Harry S. Dent Jr.'s Blog, page 17

September 5, 2019

History Doesn’t Agree with the Pundits Who Say Stocks Aren’t Overvalued

Two things should be obvious: We are in a totally artificial recovery due only to global printing of $13 trillion and more recently, tax cuts; and this is now the longest rally and economic recovery in U.S. exceeding 10 years.

There has been a recession every 10 years since I was a kid: 1962, 1970, 1973-1975, 1980-1982, 1990-1991, 2001, and most recently 2008-2009.

The sunspot cycle has captured them all and that has averaged a little over 10 years since 1900. That cycle is near a bottom and is not due to turn up until at least late 2020 and more likely 2021 or later.

What the Pundits Believe

As I said on Wednesday: How long can you keep consumers spending on ultra-low rates until everyone is re-employed that is remotely capable and everyone has refinanced their mortgage or bought a better car or house?

More and more leading indicators are showing slowing here – and around the world even more so, as I covered on Wednesday.

But then the pundits argue that there is nowhere else for investors to put their money with such artificially low bond yields, and that simply continues until there is a major economic disappointment or the bubble just bursts of its own extremes. Was there a recession when the tech bubble peaked in March 2000? Not until almost a year later. Was there a recession when Japan’s Nikkei bubble peaked at the end of 1989? Their economy looked a lot better than ours today and was not running on endless money printing yet.

But History Shows…

I have showed a plethora of charts that almost all say that stocks are the most overvalued in history, more than 1929 and every other major top, except the tech bubble that peaked in March 2000. But that saw the greatest fundamental trends converge in history that almost no one but me saw coming in the 1980s. You can’t even remotely compare economic statistics in this recovery to that unprecedented boom. The total market cap to GDP is at the highest ever, above the 2000 top, as is price to sales, which is not as manipulatable as profits.

Here’s another simple one from Ned Davis, one of the few good cycle guys on Wall Street.

This chart of the S&P 500 against its long-term trend line since the early 1900s is the first to show greater over-valuation in 1929 than 2000. But one thing is clear: We are in another major over-valuation trend that will correct and a final Dark Window rally likely ahead will only make that more extreme like 2000 and 1929. This chart is similar to the cyclically adjusted P/E ratio from Robert Shiller.

The Most Likely Scenarios

A final blow-off rally to as high as Dow 33,000 and Nasdaq 10,000 would still be the best peaking scenario with even higher overvaluation. But the megaphone patterns since January 2001 are also suggesting we may have seen the best of that final rally and we see one more rally to slight new highs only on the Nasdaq and not the Dow and S&P 500, after a deeper correction near term.

In the 5 Day Forecast for Boom & Bust subscribers on Monday, I showed the two most likely scenarios for this final top, and like the leading indicators on Tuesday, they point towards January to March of 2020. After reviewing Andy Pancholi’s latest cycles at The Market Timing Report, I would stretch that final top in the Nasdaq only to as late as early May.

This market is overvalued enough to blow any time something big enough goes wrong… or like in Japan in 1989 and the tech bubble in early 2000, even if something doesn’t.

September 4, 2019

Many Indicators Point to Early 2020 Downturn

The yield curve first flirted with inversion earlier this year. That occurred clearly recently when the 2-year Treasury bond yield crossed below the 10-year, and it has done that further more recently.

But that indicator can lead by nine months to 22 months. And Treasury bond yields have been so manipulated in the last decade of QE that who knows how meaningful that is anyway…

But certainly, this indicator is more of a warning of falling growth, as the real trend is that long-term bond yields are plummeting as the bond market sees slowing U.S. and global growth. That has been a big part of the recent correction in stocks.

But there are other, more fundamental leading indicators that are more meaningful.

Dow Jones Home Construction Index

My first non-mainstream indicator was the Dow Jones Home Construction index that peaked in late 2005, 26 months before the stock peak in October 2007. That peaked in early January 2018 suggesting on a similar lag a stock top around March of 2020.

That index has had a stronger counter rally into July than it did into early 2007 before declining again. That has been due to the unusual trend of interest rates going down into a late stage boom due to Fed easing again. It would be more confirming if that index started turning down again soon, as it looks likely to do as home sales continue to weaken.

I showed recently that RV sales peaked in 2017 and have accelerated down 20% year-over-year into 2019. That also led the October 2007 top and January 2008 recession by almost two years and suggest very early 2020.

But there are two stock sectors that also led the last top and are telling the same story: the retail and financial sectors.

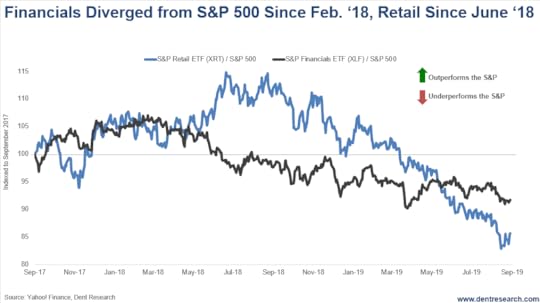

The financial and retail sectors started underperforming the S&P 500 before the 2007 top as well, and they are doing it again. Financials peaked in February 2018 and have been largely underperforming ever since. The retail sector peaked in July 2018 and has underperformed even more so. Amazon has underperformed the S&P 500 since June 2018. It appears to be turning down again.

Consumer Discretionary Signals

The consumer discretionary sector has also been underperforming the consumer staple sector since June 2018, meaning consumers are increasingly buying what they need, not what they want. How long can you keep lowering rates until all consumers have refinanced, or bought a new car or house if they were going to?

And consumer confidence has continued to rise since 2014 while GDP growth peaked and has been steadily declining. Those two have rarely diverged that long. Yet, consumer sentiment from the Michigan Survey suddenly plummeted to just below 90 in August after hitting 100 in late May and still at 98 in July. So that may already be crashing fast.

Elsewhere, there are other reports of high-end consumer spending falling, including real estate in the hottest areas from London to Manhattan to San Francisco. I have seen discounts on luxury cars similar to the one I got on a Maserati in early 2009: 20-25%! The entire dealer margin isn’t even that much.

The trends are clear from all angles. Despite never-ending stimulus and now one-time tax cuts at the beginning of 2018, we keep returning to that dreaded 2% real growth. At some point the fundamentals will win and kicking the can down the road will lose. That looks like it will occur early next year…

What Will Donald Do?

The wild card is obviously how much can Desperate Donald get away with in the last minute, desperate stimulus programs like a payroll tax holiday for the everyday citizen to get direct cash benefits? Or maybe he just talks the Congress into sending everyone a $5,000 check printed by the Fed from thin air, if they spend it before the election… but, that would be really cheesy!

Doesn’t look any more whacky and desperate than what we’ve already seen from central banks and the Donald to me. Imagine how history looks at these accomplished grown men and women feeding the economy “crack” and thinking it could all work out okay.

At best, stocks peak by early next year; at worst, just after the election, if the Donald pulls off one more major magic trick. But the wheels may already be too much in motion for even that.

If he does manage to get re-elected, he will really wish he hadn’t as he could have blamed it on the Fed when he got defeated and not be on the hot spot for the crash of a lifetime.

September 3, 2019

Will Trump Tariffs Inflate Christmas Spending?

The Labor Day Weekend is over, marking the end of summer. Now we can get on to the next holiday in line… Christmas.

We used to concern ourselves with a few calendar markers over the fall, like Halloween and Thanksgiving, but current thinking renders these holidays obsolete.

Christmas is the Sole Survivor

Halloween celebrates evil spirits, and represents a bully mentality that demands candy in exchange for restraint from vandalism. We can’t have that. Besides, someone might get scared. Nope, only costumes of do-gooders that represent all-inclusive viewpoints without offense to people, animals, the environment, bugs, or extraterrestrials are allowed. These marching orders are enforced with rioting, hazing, hate speech and crying on college campuses, where irony is dead and the search for truth has left the building.

As for Thanksgiving, it’s a great story that currently exists under a cloud. A bunch of Europeans wash up on the shores of a land already occupied, celebrate the fact that they survived, and eventually overtake the natives. That’s a no-go under 21st century sensibilities, which we now use to judge all of history, an approach C.S. Lewis called “chronological snobbery.”

Which brings us to Christmas, a holiday under constant scrutiny for favoring one religion. It still gets a pass, but not because everyone agrees with the premise of joy. It’s about the time off and the gifts. While time off is never a bad thing, Corporate America loves Christmas because Americans get to leave work and shop. In fact, they’re encouraged to do so.

Christmas Gifts vs. Trump’s Tariffs

But that shopping is very specific. We tend to buy gifts that can fit under the tree. We don’t “give” people a free trip to the doctor or a year’s worth of yard mowing. And we shop high and low, online and off, for stuff, not services, putting a portion of our holiday merrymaking on a collision course with President Trump’s trade wars. As he turns the screws by increasing tariffs on goods from China, he makes the stuff we buy more expensive.

President Trump and his trade advisers tried to avoid this Grinch-inspired move by delaying the tariffs on a list of goods that normally fall under holiday shopping. Everything from sportswear to gaming consoles to cell phones get a pass until December 15. Looking for that perfect juice extractor with a self-contained motor for domestic use to give to Grandma? Don’t worry, it’s exempt from tariffs until the middle of December.

But the simple delay might not be enough to keep prices in check. Americans live on the “what’s next?” principle, and retailers are no different.

Part of the magic of shopping for the holidays is the joy we get from elbowing our fellow consumers to grab that last 600-inch television for 79% off. We love the deals, and have devoted Black Friday and Cyber Monday to celebrating them. If retailers know, and effectively communicate, that prices will jump after December 15 because of tariffs, then there’s a good chance they’ll forgo the normal discounting, or at least hold it to a minimum, ahead of the price hikes.

Such a move would boost holiday spending even if we don’t buy more stuff than we would have otherwise. It’s the same thing that happened in the second quarter on the wholesale side of America. Companies purchased materials ahead of higher tariffs, leading to increased business activity, at least for a while.

The Revenue Will Go to Uncle Sam

In the short run, the extra revenue will flow to the retailers who stock and sell the goods that we give as gifts. But if and when the tariffs become law, the additional cost will flow to a different bank account, that of Uncle Sam.

This might not be our first choice of where our money should go, but there’s no doubt the federal government needs the cash. The CBO just increased its estimate of the fiscal year 2019 deficit to $960 billion, and annual $1 trillion-plus deficits look likely for the next decade.

You can consider tariffs inflation or simply unvoted consumption taxes. If you want to avoid them on holiday shopping, get out early, and don’t wait too long to spend those gift cards.

Between now and then, I’ll be gearing up for trick-or-treaters and definitely celebrating Thanksgiving, just don’t tell anyone.

September 2, 2019

Do Retirees Celebrate Labor Day?

I grew up in the Florida Panhandle, then moved back there for 12 years as an adult with children. I love the water and the scenery, as well as the tropical weather. I can do without the lines.

I’m not talking about Disneyworld; we didn’t spend time there. I’m referring to the grocery store, the gas station, and anywhere else that consumers of different ages meet.

A Retirees’ Schedule

The retired set seem to operate on a different time schedule, or rather, no schedule at all. They often seem taken aback when a clerk presents them with a bill at the counter, then they dig for their wallet or pocketbook, as if paying is a surprise. Meanwhile, the rest of us wait.

I don’t think it’s old age. I think it’s intentional.

I deal with many people in their 70s and 80s, and a handful in their 90s. They tend to be sharp and well-read, quick to offer a salient point or counterargument that comes from many years of living. These people aren’t suddenly struck with a stupid stick when they walk into a grocery store.

I think their slow walk through the exchange is an act of rebellion, or maybe a flippant “to-heck-with-all-of-you-impatient-people” sort of thing.

After years of hustling, having to move ever faster to keep up with the changing pace of commerce, I think that retirees take advantage of their status to call a timeout and demand that people pay attention to, well, people.

They might have somewhere to be, or not. They could be late for something, or just dawdling. They get to choose.

They’re retired.

The rat race doesn’t matter. They won, because they made it out alive.

I’m jealous.

Retirees on Labor Day

I know the history of Labor Day, but to me it’s merely a day off, which I welcome. A day with no conference calls or deadlines. I definitely take things a little slower.

I wonder if retirees stayed in bed a little longer this morning, skipped their daily work out, or had a big, fat-filled breakfast as they prepped for a barbeque and beer fest?

Maybe. Maybe not. They get to choose. Because they’re retired.

I Look Forward to It

The over-55 set is the fastest growing segment of the American labor force. The Bureau of Labor Statistics estimates that between 2012 and 2022, this group will increase by more than nine million people, which is more than the overall growth of the labor force.

I’ll join the age group soon, although retirement’s not quite on the horizon yet.

But when I get there, you can bet I’ll spend a little time “figuring out” the checkout screen at Home Depot, or deciding what to order at the deli counter, and generally annoying the younger, not-yet-retired people that have somewhere to be.

And I might still celebrate Labor Day. Or not.

Enjoy the day, no matter how old you are.

August 30, 2019

Something’s Got To Give

A wise man once said that if you need to take viagra to have sex, you need to know you have a low libido.

And if you need to pop a second pill, you need to know you’re dead.

That’s how I feel about the global economy at the moment.

We’ve been in a significant downturn lately, with all the flashing lights indicating that we’re heading for even more.

Look around: Germany’s headed toward a recession. Italy’s already there. The retail and financial sectors have been underperforming for months. Home construction peaked two years ago. RV sales have come crashing down. And we’re at a critical point in the stock markets, created by falling bond yields, a weak economy.

We’re in the dead zone, with massive government stimulus and still more planned. Trump is already talking about payroll tax cuts. That’s the one thing they haven’t done yet.

Something’s got to give. We’ll either break out of this to the past highs of July, or plummet down to the lows of early June.

I’m afraid to hold my breath.

Harry Dent: Accept the Debt & Move On

No matter how much we stimulate the economy it’s just going to get weaker, says Harry Dent. Watch now to get his recap on the week’s financial news & why he thinks we’re at a critical point in markets. Check out Harry’s latest bestseller, Dark Window, here: https://pro.dentresearch.com/m/1142369

Posted by Economy and Markets on Friday, August 30, 2019

August 29, 2019

Back to School Season Should Scare You

It’s that time again – back to school season – when we have to drive a little slower, watch for flashing yellow signs that signal much higher ticket costs, put down our cell phones, and try to remember the rules on when to stop for school buses (always on your side of the road and, if the bus is facing you, when the road doesn’t have a median).

But those things aren’t scary, they’re just good safety precautions. The worrisome parts are costs and headcount.

College Expenses is What’s So Scary

On the money side, it’s all about college.

I know the mainstream reasons why college is expensive, including higher demand, pay for personnel, easily accessible student loans, etc.

But I think there are other, hidden reasons.

College is expensive in part because we as parents are willing to pay so much to get our kids out of the house. I know this, because I’m living it.

My two older children are out of college by two and three years, respectively. We just have the last one left. The finish line is so close I can see it.

But then, the universe intervenes: Her college career will take an extra year. And it will be expensive.

My daughter transferred universities, adding on the time and moving out of state. The tuition/fees/add-ons total for just the fall semester are $17,035. This is a state school, and definitely in the middle of the pack in terms of cost.

And that doesn’t include books or living expenses, or travel costs.

We prepaid a portion, so we won’t take the full hit, at least not until her extra year, which I didn’t plan for when she was two years old. Silly me.

As for headcount, it’s related to college costs as well as other expenses.

The Rising Cost of Everything

While I’m shelling out what I think of as big bucks for an out-of-state public university, new parents are coughing up $1,000 per month for daycare. Like me, they have a window of expense which ends when the little one goes off to kindergarten, but then they have the looming cost of college just over a dozen years away after that. And Heaven help them if they want to buy a home in between.

If those same young parents took on some of the cost of their higher education with student loans, then chances are they’re making those payments at the same time as having kids and putting down roots.

The entire situation starts to feel like a financial trap, and goes a long way to explain why the birth rate among women of child-bearing age has dropped to an historical low of 1.7 kids, not even enough to replace both parents. U.S. births in 2017 dropped to the lowest number since 1987.

Study Spending Waves

It’s true that much of the drop in births occurred among teenagers, where births fell by more than 8%, but those women are not making up for the lack of kids later in life.

Our headcount is dropping. It’s a problem for the economy, and oddly, it’s mostly about money.

A research piece in the New York Times last year found that four out of the top five reasons people gave for not having, or not expecting to have, their ideal number of children were financial. The reasons ranged from “Child care is too expensive,” to “waited because of financial instability.”

Our work at Dent Research centers on how people spend in predictable ways as they age. Much of that spending is centered on raising families, which puts us on a predictable path of wanting a home, cars, clothes, and then a bigger home, before changing our focus to ourselves when they leave the nest.

Without kids, we don’t have the same need to spend, and certainly don’t have the need to buy big, financed items such as houses.

We can discuss or argue the merits of encouraging couples to have kids, along with ideas like universal childcare or increased child tax credits. I’m not making a case for or against any of it.

I’m pointing out that with fewer kids, our national economic engine will lose some steam, and it will affect all of us, from Social Security to the available labor pool. We either have to find a way to make family life more palatable, or dramatically adjust how we finance and run the economy.

In the time being, I’ll hope that I see more kids at the local bus stop while eagerly await the last college bill, which is still more than a year away.

August 28, 2019

The Great Crash Begins in 2020

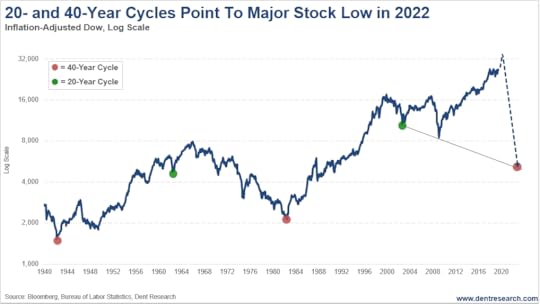

I noticed this cycle right away in my research in the early 1980s: Substantial stock market bottoms have come every 20 years, and major ones every 40.

That 40-year cycle would correspond to the generation waves of spending that have actually peaked 39 years apart, in 1929, 1968 and 2007.

Twenty years would be half of that cycle and double the average recession cycle that occurs roughly every 10 years and corresponds with sunspots. Cycles tend to be more powerful on alternating swings, as Market Timing Report’s Andy Pancholi taught me. So, we actually have 10-, 20- and 40-year cycles hitting just ahead.

Look at this chart back to 1929 showing these two cycles. Major lows occurred in May 1942 and August 1982 for stocks. Minor lows occurred in late 1962 and 2002.

Reasons for a Crash

The next major low on both cycles would be targeted for mid- to late-2022.

I have been quoting this scenario for decades, not just years. That’s how consistent these two cycles have been.

There are other reasons I am looking for the “crash of a lifetime” starting by sometime in 2020 and the “sale of a lifetime” on financial assets by late 2022+.

The 45-year and double 90-year Super Bubble/Great Reset Cycle also bottoms around 2022, following previous major bottoms right on cue in 1932 and 1842.

My infamous Generational Spending Wave forms a 3-year bottom between 2020 and 2023.

I know that governments have and will continue to throw the kitchen sink at this bubble to keep it going… especially Tantrum Trump. But you simply can’t keep a bubble going forever any more than an orgasm…

If there is any time this greatest and most pervasive bubble in modern history will burst, it is in this extreme danger zone of 2020-2022.

A normal 2-3-year crash, that would have to start sometime in 2020, preferably early 2020, as has been my best forecast. It could well be later in the year if Trump starts sending people money directly to get re-elected, as in his suggested payroll tax cut.

If it doesn’t happen by then, we have finally died and gone to heaven… a land of endless happiness with no cycles ever again… and I will be residing permanently in hell!

August 27, 2019

We’re Getting Taken for our Interest Income

The summer of 2008 was crazy. The credit markets were frozen and the federal government put Fannie Mae and Freddie Mac into conservatorship. And there was a presidential election coming fast.

That August, the Democrats made history by nominating the first black person as a major party candidate. It happened on a Thursday night, and was set to be the talk of the town on Friday.

That is, until Republican candidate John McCain took to the airwaves early on Friday morning to both congratulate candidate Barack Obama. And to announce that he’d chosen Sarah Palin as his running mate. The Palin news took some of the air out of Obama’s, just as intended, and was a brilliant move.

But it didn’t last. John McCain stole the moment, but not the momentum from the race.

I was thinking about that dynamic last Friday as I watched Fed Chair Jay Powell speak in Jackson Hole. Then read President Trump’s tweets lambasting Powell, and finally saw the President’s plan to increase tariffs on Chinese goods.

Trump moved from the Fed and interest rates to the trade war with China, pulling the spotlight back to himself, where it stayed on Monday after Trump’s comments about phone calls from the Middle Kingdom asking to negotiate. The markets and the press reacted as expected.

The trade war is important, but it’s a manufactured environment. Just as quickly as the tariffs were slapped on imports, they can be removed, and most likely will be when President Trump finds it politically expedient to do so.

But interest rates… there’s a conundrum that won’t be solved with a tweet.

The Name of the Game

There was a time when the Federal Reserve looked at the U.S. economy and tried to determine where to set short-term interest rates. The goal was to keep things from heating up too quickly, causing inflation, or cooling off too much, causing a recession and potential deflation.

But the days of navel gazing are long over. The calculus now includes the monetary policy of other central banks, most notably the ECB.

In the Continental economic bloc, German GDP went negative in the second quarter, the Italians are running a budget deficit in excess of the regulated limits, the Greeks are about to cut taxes and increase pension payments, and the Brits just want out. To say that things aren’t going well is a bit of an understatement.

In response, ECB President and short-timer Mario Draghi has his eye on another round of euro printing and bond buying, and possibly an interest rate dip from negative 0.40% to something even more abstract.

The situation drove rates across Europe so low that the German government was able to sell 30-year bonds last week at negative interest rates. Granted, they wanted to sell about $2 billion of the bonds and were able to place only $850 million, but that’s still a lot of money “invested” at a rate that guarantees a loss.

Compared to slightly negative rates, 30-year U.S. Treasury bonds at 2% look like high yield. On the same note, compared with negative -0.40% overnight rates, the U.S. Fed Fund rate of 2.00% to 2.25% also looks pretty attractive.

Fed’s Losing Out

And that’s the problem.

Our high rates attract global capital, which must buy U.S. dollars to invest in U.S. Treasury bonds, which drives up the value of the dollar compared with other currencies. To keep that situation from getting out of hand, the Fed can’t let U.S. rates remain too far above European rates.

Jay Powell isn’t fighting weakness at home; he’s fighting weakness across Europe. He won’t win, because he’s not playing the same game as the ECB.

While the Fed and Americans are concerned about economic growth and market stability among interest rates and equities, the ECB and Europeans are worried about economic growth and government survival. They’d like to see German GDP pop back above zero, but they also need to see Italy and Greece survive, which means keeping borrowing costs as low as possible. If the investment world is turned upside down for a decade or so in the meantime, well, that’s a small price to pay for national, and international, stability.

Luckily for the Fed, the U.S. growth remains lackluster, and official inflation readings are at or below the Fed’s targets. So far, the Fed doesn’t have to worry about low interest rates overheating the economy.

All of which leaves investors with a problem. Collectively, we’re giving up our interest income to support the countries and companies of Europe, whether we want to or not.

August 26, 2019

Crashing RV Sales Forecast 2020 Recession

RV sales are crashing at a year-over-year rate of 20% below sales for the same period last year. 2017 was the peak thus far and 2018 sales were 4% lower. Hence, this year’s crash is making this look like a clear top.

RVs are one of our mid-life-to-retirement sectors for Boomers. Sales used to peak at age 63, but the most recent updates to the Consumer Expenditure Survey show them peaking a bit earlier, at age 59-60. That still makes it a strong growth industry into 2020-2021 for aging Boomers.

Hence, there’s no demographic reason for this industry to be waning yet. That makes this a potent recession indicator as it was for the last recession.

This first chart shows the trends since 1990 before its Spending Wave started rising in 1997.

The last peak came in late 2006 – several months after home prices peaked – and by two years later, in early 2008, we started the worst recession since 1981-82 and 1930-33. After the peak in late 2017/early 2018, we should be seeing a recession… and soon!

The next chart hones in a bit finer through the percentage change. Growth crossed the zero line to negative in early 2006 before – about a two-year lead on the recession of early 2008. Now, it crossed again in early 2018 and is accelerating rapidly in 2019. That would portend a recession by early 2020.

Also, recall my Dow Home Construction Index that first peaked in late 2005 when home sales peaked, a little over two years before the last recession. It peaked in mid-2017 this time around and portends a recession by early 2020 or mid-2020 at the latest.

The bond markets continue to see falling yields. They are seeing this recession clearer than stocks – as it almost always tends to be the case. Bonds are more risk averse and look more for bad news, stocks are more risk prone and focus more on good news.

No wonder the Donald is beating on Fed Chairman Powell to turn up the stimulus full blast again… and he says at the same time that the economy is doing well and as strong as ever.

Better to look at the facts than listen to the hyperbole!

August 23, 2019

More Turmoil, More Recession Fears

This week wasn’t any easier than the last, with more chaos throughout the markets and more concerns that a recession is surely to come.

So, we’re at a tipping point. In the Dark Window scenario that I’ve been talking about for a year now, a move upward here would be way up – maybe even to 10,000 on the Nasdaq. Conversely, we could find the markets take a bigger break. But right now, we’re in this mini-megaphone pattern recently where we keep making slight highs when we go up but – just our luck – new lows with every down.

At this point we could go either way – 25% up or 25% down, it’s not yet clear.

Surely there’ll be some movement today. Fed Chair Jerome Powell spoke in the morning while we were filming, and markets are likely to move in one direction or another based on the reaction to his comments. And there’s still China to worry about. A continued standoff bodes poorly for stocks and would be good news for gold. But if we can reach a deal we might see markets start to move up.

But that’s not happening in the short-term. You can take that to the bank. The markets did react downward to Powell’s more muted response today, and gold is knocking at the $1,525 resistance point again. Bond yields are headed down again. This far, same trends which suggest stocks more likely to head lower and gold higher ahead. A break of the June 3 lows in stocks would be more significant for the downside scenario, as would a clear break above $1,540 on gold.

We’ll keep you updated.

Turmoil, Recession Fears, The Dark Window

We’ve had a mini-megaphone pattern going on for a couple years now, says Harry Dent. And right now the markets are about to break one way or the other…and it’s all news dependent. Watch now to find out what you should be looking for in the weeks ahead. Check out Harry’s latest bestseller, Dark Window, here: https://pro.dentresearch.com/m/1142369

Posted by Economy and Markets on Friday, August 23, 2019