Deborah Weir's Blog, page 6

June 6, 2013

I will speak to the NYC chapter of the American Assoc. of...

I will speak to the NYC chapter of the American Assoc. of Individual Investors on Wed., June 19 at 6:00. The $30 fee at the door covers a light supper.

Please join us for this public event at St. Jean Baptiste Church at 184 E. 76th St. (corner of Lexington Ave.) in NYC. http://stjeanbaptisteny.org/Buy Timing the Market at Amazon.com

Please join us for this public event at St. Jean Baptiste Church at 184 E. 76th St. (corner of Lexington Ave.) in NYC. http://stjeanbaptisteny.org/Buy Timing the Market at Amazon.com

Published on June 06, 2013 06:53

June 3, 2013

Professional investors may be taking profits in this unus...

Professional investors may be taking profits in this unusually strong market. The MACD line suggests that pros are locking in their double-digit gains.

Last week the market scored 18% YTD profits; normally, the S&P delivers just 9% annually. Maybe we should all take a few gains and wait for better prices over the summer.Buy Timing the Market at Amazon.com

Last week the market scored 18% YTD profits; normally, the S&P delivers just 9% annually. Maybe we should all take a few gains and wait for better prices over the summer.Buy Timing the Market at Amazon.com

Last week the market scored 18% YTD profits; normally, the S&P delivers just 9% annually. Maybe we should all take a few gains and wait for better prices over the summer.Buy Timing the Market at Amazon.com

Last week the market scored 18% YTD profits; normally, the S&P delivers just 9% annually. Maybe we should all take a few gains and wait for better prices over the summer.Buy Timing the Market at Amazon.com

Published on June 03, 2013 12:45

April 30, 2013

Yankee ingenuity provides constant upward force to our ec...

Yankee ingenuity provides constant upward force to our economy. One example is the new smart phone applications that bring your doctor to your bedside. This "lab in a chip" allows him/her to diagnose you remotely.

http://www.youtube.com/watch_popup?v=r13uYs7jglg

http://www.youtube.com/watch_popup?v=r13uYs7jglg

We may in in a narrow trading range for awhile, so prepare to buy on the dips.Buy Timing the Market at Amazon.com

http://www.youtube.com/watch_popup?v=r13uYs7jglg

http://www.youtube.com/watch_popup?v=r13uYs7jglgWe may in in a narrow trading range for awhile, so prepare to buy on the dips.Buy Timing the Market at Amazon.com

Published on April 30, 2013 14:21

April 15, 2013

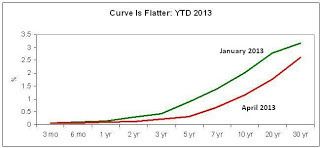

The flatter yield curve and wider credit spreads suggeste...

The flatter yield curve and wider credit spreads suggested a dip in the stock market. We certainly have seen that during the last couple of days.

As usual, investors are throwing the baby out with the bath water. All thirty of the Dow Industrials fell today. There are usually some good stocks on this list that deserve your attention under these circumstances. http://money.cnn.com/data/dow30/

Buy Timing the Market at Amazon.com

As usual, investors are throwing the baby out with the bath water. All thirty of the Dow Industrials fell today. There are usually some good stocks on this list that deserve your attention under these circumstances. http://money.cnn.com/data/dow30/

Buy Timing the Market at Amazon.com

Published on April 15, 2013 14:36

April 5, 2013

Another cautionary tale for the equity market. People hav...

Another cautionary tale for the equity market. People have to have jobs in order to buy stocks. Not enough of our employment-aged workers are in the work force. The labor force participation rate is the lowest since the Carter administration! The Bureau of Labor Statistics just provided this graph.

source data at BLS website:

source data at BLS website:

http://data.bls.gov/generated_files/graphics/latest_numbers_LNS11300000_1984_2013_all_period_M03_data.gif/Buy Timing the Market at Amazon.com

source data at BLS website:

source data at BLS website:http://data.bls.gov/generated_files/graphics/latest_numbers_LNS11300000_1984_2013_all_period_M03_data.gif/Buy Timing the Market at Amazon.com

Published on April 05, 2013 16:05

April 4, 2013

Equities usually deliver an average return of 10% per yea...

Equities usually deliver an average return of 10% per year. When investors get that much during the first quarter, as they did last year and again this year, they often lock in those gains and sit on the sidelines. The flatter yield curve and wider credit spreads suggest that this is happening now.

This is a good time to reduce the risk in portfolios.Buy Timing the Market at Amazon.com

This is a good time to reduce the risk in portfolios.Buy Timing the Market at Amazon.com

Published on April 04, 2013 13:44

March 6, 2013

Money is changing hands at an historically slow rate. The...

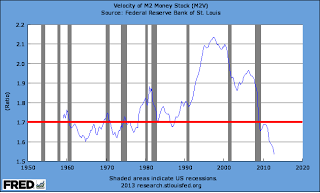

Money is changing hands at an historically slow rate.

The velocity of money, called M2V, is the lowest it has been since 1958. The red line on this graph from the Federal Reserve of St. Louis is my own definition of low velocity. Data below that mark appears to be sluggish movement of each dollar through our economy.

The stock market may have made a new high, but this low velocity suggests that we are a long way from a recession that would cause a market decline. Chart source: http://research.stlouisfed.org/fred2/series/M2V/Buy Timing the Market at Amazon.com

The stock market may have made a new high, but this low velocity suggests that we are a long way from a recession that would cause a market decline. Chart source: http://research.stlouisfed.org/fred2/series/M2V/Buy Timing the Market at Amazon.com

The velocity of money, called M2V, is the lowest it has been since 1958. The red line on this graph from the Federal Reserve of St. Louis is my own definition of low velocity. Data below that mark appears to be sluggish movement of each dollar through our economy.

The stock market may have made a new high, but this low velocity suggests that we are a long way from a recession that would cause a market decline. Chart source: http://research.stlouisfed.org/fred2/series/M2V/Buy Timing the Market at Amazon.com

The stock market may have made a new high, but this low velocity suggests that we are a long way from a recession that would cause a market decline. Chart source: http://research.stlouisfed.org/fred2/series/M2V/Buy Timing the Market at Amazon.com

Published on March 06, 2013 09:57

February 28, 2013

Our strengthening economy may trump the sequester.Consume...

Our strengthening economy may trump the sequester.

Consumers may have finished deleveraging; debt levels increased during the fourth quarter of last year. You can see more on the NY Fed's blog that is named after its address, Liberty Street. http://goo.gl/DEKL8

If, indeed, consumers have the confidence to take on more debt, perhaps this housing rebound will continue to be the third leg of the stool that supports this economic expansion. Economic expansions tend to support stock market expansions as well.Buy Timing the Market at Amazon.com

If, indeed, consumers have the confidence to take on more debt, perhaps this housing rebound will continue to be the third leg of the stool that supports this economic expansion. Economic expansions tend to support stock market expansions as well.Buy Timing the Market at Amazon.com

Consumers may have finished deleveraging; debt levels increased during the fourth quarter of last year. You can see more on the NY Fed's blog that is named after its address, Liberty Street. http://goo.gl/DEKL8

If, indeed, consumers have the confidence to take on more debt, perhaps this housing rebound will continue to be the third leg of the stool that supports this economic expansion. Economic expansions tend to support stock market expansions as well.Buy Timing the Market at Amazon.com

If, indeed, consumers have the confidence to take on more debt, perhaps this housing rebound will continue to be the third leg of the stool that supports this economic expansion. Economic expansions tend to support stock market expansions as well.Buy Timing the Market at Amazon.com

Published on February 28, 2013 13:50

February 5, 2013

The economy suffered when the government cut defense spen...

The economy suffered when the government cut defense spending last year. Now investors assume that Congress will avoid further drastic cuts that could cause even more damage. President Obama's speech this afternoon may give equity investors confidence.

Last week, the fixed-income market's quality spreads forecast a minor correction. Now the bond market suggests that the correction is over, and the equity rally may be back on track. Here is a graph of the S&P for one week.

Stay invested in equities, but don't relax. January's outsized gains cannot continue all year. Buy Timing the Market at Amazon.com

Stay invested in equities, but don't relax. January's outsized gains cannot continue all year. Buy Timing the Market at Amazon.com

Last week, the fixed-income market's quality spreads forecast a minor correction. Now the bond market suggests that the correction is over, and the equity rally may be back on track. Here is a graph of the S&P for one week.

Stay invested in equities, but don't relax. January's outsized gains cannot continue all year. Buy Timing the Market at Amazon.com

Stay invested in equities, but don't relax. January's outsized gains cannot continue all year. Buy Timing the Market at Amazon.com

Published on February 05, 2013 09:45

January 31, 2013

The Bureau of Economic Analysis released an estimate of&n...

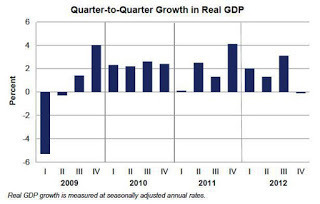

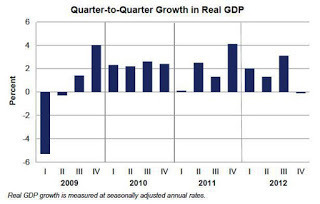

The Bureau of Economic Analysis released an estimate of fourth quarter growth yesterday. http://www.bea.gov/newsreleases/national/gdp/2013/pdf/gdp4q12_adv_fax.pdf

The number was negative.

Negative growth has frightened fixed-income investors. They are moving back into higher quality securities. Treasury prices are increasing, the curve is flatter, and quality spreads are wider.

Negative growth has frightened fixed-income investors. They are moving back into higher quality securities. Treasury prices are increasing, the curve is flatter, and quality spreads are wider.

It may be time to reduce risk in your portfolio. Buy Timing the Market at Amazon.com

The number was negative.

Negative growth has frightened fixed-income investors. They are moving back into higher quality securities. Treasury prices are increasing, the curve is flatter, and quality spreads are wider.

Negative growth has frightened fixed-income investors. They are moving back into higher quality securities. Treasury prices are increasing, the curve is flatter, and quality spreads are wider. It may be time to reduce risk in your portfolio. Buy Timing the Market at Amazon.com

Published on January 31, 2013 13:18