Deborah Weir's Blog, page 9

July 6, 2012

London Interbank Borrowing Rate (LIBOR) is just an estima...

London Interbank Borrowing Rate (LIBOR) is just an estimate of the cost of money. The 18 largest banks in the UK submit this estimate every day to the British Bankers Association (BBA). There may not be actual trades on which to base this interest rate.

Here's the definiton of the process provided by the Association; the emphasis is mine.

"Every contributor bank is asked to base their bbalibor submissions on the following question:

'At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?”

Therefore, submissions are based upon the lowest perceived rate at which a bank could go into the London interbank money market and obtain funding in reasonable market size, for a given maturity and currency.

bbalibor is not necessarily based on actual transactions, as not all banks will require funds in marketable size each day in each of the currencies/ maturities they quote and so it would not be feasible to create a suite of LIBOR rates if this was a requirement. However, a bank will know what its credit and liquidity risk profile is from rates at which it has dealt and can construct a curve to predict accurately the correct rate for currencies or maturities in which it has not been active.' "

http://www.bbalibor.com/bbalibor-explained/the-basicsBuy Timing the Market at Amazon.com

Here's the definiton of the process provided by the Association; the emphasis is mine.

"Every contributor bank is asked to base their bbalibor submissions on the following question:

'At what rate could you borrow funds, were you to do so by asking for and then accepting inter-bank offers in a reasonable market size just prior to 11 am?”

Therefore, submissions are based upon the lowest perceived rate at which a bank could go into the London interbank money market and obtain funding in reasonable market size, for a given maturity and currency.

bbalibor is not necessarily based on actual transactions, as not all banks will require funds in marketable size each day in each of the currencies/ maturities they quote and so it would not be feasible to create a suite of LIBOR rates if this was a requirement. However, a bank will know what its credit and liquidity risk profile is from rates at which it has dealt and can construct a curve to predict accurately the correct rate for currencies or maturities in which it has not been active.' "

http://www.bbalibor.com/bbalibor-explained/the-basicsBuy Timing the Market at Amazon.com

Published on July 06, 2012 09:02

June 21, 2012

Buy on these market dips. World not coming to end! Buy Ti...

Buy on these market dips. World not coming to end! Buy Timing the Market at Amazon.com

Published on June 21, 2012 08:42

June 19, 2012

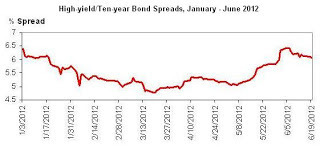

Fear is slipping away from the fixed-income market. ...

Fear is slipping away from the fixed-income market. Investors are taking on more risk by buying high-yield bonds. Increased prices drive yields down, and the spread of lower-quality bonds over ten-year treasuries collapses. Fixed-income investors, tired of historically low treasury yields, are buying riskier bonds.

Equity investors, too, can take advantage of this improved sentiment by adding risk to their portfolios. This can take the form of adding to equities from cash positions. Another strategy could be moving into more volatile stocks with lower dividends that cushion the price.

Equity investors, too, can take advantage of this improved sentiment by adding risk to their portfolios. This can take the form of adding to equities from cash positions. Another strategy could be moving into more volatile stocks with lower dividends that cushion the price.

Buy Timing the Market at Amazon.com

Equity investors, too, can take advantage of this improved sentiment by adding risk to their portfolios. This can take the form of adding to equities from cash positions. Another strategy could be moving into more volatile stocks with lower dividends that cushion the price.

Equity investors, too, can take advantage of this improved sentiment by adding risk to their portfolios. This can take the form of adding to equities from cash positions. Another strategy could be moving into more volatile stocks with lower dividends that cushion the price. Buy Timing the Market at Amazon.com

Published on June 19, 2012 11:31

June 14, 2012

I will teach a webinar based on my book TIMING THE MARKET...

I will teach a webinar based on my book TIMING THE MARKET (Wiley & Sons) for the NY Institute of Finance on Tuesday, July 10th from 8:00 - 9:30pm. This tactical asset allocation seminar is available to the public for $225. The institute is a division of Pearson Publishing in London which owns the Financial Times newspaper and The Economist magazine. http://www.nyif.com/courses/inve_1059.html

In this 90-minute, hands-on computer workshop, you will go on the Internet to collect free data and solve that critical portfolio decision - asset allocation.

In this 90-minute, hands-on computer workshop, you will go on the Internet to collect free data and solve that critical portfolio decision - asset allocation.

You will learn when to invest in the major asset classes: equities, bonds and hard assets. Free on-line information and specific benchmarks help you to identify turning points in the economy that require moving from one asset class to another.

No math is involved in this experience.

Buy Timing the Market at Amazon.com

In this 90-minute, hands-on computer workshop, you will go on the Internet to collect free data and solve that critical portfolio decision - asset allocation.

In this 90-minute, hands-on computer workshop, you will go on the Internet to collect free data and solve that critical portfolio decision - asset allocation.You will learn when to invest in the major asset classes: equities, bonds and hard assets. Free on-line information and specific benchmarks help you to identify turning points in the economy that require moving from one asset class to another.

No math is involved in this experience.

Buy Timing the Market at Amazon.com

Published on June 14, 2012 10:43

June 13, 2012

The German bond market is in disarray. Government bond yi...

The German bond market is in disarray. Government bond yields are low as investors flock to safe securities. But credit spreads are high - indicating fear. It doesn't add up.

http://www.forexpros.com/analysis/german-sovereign-cds-widening-is-a-troubling-sign-126196

http://www.forexpros.com/analysis/german-sovereign-cds-widening-is-a-troubling-sign-126196

The bottom line, according to the article on FX Solutions, is that Germany's cost of a failed Euro would dwarf that of the unification of Germany many years ago.Buy Timing the Market at Amazon.com

http://www.forexpros.com/analysis/german-sovereign-cds-widening-is-a-troubling-sign-126196

http://www.forexpros.com/analysis/german-sovereign-cds-widening-is-a-troubling-sign-126196The bottom line, according to the article on FX Solutions, is that Germany's cost of a failed Euro would dwarf that of the unification of Germany many years ago.Buy Timing the Market at Amazon.com

Published on June 13, 2012 11:07

June 4, 2012

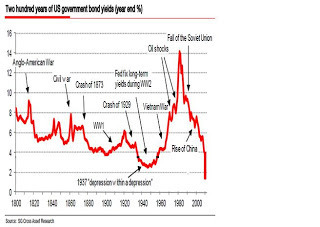

Treasury yields are the lowest in 200 years. Leverage Aca...

Treasury yields are the lowest in 200 years. Leverage Academy's blog has a graph. http://leverageacademy.com/blog/2011/03/04/200-years-of-u-s-treasury-yields-short-the-30-year-ticker-tmv/ I updated it for this year.

Soon, investors will start buying equities in order to increase the yields in their portfolios. Watch the spread of high-yield bonds over treasuries for a signal. When this spread starts to narrow, investors may be tiring of fear and swinging back to greed.Buy Timing the Market at Amazon.com

Soon, investors will start buying equities in order to increase the yields in their portfolios. Watch the spread of high-yield bonds over treasuries for a signal. When this spread starts to narrow, investors may be tiring of fear and swinging back to greed.Buy Timing the Market at Amazon.com

Soon, investors will start buying equities in order to increase the yields in their portfolios. Watch the spread of high-yield bonds over treasuries for a signal. When this spread starts to narrow, investors may be tiring of fear and swinging back to greed.Buy Timing the Market at Amazon.com

Soon, investors will start buying equities in order to increase the yields in their portfolios. Watch the spread of high-yield bonds over treasuries for a signal. When this spread starts to narrow, investors may be tiring of fear and swinging back to greed.Buy Timing the Market at Amazon.com

Published on June 04, 2012 14:27

June 1, 2012

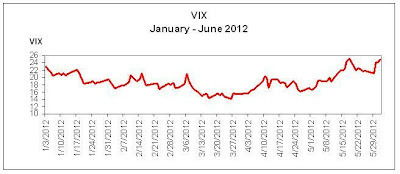

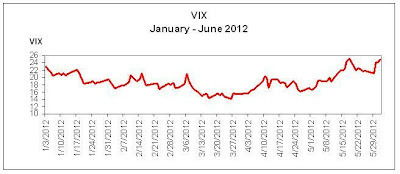

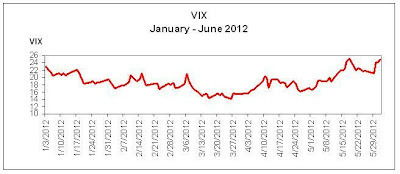

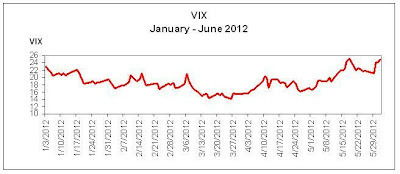

A five-percent increase in the VIX today is unnerving. Wh...

A five-percent increase in the VIX today is unnerving.

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

Published on June 01, 2012 15:23

A ten-percent increase in the VIX today is unnerving. Whe...

A ten-percent increase in the VIX today is unnerving.

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

When this excessive fear subsides, there will be bargains in the stock market. Buy Timing the Market at Amazon.com

Published on June 01, 2012 15:23

May 30, 2012

The underlying fundamentals driving our economy are still...

The underlying fundamentals driving our economy are still in descent shape: nine out of ten people in the workforce are employed and firms are highly profitable.

The concers about Greece, Spain and Ireland may be over-rated.

On a day like this, when all 30 of the Dow Jones Industrials are down, it is usually a good time to buy equities. This graph from Google.com indicates that we may be getting confirmation from the MACD line. Notice that it's ready to cross and move up.

With the ten-year Treasury note yielding 1.62%, investors will be forced into stocks in order to generate a yield for their portfolios. Buy Timing the Market at Amazon.com

With the ten-year Treasury note yielding 1.62%, investors will be forced into stocks in order to generate a yield for their portfolios. Buy Timing the Market at Amazon.com

The concers about Greece, Spain and Ireland may be over-rated.

On a day like this, when all 30 of the Dow Jones Industrials are down, it is usually a good time to buy equities. This graph from Google.com indicates that we may be getting confirmation from the MACD line. Notice that it's ready to cross and move up.

With the ten-year Treasury note yielding 1.62%, investors will be forced into stocks in order to generate a yield for their portfolios. Buy Timing the Market at Amazon.com

With the ten-year Treasury note yielding 1.62%, investors will be forced into stocks in order to generate a yield for their portfolios. Buy Timing the Market at Amazon.com

Published on May 30, 2012 12:38

May 15, 2012

I usually rely on fundamental securities analysis. Howeve...

I usually rely on fundamental securities analysis. However, relative price movements sometimes add to my confidence in my analysis of the macro economy.

In this case, the relative strength index (RSI) for the S&P is helpful. This article on StockCharts.com provides background on the RSI. http://stockcharts.com/help/doku.php?id=chart_school:technical_indicators:relative_strength_in

This indicator on BigCharts.com shows that the S&P 500 may be oversold; you can see what happens when the RSI falls below 30.

Buy Timing the Market at Amazon.com

In this case, the relative strength index (RSI) for the S&P is helpful. This article on StockCharts.com provides background on the RSI. http://stockcharts.com/help/doku.php?id=chart_school:technical_indicators:relative_strength_in

This indicator on BigCharts.com shows that the S&P 500 may be oversold; you can see what happens when the RSI falls below 30.

Buy Timing the Market at Amazon.com

Published on May 15, 2012 09:02