Harry S. Dent Jr.'s Blog, page 10

December 11, 2019

The Great Boomer Migration

Years ago, I had to adjust my real estate model for di-ers, as homes last near forever and di-ers are forced sellers that can overwhelm and offset the younger peak buyers into age 42-43 in recent years.

That’s why Japan’s real estate bust never boomed again and is still scraping the bottom 28 years after the top, despite its rising Millennial generation’s spending on housing into 2015 and overall into 2020 just ahead.

That model for the U.S. shows that net home demand peaked in late 2005 and will continue to fall into 2039 or so when the last Boomers die. The worst period will come between 2029 when I can project the retirement population will peak in size and 2039, when net demand actually goes negative for a decade rather than just steadily declining.

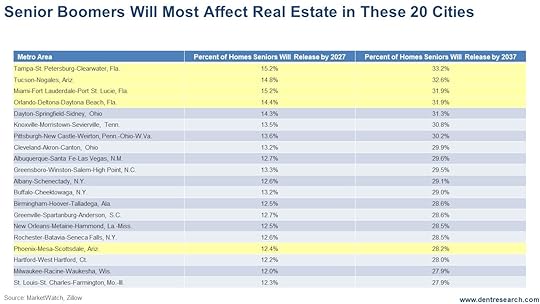

A new report from Zillow shows the top 20 cities that will see home selling by aging boomers over age 60. This will be a trend that hits broadly as the national average of percentage of homes sold by boomers by 2037 is a whopping 37%. All of these cities are above that.

My recent hometown of Tampa comes in first, at 33.2%, followed by Tucson at 32.6%, and Miami/Ft.Lauderdale and Orlando tied at 31.6%. Note that these top four are in the Sun Belt and in the top retirement areas when you add Phoenix down the rankings at 28.2%.

My recent hometown of Tampa comes in first, at 33.2%, followed by Tucson at 32.6%, and Miami/Ft.Lauderdale and Orlando tied at 31.6%. Note that these top four are in the Sun Belt and in the top retirement areas when you add Phoenix down the rankings at 28.2%.

By the way, I just read an article the other day about Sun City, Arizona. That was the first official community built just for aging boomers and retirees. The question is: Who will buy these homes so far away from working areas when these Boomers die in the next two decades? Yes, exactly my point, especially here. I would progressively turn the place into an assisted living area out of networked, but more intimate, large suburban homes, as Gene Guarino espouses and teaches at the Residential Assisted Living Academy. Then add a nursing home or so at the core.

Note that the rest are almost all in Rust Belt areas in the Midwest and Southeast where jobs are being lost in manufacturing and younger people move out more and faster than older ones.

These are cities like Dayton, Cleveland, Pittsburgh, Milwaukee, St. Louis, Buffalo, Greenville/Spartanburg, and Birmingham.

This is all part of my realization years ago that “real estate will never be the same” in most developed countries as a smaller generation follows a larger one for the first time in modern history. These are the cities that will tend to feel it the worst.

The best strategy for real estate rental investors is to buy up McMansions in these areas that will fall the most in the crash ahead and convert them into assisted living facilities with much higher cash flow and property values down the road than normal rentals – especially for these relics of the Boomer age that will be out of fashion for many years.

December 10, 2019

Golf is Back!

Most of our pictures are on the walls, and a lot of the blue tape is gone. Our new home now smells like our furniture and cleaning solution instead of cardboard. I’m not sure the trash men took the zillion empty boxes to the recycling center, but they’re not at my curb, either. So I’m happy. The move is over. Now it’s on to living.

And I joined the golf club. How could I not?

Our home backs onto the club first tee box, and hopefully no one will drive a ball into our yard. We’re about 100 yards from the clubhouse. Other than the occasional early-morning mower, it appears to be a great spot. I can walk to the club, play a few holes or go to the driving range, and be home within an hour or so. I think I’m going to like this sport. Apparently, I’m not alone.

In 2018, the National Golf Federation (NGF) reported that the sport increased participation for the first time in 14 years. The organization estimates that 24.2 million people played a round of golf last year, up from 23.8 million in 2017. Granted, that’s still 20% lower than the all-time high of just over 30 million set in 2003, but a modest increase is a lot better than another flat or down year.

The NGF attributes it to Tiger Woods and Baby Boomers. That makes sense, but I think there’s more.

I’m thinking Topgolf and college.

The NGF tracks golf course play when estimating how many people are involved, but now they also follow another statistic: the number of people involved in “off-course only” play. That’s a fancy term for Topgolf, the parking-lot looking buildings where golfing groups hang out in a “bay” and whack balls into a field surrounded by netting.

Players attempt to hit the balls to certain areas of the field and rack up points for accuracy and distance. You can eat, have a drink, and sit on comfortable benches. And you’re never in the rain.

In 2014, NGF estimates 4.3 million people were involved in “off-course only,” and that number rose to 9.3 million last year. It’s possible that a few, just a few, of those who played Topgolf in the last five years have found their way onto an actual course.

Far removed from the creature comforts and bar environment of Topgolf is the parental desire to get your kids involved in sports, particularly those that could lead to a college scholarship.

Division I and II schools offer 2,056 men’s golf scholarships and 2,101 women’s golf scholarships. Granted, that’s not a lot of slots considering the millions of kids in college, but it’s better than zero. And golf offers something else: no contact.

Youth football participation is slowing down as parents grow more concerned about concussions and the long-term health effects of playing the game.

Looking at the numbers, it appears that a fair number of kids are moving from contact and traditional sports to golf. There are more than 2.5 million junior golfers today, almost half of which are girls. That’s a 20% jump from just a few years ago.

It doesn’t hurt that young golfers now have a new group of exciting players such a Brooks Koepka, Justin Thomas, and Rory McIlroy to watch, as well as the resurgence of Tiger Woods.

But Boomers remain the biggest driver. More than 15% of the 2.6 million beginners last year were over 50, and there are millions more Boomers on the edge of retirement.

Contrary to popular belief, most people still retire by 65. Only about 30% of Americans between 65 and 69 still work, and that number drops below 20% after 70. This huge group will have plenty of leisure time to hit the links and get a little exercise.

As for taking advantage of the trend, the opportunity looks to be in real estate. The trappings of golf, from apparel to clubs, exist in the deflationary world of online retail sales, and companies can always gin up production. But golf courses themselves take a lot of effort and money to create. Almost 200 courses closed last year, whereas only 13 opened. More courses have closed than opened every year since 2006.

If golf participation rebounds in a meaningful way, there will be pressure on the existing courses, as more people demand tee times. The first response will be higher prices for golf memberships and playing a round, followed by increased demand for property near – and on! – golf courses.

If you’re near retirement, or a recent empty-nester looking for a change of scenery, consider a home on a course. It’s like having a giant park in your backyard that someone else maintains. And if you take up the sport, then you’ll get the added benefit of exercise to go with the view.

Then you can sit back and watch the value of your home appreciate.

December 9, 2019

China Has Biggest Corporate Debt Bubble

The first global debt bubble came from 2001-08, rising from $77 tr (trillion) to $180 tr. Most of that was in the developed countries (DCs). The second bubble, based on easy money from DC QE policies to bail out their debt bubble, saw that global debt rise to $250 tr.

Most of that new $70 trillion was in the emerging countries, and most of that was in corporate debt… and most of that was in China.

Now emerging country corporate debt is the dominant sector at 96% of GDP at peak recently, and now closer to 92%. That’s almost as much as all three other sectors (government, financial and consumer) combined. It was only 62% in 2007 – and debt quality is lower in these countries.

But here’s the whopper: China’s corporate debt leads the world and is crushingly high for an emerging country, at 163% GDP, and that is a bit more than half all of its combined three other sectors. And worse, it has the highest short-term component of that debt, which is more subject to default at 77%!

The secret to China’s not so alarming government debt is that they implicitly guarantee local development projects that they push, so that’s where the debt is. And China’s corporate and total debt are roughly double that of most emerging countries – with lots of empty buildings and factories to show for it.

In the September Boom & Bust, I showed that emerging market corporate debt was likely to be the trigger for the next global financial crisis, which will be greater than the last one now after we didn’t deleverage, and added more debt in the riskiest areas of the world.

So, where would the worst defaults likely occur? China, of course. They and their unprecedented debt and real estate bubble is the epicenter of the next and final global financial crisis.

And they are starting an accelerating default cycle, just like subprime loans did in 2006 forward. Oh, they were just 14% of mortgages and 10% of consumer debt – so containable, Bernanke said.

No, they were just the trigger for a global debt crisis to wake up delusional investors in “Lala bubble land”…

This is how it starts. Note the small step up in 2016 to $4.0 tr from $1.3 tr. Now the bigger step up to $17.3 tr in 2018 with 2019 set to break that record by year-end at $17.4+ tr. I would expect bigger steps up in 2020 and 2021, and then more and more.

This is how it starts. Note the small step up in 2016 to $4.0 tr from $1.3 tr. Now the bigger step up to $17.3 tr in 2018 with 2019 set to break that record by year-end at $17.4+ tr. I would expect bigger steps up in 2020 and 2021, and then more and more.

Other emerging countries like Venezuela and Argentina have already blown. Turkey could be next.

When China blows the whole thing blows, starting with corporate debt. Then spreading to the biggest real estate bubble wherein consumers have 89% ownership and 75% of their net worth in real estate… it’s 62% and 25%, respectively, in the U.S. and they are much poorer per capita.

When China’s real estate bubble blows, all real estate bubbles blow…

Let’s see central banks in the DCs try to stop that with money printing!

December 6, 2019

Stimulus Shock

I’m back in Puerto Rico after my near month of travel to Australia and then New York, and while I’m still exhausted, I’m glad to be back in the saddle and catching up on the news. And let me tell you: The news has not been good.

Let’s look at government stimulus… have you seen these figures lately? How can people not get the simple fact that no matter how much stimulus we’re dealing with, we keep slumping backwards. I mean, look at these numbers: 2% growth in the U.S., 1% in Europe, 0% in Japan. How can people not see that something is wrong here? We should be at 8% with this kind of stimulus.

We’ve been declining, and we’re filling that decline with Quantitative Easing. And that, my friends, is a recipe for long-term disaster.

So that’s at the top of my craw this week, but there’s a whole lot Dent Research senior research analyst Dave Okenquist and I had to cover in my return to the Rant saddle. Markets, stock buybacks… the whole nine yards. But the biggest things are these stimulus packages and the consequences we’ll face as a result of the propping up the government’s been doing to save face. Buckle up.

December 5, 2019

Don’t Be a Blind Pig in 2020

Every year I participate in a college football pool. There are 30 lawyers and me. I love college football. Or rather, I love the idea of the sport. I like the notion of pulling for your alma mater or hometown team, all the young people excited to be part of a group, and the unpredictable nature of amateur sports. But I don’t think for a minute that I’m better at picking winners than oddsmakers in Las Vegas.

When I come out ahead, I chalk up that victory to math, which is why my moniker is the Sightless Swine, or Blind Pig.

We talk about numbers in sports, the markets, and other things in terms of averages, implying smooth lines. In reality, things are lumpy. We get trends that stray from the averages for a while, but they don’t last.

If we flip a coin, the outcome is either heads or tails. If we flip several times, we’ll get each of those outcomes 50% of the time. But it’s unlikely that we’ll see an exact 50/50 split over the first 10, 20, or even 30 flips. Instead, we’ll get heads a few times in a row, or tails a few times. No one would attribute such a streak to brilliance or coin-flipping skill. As we add more flips, the results will gravitate toward an even split, or revert to the mean.

This year, the S&P 500 is up about 25%, making many of us feel pretty good as equity investors. If we simply sat in a broad index we did well, and if we picked some better performers then we scored even more success. In bond land, long-term Treasuries are up more than 6% for the year, and have earned an addition 2% in income. Everyone’s a hero!

But both markets are unlikely to repeat their performance next year, and that’s going to leave a lot of people looking, and feeling, pretty awful.

From 2014 through 2018, the S&P returned 13.69%, 1.38%, 11.96%, 21.83%, and -6.24%, respectively. On average, that’s 8.52%, which is within about 1% of the long-run average return of large-cap equities of about 9.5%. If the markets end the year up 25%, then the average return of just 2018 and 2019 would be 9.3%, which is even closer to the long-run average return.

But great returns this year don’t mean we’re in for a repeat in 2020.

Over the last 100 years, the S&P 500 has earned 20% or more two years in a row just eight times, with three of those instances coming in the late 1990s. It could happen next year, but what would be the driver? Global growth is waning, the effects of tax reform have worn off, and the low-regulation President is on the impeachment block and facing a bruising election year. All critical indicators to where the markets could be headed in 2020, which Harry Dent dives into in his latest research.

It’s more likely that we get a year of modest returns, which will be painful for those counting on big investment gains through broad indices to meet their goals.

As for bonds, fixed-income investors rode the wave as 30-year Treasury yields dropped from 2.98% to 2.15%, pushing up prices. It’s not impossible, but it’s highly improbable that 30-year Treasury bonds dip from 2.15% to 1.32% next year.

There’s no doubt that the gains of 2019 will make many institutions, such as pension funds, feel much better about their unfunded liabilities as they see the gap close a bit, but it won’t last. As we go through 2020 and the standard mix of 60/40 equities and bonds delivers a total return closer to zero than 20%, these same people will get nervous because their liabilities will continue to grow. In states like Illinois and Kansas, where public pension funding stands at 38% and 34% of the assets needed to pay the bills, one year of great returns isn’t going to move the needle.

They won’t change course, but individual investors can.

If you’ve banked some good money over the past year by floating on the rising tide, be happy with your good fortune and then make a plan.

Maybe you want more income, like Lee Lowell provides in Instant Income Alert, or perhaps you’re looking for individual stock selections like we have in Boom & Bust.

Charles Sizemore has also made it his mission to help readers build consistent reliable income for retirement in Peak Income.

For those who are more adventurous, Adam O’Dell highlights option trades in his new Millionaire Masterclass, as does Lance Gaitan in Profits Accelerator.

It’s likely that 2020 will be a year that favors stock pickers over those who simply ride the averages. As we go through the final weeks of the year, now is a great time to map out your investment strategy for the coming year.

As for football, I finished this year tied for second, which is fabulous. But I don’t count on my luck holding through the bowl series, or carrying over to next year. I’m just happy to have found an acorn.

December 4, 2019

You Say You Want a Revolution?

One of the main themes of my book, Zero Hour was that we are in a period of political and social revolution, the likes of which we haven’t seen since the late 1700s, with the convergence of democracy with the American Revolution; free market capitalism; and the Industrial Revolution…

1776 was the year all three came together. We had the Declaration of Independence, the patenting of the steam engine, and the greatest economic book of all times: The Wealth of Nations, by the first real economist, Adam Smith.

If you don’t think cycles are important, then ignore that date!

Look at this chart from my book:

Our kids are going to look back at this period and say, “What the hell happened here?”

Our kids are going to look back at this period and say, “What the hell happened here?”

Is there anything in human history more important than the convergence of democracy, free market capitalism, and the Industrial Revolution? That made the Agricultural Revolution 10,000 years ago look like nothing.

Why? The exponential nature of technology and evolution…

And the clean-up hitter home run of the 500-year Mega-Innovation/Inflation Cycle starting in the very late 1800s. Oh, and then the larger 5,000-year Civilization Cycle that first saw the Agricultural Revolution and settling into small towns around 8,000BC; then the advent of cities, writing and the wheel around 3,000BC; and currently, the advent of electricity, computers, the internet and mega cities.

When I talk about long-term things like this, people look at me like, “Harry, you need to get a girlfriend.”

We have seen more economic progress in the last 120 years than all of human history combined – and we are only halfway through that 500-year up-cycle that peaks around 2150. That’s why it’s important to study longer-term cycles. It’s also why I make my blockbuster issue of Leading Edge from December 2018 available for all readers as a great resource to give to your kids (who will live through much of this and live much longer), and anyone you want, or they want.

When Zero Hour came out, Brexit and Trump were already in play. I talk about 50/50 polarization everywhere in the world. Today, the U.K. is still about 50/50 split on whether to leave the European Union. The U.S., in its modern-day Civil War, is near 50/50 red vs. blue, with little indecision, on whether to impeach Trump as he throws one wrecking ball after the next domestically and globally.

There has been terrorism non-stop since 9/11, and now domestic terrorism leads here with angry white men shooting innocent kids in schools and malls – non-stop!

There have been endless civil wars around the world, concentrated in the Middle East after the “Arab Spring,” most of which have largely thus far failed to spawn democracy there due to still largely backward cultures.

Now what do we have? A major revolt in Hong Kong against the Neanderthal Chinese communist autocracy in the age of what I call the bottoms-up “Network Revolution” of this very 250-year cycle.

Congratulations to those brave revolutionaries there, and they aren’t giving up. I feared that would not happen due to the scarcity of young people who drive such revolutions due to China’s One Child policy since the 1970s from that same mafia-like, outdated government.

And just this week: major revolts against the even-more Neanderthal government in Iran, where over 200 people have bravely died. Iran has the most educated and pro-western populace in the Middle East, but a government as backward, or more, as Saudi Arabia.

This revolution against top-down autocracy and outdated governments and politics will continue to mushroom for years to come, and the greatest financial crisis of our lives between 2020 and 2023 will only exacerbate it…

And next comes top-down management in corporations – like the top CEOs buying back their own stocks into the top of the biggest bubble in history. Oh, that will look brilliant in the years ahead.

I say: “It’s about time… bring it on!”

December 3, 2019

Trading War for Money, for the Moment

Seven or eight years ago, I gave a speech in L.A. for a friend of mine, Chris Cordoba.

Afterwards, we went out to dinner with some of his friends. They asked economic questions, and eventually the conversation turned to concerns about hotspots around the world.

I had one big worry… the relationship between China and Russia.

The two nuclear powers share a long, sparsely inhabited border, with lots of energy underground. Russia is a nation marked by corruption, waning technological prowess, and an aging population of 142 million people that will soon fall in numbers. China’s economy is on the rise, with expanding technological prowess, a thirst for energy, and a population of 1.1 billion people that includes more than 50 million men with no numerical possibility of finding a mate.

The two countries have a history of acrimony and suspicion, which made me pessimistic. I was wrong. Instead of choosing to square off and punch each other, they decided to join forces. For the moment, they’ve chosen money over war, and they’re speaking in the language of energy.

This week, the Russians will begin operating their new Power of Siberia Pipeline that stretches 1,800 miles from the gas fields in Russia to a port of entry in China. The two countries struck a deal to build the $55 billion pipeline in 2014, just after the U.S. and Europe imposed sanctions on Russia. The two countries signed a $400 billion energy pact.

Sweetening the relationship, China is developing Russia’s 5G infrastructure, and Russia has increased the amount of foreign reserves held in Chinese Yuan.

Maybe humanity has developed beyond the desire for large countries to attack each other, or maybe developed nations are just getting old. Whatever the reason, it looks like the Russians and Chinese are developing a relationship that combines energy, economic growth, and people. The pair could be a counterweight to Western influence, if they can hold on.

Maybe. But I doubt it.

My wife often says that people will hold up their crazy card, or show their true colors, through their actions. Our job is to recognize those signals. The Chinese created the One Belt, One Road Initiative, and the China 2025 program. They take out page after page of advertising space in the Wall Street Journal to tout their economic development. Chinese officials have done everything but print a headline that reads, “We intend to be self-reliant and the number one economic power on the planet.”

It’s hard to see how that will sit well with a Russian leader who is ex-KGB and prides himself on controlling at least part of the geopolitical chessboard.

Vladimir Putin used natural gas as a weapon against Ukraine and Europe a few years ago, and the Chinese have a history of forced technology transfer and stand credibly accused of creating ways to spy on rivals through computer chips. It looks like a matter of when, rather than if, these new best friends will end up at odds and the fight will turn ugly.

In the meantime, the rest of the world will have to adjust. With the new pipeline, Russia will supply China with up to 10% of its natural gas needs, essentially supplanting expensive LNG imports from the U.S. With fracking efforts in the States creating so much natural gas that local spot prices have fallen below zero on several occasions in the Permian Basin, energy producing and transporting companies could be facing a brutal reality next spring. If new clients don’t appear or energy production doesn’t taper off, there won’t be anywhere for the gas to go when we switch back from drawing down inventory during the winter to building inventory during the spring and summer.

While the new hookup between Russia and China is much better than an armed conflict, it can still create winners and losers. Across the energy complex, producers and transport companies are hoping for a rocky relationship between the two countries, and really cold winter.

December 2, 2019

Video Streaming: The Final Bubble in the 45/90-Year Tech Cycle

Here in late 2019, the 45-year tech cycle is converging on the last top back in late 1972. More important the 90-year Super-Bubble Cycle is converging on that infamous late 1929 anniversary.

The crypto/bitcoin hype cycle is also right about where the internet was before the first tech crash, from early 2000 into late 2002. The internet shot up like a rocket in the last few years of the broader tech bubble of the 1990s, as bitcoin did into late 2017.

But the finale now looks like it might just be the video streaming bubble that’s soon to pop. This broader 45-year cycle started with the ascent of portable computers and cell phones, followed by the internet, email, Google, and more recently, social media. But it was broadband that allowed the video streaming finale that is coming to a crescendo now.

Netflix was the first big example in 2007 as broadband was maturing in its S-Curve penetration. The company sold cheap monthly subscriptions streamed to undercut more expensive cable services, and then they expanded to smartphones, also maturing.

And I love this model for more than the lower price… no advertising!

Spotify has led a similar trend in music streaming.

So buying and agglomerating content and streaming it appears to be the last great bubble of this super, double or 90-year version of the tech cycle.

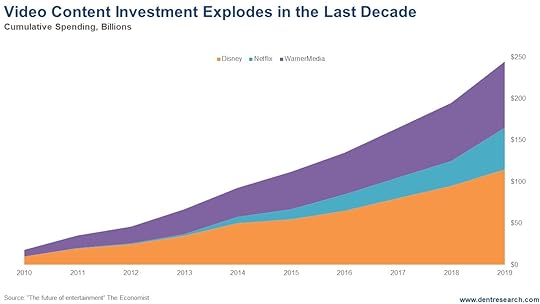

$650 billion has been invested in the last 5 years, over $100 billion this year alone. This chart shows just the top three companies: Disney, Netflix and Warner Media, which total $250 billion over the last 10 years. Other big players are Comcast, Amazon and Apple.

And of course, most of that was debt, at about $500 billion. This looks like the final disruptive trend in the internet cycle that has caused the winners like Netflix to see stock prices rise 37 times while losers like Viacom have fallen 5% in the greatest tech bubble in history.

But now this industry is maturing markedly this year, even for Netflix. Price-cutting will increase, margins will fall, and the industry will quickly consolidate.

Bitcoin may yet have one more bubble to new highs in its hype cycle if stocks correct and cause a final all-out stimulus push from the Fed and Trump. But regardless, this bubble alone could pop and trigger the closest thing to the 1929-32 crash we will ever see in our lifetimes, or our kids’.

So, I’m going to be watching stocks like Netflix, one of the infamous and leading FAANG stocks.

This bubble looks sure to pop in the coming months or year at most…

Then Humpty Dumpty comes tumbling down.

November 29, 2019

Real Estate Warnings for 2020

I just got to New York after two weeks in Australia, and while I’m glad to be back on American soil, I’m still a bit frazzled and jet-lagged from the long flights. So we weren’t able to record a rant today. We’ll be back with those next week.

In its place, I had our video team dial up a behind-the-scenes interview I did at this year’s Irrational Economic Summit about how I see the real estate market shifting as we move into 2020.

Real estate is a sector of the market I warn people about the most even if they choose not to listen. In fact, I wrote a pretty thorough ebook about real estate last year, which you can access here with a subscription.

So many people are stuck in a mindset that the value of real estate will only go up and up, but that’s simply not true. While recent American history shows real estate on a long-term uptrend, world history makes clear that real estate does not work that way.

We’re in the second bubble, and the next crash is coming. It will take longer to bottom out, and it won’t be pretty at any point. I predict things will be worse than 2008.

Watch this week’s video to learn more.

November 28, 2019

Thankful for Adam Smith, Capitalism, and Billionaires

People in the nine-zeros club rarely make my prayer list. Usually my concerns are closer to home, centered on family members and friends, or sometimes things at work. But billionaires have taken a lot of heat lately, as many people hold them up as examples of all that is wrong in our economy.

I disagree. I think they’re the logical outcome of what is right, and how we all benefit. Our economic system gives us freedom that has led to some of the best outcomes for the world in all of history. So as we gather to give thanks for what we have, it’s only right that we include a little love for the framework that makes it possible, capitalism, and some of the people that are leading the charge.

Adam Smith is considered the father of capitalism, which gets a bad rap today as an economic system that allows individuals to amass obscene amounts of money and then hoard it for their personal use. That characterization is absolutely false because it ignores both the driver of capitalism and its natural limits.

In Smith’s book The Wealth of Nations, he identified what makes capitalism work. It’s not allowing greed to run amok, or even promoting greed. We had greed long before Smith showed up. The underlying genius of capitalism is freedom. When we’re free to choose our enterprise, both as workers and consumers, we lend our voice to the call of what is important in our society.

Smith famously wrote:

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our own necessities, but of their advantages.”

Through those exercises, we shape the growth and path of the economy. It’s true, we do it because of self-interest, but that’s not the same as greed, which implies we’re taking a path that involves cutting corners, doing shoddy work, or shorting the paychecks of employees. In Smith’s framework, any such action cancels out our freedom.

We wouldn’t freely buy from someone selling food past the expiration date just to make a bigger profit, or hire a contractor who uses cheap materials to pad his bottom line. And we wouldn’t freely take a job with an employer who said in the interview, “Hey, by the way, I’ll ask you to work 45 hours per week but will only pay you for 40.”

And full disclosure wasn’t the only thing that limited capitalism. In his first book, The Theory of Moral Sentiments, Smith identified the societal norms of justice, prudence, and benevolence. As consumers and workers, we reward companies that exist within our social framework that includes these ideas, which drives companies, through their self-interest, to pursue them as well.

Granted, we don’t all agree on the norms, as they change over time. But that’s the beauty of capitalism. It can morph with society.

And the outcomes? They’re unassailable.

Yes, since the early 1800s we’ve seen the rise of billionaires. We’ve also seen a dramatic drop in the percentage of the world population living in abject poverty. In 1820, 89% of the 1.08 billion people on the planet lived on less than the equivalent of $1.90 today. Today, only 10% of the world’s population fall below that level.

As for billionaires, at least those operating in a transparent system, I’ll bet on them to be better stewards of their capital than the government anytime.

In 1994, Bill Gates became the richest man in the world (Saudi Princes notwithstanding) when his wealth reached $9.35 billion. I worked on Wall Street at the time, and I remember it well. He was roundly criticized as people called on him to give away his wealth. Warren Buffet provided a voice of reason. He said Gates should keep his money for as long as he wanted to work and invest. The $9 billion he might give away in 1994 would be spent but, if he continued to build his fortune, he’d likely give away much more later.

Today, Bill and Melinda Gates are worth $106 billion. Their foundation is worth $40 billion, and since they started it in 2000, it has given away $41 billion. In total, the Gates have amassed $187 billion, about 20 times what he had on a nominal basis in 1994, and they continue to fund health and education projects around the world.

It happened because Gates developed software that helped revolutionize the way we work and play, which satisfied his self-interest, and gave people what they wanted.

That’s something to be thankful for.

Happy Thanksgiving.