Deborah Weir's Blog, page 7

January 30, 2013

For the last six months, investors have been fl...

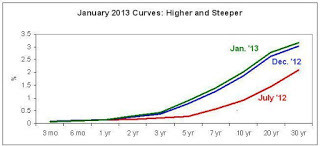

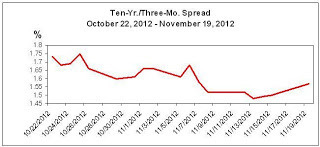

For the last six months, investors have been fleeing the ten-year note in favor of other assets. Much of that change has occured this month as indicated by the following graph.

Some of the cash went into equities. Some may have gone into hard assets such as real estate and gold. In any case, investors are redeploying money from Treasuries.

Some of the cash went into equities. Some may have gone into hard assets such as real estate and gold. In any case, investors are redeploying money from Treasuries.

Buy Timing the Market at Amazon.com

Some of the cash went into equities. Some may have gone into hard assets such as real estate and gold. In any case, investors are redeploying money from Treasuries.

Some of the cash went into equities. Some may have gone into hard assets such as real estate and gold. In any case, investors are redeploying money from Treasuries.Buy Timing the Market at Amazon.com

Published on January 30, 2013 10:51

January 3, 2013

New Benchmark

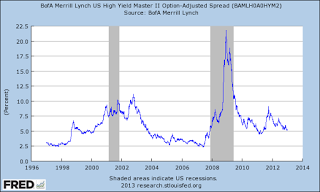

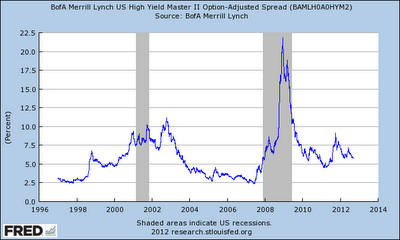

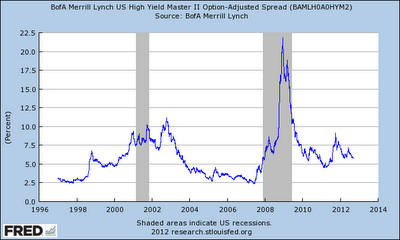

The Wall St. Journal website no longer publishes the Merrill Lynch High Yield Index as regularly as it did in the past.

This index is important because it measures changes in investors' risk tolerance. This is the difference between the yield on lower quality bonds and safer US treasuries. As investors take on more risk, this spread becomes smaller. The fixed-income market often moves ahead of equities, so you may get advance notice of movements in the S&P.

You may want a simple tool from the Federal Reserve Bank in St. Louis:

http://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

Select the option "Last five observations" to see the spreads you need. Today's data shows the spread narrowing from 5.31% to 5.16% as investors take on more risk.

2013-01-02: 5.16 Percent

2012-12-31: 5.31

2012-12-28: 5.30

2012-12-27: 5.28

2012-12-26: 5.24

Daily, Close, Not Seasonally Adjusted, Updated: 2013-01-03 9:28 AM CST

The Fed can deliver this information to you inbox every morning - at no charge. Just select "Notify Me" at the options on the left of the page.

Buy Timing the Market at Amazon.com

This index is important because it measures changes in investors' risk tolerance. This is the difference between the yield on lower quality bonds and safer US treasuries. As investors take on more risk, this spread becomes smaller. The fixed-income market often moves ahead of equities, so you may get advance notice of movements in the S&P.

You may want a simple tool from the Federal Reserve Bank in St. Louis:

http://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

Select the option "Last five observations" to see the spreads you need. Today's data shows the spread narrowing from 5.31% to 5.16% as investors take on more risk.

2013-01-02: 5.16 Percent

2012-12-31: 5.31

2012-12-28: 5.30

2012-12-27: 5.28

2012-12-26: 5.24

Daily, Close, Not Seasonally Adjusted, Updated: 2013-01-03 9:28 AM CST

The Fed can deliver this information to you inbox every morning - at no charge. Just select "Notify Me" at the options on the left of the page.

Buy Timing the Market at Amazon.com

Published on January 03, 2013 09:42

January 2, 2013

As expected, the fiscal cliff was really just a cliff-han...

As expected, the fiscal cliff was really just a cliff-hanger. Neither party in Congress could tolerate another recession - particularly an obvious recession that could be averted.

The markets are rejoicing and rewarding investors who had the courage to invest last month during the exteme concerns.

Credit spreads continue to forecast good news for equities. The only difficulty is that our usual benchmark, the Merrill Lynch High Yield Constrained Index, has been unavailable on the Internet.

http://online.wsj.com/mdc/public/page/2_3022-bondbnchmrk.html

We need to develop a backup indicator which I will present tomorrow.Buy Timing the Market at Amazon.com

The markets are rejoicing and rewarding investors who had the courage to invest last month during the exteme concerns.

Credit spreads continue to forecast good news for equities. The only difficulty is that our usual benchmark, the Merrill Lynch High Yield Constrained Index, has been unavailable on the Internet.

http://online.wsj.com/mdc/public/page/2_3022-bondbnchmrk.html

We need to develop a backup indicator which I will present tomorrow.Buy Timing the Market at Amazon.com

Published on January 02, 2013 09:45

December 21, 2012

The stock market may be down, but the fixed-income market...

The stock market may be down, but the fixed-income market suggests that there may be strength ahead. Bond investors are taking on more risk and shrinking the quality spread between high-yields and treasuries.

Another good sign is that 28 of the Dow 30 declined today. This usually happens when equity investors are selling good securities as well as bad. The stock market usually improves under such conditions.Buy Timing the Market at Amazon.com

Another good sign is that 28 of the Dow 30 declined today. This usually happens when equity investors are selling good securities as well as bad. The stock market usually improves under such conditions.Buy Timing the Market at Amazon.com

Published on December 21, 2012 15:57

November 30, 2012

Fiscal Pothole?

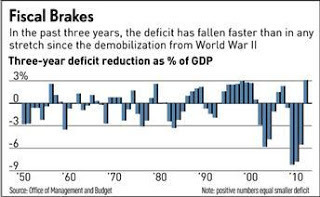

They said we couldn't grow our way out of the national deficit this time. This time it is different. The Great Recession created such a large deficit that we are peering over a "fiscal cliff."

But the Office of Management and Labor defies this thinking. Because of our (slowly) growing economy, our deficit is a smaller proportion of our national production.

Is the fiscal cliff just a pothole?Buy Timing the Market at Amazon.com

Is the fiscal cliff just a pothole?Buy Timing the Market at Amazon.com

But the Office of Management and Labor defies this thinking. Because of our (slowly) growing economy, our deficit is a smaller proportion of our national production.

Is the fiscal cliff just a pothole?Buy Timing the Market at Amazon.com

Is the fiscal cliff just a pothole?Buy Timing the Market at Amazon.com

Published on November 30, 2012 16:31

November 19, 2012

The direction of the equity market has changed. The bond ...

The direction of the equity market has changed. The bond market's optimism last week is being validated by today's equity investors.

The yield curve is steeper, and equity investors are buying again. Once again, the bond market took the lead and equities followed.Buy Timing the Market at Amazon.com

The yield curve is steeper, and equity investors are buying again. Once again, the bond market took the lead and equities followed.Buy Timing the Market at Amazon.com

The yield curve is steeper, and equity investors are buying again. Once again, the bond market took the lead and equities followed.Buy Timing the Market at Amazon.com

The yield curve is steeper, and equity investors are buying again. Once again, the bond market took the lead and equities followed.Buy Timing the Market at Amazon.com

Published on November 19, 2012 10:05

November 7, 2012

All thirty of the Dow Industrials are falling today. This...

All thirty of the Dow Industrials are falling today. This is usually a sign to buy equities. Some of the uncertainty is out of the market now that the election is over; this is one more reason to buy.

Here is a shopping list, courtesy of http://money.cnn.com/data/dow30/

MMM 3M Co

AA Alcoa Inc

AXP American Express Co

T AT&T Inc

BAC Bank of America Corp

BA Boeing Co

CAT Caterpillar Inc

CVX Chevron Corp

CSCO Cisco Systems Inc

DD E. I. du Pont de Nemours and Co

XOM Exxon Mobil Corp

GE General Electric Co

HPQ Hewlett-Packard Co

HD Home Depot Inc

INTC Intel Corp

IBM International Business Machines Co.

JNJ Johnson & Johnson

JPM JPMorgan Chase and Co

MCD McDonald's Corp

MRK Merck & Co Inc 44.48 -1.44 -3.14% 1,610,070 18.16%

MSFT Microsoft Corp

PFE Pfizer Inc

PG Procter & Gamble Co

KO The Coca-Cola Co

TRV Travelers Companies Inc

UTX United Technologies Corp

UNH UnitedHealth Group Inc

VZ Verizon Communications Inc

WMT Wal-Mart Stores Inc

DIS Walt Disney Co

Buy Timing the Market at Amazon.com

Here is a shopping list, courtesy of http://money.cnn.com/data/dow30/

MMM 3M Co

AA Alcoa Inc

AXP American Express Co

T AT&T Inc

BAC Bank of America Corp

BA Boeing Co

CAT Caterpillar Inc

CVX Chevron Corp

CSCO Cisco Systems Inc

DD E. I. du Pont de Nemours and Co

XOM Exxon Mobil Corp

GE General Electric Co

HPQ Hewlett-Packard Co

HD Home Depot Inc

INTC Intel Corp

IBM International Business Machines Co.

JNJ Johnson & Johnson

JPM JPMorgan Chase and Co

MCD McDonald's Corp

MRK Merck & Co Inc 44.48 -1.44 -3.14% 1,610,070 18.16%

MSFT Microsoft Corp

PFE Pfizer Inc

PG Procter & Gamble Co

KO The Coca-Cola Co

TRV Travelers Companies Inc

UTX United Technologies Corp

UNH UnitedHealth Group Inc

VZ Verizon Communications Inc

WMT Wal-Mart Stores Inc

DIS Walt Disney Co

Buy Timing the Market at Amazon.com

Published on November 07, 2012 11:46

October 12, 2012

The NY Institute of Finance requested an update of my boo...

The NY Institute of Finance requested an update of my book "Timing the Market" (John Wiley & Sons, 2005). They will publish each chapter as an article on their new blog: http://www.nyif.com/blog.html

The title of the first article is "A Forward-looking Investment Tool." The truth is that there is only one forward-looking tool; all of the others use historical price and/or accounting data.Buy Timing the Market at Amazon.com

The title of the first article is "A Forward-looking Investment Tool." The truth is that there is only one forward-looking tool; all of the others use historical price and/or accounting data.Buy Timing the Market at Amazon.com

Published on October 12, 2012 09:23

October 11, 2012

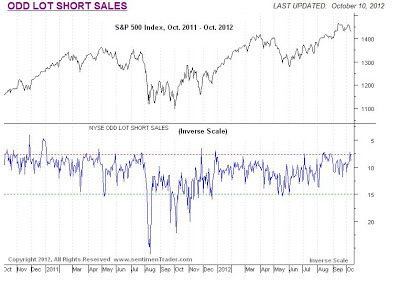

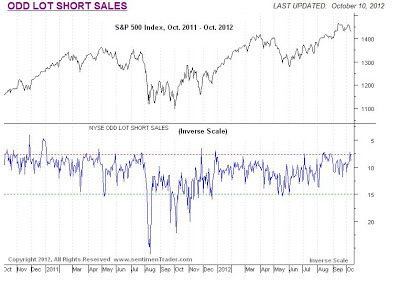

One indicator of investor sentiment is the volume of shor...

One indicator of investor sentiment is the volume of short sales by small investors. "Odd-lot shorts" usually decline just when the stock market is ready to rally. This graph from Sentiment Trader shows the negative correlation between the S&P and odd-lot traders. Now that these small traders are shorting the market, this correction may be over. http://www.sentimentrader.com/subscriber/charts/ODD_LOT_SHORTS.htm

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on October 11, 2012 07:56

September 10, 2012

The equity and fixed-income markets are in disagreement. ...

The equity and fixed-income markets are in disagreement. Stocks are lower, but bonds are registering investor confidence. Bond quality spreads are shrinking in anticipation of better times ahead. Here is the St. Louis Fed's graph of quality spreads.

Bonds usually forecast the stock market, so you can consider taking on more risk in your portfolio.Buy Timing the Market at Amazon.com

Bonds usually forecast the stock market, so you can consider taking on more risk in your portfolio.Buy Timing the Market at Amazon.com

Bonds usually forecast the stock market, so you can consider taking on more risk in your portfolio.Buy Timing the Market at Amazon.com

Bonds usually forecast the stock market, so you can consider taking on more risk in your portfolio.Buy Timing the Market at Amazon.com

Published on September 10, 2012 07:40