Harry S. Dent Jr.'s Blog, page 24

June 5, 2019

The Contrarian Behind Our Best Money-Making Insights

Man! Those were the days.

Greed was good.

Shoulder-pads were big.

Hair was worn slicked back.

Surfing was all the rage and I was hooked (at least for a while).

It was the 80s… and, just like me, Rodney was intent on making a name for himself in the markets. A goal he achieved, and then some.

He’s been a bond trader… hedge fund manager… and now he’s the contrarian behind Dent Research’s best money-making insights, including the Second Wave Cycle.

Today I want to share with you a video about Rodney. Help you get to know him better. After all, as Portfolio Manager for Boom & Bust and Editor of the new Fortune Hunter, it’s good to know something about the people you read and trust.

You’ll hear about how he got his start in the industry… his “hybrid” approach to the market… a strange fact that most people don’t know about me… and much more.

It’s fascinating stuff.

And you can watch it now by clicking the image below.

Harry

June 4, 2019

A Profit Weapon for 2019 and Beyond

I believe the Second Wave Cycle can help you grow your wealth in the second half of 2019 and beyond.

In the video Harry sent you on Monday, I described the Second Wave Cycle as a way to get into hot profit trends through a unique window of opportunity when prices are low so you can really maximize your profits.

And that’s particularly powerful for trends driven by lots of hype.

I’m talking about events where certain assets climb to unrealistic valuations after they’ve been pumped-up by investors and the media.

In the past, these were things like the biotech boom in the late 80s… the dot-com boom in the late 90s… housing in the 2000s… FAANG stocks in the 2010s… and many more.

If you’d used the Second Wave Cycle to trade trends like these, your results could have been incredible.

Paying the Price, Reaping the Rewards

In developing this tool, I put my own money on the table. Nothing motivates success better when it’s your own hard-earned cash at stake, right? As I worked out the teething problems, there was some pain… but the system began to yield stunning results.

For example, after the Second Wave Cycle pointed me to Odyssey Marine, which had been a treasure hunting firm. This company was ripped off by the American government (to the tune of $500 million)… so it changed tack and got into underwater mining.

Most investors wrote them off as they made the switch. My research and the Second Wave Cycle showed me otherwise. So, I bought the stock when it was trading at $4 a share. And when the time came, I sold it at $13 a share. I got in when it was beaten down and made 225%.

Another example came after Hurricane Harvey, which I lived through. With 50 inches of rain, I was stuck in my house so I logged onto my trading account and bought call options on GM and Ford, because I knew hundreds of thousands of cars would need to be replaced.

That number turned out to be 500,000. I doubled my money on GM in just over two weeks and earned a quick 50% on Ford. I also bought call options on KBHomes at the same time. There were 40,000 people displaced and Houston needed a lot of new construction. I made another 50% on that.

Here’s the thing…

These are “hype-driven” booms and ignored sectors…

And they’re happening more and more frequently. Think about it. In just the last few years, we’ve had Bitcoin, 3D printing, Big Data, the Internet of Things (IoT), cloud computing, you name it.

But in addition to happening more frequently, noted Venture Capitalist Matt Turck, says these events are also occurring, “Much faster, with the time between boom and bust going from years to mere months. They’re also more pronounced, with sharper spikes that feel like instant bubbles.”

This is happening for two reasons:

1) The increased pace of technological innovation; and

2) The increased connectivity of our world.

These days the hype surrounding a new technology or sector can go global within seconds thanks to social media. As Matt Turck puts it, “everyone around the globe now reads the same press and social feeds in real time.” So, people can pile their money into a new trend from all over the world.

Here’s what this means for you: Today, there are more opportunities to make money using the Second Wave Cycle than ever before. And the profit potential is far greater. Even better news, I have identified three new investments that are ripe for the picking.

Rodney

June 3, 2019

The Biggest Investment Mistake Harry Dent Ever Made

Just last week, Rodney Johnson, our Boom & Bust Portfolio Manager, launched an investment research service that pivots on one of my favorite things: a cycle.

As we worked together to finalize the offering for readers like you, we got to remembering how it all started, decades ago. Back then already, Rodney was harnessing the power of what he now calls the Second Wave Cycle. When we first met, he taught me some valuable lessons that helped me step out of the biggest investment mistakes I was making.

Since then, Rodney has been on a mission to make this Second Wave Cycle accessible to every day investors like you. Finally, he’s done it. So he, our senior research assistant, Dave Okenquist, and I got together to talk about it.

Today, I want to share that video with you… in part because you’ll benefit from understanding the Second Wave Cycle better, but also to reveal the embarrassing investment mistakes I was making before I met Rodney.

In fact, in hindsight, I think these mistakes may have been my biggest ever. Not only did I lose money… I watched others swoop in and take what could have been mine!

Here’s the video…

For more details about this Second Wave Cycle, watch this webinar Rodney recorded last week. He shows you how this new predictive tool could turn a modest investment into .

Harry

May 30, 2019

Why is Mexico’s Growth Slowing?

Didn’t expect that! Mexico first had a worrying growth hiccup in the second quarter of 2018. Now its slowdown is looking real.

Italy fell into an official recession late last year, and Germany’s growth is declining fast. It barely escaped a recession with a minor bounce in the first quarter. Its demographic trends look like Japan’s in the late 1990s. If it weren’t one of the strongest export economies in an over-stimulated global economy, it would already be toast!

The real question is not how Germany will save the EU, but who will save Germany when world trade goes down, which is accelerating ala Heir Trump.

Japan is barely growing, even though its substantial Millennial generation will hit the top of its Spending Wave next year. What happens when that trend turns down and the world economy collapses?

It’ll be even darker days in the land of the rising sun, that’s what.

It’s a growing trend…

China keeps slowing and their official numbers can’t possibly be right. You just need to look at basic figures, like electricity use and empty condos, at 22%, to know that. But, of course, they’re stimulating again to “bulk” up for the great trade war.

Rodney and I chatted with Gordon Chang, an expert on all things China, and one of the speakers scheduled for our Irrational Economic Summit later this year, on Tuesday. Among other things, we talked about what China is doing and why they’re fighting this trade war with Trump. We recorded the conversation and will be sharing with Boom & Bust Elite members on Friday. If you’d care to listen in, you’ll find details on how to do that here.

But Mexico?

It just reported negative 0.2% growth in the first quarter of 2019, with March the worst month, down 0.6%.

What?

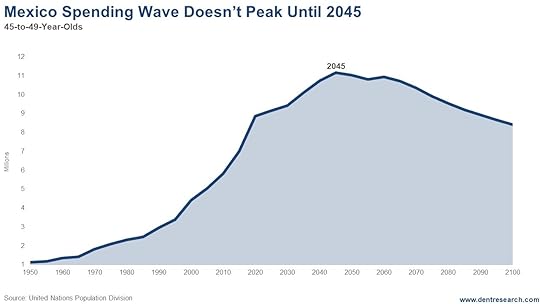

The U.S., its biggest export partner, is supposed to be growing a bit faster… and Mexico has stronger demographic trends into around 2045. There should be NO reason for slowing there.

There’s only one explanation…

There’s only one explanation…The slowing global trade initiated by Trump’s trade war, and rising debt everywhere, including Mexico and emerging countries.

While Trump’s tax cuts fuel the “Dark Window” blow-off rally, which U.S. and tech stocks will lead, the rest of the world keeps slowing, more than growing…

We’re the last suckers on the stimulus boat to hell!

But China will be the worst hit when the “Reckoning” comes because it is the epicenter of this greatest of all global bubbles, with its massively overbuilt infrastructures and overvalued real estate…

How do you get such overvalued real estate when 22% of it stands empty?

It’s called State-Driven Capitalism.

And economists love it as much as they did Japan’s overbuilt boom into 1989… and Southeast Asia’s overbuilt boom into 1997.

We’re in trouble. All the signs are there, even the ones we’re not looking for, like Mexico’s slowing growth. Make hay while the sun shines through this Dark Window. Then get ready for a wild ride.

Harry

May 29, 2019

What Would You Spend to Save Your Child?

I’m guessing that most of us with children have listened to a cough or looked at a cut and thought, “Is it worth going to the doctor for this?”

In addition to the outright cost, a doctor’s visit often proves to be quite a hassle. Scheduled appointments for vaccinations or routine checkups are one thing. But an emergency visit? What a pain!

Those types of deliberations are really a luxury. Eventually, the nagging in our brain gets us off the couch or out of what we’re doing, and we drag our afflicted kid to the walk-in clinic or emergency room for some professional care. At the end, we get a bill that we hope is the entire thing (meaning, no “surprises” from an out-of-network-whatever that happened to be in room that day), grimace when we pay, and go home.

It’s just another story to tell at work or the ball field the next day.

But things are different when your kid isn’t just a little sick…

Or needs more than a few stitches. Arguably, parents in that situation aren’t facing “choices” at all. They are looking at the difference between life and death, and what stands in between can be more than a million dollars.

The FDA just approved Novartis’s new spinal muscular atrophy (SMA) drug, Zolgensma. The company claims the drug can defeat type 1 SMA with one treatment, which is a godsend. SMA is divided into “types” based on the age at which it afflicts the patient. The lower the number, the younger the age. And the younger the age, the more severe the effects. Type 1 SMA is often fatal.

The current treatment for Type 1 SMA, Biogen’s Spinraza, hasn’t been around long and cost $750,000 for the first year, and then $375,000 for each subsequent year, with a 10-year treatment window. The drug costs $4,125,000 over the span of treatment, and the Institute for Clinical and Economic Review (ICER) estimates that Spinraza costs $728,000 per quality of life adjusted year (QLAY).

Given the cost of Sprinaza, leading up to the approval of Zolgensma, Novartis argued that its new compound would be “cost effective” at $4 million to $5 million. As the day of approve drew near, Novartis’s CEO said that even though it would be worth it at that price, the drug would cost a fraction of that.

Now we know the fraction, about 50%.

Just after receiving approval the Friday before Memorial Day weekend, Novartis announced that Zolgensma would cost $2.125 million. Which should put it somewhere around $250,000 per QLAY, a bargain compared to the current standard of care, but way above the industry threshold of $150,000.

The drug has the distinction of being the most expensive medicine in the world. But don’t worry, you don’t have to pay for it all at once. You can go on the installment plan and pay just $425,000 per year for five years. And there’s even talk of a money-back guarantee if the drug doesn’t work for your patient.

Nice…

But it doesn’t really matter. The only thing that’s certain is that parents of children with SMA will do anything – pay anything – to help their children live.

And that’s the problem.

The U.S. outpaces the rest of the world when it comes to pharmaceutical R&D. We also have the highest medicinal costs. Those two are related. Companies get into the business and do the research because the payoff can be astronomical. Novartis is a huge company. Its net profit margin last quarter was 24.55%. That’s pretty fat.

So, where’s the cap? How do we say that a drug costs “too much” when it can save or significantly extend a person’s life? On the other side of the coin, is it right for private companies to charge such prices to earn substantial profits?

I don’t know the answer…

I’ve researched the topic and found that many people call for nationalizing drug companies, or at least regulating them like utilities, but that seems like a recipe for killing R&D. Then we’d never get the next Zolgensma. There’s a fuzzy call to limit profits to a “reasonable” level, but defining that remains elusive.

And how will we react when the cause isn’t a treatment for those at the beginning of life, but those at the end?

As the massive Boomer generation nears the end of life, the issue of drug costs will move front and center. What’s it worth to treat our elderly population – to give them another year, or perhaps two or three? As very expensive drugs come to market and we’re asked to pay for them through Medicare and private insurance, we’ll face difficult decisions.

We’d probably do anything for our children, and almost anything for our parents. Maybe we’d move mountains for our neighbor’s children… but our neighbor’s parents?

We have a framework for evaluating drugs, as the ICER measure of price per QLAY shows. But will we enforce it? Will we lower it as more people need expensive medication?

We can’t know what will happen, but it seems like the pressure is building to create, or strengthen, some measure that will limit drug prices. Such an effort would have to come from the government, and would clearly mean lower profits for drug companies.

As we move into the next decade, we might use a lot more health care, but it might be less profitable than in years past. Be careful how you allocate your investments. With good intentions, the government might limit your returns.

Rodney

May 28, 2019

Iran: Are We On the Cusp of WWIII

Tensions were running high between the U.S. and Iran a week ago. Our troops in Iraq and Syria were under threat and we went as far as sending the Lincoln Carrier Strike Force towards Iran. The country is threatening to stockpile nuclear materials again if Europe doesn’t give it aid to offset the damage from sanctions. And John Bolton has been calling for a pre-emptive strike against Iran since his New York Times op-ed in 2015.

It’s seems like a gas-soaked bonfire just waiting for a match. But I don’t believe war is on the cards, for many reasons, the most important of which I’ll explain in a minute.

Look, I’m not to say we won’t hear drum beats of war or see more chest thumping. In fact, this situation, along with the continuing trade war with China will likely determine whether the next correction in my Dark Window scenario is brief and shallow or longer and deeper before the final orgasmic blow-off rally.

But beyond that, this should turn out to be little more than a storm in a tea cup.

When Wars Happen…

World wars often follow depressions and long recessions, which shrink the economic pie and pit nations against each other. Wars are also a tempting way to stimulate an economy out of a depression, which is what Hitler did in the 1930s to return Germany to greatness. BUT, this was during the last negative arm of the Geopolitical Cycle.

While we’ve lived through a brutal negative turn of the Geopolitical Cycle since 2001 – as I’ve said before, just glance at the timeline I published in Sale of a Lifetime for a shocking look at how bad it’s been – we have not had a depression and the Great Recession was short lived thanks to Central Bank efforts. And, this cycle is due to bottom by late 2019/early 2020.

Still, everyone I talk to is wondering…

Will this next crash and debt deleveraging lead to a major war or World War III? I mean, I just said wars are often born out of such times. Still, my answer remains NO!

The combination of U.S. and Europe is still too strong for the likes of China or Russia… or Iran… to challenge. Besides, China and Russia may be allied against the western democracies, but they aren’t exactly “kissing cousins.”

If I were Russia, I would be worried about China targeting my vast resources in the future as my demographics continue to weaken.

Besides, the U.S. has both more and larger aircraft carriers than all of the other countries combined.

Why it Won’t…

But again, and most important, all these rumblings aren’t likely to escalate too far as this cycle bottoms…

Instead, it’s most likely to represent the crescendo of this negative arm of the cycle, which has seen horrific acts of terrorism and civil wars.

Europe is campaigning hard against escalating tensions with Iran because it fears more refugees and the repercussions of Iran closing the Strait of Hormuz. That would impact 40% of oil flows into the continent.

Russia is one of Iran’s few and only powerful ally, and even it’s pushing against deepening the rift between Iran and the U.S.

Even The Donald himself campaigned against the U.S. being involved in overseas affairs as much in his America First theme.

The People Speak…

Polls by Reuters/Ipsos show that 51% of Americans do expect some sort of war with Iran in the next few years, but a mere 12% are behind a pre-emptive strike and 60% say “hell no” – so good luck Bolton! 79%, republicans and democrats, would favor a strong retaliation if Iran struck first; 49% favor a limited response; 35% a full invasion. And 61% disagreed with The Donald pulling out of the Nuclear deal with Iraq.

So, in the end, this looks like a lot of huffing and puffing between two countries that have hated each other since the U.S. supported the overthrow by the Shah of Iran in 1979.

My Geopolitical Cycle is the first to bottom between 2020 and 2023, where the combination of my four cycles is at its worst and strongly favors a Great Depression after central banks have kicked the can down the road for more than 10 years with a little help from The Donald’s unnecessary tax cuts for corporations.

The worst of the last Great Depression from 1930-1942 happened on the front end of the cycles. The worst of this Economic Winter season from 2008-2023 should occur on the back end.

The goods news is that my hierarchy of cycles suggests the worst will both occur and be over by 2023 or so, and the next global boom will set off in 2023 and run through 2036/7. My Geopolitical Cycle is up the entire boom from 2020-2036/7, as is the U.S. Spending Wave for Millennials from 2023-2037…

But it will be a very mixed boom and not broad-based, unlike the one from 1983 to 2007. We will tell you exactly where to invest to capture it most fully.

Harry

May 27, 2019

Memorial Day 2019: Honoring The Legacy of those Lost

My three children took different paths as they became young adults. They’re kind enough to include my wife and me on their journeys. Through texts, emails, calls, and the occasional visit we hear about their days.

From time to time, I’m reminded of the old adage that you’re only as happy as your saddest child. We have those days. But even then, we’re still here. Together.

What happens when you lose a child, at any age? We’re not wired to lose our children. Thankfully, I have not. We did lose my brother to illness, so my mother is a member of that unfortunate club.

And what happens when it’s not a person that loses a loved one, but a nation? What’s the proper response? Peoples around the world build memorials and describe the battles, but that doesn’t capture the emotion, and it’s hard to keep in our minds the people we didn’t personally know.

As a nation, we’ve lost some of our sons, and now some of our daughters…

Some families feel this at the dinner table or holiday gathering, when there’s an empty place that once was occupied by a loved one who joined the service.

The rest of us? It’s complicated.

The idea of one nation seems quaint, but not nostalgic. Any reading of history tells me that we’re only united when we’re attacked, when our existence is threatened.

That makes sense.

Apart from that, we’ve always been a roiling mess of competing interests. The commonality has been that we all think we are right, and that we believe we have a right to express ourselves, be heard, and live as we see fit.

We’re on the cusp of the 2020 election season, with a full two dozen Democrats lined up to unseat President Donald Trump. Whether you hope they succeed or fail isn’t the point. It’s that, as a nation we have lost some of our most precious resources – our sons and daughters – in the effort to make sure that we have the right to choose… to set our path.

The race to November 2020 will be marked by people desperate to point out our failures, our inadequacies. Opportunities in this country aren’t equal. Our history is full of blemishes. We’re not perfect. We’re human.

I have to try harder to reconcile the shortcomings I think I see in our nation with the price we pay for our existence: someone else’s son, someone else’s daughter.

Past and present. Again, it’s complicated.

The best way I can honor that sacrifice…

On this Memorial Day or any other day, is by doing my best to help us move in the right direction. Learn the issues of our governance. Vote. Respect the opinions of others. Respect their rights in the way I believe they should respect mine.

It’s not an equal trade for the sacrifices made, but it’s what I can offer.

And then I can celebrate. I can be joyful for their memory, and for our continuing existence, abundance, and our future, which they purchased for us.

Happy Memorial Day

Rodney

May 22, 2019

How Will You Get Your Money Out in Retirement?

We’re in the thick of the real estate game now. Our home is on the market, which means it’s much cleaner, and more spare, than usual. When we have showings, we vacate the premises, and of course need to take the dog. That’s more of a challenge than we’d thought, but she’s gotten used to sitting with us in the car at the nearby Sonic, and the crew on roller skates thinks she’s adorable. I hope they wash their hands after petting her.

All of this comes out of our talks about where, and what kind of life, we should live. The house is fabulous, but big, and on open water in a flood prone area. With taxes and flood insurance moving higher, the cost of carry is on a one-way train uphill. In our early 50s, this looks like a good time to sell while there are still buyers for this sort of property.

This hits on a theme Harry has written about for a while…

The Millennial problem…

Not enough Millennials being in a position to buy the housing stock that Boomers want to sell as they move to the next phase of life. It’s something that could dramatically reduce the equity Boomers think they’ll pull out of their homes, and thereby reduce what they can put toward their retirement.

But it goes beyond real estate. What happens in the investment world?

I was in Baltimore earlier this week, finishing up some loose ends regarding my about-to-be-launched trading service, Fortune Hunter. While there, I had the opportunity to meet with my editor, and the discussion turned to our parents and in-laws. We talked about one of the biggest frustrations I see with aging Boomers in my world isn’t a lack of savings but that there’s often no plan on how to turn the nest egg into a revenue stream.

This leaves older investors looking at their accounts, full of growth stocks that have done well, wondering how to turn shares of Netflix (Nasdaq: NFLX) into mortgage or health insurance payments. Do you sell the shares a bit at a time? Sell all the shares and buy income-producing stocks? Move to annuities?

What if you simply wait? Will there be enough buyers of stocks in the future, essentially Millennial investors, to pick up the slack as the Boomers try to get out of the markets?

The move…

This move from the accumulation phase to the distribution phase can’t be overstated, and yet it seems to be underserved and under-discussed.

We need to have these conversations, at the dinner table, at family gatherings, and in these pages.

Charles attacks this problem head-on in Peak Income, giving subscribers a way to build streams of income that beat the pants off of traditional bond investments or dividend stocks. It’s great work that can help you build a steady stream of mailbox money that pays the bills.

But don’t be scared away from alternative streams such as annuities. I’ve written about them from time to time, although we don’t cover them consistently. In their simplest form, annuities move the risk of longevity, or running out of money, from the investor to the insurance company. They send you a check for as long as you’re still on the planet, and can come with a rider that makes sure you or your estate gets back at least what you put in, just in case your stay on the planet is shorter than anticipated.

There’s no free lunch here…

Deferred income annuity payments work out to about a 3% annualized return if the recipient passes at the average age in the IRS mortality tables. That’s about what you’d get from 30-year Treasury bonds.

But you get a check, every month, for the rest of your life. Guaranteed. You no longer worry about equity market returns or think about when to sell. You cash the checks.

I’m not shilling for any annuity company, I’m trying to make the point that the distribution phase of life will be just as complicated, and just as fraught with danger for the Boomers as was the accumulation phase. We should be addressing this issue regularly to make sure there are no surprises, and come up with the plans that fit our situations the best.

Maybe it’s cobbling together a mixture of stocks, bonds, and annuities. Maybe it’s rental properties and closed-end funds. Whatever the resulting plan, keep in mind the goal. Few people want to have the most Amazon stock as they age. What they want is an increasing ability to do what they want and remain independent. For that, you have to know how you’ll turn that Amazon stock… or big house… or private business… into spendable dollars.

Rodney

How to Avoid Hype-Burn in this IPO Mania

Given that we’re in the greatest global bubble in history, almost everything is overvalued. We’re expecting central banks to keep printing money, interest rates to stay near zero, growth to continue “into a plateau of prosperity.” Just like 1929.

Dare us to say: it’s hard to find good value investments out there.

Look at this chart of accelerating IPOs at higher and higher prices, most often from companies that have no or little profits. People are buying into the bubble at prices that companies could not possibly fulfill even in many years, if ever. They don’t call these companies “unicorns” for nothing.

At the top of the massive tech and internet bubble in 1999 and 2000, the key IPOs only totaled $17.6 billion.

At the top of the massive tech and internet bubble in 1999 and 2000, the key IPOs only totaled $17.6 billion.

Look at the progression as the greatest stock bubble in history keeps hitting new higher levels…

Bigger and bigger…

Google and the high-profile IPOs of 2004 to 2006 raked in $45.3 billion. Between 2012 and 2014, Facebook & Co. cumulatively valued at $143.2 billion.

Now it’s Uber and its peers, collectively valuing at $182.9 billion. And this bubble isn’t over yet.

Yet Uber has $16 billion in cumulative losses, no chance of profits anytime soon, if ever. It’s drivers are overworked and underpaid. They likely won’t stay with the company for long. And its IPO is backing off that $100 billion initial valuation. (That may be a sign that this bubble is getting close to peaking, but more on that another time.)

So, how do you make money on companies like these that have no profits and are valued 10 to 20 years out, on the assumption of success?

How do you find the Amazons of this world without the wild roller coaster ride – up and down — at the beginning?

Amazon IPO’d in May 1997 with a value of only $438 million. A year later it was smacked down 88%. In the tech wreck of 2000 to 2002, it was whacked down again, 93% from its highs.

After hitting $6 per share, it began its ascension and recently got as high as $2,039 per share. PER SHARE!

How do we get on the train at THAT point?

I guess those are the questions every investor asks, and one of the reasons you follow our work. You hope we have the answers.

We do.

Finding the next Amazon…

There’s a new twist on our four-season and S-curve model of business that Rodney, our Boom & Bust Portfolio Manager, has identified. It’s called “The Second Wave,” and it’s giving investors like you the opportunity to board the profit train AFTER the hype has done its damage.

I recognized it’s power as soon as Rodney revealed it to me recently…

I spent years consulting to, running, and investing in new ventures. Being an entrepreneur myself and having a natural attraction to risk, I tended to invest in that brutal first wave… the one that crushes you when the wave breaks. My thinking would be something along these lines: “Here’s a new product/technology. It’s radically better than the existing ones.” Why not get in early on? The problem is that it is just getting off the ground, has to raise money with no track record, get initial customers for credibility and cash flow, and if successful, has to manage rapid growth. There are a million things that can go wrong at that vulnerable stage.

Inevitably they face a crisis, even if successful. Too many competitors will enter the market and over-expand. The creative entrepreneur will find he has no skills at managing the growth he created, funding will dry up in stock crashes like 2000-2002, or 2008-2009… and on and on.

Beating the shakeout…

Every new growth industry faces a shakeout. Actually, there’s a series of shakeouts. It’s especially during that first shakeout, when the tide recedes, that you first see who’s swimming naked. The weak are weeded out and the strong survive.

That’s where I should have invested when the new industry or company was still young – at the beginning of that second wave. It’s where the winning candidates come into their own and the direction of the industry comes into clearer focus. That’s where I invest now that I’m wiser, smarter, have three decades of research under my belt… and have a business partner like Rodney Johnson.

I have convinced Rodney to share with you how he uses the Second Wave to get investors into profitable investments without getting hype-burn. He’s scheduled time to do so next Thursday, May 30, at 1 p.m. Make sure you’re there to hear all about it so you can potentially add the next big thing to your portfolio without facing the prospect of being body slammed by a crashing wave.

Harry

May 21, 2019

Robert Smith’s Student Loan Pledge Sends the Wrong Message

Vista Equity Partners Chairman Robert Smith made quite a splash over the weekend when, during a commencement speech at Morehouse College, he pledged to pay off the student loan debt of every member of the class of 2019 who had accrued a tab.

Smith is worth $5 billion, so he can afford to be generous. In fact, he’s the richest black person in the U.S. – richer than Oprah Winfrey.

We don’t know exactly how much this will cost the philanthropist, but those watching expect the pledge to cost the man around $40 million. That would make the tally 0.8% of his wealth… like a millionaire giving away $8,000.

That’s not meant to diminish Smith’s gift. This particular piece of generosity is part of his much larger plan, through the Giving Pledge, to donate at least half of his vast net worth during his lifetime.

And how he does this is his business. He made the money…. took the risks… earned the education. And he needs no advice or input from me or anyone else. He could give it all to the Pet Rock Society.

It’s great that he’s chosen education…

But student loans for graduates? He’s missing the biggest point of pain for students…

The Biggest Point of Pain

When it comes to student loans, there are three distinct groups:

Those with big loans…

Those with moderate loans…

And those who take on smaller loans.

You might believe that the big loans hurt the most, but that’s not true.

The largest student loans often go to those with graduate degrees, like doctors and lawyers. People pursuing those professions typically rack up between $100,000 and $250,000 in student loan debt, wildly skewing the average numbers. But on the flip side, their career earnings end up being high enough to pay the loans no problem.

The middle group tends to encompass most graduates who earn bachelor’s degrees. They have loans around $30,000, which often takes 20 to 25 years to pay off, making it a drag on their financial situation. But the degree allows them to earn more.

The Pew Research Center reports that Millennials with a college degree earn $56,000 on average, compared with those who hold just a high school diploma and take home $31,000. Those numbers would seem to make the collegial investment worth the price.

It’s the last group – those with small loans – that tend to feel the most pain. Not because of the size of the loan, but because so many didn’t actually graduate from college.

Including community colleges, the dropout rate for higher education is greater than 50%. Without community college, it’s still above 30%. Many of those students took out loans, but then didn’t complete their degrees. This leaves them with debt, and yet no better earning potential. Because the loans are so difficult to discharge, they follow these people throughout their lives, weighing on their financial situations.

If Mr. Smith wanted to lift an incredible burden off the backs of a specific group, he could have sought out those who borrowed to attend Morehouse but never completed their degrees.

This might sound like it’s rewarding failure, but let’s remember the goal, which is lifting a burden.

And there’s no doubt that even Mr. Smith’s generosity is an act of favoritism.

An act of favoritism…

He paid off debts; he didn’t grant all class members a financial stipend.

What about those who worked instead of taking on debt? Or those parents who saved instead of spending on themselves, and used the funds to put their kids through Morehouse with no debt? And what about the students who excelled in high school and earned scholarships?

They were just told that their efforts were wasted. They should have spent their time and money on themselves and maxed out their loans, because all would be forgiven.

And what about the university itself? This isn’t meant to pick on Morehouse, since almost all universities fit the bill. The institutions have added staff over the last 20 years well beyond what was called for by enrollment, growing their costs and passing it on to students.

Education shares a sad characteristic with the government: It’s one of the few areas in which technology didn’t make things cheaper. In other industries, technology made things much cheaper.

That’s because colleges don’t need to think about cost cutting. Their constituents are encouraged to borrow five-digit sums to buy their goods, and can do so from the federal government with no credit check, and no estimate of future earnings.

The system is broken…

The system is broken, and we can’t fix it by looking at the end of the process. We need to attack it at the beginning, dramatically curbing or ending student loans before they start.

We can only hope that the students of Morehouse who benefit from Mr. Smith’s generosity accept his challenge to them, which was to pay it forward.

Let’s hope the best and brightest of them, those on scholarship without loans who didn’t benefit from his largesse, choose to do so as well.

Perhaps they’ll be the group that figures out how to break the chokehold that universities have on the education system.

Rodney