Deborah Weir's Blog, page 13

December 30, 2011

This year provided thrills and chills...but no stock mark...

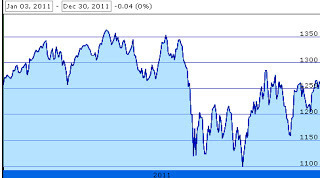

This year provided thrills and chills...but no stock market return. The S&P 500 went nowhere.

http://www.google.com/finance?q=INDEXSP:.INX#Buy Timing the Market at Amazon.com

http://www.google.com/finance?q=INDEXSP:.INX#Buy Timing the Market at Amazon.com

http://www.google.com/finance?q=INDEXSP:.INX#Buy Timing the Market at Amazon.com

http://www.google.com/finance?q=INDEXSP:.INX#Buy Timing the Market at Amazon.com

Published on December 30, 2011 14:59

December 29, 2011

This year is ending with good news:Four straight weeks of...

This year is ending with good news:

Four straight weeks of initial unemployment claims below the benchmark 400,000.Italy's bond auction produced lower yields than a month ago.Pending contracts for new home sales increased.Retail sales are up.Consumer confidence is up.It's no wonder that the stock market is up as well.Buy Timing the Market at Amazon.com

Four straight weeks of initial unemployment claims below the benchmark 400,000.Italy's bond auction produced lower yields than a month ago.Pending contracts for new home sales increased.Retail sales are up.Consumer confidence is up.It's no wonder that the stock market is up as well.Buy Timing the Market at Amazon.com

Published on December 29, 2011 08:52

December 9, 2011

http://www.treasury.gov/resource-cent......

http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

The 3-mo. treasury bill is at an all-time low at 0.00% according to the NY Fed. Investors can't live on that return and will be driven into te stock market for better yields.

Date 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr

12/01/11 0.02 0.01 0.05 0.12 0.27 0.41 0.97 1.55 2.11 2.82 3.12

12/02/11 0.02 0.02 0.06 0.12 0.25 0.39 0.92 1.49 2.05 2.74 3.03

12/05/11 0.01 0.01 0.05 0.11 0.27 0.40 0.93 1.49 2.04 2.73 3.02

12/06/11 0.00 0.01 0.04 0.11 0.25 0.41 0.94 1.52 2.08 2.74 3.09

12/07/11 0.00 0.02 0.05 0.11 0.24 0.36 0.89 1.46 2.02 2.74 3.04

12/08/11 0.00 0.01 0.04 0.10 0.22 0.35 0.86 1.41 1.99 2.70 3.00

12/09/11 0.00 0.01 0.05 0.11 0.22 0.37 0.89 1.48 2.07 2.79 3.10

Buy Timing the Market at Amazon.com

The 3-mo. treasury bill is at an all-time low at 0.00% according to the NY Fed. Investors can't live on that return and will be driven into te stock market for better yields.

Date 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr

12/01/11 0.02 0.01 0.05 0.12 0.27 0.41 0.97 1.55 2.11 2.82 3.12

12/02/11 0.02 0.02 0.06 0.12 0.25 0.39 0.92 1.49 2.05 2.74 3.03

12/05/11 0.01 0.01 0.05 0.11 0.27 0.40 0.93 1.49 2.04 2.73 3.02

12/06/11 0.00 0.01 0.04 0.11 0.25 0.41 0.94 1.52 2.08 2.74 3.09

12/07/11 0.00 0.02 0.05 0.11 0.24 0.36 0.89 1.46 2.02 2.74 3.04

12/08/11 0.00 0.01 0.04 0.10 0.22 0.35 0.86 1.41 1.99 2.70 3.00

12/09/11 0.00 0.01 0.05 0.11 0.22 0.37 0.89 1.48 2.07 2.79 3.10

Buy Timing the Market at Amazon.com

Published on December 09, 2011 17:38

December 8, 2011

Twenty-nine of the Dow 30 Industrials fell today. Only Ma...

Twenty-nine of the Dow 30 Industrials fell today. Only MacDonald's went up; cheap fun food has constant appeal.

The stock market generally goes up the day after investors sell so indiscriminately. (Trouble in Europe has been priced into this market for several months. Enough already!)

Tomorrow morning may be a buying opportunity. Buy Timing the Market at Amazon.com

The stock market generally goes up the day after investors sell so indiscriminately. (Trouble in Europe has been priced into this market for several months. Enough already!)

Tomorrow morning may be a buying opportunity. Buy Timing the Market at Amazon.com

Published on December 08, 2011 13:47

Jon Corzine has mastered the art of being a Capitalist. H...

Jon Corzine has mastered the art of being a Capitalist. He will probably handle the MF Global bankruptcy in the most politically-correct manner and emerge with the least possible damange to himself.

The movie "Margin Call" has a similar character - and he escaped unscathed. Buy Timing the Market at Amazon.com

The movie "Margin Call" has a similar character - and he escaped unscathed. Buy Timing the Market at Amazon.com

Published on December 08, 2011 12:55

December 2, 2011

One of the backbones of finance is short-term, unsecured ...

One of the backbones of finance is short-term, unsecured loans to corporations known as commercial paper. These loans range from a few days to a few months in duration. They pay current expenses such as inventory and payroll. Increasing levels of CP suggests stronger business.

These numbers from the NY Fed are good news for the stock market. You can follow the CP market at http://www.federalreserve.gov/releases/cp/

Weekly (Wednesday) levels

Nov. 2 $ 979.7

Nov. 9 $ 967.7

Nov. 16 $ 999.6

Nov. 23 $ 999.7

Nov. 30 $1,002.1

Buy Timing the Market at Amazon.com

These numbers from the NY Fed are good news for the stock market. You can follow the CP market at http://www.federalreserve.gov/releases/cp/

Weekly (Wednesday) levels

Nov. 2 $ 979.7

Nov. 9 $ 967.7

Nov. 16 $ 999.6

Nov. 23 $ 999.7

Nov. 30 $1,002.1

Buy Timing the Market at Amazon.com

Published on December 02, 2011 11:12

November 29, 2011

Economists shun non-scientific, annecdotal evidence. Howe...

Economists shun non-scientific, annecdotal evidence. However, it is difficult to ignore the packed parking lots, standing-room only commuter trains and crowded streets of Greater NYC. These crowds started in the middle of November - before the holidays. Buy Timing the Market at Amazon.com

Published on November 29, 2011 07:01

November 22, 2011

Investors seem to have post-traumatic stress syndrome fro...

Investors seem to have post-traumatic stress syndrome from the 2008 cirsis. They may be underestimating the value of improving economic indicators:

Declining initial unemployment claims - the lowest since last AprilIncreasing retail sales (0.1% in June to 0.6% in September)Improving Purchasing Managers IndexGrowing Consumer Sentiment Index (55.7% in August to 64.2% now)Buy Timing the Market at Amazon.com

Declining initial unemployment claims - the lowest since last AprilIncreasing retail sales (0.1% in June to 0.6% in September)Improving Purchasing Managers IndexGrowing Consumer Sentiment Index (55.7% in August to 64.2% now)Buy Timing the Market at Amazon.com

Published on November 22, 2011 08:52

November 17, 2011

We have an unusual signal to buy stocks.Conventional...

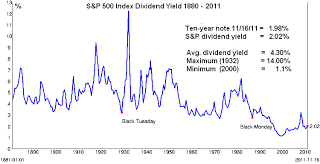

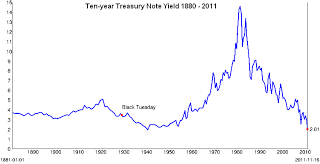

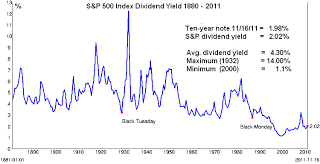

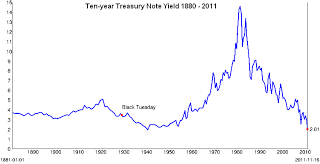

We have an unusual signal to buy stocks.

Conventional wisdom says, "Buy stocks when the dividend yield is higher than that of the 10-yr. note." The only trouble is, we haven't seen stocks yield more than fixed-income in many decades.

http://www.multpl.com/s-p-500-dividend-yield/

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Conventional wisdom says, "Buy stocks when the dividend yield is higher than that of the 10-yr. note." The only trouble is, we haven't seen stocks yield more than fixed-income in many decades.

http://www.multpl.com/s-p-500-dividend-yield/

Buy Timing the Market at Amazon.com

Buy Timing the Market at Amazon.com

Published on November 17, 2011 09:38

November 15, 2011

Not much has changed since this 2009 interview.Buy Timing...

Published on November 15, 2011 09:16