GDP rose 1.5% in Q-II. This was better than expected. The Bloomberg survey of 82 economists produced a median expectation of 1.4%. A small improvement to be sure, but enough to help keep this stock market rally on track.

http://www.bloomberg.com/news/2012-07-27/economy-in-u-s-grows-at-1-5-rate-as-consumer-spending-cooled.htmlSeveral indicators suggest more strength in equities. This may continue to be an opportunity to add to stocks.

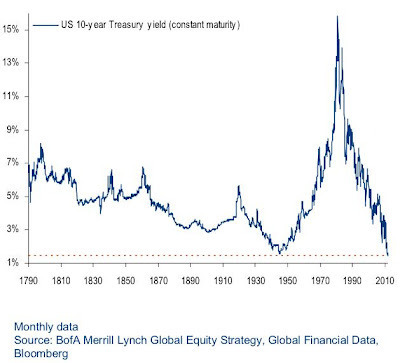

The VIX has started a downward trend.Quality spreads are narrowing.Interest rates are at a 300-year low.

These low interest rates are good for business and the stock market.

Buy Timing the Market at Amazon.com

Published on July 27, 2012 07:13