Harry S. Dent Jr.'s Blog, page 28

April 5, 2019

Stephen Moore: The Fed’s New Bucking Bull

Last weekend I went to a local rodeo with my wife and parents.

Before the teen bull riding competition started, an older gentleman next to me asked to open the screw top on his beer. He told me that 10 back surgeries had stripped him of the strength and leverage to do such things.

We began talking, and I found out his son was competing. He wasn’t as old as I thought… He’d ridden bulls for eight years himself, and the life had taken its toll.

I learned a lot about bull riding from him, and how the cowboys manage the bulls in the chutes before they’re turned out… The menacing beast has to be positioned just so, with its head facing out, or else it could cause even greater harm to the rider.

It doesn’t always work out. Several of the young men were hurt that night, with broken bones and muscle tears.

They’ll all recover, but it will hurt for a long time.

The unpredictable nature of the sport came to mind when I considered Trump’s nominee for the Fed Board of Governors, Stephen Moore.

Stephen Moore a bucking bull?

Moore’s a long-time economic advisor in Washington, steeped in free markets, low taxes, and low interest rates. He’s probably most famous for creating the conservative Club for Growth in the early 2000s.

I think of him as an extreme version of a conservative economist, calling for big policy moves that have the potential to disrupt monetary policy and cause a bit of chaos in the markets.

We had Mr. Moore speak at our conference 2008, along with previous Dallas Federal Reserve Bank President Bob McTeer. The difference in temperament between the two was stark.

Moore was impassioned and came across as impetuous. McTeer was the older, steady hand. Now Moore will likely end up with a vote at the central bank. He’s the bull entering the Fed’s china shop, and something’s going to wind up broken.

And you and I will be the ones to pay for the damage.

The Man and the Myth

Moore called for Fed Chair Jerome Powell to resign after raising interest rates in December, a move that Moore thought was clearly out of step with the U.S. economy. He has since apologized for the brash response, but believes the Fed should immediately lower interest rates by 50 basis points, and then use a commodity pricing rule to set rates in the future.

Funny, I’ve never thought of commodity prices, which can shoot higher or sink lower based on weather, geopolitics, and good old-fashioned manipulation, as long-term, steady trend indicators that should be relied upon for monetary policy.

Moore claims that this is the same approach that Paul Volker, the inflation-slayer of the early 1980s, used to set Fed policy.

There’s only one problem… It’s not true.

George Selgin recently wrote at the Cato Institute that, “…despite what Stephen Moore has written, there’s no evidence that either Paul Volcker or any later Fed chair ever deliberately linked Fed monetary policy to real-time changes in commodity prices.”

Moore is smart and clearly research-driven, which makes his commodity price model all the more questionable. He’s holding tight to something even though the evidence suggests a change is warranted. That’s a problem, and it doesn’t fit at the Fed.

Not a fan…

I’m not a fan of the Fed. They’ve essentially been the guarantor of bank profits for a decade as they exploded excess reserves by the trillions of dollars, and then directly paid banks interest on those excess reserves.

This saved the likes of Citibank, Bank of America, Wells Fargo and others during the financial crisis, and now those institutions are claiming to be pillars of strength. Right… With our money.

But that doesn’t mean that we should inject a level of uncertainty into the system just to see what shakes out.

I prefer the devil I know, thank you, and so do the markets. When investors are uncertain about, well, anything, volatility goes up and returns tend to fall.

We have plenty of real issues to deal with today…

We’re still in this Economic Winter Season, marked by weak GDP growth and poor productivity, and it’s made worse by the trade wars with China and Europe as well as our ossified political class.

It would be better to remove some of the unpredictability of the Fed instead of making it worse. While Mr. Moore appears to mean well and have the best interests of the country in mind, he’s better for us as an outsider demanding change than a central bank insider wreaking a bit of havoc.

Rodney

April 4, 2019

The Real Story Behind the China Trade Deal

Since last November I’ve been forecasting that we are likely moving into another Dark Window of spectacular gains before a big crash in early 2020.

It didn’t look that way into December when stocks were down 20% or more, the largest correction since 2011 during the euro and Greek crisis. But my short-term indicators were saying this was not yet a crash, just another correction.

Yet the Fed backed off its aggressive tightening stance. Capitulating to Trump? More like the slowing global economy from Europe to China.

The response brought a sharp rally: Markets are still high “on the crack” and raring to go on good news.

After the 20% to 25% rally in March, the markets looked like they might take a break and correct before exploding up into the next wave …

But the markets won’t back off. In fact, they’re now looking for the second relief switch…

The Trade Deal with China

Currently, stocks look likely to retest the late September/early October highs before taking a substantial correction.

Oh, it’s got to be imminent. China needs it more than us as they export three to four times to us what we export to them…

But you have to remember that China has a long-term plan: To become the number 1 country in the world and supplant the U.S. leadership since World War II. They are more willing to take more pain for that than we are…

And Chairman Xi is now largely grandfathered in forever as their leader.

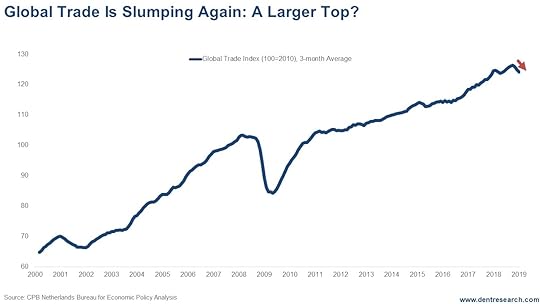

I cover this “peak in globalization” in Zero Hour with a great long-term chart with peaking surges in global trade in 1913 and NOW – every 100 years or so.

Trade just seemed to peak recently, as this chart shows.

Donald Trump should be worried about that. The president is perhaps the most controversial figure to hold office in history. He knows he needs to get re-elected in 2020.

Donald Trump should be worried about that. The president is perhaps the most controversial figure to hold office in history. He knows he needs to get re-elected in 2020.

And I am predicting the greatest crash in our lifetime to likely start by early 2020…

Uh-oh.

He’s not aware of that threat, given the confidence he’s shown in his 3% to 4% growth economy, although that already seems to be fading fast as I forecast. But he needs this deal to look good even though the near-term consequences do not hurt him as much as they do China’s economy, although China’s recent reprieve on the Mueller report gives him a boost.

Beyond that, China’s recent stimulus now seems to be working, and current statistics like the Purchasing Managers Index and its stock market are up strongly again.

Maybe China does not need this deal quite so urgently near term…

Either way, the deal is likely to go ahead in some form. And that could launch the next wave up of the Dark Window blow-off rally.

We may still see a more substantial correction in the next week or two as I have been forecasting if this deal continues to delay. But if it does go through, the markets are likely to surge upward, maybe very short term, and then a sell-off after the news. Or, the beginning of the next wave up into June/July that could see substantial new highs and prove the Dark Window scenario more fully.

My preferred scenario is that we see a minor setback over the next couple weeks, then the markets rally into the next strong surge up into the summer – on the way up to a final massive peak into September… or January at the latest.

This trade issue with China is clearly the linchpin, either way…

Do you see now why I almost always have two scenarios in the near term and only one scenario in the longer term? The near term has many more cycles at play and politics matter much more.

I’ll keep you updated.

Harry

April 3, 2019

Bitcoin’s Surge Proves It’s a Bad Currency

If you went to the store two days in a row and all the prices had gone down by 20% on the second day, would you wonder what was going on?

What if prices jumped 10% one day, then fell 7% the next?

What if, over the course of a year, prices skyrocketed by 400%?

This is what the world is like for those who view Bitcoin as currency.

Last week the price of Bitcoin shot up almost 20% in one day. Crypto aficionados envisioned the start of a new bull market.

Think about that…

A new “bull market” in a currency that’s not driven by comparing it to other currencies… or looking at the productive capacity of a nation… or even the amount of the currency outstanding.

This is about people buying units for… what?

The fact that the value of something labeled a “currency” can fluctuate by not 1%, or even 2%… but 20% in a single day should scare off anyone who is interested in their currency holding value over time.

If people want to “invest” in bitcoin, which is nothing more than gambling by hoping one day someone will pay you more for it since it has no intrinsic value, that’s great… as long as they limit it to no more than they can afford to lose.

What can go up can just as fast go down…

The one-day jump was driven by a single order to buy 20,000 bitcoin split across three exchanges: Coinbase, Kraken, and Bitstamp.

Think about it: One order for 20,000 units drove up the price by 20%.

That’s not how currencies operate. Functioning currencies are storehouses of value that are mediums of exchange divisible into small, useable units.

Bitcoin fails on two out of three.

It’s not a storehouse of value if it fluctuates wildly, and it’s not a medium of exchange since it’s hardly used in commerce. That leaves being divisible into small units.

As a digital asset, this one fits the bill.

But unlike the Meatloaf song “Two Out of Three Ain’t Bad,” in this instance, two out of three is terrible.

I have no idea whether bitcoin is going up or down from here, but I know one place it won’t go… my digital wallet.

Rodney

April 2, 2019

Stock Buybacks: Worst Mistake Ever

A lot’s driving this bubble we’ve been in since 2009, but good fundamental trends and things like demographics and technology are not among them.

The biggest inflator has been the $13 trillion worth of quantitative easing (QE) courtesy of central banks. Thanks to their significant gift to all but retail investors like you and me, speculation has become the norm.

With higher cash flow and cheaper borrowing rates – all in a slow growth economy – companies quickly learned that the best way to increase their earnings per share (EPS) was to shrink the number of shares available.

Just look at this…

In 2018, Trump added the massive tax cuts to the stimulus plan. That created even more direct cash flow to corporations, who responded with record stock buy backs of $806 billion last year, which was a 56% increase over 2017. JP Morgan expects we’ll see about as many buybacks this year. The 2019 number is an estimate. Regardless, it’s insanity.

In 2018, Trump added the massive tax cuts to the stimulus plan. That created even more direct cash flow to corporations, who responded with record stock buy backs of $806 billion last year, which was a 56% increase over 2017. JP Morgan expects we’ll see about as many buybacks this year. The 2019 number is an estimate. Regardless, it’s insanity.

Since 2009, corporations have done more than 90% of net buying in the stock market. As The New York Times accurately describes it, “This stock market rally has everything except [individual] investors.”

Institutional buyers – aka the smarter money – have been net sellers.

Individual investors – you and me – have been neutral while foreign buyers have been only slightly involved in stock purchases.

Rather, the dizzying gains the U.S. stock market has enjoyed are a result of $5.6 trillion worth of stock buybacks over the last decade!

That’s an average of $500 billion per year. It’s no wonder democratic politicians like Senator Tammy Baldwin have introduced a bill to ban open-market stock buybacks. Senators Bernie Sanders and Chuck Schumer are on this bandwagon as well, as Rodney has mentioned before.

The Stark Disconnection Between Markets and the Economy

All this while U.S. GDP between 2007 and 2018 only reached a cumulative 19%. That’s lower than GDP during the Great Depression, which came in at 20%, cumulatively, between 1929 and 1940.

The financial asset bubble is, in fact, even greater than the one we enjoyed in the 1990s, when the internet was moving mainstream on an S-Curve (as we predicted) and the Baby Boom spending cycle was at its strongest (as we also predicted).

It all just goes to show that this 21st century market bubble is built on nothing but B.S. And it’s risen so high on all the resultant methane, that the inevitable crash will be mind-numbingly devastating.

Imagine the nightmare the CEOs, CFOs, and boards of executives –stockholders of these companies – face when they realize that they soaked up more than 40% of their cash buying back their own stocks at the highest prices and valuations in history.

What the hell are they going to do when they desperately need that cash to survive the greatest economic shakeout since the 1930s?

They’re not going to be laughing all the way to the bank… They’ll be crying, many crawling on their hands and knees.

And their shareholders are going to be pissed!

Who’s the dumb money now? It’s not the shoe shine boys and housewives.

While this bubble experiences it’s last hurrah in an extreme blow-off rally into the end of this year, make sure you’re taking advantage of the Dark Window opportunities. We’re in the final stretch of this low-growth, stimulus-driven, something-for-nothing, gravy-train ride.

Harry

April 1, 2019

Facing Down Financial FOMO with Lyft

Biotech in 1990, internet companies in 1999, vacation homes in 2005, cryptocurrencies in 2017. Now the fast money is chasing ridesharing pioneer Lyft, as well as other unicorns (private, money-losing companies valued at $1 billion or more). The Fear of Missing Out (FOMO) can certainly make us look foolish.

My mother warned me about things like this. Something about following friends off a bridge…

Luckily, my friends today are too old to consider bridge jumping. Although in our younger years… but that’s a different story.

Manias are easy to spot in retrospect: big price moves, big-time hype, big promises of untold riches, and then poof!… it’s all gone.

People get righteous when they talk about how they never got caught up, never lost money, never got deceived.

That ignores the times when the hype played out.

Remember falling interest rates during the 1980s, booming equities in the late 1990s, computers, cell phones, and of course the internet? People who dismissed those trends look pretty foolish in retrospect…

The cell phone was already ubiquitous in 2007. Then Apple introduced the iPhone.

I thought it would fail… not because of the functionality of the phone, but because it was only available on AT&T, a network that, in all fairness, sucked.

Needless to say, the iPhone didn’t fail. I definitely missed that one.

The next big thing…

Now Lyft is a public company, with shares initially priced in the mid $70s, valuing the money-losing, ride-hailing app firm at a cool $24.4 billion.

Yes, the firm dramatically increased revenue over the past several years; and yes, it controls about 25% of the market. But Lyft burned $911 million in 2018, and has no path to profitability.

Ride hailing apps lose money. To make money, they would have to charge customers more, pay drivers less, or introduce some combination of the two. That would bring them closer to the business model of the taxis they are trying to displace.

Lyft thinks scooters will do the trick, but none of those companies make money, either.

Uber, Lyft’s big brother, which is valued at $120 billion, is hoping food delivery and load delivery services for trucking will help. Maybe, but will it make the company worth more than $100 billion?

But the force behind FOMO is strong, so investors flocked to Lyft’s IPO… just as they snapped up cryptocurrencies in 2017… and will likely go after shares of Uber when they go public this year.

I’m not sold, even though I recognize what others want and need… better returns, financial security for the future, some way to retire with dignity.

Speaking of retirement…

The Government Accountability Office just reported that 29% of Americans 55 and over have no funds in an IRA or 401(k), and no defined benefit pension.

These people aren’t buying shares of Lyft. They aren’t buying shares of anything; they have no savings.

It’s the rest of us who consider buying such IPOs because we understand that we’ll be supporting a lot of others as we go through our own retirement. Benefits will be means-tested, taxes will go higher. We’ll pay. We’d better make some money while we can.

But purchasing unicorns on the IPO? In this economic environment?

Lou Basenese spoke at our Irrational Economic Summit last fall in Austin about tracking companies through a predictable hype cycle. Investors push stocks to dizzying heights, then grow tired as they wait for the industry to take off, so they sell the darlings of yesterday.

As the industry eventually makes headway, the same discarded companies turn into growth engines.

But not all of them. Some become the Pets.com of their sector, and some sectors fade away.

We make money by knowing the difference… or simply waiting for proof.

Lighting up the markets…

The marijuana industry is growing at lightspeed as more states legalize the plant for both medicinal and recreational use. There are many companies in the space, most of which lose money and are more hype and hope than sales and profit.

But there are some decent prospects in the space, which has already been through at least one iteration of the hype cycle as Canada legalized pot last year only to see related companies lose value in the aftermath.

I cover the pot market in this month’s issue of Boom & Bust, and I highlight a company poised for growth. With the U.S. economy slowing down and equity markets fully valued, now is a good time to look for non-traditional ways to make money.

A sector like pot– which is new and has already had ups and downs – can easily move counter to the prevailing market indices and expand rapidly even as the overall economy slows down.

With fourth quarter GDP revised lower to 2.2% and first-quarter GDP looking anemic, my FOMO is morphing into FOGC: A Fear of Getting Clobbered…

So, I’m following my mom’s advice: I won’t be following my investment friends into Lyft, at least not yet. For the time being, I’ll stick with my outside businesses, like the golf cart endeavor, and look for industries such as marijuana that have a lot of growth in front of them, but have already been taken down a notch or two.

Rodney

March 29, 2019

Start Investing Like the Mafia Now

An article caught my eye earlier this week: 102-year old John “Sonny” Franzese, a former Colombo crime family member, incarcerated for 50 years for refusing to rat on his friends, is finally speaking out. This, on the heels of the Francesco “Frank” Cali murder on March 14 – the first killing of a New York mob boss in more than 30 years – got me thinking about the infamous Great Depression group.

Despicable people.

Smart too.

In the pre-depression bubble, they cornered the bootleg booze market. Their cash profits were staggering. Then, when the markets and economy went tits up in 1929, they took on the banking sector. Because they had piles of cash, they lent when no one else would, at rates of 20% or more. Desperate businesses made desperate choices. And when they couldn’t pay back, the mafia took over their operations. By the time things began turning around, they had scooped up so many opportunities, they were perfectly positioned to become even richer.

In short, they were so financially smart, they took advantage of the sale of a lifetime that opened in front of them.

That same opportunity is now in front of us.

Listen to my latest video to hear more details about the opportunities ahead, when and how to start preparing, and why you should take a page from the mafia’s playbook (without breaking any laws or knocking anyone off, of course).

Also in today’s video, I elaborate on three principles you must focus on between now and 2020. And I share two other, less radical but equally inspirational, examples of how investors and businesses took advantage of the last sale of a lifetime.

Also in today’s video, I elaborate on three principles you must focus on between now and 2020. And I share two other, less radical but equally inspirational, examples of how investors and businesses took advantage of the last sale of a lifetime.

March 28, 2019

Mueller, Money, Marijuana

Last weekend wasn’t exactly sunny on the Texas coast, but it was the closest we’ve gotten in two months. Early on Saturday, I started work in the yard. 96 bags of mulch later, I took a much-needed rest and made my way through the day’s news. It was all Mueller, which is unfortunate because there are many other things to discuss.

Here’s the breakdown: Special Counsel Robert Mueller issued 2,800 subpoenas, interviewed 500 witnesses, executed hundreds of search warrants, employed 19 lawyers, and was assisted by a team of 40 FBI agents, intelligence analysts, forensic accountants, and other professional staff…

According to Attorney General William Barr, Mueller reports that neither Trump nor anyone on his team conspired or colluded with Russians trying to influence the 2016 presidential election.

Did Trump obstruct justice? Maybe, maybe not.

Does any of it matter?

Without a bona fide crime, not one bit.

Republicans claim victory. Democrats claim they know Trump colluded, even though a zillion man hours and millions of dollars wasted on the special counsel says otherwise.

It’s the same schtick. Both sides are shocked, shocked!, at whatever outcome they didn’t like, and then pledge to keep fighting for the truth.

How about fighting for something else, like progress in the U.S.? How about moving the country forward instead of posturing over the latest fake outrage?

They’re all Nero, and Rome is burning.

Trouble at the Fed

The Fed told the world last week that they probably went too far raising rates in 2018… and compounded the mistake by squeezing liquidity as they shrank their balance sheet.

They’re too modest. The Fed’s recent string of mistakes goes back a decade as the self-enlightened group took on the role of economic arbiter, deciding who lived and who perished, using funds scraped from savers through record-low interest rates.

Instead of buying bonds to prop up certain markets while gifting billions of dollars to banks and the U.S. Treasury (which will continue, now that the Fed has called a hiatus on letting bonds roll off), the central bank should’ve stuck to its knitting, lending against good assets in stressful times, charging a painful interest rate.

Good companies would’ve survived. Bad companies would’ve died, but now they’re still with us, paying their executives millions and claiming success.

Now that the initial rush from tax reform is wearing off, we’re back to modest growth, but with a kicker… We’ve turbo-charged our deficits for good measure.

Instead of going backward by a mere half a trillion dollars each year, we’re making great strides toward adding a full trillion dollars in debt every 12 months. There’s something to be proud of.

But don’t worry, those deficits will fall over the next decade… as long as we hike taxes on individuals and claw back the money we doled out last year.

No Virginia, there is no economic Santa Claus. We’re still in the Economic Winter Season, marked by low productivity and weak growth, no matter what the government tries to do.

Boom & Bust

All of this stress is taking a toll on the markets, which caused the Dow to puke up more than 400 points on Friday. That’s OK with me. In our Boom & Bust portfolio, we added white-hot companies in the chip sector at the start of the year, and then more conservative plays after the initial run up. The goal is to form a barbell, seeking high growth on one end and steady-paying investments on the other.

There’s no sure thing, but the approach is working out.

Further from the mainstream, we’ve also put a stake in the ground in the cannabis industry. I’ve been researching that market for years, and personally investing in it for a while. While I don’t partake of the product, I’m a big fan of the market gains. One of our current plays is up almost 100% since December, and the company has a not-so-secret secret… it makes a profit.

Those are the kinds of numbers I like.

Rodney

March 27, 2019

Recession? Yes, But Not Yet

In the last week, there have been a slew of articles warning that we’re on the verge of a recession.

The most prominent is talk about the yield curve – the 10-year versus the three-month Treasurys – finally inverting. That has led every recession since 1955, and only gave one false signal in the 1960s.

I agree. This is something to worry about. But, this signal typically appears about a year before any recession hits. That means stocks could run up another six to nine months before they react. That’s all we need for my Dark Window blow-off rally scenario.

Then there was what was called “The Vicious Trifecta”…

German 10-year bonds went back into negative yields adjusted for inflation when European manufacturing data came in weak. This follows other slowing indicators, including Italy falling into a recession in the last two quarters of 2018.

S. manufacturing data also came in at the lowest rate in two years and 10-year Treasurys have fallen to 2.36% since, near negative yields just above the inflation rate.

Fund managers pulled capital out of equities to the tune of $20.7 billion in the week ending March 21.

So much for those tax cuts creating sustainable 3% to 4% growth as we warned they would not.

Gary Shilling, known for his deflationary leanings, issued a warning because we can’t seem to break above the Fed’s 2% inflation target, even though unemployment has fallen from 10% in 2009 to a recent low of 3.5% (it’s currently at 3.8%). That’s a sign of deflation and recession.

Then both Morgan Stanley and RBC Markets warned that the correction into late December looked like ones that have preceded previous recessions and larger corrections.

Well, that’s where I most disagree…

It might be true for normal stock crashes and corrections. But this is the peak of the largest and most global bubble of our lifetimes. My research and analysis prove without a shadow of a doubt that stock bubbles go out with a bang, not a whimper. And like I said recently, the late September/early October top in the markets was a whimper. That was the first sign to me.

The second was that you only know a major bubble has finally topped when you see a first violent correction, with losses ranging from 30% to 50% in the first two or three months (the average loss is 42% in 2.6 months).

Halfway into the last correction in mid-November, I could tell we weren’t on that trajectory and declared this just another correction, not a top and the start of a major crash yet.

In light of this, here’s a chart I just came across that argues we’re nearing a final buying opportunity into this Dark Window blow-off top scenario I’ve forecast…

The percentage of asset allocations that claim they’re over-weighted to equities is near zero. Outside of being at the bottom of the major stock crash/recession in late 2008/early 2009, where the reading was -40% to -45%, near zero is where you want to buy!

The percentage of asset allocations that claim they’re over-weighted to equities is near zero. Outside of being at the bottom of the major stock crash/recession in late 2008/early 2009, where the reading was -40% to -45%, near zero is where you want to buy!

If we were near a top and major turning point down, we should have seen investors pouring into equities, not being this conservative.

In short, all the pieces fit perfectly into my favored Dark Window scenario, in which we could see a final blow-off rally that takes the Dow to 33,000-plus and the Nasdaq to 10,000 by early 2020. After that, it’s tickets.

Yes, things are slowing.

Yes, there is reason to worry.

But not yet.

I share with Boom & Bust Elite subscribers the lines in the sand I’m watching. If any of those lines are crossed, we can start worrying earlier. If not, don’t miss the opportunities in front of you.

Harry

March 26, 2019

FEMA’s 2020 Changes and the Need for Income

I live 200 feet from open water, facing Clear Lake, Texas. It’s not a lake, it’s a bay off of Galveston Bay, and it’s definitely not clear. But other than that, the description is perfect.

My downstairs area is 9.2 feet above sea level and consists of garage space and a storage area. The first living space is 18 feet above sea level. Still, I’m in FEMA’s Flood Zone A1, so, as long as I have a mortgage, I’m required to have flood insurance.

That could be a problem.

The Trump administration just announced it will restructure the program, better aligning premiums with risk. The new rates will be published by April 1, 2020, and will go into effect October that same year.

I’m certain my rate will increase, which is enough for me to consider, “Do we sell the house?”

The question is bigger than just our home, because we have to think about long term costs and cash flow. This is the same math that all of us must do as we get older.

How do we manage costs as we get closer to a fixed income?

Flood insurance has always been a racket. Private insurers got out of the business decades ago, leaving just the federal government, which charges something of a flat percentage on your home based on your risk of flood.

But the flood maps haven’t been updated for some time, and the program doesn’t account for different loss experiences.

Notably, expensive homes tend to have more expensive repairs, and therefore use more of the program’s assets. Combining those two issues, people less susceptible to flood subsidize those in higher risk areas, and lower-priced homes subsidize higher-priced dwellings.

Tightening up the program makes sense, but it could still be personally painful, and now there’s a hard deadline of next October.

The conversation…

My wife and I have only been here a couple of years, and we really like the home and neighborhood. But the yard is bigger than I want to manage, and the house is more than we need. Now we have another reason to consider a change.

But as we all know, moving sucks. And the older I get, the worse it becomes.

Maybe I should pay off the house and then go without flood insurance. But even just writing that down sounds like a terrible idea.

We simply could buck up and pay the extra cost, and then hope that the new insurance tables don’t dramatically tank property values. However, lower property values would decrease my property taxes. If my wife and I plan to stay here for many years, we have an odd incentive to see property prices fall.

Looking farther afield, we have to consider the larger economic landscape…

When the U.S. economy next hits upon hard economic times, chances are that our home will take a bit of hit. Maybe not as much as other locations since we’re at the epicenter of the energy boom, but a general downturn certainly won’t help us.

That leaves two things to consider. We’ve got to determine how long we think we’ll live here, which will drive the decision to either move within a year or stick it out. And then we have to look at the other side of the equation, generating income instead of growth from our portfolio.

Why income matters

Last week, I mentioned my new business venture of renting golf carts on the beach. It’s no accident that I chose a business that throws off a bunch of income.

I’m looking down the road at a time when steady income will be the most important attribute of my portfolio. Unfortunately, that time keeps getting closer!

In addition to outside business interests, I also keep a sharp eye on Charles’ Peak Income service.

It’s no secret that I’m a fan of closed-end funds, and I think pipeline companies offer good value. Today, I can use the income from such investments to reinvest (just like Charles does personally, as he noted in The Rich Investor) and grow my position.

In the future, I can switch from reinvestment to receiving the cash flow. Even better, such investments should weather any economic downturn better than general equities. That might give me some cushion against falling home values, and a way to pay my future flood insurance premiums.

What rising expenses (no pun intended) do you face?

And on the flip side, have you added more income to your balance sheet in recent years, maybe through home rentals, Airbnb, or a new side business like mine?

Let me know at economyandmarkets@dentresearch.com, or on our social media channels.

Rodney

March 25, 2019

Where to Next For the U.S. Dollar

People don’t understand gold. They don’t understand the U.S. dollar either.

Mostly, it’s the same people.

Gold bugs thought we were debasing the dollar by printing our way out of the 2008/9 financial crisis. Ha! Actually, the dollar has been rising since the start of that recession. The dollar, not gold, is actually the safe haven for the markets.

Right now, it’s range bound, but the dollar strengthened as much as 47%, at its best, during the last 11 years.

The dollar saw its best rally in mid- to late-2008 when Lehman Brothers was collapsing and the financial system was in dire straits.

The dollar saw its best rally in mid- to late-2008 when Lehman Brothers was collapsing and the financial system was in dire straits.

Do you remember what gold did during that turmoil? It fell 33%. Silver lost 50% of its value. So much for “safe haven.”

But, like I said, the Greenback has been in a trading range, between 89 and 104…

Is the Dollar About to Crash?

Late last week, Bloomberg published an article saying that the Fed’s recent “surprise” move – to hold the benchmark rate steady for the rest of 2019 – could spell disaster for dollar bulls.

Besides this being the time of year when the Greenback typically peaks, followed by some weakness, are these “experts” right?

I don’t think so. Not with Brexit on the horizon.

The thing is, and it shocks me that the “experts” seem to miss this all the time: Currencies trade relative to each other.

The U.K. is set to leave the EU by either next week or by May 23 if the British Parliament is willing to accept Prime Minister Theresa May’s deal. She’s even offered to resign in return for a “yes” vote.

Either way, the deal isn’t pretty and disruptions will ripple through the continent. Any weakness in the euro could prop our dollar up, regardless of what the Fed does.

This speaks to the fact that we remain the “best house in a bad neighborhood.” Even with our crazy money printing, we only capped out at 26% of GDP. The European Central Bank (ECB) printed 42% of the eurozone’s GDP. Japan printed 100% of its GDP.

I don’t see the dollar crumbling in the near term. In fact, I expect it to stay in its current trading range, with first support at recent lows around 93 or 94, and ultimate support around 89.

What To Do When It Rallies…

Ultimately, I expect it to rally at least one more time, up towards around 120 or 122, a move we could see into the next crisis, between 2020 and 2022. Since the coming crash and financial crisis should be much worse than what we endured in 2008, in the 1980s, or even the 1930s, the dollar should shoot higher.

But, once we hit 120 or so, I’m neutral on the dollar. At that point, it would be time to start taking money out of the U.S. dollar, Treasury, and AAA corporate bonds and putting it back to work in the stock market and commodities, including gold.

It would be best to do this around late 2022 or so.

For now, though, don’t pay too much mind to the “experts.” The dollar remains a safer haven than gold. And the stock market – in the Dark Window event we’re experiencing now – is the play to be to make money.

Harry