Harry S. Dent Jr.'s Blog, page 20

July 26, 2019

World Debt Is The Achilles’ Heel of This Bubble

Do I regret moving to Puerto Rico in light of all these protests lately?

Absolutely not.

What I do regret is that people in the U.S. seem unwilling to fight for their rights the way the Puerto Ricans have the last few weeks.

But today I don’t want to talk about what’s happening on the ground in this beautiful place. Rather, I want to tell you about the Achilles’ Heel of this bubble.

It’s emerging world debt!

And it’s a much bigger problem than we’re being led to believe.

Listen to my video today to find out why world debt may by the last straw to burst this bubble… and what we can expect next.

Harry Dent: Puerto Rico Isn’t the Only One Protesting

It’s important to keep an eye on international politics & emerging countries for economic indicators. Watch Harry's latest video to learn why debt bubbles at dangerous highs shouldn’t be ignored. Check out Harry’s latest bestseller, Zero Hour, here: https://pro.dentresearch.com/m/1113466

Posted by Economy and Markets on Friday, July 26, 2019

July 25, 2019

The Government Just Screwed Us Again

I’ve got friends on both sides of the political aisle.

Some are huge Trump supporters. They’re giddy over his tweets about “The Squad.” They think, why not call out people who demean the country? And if they don’t like it here, why don’t they just go anywhere else?

And how about enforcing the rule of law once in a while by sticking to our immigration policies? We’re not rounding up migrants because they come from other countries; we’re demanding that they comply with the law, which means leaving the country when their asylum claims have been denied after a hearing.

Other friends don’t agree. As card-carrying liberals, or even conscientious conservatives, they can’t abide by much of what the president does, or anything he says. They feel betrayed when he pushes zero tolerance in dealing with migrant families and see the world going backward when he eases regulations on coal-fired electrical plants.

And tax reform? That was a gift to Trump himself and his wealthy friends. When it comes to foreign policy, they see an inept bumbler alienating our allies while sucking up to our enemies, all while Iran and North Korea build nuclear weapons.

The two sides don’t seem to agree on anything, and hope their respective leaders will fight to the bitter end to protect their points of view and interests.

Well, those leaders are fighting alright, but not for any of us – and the proof is there for everyone to see in the new spending bill.

Political leaders just tacked on $320 billion in new debt over two years and $1.7 trillion in additional debt over a decade. And they’re happy about it, claiming they avoided a shutdown and were able to spend more on the military and domestic programs.

Really?!

How hard was it to say, “Hey, let’s just keep racking up the debt and spending it without doing the hard work of living within our means”?

The biggest goal these politicians have is their own re-election, not good stewardship.

Both sides act as if the magic pony theory of money, Modern Monetary Theory, which claims you can borrow forever as long as you borrow in your home currency, makes sense.

But if they read the theory, they might find the flaw. When lenders refuse to give you more money in your home currency, you’re screwed. You just don’t know when that’s going to happen.

Acting as if interest rates will remain at record lows for all of time is idiotic. Rates will march higher one day; when they do, our national debt, which currently stands at $22 trillion and is increasing by $1 trillion per year, will become breathtakingly expensive. The interest payments alone will crowd out other spending, requiring us to borrow a lot more, spend a lot less, or pile on the taxes.

Which One Do You Think Will Happen?

When the fateful days come, when the government can’t print its way out of the mess for fear of crashing the economy, the politicians will look around and wonder how they can fill the gap. And they’ll eventually land on our assets. They will claim that they need more tax dollars and it’s our patriotic duty as citizens to support the nation.

What About Their Support?

What about government officials who take an oath to protect the nation and faithfully execute our laws?

The worst part is, few people seem to care. A few conservative Senators are making a stink about it, but they’ll be shouted down “for the good of the party.”

I think the national debt was mentioned exactly one time during the Democratic debates, showing zero appetite for even broaching the subject. And Trump has always had a penchant for using debt.

In a way it seems the two parties reflect the views of the majority of the nation – give me what I want, what I think I deserve, but don’t ask me for more money.

That might work for a few years – and in the history of a nation, a couple of decades is just a blip in time – but eventually the debt comes due. When that happens, we won’t be asking people for more, we’ll be demanding it, and then simply taking it.

As a wise person once wrote, a train wreck in slow motion is still a train wreck.

Right now we’re all stuck on the train.

July 24, 2019

Can You Stomach Pot Stocks?

The cannabis industry as a whole holds a ton of promise, which Rodney alluded to yesterday when he discussed Tuesday’s Senate Banking Committee hearing. But since many companies won’t live up to their hopes and dreams, I think investors are best-served taking a technical approach to buying pot stocks.

In mid-May, I shared my “technical take” on Aurora, Cronos, and Tilray, three of the industry’s biggest players. At the time, they were all on my “avoid” list. They didn’t (and still don’t) meet the stringent criteria of my trend and momentum system… so I’m avoiding them for now.

Since sharing that analysis, shares of Cronos (Nasdaq: CRON) are down about 2%, while Tilray (Nasdaq: TLRY) has lost 10.6%, and Aurora has shed more than 18%!

Of course, I’m not taking credit for forecasting the price declines of those specific stocks. The reality is that the broader cannabis space had been suffering through a pullback. The industry’s most liquid ETF — the ETFMG Alternative Harvest ETF (NYSE: MJ) — is down around 10% since mid-May.

In fact, a string of bad news and PR has caused some hesitation among the industry’s investors of late.

Regardless, I’m incredibly bullish on the cannabis space as a whole. So much so that I believe that, using the Cannabis Profit Code I’ve created, you could bank up to 25 1,000% winners in the next five years!

Cannabis stocks are more volatile than your “average stock,” so I strongly advocate following a proven strategy in this space. Let me show you what I mean…

One Wild Ride

As I said, cannabis stocks are volatile.

You expect that from the smallest and most speculative pot stocks. But even the big industry-leading ones are far more volatile than what you’ll find in the S&P 500.

There are currently about 250 to 300 publicly traded stocks that we can call “pot stocks.” Of those, there are only 25 stocks that have an average daily trading volume equal to $10 million or greater. In comparison, there are only three stocks in the S&P 500 that trade less than $10 million a day — most S&P 500 stocks trade far more.

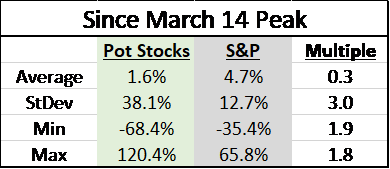

So today, let’s look at the volatility of the biggest pot stocks… during two time periods. Cannabis stocks reached a mid-year peak on March 14 and then pulled. Here are some summary statistics since then:

As you can see, the average “big-and-liquid” pot stock has gained a measly1.6% since mid-March, whereas the S&P 500 is up 4.7%. And that’s reflective of the cannabis industry’s recent pullback.

More importantly though, the standard deviation of those 25 pot stocks has been three-times greater than S&P 500 stocks!

And you can see these extremes more closely by considering the minimum and maximum returns. One pot stock is down 68%, whereas the worst S&P 500 stock is down a milder 35%… one pot stock is up 120%, whereas the best S&P stock is up just 66%.

All told, these statistics clearly point to pot stocks being far more volatile than S&P 500 stocks. And remember, these are the biggest, most heavily traded pot stocks out there!

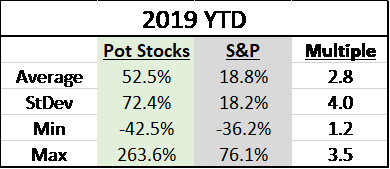

But how do these numbers look year-to-date?

They look essentially the same, though pot stocks are showing remarkable returns, even despite the more recent pullback!

The average 2019 year-to-date return of the 25 pot stocks I analyzed comes in at an impressive 52.5%, trouncing the S&P’s 18.8% return.

With that 2.8-times greater return comes a 4-times greater standard deviation, which means far more variability around the average.

Though, interestingly, it appears pot stocks have offered a good trade-off between “max” winners and losers this year. The worst pot stock is down 42.5% — just 1.2-times worse than the worst S&P stock. While the best pot stock has been up 263.6% — or 3.5-times better than the top-returning S&P stock this year.

So here’s the big question…

Is Volatility A Bad Thing?

I’ve long said that volatility is neither good nor bad. It all depends on your comfort level and if you know how to harness the good aspects of volatility, while also mitigating the bad aspects.

In my Cycle 9 Alert research trading service, we routinely trade highly volatile instruments (options). But since we put what I call the “asymmetry of risk and return” in our favor, we’ve been able to establish a long track record of success.

Yes, some of our volatile investments blow up in our face. But since our winners are bigger than our losers, we come out on top in the end!

I expect much of the same experience with my Cannabis Profit Code!

Pot stocks will be far more volatile than your average S&P stock. Many pot stocks will lose 50% or more in short order. And more than a few will go all the way to zero. But the upside potential for many of these highly volatile pot stocks is enormous — far greater than anything you’ll find among the major market averages.

So, the real question is: Can you stomach the volatility?

Cannabis is known to settle the stomach, but cannabis stocks may have the opposite effect! In the end, I think all serious investors should figure out a way to gain exposure to the cannabis space, despite the excessive volatility. And I’m looking forward to sharing a few techniques I have up my sleeve to do just that.

The first step is simply acknowledging how volatile these stocks can be. Once you’ve done that, you can establish an action plan… which I’ve done for you. Check it out here.

July 23, 2019

The Cannabis Industry Is About to Get a Huge Jolt

It’s another hot week on the Texas Gulf Coast. For yet another day, when I went on my morning run at 4:45 am, the temperature was 84 degrees. And with humidity, it was a heat index of 96.

This Was The Coolest Time Of Day

It’s about now that we start longing for the cooler days, which down here won’t come until after Halloween. Sure, we’ll get a cool morning here and there. But things don’t turn around here before some time in November, which seems like forever.

Between now and then, I’ll keep running before daylight and drinking plenty of fluids. But it’s not all bad. With so much sunshine and warm weather along the coast, plenty of people are interested in my new side hustle, renting out golf carts.

My Side Hustle

The business, which I’ve described here before, is straightforward. My business partner offers golf carts for rent on the main drag on Galveston Island. What’s more, he’s the only provider by a fluke of local traffic law.

The business has been running for about five months and is doing well, but there was one aspect we had to address… cash.

At first, we accepted cash, but it’s hard to track, has to be secured, is a temptation for abuse by employees, offers no recourse if someone damages a cart, and puts the business at risk of theft. We stopped taking cash after 45 days and haven’t missed it.

Imagine if we didn’t have a choice. Think about all the issues with verifying every transaction, making the right change, storing thousands of dollars each day on site, transporting cash for deposit each weekday, watching employees to guard against leakage, whatever. In a world set up for credit cards and Apple Pay, it would have been a disaster. And this is just for my small, but thankfully growing, golf cart business!

Now, multiply those problems by the size of the cannabis business, and you’ll get a sense of what that industry faces – because it mostly runs on cash.

With marijuana still illegal at the federal level, banks and other nationally regulated or licensed institutions are hesitant to get into the business. This leaves cannabis businesses at every level dealing with mounds of cash. They have to secure it, track it, and transport – all of it! In 2018, Colorado alone collected $270 million in taxes on marijuana sales, much of it paid in cash!

But Those Days Could Be Ending Soon…

The Senate Banking Committee is holding a hearing today on the Safe and Fair Enforcement (SAFE) Banking Act, which has been championed by Senators Jeff Merkley (D-OR) and Cory Gardner (R-CO). A House committee already passed a companion bill. The hearing in the Senate committee gives the legislation new life and moves it one step closer to becoming a law.

The bill will provide safe harbor to companies that provide services to cannabis businesses in states where it’s legal, which will open the door to credit cards and other payment services, national accounting services, and a host of other things that will make the cannabis industry more efficient.

And the legislation will do something else…

It Will Bring In The Big Guns

Because they have a “get out of jail free” card, large national and multinational service companies will be free to get into the business without worrying about running afoul of the federal government, which will create a rush to gain market share in what will be one of the biggest growth industries in the country for years to come. The onslaught of competition should bring down prices, boost profits, and even increase investment in the space.

Banking, like state-by-state legalization and federal inclusion on the Schedule I Drug list, remains an obstacle to growth in the marijuana industry. Every time one of these impediments falls, the potential for business grows. In both my Fortune Hunter service and Adam’s Cannabis Paydays, we’re working to find investments that will grow exponentially as the business expands.

The key is to stake out a position before the changes happen, so you can benefit every time the cannabis industry clears another hurdle.

July 22, 2019

When the Predictable Becomes Unpredictable… That’s When the Breakthroughs Happen

The biggest breakthrough in my research came in 1988. That was when I came up with my Generational Spending Wave. With it, I could predict the economy almost five decades out. And I did so by lagging the birth index for the predictable peak spending of the average household.

I Needed To Make Some Tweaks

The generation before peaked at 44, not 46. And the generation cycle was not as over-arching and powerful before World War II, when everyday households weren’t middle class and higher income.

But that’s why I have a hierarchy of cycles. Including the most important, long-term 45-year technology cycle. Remember, every double – or 90 years – that cycle becomes the Bubble Buster!

It was the assembly line innovation, along with others, that suddenly made everyday households the key driving factor of developed countries. And now in emerging countries as well.

Our productivity is the highest at the peak of this 45-year cycle and it affects demographics as well.

The first acceleration of our lifespans began around the peak of the 1875 tech cycle. And extended through the next two into 1920 and 1965. Life spans at birth roughly doubled, adding 40 years.

Do you know what that did to demographic trends?

Not only did it boost births dramatically into the early 1960s, globally, but also significantly reduced the number of people dying.

Urbanization

Another important demographic trend is urbanization, wherein average GDP per capita triples with no added education at first. That is now the most powerful trend in the still less-urban emerging world today – stronger than even generational spending. It’s straight line progression and correlation with GDP per capita by country is astounding.

The acceleration of global urbanization began in 1920, right at the top of that 45-year tech cycle. And is due to reach 75% to 80% near-peak urbanization by the cycle that peaks in 2100. Lifespans will start to accelerate again by the top of the next cycle in 2055, if not earlier.

First lifespan acceleration, then urbanization, and then lifespan again. The two most important trends driving the greatest economic expansion in history. Both demographic and impacted by my technology cycle predictably.

I explored this unprecedented economic explosion in the December issue of Leading Edge. I’m making that available for you, not only for your own interest, but also for you to send to every high school or older kids or grandkids you have. With this information, they will know more about what’s important than the best economists and world leaders.

What If…

our life spans went up another 40 years to 120 and we peaked in spending more like age 75, had two sets of children, and retired more like 100-plus? What would that due to demographic trends? What would that do to productivity? The impacts would be massive across the board.

I’ll tell you one big change it would have: We won’t see zero population growth by 2100 nor a peak at 11 billion, as scientifically projected today. The peak spending wave of the most impactful Southeast and South Asia region of the world that is set to crest in 2055, could come 10 or so years later and higher.

This is the only trend that could bring demographic growth back to the aging developed countries like the U.S., Europe, and East Asia.

Here’s My Point:

Our demographic trends at Dent Research are the most important in economics today, yet most economists still don’t appreciate how impactful and how forecastable this all is.

And even though demographic factors do change – making the predictable sometimes unpredictable – largely due to advances in technology, we will always be the first to notice and adjust for such changes in peak spending, life expectancies, consumer sectors, urbanization rates, etc… way before they impact you and our economy.

So, keep reading. And for entertainment purposes only, you could keep watching the “experts” miss every major trend change in history, just like they missed the fall of Japan and the greatest stock and real estate bubble in history

Leaked Data Video #3: So What’s Next?

Thursday and Friday last week I shared two videos with you, revealing the power of the “leaked data” I spent $250,000 to make it accessible to people like you.

This is data that the Bureau of Labor Statistics gathers regularly, and makes public. But it does so in such a way as to make the information all but useless to you. Only those with a very specific college degree can make heads or tails of it. So I found someone like that and paid them a boat load of money to process the data into useful information.

In today’s video, the third in the series, Rodney and I look at what this data tells us to expect next.

This is not something you want to miss.

Watch now…

You can find more revelations from this leaked data here.

July 19, 2019

Bad and Good News for Pot Investors

Pot. Pot. Everywhere. It’s new, it’s exciting. It’s an emerging high growth industry that has investors clambering over themselves to invest in the big one now so they can hold the stock for 10 years and then walk away millionaires.

I’ve got bad news for them. And some good news.

Bad News First…

They’re going to get burned by the hype if they think they’ll be luckily enough to pick “the one”… and if they have the guts to hold on through the big reset looming early in 2020 or so.

The Good News Is…

There is a better way to join this cannabis game, make more money, in less time, with less volatility. All you need to do is find those companies breaking out. Usually the biggest moves are made in short bursts. You get in, ride the rocket skywards, get out with your profits.

So, in today’s video, Dave and I discuss how you can do this, because I assure you, it’s even harder than I made it sound. But it’s not impossible.

Watch now for the details. And apologies for the poor quality of my video. I’m experiencing some internet trouble that we’ll hopefully resolve soon.

Harry Dent: Let’s Break Down the Pot Hype

This week Harry discusses the latest research of Chief Investment Strategist, Adam O'Dell, focused on the cannabis industry. Watch to learn how some break-out companies in this growing sector can potentially make you millions, even as the dark window is closing. Get the scoop on Adam's research: http://buddingprofits.com Learn more: https://economyandmarkets.com/markets...

Posted by Economy and Markets on Friday, July 19, 2019

Leaked Data Video #2: What Few Saw Coming

Yesterday I shared the first of three videos with you, revealing the power of the “leaked data” I spent $250,000 to make accessible to people like you.

This is information that the Bureau of Labor Statistics gathers regularly, and makes public. But it does so in such a way as to make the information all but useless to you. Only those with a very specific college degree can make heads or tails of it. So I found someone like that and paid them a boat load of money to process the data into useful information.

In today’s video, Rodney and I continue to explain what this information allows us to see. And even more importantly, how you can benefit from it as well.

Come back Monday to see the third of these three videos. In the meantime, if you haven’t already done so, you can find more revelations from this leaked data here.

July 18, 2019

Leaked Data Video #1: The Secret Behind Making Money

Several years ago, I uncovered something shocking hidden inside official public documents from the U.S. Bureau of Labor. It was data so powerful that the government had done an ingenious job of hiding it from people by putting it in plain sight.

I invested more than $250,000 to decode this information and turn it into a roadmap that businesses and investors could use to make money in the least expected places. This same roadmap could also help them avoid losses from the least expected quarters.

Today, I want to share with you the first of three videos that reveal the power of this “leaked data.”

Come back tomorrow to see the second of these three videos. In the meantime, you can find more revelations from this leaked data here.

The Investor’s Case For Cannabis

It’s only been a half-decade since 2014, but it really seems like a lifetime ago. I still had a kid in high school, I wasn’t quite yet 50, and marijuana was still illegal… for the most part.

Marijuana sales for medical use had been legal in several states since the mid-1990s. However, 2014 was the first year that Colorado allowed legal marijuana sales for recreational use. Which started a huge conversation across the nation.

Should it be legal?

At what age?

Is it a gateway drug?

Legalization of Marijuana

A few years ago I wrote about marijuana sales in 2014 from the standpoint of economics. The State of Colorado had legalized the sale, possession, and consumption of the plant. That opened the door to a new industry, from agriculture to retail sales, and creating a new tax revenue stream as well. There would be issues, for sure. Including policing access, how to deal with people who are high in public, and navigating the banking system because the drug remains illegal at the federal level.

One of the conversations on the topic happened at dinner during our Irrational Economic Summit in Miami that year. I was sitting with Harry and his lovely, bright wife, as well as two long-time readers and friends, Kathy and Charlie. Harry’s wife insisted that legalization was overdue, and concerns, like mine, about children’s access were overblown.

So far, she’s been proven right, which makes me wrong… and I couldn’t be happier.

Old People Like Marijuana

According to a recent study published in the Journal of American Medical Association Pediatrics, legal marijuana for medical use doesn’t appear to sway teen use, while legal recreational pot is actually associated with an 8% decline in teen use. The study suggests that perhaps teens can’t access the drug as readily from legal sellers as they could on the black market, but I’ve got a simpler notion: Maybe they just don’t want to be like their parents.

Selling drugs to old people… that’s where the money is.

The Journal of Psychoactive Drugs surveyed 1,000 customers in two retail pot stores in Colorado, asking why they buy the drug. 65% reported buying cannabis as a method of pain relief, while 74% said they bought it as a sleep aid.

In every state that had legal medical marijuana and then legalized the drug for recreational use, the sale of medical marijuana dropped.

People are self-medicating with pot. With the Boomers, a generation comfortable with the compound, retiring at record rates and reaching ages where aches and pains are common, we can expect the trend to accelerate. Pot sales should grow exponentially, giving investors an opportunity to be part of a huge industry from what is still a very early stage.

The Question Is, “How?”

How do you know which of the many different companies to buy?

As the saying goes, there’s more than one way to skin a cat, and more than one way to buy a stock.

In my service, Fortune Hunter, I own a number of cannabis companies. I’m looking for firms that have a proven record of providing a service or product, typically already profitable, and with the ability to grow rapidly with the industry. If possible, I’d like such companies to have smaller valuations so that quick growth will drive the stock price higher at a rapid pace.

After looking for companies that check those boxes, I wait until they’ve had a good, or even great, run, and then rolled over, providing a better entry point.

Every measure I listed except the last one is fundamental. I want to know what’s going on with the company, and only after that do I look at how the stock has moved.

Cannabis Paydays vs. Fortune Hunter

Compare that with how my friend Adam O’Dell approaches the market in his new Cannabis Paydays service. Instead of using an inside out approach like I do, he focuses almost exclusively on price movement.

His point is that the company can be fabulous, but if the stock isn’t moving then you’re not earning profits. He overlays his successful investment approach on the cannabis market so that he can potentially identify the best chances for profits in an industry set for explosive growth.

Both approaches – fundamental and technical – work, which is why both have existed on Wall Street for nearly a century.

The one thing that doesn’t work is sitting on the sidelines. From there, all investors can do is watch the industry grow without them. If they live in the right state, maybe they can purchase a little legal cannabis to ease the pain.