Harry S. Dent Jr.'s Blog, page 23

June 19, 2019

The Fed is Wrong About the Economy

As you know, the Federal Open Market Committee (FOMC) meets every six weeks to decide whether they need to change policy to coax our economy in the right direction. You also know that the Fed has a Congressional mandate to provide maximum employment and stable prices, which it works to achieve by manipulating interest rates.

Well, Fed Chair Jerome Powell delivered his policy statement and their latest rates decision this afternoon. Drum roll please…: the overnight rate remains unchanged at 2.25% to 2.50%.

Yet Treasury bonds clearly show that the Fed is way off on its assessment of the economy and monetary policy. Long-term Treasury bonds are telling us that short-term rates need to be lower for the economy to grow further, especially since inflation is and has been muted.

But since December, when it moved rates higher, the Fed has been bungling from one meeting to the next. The markets reacted swiftly to its end-of-year mistake. The yield curve flattened and stocks fell sharply into the holidays.

At the time, the Fed was considering two more hikes in 2019 and Powell stated that the balance sheet would continue to shrink for the foreseeable future.

As the carnage unfolded, he and the other voting members of the FOMC backed off previous statements and eventually calmed the stock markets, which have recovered nicely since then.

Then, in May, the Fed decreased the balance sheet reduction to $15 billion per month, with the goal to end the “normalization” process in September, with a little over $3.5 trillion in Treasury securities.

Ahem…

I’m not sure why the Fed thinks the balance sheet is “normalized” at $3.5 trillion, when it was less than a $1 trillion before the 2008 financial crisis. It’s just more evidence that the Fed gang isn’t seeing the world the rest of us see.

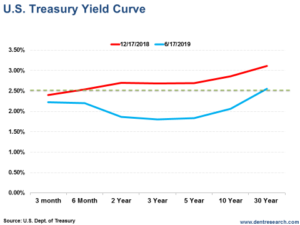

Take a look at how the yield curve has developed since just before the December rate hike in the chart below…

As of yesterday, all of the Treasury yield curve (the blue line), except for the 30-year bond that ended the day just above 2.55%, was trading lower than the federal funds rate (the green dotted line). The red line is the yield curve just before the Fed hiked in December.

Clearly, the Treasury bond market is telling the Fed that it is very wrong in its assessment of inflation and economic prospects.

Yet here we are…

Understanding the Fed’s Decision

So, what is the Fed thinking?

Well, the Committee sees “sustained expansion of economic activity, strong labor market conditions, and inflation near its symmetric 2% objective as the most likely outcomes, but uncertainties about this outlook have increased.”

The Fed statement goes on to say that, in light of these uncertainties and muted inflation pressures, they will be closely monitoring incoming information and act as appropriate to sustain the expansion.

The big change from the last meeting was the Fed’s intent to be “patient” with past policy. Everything appeared to be moving along as expected, now… not so much.

The lone voice of reason was James Bullard, the St. Louis Federal Reserve Bank President. He objected to the decision and voted to cut rates by 0.25%.

Even though the Treasury bond market didn’t react much to the Fed decision today, its pricing in three rate cuts for this year, based on futures trading. That means it expects the economy to take a turn for the worse.

Happy Days Are Not Ahead

There weren’t significant changes to March projections but, the Fed is looking for inflation to drop further this year. Headline inflation is expected to drop to 1.5% while core inflation (excluding food and energy) is expected to drop to 1.8%, well below the target 2% rate.

The Fed is projecting no further rate change this year, a rate cut in 2020, and a rate hike in 2021. So, if the economy plugs away at around a 2% growth rate, the jobs market doesn’t collapse, and inflation remains near the Feds target 2% rate, don’t expect any change in policy.

The global outlook hasn’t changed much either. The trade war outcome is uncertain, as is Brexit. Global growth is slowing. And Powell himself notes that, while there has been some growth in consumer spending, inflation is muted, business capital spending is soft, and debt levels are increasing.

So, what does it all mean for you?

It means you should sit up and pay attention. The Feds projections for the next few years seems to be steady as she goes, but my advice is to be on your toes!

The Treasury bond market is giving the Fed a failing grade on policy.

The Fed has notoriously and historically been behind the curve when it comes to projections and policy change. The Committee seems to prefer reacting rather than being proactive about adjusting policy.

Don’t let the Fed’s apparent complacency fool you. The economy, the markets, inflation and just about everything is in flux and most move in cycles. We’re moving into a period of higher volatility and that means greater opportunities, so be ready!

June 18, 2019

Facebook’s New Cryptocurrency Probably Offers You Nothing

The dark days of 2009 now seem like forever ago.

We didn’t know which banks would survive. The Fed made all banks take bailout money so that citizens wouldn’t know which ones were in trouble and then drain them of deposits. The Fed made bank stocks ineligible for shorting so that investors wouldn’t drive their market caps to zero.

We worried that fiat currencies, those printed by governments and backed by nothing, would go to zero.

Against that backdrop, bitcoin and other cryptocurrencies entered the public realm, and for the next eight or nine years they gained credibility and traction.

Cryptos were going to do everything. Replace the dollar. End all fiat currencies. Replace gold. Put transaction companies out of business. Make moving money immediate and seamless.

With such incredible promise, cryptos eventually boomed in 2018… then imploded.

Two things drove their downfall: Cryptos delivered on exactly zero of their promises, and we came to understand that traditional currencies are still here… and will be here as long as governments exist.

With that as background, there aren’t many reasons for Facebook to enter the space with its new cryptocurrency, libra, except one: avoiding banks.

The new currency, unveiled today, though it won’t be put into use until sometime next year, will be a stable coin, meaning all units will be backed by something of value. Facebook says the coins will be backed by a basket of currencies held in a trust account. For every unit you buy, you’ll essentially own a unit of yen, euro, U.S. dollar, British pound, or Chinese yuan, for example.

This isn’t a reason to buy libra. If your home currency appreciates against others in the world, like the U.S. dollar getting stronger against the euro, then your libra will go down in value against your home currency.

Yeah, But Should I Use It?

If everything, or almost everything, you do financially is in one country – and that country has a stable, well-functioning banking system – then libra doesn’t make much sense. Use your debit card to buy stuff, and use Venmo to send money to friends and family.

But if you live in a place where banking is questionable, the home currency is volatile, or you commonly send funds across borders, then libra makes a lot of sense.

By exchanging your local currency for libra, you can immediately hold a basket of stable, large currencies. You can buy things online and avoid your local banks. And you can send money to anyone in the world with no slippage. Workers in Qatar can send funds home to the Philippines. Immigrants in the U.S. can send money home without paying Western Union. Farming co-op members in Senegal can pool resources and buy seed and equipment from foreign suppliers.

In May 2019, Facebook had 2.38 billion active monthly users, with less than 600 million in North America and Europe. Giving the other 1.7 billion users in other parts of the world access to stable currency that can be transferred instantly with no slippage could be life-changing.

But don’t call it a cryptocurrency.

Call It a Cryptobank

Libra doesn’t supplant national fiat currencies. By definition, every unit will be backed by national currencies. Instead, libra displaces banks, particularly those that deal in cross-border transactions and those in less reputable parts of the world.

And the currency will generate a profit for Facebook and its partners, companies like Visa and Uber. Each partner organization will kick in $10 million to create the original pot of units, and will operate one of the nodes that verify and approve transactions. In return, they will get their respective cut of interest earned on the pot of cash that is held in trust to back the currency, as well as their share of transaction fees generated.

But there’s a question: How will governments react?

Libra transactions are supposed to be anonymous, not connected to any data that links back to your actual identity. If the digital currency supplants banking in developing nations, it will rob those systems of deposits, which reduces money supply, and will also allow consumers to move money out of the country without government approval.

As libra takes hold, it could cause incredible disruptions…and it will strengthen the U.S. dollar ever so slightly. And as it grows, it will require the trust account to grow too, buying ever larger quantities of the currencies that make up the basket. There is no question the U.S. dollar will be a part, it’s only a matter of how much. Those purchases must be made no matter what the currency trading environment looks like, or the level of interest rates, or anything else.

Granted, in the currency world this will be less than a drop in the bucket… more like a grain of sand on a beach. But in times of trouble, if people are flocking to libra, they will be piling into the U.S. dollar and the other currencies in the basket.

It’s likely that libra will take off when Facebook launches it next year, gathering tens if not hundreds of billions of dollars, because it’s novel and gives people who’ve avoided cryptocurrencies a chance to feel like they’re in the group. For most people, it simply will be a novelty, one more way to pay for stuff or transfer money, which will eventually lose its appeal. But for those who live in countries with questionable banks and shaky currencies, it could be a godsend… if their governments don’t shut it down.

June 17, 2019

Your Kids’ Great Depression in the Making

With all eyes focused on Facebook’s cryptocurrency reveal tomorrow, what the Fed will do this Wednesday, and Slack’s IPO on Thursday, all of which we’ll address in the coming days, let’s turn our attention to another major issue that is silently unfolding: the great baby bust. More than any of the current hot events, it will have a significant impact on the future of our economy and the success of your investments…

Decades before births peaked in 2007, I was projecting it would happen. But how could I know that? Easy. Because births fall when the economy slows, especially in the Economic Winter Season, which we’re in the latter part now.

A warning: I’ve got to get technical here to make my point clear. Bear with me…

The first wave of Millennial – or Generation Y – births peaked in 1990, at 4.16 million, just below the Baby Boomer peak of 4.3 million in 1957. The second wave, now increasingly called a new Generation Z or Zillennials, peaked in 2007 at 4.32 million, just barely above the Boomer peak.

The Boomer plateau peak was 40 years after the Bob Hope peak in 1921. That’s right on the typical 40 years generation cycle. However, the difference between the Boomer top in 1961 and the Y top in 1990 was just 29 years and between Y and Z was only 17 years.

The generation cycle is collapsing in the U.S. and our next four-season economic cycle will be shorter, more like 50 years, taking us back towards the Kondratieff Wave average 60-year rhythm.

That means we’ll get the next Spring Spending Wave peak around 2036-37, an inflation or summer peak around 2039-40, and a fall bubble boom peak around 2055-56… and here’s the kicker… a longer depression into around 2072 – 2073-plus.

That’s bad news for today’s young kids and future grandkids. The Fed’s actions today, won’t help them. Nothing Facebook or the next IPO or the Donald does will change this. Really, it’s up to you to get them ready and we’re here to help (something we’re focusing on this week in The Rich Investor, so be sure to read your emails). Particularly because, besides the numbers, these economic cycles will also have different drivers going forward.

With the emerging world, especially India and Southeast Asia, leading the way in the coming decades and next four-season economic cycle.

The massive baby booms in the western world all peaked between 1960 and 1964 and both exaggerated the magnitude of the inflation cycle, stretching that 60-year cycle to two 40-year generation booms and busts – 80 years from boom tops and between bottoms, like the depression bottoms of 1942 and the one I project for 2022.

But the inflation cycle that was always the foundation of the K-wave didn’t change. It continues to peak about every 60 years. It’s still the real four-season economic cycle rhythm.

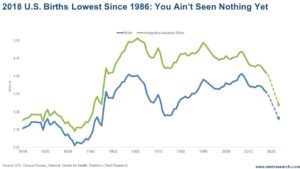

Here’s what actual and projected birth and immigration trends say…

The Situation Looks Bad

Births peaked at the top of the “real” fall boom in 2007 (before QE). They’ve fallen ever since, despite a modestly growing economy after the Great Recession of 2008-09 and the greatest stock bubble ever from QE.

The blue line is the U.S. birth rate. The green line includes legal and estimated illegal immigrants. Immigration had a huge impact on the immigration-adjusted birth index through the early 1970s. Immigration peaked in 2001 and the average immigrant is age 30. Since then the immigration impact has continued to narrow with the crash in immigrants from 2.71 million in 2001 to 1.00 million in 2015.

Note, that the next fall bubble boom from around 2045 – 2056 will be minimal due to the declining immigration trends.

When we see a stronger downturn and debt deleveraging into 2023 or so, births and immigration will plummet even faster.

Note my projections into around 2023 of about 3.0 million actual births and 3.4 million immigration-adjusted births. The birth lag for the Spending Wave should be 49 – 50 by then.

All of this is to warn you that the Millennial (Y Generation) Spending Wave decline is shaping up to be steeper than the one after the Bob Hope or even the Baby Boom generations. It points toward the next winter or depression season between 2057 and 2072/73.

Stock prices adjusted for inflation are not likely to exceed the 2019 projected top, and will then likely retest the projected 2022 bottom by 2073. That means a sideways market for the rest of your kids’ lives… unfortunately. But that’s why we will advise you – and them – to invest more in Asia and the best demographic sectors in coming booms.

The U.S. will fade more noticeably as a major power unless we both attract immigrants in the coming Economic Spring Boom – which is not typical historically – and/or we start living a lot longer to amplify our aging demographic trends. Such a life expectancy surge is likely to hit in the rising tide of the next 45-year Technology Cycle between 2032 and 2055…

That’s our last great hope, especially for your kids.

June 14, 2019

The Best – Most Controversial – Cycle for Better Investing

When my team first heard of this cycle, they thought I was crazy. They begged – begged – me not to publish anything about it. I did it anyway, and when people heard about it, many thought I was coo-coo. Some people still do. But this cycle has proved to be one of the best – albeit most controversial – cycles I’ve ever found… and successfully used to forecast for investment and business purposes.

What cycle is that?

Well, listen to today’s video to find out…

I’d seen this cycle before, but couldn’t identify the correlation with the markets, so I dismissed it. Then, one of the top fund managers in the country – a guy from Pimco – talked about it in an article. He explained that it was this cycle that had saved him from the tech wreck in 2000-2002. So, I re-examined the cycle and discovered something incredible…

It turned out to be so powerful that it is now part of my cycle hierarchy. In fact, top scientists at NASA and Stanford University tracks this cycle!

But there’s a challenge with this cycle. I share the details in today’s video.

Some people are already calling this “the one financial guide everyone needs.”

And if you consider yourself a serious investor or business owner, it could quickly become an important go-to resource for you for years to come.

You be the judge.

June 13, 2019

New Jersey, You MUST Buy Electric Vehicles

The state of New Jersey is putting a stake in the ground. Or rather, a stake through the hearts of taxpayers and citizens. But that’s nothing new.

Anyway, Governor Phil Murphy recently announced the state government’s goal to reduce carbon emissions 80% by 2050, compared with the 2006 levels. That’s great. He plans to do it by massively renovating infrastructure, dramatically changing building codes… and somehow encouraging hundreds of thousands of New Jersey residents to buy electric cars.

That sounds iffy, at best.

The initiative is called the New Jersey Partnership to Plug-In and will be co-led by the New Jersey Board of Public Utilities, New Jersey Department of Environmental Protection, and the New Jersey Economic Development Authority. So… a huge undertaking to shift the state’s economy to a different energy profile won’t have one clear leading entity, but rather three government bureaucracies.

That always works out.

The government hasn’t put a price tag on the infrastructure build out or increased regulatory costs, but it does think the new move will create some jobs. That seems pretty obvious, since it clearly will require lots of new government clerks, administrators, and inspectors, and probably gobs of consultants.

At least in the auto industry we get a glimpse of the size of the issue.

The governor’s plan calls for adding 330,000 zero-emission vehicles (battery electric vehicles, most likely) to the road between now and 2025. On a straight-line basis, that would mean New Jersey consumers buying 66,000 per year, which is about 5% of the total of all new vehicles sold in the Garden State last year. But of those sold last year, only 12,000, or roughly 2%, were electric vehicles.

Clearly, something has to change.

Perhaps New Jersey residents will pick up the pace. But buying 150% more in 2019? That seems like a stretch. And every year that they don’t take one home means more that must be sold in later years to reach the goal.

Expect the program to run into problems when consumers don’t find the sparky cars as electrifying as the government overlords. This is a topic I .

Maybe people like to take trips, so “range anxiety” is more than just a bad feeling.

Maybe people don’t want to spend the money on tired designs (see all Tesla models, which were cool, but let’s update a little), or just ugly cars (see every money-saving vehicle by Chevy).

Sure, the Porsche Taycan is awesome, as are the Jaguar iPace and Audio E-tron, but those aren’t exactly mainstream vehicles.

In fact, the only mainstream, Middle America car that fits the bill today is the Nissan Leaf, which won’t win any styling awards… at least by sighted people. Functional, yes, but beautiful lines… no.

To make the transition more attractive, the state of New Jersey will have to get creative with incentives and punishment…

Perhaps giving free parking to electric vehicles at sporting events and concerts would help… or requiring gas-powered car drivers to allow electric vehicles to cut in drive-through lines and turn-only lanes. Those might sound fun, but it’s more likely the state will use the age-old cudgel – cash – and pay incentives to buyers while charging higher taxes on those who insist on sticking with “yesterday’s technology.”

But here’s the thing about incentives: Someone has to pay for them. Whatever the state does to entice new electric car buyers, taxpayers will ultimately pay for the gifts, gimmicks, and bribes. Even taxes on current fossil-fuel vehicles, or simply the fuel itself, is borne by the broad citizenry because it captures delivery trucks, service providers, etc., who pass along the cost.

If the state government were really interested in cutting emissions, it could ban all air travel by state employees for government business, demand that all who can work from home stay off the roads, and close major airports like Newark, because air travel is the most polluting way to get around. But all of those are inconvenient and would reflect badly on the government.

So, New Jersey will be stuck with a boondoggle of an initiative that will artificially boost the sale of cars that most people don’t want, while making it more expensive in general to live in the state. That sounds like a typical government plan.

June 12, 2019

China’s Grand Belt and Road Initiative: Another Overbuilding Debt Bomb

Never mind that China is the talk of the world, right now, what with the U.S.-China trade war in full swing, I’ve talked a lot about China’s overbuilding bonanza since the 1980s… and especially since 2000 with total debt exploding 64 times since.

China doesn’t just print money like the rest of the developed world. Instead, it “prints” condos… and roads, railways, bridges, office buildings, and malls. All with less visible local debt that the Chinese government implicitly guarantees.

It does this to create a rapid job train to attract rural migrants into fast-growing cities where their GDP per capita tends to triple. It’s a great plan. They’re long-term thinkers, much more than we are. Only problem is, they’re overdoing it more than any major country or region in history! In the process, yet another debt bomb is under construction.

Southeast Asia and South Korea had a similar infrastructure spending binge into 1997 that saw a crash and a four-year financial crisis and downturn into 2002.

That was nothing compared to what China is now doing.

And, as if it weren’t enough to massively overbuild its infrastructures, now China has the even grander Belt and Road Initiative. A vision they’re creating with debt to fund infrastructures to link Asia, the Middle East, Europe, and Africa for greater trade. Again, great long-term plan… if only the debt bomb weren’t a side effect.

They’re overdoing it all again, especially in the late stages of the greatest global bubble in history, of which China is the epicenter much as the U.S. was for the Roaring 20s Bubble.

Look at the public debt, much of it owed to China, that is being created in some very marginal emerging countries. This WILL cause financial crises and defaults – much of it to China!

The worst is tiny Djibouti in the Horn of Africa, at the strategic tip of the Red Sea (where humans first crossed out of Africa to populate the rest of the world). It’s headed towards 110% public debt to GDP, 55% now and 90% projected to be owed to China.

Kyrgyzstan is next, with 99% projected and 61% to China.

Pakistan is the largest country, with 81% of GDP debt, but only 12% to China.

Normal public debt ratios would be more like 80% for developed countries and 40% for emerging ones, who are less credit-worthy and much more fragile.

There have been many countries already objecting to China’s plans and resisting taking on more debt.

And China is now exporting its overbuilding and debt strategy at the worst time possible to the worst countries possible.

I’ve been warning that emerging country corporate debt is out of control and cruising for a bruising. So is public debt with countries that have been pushed into China’s grand global plan.

The emerging country debt problem is one of many triggers for the debt crisis ahead, but likely the first. The greatest impact will come from the global real estate bubble, in which China is also the most overvalued and the epicenter as well.

June 11, 2019

Beyond Meat: The New Tesla?

I haven’t tried a Beyond Meat (Nasdaq: BYND) burger, but I want to.

With all the hype surrounding the company, and restaurants adding it onto their menus, it just seems logical to give it a test run. What’s the worst that could happen, I waste $7 and never do it again?

My wife isn’t convinced. A plant-based burger? Why, when all-beef burgers are as tasty as they are? She calls the plant-based versions “Frankenburgers.”

There are lots of reasons to opt out of beef, of course, from ethical concerns about the treatment of farm animals and eating meat in general to the amount of resources required to raise a cow. But still… we’re in Texas, where beef is king, barbeque is sacred, and meat remains dang tasty.

I’m also interested in Beyond Meat for another reason – I desperately want to short the stock, or find another way to bet on its shares falling back to earth. The company is so far overvalued that it makes Tesla (Nasdaq: TSLA) and Uber (Nasdaq: UBER) look like value plays.

Beyond Meat went public at $25 at the beginning of May, less than 45 days ago. On the first day of trading it shot up more than 150%. By the time the company announced earnings, about a month later on June 6, the shares were up 300%.

Two days after earnings on Monday, June 10, the shares had pushed through $180, up 620% from the IPO price. Roughly speaking, that gives the shares an annualized gain of 7,400%.

But Beyond Meat reminds me of Ben Franklin’s remarks when asked what he’d wrought during the Constitutional Convention. He responded, “A Republic, if you can keep it.”

Beyond Meat is the financial markets’ model of a true blockbuster stock – if they can keep it up.

This darling company has generated incredible buzz with its PR machine, well-timed IPO that matches up with environmental concerns, the need of investors to find the next big thing for returns, and a conference call that left analysts and investors positively giddy.

So can they keep it up? Not a chance.

Sales of Beyond Meat burgers and other products surged after the IPO as potential customers (like myself) learned a bit more about the company and its offerings. But while introducing your products to new customers is the way to grow any business, it’s a long way from sustained sales that would justify the company’s $9.8 billion market valuation.

Think about that market cap in relation to the numbers the company posted during its earnings call. In what many people felt to be one of the best reports of the year, Beyond Meat noted that it lost $0.14 per share in the latest quarter, just a penny better than the -$0.15 estimate, and brought in $40.2 million in revenue, about $1.3 million, or 3.3% above expectations. The company expects first year sales to reach $210 million, and it might break even by the end of the year.

That’s great, but is it worth almost $10 billion?

At that valuation, when the company earns $210 million in revenue for a full year (which is not today), the shares will trade at 47 times revenue. That’s not 47 times earnings, it’s times revenue. To put that in perspective, Tyson Foods sells at 0.7 times revenue, and Tesla trades at 1.7 times revenue. Even that other unicorn, Uber, trades at just 6.7 times revenue.

There’s no rational reason for investors to believe that Beyond Meat is worth this valuation, but there might be good reasons as to why the stock is rocketing ever higher… momentum and short selling.

Momentum players don’t care what a company might be worth, or “should” be worth, from a valuation standpoint. The only metric that matters is the rate at which a stock price is moving higher. For those who buy IPOs and expect growth, Beyond Meat is a godsend.

Compounding matters are the short sellers.

The company only has about 11.5 million shares outstanding and, according to Bloomberg, 51% of them are sold short. A lot of short sellers are getting the life squeezed out of them as the shares rocket higher.

Even the options are out of whack. An at-the-money put expiring in November was quoted at $60, or 30% of the value of the stock. That might be logical on a Black-Scholes options pricing model, but it kind of makes your eyes bug out when you see it.

The trading in Beyond Meat screams “bubble!” in a way that makes even Tesla and Uber seem tame. But that doesn’t mean you should take a position either way. The run up will stop when the mania ends, and as tulip buyers, land speculators, and pets.com shareholders will tell you, that’s hard to judge. On the short side, establishing a position might be so expensive as to outweigh the gains.

The only thing to do at the moment is sit back and enjoy the show as we march closer to October 29, which is the end of the lock-up period when restricted shares will hit the street. Chances are many newly-minted millionaires will rush to sell their shares, and if any short-sellers are still standing, they’ll be vindicated.

While you wait, consider having a plant-based burger. Let me know what you think it, and I’ll report back when I finally try one… without my wife.

June 10, 2019

What Happens on the Other Side of This Bubble

I recorded this video on Friday because last week’s market action moved us closer to my second scenario in the greater Dark Window play, but I waited until today to send it to you because I wanted to see how markets opened this morning. Earlier, I wrote to Boom & Bust subscribers with an update, so if you haven’t read that yet, you might want to give it a look now.

But, in today’s video, I explain that, while understanding this bubble and its likely dramatic ending just ahead, equally important is knowing what happens on the other side. What will it look like when this bubble finally bursts?

Let me tell you, it’s ugly. Trillions in wealth will vanish. I’m not talking M2 or M3, as money is described in economics. I’m talking people’s financial assets, like stocks and bonds, the value of real estate and cars, you name it.

And there is one group in particular that will suffer the worst of it.

Watch to my latest video for the details. But be warned: you’ll want to be sitting down for this one.

June 7, 2019

When Investing, Unchain from the News Cycle

A couple of weeks ago my family gathered at my sister’s house for an afternoon by the pool. At one point, my dad looked over and said, “Thanks for the investments last month. Does that one company do music?”

I handle his portfolio, and he’d made good money the previous month, with one holding standing out from the rest. At his age, I have him in the requisite fixed income holdings, like the closed-end funds that Charles buys in Peak Income, and I also use an option strategy that gives him exposure to the S&P 500 while limiting potential losses. But the fun stuff, the investments that have the potential to add an Alaskan cruise to his life… those are the ones he wants to talk about.

And no, it doesn’t do music.

He’d confused the company he owns, Shopify (Nasdaq: SHOP) with Spotify (Nasdaq: SPOT). It’s easy to see the similarity in name and ticker.

He didn’t know, and didn’t really care, what Shopify does. That’s my job.

When I came across the company a couple of years ago, I found the premise interesting for several reasons. The company offers small businesses a way to immediately access online payment systems for their goods and services… and provides incredible support. With more consumers moving online, it makes sense that more businesses are doing the same. And the easier it is to create a business, even if it’s a part-time gig, the more people are likely to give it a go.

Beyond that, it has nothing to do with the news cycle, including trade wars and politics, and it doesn’t rely on the Fed.

When I’m looking for game-changing investments, I’m not trying to find something that fits the current broad narrative, I want something unrelated, so that it can make big moves (hopefully higher, of course) without relying on macroeconomic trends.

Shopify fit the bill.

It also had one more, great attribute: Andrew Left of Citron Research hated it.

I don’t know Mr. Left, but I casually follow his research because I find him smart and articulate. The stocks he comments on tend to be big movers. When I disagree with him, I sometimes fade his call, or even go the opposite, which has paid off. Names like iRobot (Nasdaq: IRBT) and Exact Sciences (Nasdaq: EXAS) have done well after he said they should crater, just like Shopify.

To be fair, he’s made some great calls as well, so this isn’t bashing at all. He makes bold calls on fast-moving names, it’s all part of the game, and it’s what can give you an investing advantage.

When looking for investments that can super-charge your returns, you must look farther than the typical names that cross the tape during the day. In my new service, Fortune Hunter, I use several approaches to identify potential home runs, including the Second Wave Cycle, that identifies great stocks that have been temporarily beaten down and forgotten, as well as stocks that have been underestimated or recently knocked back by a research report or other outside influence.

When Andrew Left issues a report knocking a company’s stock price, you can bet that the shares will fall… at least for a while. If you think he’s wrong, then buying the shares on the set back can be a great way to realize hefty gains.

All of it points back to the same thing, using research to find, and unlock, value that’s temporarily hidden from view, which is a lot like what fortune hunters do. If you haven’t had a chance to check out my new service, click here and give it a look.

June 6, 2019

How to Harness the Second Wave Cycle

You understand how powerful cycles can be at predicting market moves ahead of time. Here at Dent Research, we’ve used them to help predict almost every major market move of the last 30 years.

For example, using the power of cycles we called…

The U.S. recession of 1990-1991;

The following bull market from 1994-2000;

The top in internet stocks at the height of the Nasdaq bubble;

The bull market of the 2000s and the top in stocks in 2007 thirteen years in advance;

The bottom in stocks in 2009 to the day;

And many more…

That’s why you read our work (and for that we thank you).

Well, I have developed a way to harness one of those cycles – the Second Wave Cycle – in a new way.

Harry and I have been talking to you about this all week. If you missed any of it, just click on the links below.

Harry’s biggest investment mistake?

My best profit weapon for 2019 and beyond

Wild in the 80s

The Second Wave Cycle can help you get into some of the market’s hottest profit trends when others are looking away… and when prices are dirt cheap. It’s a way to invest without getting burned by the hype, which happens all too often.

In fact, if you’ve followed my work over the years, you’ll know I’m not one to make exaggerated profit claims. I hate the hype that pollutes our industry as much as you do.

That’s why I like the Second Wave Cycle. It actually helps us improve our investment success by working against the hype. I saw how it could have helped investors maximize their gains in many hype-driven booms since the 1980s. I’m talking biotech stocks in the ‘80s… dotcom stocks in the ‘90s… housing in the 2000s… the FAANG stocks in the 2010s… and many more in between.

For example, during the biotech boom of the ‘80s it could have helped investors buy some the best stocks in the industry when they were near all-time lows. Like Amgen here:

A $5,000 stake in this play could have turned into $94,050.

A $5,000 stake in this play could have turned into $94,050.

A $3,000 stake in Gilead could have ballooned into $130,200.

A $2,500 stake in Biogen into half a million dollars.

I’m not claiming that investors would have held long enough to realize those incredible gains. I’m simply pointing out that waiting for the first big hype cycle to pass, and then buying into incredible growth industries at lower prices, can be incredibly rewarding.

The potential here is abundantly clear. And the timing couldn’t be better.

Market Conditions Are Perfect to Monetize the Second Wave Cycle

You’ve probably noticed that there’s been an increasing number of hype-driven booms over the last few years. I’m talking about events where certain assets have climbed to sky-high valuations after they’ve been hyped by investors and the media.

There’s been the crazy run-up in FAANG stocks, 3D printing, Bitcoin, big data, the internet of things, IPOs… and many more. In fact, these kinds of events are happening with increasing frequency… representing a great opportunity to make lots of money, if you’re savvy.

But many people trying to invest in growth industries actually lose money. They get in at the top… and catch all of the inevitable downside when the trend runs out of gas.

That’s why the Second Wave Cycle is so important right now. It’s a way to take advantage of these “hype-driven” markets… not by piling in at the top with the rest of the market… but by buying in low when most investors look the other way.

And this is what I intend to help you do in the latest, hottest investing trend of the year (and it’s not the IPO mania underway)… potentially turning a modest stake into in incredible sum… up to $223,500.

Keep reading these emails because I’ll share details here regularly. In the meantime, watch this webinar. Here, I’ll give you the low down on this new cycle, and details about three investments you can make now.

Rodney