Deborah Weir's Blog, page 11

March 28, 2012

This past week, the yield curve has become flatter from t...

This past week, the yield curve has become flatter from three months to ten years. At the same time, bond quality spreads that measure investor confidence have registered fear in the marketplace. Equities, until today, have ingnored this bad news from the fixed-income market.

I think that people are finally taking capital gains in equities and locking their stellar year-to-date return. (Please see the Feb. 21 entry on this blog regarding the behavior of professional money managers at the end of the first quarter of the year.)

It might be a good idea to do likewise and re-invest after the end of this quarter.Buy Timing the Market at Amazon.com

I think that people are finally taking capital gains in equities and locking their stellar year-to-date return. (Please see the Feb. 21 entry on this blog regarding the behavior of professional money managers at the end of the first quarter of the year.)

It might be a good idea to do likewise and re-invest after the end of this quarter.Buy Timing the Market at Amazon.com

Published on March 28, 2012 11:10

March 23, 2012

Banks are lending again. Commercial and industrial loans ...

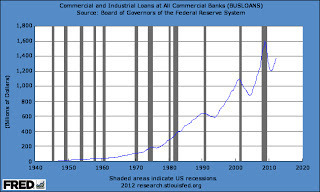

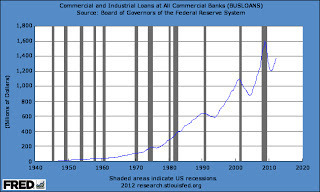

Banks are lending again. Commercial and industrial loans are increasing and will provide stimulus for the economy and the stock market. The struggling real estate market may benefit as new liquidity searches for inexpensive assets to buy.

The St. Louis branch of the Federal Reserve system produces clear graphs of economic indicators such as the one below. http://research.stlouisfed.org/fred2/series/BUSLOANS

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

The St. Louis branch of the Federal Reserve system produces clear graphs of economic indicators such as the one below. http://research.stlouisfed.org/fred2/series/BUSLOANS

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on March 23, 2012 09:26

March 14, 2012

You can now take my seminar in the comfort of your own ho...

You can now take my seminar in the comfort of your own home and at a much reduced price. The NY Institute of Finance has included the class on their e-learning platform. It will take place on July 10 from 8:00 - 9:30PM for an introductory price of $225. You can earn 1.5 CPE units.

http://nyif.com/courses/inve_1059.html

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

http://nyif.com/courses/inve_1059.html

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on March 14, 2012 10:06

March 12, 2012

The stock market rally may receive support from China. Th...

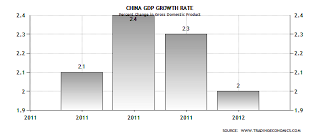

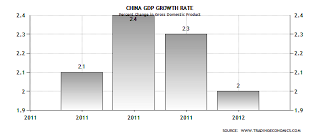

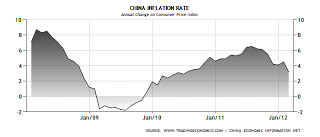

The stock market rally may receive support from China. This country's central bank may soon begin to lower interest rates to counter China's declining economy.

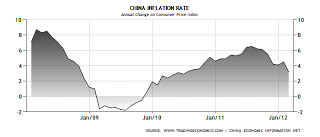

Inflation has abated in that country and provides less reason for high interest rates there.

Inflation has abated in that country and provides less reason for high interest rates there.

The People's Bank of China (PBOC) has cut its reserve requirements for Chinese banks while the country's exports have weakened.

The People's Bank of China (PBOC) has cut its reserve requirements for Chinese banks while the country's exports have weakened.

This cut in required reserves comes at a time when Western central banks are pausing to assess their recent monetary expansion. Further monetary expansion may come from the PBOC. To the extent that such expansion moves money into the stock market, China could provide fuel for this rally.

This cut in required reserves comes at a time when Western central banks are pausing to assess their recent monetary expansion. Further monetary expansion may come from the PBOC. To the extent that such expansion moves money into the stock market, China could provide fuel for this rally.

Trading Economics has great data and graphs: http://www.tradingeconomics.com/china/indicatorsBuy Timing the Market at Amazon.com

Inflation has abated in that country and provides less reason for high interest rates there.

Inflation has abated in that country and provides less reason for high interest rates there.

The People's Bank of China (PBOC) has cut its reserve requirements for Chinese banks while the country's exports have weakened.

The People's Bank of China (PBOC) has cut its reserve requirements for Chinese banks while the country's exports have weakened.  This cut in required reserves comes at a time when Western central banks are pausing to assess their recent monetary expansion. Further monetary expansion may come from the PBOC. To the extent that such expansion moves money into the stock market, China could provide fuel for this rally.

This cut in required reserves comes at a time when Western central banks are pausing to assess their recent monetary expansion. Further monetary expansion may come from the PBOC. To the extent that such expansion moves money into the stock market, China could provide fuel for this rally.Trading Economics has great data and graphs: http://www.tradingeconomics.com/china/indicatorsBuy Timing the Market at Amazon.com

Published on March 12, 2012 14:03

March 7, 2012

This rally could extend for awhile now that a modest stoc...

This rally could extend for awhile now that a modest stock market adjustment has occurred.

On Feb. 21st, I suggested that professional money managers may start selling stocks. Many pension funds have a required return of about 8%. Their managers may have sold stocks recently to convert their paper profits into real cash profits. These same managers probably want to participate in any rally resulting from stronger US economic data such as improved employment and a better housing market.

European problems will persist, but Europe is a smaller economic force than in the past. For example, Brazil has just surpassed the UK as the world's sixth largest economy. Please see the article in "The Guardian" newspaper. http://www.guardian.co.uk/business/2012/mar/06/brazil-economy-worlds-sixth-largest?newsfeed=true

You can stay on top of great economic reporting, such as this article from "The Guardian," by subscribing to the CFA Institute's Financial NewsBrief. It's free to the public. https://www.smartbrief.com/cfa/index.jspBuy Timing the Market at Amazon.com

Published on March 07, 2012 08:57

February 29, 2012

Another sign of economic recovery - banks are stronger th...

Another sign of economic recovery - banks are stronger than in the past few years. Last year's earnings increased 40% and are the highest since 2006. Granted, most of these earnings came from taking back reserves for loan losses, but it's still good news for the banking system.

Details at: GARP - StoryBuy Timing the Market at Amazon.com

Details at: GARP - StoryBuy Timing the Market at Amazon.com

Published on February 29, 2012 09:15

February 28, 2012

The Fed's announcement to keep interest rates low until 2...

The Fed's announcement to keep interest rates low until 2014 just happens to coincide with the end of Chairman Bernanke's term in office...and his possible re-appointment. See the article by Subodh Kumar, CFA for details. https://twitter.com/#!/subokumarBuy Timing the Market at Amazon.com

Published on February 28, 2012 15:36

February 24, 2012

History suggests that this stock market rally could last ...

History suggests that this stock market rally could last another two years. Zacks Research provides data on previous DJIA increases for the five years following a crash. This rally could run from 2009 to 2014.

http://seekingalpha.com/article/386511-our-5-year-s-p-1500-and-sector-forecast?source=email_macro_view&ifp=1Buy Timing the Market at Amazon.com

http://seekingalpha.com/article/386511-our-5-year-s-p-1500-and-sector-forecast?source=email_macro_view&ifp=1Buy Timing the Market at Amazon.com

http://seekingalpha.com/article/386511-our-5-year-s-p-1500-and-sector-forecast?source=email_macro_view&ifp=1Buy Timing the Market at Amazon.com

http://seekingalpha.com/article/386511-our-5-year-s-p-1500-and-sector-forecast?source=email_macro_view&ifp=1Buy Timing the Market at Amazon.com

Published on February 24, 2012 10:05

February 21, 2012

Professional money managers may be writing up some "sell"...

Professional money managers may be writing up some "sell" tickets.

They have a history of selling stocks if the market increases 10% by the end of Q-I. That's the long-term expectation for equities - per year. If managers have achieved that benchmark return by March 31, they often sell stocks to lock in their gains. The S&P is already up over 8% this year...

Buy Timing the Market at Amazon.com

They have a history of selling stocks if the market increases 10% by the end of Q-I. That's the long-term expectation for equities - per year. If managers have achieved that benchmark return by March 31, they often sell stocks to lock in their gains. The S&P is already up over 8% this year...

Buy Timing the Market at Amazon.com

Published on February 21, 2012 10:10

February 17, 2012

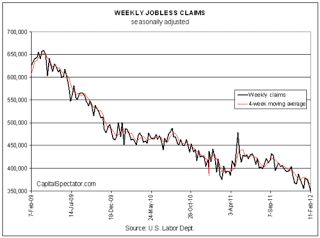

Good news for the stock market keeps rolling in. Jobless ...

Good news for the stock market keeps rolling in. Jobless claims are at a four-year low as described in James Picarno's article. http://seekingalpha.com/article/371841-jobless-claims-fall-again-to-a-new-4-year-low?source=email_macro_view&ifp=1 Mr. Picarno's graph tells it all.

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on February 17, 2012 07:47