Harry S. Dent Jr.'s Blog, page 8

January 8, 2020

The Sunspot Predicting a Mega Crash

I was looking at some cycle work from J. M. Hurst, and there were related articles on how sunspot cycles affect very short-term movements in stocks – not just the 8-14, or near 10-year average cycles in booms and busts. I will be looking more into that.

I was recently looking at the longer-term cycles, as they have been declining in intensity since the highest peak in hundreds of years in 1957… I am thinking that’s right when the massive Baby Boom birth cycle started peaking in a plateau from 1957 into 1961.

Why wouldn’t the highest energy radiation stimulate people to have more sex and more babies? Just as they spend more or speculate more in stocks when they feel more energy at the normal, plus-20% sunspot cycle top in radiation.

Then I noticed the next minor peak was in 1989, just as the Millennial births were peaking in 1990. Coincidence? I don’t think so. Births and immigration trends continue to decline after that 1889 top – not good for demographic trends in the future.

Also, look back at the last highest peak in measured history, in 1778. That was right at the beginning of the Revolutionary War and right after the Declaration of Independence. Was that a high time of energy… a major moment in American and world history?

So, I’m starting to see 60- and 120-year cycles. Inflation cycles have been historically close to 60 years, and commodity cycles, 30 years. So, this is already a natural harmonic. One scientific study found 78 significant climate swings in the last 4,500 years. That averages 58 years, very similar to the difference between the 1778 and 1836 peaks, at 58.5 years.

That 1836 peak came right at the top of the greatest westward migration and real estate boom peak in the Midwest, which was fostered by the canal revolution linking Chicago and the Midwest to the Atlantic Ocean, and heavy government stimulus with cheap land grants and low-cost easy financing.

And the 120.8-year cycle between the 1836 and 1957 peaks is roughly twice that!

The fact that intensity is continuing to decline 60 years after the last peak suggests that we could be in for a more prolonged cooling period in the decades ahead.

Scientists have realized that the 8 to 14-year variations on the 10-year average cycle are caused by the gravitational pull of Jupiter, the Earth and Venus (Mercury and Mars are too small to matter that much). Combined, that does correlate closely with the sunspot peaks and bottoms.

But these 60-year cycles would suggest impacts from Saturn.

Also, note the Mini Ice Age between 1640 and 1720 for about 80 years (midpoint at 1680). There were virtually no sunspots. The last time we had a period near that cold was around 720 AD, or about 960 years earlier. Before that was 250 BC, about 970 years before 720 AD! So, we look to also have a near 1,000-year cycle in larger cooling periods due to sunspots alone and not the larger Milankovitch 100,000-year ice age cycles.

And then, take note of the fact that when sunspot cycles move into low-intensity periods, like the Dalton Minimum and right now, the down cycles are longer and the bottoms also take longer to complete. On the chart, I marked in the blue circles all of the longer bottoms that ranged more from 3-5 years. That last one was a bit longer than average, at two years.

A minority of scientists and I see this bottom that started in late 2018 lasting into late 2021 and possibly longer. That bolsters the forecast for a major crash beginning sometime in 2020 and lasting into as late as 2022.

But here is the most important insight…

The biggest crashes and downturns tend to come in the lower intensity cycles, like the 1973-74 crash, and the one in 1929-32.

This current cycle is bottoming in the lowest intensity cycle – both since the strongest peak intensity cycle in 1957 and the lowest since the early 1820s, Dalton Minimum.

The infamous Tulip Bubble and 1720 South Seas Bubble crashes both came in very low intensity periods.

This alone forebodes a worse crash than 2007-09 and 1973-74 – both of 50%+ magnitudes. This should be more like 1929-32, or 80%+, as the 90-year Super Bubble/Great Reset Cycle also strongly suggests.

I may well do a whole article on climate change and the longer- and shorter-term sunspot cycles in The Leading Edge sometime soon, as it does seem to be more than meets the eye… and it’s the fourth cycle in my hierarchy and critical to pinpointing recessions and more serious stock corrections.

But more on that later.

January 7, 2020

How Smart is Your Smartphone?

As Americans, we profess to love our privacy. Gone are the days of our youth when backyard football games stretched across several properties. Now everyone has a six-foot privacy fence and a host of webcams that ping us every time a feral cat crosses the front lawn.

And yet, we carry smartphones.

That nifty electronic slab in your pocket or purse is fabulous for communicating on the go, calling or texting when you’re bored in the dentist office, and even watching cat videos. But it does something else, too. Chances are your phone tells thousands of companies where it is and, by default, where you are, every few seconds of every day.

The info travels through the apps that you download and use. Some of these apps, like the WeatherBug app, have a legitimate purpose for collecting the data. If you quickly want to know what the weather looks like in your area, WeatherBug needs to know where you are. The company collects the exact latitude and longitude for your location, and then uses that pinpoint accuracy to feed you the current weather and the forecast. That seems reasonable.

But then WeatherBug goes a bit further. The company shares your exact location data with 40 companies, and you can bet that they get paid handsomely for passing along this tidbit of information.

It’s not illegal. You agree to allow the company to share your data when you download the app and quickly click through the terms and conditions.

WeatherBug isn’t alone. On Google’s Android operating system, researchers found over 1,000 apps that shared your location, and 17 that sent along exact coordinates to more than 70 companies.

Some of the apps, like WeatherBug, at least have a legitimate reason for collecting your location data, but others simply scoop it up to sell it. Is there a reason that the Angry Birds video game app needs to know where you are? And how about Clean Master, an app that scans for viruses and optimizes your phone service?

Don’t think that your information is anonymous. In addition to advertising data and coordinates, apps also collect unique identifiers for your physical phone, so they know exactly which phone travels where and when, even if you turn it off for a bit or take an airplane ride.

Imagine what you could learn about a person if you knew where they went during the day and where they lived. By cross-referencing public records, you could quickly put a name with a phone, and then connect it with that person’s personal physician, their mechanic, and their friends. A bit more data will show you how they vote, and which political candidates they funded.

Suddenly, the privacy fence and a couple of door cams don’t seem like such a good defense.

When it comes to our phones, there are measures we can take, but most people won’t do it because it’s a hassle.

On the iPhone, you can scroll through settings and click on each app to see which ones use your location services. Apple allows you to share your location data always, never, or only when using the app. You can also click on the universal location services button under privacy and turn it off. You’ll have to turn it back on whenever you want to use something that requires your location, like maps, but you won’t be broadcasting your whereabouts 24/7.

Google’s Android isn’t as easy. You can still scroll through your apps in settings and see which ones use your location services, but their choices are limited to “yes” and “no.”

With impeachment back on the scene as Congress reconvenes, the presidential election on the horizon, and the heightened conflict with Iran, the privacy dust-up of 2019 has faded to the background. Our chances of getting meaningful help from the major tech players seems remote as the pressure eases and they continue to earn billions by selling our data.

But that doesn’t mean you have to be a willing participant.

Take a few minutes to scroll through the apps on your phone and ask yourself if you want to be sharing your data with each app so they can make a few pennies. Is your privacy worth their profit? If not, turn off location services for that app, or better yet, ask yourself if you need the app at all.

January 6, 2020

On the Soleimani Assassination

What was Trump thinking when he assassinated Iran’s top general Qassem Soleimani with a drone strike in Baghdad?

Obviously, he was involved in many plots to threaten Americans and our interests. U.S. General David Petraeus claimed this was a bigger event than taking out Bin Laden… But wouldn’t it also be an obvious declaration of war out of an acceleration that started with Trump’s backing out of the Iran Nuclear Treaty and putting heavy sanctions on the country?

Now the world awaits Iran’s imminent response, with Trump threatening the worst if they do. This could escalate fast.

One of the central points made in my book Zero Hour was that the world was having a backlash to globalization after having been thrust so close together by global trade and the internet. People naturally come into conflict most often over political, and, more so, religious ideologies and beliefs.

The best solution in this 250-Year Revolutionary Cycle we find ourselves in is that political boundaries and systems realign along religious and cultural lines so that people can be happier and more focused in their own ideologies while networking and trading in a more diverse, globalized world.

Where have the greatest conflicts been in the Middle East, which is the area of most intense turmoil since the 1970s? It has been in Iraq, Syria, and Afghanistan. These are countries, especially Iraq, that have a very split populace of Sunni and Shia, and sometimes Kurd and Christian.

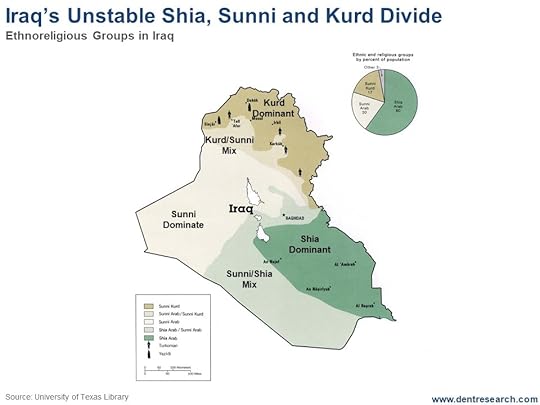

Here’s the map of Iraq from the book on page 64:

The southern side of Iraq, bordering Iran, is mostly Shia (as is the majority of the country at 60%); the middle is more Sunni (20% nationally); and the northern is more Kurd (17% nationally), with two smaller sectors clearly mixed.

I proposed that the best outcome here would be for the Kurd-dominated areas to merge with the Kurdish sectors of Turkey; the Shia-dominated area merge with Iran (or possibly as Iraq as an ally); and the rest become a Sunni country or merge with Syria which is Sunni dominant.

Look at the first actual outcome of this weekend’s attack. Iraq’s Parliament votes 170 to 0 to oust the U.S. from Iraq. This is a big victory for Iran, which has been working its Shia influences in Iraq, Syria and Lebanon to bolster their interests. And it was already the U.S. that ousted Saddam Hussein’s Sunni minority regime to Shia-dominant Iran’s favor.

Now Iraq kicks us out in immediate response to Soleimani’s assassination as the Shia majority interests are more in control now – and they use this as an excuse to back out of all limits on uranium enrichment. This move by Trump also only served to embolden the Iranian public against the U.S. when they were not as anti-U.S. as their government.

Next, Iran uses its influence to pressure the U.S. out of other areas – and maybe Russia has to step in as the deal maker as it did in Syria.

The real truth is that we have been the biggest destabilizing and inflammatory ingredient in the Middle East. As “infidels,” we only add Western religious tensions to the already strong religious ones there… The U.S. getting kicked out may be the best outcome yet, for us and the region… We’re most often hated even when we win or do something good.

My 35-year Geopolitical Cycle moves in 17- to 18-year positive and negative phases. The last negative cycle started with 9/11 in late 2001 and is due to bottom right around now – late 2019/early 2020. I have been saying that the U.S./Iran conflict intensifying here is likely the culmination of this negative cycle that should start turning up slowly in 2020, like the Cold War did in 1983 when Reagan started talking with Gorbachev.

Hence, I do not expect this to turn into another lengthy war in the Middle East like Iraq and Afghanistan. It may just set the stage for a faster realignment of Iran, Iraq, Syria, and possibly Afghanistan – which could allow for a more stable outcome in the years ahead. I expect a quicker resolution here, even if it ends up being dramatic and scary at first. If Shia and Sunni can separate into their own kingdoms, then they don’t have to fight as much.

What is still left here: Does Iran quietly take this victory of kicking the U.S. out of the region increasingly in stride with more tolerable responses, or does it react aggressively and open up for a more fatal blow from Trump that calls their military inferiority into clear view and capitulation?

Trump’s advantage here is that he clearly looks crazy and impulsive enough to strike back with major force against Iran. But our allies are likely to be more eager to re-negotiate with Iran and deter their rekindled nuclear ambitions again. Wouldn’t the U.S. withdrawing more from the Middle East most serve Trump’s America First policy?

This short-term crisis should also be the biggest factor in the stock market “on crack,” which reacted tepidly on Friday to this potentially huge issue. These types of markets typically ignore all bad news at first, and that’s been the case with this one, as it advances with over $400 billion (and rapidly rising) of recent Fed injections to fight the repo crisis. Soleimani’s assassination should have brought a 1,000-point+ slide.

Markets are heading back down on Monday, but not that strongly at all. We could get a continued melt-up and blow-off if this is resolved more peacefully and quickly, or that nasty 30% megaphone correction if it escalates dramatically.

Stay tuned on this one! The next four weeks should be critical.

January 3, 2020

The First Five Days

Seeing as this is my first Friday rant of the New Year, it’s important to remind you that historically the first five days of market action are indicative of the direction we’ll take for the next 12 months. And already things have been somewhat positive, with the Dow up about 330 points at the close on Thursday and the Nasdaq also getting a nice boost.

Yet shortly after the close, a U.S. drone strike in Baghdad killed Iranian General Qasem Soleimani, who many claim to be the No. 1 bad guy and taker of U.S. lives in recent times. This is victory for us in the short-term, but there will surely be some sort of major retaliation in the coming days or weeks.

Stocks were down over 300 points at worst early on Friday morning, largely erasing yesterday’s strong gains. More important, the markets are backing off of my key resistance point just over 28,000 on the Dow. Breaking above yesterday’s high of 28,873 will be bullish near-term, but breaking below 26,300 will be more bearish.

We’ll have to see how things continue to progress. And remember, one thing that’s a better indicator than the first five days? The first full month.

Of course, 2020 is expected to be an anomaly, as I’ve been writing about for quite some time, so it’ll be tough to apply the conventional wisdom of market trends to what happens over the next few weeks.

Remember, we’re still deep into this megaphone pattern, and a downturn could also be coming that would scare people before the 2020 peak. That, along with the tumultuous political landscape at the moment – to say nothing of what happened in Baghdad overnight – will only further muddy the waters. And that’s to say nothing of the pressures Trump will put on the Fed in order to keep the economy humming as he moves toward his re-election.

To put it lightly, we’re in for quite a wild one. I have more in this week’s Friday Rant.

January 2, 2020

The First Gift of 2020

For Christmas, did you get anything that weighed 4,500 pounds and cost more than $50,000? Did someone surprise you with a car or truck you didn’t know was coming, walking you out to the driveway and handing you the keys? I know it happens, I’m just not sure it occurs often enough to warrant the 8 billion car commercials I see on television every holiday season.

But this year, instead of being annoyed by car ads, I saw them in a new light, sort of like watching an entire industry on the verge of committing corporate suicide. It brought to mind the old saying, “a train wreck in slow motion is still a train wreck.”

On the face of it, auto companies are hawking SUVs and trucks, with just high-end companies promoting sedans. I know those vehicles bring in beaucoup profits, so it makes sense that they push these vehicles. But behind the scenes, they’re doing something else… shifting to electric vehicles (EVs).

Volkswagen is the largest car company in the world, selling roughly 11 million units per year. The firm was slammed by the emissions scandal, which cost it $30 billion. Now Volkswagen is investing $90 billion over the next decade in EVs, and plans to convert 25% of its offerings to electric power by 2025, a mere five years away.

Daimler Benz will invest $42 billion in EVs, and Ford has committed $11 billion to the cause. General Motors is making its own investments, and plans to make all Cadillacs electric.

Who will buy them?

Tesla remains the test case for selling such cars on a voluntary basis, and the record isn’t convincing. The company probably sold 360,000 cars in 2019, which isn’t too shabby for a new brand, but it doesn’t turn a profit, makes significant revenue from selling emission credits, and is watching sales of its high-end Models S and X drop like a rock. Nothing about that screams “unmet demand,” and yet competing car companies are jumping in with dozens of new EV models and spending between $100 billion and $200 billion to make it happen.

They’re not drawn by Tesla’s unlimited success; they’re responding to regulations in the EU, China, and even North America. But just because regulators make you build EVs doesn’t mean consumers will want them, and certainly doesn’t mean consumers will pay high prices for them.

All of this will weigh on the automakers in 2020 and beyond, and the most pressure should fall squarely on Tesla.

The company made a cool car in 2012, but the Model S still looks like it did in 2012. The model X is fine, but not flying off the showroom floor, and the Model 3 earns the company little profit. The Cyber Truck won’t be in production for at least another year, which leaves Tesla banking on the Model Y.

Tesla trades at about $420, with a negative P/E of -4.77. The company needs to sell an awful lot of its new model at big prices to earn a profit that will support the stock at $420. If Tesla earned $1 billion, it would be roughly $5.55 earnings per share. At that level, the company would need a P/E of 75 to sustain a stock price near $420. Apple carries a P/E of 24.5, while Ford and GM have P/E’s of 23 and 6, respectively.

Obviously, investors are placing speculative bets that Tesla can do something magical with its car business, but I think that time has passed. While the company built out production facilities, and even recently secured $1.6 billion to build its factory in China where it just rolled out its first vehicle, competitors caught up. Those willing to spend $60,000 to $130,000 on an electric vehicle can buy a

vehicle from Porsche, Jaguar, Audi, and a number of other producers. And soon, those wanting to spend a little less will have their choice of vehicles from GM and Volkswagen.

Soon, Tesla won’t be special, and it still won’t earn much profit.

To kick off 2020, consider a bearish position on a darling stock, buying puts on Tesla. As often mention to Boom & Bust subscribers, I don’t short stocks because I like to limit my potential losses, so a put option that expires in nine months or so is where I’d look. If I’m wrong, then I’ve lost a little money betting against a company that burns cash has looming competition. If I’m right, then I’ve given you your first investment gift of 2020.

January 1, 2020

Where Adults Spend Their Money

Credit Suisse just came out with their excellent Global Wealth Report for 2019. I will likely do a more in-depth report in The Leading Edge earlier in the New Year.

The focus is on wealth, but the income statistics are even more illuminating in this time of peak inequality. I especially like their comparisons per adult as opposed to per capita or per household.

Adults are the people who spend their own money – whether it be earned or saved. Minors are spent on, and it is a lifestyle choice to have kids or not – as well as to have a certain number of them. Of course, if you have more kids you will have less income per person. But people who choose that typically prefer that for their lifestyle. So, this is the best measure to me of how much income and spending power people have in different countries.

Then there are the comparisons of income in PPP, or purchasing power parity. I like that comparison, as well, and it works best for measuring how standard of living grows with urbanization. But although countries with lower costs of living makes life more affordable, there is a quality of life factor that is also a choice. New York or London or Sydney or Geneva or Singapore may cost more to live, but they are considered worth it due to their immense choices and lifestyle quality.

So, in this article, I will show the GDP per adult for the developed countries over 5 million in population – and there is a great variance, from $30.9k to $108k.

First, note the three highest countries, as they all have some exceptions for their high achievements here. Ireland is the highest, but it is a small country with strong tax incentives to attract multinational companies with high paying jobs. Norway is a small country with high relative oil revenues, like a mini Saudi Arabia. Switzerland is the most expensive country in the world, typically with high-value exports. Their companies have to pay more for the privilege of being there.

The U.S. really stands out here, as it is a very large country with a high ratio of lower income immigrants. At $85.3k, it is 7% higher than Singapore that has a 100% urban population and attracts the best of Asia. I did not expect the U.S. to outperform it on this measure. The U.S. is also 44% higher than Hong Kong, which is also 100% urban and attracts the best of Asia.

I look at Belgium here as being right in the middle – like the median – at $59.4k. The U.S. is 44% greater than that. The other countries in Europe that stand out are Denmark, Sweden and the Netherlands – very northern.

Outside of Ireland, the U.S. is also the strongest of our cousins, the English Offshoots. Australia at $76.0k is only 11% lower than the U.S., and they don’t work as long hours. Canada at $59.2k is a surprising 31% lower than the U.S. New Zealand comes in at $58.7, also 31% lower. All the offshoots have now surpassed the U.K, and at $55.2 it is 35% lower than the U.S.

Spain is the lowest in Europe at $38.1k now, about the same as its Spanish cousin Puerto Rico at $37.6k. Kudos to my new home country, which was still an emerging country a few decades ago. Taiwan is the lowest at $30.9k, that was also a surprise to me and likely reflects its still restrictive ties to China.

The U.S. still looks surprisingly good. Too bad we look to peak and fade by 2036-37 at the top of the next global boom.

December 31, 2019

Crazy Possibilities for 2020

In the spirit of the New Year, I’m reviving my theme from last year – crazy possibilities. These are the “what if’s” and “why not’s?” that Americans live for. Think of them in the same light as that promising biotech penny stock you bought on your brother-in-law’s recommendation that hasn’t quite panned out, or the lottery ticket you pick up at the corner story every now and then. It’s not likely, but hey, it’s possible.

For 2020, the list isn’t really crazy, just unlikely – and certainly be entertaining if they happened!

Trump Chooses Kanye West as Running Mate

Mike Pence appears to be a nice, principled guy. Many people disagree with him, of course, but they understand who he is, how he works, and what he will do. All of which makes him incompatible with President Trump’s seat-of-the-pants, whatever-comes-to-mind style of governance. Searching for a running mate that can move as fast as he does, and one that might give him more support with the black vote, Trump recruits music star Kanye West, who’s not only married to a Kardashian, but also recently turned his back on pop music when he found religion.

In Kanye, Trump could produce a hat trick, earning points with a minority voting bloc, social media followers, and the evangelicals all at once. Besides, it’s obvious the two have a bromance going on. They should spend more time together.

As an offshoot of the new pairing, Melania Trump and Kim Kardashian start a new clothing and make up line called Stronger, playing off of Kanye’s hit song. Understandably, they don’t reference most of his other work.

Electric Cars (EVs) Perform as Advertised

Paying pennies to charge your car and almost nothing on maintenance sounds great, but the reality of owning an EV is a bit different. From waiting more than an hour to access an ironically-named fast-charging station to vehicles that suddenly “brick” and must be towed for simple things such as dead batteries and flat tires, EVs fall short in the real world. But in 2020, Elon Musk and his ilk announce that they’ve unlocked their vehicles to give consumers control over maintenance issues, and they’re partnering with McDonalds and Walmart to put fast-charging stations about every 6 blocks across America.

Ford and GM immediately breathe sighs of relief because the changes to the industry make their business plans, which call for heavy EV investments, viable. They won’t make profits, but at least they won’t lose billions of dollars.

Small Oil and Gas Companies Earn Profits (It Could Happen)

U.S. Energy exploration and production companies, famous for introducing the word “fracking” to our lexicons, shut down enough production to lower supply and raise energy prices. Many of the small firms run out of cash and go bankrupt, but the survivors consolidate and create a more stable energy complex across America. The Saudis are happy because it increases the value of the recently-IPO’d Saudi Aramco company, but American drivers are miffed because they have to pay $2.75 per gallon for gas. Sure, even at that level gas prices remain near their lows of the last decade, but that’s yesterday’s news.

Banks and bondholders suffer with defaults, but are thrilled the industry appears to bottom.

Andrew Yang Wins Democratic Nomination, Picks Marianne Williamson as Running Mate

Andrew Yang, the forgotten Democratic Presidential candidate who continues to make the debate stage because he promises universal basic income, surges to the top of the list as Bernie crashes for health reasons, Warren sputters after letting it slip that she wants the nation to be a giant collective where she decides who gets paid what, and Buttigieg decides to retire and write a book about what he learned as the Mayor of South Bend, Indiana. (Biden failed because was too busy explaining why his intervention in Ukraine was obviously different than Trump’s.)

Yang decides to take Williamson as his running mate because she’ll bring a ton of “positive energy” to the campaign, and can hopefully spread her message of joy across the nation. She makes her quote, “Joy is what happens to us when we allow ourselves to recognize how good things really are,” the campaign slogan.

Finally, Britain Leaves the EU, and No One Cares

This is a repeat from last year. It could happen.

A Little Less Crazy

With equity markets up around 30%, we’ve pushed valuations to very high levels even as profits remain flat and GDP growth eased. I’m glad we remained invested in our Boom & Bust portfolio, taking advantage of the market growth that we expected and Harry forecast. Now we’re more cautious, and looking to protect our gains as we start the New Year and the new decade.

Buckle up, we expect a bumpy ride in 2020!

Happy New Year.

December 30, 2019

The Fed’s Big, Red Flag

I knew this repo crisis would require more injections, but it wasn’t easy to get clear data on just how many it would take. I was trying to identify how much money has gone into propping up the repo or overnight bank lending market since its sudden spike in rates to 10% signaled a crisis in liquidity.

It’s like no one on Wall Street wants to talk about this… Hmmm….

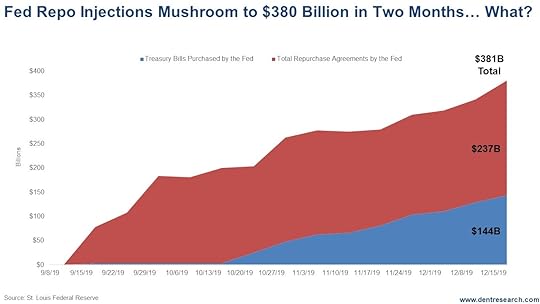

Rodney Johnson finally found a credible article. Remember that $60 billion initial injection in mid-September that came to calm that spike in rates? Well, it mushroomed to $380B (billion) as of mid-December. No wonder Wall Street is not talking about this… It’s obviously not a small, temporary crisis! This is a big, red flag. At the peak of quantitative easing, $60B a month was being injected into the financial markets. This is the equivalent of $190B a month!

In mid-September, the large banks suddenly decided that they would rather keep their reserves with the Fed at 1.55% than lend at slightly higher rates to smaller banks, and leveraged investors that have to borrow overnight to cover their short falls.

There are two reasons for this, from what I can see. First, the Fed finally tapered a bit and sold of some of their bond stash which took reserves and liquidity out of the system, so less excess to lend. Second, these larger banks are starting to smell more risk in this normally risk-free overnight market. Some of these loans are to gunslinging, leveraged hedge funds.

Here’s the chart that tells the real story.

The largest chunk of the $380B through mid-December is the Fed purchasing repo agreements directly or lending against them to bail-out the lenders and borrowers overnight. That’s $237B. The other $144B is the Fed buying T-bills. They are doing that to make it look like something other than QE, which tends to buy longer-term bonds to push down longer-term rates that they can’t control as easily as they do by simply setting short-term rates through the Fed funds rate. They buy bonds artificially with funny money and push rates down.

But that misses the bigger point. These injections are coming from money printed out of thin air, and they are injected into the financial asset markets, not into bank lending or money supply. Just like QE, there is more money chasing the same bonds, stocks, real estate assets, etc., which pushes up the prices of everything.

This whole bubble since 2009 has been about injecting more money into the financial asset pool – and investors, especially those Wall Street gunslingers, trading up into higher risk given a market that is literally insured not to go down due to constant new money flowing in and strong reactions with injections when stocks or the economy do stumble… And this is a big stumble here!

This, along with cheap stock buybacks that leverage companies’ own stocks, explains why stocks are overvalued 120% from where they would be on my Spending Wave model that has tracked so closely for decades. Stocks are at record highs and we are seeing the greatest and most global financial asset bubble ever, when real growth in the recovery since 2009 has been the worst ever.

The economy does not have the fundamental trends to grow at 4%+ a year again, until bad debts, banks

and companies are purged and demographic trends turn back up from 2023 forward. So, it’s stocks and financial assets that have to come down to reality – big time.

But what’s happening since September when repo QE started – without any significant good news for the markets after trending more sideways since January 2018? They just keep melting up with the help of a largely undisclosed $380 billion.

Most fundamentally: This is an under the radar way for the Fed to reverse its tapering policies that proved again that the broken over-leveraged economy and banking system cannot survive without endless QE… more crack! The Fed balance sheet is now nearing its peak in late 2014 and will soon exceed it again.

I’m still looking for Nasdaq 10,000 by early 2020 in a final blow-off rally unless we get a big surprise correction near term – and one more surge after that, which would last later into 2020.

But this is another sign that it just gets harder to keep stretching that rubber band to such extremes without it snapping back!

This “little repo crisis” is a big snapback with more to come.

December 27, 2019

Another Bitcoin Bubble Just Ahead?

I hope you had a wonderful Christmas and are busy gearing up for whatever you plan to do to ring in the New Year. 2020 is going to be an extremely consequential year, as I’ve been forecasting for quite some time.

Today, however, I wanted to focus my video specifically on Bitcoin and crypto stocks, because I get a lot of questions about whether or not we’re going to see another bubble.

Let me start here: whether we do or not near term – and either is possible in 2020 – the real bull market will not come until 2021 or 2022. Then it will prove to be the next big thing!

The truth is Bitcoin’s a lot like the Internet stocks, insofar as they first bubbled massively, peaked, then crashed. Then out of the ashes began the real longer-term boom from late 2002 into now, and especially since 2009 with the QE-driven bubble. That’s why you have to play that market quickly in this stage; people who think they can just buy and hold crypto stocks are crazy!

Look back at history: It makes things clear that cryptos are just like the Internet in its early “hype” phase and many others before it. Buy and hold will be an effective strategy only after this stage sees a 90%+ crash and many superifical companies go under as occurred between 2000 and 2002 for the internet stocks.

Forget the debate whether this is just a silly bubble or really the next great thing…

It’s both! It just depends on where we are in the cycle.

Watch this week’s video for more…

December 26, 2019

Why Gift Cards?

It’s the day after Christmas and, if you’re like three-quarters of Americans, you either gave or received a gift card. Have you ever asked yourself, “Why?”

I hate stories that start, “When I was a kid,” but indulge me…

When I was a kid, my grandparents would sometimes give me $5 or even $10. As the amount grew, it became more likely that the gift was accompanied by a command, “Don’t spend it all in one place!”

The point was obvious: try to make the newfound wealth last a bit, and spread it around.

Then came gift cards. Other than Visa prepaid cards, gift cards require that we spend all the money in one place! Maybe they come with a whiff of authenticity, as if the giver knew the recipient really enjoyed spending time at Chili’s restaurant, or could ask for nothing more than a $50 credit at Apple.

At least with an Amazon gift card the recipient can shop for that extra special Baby Yoda, or whatever it is they really wanted for Christmas but didn’t tell anyone.

But there is an alternative to this practice

Instead of spending 90 seconds desperately searching the gift card rack at the grocery store, or even navigating online to the “Send eGift!” button, we could go to the tried-and-true method of giving when we have no clue what people want. We could gift them cash.

Contrary to forecasts from various corners during the Fed’s QE phase, greenbacks still have plenty of value, and they have the advantage of being accepted in every retail location in the nation. Have you ever tried to use a Chili’s card at Ruby Tuesday’s? It’s a faux pas that won’t get you lunch. But the waiter won’t care which regional Federal Reserve bank issued your dollars (it’s printed right there for everyone to see); they still spend just the same.

But cash is not our style. Over the past two decades, gift cards have become “the thing,” as it seems crass to ask for cash. Somehow asking for the plastic intermediary is much more civil.

This year, 59% of Americans asked for a gift card for Christmas, ahead of clothes and accessories at 52%, and well ahead of electronics and games, at 35%. This is the 13th consecutive year that gift cards top the list.

Just over 75% of us gave a gift card this year, up from 72% last year.

Now that we have them, it’s time to do our part.

Take a few minutes and spend all the money. Do your part to give the economy a post-Christmas retail boost that will hopefully push GDP just over 2% for the fourth quarter. It’s not like leaving funds on the cards earns you interest, and if you put it off too long, you might just forget the cards exist.

Which is another reason we should just give cash. Can you imagine “forgetting” that you have cash? It’s silly. And yet, many of us have neglected gift cards. Maybe we put them somewhere for safekeeping. Maybe we thought we’d regift them. Or perhaps we simply never made it back to the place of business where the cards were issued.

If you can’t imagine using the card for whatever reason – maybe it’s from a place you don’t frequent, like a punk rock skateboard shop, Home Depot, or Walmart – you can still get some value out of it. Websites like www.cardpool.com specialize in selling and exchanging gift cards, and you can always donate them.

Whatever you do, make sure they get used. There’s no reason the issuer should be given the credit balance.

And if you’re ever of a mind to send me a gift card, I’ll gladly accept it, and even drop you a thank you note. But the truth is, I prefer cash.