Jonathan Chait's Blog, page 147

December 1, 2010

A Weak Attempt To Justify Extending The Bush Tax Cuts

National Review editorializes in favor of permanently extending all the Bush tax cuts.The argument begins by asserting that even the compromise Democratic offer to extend tax cuts for all income below one million dollars a year would be too onerous for the poor, poor families trying to scrape by on a low seven-figure salary:

Plan B was a large tax hike on families earning $250,000 or more. But that would have punished a lot of small businesses, not to mention a fair number of two-earner households consisting of the likes of policemen, nurses, public-school administrators, and other professionals whose combined household incomes frequently top $250,000 but who can hardly be demonized as “the rich.” So now Sen. Claire McCaskill, a Missouri Democrat, has trotted out Plan C: confining rate hikes to “millionaires,” meaning any household with an income exceeding $1 million. Senator McCaskill has never been the sharpest financial mind in the Senate, but even she should be able to figure out that a married couple earning $1 million in 2010 does not necessarily consist of “millionaires” — depending on their state and local tax burdens, they’re likely to be barely halfway there even before they have spent one thin dime of their own earnings.

Of course, the definition of "millionaire" is not net income over a million dollars a year, it's net wealth over a million dollars. That's the sort of thing you ought to get straight before accusing your targets of stupidity.

Anyway, households earning more than a million dollars a year constitute less than two-tenths of a percent of America. At some point, you have to give up the poor regular middle-class folks and just admit you're defending tax cuts for a tiny slice of the very richest Americans.

More interestingly, NR proceeds to argue that the Congressional Budget Office has actually blessed the idea of making the upper-income portion of the Bush tax cuts permanent:

As the always-sensible Reihan Salam reports in the current edition of National Review, economists expect that raising taxes at the top end would reduce economic growth significantly. Democrats will call that a Republican talking point, but it is consistent with the findings of the nonpartisan Congressional Budget Office, currently under the management of Douglas Elmendorf, a Democratic appointee. The CBO numbers suggest that a partial preservation of the Bush tax rates — meaning a compromise that raises taxes on “the rich,” in this instance defined as those earning $250,000 or more — would reduce real GNP by 1.2 percent, as lower revenue necessitates more government borrowing, slowing down long-term economic growth. But an across-the-board extension would reduce real GNP by only 0.6 percent, cutting the economic losses in half. Another way of saying that is that the growth effects of extending the tax cuts at the affluent end of the scale would make up half of the forgone real GNP associated with the tax cuts. That isn’t Arthur Laffer’s analysis, it’s the Democratic-led CBO’s.

Wow, so the CBO says the tax cuts will increase growth? Not exactly. Here's what Reihan Salam actually wrote:

the CBO’s strong labor-response model finds that a partial tax-cut extension as proposed by the president would reduce real GNP by 1.2 points — the growth effects of the tax cuts would not be sufficient to offset the lost government revenue. A full extension, in contrast, would reduce real GNP by only 0.6 points, suggesting that the addition of the high-income rate reductions would actually increase GNP by 0.6 points, despite the revenue loss. The weak labor-response model finds that partial and full extension have the same impact on GNP.

What is the "strong labor response model"? Let me explain. For years and years, conservatives been been lambasting the CBO because its economic models do not assume the explosive incentive effects that supply-siders believe, in the face of all evidence, must exist. After years of hounding, the CBO has including a "strong labor response model" in its projections alongside its normal projections. NR pretends that this one alternate assumption is the CBO's only finding.

Anyway, even if taken at face value, NR doesn't seem to realize just how weak of a claim it's making about the CBO. Here's the CBO report they trumpet in chart form:

[image error]

CBO is saying that extending the tax cuts, in any form, will decrease long term economic growth. Under one set of assumptions -- the assumptions that NR pretends are the only assumptions in the report -- extending all the tax cuts will harm the economy less than extending only tax cuts on income under $250,000. In other words, if we accept right-wingers' views about the incentive effects of tax cuts, then we can go an additional $700 billion in debt in order to decrease economic growth by 0.6% of GDP less than otherwise. The overall policy is to take on hundreds of billions in additional debt in order to decrease long-term economic growth. This is what NR is touting as an endorsement of the tax cuts!

Indeed, CBO's analysis is consistent with the assumptions of essentially all economists from left to right. Debt-financed tax cuts decrease economic growth. The only way you can create an assumption of higher economic growth is to package those tax cuts with equal-sized spending cuts. Of course, the tax cuts in question are not packaged with any spending cuts whatsoever.

NR waves away this inconvenient fact by citing a "mood" to cut spending:

If the CBO is correct, then there probably will be revenue forgone by extending the Bush tax rates, but the wholesome fact is that the American people and the new Republican majority in the House are in a mood to cut spending. Thankfully, the chairmen of President Obama’s deficit commission have shown a good deal more sense than the tax-happy Democrats in Congress, and their list of spending cuts would be an excellent place to get started reducing the size, scope, expense, and arrogance of the federal government.

It's nice that they're conceding that it's "probably" true that tax cuts will decrease revenue. It's also touching that NR has so much faith that in the power of Congressional anti-spending rhetoric, though I note that this rhetoric has not manifested itself in, say, a requirement that Congress at least find offsetting spending cuts before it digs the deficit hole deeper with more tax cuts. I'd also note that NR is advocating revenue levels far below the spending levels that would prevail even in the wildly unlikely event that the Republican leadership spending plans are approved wholesale. So, beneath the veneer of reality-based economics, what we have here is the familiar, faith-based insistence that tax cuts for the rich will lead to a massive growth spurt along with a vague hope of future spending cuts.

Let me clue you in on how this ends: the tax cuts pass, the spending cuts don't materialize, the deficit stays high, and NR laments that true conservatism was never really tried.

The Day In Black Comic Fiscal Juxtaposition

There was a grim, understated hilarity to the Senate debate over extending unemployment benefits yesterday. Republicans piously insisted that any extension of unemployment benefits, whose cost to the government is both small and temporary, must be offset with spending cuts:

The lift just got heavier for Senate Democrats with the swearing in this week of Illinois Republican Mark Kirk. Asked whether he would support extending the jobless benefits, Kirk took a stance most Republicans take: "If it's paid for by cutting other items in the budget, I will be a yes vote. If it's added to further debts of the United States, no."

Late Tuesday, Rhode Island Democratic Sen. Jack Reed defended his party's proposal to extend unemployment benefits for a year without cutting other items in the budget.

"We've always done it on an emergency basis, because it truly is an emergency," Reed said. "We haven't sought to offset it, because we've always determined that it was necessary to get the money to the people who could use it, who needed it desperately, and we should do that again."

Reed then proposed that the Senate take up the extension. Massachusetts Republican Sen. Scott Brown objected, even as he expressed sympathy to onlookers in the Senate gallery for those losing their benefits.

"Make no mistake, I agree that they need help, but I look at it as: Are we going to do it from the bank account, or are we going to put it on the credit card?" he said.

Democrats in turn rejected Brown's proposal to cut other government funding to pay for more jobless benefits. Both sides say the solution may be to attach those benefits to a deal extending the Bush-era tax cuts.

The last line is the funny part. The Republican position is that it's fiscally irresponsible to temporarily extend unemployment benefits during an economic crisis. But they might accept a "compromise" to extend them along with a vastly more expensive and completely un-paid-for extension of the Bush tax cuts! If I were more cynical I might doubt the sincerity of their claim to be concerned about the national debt.

November 30, 2010

Shadeggelic

Watch John Shadegg express astonishment at the notion that unemployment benefits could provide economic stimulus:

BARNICLE: What about the fact that unemployment benefits pumped into the economy are an immediate benefit to the economy? Immediate…

SHADEGG: No, they’re not! Unemployed people hire people? Really? I didn’t know that.

BARNICLE: Unemployed people spend money Congressman, ’cause they have no money.

SHADEGG: Aha! So your answer is it’s the spending of money that drives the economy and I don’t think that’s right. It’s the creation of jobs that drives the economy…Actually, the truth is the unemployed will spend as little of that money as they possibly can. Job creators create jobs.

Shadegg is expressing -- I was about to call it an "idea" but it's more of an impulse or a prejudice -- common among conservatives, which is that rich people having more money is always good for the economy. Rich people use their money to create jobs, and poor people just blow it on booze or whatever. Liberals may want to give more money to the poor out of some misguided soft-hearted compassion, but to really help people you need to give them jobs which means the rich have to have more money.

Like I said, this isn't an idea. It's just a vague sensibility that flows from the rich man's view of the world and resonates with uninformed minds sympathetic to anything that sounds like conservative thought. The truth is that the blunt "trickle down" theory espoused by Shadegg isn't rooted in any kind of economics, conservative or otherwise. And in point of fact, businesses are sitting on mountains of cash right now. The notion that they need more cash to start hiring is totally implausible.

TARP Getting Even Cheaper

TARP may end up going down as one of the most successful policy initiatives in American history:

The projected cost of the $700-billion financial bailout fund — initially feared to be a huge hit to taxpayers — continues to drop, with the nonpartisan Congressional Budget Office estimating Monday that losses would amount to just $25 billion.

That's a sharp drop from the CBO's last estimate, in August, of a $66-billion loss for the Troubled Asset Relief Program, known as TARP. Going back to March, the budget office estimated that the program would cost taxpayers $109 billion.

The new, more optimistic forecast largely reflects money the Treasury Department has received as banks have repaid their loans and repurchased stock warrants. It also takes into account lower estimated costs for assistance to insurance giant American International Group Inc. and General Motors Corp., which recently held a highly successful initial public offering, the CBO said.

Sarah Palin And The GOP's Collective Action Problem

Joe Scarborough implores Republicans to denounce Sarah Palin:

Republicans have a problem. The most-talked-about figure in the GOP is a reality show star who cannot be elected. And yet the same leaders who fret that Sarah Palin could devastate their party in 2012 are too scared to say in public what they all complain about in private.

Enough. It’s time for the GOP to man up.

In fact, many Republicans are castigating Palin in public. There's Karl Rove:

“With all due candour, appearing on your own reality show on the Discovery Channel, I am not certain how that fits in the American calculus of 'that helps me see you in the Oval Office’,” Mr Rove told The Daily Telegraph in an interview. […] “There are high standards that the American people have for it [the presidency] and they require a certain level of gravitas, and they want to look at the candidate and say 'that candidate is doing things that gives me confidence that they are up to the most demanding job in the world’.”

Conservatives talked a lot about Ronald Reagan this year, but they have to take him more to heart, because his example here is a guide. All this seemed lost last week on Sarah Palin, who called him, on Fox, "an actor." She was defending her form of policical celebrity—reality show, "Dancing With the Stars," etc. This is how she did it: "Wasn't Ronald Reagan an actor? Wasn't he in 'Bedtime for Bonzo,' Bozo, something? Ronald Reagan was an actor."

Excuse me, but this was ignorant even for Mrs. Palin. Reagan people quietly flipped their lids, but I'll voice their consternation to make a larger point. [… Reagan] wasn't in search of a life when he ran for office, and he wasn't in search of fame; he'd already lived a life, he was already well known, he'd accomplished things in the world.

Rep. Spencer Bachus, R-Ala., a favorite to become chairman of the Financial Services Committee in the incoming Republican-controlled House, said that while tea party candidates fared well in House races, in the Senate "they didn't do well at all," according to the Shelby County Reporter.

“The Senate would be Republican today except for states [in which Palin endorsed candidates] like Christine O’Donnell in Delaware,” Bachus said at the November 4 meeting in Columbiana, Ala. “Sarah Palin cost us control of the Senate.”

“I sat next to her once. Thought she was beautiful," Barbara Bush said. "And she's very happy in Alaska, and I hope she'll stay there."

And a major hit piece in the Weekly Standard. (The author, Matt Labash, may not be an organ of the Republican Party, but the editors are, and it's hard to imagine them having published something like that two years ago.)

Now, Scarborough is correct that elected Republicans, and especially Republican presidential candidates, have shied away from attacking Palin on the record. There's an obvious collective action problem at work. The party as a whole would stand to lose a great deal if she captures the nomination. She runs a good 8 points worse against Obama than against a generic Republican or Mitt Romney. On the other hand, she's popular among Republicans, and a candidate who attacks her would put his own candidacy in grave danger. So the heavy lifting is going to have to reside with Republicans who aren't running for office.

The Meaning Of "Constitutional Conservatism"

The emergence of "Constitutional conservatism" as a new aspect of right-wing thought is about nine-parts empty slogan and one-part actual idea. When you look at the actual idea, it's fairly scary. Conservatives are correct that the country has changed its original understanding of the Constitution. Those changes have primarily involved making the country more democratic -- we now get to elect Senators, a privilege many conservatives would like to remove. Another change is that the franchise is no longer restricted to white, male property owners. I don't see anybody looking to reverse women's suffrage or restore slavery, but Tea Party Nation Judson Phillips thinks the franchise should be taken away from renters:

The Founding Fathers originally said, they put certain restrictions on who gets the right to vote. It wasn’t you were just a citizen and you got to vote. Some of the restrictions, you know, you obviously would not think about today. But one of those was you had to be a property owner. And that makes a lot of sense, because if you’re a property owner you actually have a vested stake in the community. If you’re not a property owner, you know, I’m sorry but property owners have a little bit more of a vested interest in the community than non-property owners.

This particular element of "constitutional conservatism" also hews to the pervasive sense among conservatives that the political process has been captured by poor, lazy leeches who are exploiting the hard-working rich/middle class.

A Tea Party-Teachers Union Alliance?

Diane Ravitch has mainly been preaching her anti-education reform message to teachers unions, which, in turn, she has presented as heroic and selfless. The other day, though, she took her anti-reform message to the pages of the Wall Street Journal, which called for a slight change in tone:

Now that Republicans have regained control of the House of Representatives, they must take a stand in the battle for control of American education. The issue today is between those who want to federalize education policy and those who want to maintain state and local control of the public schools.

Historically, the GOP has always been the party of local control, and for most of the 20th century Republicans opposed almost every effort by Democrats to expand the power of the federal government over the nation's public classrooms. ...

The question today for Republicans is whether they are a party that endorses top-down reform from Washington, D.C., or a party that respects the common sense of the people back home and their commitment to their local public schools.

Ah, local control, that historic panacea! Not quite the same tune she's been preaching to her union audiences -- indeed, the paeans to unionism that characterize Ravitch's argument are curiously absent here -- but surely a more effective talking point for a Republican audience.

Meanwhile, in the middle of her wildly misleading praise of local control, Ravitch writes this:

The present course is virtually the opposite of what high-performing nations do. Countries like Finland, Japan and South Korea have improved their schools by offering a rich and broad curriculum in the arts and sciences, not by focusing only on testing basic skills, as we do. These nations have succeeded by recruiting, training and supporting good teachers, and giving continuing help to those that need it. The Obama administration, by contrast, has disregarded the importance of retention and improvement of teachers, while encouraging an influx of non-professionals into the field.

What else do these high-performing countries have? National curricula. Not local control. Oh, and the part about Obama's reforms disregarding retention and improvement of teachers is nonsense.

McConnell, Boehner Not In Compromising Mood

John Boehner and Mitch McConnell say the election proves the American people favor the hard-line Republican agenda on everything:

When congressional leaders of both parties meet at the White House today, all of us will have an opportunity to show the American people that we got the message of the elections earlier this month.

Republicans heard the voters loud and clear. They want us to focus on preventing a tax hike on every taxpayer, reining in Washington spending and making it easier for employers to start hiring again. Today, Republican leaders renew our offer to work with anyone, from either party, who is ready to focus on the priorities of the American people.

The day after the election, President Obama seemed to acknowledge that a change in course is needed when he conceded that "the overwhelming message" he heard from the voters was "we want you to focus completely on jobs and the economy."

Despite what some Democrats in Congress have suggested, voters did not signal they wanted more cooperation on the Democrats' big-government policies that most Americans oppose. On the contrary, they want both parties to work together on policies that will help create the conditions for private-sector job growth. They want us to stop the spending binge, cut the deficit and send a clear message on taxes and regulations so small businesses can start hiring again.

This is so deep into the realm of spin it's not worth evaluating as a normative claim. (When Democrats win elections, Republicans say that the message is that they should enact the agenda of the Republican base; when Republicans win elections, they say the message is that they should enact the agenda of the Republican base.) What's interesting is that the Republican leaders are not bothering to even feign interest in cooperation. And of course this makes perfect sense. The GOP's interest as a party is to refrain from giving President Obama any bipartisan accomplishments he could use to help win reelection. And Boehner and McConnell's interests as party leaders is to avoid the perception that they're too cozy with Obama, which is the only real threat to their power.

In any case, there's not much point in pretending that the parties might cooperate on anything.

November 29, 2010

&c

-- James Mann argues that Wikileaks hasn't ruined diplomacy.

-- PPP has Mike Bloomberg's poll numbers. They're not good.

Lying Chart Of The Day, Classic Edition

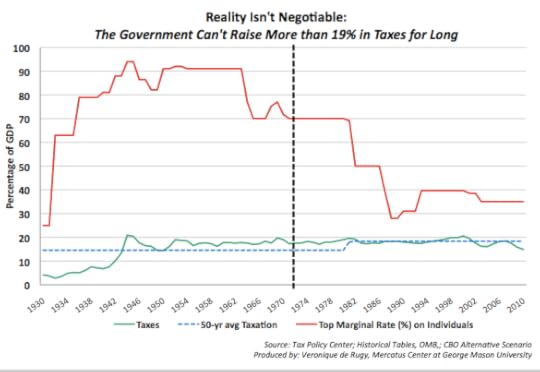

Ubiquitous libertarian anti-tax pundit Veronique de Rugy pulls out the old hackneyed Republican line that tax revenues can't go above 19 percent. She even has a chart!

Normal

0

false

false

false

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:"Table Normal";

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-parent:"";

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin:0in;

mso-para-margin-bottom:.0001pt;

mso-pagination:widow-orphan;

font-size:10.0pt;

font-family:"Times New Roman";

mso-ansi-language:#0400;

mso-fareast-language:#0400;

mso-bidi-language:#0400;}

Democrats still think they will be able to raise more revenue by letting marginal rates go up. But that ignores the fact that the federal government has never been able to get much more than 19 percent of GDP in tax revenues, no matter how high the top marginal tax rate goes. Consider this chart:

It shows the historical path of federal taxation as a percentage of GDP (using the earliest records available from the OMB) alongside top-marginal-tax-rate data from the Tax Policy Center. From 1930 to 2010, tax-revenue collection in the United States has never topped 20.9 percent, averaging 16.5 percent of GDP over 80 years. This despite the drastic historical fluctuation in tax rates on the wealthiest Americans.

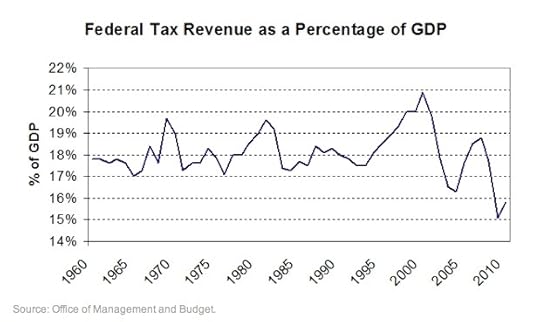

I've seen versions of this dating back two decades. Part of the scam is a simply visual trick familiar to anybody who read "How To Lie With Statistics" -- you scale the chart to make a major change appear tiny. De Rugy's chart, one which the scale of federal tax revenue goes from an absurd o to 100, seems to show little change, thus proving the supply-side claim that increasing marginal tax rates is self-defeating. Here's a chart showing the range of revenue within a reasonable scale:

As you can see, the swings are fairly dramatic. De Rugy's chart purports to show that reducing the top marginal tax rate produced no real change in revenue. But of course the first Reagan tax cuts in 1981 caused revenue to plummet. The top marginal tax rate was also reduced in 1986, but that was accompanied by equally large reductions in tax expenditures, and the whole reform was not designed to reduce revenue.

Meanwhile, the tax hikes by George W. Bush and Bill Clinton -- which supply-siders claimed would not increase revenue -- were followed by a massive spike in revenue. And then the tax cuts by George W. Bush -- which supply-siders claimed would not reduced revenue by very much -- were followed by a massive, 5% of GDP drop in revenue, which receded to 2% of revenue at the peak of the 2000s economic cycle.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers