Jonathan Chait's Blog, page 149

November 24, 2010

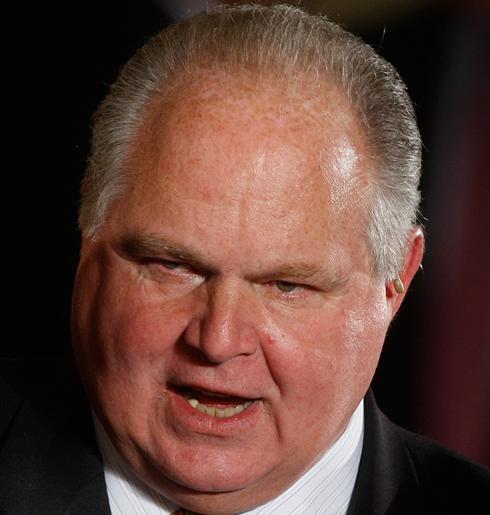

"Driving And Oxycontin Don't Mix"

Rush Limbaugh lambasted Motortrend for giving its Car of the Year award to the Chevy Volt, on the grounds that nobody has purchased a Volt yet. Motortrend's Todd Lassa takes him apart:

[O]ur credibility, Mr. Limbaugh, comes from actually driving and testing the car, and understanding its advanced technology. It comes from driving and testing virtually every new car sold, and from doing this once a year with all the all-new or significantly improved models all at the same time. We test, make judgments and write about things we understand.

Chevrolet has not sold one Volt because it’s not on sale yet. It will not sell 10,000 this first model year (although GE plans to buy truckloads for its fleet), because it takes time to ramp up production. See, Rush, because we’re the World’s Automotive Authority, we get access to many cars before they go on sale. ...

In its attempt to force cars that don’t use much gas on us — how un-American/un-ExxonMobil/un-Halliburton is that? — the Obama administration is offering a $7,500 tax credit on the Chevy Volt, grabbing tax breaks and credits right out of the deserving, job-creating pockets of America’s richest individuals. How dare he?

This is another of your distortions, Rush, repeated by the otherwise more level-headed George Will in The Washington Post last Sunday. The $7,500 Obama tax credit is an expansion of President Bush’s hybrid credits from the last decade. The Obama tax credit extends to the new Nissan Leaf, too, but if you or Will slammed that car, I’ve not heard or read it. I’d be surprised if you did, though, as Nissan is building the Leaf in a non-union factory in a right-to-work state represented by two Republican senators. A factory located there because Tennessee offered Nissan big tax credits.

There's a lot more there worth reading. It's pretty interesting to watch the conservative movement add the American automotive industry to France, academia, environmentalists, and the rest of their enemies. In many parts of the Midwest, especially Michigan, the auto industry is right behind God and country. I don't see how Republicans are going to win a lot of races being attached to a party that sneers at, and diminishes the genuine accomplishments of, an industry that sits at the heart of the region's prosperity.

November 23, 2010

Daring Health Care Repealers To Put Up

This is a pure legislative stunt, but I like it:

Rep. Gary Ackerman (D-N.Y.) is daring Republicans to make good on one of their top legislative priorities: repealing the healthcare law.

Taking a somewhat unusual tactic, Ackerman, a strong advocate for the healthcare reform law, vowed Tuesday to introduce a series of bills next week that would roll back some of the most popular provisions of the law.

The congressman said the legislation — all titled the HIPA-CRIT (Health Insurance Protects America—Can't Repeal IT) — will give Republicans a chance to "put up, or sit down" on their campaign promise to repeal the eight-month-old law.

"This will be the big chance for Republicans to do what they've vowed to do," the 13-term member said. "These bills will be their chance to at long last restore liberty and repeal the evil monster they've dubbed 'Obamacare.' "

Ackerman has begun circulating a letter to fellow lawmakers telling them to "Go ahead, make my day. Become a cosponsor."

"The Affordable Care Act contains these and many other foolish protections for our constituents," the letter states. "So, join other Members of Congress who want to deprive their constituents of these silly safeguards from the big insurance companies. You can cast your courageous vote on a series of SIX bills to do it. Feel free to call it the HIPA-CRIT Act when you explain your vote."

The measures would overturn six consumer protections in the new law that:

• Ban health plans from rescinding coverage;

• Eliminate annual coverage limits;

• Eliminate lifetime limits;

• Prevent plans from turning down adults with pre-existing conditions;

• Prevent plans from turning down children with pre-existing conditions; and

• Require that insurers offer coverage for dependents up to age 26 on family plans.

Republicans are holding votes on repealing just the unpopular aspects of the bill. Why not vote on the popular parts too? Ackerman's proposal is more coherent: you can have an individual mandate without banning discrimination against preexisting conditions. But the Republican proposals to eliminate the mandate without getting rid of the discrimination ban is a recipe for disaster.

Business: Record Profits Not Enough

Politico has a story entitled, "Business: Barack Obama's outreach not enough," which details the complaints of the business lobby:

After business leaders sank millions into the midterms to defeat Democrats, a chastened Obama administration is seeking reconciliation with the corporate community.

But after two years of building frustration, the executives say they won’t be won over by another round of private lunches and photo opportunities at the White House.

If President Barack Obama has any hope for a truce with corporate America in time for his 2012 reelection campaign, he needs to drop the name-calling, try to see their point of view better and step up with some specific proposals.

As I was trying to figure out how to comment on this, I saw a news story in the New York Times:

The nation’s workers may be struggling, but American companies just had their best quarter ever.

American businesses earned profits at an annual rate of $1.66 trillion in the third quarter, according to a Commerce Department report released Tuesday. That is the highest figure recorded since the government began keeping track over 60 years ago, at least in nominal or non-inflation-adjusted terms.

Corporate profits have been going gangbusters for a while. Since their cyclical low in the fourth quarter of 2008, profits have grown for seven consecutive quarters, at some of the fastest rates in history.

It's historically unusual enough that we live in a period of record corporate profits coinciding with stagnant incomes. What's amazing is that the business world views this situation as symptomatic of insufficiently pro-business policies, and, further, that this complaint has recieved a widespread and generally sympathetic hearing in the political media.

Conservatives At Sea

Somebody who attended National Review's post-election cruise has created some paintings:

and:

and:

Terrifying.

Apply to Be a TNR Web Intern!

The New Republic Online is looking for college students and recent graduates for its winter 2010 Web internship program. Internships are unpaid but offer substantial experience in the production of a daily online publication. Interns must be able to work in our Washington, D.C. office. Responsibilities include:

Research projects and assisting TNR's senior writers

Writing articles and blog posts, and helping to create multimedia content

Participating in TNR staff meetings

Preparing and updating TNR's homepage

Helping to maintain TNR's blogs and other aspects of the site

Political journalism experience is preferred, but not imperative; some familiarity with HTML is helpful, but not crucial; and fluency in search techniques like LexisNexis is mandatory. A full-time commitment is preferred.

Applications for our winter internship (December/January through May/June) are currently being accepted on a rolling basis, though we'd prefer applications by December 10. For the Web internship program, please e-mail a cover letter and résumé to Seyward Darby and Barron YoungSmith.

Barney Frank Points The Way For Dems

[image error]Republicans are currently joining with (self-serving) Chinese to attack the Federal Reserve's plan to reduce unemployment, and even insisting the Fed should stop caring about unemployment altogether. All this is taking place against a backdrop of mass unemployment and rising resentment of foreign countries, and esepcially strong anti-Chinese xenophobia.

So Barney Frank's counterattack on the Republicans was kind of hiding in plain sight:

“The Republicans are joining the Central Bank of China in criticizing [Fed Chairman] Ben Bernanke ” Mr. Frank said Monday during an interview on Bloomberg Television. “This is really distressing to me.” ...

Mr. Frank said complaints about currency manipulation from Chinese central bankers “is like being called silly by the Three Stooges.”

“And then to have Republican leaders in Congress” agree with those complaints “is bizarre,” Mr. Frank said. “The Republicans are arguing that the Fed should not even be concerned about unemployment.”

I have to admit it didn't occur to me before, but this seems like the most obviously ripe political line of attack you can imagine.

Megyn Kelly Against Fabric, Judging Right-Wing Ignorance

Fox News host Megyn Kelly does an interview and photo shoot with GQ (photo at right -- feel the journalistic credibility) and gets oddly un-judgmental about people who think President Obama is a Muslim:

Fox News host Megyn Kelly does an interview and photo shoot with GQ (photo at right -- feel the journalistic credibility) and gets oddly un-judgmental about people who think President Obama is a Muslim:

Are you a secret Muslim?

Maybe.

What do you make of the folks who still think that about Obama?

I don't have any thoughts about this.

C'mon, it's loony. He's clearly not Muslim.

Right. But I don't have any thoughts about the people who think all that.

Because a lot of them watch Fox?

I just think, I don't know where their information is coming from or what they base their views on. I don't want to judge anybody. He's clearly not a Muslim.

Her tone may sound odd, but conservatives believe strongly that we shouldn't judge people.

Public Sides With Affordable Care Act

A lot of the polling on the Affordable Care Act has had wording that's slanted toward one side or another. McClatchy's new poll seems admirably clean, offering four options: repeal the bill, amend it so that it does less, keep it, or amend it so that it does more. The latter two options have the majority:

A majority of Americans want the Congress to keep the new health care law or actually expand it, despite Republican claims that they have a mandate from the people to kill it, according to a new McClatchy-Marist poll.

The post-election survey showed that 51 percent of registered voters want to keep the law or change it to do more, while 44 percent want to change it to do less or repeal it altogether.

As per usual, people strongly favor most of the provisions but oppose the parts (like the individual mandate) that are needed to make the popular stuff work.

November 22, 2010

&c

-- Ed Kilgore looks ahead to the 2012 GOP primary.

-- Hendrik Hertzberg on Glenn Beck and his puppetmasters.

Ireland Then and Now

It was not long ago that Ireland was every American conservative's beau ideal of a European state. Low taxes, low regulation, it was the operfect case study in the success of free market policies.

Former AEI fellow, and head of Bush's Domestic Policy Council, Karl Zinsmeister, October 5, 2000:

One exception to Europe's tepid economic performance has been the Irish. Ireland -- which I visit regularly, including this summer -- is an economy on fire. As recently as the late 1970s, when I attended college in Dublin, the country was still a kind of developing nation. Today, after two decades of red-hot growth, the Irish, stunningly, enjoy a per capita income higher than the Germans.

How has Ireland become a "Celtic tiger" (a la Hong Kong, Taiwan and Singapore, the earlier "tiger" economies in Asia)? Simple: By clinging for dear life to the coattails of the American economy. The Irish have basically set themselves up as a free enterprise zone for U.S. companies wanting a base in Europe, rolling out a business-friendly red carpet.

The government also mimicked American growth policies in some important areas - chopping taxes and reducing regulations. More than in other parts of Europe, Irish entrepreneurs studied and then cloned some of America's hypercapitalist airlines, energy companies, communications businesses and computer firms. Ireland's smashingly successful Ryanair, for instance, is a direct knock-off of Dallas-based Southwest Airlines.

Cato fellow Benjamin Powell, "Case of the Celtic Tiger," Cato Journal, Winter 2003 issue:

The fact is Ireland had not been catching up for 30 years; it accomplished its catching up in 13 years. Rapid rates of growth have continued to be recorded since converging with Europe’s standard of living. The neoclassical growth model does not account for Ireland’s success. Rather, rapid growth has been driven by increases in economic freedom. As long as Ireland continues to pursue policies that increase economic freedom, the Irish “miracle” is likely to continue.

Veronique de Rugy, May 10, 2004:

In the 1980s, Ireland faced the same dilemma that now confronts the EU. It made the wise choice to implement supply-side tax reforms that were and are still successful. Sweeping corporate tax rate reductions from 38 percent to 12.5 percent created a decade of economic growth, and the "poor man of Europe" is now the "Celtic Tiger" with the second-highest living standards in the EU (behind tax haven Luxembourg). The Irish model shows how fiscal discipline and low tax rates help attract capital and entrepreneurs instead of scaring them to other countries.

Daniel Mitchell, then a Heritage senior economist, April 14, 2005:

Ireland doesn't have a flat tax, but it has slashed its corporate tax rate from 50 percent to 12.5 percent. Combined with other tax cuts, this helped turn the "Sick Man of Europe" into the "Celtic Tiger." Unemployment has dropped from 17 percent to 5 percent, and Ireland is now the second-richest nation in the European Union.

Marc Miles, director of Heritage's Center for International Trade and Economics, January 9, 2006:

Instead of double-digit unemployment, Ireland imports workers today. Instead of little or no growth, Ireland's growth outstrips world averages. The 'sick man' of Europe has become the Celtic Tiger, with prospects far better than those of its neighbours on the continent.

How did this happen? Ireland went against the grain and made it easier for people to pursue their dreams. It adopted pro-market, pro-growth policies that have made it the fastest-growing economy in Europe and the third-freest economy in the world.

Chris Edwards, director of tax policy studies at Cato, National Review, March 16, 2007:

On Saint Patrick’s Day, we wear green and celebrate the culture of Ireland. I’ll be down at the pub Saturday, but I’ll be toasting Ireland’s success at attracting greenbacks — all that investment flowing into the Emerald Isle and the resulting prosperity. Ireland has boomed in recent years, and it now boasts the fourth-highest gross domestic product per capita in the world. In the mid-1980s, Ireland was a backwater with an average income level 30 percent below that of the European Union. Today, Irish incomes are 40 percent above the EU average.

Was this dramatic change the luck of the Irish? Not at all. It resulted from a series of hard-headed decisions that shifted Ireland from big government stagnation to free market growth...Now if only we could chase the leprechauns out of this country and cut our corporate tax rate, we’d be enjoying Irish-level growth rates by next St. Paddy’s Day.

Cato senior fellow Alan Reynolds, Politico, June 2010:

Though Greek deficits and debts have dominated the news lately, Ireland's fiscal crisis was widely considered at least as dangerous to the euro late last year. Ireland is in the worst trouble of all the eurozone countries, the International Monetary Fund then reported. Ireland's budget deficit was as large as that of Greece in 2008, and the Irish economy had shrunk 9 percent in 2009.

But we don't hear much about Ireland today. Why not? Because that country successfully repeated what it had done so boldly in the late 1980s — slash spending on payrolls and benefits, subsidies and transfer payments.

Ireland's public service salaries, for example, were reduced last year by 5 percent to 15 percent. Unlike Portugal, Ireland did not adopt damaging tax increases. Unlike Greece, which is getting ever deeper in debt to its neighbors by begging for a bailout, Ireland is now lending 1.3 billion euros to Greece.

In short, Ireland offers an admirable lesson in fiscal responsibility for Greece, Portugal and Spain — and, possibly, the United States.

Sadly, the Irish fiscal crisis has prompted a quick realization that Ireland was not actually the free market state we thought it was. Indeed, it turns out to represent Obama-ism run amok.

Allister Heath, an associate editor at the British conservative publication The Spectator, blames the central banks:

There is a crucial aspect of the Irish crisis that everybody appears to have forgotten, which goes a long way towards explaining Ireland’s problems: its membership of the dysfunctional single currency, an institution it should never have joined. Ireland, like Britain, had its economy deformed by debt — the result of year after year of dangerously cheap credit, aided and abetted by central banks. Ireland’s cheap money came from the European Central Bank, which kept interest rates even lower than the Bank of England, thus guaranteeing an even greater boom and subsequent bust. Even in January 2006, when many of the stupider lending decisions taken by Irish banks were being planned, eurozone interest rates were only 2.25 per cent. This arguably made sense for Germany, but was absurdly low for Ireland; it could have done with 9 per cent.

Reihan Salam blames the progressive tax structure, public sector overcompensation, and poor quality of the state:

Let me say that I’m quite willing to believe that an excessively progressive income tax in Ireland exacerbated underlying political economy problems...The structure of the tax system was a problem, but it wasn’t the mere fact that top-line rates or even total revenues were relatively low...Yes, the state grew dependent on the housing bubble. But the strikingly low quality of the Irish state and overcompensation in the public sector (two sides of the same coin) were clearly relevant to the broader fiscal picture. And that raises a different set of questions.

Nicole Gelinas picks the Irish bank bailout:

A big reason for Ireland’s current sub-crisis is that in the fall of 2008, the nation guaranteed all of its bank liabilities. This fateful choice was not a market decision, but a government one.

One could make the case that had Ireland let its bank bondholders go, as Iceland did, Ireland would be better off today. Unlike Greece, Ireland has competitive tax rates, an English-speaking population, and a workforce that desires work.

But Ireland instead hitched the brick of bank liabilities to its sovereign balloon. The balloon hasn’t brought the bricks up; the bricks have brought the balloon down. Europe — if the Continent (and Britain) were to require Ireland to raise its tax rates as a bailout condition — could pop it.

That price may be too high for Ireland. But now, Ireland can’t undo what it did two years ago, at least not easily. Because of Ireland’s guarantees, investors would view dropping the banks now as a selective sovereign default.

And Daniel Mitchell, now at Cato, blames government spending:

When the financial crisis hit a couple of years ago, tax revenues suddenly plummeted. Unfortunately, politicians continued to spend like drunken sailors. It’s only in the last year that they finally stepped on the brakes and began to rein in the burden of government spending. But that may be a case of too little, too late. [...]

There are lots of lessons to learn from Ireland’s fiscal/economic/financial crisis. There was too much government spending. Ireland also had a major housing bubble. And some people say that adopting the euro (the common currency of many European nations) helped create the current mess

The one thing we can definitely say, though, is that lower tax rates did not cause Ireland’s problems.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers