Deborah Weir's Blog, page 4

March 17, 2014

One of the most successful banks in the U.S. is the Feder...

One of the most successful banks in the U.S. is the Federal Reserve. The securities that it bought during the financial crisis, among other investments, are paying off.

The Fed paid an estimated $77.7 billion to the Treasury Department last year according to a news release on its website http://www.federalreserve.gov/newsevents/press/other/20140110a.htm

While this payment is less than that in 2012, the Fed has transferred funds to the Treasury every year since 1934.Buy Timing the Market at Amazon.com

While this payment is less than that in 2012, the Fed has transferred funds to the Treasury every year since 1934.Buy Timing the Market at Amazon.com

The Fed paid an estimated $77.7 billion to the Treasury Department last year according to a news release on its website http://www.federalreserve.gov/newsevents/press/other/20140110a.htm

While this payment is less than that in 2012, the Fed has transferred funds to the Treasury every year since 1934.Buy Timing the Market at Amazon.com

While this payment is less than that in 2012, the Fed has transferred funds to the Treasury every year since 1934.Buy Timing the Market at Amazon.com

Published on March 17, 2014 09:34

March 12, 2014

An astute, although anonymous, reader requested the sourc...

An astute, although anonymous, reader requested the source of the odd-lot short positions. It is free on Sentiment Trader:

http://www.sentimentrader.com/subscriber/charts/ODD_LOT_SHORTS.htm

This contrarian index is almost unchanged since last week and suggests that investors might be able to add to their equity positions.

HOWEVER, quality spreads have been widening during the last few days. It may be wise to wait a day or so for this critical indicator to change direction before making a purchase.Buy Timing the Market at Amazon.com

http://www.sentimentrader.com/subscriber/charts/ODD_LOT_SHORTS.htm

This contrarian index is almost unchanged since last week and suggests that investors might be able to add to their equity positions.

HOWEVER, quality spreads have been widening during the last few days. It may be wise to wait a day or so for this critical indicator to change direction before making a purchase.Buy Timing the Market at Amazon.com

Published on March 12, 2014 12:34

March 3, 2014

This dust-up in the Crimea may provide a small window of ...

This dust-up in the Crimea may provide a small window of opportunity for equity investors to add stocks.

While the yield curve and the VIX point to a lower market, other indicators disagree. Credit spreads and short sales suggest underlying market strength.

History suggests that even major political crises, such as Pearl Harbor and 9/11, drive markets down less than 10% and for less than a few days. You can find the statistics - and current market fears - in USA Today. http://goo.gl/XblC41Buy Timing the Market at Amazon.com

While the yield curve and the VIX point to a lower market, other indicators disagree. Credit spreads and short sales suggest underlying market strength.

History suggests that even major political crises, such as Pearl Harbor and 9/11, drive markets down less than 10% and for less than a few days. You can find the statistics - and current market fears - in USA Today. http://goo.gl/XblC41Buy Timing the Market at Amazon.com

Published on March 03, 2014 10:53

February 18, 2014

Volatility fears may be overdone. Several technical indic...

Volatility fears may be overdone. Several technical indicators for the S&P have turned positive; we are seeing upticks in both the MACD and in money flow.

The underlying strength of this market continues to be earnings growth and lack of competition from bonds. Even emerging markets are not attracting investors at the moment, so the US stock market wins by default.

This could be another good year.Buy Timing the Market at Amazon.com

The underlying strength of this market continues to be earnings growth and lack of competition from bonds. Even emerging markets are not attracting investors at the moment, so the US stock market wins by default.

This could be another good year.Buy Timing the Market at Amazon.com

Published on February 18, 2014 10:34

January 24, 2014

Bloomberg radio host Pimm Fox brought a cast of Wall St. ...

Bloomberg radio host Pimm Fox brought a cast of Wall St. stars to the annual forecast dinner in CT last night. The consensus was for moderate returns in the stock market with substantial volatility. Today's market losses are validating that outlook.

This could be a difficult year for nervous investors. You will need courage to buy on these dips. However, you will probably be richly rewarded for doing so.Buy Timing the Market at Amazon.com

This could be a difficult year for nervous investors. You will need courage to buy on these dips. However, you will probably be richly rewarded for doing so.Buy Timing the Market at Amazon.com

Published on January 24, 2014 08:41

January 13, 2014

ETFs for the Dow and the S&P are higher in after-hour...

ETFs for the Dow and the S&P are higher in after-hours trading. They are compensating for the extreme selling that took place today when twenty-nine of the Dow 30 Industrials declined. Only MRK was up. Such broad selling is usually overdone and presents a buying opportunity.

This may be yours. Buy Timing the Market at Amazon.com

This may be yours. Buy Timing the Market at Amazon.com

Published on January 13, 2014 16:06

December 10, 2013

Is this stock market rally getting old...or getting start...

Is this stock market rally getting old...or getting started? The rally's fifth anniversary is coming up next spring, and my article on the New York Institute of Finance makes a projection.

https://www.nyif.com/blog/2013/12/can_this_stock_marke.html

Another version of the article is on The Daily Journalist.

http://thedailyjournalist.com/the-financier/can-this-stock-market-rally-last/

Buy Timing the Market at Amazon.com

https://www.nyif.com/blog/2013/12/can_this_stock_marke.html

Another version of the article is on The Daily Journalist.

http://thedailyjournalist.com/the-financier/can-this-stock-market-rally-last/

Buy Timing the Market at Amazon.com

Published on December 10, 2013 13:23

November 13, 2013

Did you know that the U.S. has the world's cheapest energ...

Did you know that the U.S. has the world's cheapest energy?

The WSJ quoted Incitec Chief Executive James Fazzino in an article entitled "Foreign Firms Tap U.S. Gas Bonanza."

"If you think about the competitive advantages of an economy, having low-priced energy is about the most important," Incitec Chief Executive James Fazzino said. Combined with a stable regulatory framework and a trained labor pool, the U.S. "is really the most attractive place in the world to invest," he said.

I will learn more about this generational change in energy at the Chartered Financial Analysts' meeting in Stamford, CT where IHS will present a panel of experts. http://www.ihs.com Let me know if you would like copies of any handouts.

Let me know if you would like copies of any handouts.

Buy Timing the Market at Amazon.com

The WSJ quoted Incitec Chief Executive James Fazzino in an article entitled "Foreign Firms Tap U.S. Gas Bonanza."

"If you think about the competitive advantages of an economy, having low-priced energy is about the most important," Incitec Chief Executive James Fazzino said. Combined with a stable regulatory framework and a trained labor pool, the U.S. "is really the most attractive place in the world to invest," he said.

I will learn more about this generational change in energy at the Chartered Financial Analysts' meeting in Stamford, CT where IHS will present a panel of experts. http://www.ihs.com

Let me know if you would like copies of any handouts.

Let me know if you would like copies of any handouts.

Buy Timing the Market at Amazon.com

Published on November 13, 2013 11:29

November 8, 2013

I had the honor of guest lecturing at Sacred Heart Univer...

I had the honor of guest lecturing at Sacred Heart University in a class on "Contrarian Investing." Prof. John Gerlach's students asked many pointed questions and made insightful remarks.

The ppt for the class is available to you; just let me know by leaving a comment, email DebWeir@WealthStrategies.bz, or @debweir

Buy Timing the Market at Amazon.com

The ppt for the class is available to you; just let me know by leaving a comment, email DebWeir@WealthStrategies.bz, or @debweir

Buy Timing the Market at Amazon.com

Published on November 08, 2013 09:55

October 31, 2013

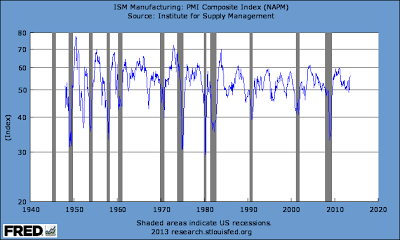

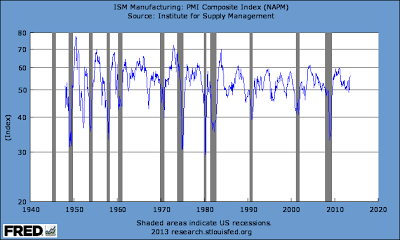

Business in the US appears to be picking up steam. The Ch...

Business in the US appears to be picking up steam. The Chicago Purchasing Manager's Index gives a preview of the national data coming out tomorrow. Today's CPMI grew at the fastest rate in 30 years according to Business Insider: http://www.businessinsider.com/october-chicago-pmi-2013-10

Note that the line on the St. Louis Fed's graph shows an abnormally-large increase last month.

Buy Timing the Market at Amazon.com

Note that the line on the St. Louis Fed's graph shows an abnormally-large increase last month.

Buy Timing the Market at Amazon.com

Published on October 31, 2013 11:22