Harry S. Dent Jr.'s Blog, page 3

March 17, 2020

Buy… with Caution

Sixteen years ago today, I was wearing a kilt, driving around Dallas, Texas, to different Irish bars in my friend’s 1954 French, open-air, firetruck. It was sort of awesome.

There won’t be any such celebrations today, which will deprive many an Irish pub of its peak sales for the year. I might drink a pint in their honor as I consider the effects on the economy.

I’m not a viral epidemiologist. I don’t know how mild or severe the coronavirus will be. Because it is novel, or new to humans, we don’t have natural immunity from previous exposure, so I understand it can spread almost unimpeded when people get together. But I’m paying close attention to the numbers of cases and deaths, as well as estimates of the spread, and some things look out of whack.

The fatality rate has been reported anywhere between 1% and 4%, but we can’t know because we don’t know how many people have it. We know the number of deaths, but there’s been no randomized testing of the general society, only of those who present symptoms. Many people carry the regular flu with a range of symptoms from almost none to severe. The coronavirus is likely the same. As we add more testing, we’ll increase the denominator of the mortality rate, which will drop the overall ratio.

The New York Times has published an infection estimate between 70 million and 140 million Americans, but it qualifies in the report that those numbers were developed in February, and that any mitigation efforts would change the forecast. It’s safe to say that we’ve engaged in mitigation efforts.

The federal government has some decent proposals, like paid sick leave and free testing, but stopping the accrual of interest on all student loans? The largest student loans are taken out by those going to grad school, future lawyers and bankers. How does it help to give such borrowers a pass? The government could have limited the interest-free program to loans in forbearance, where the borrower is unemployed or has some other hardship. Millions of people unaffected by the virus will get a benefit at the expense of taxpayers simply because they borrowed a lot of money. That’s a slippery slope I hope we don’t travel down.

In the financial world, things change by the minute. The Fed lowered rates to the zero bound again and, just like last week when it announced $1.5 trillion in repo operations and two weeks ago when it lowered rates, the markets fell anyway. The Fed isn’t dead, but it’s not effective in this environment and should stop trying to fight the last war.

Investors don’t know what to expect. Will the government close the equity markets for a few days, or a week? Will the Fed make it illegal to short certain stocks, like airlines or cruise ship companies, just as they did with banks in 2009? Will we bail out some industries but not others? Will we mail checks to everyone?

The unclear future leads to a dark assessment, and opportunity.

I don’t know when the selloff will end, but it will end. On the risk side, consider buying an option or two on the S&P500, the Nasdaq 100 Trust (NYSE: QQQ), or a stock you like. Don’t overbuy. Each option contract represents 100 shares of the stock or index. The options are expensive right now, meaning they have large time premiums, but that’s okay. The goal is to limit losses, if they happen. By purchasing an option, you limit your downside but the upside is free to run. That sounds pretty good right now.

In fixed income, things are a bit more clear. Buy it. I’ve mentioned closed-end funds before. I like them a lot. Typically, they borrow money to increase their holdings, which supercharges the income they throw off. We hold Blackrock Taxable Municipal Bond Trust (NYSE: BBN) in the Boom & Bust portfolio. It’s paying 5.55% even though the 30-Year U.S. Treasury trades around 1.4%.

Investors have sold many bonds and bond funds because they’re scared, or perhaps they need liquidity. But the panic will pass, and yet the Fed will still be spending $700 billion to buy U.S. Treasury bonds and mortgage-backed bonds, which will weigh on the yield curve, and short-term rates will still be at 0.00% to 0.25%. When the smoke clears, investors earning more than 5% on high quality fixed income will be very happy.

The post Buy… with Caution appeared first on Economy and Markets.

March 16, 2020

Stocks Crashing Again Despite Fed Super Bazooka

In China for the last two months, retail sales are down 21%, industrial production is down 13%, and fixed investment is down 25%. The travel, restaurant and entertainment industries both in the U.S. and worldwide have been absolutely decimated with more to come…

And Treasury Secretary Steven Mnuchin says this won’t cause a recession and it’s not like 2008, so there will be a strong rebound… Even if you love Trump, you can’t like the unforgivable denial here. I see a definite recession in the second quarter, down around 5% or so, and it could continue into the third quarter.

The Spanish Flu of 1918 exploded due to the suppression of the news and the close encounters in Europe of World War I… and it had three surges: a small one in July 2018, then the big one in October/November and a final one into the following February. It infected around 500 million people and killed 20-50 million, 5% of the population – way more than all the deaths in World War I.

Goldman Sachs just had a massive call with its corporate customers saying that this could infect 50% of Americans, over 150 million and 70% of northern European countries like Germany… 3 million deaths in the U.S. alone. They see it peaking around mid-May, but if it doesn’t hit “herd immunity” with such massive infections by then, it could return next fall/winter to finish the task.

This is an extreme forecast for sure, but it’s not out of the question and the increasingly extreme precautions are warranted. The two keys proven in the past and recently by South Korea, Singapore and Taiwan: test massively and quickly isolate the infected and determine where the infections are coming from; and strict social distancing – six feet is the standard – with no larger public events and gathering, even in restaurants.

Italy is still accelerating, seeing as many as 368 new deaths per day as of Sunday, despite draconian lockdown. Spain just joined in a nationwide lockdown with France and Germany following fast… And Mnuchin’s saying there won’t be a recession???

After the first very strong rebound on Friday, U.S. stocks are limit down overnight (5%) and will likely open up another 2% down immediately with the second circuit breakers at 7%. The Thursday lows, already 30% from the top, will likely be retested. Australian stocks are down the worst, down 9.7% today.

And here’s the really scary part: The Fed pulled out all the stops between last Thursday and Sunday night in an emergency meeting. It cut the Fed funds rate back to zero (0.0-0.25%), as in the 2008 crisis into 2015. The Fed already committed $1.5 trillion (yes, that’s trillion!) in repo funding as needed and up to $5 trillion just ahead…

That’s more than the entire unprecedented QE from late 2008 thru 2014 of $3,7 trillion. And that’s not all: $700 billion of new broad-spectrum QE (not just T-bills anymore), $500 in T-bonds and $200 in mortgage backed securities… What?

And that was not enough to keep markets from crashing again overnight. Dollars for offshore lending are still short due to the fear of crashing businesses not being able to repay. That’s why Germany offered unlimited loans to businesses.

For years, everyone has told me that the central banks will just keep printing more money to prevent a downturn, and I have said, “they will simply lose credibility at some point.” And here we are with the most massive money printing ever, by far, and the markets are crashing anyway…

And here we are heading towards that first 40% or so crash in less than 2.5 months, this one could be there in the next week.

Look at this megaphone pattern in the Nasdaq.

If this rally fails, as looks very possible, we could see that 40% plus fall in near one month just ahead. The same pattern projects down 38% for the S&P 500 down to around 2,100 and minus 34% for the Dow at around 19,500.

As I said last week, it’s time to seriously consider selling on any short-term rallies, and the one on Friday occurred largely at the end of the day, not providing much of a chance.

Now, there will likely be a very strong bounce once this virus finally slows down. The first potential vaccine is being tested today in Seattle. But that may still not be available for a year plus even if it works. So, how low could stocks go first?

If this current crash merely retests the lows of Thursday and then rebounds given all of this massive stimulus, then good targets near term would be around 8,200-8,400 on the Nasdaq and 23,300-24,000 on the Dow… But will we even get back there?

If things keep moving fast and we do hit that megaphone low target soon and bounce more strongly, then sell into that bounce. That could retrace as much as half of the losses in the months to follow.

But, this is the “real” Black Swan, and it is therefore not very predictable.

I say it’s better to be safe than sorry here.

Ultimately, we should get a rally into the election and that could take us back up to levels like 8,800+ on the Nasdaq and 25,000 on the Dow after the virus first fades and the stimulus really kicks in… But even that is not anywhere near a sure bet.

I am tracking this crash vs. the first tech bubble crash between March 24 and May 24 in 2000 and it correlates well thus far. I will update that chart on Wednesday if we can hold the previous lows today and tomorrow.

The post Stocks Crashing Again Despite Fed Super Bazooka appeared first on Economy and Markets.

March 13, 2020

Where the Coronavirus Might Take the Markets

It’s an understatement to say that this week was particularly wild, and we’ve seen global chaos from the coronavirus’ spread lead to a rapid and mindless downturn in the markets. More and more known figures are testing positive for the virus – from Tom Hanks and Rita Wilson to Sophie Trudeau and Jair Bolsonaro to potentially a significant amount of the Utah Jazz basketball team – and people are starting to finally realize that this spread will have a significant impact on our financial systems and way of life.

As I’ve been saying, this is the definition of a “black swan.” It’s the most abused financial term in history, but this is really it. Nobody could have seen such a volatile scenario unfolding, and now it’s really here – and the markets started reacting as soon as it hit the Western world in Italy.

This is what happens when bubbles first start to burst, but the one we’re in now is bigger, moving faster, and will break harder than previous instances. Normally, the bubble peaks when the smart money starts selling into it and shorts leverage, but that’s not what’s happened here. Instead, the smart money has not been selling into this – and that’s something we’ll have to prepare for. There’s potential for things to wear off by April or so with a strong counter rally, but it’s not really clear yet.

So this week in the Friday rant, I’ve put together a few scenarios for you to consider. Most likely is that we’ll see a temporary recession and strong rally when this wears off, and an economic recovery into the election, followed by a big recession/depression after that, whether Trump gets re-elected or not. But again, this is a fast-moving thing and we really have no clear idea yet how it might play out. So stay tuned. We’ll keep you updated.

Another crazy week in the markets

Coronavirus continues to spread around the world and the Dow had its biggest drop since 1987 yesterday. Listen to Harry's take on the markets, Fed announcement and more right here!

Posted by Economy and Markets on Friday, March 13, 2020

The post Where the Coronavirus Might Take the Markets appeared first on Economy and Markets.

March 12, 2020

Corona Chaos

Congress looks like it will pass a bill aimed at stemming some of the economic pain from the precautions taken to stop the spread of the coronavirus COVID-19. Notice I said pain from “precautions,” not pain from the virus itself.

COVID-19 is estimated to be between 10 and 20 times more deadly than the regular flu, or influenza, so we should take it seriously. But our national reaction is quickly moving from concern to panic. That seems premature. We’re not Italy, which has much greater cause for concern.

The new virus appears many times more deadly than the regular flu, but the numbers are likely skewed too high because many people who get the new virus never report it. They suffer light symptoms and go about their days. We’re comparing deaths to an artificially low number of infections. It appears that young children get only mild cases of the disease, so their parents never have them tested.

So far, older men are the most at risk of serious complications and death. Italy has a lot of those, and they tend to congregate.

Places like nursing homes in Washington State are rightly concerned. But colleges? Elementary schools? People going to work on a daily basis? We’re clamping down the economy in a way that seems outsized to the problem, and we’re about to spend a lot of money on a solution that the calendar will take care of, at least in part.

We’re comfortable with 40 million or so Americans a year getting the regular flu, accompanied by 40,000 deaths. We’re encouraged to get flu shots, which most of us don’t, and to wash our hands often, which many of us don’t.

About 1,200 Americans have the coronavirus. The number is growing, but not by the thousands, much less the millions.

Around the world, almost 400 million people get the flu each year, and an estimated 389,000 perish from complications. To date, roughly 4,700 people have died from the coronavirus.

And yet, we’re starting to wear masks, which tend to stop infected people from spreading the disease more than they help people avoid it. And we’re buying Purell like it’s a magic tonic. The NBA suspended the season, the president implemented a travel ban on Europe, carving out exceptions for the U.K. and Ireland, and Washington State has banned public gatherings of more than 250 people.

We talk about flu season because such viruses spread quickly in cold weather, then go all but dormant in warm weather. Infections peak in February, with the second highest number in December, followed by March. In April, infections drop dramatically. A quick look at the calendar tells me we’re getting close to that natural end.

That doesn’t mean we won’t feel economic pain. The supply chain disruptions in China are real. We don’t know how big the effects will be, but we’ll have an idea by late April and early May. We might see some odd shortages of items that include Chinese components.

But we don’t have to make things worse here at home by shutting down daily activities and assuming every sniffle is COVID-19. Millions of Americans have the regular old flu right now. Thousands could have COVID-19, but it’s so mild, or so like the regular flu, that they’ll never be tested.

The least helpful thing will be long-lasting, generalized government assistance programs that throw cash at a problem that testing kits and time can tackle. Knowing who has this disease, especially among those who are older or work with an older population, can be life-saving. Giving workers an extra $50 in their monthly paychecks won’t help.

As for targeted relief, it’s easy to say and hard to do. It’s easy to identify the laid off hotel worker because travelers cancel reservations. It’s harder to trace the line back to the restaurant near the hotel that fed workers and guests, or the supply company that handled that establishment’s linens. The assistance legislation quickly winding its way through Congress is well-intentioned, but it will have to be so broad as to create another economic safety umbrella, or dramatically increase access to existing programs.

On the business side, we can see that airlines and hotels will suffer, but is it the place of the government to rescue them? Are we going to rescue the fracking industry because the Saudis and Russians are fighting, and neither side is too upset that their tiff is destroying American companies? Will we make investor retirement accounts whole because people own stock in all of these companies? Where do we draw the line, and what do we say to those on the other side of that line, the ones who didn’t quite make it in?

It’s eerily similar to saving the car companies, and some, but not all, of the banks during the financial crisis. Picking winners and losers with taxpayer money is a dangerous game that is certain to make some people happy, and many people angry.

April can’t get here fast enough.

The post Corona Chaos appeared first on Economy and Markets.

March 11, 2020

Stock Scenarios Amidst the Coronavirus

Stocks finally bounced 1,167 Dow points on Tuesday, but already gave back 750 points on the open today. I’ll give two preliminary scenarios today, but let’s review some key facts first.

The CV-19 virus continues to explode outside of China, especially in Italy. Why Italy? Look at their customary greeting: not a handshake, or one peck on the cheek. No, it’s one peck on each cheek and then often a kiss on the lips. Highest contact possible.

Italy’s infection rates have soared from just over 7,200 on Monday to 10,149 today, with 631 deaths. That’s now a 6.2% death rate, much higher than China’s 3.8% or the 3.6% figure globally. This is getting scary, and Angela Merkel now fears that Germany will see 60% to 70% of its population infected.

Worldwide, it’s now at just over 118,000 and 4,262 deaths, or 3.6%. In the U.S., which is still in its early stage, it’s 805 infections with 28 deaths, or 3.5%.

Italy’s statistics show how it really does almost only hit older people, with 59% of its deaths 80 or older. The full stats are 14% over 90; 45% between 80 and 89; 32% between 70 and 79; 8% between 60 and 69; and 2% between 50 and 59… none under 50!

Despite this grim potential crisis, it will clearly have the lowest impact on future demographic trends.

And of course, central banks are stepping up rate cuts. The Fed looks do another 50-75 bps cut on top of the recent 50 bps, bringing us down to either a 0.25-0.50% or 0.50 – 0.75% range for short-term rates. The 10-year Treasury has already been down as low as 0.37% and is at around 0.71% today. The Fed added $75 billion to its balance sheet last week and will certainly add a lot more this week.

Trump is floating a zero payroll tax through the end of the year… oh, just long enough to get re-elected! That could add up to $3,000+ to the typical $60,000 household income in the next 9 months. That’s direct to the consumer, or the beginning of helicopter money. Does it go to the business and self-employed side, as well? Then that would double the impact.

So, the markets come down to the simple reality: a virus that could continue to explode at least for months and disrupt business and spending versus “a lot more crack.” And the markets love money printing and tax cuts the most.

I still think the market reacts for a while to the rising stimulus packages and at least attempt to make one more new high on the Nasdaq.

There are two past scenarios that could be similar:

1) In the 2000 tech/Nasdaq top, it first peaked on March 10 at 5,132, then crashed 13% to 4,455 on March 16, then rebounded to near a new high into March 24. Then it crashed 41% into May 24 – my typical 41% crash in 2.5 months from the March 10 top. This correction is taking about twice the time, but we could see a run to near the 9,838 high of February 19 or even a slight new high to 10,000 or so into late March and hit my top trendline that was not quite hit on February 19. Then we see that first 40% or so crash into around early June.

2) The market has a more extended and muted rally that takes it to a new high well above 10,000 by late April or early May. This would follow the topping scenario between late July and early October of 2007, likely with many major stock indices not making new highs, creating important divergences that signal a top. Then we get that first 40%+ crash that bottoms between mid-June and early July, followed by a rally into the election that does not come close to new highs… then the long crash into late 2022 or so.

If stocks cannot rally meaningfully in the next week or two and start to crash again, then the top is likely already in on February 19 and we’re back at the December 2018 lows or lower by May. Then we bounce into the election or so.

As in the sharp crashes of early 2018 and late 2018, I will be tracking this crash with those two past scenarios to see whether this crash will see a new high, or near new high first, or whether stocks will start failing by late March or early April as in the first crash in 1929 and in 2000.

I’ll keep you updated and will report the Fed balance sheet rise from Thursday late afternoon in Friday’s rant… the more, the better for stocks near term.

The post Stock Scenarios Amidst the Coronavirus appeared first on Economy and Markets.

March 10, 2020

The Fed Can “Fix” This, Right?

I had two reactions as I watched the markets puking their guts up. I had the strong urge to buy undervalued assets, and I periodically cursed the Fed and other central banks.

I don’t think central bankers are stupid, out-of-touch, or somehow divorced from economic reality. They appear to be bright people who are trying to do the best they can. But none of them seemed to have learned the one word we try to teach our children… No!

We established the central bank in the U.S. to protect the currency. Within 20 years, the bankers saw themselves as the protectors of the economy, working to eliminate the business cycle, although they never seemed to succeed. The bankers should have said no.

Then, during FDR’s profligate spending years before WWII, the Fed became the federal government’s enabler, holding long-term interest rates at 2.5%. This went on until the Korean War. After 17 years, central bankers finally, for once, said no.

In the 1970s, Congress tasked the Fed with moving the economy toward full employment, because if a bunch of lawmakers who can create tailored fiscal policy can’t move that needle, then maybe bankers who control just interest rates and a few financial tidbits can get it done… right? Again, the governors of the Federal Reserve should’ve told members of Congress to do their jobs.

Then we get to the great financial crisis. It made sense to print money and buy mortgage-backed bonds in a concerted effort to unfreeze that corner of the market. The Fed actually returned to a shade of its original purpose, buying good assets at distressed prices to add liquidity.

But everything since then has been nothing more than a concerted effort to levitate the economy. After more than a decade of sub 3%, and often sub 2%, growth, it should be clear that it’s not working! Instead, we’ve seen financial asset prices skyrocket. Fed buying sent bond yields through the floor, and cheap debt gave companies a way to buy back their own shares… $4 trillion worth.

Investors are stuck in the middle. We can’t buy bonds because they don’t provide enough yield to live on, but equities are fully priced. What’s a retiree to do? Investors were almost forced to buy stocks. They’ve been rewarded, but now the coronavirus has changed investor sentiment from risk on to risk off.

We’re suddenly value investors, and there’s not a lot of value to be had. Interest rates are headed to zero in the U.S., following yields in Europe and Japan.

But hey, don’t worry, the Fed can “fix” this. Or can they?

Traders expect the Fed to lower rates by 0.75% at their meeting this month, which will do nothing more than bring overnight rates in line with the rest of the yield curve, and cut into bank profits for at least the rest of this year. The Fed guarantees bank profits by paying interest on excess reserves, but if that interest rate falls to 0.375%, it won’t be enough to keep earnings rolling in, which is why the financial sector is reeling.

The big question is, what happens next? On a day in which Saudi Arabia isn’t out for revenge against the Russians, and the coronavirus fears subside, do we just race back to the top? It doesn’t seem likely because it will take time to understand the extent of the economic damage to the supply chain as well as consumer sentiment.

But the problem we’ve had for much of this decade remains. There is no alternative (TINA) to equities if your looking for growth. Now that the 10-year and even the 30-year Treasury bonds trade with a zero handle (less than 1%), what’s an investor to do?

We can curse the central bankers for creating this mess with continued interventions, and do our best to resist buying (too much) in this market as we wait for the dust to settle.

The post The Fed Can “Fix” This, Right? appeared first on Economy and Markets.

March 9, 2020

The Black Swan Coronavirus

Nothing like getting texted at dinner last night about how the Dow futures were down over 1,000 points. Then I get home and they’re at lockdown 1,300 points – down 5% for all three major, indices including the Nasdaq 100. They just opened up down 7%, triggering a second circuit breaker to stop trading… Damn.

The culprit this time is more the oil price war between Russia and Saudi Arabia, with overnight prices hitting as low as $27.59, nearing the 2008 crash lows of $26. OPEC is breaking up given the global slowing, but in turn, having a lot to do with the coronavirus (COVID-19) spreading more rapidly outside of China...

Russia and Saudi Arabia are also aiming straight at our shale oil producers who are higher cost. Defaults there would be nasty for our corporate bond and leveraged loan markets.

Hence, although the 20% to 30% sudden oil price crash grabs the headlines, it still comes back to the impending pandemic and a growing global slowdown in reaction!

All of this, along with the biggest crash in Treasury bond yields, down to as low as 0.47% last night screams global recession… Who’s the safe haven here? Certainly not Bitcoin, down 26% since mid-January. Not even the U.S. dollar, down 10% vs. the yen and 5% vs. the euro. Gold has done well, up about 3% since stocks topped, but more mixed lately – and I’ve been calling the rally in gold and still see $1,720 – $1,800 on the upside.

But it’s really been all about the 10-year Treasury bond, up near 20% since stocks topped. Even high-grade corporates have only been up about 4% since then, although they have been up 23% over the last year vs. 10-year T-bonds up over 40%.

The truth here still comes back to the black swan coronavirus. It is the first thing central banks can’t stop with massive money printing… Take that Kuroda, Draghi and Powell!

They can stop banks and companies from failing, and can stop a recession or most stock crashes. They can even cushion the economy from the impacts of quarantines and business shutdowns… but they can’t stop the virus from spreading!!!

You would think the fact that China has already seen a peak and that moderation would be a good sign. But recently, it has suddenly spread to many places, and it is exploding in the colder ones where the virus is favored vs. warmer temperatures in mid- to southern China and Southeast Asia.

South Korea was the first to see the strongest surges outside of China. But its strong testing program has kept the death rate out of near 7,000 cases to only 42, or only 0.6% versus the 3.8% death rate in China…

But now the big story is northern Italy, with a 16 million-person lockdown – one quarter of its total population. That’s in response to now over 7,300 detected through massive testing and a very dangerous death rate of 366, or 5.0%! Now that’s scary.

South Korea and Italy are in colder regions that are still seeing the last days of winter. That means the dangers are likely to be the worst in the northeast, upper Midwest and northwest in the U.S. ahead, and northern Europe.

The U.S. has now seen 500 cases and 19 deaths for a rate similar to China’s at 3.8% — not good.

The trillion-dollar question now: Do governments and central banks respond strong enough for the markets to see a strong initial rebound out of this crash? Do we get that bounce to new highs in the Nasdaq, or does this rout continue into that typical 42% down in 2.6 months? I outlined both of these scenarios in the March Boom & Bust.

Stocks are just 2%-3% below the February 28th first crash lows at the open, and so oversold that a strong bounce is still clearly likely… but they need to hold near here!

I will update you on Wednesday after we see what the markets do, and again in Friday’s video rant after I get an update on how much the Fed ups its money printing by Thursday’s report. That figure last week was up$75 billion, and still most people didn’t notice.

The post The Black Swan Coronavirus appeared first on Economy and Markets.

March 6, 2020

Market Turbulence

The Dow opened down strong today after another bad afternoon on Thursday. All told, we’ve had an extremely turbulent week, and even most experts have no actual idea of where we’re headed over the near-term moving forward.

Meanwhile, we’re seeing the 10-year Treasury bond rate going as low as .72%. This is extremely under-reported news. We’ve seen minor yield curve inversions in the last year, but the way it’s happening right now indicates for real that a recession is looming for us.

I’m looking at two other things:

The Fed balance sheet and what’s happening with the repo crisis re-run. Big banks that fund big loans aren’t feeling good right now what with the coronavirus and other risks, leaving the Fed in a rough spot. So, it’s had to step in full blast on the repos again and QE on top of that to bolster bank reserves. That’s a big plus for stocks near term despite the headwinds of corona.

The election and the winnowing field in the Democratic party. Over the last week we’ve seen both Michael Bloomberg and Elizabeth Warren back out of the race. That leaves Joe Biden and Bernie Sanders – a mediocre centrist and a balls-out socialist – and you can bet your butt that the markets want Biden. But the election in general is totally up in the air, and it’ll be a long way to go before the dust settles and we see who will take on Trump.

So, a lot of shakeup in the financial space this week, and no clear indication of what’s going to get it back on level ground. I keep telling people: This is a true black swan. It could get really big, or it could peter out. No one has any clue what to expect here.

I’ll tell you what I think is most likely to happen in this week’s video. But when? That’s a tougher question: it could be weeks, or perhaps a few months.

As always, we’ll keep you updated.

The post Market Turbulence appeared first on Economy and Markets.

March 5, 2020

The Virus Your Town Can’t Shake

It’s obvious that central banks cutting interest rates won’t do a darn thing to soften the economic blow from the spreading coronavirus. Fed Chair Jay Powell and his fellow bankers are smart people. They know this.

But they’re also aware they had to do something at least to appear like they were in tune with the market jitters, even if making loans cheaper won’t solve the problem of falling business activity.

Yes, there were other reasons for the Fed to act, like bringing U.S. rates a bit more in line with rates in other countries so that the U.S. dollar didn’t jump to nose-bleed levels. But that still leaves a gaping hole in consumption.

There’s only one type of policy that can address this, fiscal policy. However, even if Congress tries to ride to the rescue, they can’t solve the biggest financial headache, which is coming soon to your town.

With the virus spreading around the world, who wants to get into closed metal tube, fly across the nation, and breathe partially recirculated air with 160 other people?

The problem isn’t a lack of money, it’s that consumers both here and abroad are less likely to spend their cash in ways that require congregating in public places. With that as a backdrop, any government policy that puts more money or credit in the hands of consumers won’t make a difference. To the extent that government wants to help, it must direct policy at the businesses themselves. Think corporate welfare.

I don’t know if this will fly, given that large businesses are flush with cash after two years of much lower tax rates, but from what I read it looks like we’re headed this direction. Such a policy would be controversial, and would also miss the bigger mark, local and state budgets.

The Wall Street Journal analyzed data from 478 cities across the U.S. as reported to the National League of Cities, and found that 27% expect their 2019 real revenue to be less than 2018.

The real total general fund revenue for U.S. cities is expected to fall in the final 2019 numbers for the first time in seven years. Only about half of the cities surveyed expected real general revenues to increase in 2019, and of course, this is before any effect of the coronavirus.

Falling business activity across the nation will mean falling tax revenue, which will leave a hole in many already-tight city budgets. It’s likely that many city officials will look for a place where they can trim expenses, and unfortunately some will land on the same old line item, pension contributions.

Merritt Research estimates that in 2018, U.S. cities owed $500 billion in pension liabilities, up 25% from 2013. Keep in mind, these were good years when cities were raking in higher tax revenue. As revenues fall, some cities will slash their pension contributions, making the problem worse, while others will have to shift spending to make good on what they owe.

At the same time, the recent fed move will make pension liabilities increase, putting pension sponsors like cities and states in a deeper hole. As interest rates fall, the future payments promised to current and future retirees are discounted at a lower rate, making the present value bigger. This requires pension sponsors to put away even more money than they already were, at a time when they have less money to spare.

Even when the virus scare fades, either because a company developed a therapeutic, or summer arrived and the virus can’t live as long outside a host – or both! – we’ll still have to deal with an impaired economy and jittery markets.

It’s questionable if the equity markets will shoot back to record highs, especially in the midst of an election when the Democratic nominee, whomever wins that slot, has promised to raise corporate taxes by at least 30%. Investors will likely spend some time on the sidelines, protecting their gains from 2019 and waiting to see how things shake out.

All of this points to the same end… higher taxes at the local and state level, to pay promises made decades ago that politicians refused to fund in the intervening years. The bill is coming due.

The post The Virus Your Town Can’t Shake appeared first on Economy and Markets.

March 4, 2020

The Real Black Swan

The Nasdaq crashed 13% from February 24-28. The three-month crash into late December 2018 was 20%+, but not this sharp. This crash is now the fastest in one week following a new high in stocks.

The coronavirus is what I call a real “black swan.” Something that comes out of left field and is different enough from past such pandemics; not as predictable, and we don’t have proven vaccines, and it will take too long to get them developed and approved as it currently stands.

The markets on crack ignored it at first, as they did the Iran standoff. But then when the coronavirus hit a western country, Italy, and started popping up in many places… that is the definition of the early stages of a pandemic.

It has been contained substantially in China and Asia, but warmer weather was working in those countries’ favors. In Europe and the U.S., we are in the late stages of winter and that helps the virus expand.

The Fed has already cut rates 0.5% and other central banks are doing the same this week – and higher QE is likely, as we will monitor. The Fed already went full bore back into money printing in mid-September due to the repo crisis, now the coronavirus crisis gives it the excuse to keep going.

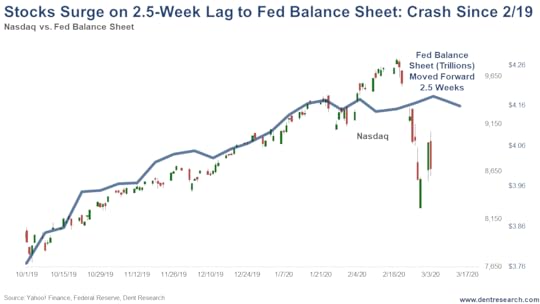

As this chart shows, stocks have gone straight up in response on about a 2.5-week lag.

The first surge was directly in line into the January 24 top. But Repo funding has naturally dropped off, while the Fed kept goosing QE both to make sure the repo crisis doesn’t come back and now to cushion the potential coronavirus pandemic.

We were still at the high side of this correlation when stocks suddenly crashed February 24-28. This crash has gotten stocks very undervalued versus this chart.

Stocks continued their rally since Friday’s bottom into early Tuesday, but then reversed back downwards by about 3%. But stocks have rallied back sharply erasing most of those losses on the strong Biden wins on Super Tuesday.

This pullback is normal thus far, but much lower and we could retest the lows on February 28, or go a bit lower.

The odds favor a V-shaped rebound if there are no serious signs of the virus continuing to mushroom ahead. That could actually take the Nasdaq to new highs of 10,000+ by late April or early May, and possibly sooner.

But I also think there is a strong chance that such a new high would not be confirmed by other major indices. That would suggest a major top and would be very similar to the August to October topping scenario for the 2007 top with such divergences. A bump up in QE this week or next would only further favor this scenario.

But if we get more of a dead cat bounce the next few weeks, back to no higher than 9,200 or so at best, and markets move sideways for weeks or head sharply back down… then the odds grow that we’ve already seen a top.

Again, even a retest of the lows on Friday February 28, or slight new lows near term would not invalidate this final V-shaped rally scenario.

If stocks do turn down more strongly with exploding bad news, then the next strong support would be the bottom trendlines for the entire bubble since 2009. That would hit around 2,550-2600 for the S&P 500 and 6,000-6,200 for the Nasdaq, which would strongly suggest this bubble is over. There would then be a several-month bear market bounce into the election before the long fall into around late 2022 down 80%+.

I cover this and more in the March Boom & Bust issue, which went out to subscribers on Monday evening.

The post The Real Black Swan appeared first on Economy and Markets.