Jonathan Chait's Blog, page 153

November 17, 2010

Fox News Exposes Obama As Indian, Not Kenyan, Anti-Colonialist

If you've ever seen "Airplane 2 -- and, to be sure, I am not recommending that you do so -- there is a funny complication of television news coverage from around the world of an impending shuttle disaster:

: [with a gun pointed to his head] A Four-alarm fire in Downtown Moscow clears way for a glorious new tractor factory. And on the lighter side of the news, Hundreds of Capitalists are soon to perish in Shuttle disaster.

Somehow Fox News has managed to exceed even this parody. Per Gawker, USA Today has a typical soft-focus feature on President Obama's book for children. Headline:

Obama shares dreams for his kids in book on 13 Americans

Fox News ran with the story on its website, but tweaked the focus a bit to emphasize the fact that the book praises Sitting Bull. Here is the Fox News headline:

Obama Praises Indian Chief Who Killed U.S. General

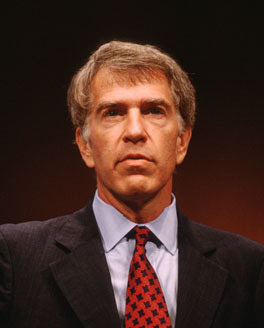

Roger Altman And Washington's Structural Pro-Business Bias

Bloomberg News reports that Roger Altman recently interviewed to replace Larry Summers as head of the National Economic Council. I'm generally pretty sympatico with Clintonite moderates like Altman and their progressive fiscal conservatism. At the same time, people like Altman both reflect and create the massive structural upper-class bias in Washington policymaking. Here's Altman writing last December in an otherwise sensible Wall Street Journal op-ed:

Bloomberg News reports that Roger Altman recently interviewed to replace Larry Summers as head of the National Economic Council. I'm generally pretty sympatico with Clintonite moderates like Altman and their progressive fiscal conservatism. At the same time, people like Altman both reflect and create the massive structural upper-class bias in Washington policymaking. Here's Altman writing last December in an otherwise sensible Wall Street Journal op-ed:

A third step involves the party's deteriorating relations with industry. This relationship must be fixed because the views of industry often coincide with those of independent voters. The commitment to address the deficit would help, together with moderate regulatory policy on telecommunications and antitrust, and adding one or two businessmen or women to senior levels of the administration.

The notion that business leaders represent some reflection of main street America, rather than an interest group whose policy preferences often differ with the public's as a whole, is commonplace. When you think about it, it's ridiculous. I commented on Altman's op-ed at the time. There are any number of issues -- TARP, free trade, progressive taxation -- where business, for better or worse, has very different views than the majority of Americans.

You'd never see somebody asserting without evidence in a mainstream forum that the views of labor reflect the views of independent voters. Or, at least, somebody who wrote that would never be in a position to run something like the N.E.C. Yet that's the sort of person who can get hired in a Democratic administration. And the people who get hired in Republican administrations are dramatically more right-wing than that.

November 16, 2010

The Debt Commission Plan: No Deal

The wonks have finally gone through the debt commission's plan, and the findings are... not so good. The Center on Budget and Policy Priorities -- a liberal group more favorable to deficit reduction than most liberals -- goes through the main problems here. In short, there's too much pain imposed on people with low incomes.

More problematically, the Tax Policy Center has broken down the distribution of the tax changes. The commission's plan would be more progressive, and would tax the rich at higher rates, than the Bush era tax code. But it would be less progressive and would tax the rich at lower rates than the Clinton-era tax code.

That's a total non-starter. The Bush tax cuts are slated to expire, and President Obama has stated he will not accept a permanent extension. You can argue either side of which policy baseline -- Bush-era tax rates or Clinton-era tax rates -- is the fair baseline to start from. But the fact is that the Bush tax cuts are slated to expire. Liberals don't need to do anything to get Clinton-era rates on the rich to return. There's simply no way Democrats can agree to assume Bush's low, low tax rates on the rich as a starting point, and then have the commission claw back some of those rates. That would mean rich's people's contribution to shared sacrifice would be something that is slated to happen anyway. I understand the need to trim back the welfare state, but we're not going to trim it back far enough for the rich to enjoy sub-Clinton-era levels of taxation.

I would really like to see some kind of bipartisan agreement to reduce the deficit, and I understand it would require changes that people like me would not impose if we had our druthers. That's the nature of making policy in a polarized environment with a supermajority Senate requirement and a public opinion landscape hostile to almost any specific measures to raise revenue or reduce outlay.

But it's worth keeping in mind that, while liberals may not have a strong hand, conservatives have an even weaker hand. First of all, the default option is for spending to rise rapidly. Second, much as conservatives like to imagine that tax revenue determines the size of government, in fact spending levels determine the size of government. Third, while the public doesn't want to raise taxes to pay for the level of government it prefers, it wants to cut spending even less. When push comes to shove, liberal priorities such as lower defense spending and higher taxes, especially on the rich, are a lot more popular than cutting Social Security or Medicare.

Conservatives do have a couple advantages. They have the ability to exact a high political price if Democrats attempt to put the government on sound fiscal footing without their consent. They've done this with taxes, in 1993 and other times, and they did it with the Affordable Care Act, a crucial element in curtailing health care cost inflation.

The long-term deficit is a kind of mutually-assured destruction scenario, where two adversaries must cooperate, though each has an incentive to push for cooperation on the most advantageous terms. In a scenario like this, a player who cares less about the consequences of failure, or can persuade his opponent that he cares less, has a commanding advantage. Republicans have gained such an advantage by demonstrating a total disregard for the consequences of deficits and the apparently genuine embrace of lunatic fiscal doctrines like supply-side economics and "starve the beast." (Imagine how the Cuban Missile Crisis would have played out if Khrushchev was convinced America's nuclear arsenal was harmless, and Kennedy knew this.)

Republicans screamed loudest about the debt commission, and in so doing persuaded the commission to tailor its plan to their liking. The closer one looks at the Bowles-Simpson plan, the more clear it becomes that this is not the appropriate basis for a compromise.

The commission's plan has some useful concepts. But, as Paul Krugman points out, having some useful concepts isn't enough:

what on earth are people who say things like, “This proposal can be a starting point for discussion” thinking? We’ve been discussing and discussing, ad nauseam; the commission was supposed to provide a finishing point for discussion. Instead, it produced a PowerPoint that is one part stuff that has long been on the table, one part conservative wish-list, and one part just weirdly ill-considered.

Again, liberals should expect a fiscal adjustment to do a lot of things they wouldn't do if they could design a solution on their own, because the ideal liberal solution isn't politically feasible. But there's a floor and this plan falls below it. What's more, as argues, there are other fish in the debt commission sea:

With the thing going nowhere, Simpson and Bowles seem to have simply grabbed whatever they had on the table and declared it a plan, hoping it would get the others engaged. Instead, it seems to have made the whole project irrelevant.

That’s why I’m more interested in the deficit-reduction report that is due this Wednesday from the task force assembled by the Bipartisan Policy Center's task force, chaired by former OMB Director Alice Rivlin and former Sen. Pete Domenici. And there’s a set of people in Washington, mostly not elected officials, who understand the federal budget inside out, who (I think) wouldn’t produce the kind of amateurish product that is Simpson-Bowles.

Sadly agreed. There will probably need to be a debt commission, but not this debt commission.

&c

-- The most spectacular congressional flameouts.

-- Michele Bachmann hates earmarks, except for the earmarks she likes.

-- The RNC's political director resigns, blasts Michael Steele.

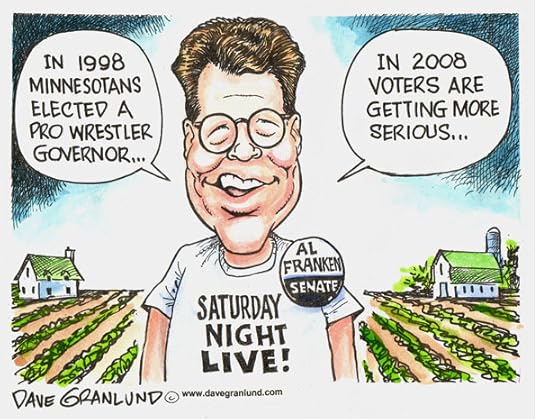

Jeff Rosen On Al Franken

Ever since he declared his campaign for Senator, Al Franken has been trailed by endless Stuart Smalley jokes. In TNR's latest issue, though Jeff Rosen trails Franken around and concludes that Franken is, indeed, good enough and smart enough:

In recent years, congressional hearings have become little more than televised sideshows in which most senators rely on questions scripted by their staff and seem unable to ask tough or even relevant follow-ups. Franken clearly aspires to an older tradition, when lawmakers could think on their feet and were capable of grilling witnesses without aides handing them notes or whispering furtively in their ears. He studies issues exhaustively, which allows him to negotiate directly with senators and their aides rather than intermediaries. His staffers say that he encourages them to challenge him during the murder boards he assembles to prepare for hearings and sometimes insists on staying past midnight.

I saw evidence of Franken’s careful preparation firsthand, when I testified in a Senate Judiciary Committee hearing last March on the Citizens United campaign-finance case that enabled unlimited corporate spending in election campaigns. One of the witnesses, Bradley Smith, had criticized a provision of a bill Franken had introduced which said that if a foreign national controls more than 20 percent of a company, that company shouldn’t be allowed to spend unrestricted amounts on American elections. When Smith confidently stated that 20 percent ownership didn’t constitute corporate control, Franken pounced:

FRANKEN: Yes or no, please. Do you know how Delaware, the leading state for corporate law, defines a controlling shareholder?

SMITH: No, I do not, nor do I think it is relevant to the question of whether control ...

FRANKEN: I asked you to respond yes ... or no, sir, and you said no, you do not. ... Now, the fact is that thirty-two states that define control with a number, thirty-one of them define it as twenty percent ownership or less, most of them less.

Franken is not an attorney, but with a few deft questions he had demonstrated that Smith, a law professor, didn’t know what he was talking about.

Not only that, but, gosh darn it, people like him!

For all of his efforts to play down his past life as a comedian, Franken frequently deploys humor to bond with Republicans in the Senate. “Every time I vote against a Thune amendment, I go up to him and say, ‘John, I voted against you this time, but I swear it’s the last time!’” Franken told me gleefully. “I do it every time! And Thune does a very funny Perot; yes he does.” Franken added that Kansas Republican Pat Roberts is a “huge” fan of Jack Benny, the vaudevillian comic. “He’s really funny—although we never agree on anything—and every time we see each other, we go, ‘You again!’” He added, “There are some people here that I have a very fond relationship with that I didn’t imagine I would.”

Jeff, unlike me, places a high value upon Senatorial comity, whereas I think it's a shame Franken has had to sheath his satirical edge. I've written about this before, but the overt hostility toward Franken by right-thinking people everywhere reflects a mistaken belief that comedy and satire are incompatible with intellectual seriousness. In any case, Jeff's piece -- which is subscription only, so subscribe! -- is a terrific read and you should absolutely read it in its entirety.

David Brooks and Cultures

[Guest post by James Downie]

In today's New York Times, David Brooks argues that liberals have dispensed with feelings and morals.

Many of the psychologists, artists and moral philosophers I know are liberal, so it seems strange that American liberalism should adopt an economic philosophy that excludes psychology, emotion and morality.

Yet that is what has happened. The economic approach embraced by the most prominent liberals over the past few years is mostly mechanical. The economy is treated like a big machine; the people in it like rational, utility maximizing cogs. The performance of the economic machine can be predicted with quantitative macroeconomic models.

These models can be used to make highly specific projections. If the government borrows $1 and then spends it, it will produce $1.50 worth of economic activity. If the government spends $800 billion on a stimulus package, that will produce 3.5 million in new jobs.

Everything is rigorous. Everything is science.

Obviously, what leaps off the page most throughout the column is the wild generalizing about liberals, but Brooks is not the first, nor will he be the last columnist to resort to clumsy stereotypes. But even the facts he is basing the stereotypes on are incorrect. Multipliers, which are the basis for statements like "unemployment benefits will produce $1.50 of economic activity for every dollar spent" in fact are quite inexact, and policymakers know that. The CBO's January assessment of various policy options, for example, marks the range for the multiplier effect of increasing unemployment benefits as between $0.70 and $1.90 per dollar, a range "designed to encompass most economist's views." (The low end is still $0.30 higher than the high end for extending the Bush tax cuts.) Yes, policymakers and economists give specific numbers, but they do so out of convenience. For similar reasons, Brooks would likely think it unnecessary for Gallup to report Obama's most recent approval rating as "between 45 and 51 percent approval and between 42 and 48 percent disapproval," rather than just "48% approval, 45% disapproval."

Conservatives, who are usually stereotyped as narrow-eyed business-school types, have gone all Oprah-esque in trying to argue against these liberals. If the government borrows trillions of dollars, this will increase public anxiety and uncertainty, the conservatives worry. The liberal technicians brush aside this soft-headed mush. These psychological concerns are mythological, they say. That’s gaseous blathering from those who lack quantitative rigor.

Other people get moralistic. This country is already too profligate, they cry. It already shops too much and borrows too much. How can we solve our problems by borrowing and spending more? The liberal technicians brush this away, too. Economics is a rational activity detached from morality. Hardheaded policy makers have to have the courage to flout conventional morality — to borrow even when the country is sick of borrowing.

Brooks later comments that he has had "hundreds" of conversations with businesspeople who are too "scared of the future" to invest. But he misses the reason liberals take the uncertainty complaint with a grain of salt: conservatives have been using it for everything, from the size of government, to taxes, to the deficit, to Obama's health care plan. Is "uncertainty" a problem in the current economic recovery? Yes, and liberals believe that government spending will help the economy, more than it will "increase uncertainty" while the private sector is still reluctant to spend money. Even if the previous sentence is debatable, though, what's not debatable is that the Republican plan for extending the tax cuts will lead to far more borrowing than the recovery plans liberals have tried to push through since the stimulus.

Skipping ahead to the end:

It’s become harder to have confidence that legislators can successfully enact the brilliant policies that liberal technicians come up with. Far from entering the age of macroeconomic mastery and social science triumph, we seem to be entering an age in which statecraft is, once again, an art, not a science. When you look around the world at the countries that have come through the recession best, it’s not the countries with the brilliant and aggressive stimulus models. It’s the ones like Germany that had the best economic fundamentals beforehand.

It all makes one doubt the wizardry of the economic surgeons and appreciate the old wisdom of common sense: simple regulations, low debt, high savings, hard work, few distortions. You don’t have to be a genius to come up with an economic policy like that.

As I said at the beginning, Brooks's conceit depends heavily on stereotyping a culture of "liberal technicians." He could be forgiven this common, venial sin if behind those stereotypes lay some well-founded facts. His choice of Germany, then, is strange for three reasons: first, Germany has more regulations, more distortions, and a lower GDP per hour worked than the United States, which makes the country 2 for 5 on his "common sense" criteria. Second, before the recent recession, Germany's economy had stagnated for much of the past decade, even shrinking in 2003, and unemployment hit nearly 11% in 2005. Third, as The Economist's Ryan Avent has said (emphases original):

Germany has committed itself to deficit cutting, but it is not cutting now. Germany is one of the few euro zone countries to increase its budget deficit from 2009 to 2010. And planned 2011 cuts are quite small relative to those in countries pursuing crash austerity programmes, which are also suffering very weak recoveries (Greece has yet to get out of recession, and Spain may be heading back in).

This doesn't mean that stimulus is the key to German success. But Germany is absolutely not an example of strong growth despite austerity.

Non-Triumph Of The Will

George Will devoted his Sunday column to sneering at the Chevy Volt:

The Volt was conceived to appease the automotive engineers in Congress, which knows that people will have to be bribed, with other people's money, to buy this $41,000 car that seats only four people (the 435-pound battery eats up space).

Mark Reuss, president of GM North America, said in a letter to the Wall Street Journal: "The early enthusiastic consumer response - more than 120,000 potential Volt customers have already signaled interest in the car, and orders have flowed since the summer - give us confidence that the Volt will succeed on its merits." Disregard the slipperiness ("signaled interest" how?) and telltale reticence (how many orders have "flowed"?). But "on its merits"? Why, then, the tax credits and other subsidies?

Somewhat awkwardly for Will, Motortrend has a slightly different view, it announced today:

The Volt absolutely delivers on the promise of the vehicle concept as originally outlined by GM, combining the smooth, silent, efficient, low-emissions capability of an electric motor with the range and flexibility of an internal combustion engine.

It is a fully functional, no-compromise compact automobile that offers consumers real benefits in terms of lower running costs.

The more we think about the Volt, the more convinced we are this vehicle represents a real breakthrough. The genius of the Volt's powertrain is that it is actually capable of operating as a pure EV, a series hybrid, or as a parallel hybrid to deliver the best possible efficiency, depending on your duty cycle. For want of a better technical descriptor, this is world's first intelligent hybrid. And the investment in the technology that drives this car is also an investment in the long-term future of automaking in America.

Moonshot. Game-changer. A car of the future that you can drive today, and every day. So what should we call Chevrolet's astonishing Volt? How about, simply, Motor Trend's 2011 Car of the Year.

Will sneers at "the automotive engineers in Congress," though apparently his own automotive engineering sensibility towers above Motor Trend. Why has he been been denying us his expert automobile criticism?

Of course, the main problem with Will's critique is that it elides the fundamental premise. There's an electric car subsidy in order to jump-start the market for electric cars, which can then create efficiencies of scale. All of this is premised on the need to reduce carbon dioxide emissions. But Will, who also sees through the scientific consensus on climate change, sees no need to reduce carbon dioxide emissions, either. So obviously, from the climate science denier point of view, any expenditure designed to reduce carbon emissions is wasteful. Arguing about which particular anti-climate change intervention passes the cost-benefit analysis when you start from Will's premises is fairly pointless.

Why Did McConnell Fight The Earmark Ban?

Now that Mitch McConnell has caved on the earmark ban, it's worth revisiting the question of why he so vigorously opposed it in the first place, given that he was clearly doomed to fail. Yes, he likes to bring home the pork, but he doesn't need to bring home pork to safely win re-election as long as he desires. I previously suggested that opposition to earmarks represents a species of good government reform that strikes at the core of McConnell's essence.

Another reason is that President Obama supports the earmark ban. And McConnell's strategy is to deny Obama Republican support for any element of his agenda, thereby rendering Obama a partisan figure and reducing his chances for reelection. Indeed, supporting the earmark ban is a cheap, nearly symbolic move that carries disproportionate weight with the voters. Obama is going to be able to boast that joined with Republicans to ban on the historic practice, and that boast will help his reelection prospects. No wonder McConnell tried to stop it.

What Lessons Have Republicans Learned From The Last Shutdown?

[image error]

One thing I expect out of the Republican House is a government shutdown. The House leadership, which remembers 1995, may not want another shutdown. But the only alternative to shutting down the government is to immediately compromise with the Obama administration, and pass a series of policies Republicans consider unacceptable (if not tyrannical.)

What about the lessons of Newt Gingrich? That's not how Republicans remember the episode. Politico has a story headlined, "Freshmen Vow Not To Repeat 1994." Does that mean they don't want to go too far, demand too much and provoke a backlash? No, it means don't cheat on your wife or start getting earmarks:

The last big class of GOP outsiders intent on setting off a stink bomb in the clubby capital city is now remembered more as a ripped-from-the-headlines compilation of Republicans laid low.

There are Mark Souder, Mark Sanford and John Ensign, all adulterers of recent vintage. But what’s remarkable is how many other, less notorious, members of the Class of ’94 also carried on affairs or were caught in sex scandals.

Then there was Bob Ney, the Ohioan who served 17 months in federal prison on corruption-related charges stemming from the Jack Abramoff scandal.

And this is to say nothing of the other Republican Revolutionaries who ran against business as usual and went native when they saw the easiest way to reelection was to crack the Appropriations piggy bank. Take former Arizona Rep. J.D. Hayworth, for example, whose fondness for earmarks caught up with him in his Senate primary this year against John McCain, during which he was tailed by a heckler in a pig costume.

Interviews with more than a dozen Republican freshmen reveal a group determined to serve as delegates for the discontent that powered their elections but also to avoid the pitfalls of their predecessors.

Many said that the difference between this moment and 1994 is that the country’s fiscal problems are more urgent now and that voters would therefore be more apt to turn them out with haste if they didn’t enact change.

In other words, aside from keeping their pants zipped up, the primary failure of the last GOP takeover was failing to move fast enough.

There Will Always Be An England

[Guest post by Isaac Chotiner]

Sarah Lyall's New York Times write-up of the news that Prince William is engaged goes through the predictable handwringing over the bride-to-be's relatively "modest" upbringing before giving an account of how David Cameron and his cabinet reacted to the announcement.

Prime Minister David Cameron said that when he announced the news, members of his cabinet responded with a “great cheer” and “banging of the table.”

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers