Harry S. Dent Jr.'s Blog, page 14

October 16, 2019

Peak Debt

In the September issue of Boom & Bust, I talked about corporate debt being the greatest threat globally this time around. The worst is in the emerging world that used cheap printed dollars from the developed countries, primarily the U.S., to fund a debt binge concentrated in the corporate sectors. But our corporate sector also added a lot to their debt and only 39% of their bonds are investment grade, with 39% BBB and 22% junk.

Last time the bigger binge was by consumers playing the great housing bubble. With low rates and a good economy, why not buy a bigger house, or a vacation house, or speculate in a few to rent out and/or flip.

Consumer Debt

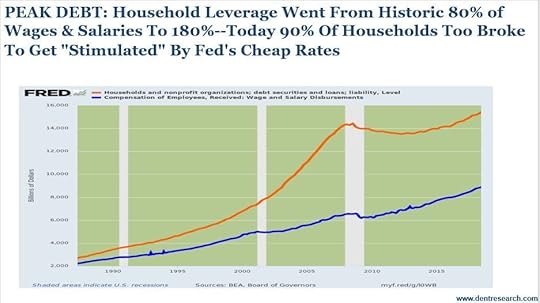

So, I’ll start with consumer debt and a slide from David Stockman’s presentation at our recent IES conference in D.C.

Stockman remarked that consumers had transitioned from a more historical level of debt leverage of 80% up to 180%. In this chart, total consumer debt has grown 505% today at $15.5T (trillion) from its $2.6T in 1987. In the 13 years up until 2000, it grew 162% to $6.8T.

Then the real bubble hit starting in 2000 when stocks crashed and people switched to speculation in real estate . Their debt grew 112% in just 8 years to $14.4T in 2008. It backed off with minor deleveraging to $13.5T in 2012 and then grew a much more sober 17% into now, 2019.

Hence, households have not been the big borrowers this time around.

The Corporate Side

This chart goes back to 2000. In the last bubble corporate debt went from $6.2T in 2000 to $10.6 in 2008, up 71% and less than that 112% for consumers. That debt fell modestly to $10.0T and then grew a not sober 57% to $15.7T. It is now near total consumer debt at $15.8.

But the growth rate since 2000 has been higher overall for the corporate sector, 153% vs. 132% for consumers.

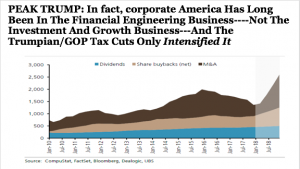

Again, consumer debt grew more from 2000 to 2008 and corporate debt more from 2010 to 2019. Consumers speculated more on housing in the first bubble and corporations did worse this time around. They speculated on their own stocks: $5.7T since 2009! Oh, that’s the exact amount of the net debt increase since then.

Housing fell 34% last time and could fall closer to 50% this time. But those corporate stocks could fall 80%+. How foolish the corporate CEOs and boards will look… the dumbest money in history – not for shoe shine boys anymore.

So, who’s going to be more in trouble this time around with 61% of their corporate bonds not investment grade – BBB or less including 22% junk bonds?

October 15, 2019

Tax Cuts: Thanks For Nothing – Trump and Corporate America!

David Stockman, Dr. Lacy Hunt and I agreed on a lot of things last week at the seventh annual Irrational Economic Summit in D.C.

The Truth About Tax Cuts

One of the key points that I have been harping on over the last year is simple: The recent tax cuts were destined to go into financial engineering to leverage earnings per share, not into new productive capacity that would create future jobs and earnings…

Why else do you think that Lacy Hunt’s acid test for productive investment – money velocity – keeps sinking despite the so-called recovery?

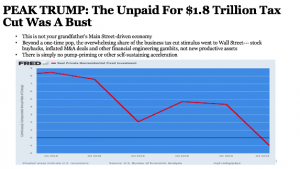

Couldn’t be clearer than this chart from Stockman’s presentation.

Just Look at the Data

When the tax cuts hit in the first quarter of 2018, real capital investment was at 8.5% growth. It not only went down, it plummeted to negative 1% just five quarters later in Q1 2019…

They could have at least faked a little investment for a year to make Trump look good!

Stockman, Hunt, and I all warned about this before it happened .

Companies do not need extra capacity. They already over-invested in the bubble boom that peaked in 2007. This recovery has been the weakest on record. In fact, from the top in 2007, the cumulative growth in GDP 11 years later has been a mere 19%, less than the horrific 1929-40 Great Depression at 20% – and we still have the worst ahead of us when this totally artificial bubble finally bursts.

And it went right where we all said it would go – the same place it already had been going, just faster with such a boost for no logical economic reason.

Dividends just kept drifting up as usual. But stock buybacks accelerated more dramatically since the beginning of 2018, and so did mergers and acquisitions – re-arranging the assets.

Why would anyone do anything else as zero interest rate policies and endless money printing gives incentives to do so easily and cheaply. Building plants and stores and warehouses is hard work. Buying back your own stock is just pushing a button …

And this is supposed to turn out okay?

October 14, 2019

The Economic Fist Fight

The two fighters were nice enough to each other. They exchanged pleasantries, took their places on the stage, and then began to trade their blows.

This took place at our Irrational Economic Summit over the weekend when David Stockman and Lacy Hunt squared off and went at it. The topic was the Fed – or more specifically, the Fed’s latest bond-buying program, and what it means for the economy.

To Stockman, the Fed’s new program to buy $60 billion per month of U.S. one-month T-bills is yet another example of quantitative easing. A method where the Fed magically prints money and expands credit while crowding private investors out of the T-bill market. The laws of supply and demand haven’t been suspended. So, Stockman reasons that the extra purchasing will drive up prices and drive down interest rates.

Lacy, in his southerly Texan way, disagreed.

To him, the Fed is simply taking care of a housekeeping issue that should never have been allowed to exist. The Fed controls money supply, and is well aware of the consequences of the Systemically Important Financial Institution (SIFI) designation. Financial companies tagged with SIFI must hold larger, higher quality capital cushions than others, so they aren’t as likely to lend their deposits to other banks. As excess reserves eased out of the banking system through increasing loans and the dwindling Fed balance sheet, institutions of many types couldn’t get their hands on enough cash to meet their short-term, and often overnight, obligations.

The repo market, where such institutions can borrow money for a day or two, ran out of cash. There weren’t enough lenders to meet demand. The Fed is buying very short-term Treasury Bills just to put enough cash in the system to grease the repo wheels.

Two Experts at Work

In a way, both Stockman and Hunt were right. By definition it’s quantitative easing, but the effects on the bond market should be negligible.

The sparring was fun to watch, and then moved on to other topics. Should we return to the gold standard? Should the Fed adjust money supply and interest rates? Or should the Fed exist at all? Every topic drew a sharp, smart response from both sides, which were often at odds.

David Stockman is certain the Fed has little purpose. Market forces should be allowed to discover prices, which will show up as interest rates on bonds, loans, and deposits.

Dr. Hunt sees the Fed as a bedrock of our monetary system. However, he thinks they’ve overplayed their hand and done things since the financial crisis that, while well-intended, have created huge, misaligned asset prices.

This rapid-fire exchange between two men distinguished in their fields exemplified the 2019 Irrational Economic Summit. It also explains why I always look forward to these events , and come away mentally exhausted!

If you weren’t fortunate enough to be there or watch it live, visit our website and get access on demand , it’s definitely worth your time!

One Big Test

As Lacy and Stockman went back and forth, it reminded me that we’re in the middle of a huge financial experiment. Central banks around the world printed $26 trillion of new money since the financial crisis,

while governments went further into debt. As Lacy pointed out, every time in history that a developed nation has incurred large amounts of debt, it has endured a period of austerity to unwind the debt and get back to normal GDP growth.

This time, as we face a $22 trillion national debt and GDP growth of just 2%, our central bank has already deployed the tools in its arsenal.

I’m not sure exactly what the financial austerity ahead looks like, but I’ll bet that it means bursting asset bubble prices in many areas, including stocks and real estate. That’s an outcome on which even Lacy Hunt and David Stockman seemed to agree.

October 13, 2019

Global Trends, Market Red Flags & Rare Money-Making Ideas: IES Wrap-Up

The 7th Annual Irrational Economic Summit has officially come to an end. This by far was the best, most contrarian event yet.

With over 260 attendees filling the conference rooms each day and another 250+ livestream viewers, savvy investors got direct access to strategies and insights from the brightest Wall Street analysts and economists in the world.

NEXTMERICA Panel

And the NEXTMERICA panel Saturday afternoon with Harry Dent, Lacy Hunt, Ph.D., and Keith Kaplan, President of financial technology firm, TradeSmith was proof of that. The brilliant trio took investment questions from the audience and led an interesting discussion on where to put your money to reduce your tax exposure. If paying taxes on your gains is a nagging worry you have, then get the full transcript of their guidance, right here.

John Del Vecchio

But when it comes to uncovering those Hidden Fortunes years before everyone else, forensic accountant turned stock-picking guru, John Del Vecchio is the guy to ask. His 2020 stock to buy had the audience excited at its potential, especially because it takes advantage of an obscure Supreme Court ruling, giving investors a little-known way to tap into a $150 billion industry. That’s why you need to get the ticker symbol and put this stock on your buy list now. Click here to request John’s entire presentation.

Seven-Figure Nest Egg

Day 3 ended on yet another high note with a panel discussion focused on building a seven-figure nest egg for retirement. Peak Income editor, Charles Sizemore, Keith Kaplan, and John Del Vecchio detailed under-the-radar strategies you can use to maximize your profits, even in a severe market downturn. But the crowd was blown away by a question asked by one of the attendees, an 18-year-old college freshman. Keith’s response is exactly why going to the Irrational Economic Summit is the event to attend to secure your financial future.

There’s still time left to get direct access to all of the presentations, slide decks, transcripts, and behind-the-scenes interviews with all of the editors. Plus, a host of additional bonuses when you purchase yours today.

Grabbing the IES On-Demand video kit is the wisest thing to do to strategically position yourself to profit in 2020 and beyond. Click here to get the video kit at the lowest price.

October 11, 2019

Little-Known, Market-Tested Strategies to Grow Your Money: Live from IES

Yesterday kicked off Day 1 of the 2019 Irrational Economic Summit, and was by far one of the best days since this event started in 2012.

Mark Yusko

If you have even a dime of your money in the market, the research-backed insights from Morgan Creek Capital Management’s CEO Mark Yusko, alone, could get you in the right investments to make money well into the future. While some analysts are sounding the alarm on cryptocurrency, Mark’s unique perspective could have you cashing in big on blockchain technologies.

“We’re moving out of the internet as we know it and into what I call ‘trustnet’. And when you understand what this is, you’ll know why I say blockchain cannot be ignored,” Mark detailed in his hour-long presentation.

Want to know exactly what Mark’s must-buy recommendations are? Get the full video kit right now and carefully study his slide deck. Pay particularly close attention to the fifteenth slide!

David Stockman

David Stockman, the Father of Reaganomics, wrapped Day 1 up. And he did not disappoint.

“We are in 124 months of the longest, weakest, sickest economic expansion in history. I expect a recession within the next year,” Stockman warned.

And he had lots of irrefutable economic proof to prove that the financial downturn coming our way could be the most catastrophic yet. Especially when you take the GDP 10-year rolling average that almost topped out at 4% in the roaring 1950s.

Now, we’re barely breaking 1.5% with the trend dropping faster than the interest rates.

I’d strongly recommend requesting access to his presentation to make sure you’re in the right financial positions well before the bubble bursts.

The night ended with a lively welcome reception. Attendees got to mix and mingle with all the gurus and speakers. This is the only event I know that brings together the brightest economic and investing minds to truly help everyday Americans get in on some of the best market-tested, under-the-radar strategies.

Day 2 is proof of that fact.

Adam O’Dell

The morning started with an in-depth Options 101 presentation by Adam O’Dell, Chief Investment Strategist and the technical analyst behind the profitable Cannabis Paydays newsletter. He walked the room full of attendees through the ins and outs of options and why they make the perfect investment vehicle in a volatile market.

After a few Day 2 welcoming remarks, we dove into more eye-opening economic insights led by Rodney Johnson, co-founder of Dent Research.

“When you understand these demographic cycles, you’ll know just where you need to put your money to profit. And what may look like a weird trend can be telling if you look at the reasons why. For example, cereal is down for a reason…” Rodney explained before detailing the rare insights that many investors are overlooking.

J.C. Parets

But, one of my favorite presentations of the day was from the “New Wizard of Wall Street”, J.C. Parets. Despite the doom and gloom of the market, he’s taking a very bullish stand on where he sees markets headed. And with his top five stocks to look at, savvy investors will be wise to take note and follow his recommendations. “The money is in mobile payments. Get in now and ride the wave.”

Charles Sizemore

The morning session concluded before lunch with retirement investment analyst and Peak Income editor, Charles Sizemore. With his presentation aptly titled, “Getting Paid in an Upside-Down World of Negative Interest Rates” he made a bold prediction on the best investment to look to for long-term growth. To see what it is, click here to get the video kit and his full slide deck. I know I’ll be looking more into this investment area for my retirement account.

Stay tuned tomorrow morning and afternoon for even more must-read summit updates.

It’s a Mad Market: Live from the Irrational Economic Summit

As you know, this week myself and the Dent Research team are at the National Harbor outside Washington DC for the 7th annual Irrational Economic Summit. Festivities kicked off Thursday, and it was simply a great day – and Friday and Saturday should be just as wonderful. (You can get fully caught up, and even watch the livestream, by clicking here.) I can’t thank our team enough for the hard work they’ve put into this year’s event. Everything has been above and beyond.

One thing that I love about the Irrational Economic Summit is that it gets everybody at Dent together. We telecommute – Rodney’s in Texas; I’m in Puerto Rico; Charles splits his time between America and Peru – we’re everywhere! So when we are able to get together and catch up on what we’ve been seeing (and what we expect to see moving forward!), it’s a welcome change. I loved being back in the room with Dent’s senior research analyst Dave Okenquist for this Friday rant.

We talked about the markets and politics – a few of our favorite things. In both cases, it’s not fully clear where we are headed.

We’re changing things up a bit this week while we’re at IES 2019 as we get to interview Harry Dent in person. From bitcoin’s movement to potential presidential impeachment, Harry breaks down the week’s news and the markets’ recent chaotic behavior.

Posted by Economy and Markets on Friday, October 11, 2019

October 10, 2019

Craziness in the Markets: Live from the Irrational Economic Summit

The 2019 Irrational Economic Summit is already off to a big start.

The Irrational Economic Summit opened with a full house of 260 attendees. Boom & Bust co-editor Rodney Johnson drove home the importance of pinpointing the right information, at the right time, to take the right action on your money.

“We don’t just give you research unless it’s actionable and accurate for us to follow,” Rodney explained in his opening speech. He then invited the conference’s scheduled speakers to the stage, investors like Lee Lowell, John Del Vecchio, Charles Sizemore, and Lance Gaitan. Getting a preview of each of their researched-supported topics makes clear that we have a jam-packed weekend ahead. It will be full of under-the-radar strategies and stock recommendations.

Adam O’Dell, Dent Research’s options trading expert behind the innovative Cannabis Paydays, will share the top 20 ticker symbols you need to buy in 2020 on Friday at 3pm. And J.C. Parets, the wizard technical trader, who reviews over 5,000 charts a day for his Off the Charts and Breakout Profits trading services to find overlooked money-making opportunities. Tomorrow at his 9am presentation, he’ll have a list of charts that are “certain will break out and go 300-400% higher.”

Craziness in the Market

But attendees were in their seats for Harry Dent’s opening session. His speech detailed why the “craziness” behind the current bubble market is purely driven by the government making irrational economic decisions. Harry likened the drastic economic stimulus (a.k.a. quantitative easing) to the addictiveness of crack: Feed an addiction and you’ll have to keep feeding it, until there’s nothing left but destruction.

“Guess who is buying the S&P 500 stocks?” he asked. “The S&P… Sounds like cheating the market to me. When the bubble explodes everything will be worthless.

“Nobody can forecast the future. It’s too complicated to predict. But that’s beyond the truth. The easiest thing to see well in advance is the long term, and I’ll show you how…”

And predicting every major market event is exactly what Harry Dent has been able to do — with eerie accuracy. If you aren’t a livestream viewer, I strongly urge you to keep an eye out for the complete 2019 IES video kit to get lifetime access to Harry’s full presentation and slide deck.

Up Next…

With Gordon Chang, Mark Yusko, and the highly-anticipated David Stockman keynote in the next few hours, there’s plenty more action ahead for the Irrational Economic Summit. I’ll send a detailed day 1 recap tomorrow morning with additional must-read insights.

October 9, 2019

The Game-Changing Event of the Year Kicks Off Tomorrow

Harry and Rodney are in the air today, onboard separate planes bound for Washington DC and the 7th Annual Irrational Economic Summit, set for Thursday through Saturday at the National Harbor. They’ll be checking in throughout the conference, and we’re also excited to feature Economy & Markets reporter Llacey Simmons through the week. Llacey will have dispatches each day of the conference, as well as a wrap-up on Sunday. So stay tuned, and tune in to the livestream if you can’t make it!

With so much turbulence in the market these days, savvy investors are looking for those under-the-radar strategies and insights to help protect their money. That’s why Washington, D.C., will be all abuzz tomorrow with the kickoff of the 7th Annual Irrational Economic Summit .

And this event couldn’t come at a more opportune time. From the trade wars in China to the recent impeachment inquiry, there’s no telling where our country and economy might be headed.

That’s why Harry and Rodney pulled all the stops this year to bring the brightest minds together for this rare three-day event. Don’t worry, if you can’t make it in-person, you can stay caught up with me. Harry is also extending a special invitation to select readers. Click here to see how you can access the Irrational Economic Summit at home.

Because the little-known and proven guidance that you’ll get from even the first day is sure to help investors profit in the year ahead.

Harry Dent

The first three speakers alone will give you insights you can’t find anywhere else. Harry’s research-backed presentation, 2020: The Tipping Point is already generating chatter in economic circles. He’ll show attendees and livestream viewers the ins and outs of exactly where his research predicts the markets are going through the New Year and well into next November’s contentious election. And, knowing Harry and his eerie accuracy, what you think is coming our way is not at all what his spot-on guidance suggests. Be sure to catch my Day 1 wrap-up to see what he shared. Or, grab one of our remaining Livestream Passes right here to watch his presentation live for yourself.

Gordon Chang

Tomorrow’s afternoon presentations won’t disappoint either, with America’s #1 China Expert, Forbes columnist and bestselling author Gordon Chang, revealing what he sees Beijing’s next move being and how hardworking American investors like you can profit from the Chinese economy.

Mark Yusko

But that’s just the tip of the iceberg. Because with your retirement and your family’s financial future at stake, we all need to know what strategies will work even in the bearish of markets. And when billion-dollar investment groups need tried-and-true investment guidance, they turn to Mark Yusko time and time again. As the Founder and Chief Investment Officer of Morgan Creek Capital Management, Mark has managed in excess of $1.5 billion, easily making his session on Blockchain Technology one of the most highly-anticipated talks of the first day.

David Stockman

And to bring the already insight-driven first day to a close, keynote speaker David Stockman will take the stage. What he shares is likely to be the most important “secret” of the day, especially as the money grabbers in Washington take their last handfuls before Trump’s likely impeachment. Hands down, as one of the most influential former government insiders and the Father of Reaganomics, Stockman’s 75-minute session will be full of vital advice you won’t ever see on any mainstream media outlet. To see his complete presentation, live tomorrow at 5:15 PM EST, click here.

Be Sure to Stay Tuned

Over the next few days, I’ll personally keep you updated on the movers and shakers at this year’s event. So, stay tuned for more insights coming your way. But, if you want complete and immediate access to every presentation, as they happen, then you must get your Livestream Pass right now.

For the first 100 readers today only, Harry is giving you complete access to the Livestream Pass at a heavily discounted rate. If you have any money in the market, you can’t afford to miss even a single presentation or interview. Get your 2019 Irrational Economic Summit Livestream Pass before they run out.

October 8, 2019

Warren or Sanford? Eyeballing 2020

In a recent interview with MSNBC, Representative Adam Schiff (D-CA) said that his House Permanent Select Committee on Intelligence had no knowledge of the UkraineGate whistleblower claim before notification from the Inspector General.

That statement was eventually proven false. As the first whistleblower approached staffers for Schiff’s committee before going to the IG. For the falsehood, the Washington Post awarded Schiff “four Pinocchios.”

Although, as my Millennial kids would tell me, if we’re counting falsehoods, the Washington Post would probably award Trump “all the Pinocchios.”

The Ukraine phone call scandal might not sink President Trump. However, he’s still polling well behind Democratic presidential nominees Joe Biden and Elizabeth Warren in head-to-head polls. As investors, we’d be fools not to think about what might happen in the very real scenario where Trump doesn’t occupy the White House in the last week of January 2021.

Scenario No. 1: Removal from Office

It’s not likely that the Republican Senate would convict the president following the House’s almost inevitable impeach, but it’s possible. Should Trump gets the boot early, we’d need a Republican candidate to run in 2020. Former Governor of Massachusetts Bill Weld is running in the Republican primary; at least, he is in the states holding a primary. Former South Carolina Governor and Rep. Mark Sanford has also thrown his hat in the ring, along with former Illinois Rep. Joe Walsh.

Sanford is the most interesting of the three because he’s a) from south of the Mason-Dixon line, a positive for a Republican, and 2) he’s the only candidate who claimed to be hiking the Appalachian Trail when he’d actually run off to Argentina to have an affair.

Scenario No. 2: We Get a Democrat

With a tailwind, no real competition, and Joe Biden gaffing his way through Iowa, the election could be Sen. Elizabeth Warren’s to lose.

That should give investors some real pause.

Contemplating a Hillary presidency, investors took the S&P 500 in late October 2016 back down to exactly where it had been a year earlier. Hillary promised higher taxes and more regulation. When Trump won, the futures fell 800 points, then turned on a dime and shot to the moon. Since his inauguration, Trump’s supported lower taxes and fewer regulations. The trade wars hurt, but they’re (supposed to be) temporary.

Warren promises much more than Hillary ever dreamed of.

Higher Taxes?

Of course. According to a new book due out next week, The Triumph of Injustice, the average tax rate on the 400 wealthiest households in 2018 was just 23%, well below that of Middle America. This will be the statistic that Warren and others use as a billy club for the rest of the election cycle.

More say and Pay for Workers?

It’s already on the table. More than 180 members of the Business Round Table, a gathering of CEOs from the largest American companies, recently signed a statement claiming that shareholders are no longer their central focus. From this point forward, they’ll focus on all “stakeholders,” including customers, workers, the environment, probably extraterrestrials, and somewhere down the line they might still give a thought to the providers of capital.

Senator Warren was delighted, and sent several of the CEOs a letter explaining her Orwellian Accountable Capitalism Act, which requires companies worth more than $1 billion to obtain a federal charter, and for 40% of the board seats to be awarded to members of the workforce. She also noted that, given their signatories on the roundtable statement, she “expects” them to fully endorse her proposed act, which will become a demand if she earns the seat in the Oval Office.

This is just a taste of what will be a very unsavory meal for Corporate America.

Stay Tuned

This might be what the country needs, or it could be the biggest setback since the 1970s. That’s for voters to decide. But as investors, we’d be crazy not to evaluate the likelihood of a Warren presidency and the possible effects it would have on the economy and our holdings. As more facts about UkraineGate come to light and November 2020 inches closer, don’t be shy about taking profits off the table.

As many smart people before me have said, “You never go broke taking a profit.”

October 4, 2019

Previewing Irrational Economic Summit

We’re less than one week out from this year’s Irrational Economic Summit, and let me tell you, we could not have picked a better place to hold this year’s conference. Washington DC in the middle of this political climate? Just perfect. And we couldn’t have a better keynote: David Stockman, the former Congressman and Budget Director under Ronald Reagan. His knowledge of the intersection of politics and finance is ideal for these headwinds, and I can’t wait to hear what he has to say.

As for what I’ll have to say, well, there’s plenty to be talking about. But I’m going to focus on two things:

The very unusual and atypical triple megaphone top we’re seeing right now in the markets. This is the next phase of our long, slow march towards a crash that you need to get you need to get ahead on, because it’s obvious to me that Wall Street won’t.

The “Trump Wild Card Scenario.” Let’s face it, Trump’s not having a good run these days. But then again, neither are many of the Democrats. Biden’s stumbling, Bernie’s in the hospital. The only one who seems to have any momentum is Elizabeth Warren, which is bad news for the banks. But it won’t be easy for her should she go face-to-face with Donald Trump. It never is. And Trump will do anything to hold power, so expect a few tricks. I’ll forecast one next week.

A busy talk for busy times, and I’ll also have a few nuggets of advice about what to do about your current holdings. More there , and in the Friday rant below.