that the Fed has committed to continue buying $85 bil...

Now that the Fed has committed to continue buying $85 billion every month, when will we see the next buying opportunity?

Keep an eye out for bargains in mid-October when the media focuses on the debt ceiling and potential shutdown of the US government.

Business Insider reported on Sept. 16, 2013 that this could get ugly. http://finance.yahoo.com/news/obama-adviser-last-debt-ceiling-133000155.html;_ylt=A2KJ3Cac_jlSJVcAtliTmYlQ The emphasis below is mine.

Business Insider reported on Sept. 16, 2013 that this could get ugly. http://finance.yahoo.com/news/obama-adviser-last-debt-ceiling-133000155.html;_ylt=A2KJ3Cac_jlSJVcAtliTmYlQ The emphasis below is mine.

"Gene Sperling, the director of the National Economic Council at the White House, told reporters on a conference call that, according to business leaders who have shared their thoughts with the White House, the 2011 debate over raising the debt ceiling hurt consumer confidence on a level comparable with 'Pearl Harbor or 9/11.'"Buy Timing the Market at Amazon.com

Keep an eye out for bargains in mid-October when the media focuses on the debt ceiling and potential shutdown of the US government.

Business Insider reported on Sept. 16, 2013 that this could get ugly. http://finance.yahoo.com/news/obama-adviser-last-debt-ceiling-133000155.html;_ylt=A2KJ3Cac_jlSJVcAtliTmYlQ The emphasis below is mine.

Business Insider reported on Sept. 16, 2013 that this could get ugly. http://finance.yahoo.com/news/obama-adviser-last-debt-ceiling-133000155.html;_ylt=A2KJ3Cac_jlSJVcAtliTmYlQ The emphasis below is mine."Gene Sperling, the director of the National Economic Council at the White House, told reporters on a conference call that, according to business leaders who have shared their thoughts with the White House, the 2011 debate over raising the debt ceiling hurt consumer confidence on a level comparable with 'Pearl Harbor or 9/11.'"Buy Timing the Market at Amazon.com

Published on September 18, 2013 12:45

September 13, 2013

Here is another reason for the Fed to continue its curren...

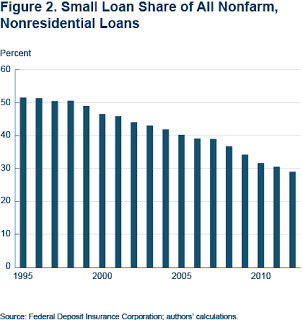

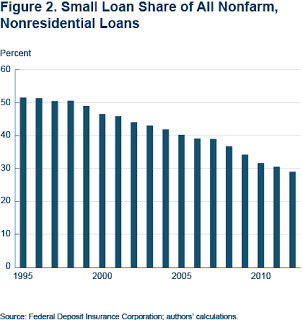

Here is another reason for the Fed to continue its current policy of monetary ease. Small businesses are the engine of job creation, but banks continue to decrease lending to this sector.

This disturbing graph is available in the Cleveland Fed's "Economic Commentary" by Ann Marie Wiersch and Scott Shane.Buy Timing the Market at Amazon.com

This disturbing graph is available in the Cleveland Fed's "Economic Commentary" by Ann Marie Wiersch and Scott Shane.Buy Timing the Market at Amazon.com

Published on September 13, 2013 07:10

August 23, 2013

The Federal Reserve may not "taper" for a long time. For ...

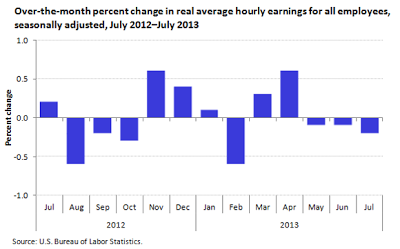

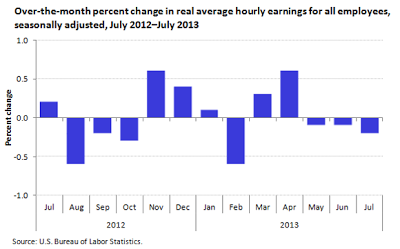

The Federal Reserve may not "taper" for a long time. For the past three months, earnings adjusted for inflation have been declining according to the Bureau of Labor Statistics.

The Fed will probably keep buying securities until this graph turns positive again.

http://www.bls.gov/opub/ted/2013/ted_20130819.htmBuy Timing the Market at Amazon.com

The Fed will probably keep buying securities until this graph turns positive again.

http://www.bls.gov/opub/ted/2013/ted_20130819.htmBuy Timing the Market at Amazon.com

Published on August 23, 2013 14:46

August 16, 2013

Stocks are down about 3% during the last 30 days, but thi...

Stocks are down about 3% during the last 30 days, but this may be one of our only opportunities to add to equities this summer.

Fundamental economic analysis supports this decision:

Fundamental economic analysis supports this decision:

1. The yield curve is steeper in anticipation of a stronger economy ahead.

2. Bond credit spreads are narrower as investors take on more risk in the fixed-income market. Equities usually follow the lead of this larger and deeper market.

3. Twenty-nine of the Dow 30 fell yesterday as investors sold indiscriminately.

Buy Timing the Market at Amazon.com

Fundamental economic analysis supports this decision:

Fundamental economic analysis supports this decision:1. The yield curve is steeper in anticipation of a stronger economy ahead.

2. Bond credit spreads are narrower as investors take on more risk in the fixed-income market. Equities usually follow the lead of this larger and deeper market.

3. Twenty-nine of the Dow 30 fell yesterday as investors sold indiscriminately.

Buy Timing the Market at Amazon.com

Published on August 16, 2013 07:35

July 10, 2013

My July 8 presentation at the New York Institute of Finan...

My July 8 presentation at the New York Institute of Finance, "Introduction to Wealth Management," is available. It provides links to free websites so you can update the information in real time.

Leave a comment with your email address to receive your copy.

Leave a comment with your email address to receive your copy.

Buy Timing the Market at Amazon.com

Leave a comment with your email address to receive your copy.

Leave a comment with your email address to receive your copy.Buy Timing the Market at Amazon.com

Published on July 10, 2013 08:19

July 9, 2013

The equity markets may see prices decline a little in the...

The equity markets may see prices decline a little in the next few days.

The spread between high-quality bonds and junk bonds has been wider this week. Fixed-income investors are selling high-yield securities and buying US government bonds for safety. The stock market usually follows the lead of the bond market.

Stock may decline and present another opportunity to add to your equity portfolio.

Buy Timing the Market at Amazon.com

The spread between high-quality bonds and junk bonds has been wider this week. Fixed-income investors are selling high-yield securities and buying US government bonds for safety. The stock market usually follows the lead of the bond market.

Stock may decline and present another opportunity to add to your equity portfolio.

Buy Timing the Market at Amazon.com

Published on July 09, 2013 14:47

June 24, 2013

Try not to panic.The Fed may practice taking money out of...

Try not to panic.

The Fed may practice taking money out of the system over the next few days. This is just a test - not an emergency.

"The New York Fed announced today that it intends to conduct a series of small-scale repurchase (repo) transactions in the near future with its Primary Dealers, using all eligible collateral types. Just like previous repo and reverse repo operational readiness exercises, this work is a matter of prudent advance planning by the Federal Reserve."

Buy Timing the Market at Amazon.com

The Fed may practice taking money out of the system over the next few days. This is just a test - not an emergency.

"The New York Fed announced today that it intends to conduct a series of small-scale repurchase (repo) transactions in the near future with its Primary Dealers, using all eligible collateral types. Just like previous repo and reverse repo operational readiness exercises, this work is a matter of prudent advance planning by the Federal Reserve."

Buy Timing the Market at Amazon.com

Published on June 24, 2013 08:24

June 20, 2013

All thirty of the Dow Industrials are down today. Investo...

All thirty of the Dow Industrials are down today. Investors are selling indiscriminately in their panic that Bernanke may provide less monetary ease if the economy is stronger next year.

1. We already knew that.

2. Obama fired Bernanke during the Charlie Rose show last Monday.

3. Bernanke won't be here next year to provide less monetary ease under ANY conditions.

Therefore, you may want to add equities to your portfolio.

Therefore, you may want to add equities to your portfolio.

Here is Charlie Rose's interview of Obama: http://bloom.bg/12Utu7kBuy Timing the Market at Amazon.com

1. We already knew that.

2. Obama fired Bernanke during the Charlie Rose show last Monday.

3. Bernanke won't be here next year to provide less monetary ease under ANY conditions.

Therefore, you may want to add equities to your portfolio.

Therefore, you may want to add equities to your portfolio.Here is Charlie Rose's interview of Obama: http://bloom.bg/12Utu7kBuy Timing the Market at Amazon.com

Published on June 20, 2013 11:28