Harry S. Dent Jr.'s Blog, page 29

March 22, 2019

Take Notice of the Fed’s Big Red Flag

Every six weeks the Federal Open Market Committee (FOMC) meets to decide whether a change in policy is needed to coax our economy in the right direction. They wrapped up their latest meeting on Wednesday. When Fed Chair Jerome Powell delivered his policy statement, stocks bounced and Treasury yields fell sharply.

(Keep in mind the Fed has a Congressional mandate to provide maximum employment and stable prices. It accomplishes this goal primarily by manipulating interest rates.)

According to Powell, interest rates aren’t helping or hindering economic growth. The jobs market is strong, and inflation is near the Fed’s 2% target. Everything seems just about right. So, the Fed is now looking for signs of a slowdown, even though they aren’t expecting one.

What caught investors’ attention was the Fed’s change in projections. Back in December, the Fed expected to hike twice: one in 2019 and another in 2020. But now the Fed isn’t projecting any rate hikes in 2019.

Why the Change of Heart?

Worry over the prospects of our economy.

All evidence indicates that a slowdown is indeed ahead. Housing is worrisome, consumer spending is falling, and inflation isn’t rising as planned. The Fed may have gone too far already in hiking rates and reducing the balance sheet, even if Powell seems reassured.

The Fed decided to leave the federal funds rate (the overnight interest rate it charges borrowing member banks) unchanged at the 2.25%-2.50% range for now. An increase to the rate means that the economy is growing too quickly, or inflation is moving too high. A cut to the rate suggests a sluggish economy or falling prices.

“Normalize” the Balance Sheet

The balance sheet before October 2017 stood just above $4.5 trillion, and held a mix of mortgage-backed and Treasury securities. Since then, the Fed has been shedding $30 billion per month of maturing bonds by not reinvesting. When May comes around, the Fed will reduce that $30 billion to $15 billion per month, leading to the end of “normalization” in September with a little over $3.5 trillion in Treasury securities.

I’m not sure how the Fed declares $3.5 trillion as “normalized” when it was less than $1 trillion before the 2008 financial crisis… but, according to Mr. Powell, it is.

At least the markets know the end is in sight for this “normalization.”

Meanwhile, judging by futures trading, the Treasury bond market is pricing for a rate cut for later this year in anticipation of the economy taking a turn for the worse…

Hard Times on the Way

The economy’s broadest measure is gross domestic production (GDP). The Fed predicts it will now only grow 2.1% this year as opposed to the 2.3% they projected last December. And the GDP is expected to drop to 1.9% in 2020 – down from the projected 2%.

Though still historically low, unemployment will take its licks in the coming years. As of the latest update, it currently sits at 3.7%. And it’s projected to be 3.8% in 2020 and 3.9% in 2021.

Here’s the thing… the Fed originally projected the federal fund rate to be 2.9% in 2019, but now the estimate stands at 2.4%. So, the Fed doesn’t expect a hike the rest of the year. In 2020 and 2021, the Fed expects the rate to climb to 2.6%. That change in the projected rate is the big market mover. No other data will affect the markets quite like this.

Don’t get me wrong… the Fed always adjusts its projections. In this case, they’ve implied that rate hikes in the near future are on hold because the economy looks to have slowed too much. That was a complete flip to what was said before, and it’s a big red flag!

Markets Are Getting Ready

If long-term Treasury yields remain low, and the spread between short- and long-term Treasurys continue to narrow – with yield curves flattening – the markets are positioning for a worsening economy.

And if – and this is a big if– the economy plugs away around a 2% growth rate… and the jobs market doesn’t collapse… and inflation remains near the Feds target 2% rate… don’t expect any change in policy.

Mr. Powell did note slower growth in consumer spending and muted inflation, as well as a slowdown in jobs growth. But with wages on the rise, there’s little concern. Powell’s also monitoring the risks associated with global trade negotiations and the Brexit uncertainty since the U.S. will feel any global slowdown.

China’s economy has slowed, but Powell expects it to stabilize, and he isn’t concerned about Europe’s slowdown leading to a recession.

What Does This Mean for You?

The Fed has reversed its path on interest rates hikes and its outlook for the economy. You need to take notice. The Feds projections for the next few years seems to be steady as she goes, but my advice is to be on your toes…

Don’t get fooled by the Fed’s apparent complacency. The economy, the markets, inflation – just about everything – is in flux.

We are likely moving into a period of higher volatility. And that means greater opportunities to profit!

Lance

March 21, 2019

Don’t Punish the Admissions Scandal Kids… Educate Them

The admissions scandal is starting to fade; I saw only three articles on it in the past couple of days. Now, according to The New York Times, universities are starting to consider if they should de-enroll (not expel) students who matriculated through fraud, whether the students were aware of it or not.

As the paper put it, these students “face a reckoning as universities seek to determine whether they were innocent victims who should keep working toward their degrees or unethical schemers worthy of discipline.”

Ouch. That’ll make peer pressure tough in their dorms and classes…

I’ve got a better question…

Fraud should be eliminated, and if a kid played a part, kick them out. But for the rest of the involved students, shouldn’t we ask if they’ve been doing their work?

The entire situation speaks to a bigger problem. We’re so caught up in “fair” that we downplay “competent.”

With unemployment sitting at or below 4%, this might not sound like much of a problem. If you want a job, you can get a job, almost regardless of your attitude and aptitude.

But businesses aren’t charities. They don’t troll for more donations to keep the doors open.

When the economic cycle rolls over in the next year or so, companies will be paring their payrolls to match falling revenue. Less productive, and more troublesome, employees will be the first ones shown the door. And when your kids exit through that door, they can find themselves at your door, which can be a problem.

I speak with my kids every week, including my son in his mid-20s in Colorado. The current brouhaha reminds me of when he was going through the college application process in 2011, between his junior and senior year of high school. It was a pretty dark time for the U.S. economy, and the world was trying to hide in academia. He’d done well at a college prep high school, and had solid extracurricular activities, so I thought he’d be okay when applying to colleges.

Then he threw me a curve ball…

That summer he went to an honors early-college program at the University of Alabama. They lived in dorms, went to college classes, and earned a couple of credits. I asked why he wanted to go, and he told me, “I get to live away from home for five weeks.”

It was good enough for both of us.

He enjoyed the program, earned As, and when he got home, he applied to Alabama. With his SAT scores he was admitted and received a substantial academic scholarship, which brought the cost down to in-state tuition.

I told him that was fine, but wondered why he didn’t want to apply to a reach school.

He replied, “Reach for what?”

I’ve always considered writing a book with that title. In one short response he encapsulated a perverse world where admission to an elite school is considered an objective stamp of approval for the child and the parents. Both earn a merit badge that shows the world their demonstrable success.

Make no mistake, it can matter, at least at first…

When we see elite college names on resumes, we notice. When parents throw down college names like Pokémon cards at neighborhood barbeques, it catches people’s attention. But parents are fighting yesterday’s war, where we as employers and business owners have to play by today’s rules.

A recent Morning Consult/New York Times poll captures the problem.

The results show that 76% of parents with young adults aged 18 to 28 years would remind them of a deadline for homework or a test. 74%, made appointments for them, like doctor’s visits.

A smaller but still-significant number were even more involved. 16% helped their kids write job applications, and 11% said they would call their child’s employer if they had a problem at work.

Remember, these are young adults…

Unfortunately, we can’t rely on an educational pedigree to guarantee that a newly-minted graduate is ready to work. Sure, they have the piece of paper, but can they do the job without their parents? Did they learn enough to contribute? And importantly, can they handle the rough and tumble real world where they must confront ideas they don’t like, and then work through logic and reason to deal with them, instead of worrying about hurt feelings?

As a parent who’s very interested in my kids being on someone else’s payroll, I pay attention to this. I want my kids to contribute to the bottom line, be first to volunteer for extra work, and help their employer weather the tough times ahead.

When I talk to them and hear their tales of woe from the office, I commiserate… and then I remind them that businesses are not democracies, and aren’t the moral arbiters of society.

Fair is a nice concept, but equal under the law is our best shot as a nation.

If they can establish themselves as great employees and workers now, perhaps they will be economic survivors in the years to come, which will help them with their personal circumstances, and allow me to focus on my eventual retirement.

My son had a fabulous time at Alabama. He has no student loan debt, and has been off my payroll for some time. Clemson notwithstanding, Roll Tide!

Rodney

March 20, 2019

Climate Change, Economies, and the Markets

The cold makes people happy (and more productive… in every way… ahem). The warmth makes people unhappy (and less productive). And, as Rodney and readers have been debating a lot lately, temperatures across the globe are changing. Frankly, I was surprised at the hot button this topic proved to be!

But, just like productivity, and even happiness (weather considerations included), global warming is cyclical. I learned long ago that there is always a hierarchy of cycles for any particular phenomenon. The weather. Demographics. Markets. You name it. You wouldn’t believe what my hierarchy of economic and market cycles have teed up for us this year!

There’s always a single, dominant trend, but also always another two or three that have significant impacts worth including. Of course, there are dozens of other cycles of every duration, but if you considered them all, your brain would explode. Besides, most are insignificant and too variable.

Three cycles…

There are three particular cycles that have a bearing on the noticeable changes we’ve seen in the Earth’s climate in recent decades and centuries.

The first is the longest-term Ice Age Cycle. It bottomed around 20,000 years ago, after which it entered a rapid warming period from 12,000 to around 5,000 years ago. These Ice Age Cycles come about every 100,000 years and are mapped out in the infamous three Milankovitch Cycles, which describe the collective effects of change in the Earth’s movement on our climate. According to the Russian’s research, the cycles should have seen cooling a bit since five centuries ago, but are now warmer than ever.

Have you noticed how good Russians scientists seem to be at identifying and isolating cycles? Think of Milankovitch or Kondratieff, whose work led me to discover the Four-Season Economic Cycle, which warns that the end of this year’s Dark Window will be more devastating than any other in history.

Must be the cold.

Besides, scientists are cycle masters. Economists, not so much.

Clear evidence we’re to blame…

This divergence from clear cycles was evidence to me that man-made cycles were indeed influencing natural ones.

Central Banks have staved off the worst of the Economic Winter Season (not prevented it, mind you… we’re still facing that epic crash), and humanity in general is changing global warming and cooling cycles.

That brings me to the second cycle in this hierarchy of three: rising CO2 levels from pollution (and methane, ocean acidification, fertilizer and effluent run-off into soil and water). This is dangerous stuff! The crime of the century, from my view. Not recycling your wastes is like shitting in your own back yard.

This is more like an exponential rising trend than a cycle. Its impacts are also cumulative, making it harder to reverse and that much more dangerous. CO2 and warming since 1800, and especially since 1900, correlate perfectly. And it will very likely have major consequences in the future for warming and the toxicity of everything.

There is another, important, shorter-term cycle involved as well: sunspots.

Where have all the sunspots gone?

Sunspot cycles have been diminishing in intensity since 1959, and much more dramatically since 1990. Scientists expect this to continue for another 10 to 20 years, maybe longer. It would be the joke of this century and a hand well played by God if we ended up seeing a mini-ice age in the coming decades after fears of runaway global warming!

The following chart shows sunspot cycles back to the last mini-age in the 1600s, called “The Maunder Minimum.”

The biggest impact of this cycle was an 80-year period of very minimal sunspot activity causing a mini-ice age between the mid-1600s and early 1700s. It’s even possible the present cycle could morph into something that bad, but it’s more likely it will be more moderate like the Dalton Minimum of the early 1800s.

The biggest impact of this cycle was an 80-year period of very minimal sunspot activity causing a mini-ice age between the mid-1600s and early 1700s. It’s even possible the present cycle could morph into something that bad, but it’s more likely it will be more moderate like the Dalton Minimum of the early 1800s.

But, you can’t use this shorter-term, lesser Sunspot Cycle to argue that we don’t have to worry about longer-term CO2 accumulation and warming trends. And, even if this cycle counters that trend even more and for longer, human pollution of this unprecedented depth and breadth has serious consequences on its own.

Sunspot Cycles also play an important role in economic and market activity, as I demonstrate in Zero Hour. In fact, this cycle is one of four in my hierarchy of cycles for economic and market forecasting. The other three are the Demographic Spending Wave, the Geopolitical Cycle (which I talked about on Monday), and the Technology Cycle.

The latter is a 45-year cycle, but as I recently discovered, most cycles have a magnified effect every second turn. So, every 90 years, the Technology Cycle has an outsized impact on the economy and markets.

Guess where we are in that cycle this year? Yup! Right on the 90-year mark. It’s one of the reasons I’ve forecast we’ll see a Dark Window in the markets in 2019… and why there will be a catastrophic crash to end it.

But that’s a topic for another day.

Harry

March 19, 2019

The Comfortable Call for Socialism and Your Tax Dollars

Democrats keep boarding the presidential hopeful bus, but they all want the same seat… the one all the way to the left. Whatever the topic, make it free, make it angry, and make it a “right.” The word socialism is getting new life, as even beer-brewer John Hickenlooper can’t bring himself to own the label “capitalist.”

I can’t help but notice that the call for more stuff, at the cost of others, comes from many who have never created said “stuff,” with Hickenlooper and Howard Schultz being outliers. Many of those aboard the President Express currently sit on the perch of a taxpayer-funded job, like a senator or governor. They get steady pay and benefits, including pensions, no matter what happens on their watch.

Must be nice.

Back in the real world, we have to run our businesses and do our jobs, where we hopefully contribute to profits, and pay the taxes to support all that stuff, which is decidedly not free. Contrary to how it seems when described by those calling for greater contributions, running a business takes effort… and perseverance.

Renting Golf Carts to Boomers

As a demographic play and another side hustle (to use a hip term), I recently started a golf cart rental business at the local beach. To be fair, my contribution is cash, as well as business acumen. My business partner is doing the heavy lifting. Many boomers want to see the beach and enjoy the atmosphere, but aren’t up for the walk. The business has great promise… if we can get there.

Beyond the regulations and permits required to start a business, we have to deal with site regulations for the properties and historical district restrictions on where golf carts can park… really. One struggle has been educating the police on where the carts can legally travel. They’ve been receptive, and we’re making progress.

We just received a nice note from the city asking for a list of business inventory so they can tax it, which adds to the list of payments that go out the door for everything except running the business.

I’m guessing the clarion call for higher taxes, while about me and millions like me, isn’t aimed at me. Instead, those hoping for the highest office (excluding the current occupant) are trying to get the votes of a younger generation. Axios just released a survey showing that 73.2% of Millennials and Gen Z-ers (the even younger set) want the government to provide health care. 67.1% believe education should be free. 49.6% want to live in a socialist society.

Socialism or Fantasyland?

I wonder if they’ve confused socialism – where the government owns the means of production and exists in garden spots like Venezuela and Cuba – with Fantasyland, where everything is free but exists nowhere beyond your parent’s home?

It could be that many of them are ignorant of the different forms of government and markets, and are confusing capitalism (good) with cronyism (bad). Given the current state of education, that makes sense. In a capitalist society combined with a republic, we have rules that apply equally to everyone, and all are allowed to pursue our own interests. We’re supposed to have equal opportunities in the eyes of the government, which is not the same as having equal backgrounds and support. We don’t have such a thing, but we come close.

In cronyism, the powers of nepotism, position, and wealth determine your status and path. Judging by the latest college admissions scandal, it looks like some of the highest profile college students got their spots through cronyism instead of merit and effort, so perhaps we can forgive them for their lack of knowledge.

I’ll say this about the scandal: It’s fabulous to see it exposed and the perpetrators facing charges.

I’ve always thought socialism has wonderful aspirations but no path for achievement, because it involves people. We humans are fallible beings, so we end up making a mess of such wonderful plans. As Lord Acton noted, “Power tends to corrupt and absolute power corrupts absolutely.” So far, capitalism has lifted billions of people out of poverty and improved the lot of most of the world.

I’ll take capitalism for $1,000, Alex. And by the way, we’re all with you in your fight against cancer.

The Sobering Act of Watching Your Paychecks Shrink from Gross to Net

Maybe the younger generations will gain a better appreciation for capitalism as they move out of their parents’ basements and work toward a life of their own. As they watch their paychecks shrink from “gross” to “net,” they’ll better understand the tax bite and begin to wonder where it all goes, and who gets to decide.

The worst part will be that, even though the current clamoring for more spending is leading to greater national debt today, it will morph into a lower standard of living tomorrow, just as our newest adults are trying to build their lives and their fortunes.

The misplaced idea that a nation can borrow all it wants as long as it borrows in its home currency misses the fatal flaw. This only works until it doesn’t, meaning one day foreign investors won’t be interested in lending to you in your own currency, but you’ll still have to repay them. That will require higher taxes, inflation, or both, which will damage the very voters who are being courted with socialist policies today.

In a weird way, I want our financial house of cards (as Harry describes) to crash as soon as possible so that we can begin the true rebuilding. This would be the sorting process we didn’t go through after the financial crisis of 2008, when we merely papered over productivity losses and other problems by printing money and issuing more debt. Better the debt bubble burst soon, both here and around the world, than continue to grow.

When the bottom does fall out, many calling for socialist policies will get their wish: We’ll have much greater income and wealth equality in our population.

But it won’t happen because we all got richer. Instead, it will come about because so many rich people suddenly became poorer.

And then the government will really need to raise taxes.

I hope that people still go to the beach to forget their troubles during tough economic times. And I hope they want to rent a golf cart.

Rodney

March 18, 2019

The Economic Benefit of Happiness

It always strikes me as odd that the happiest countries tend to be in cold-as-hell places like Scandinavia and Canada. It’s kind of similar stateside, too.

This weekend I saw a recent study by WalletHub that shows that the happiest states in the U.S. tend to be in the upper Midwest region – you know, where the Arctic vortex comes on through! In order of happiness, we have Minnesota, North Dakota, Iowa, South Dakota, Nebraska, and Wisconsin.

Those in the less-frigid-but-still-cold Northeast are also generally happier. We’re also talking just south of there: Virginia, North Carolina, and Georgia. And of course, the west coast is largely happy, except Oregon. The Rockies also, except Wyoming. And then there is the Southwest… Well, except for New Mexico.

The unhappiest states mostly fall in the inland Southeast and lower Midwest. West Virginia is ranked as the least happy state in the nation. Note the whitish and very light blue shadings.

So, what’s going on here and what economic significance does the data seem to carry?

So, what’s going on here and what economic significance does the data seem to carry?

Common denominators…

Well, two of the tangible common denominators from the individual categories are, not surprisingly, rising incomes and low crime/safety. The upper Midwest states have steadily growing shale jobs, which makes for a happier population. The Southeast and lower Midwest have been the hardest hit from our steady loss of manufacturing jobs.

There is also the fact that upper Midwest states have much more ethnic/cultural homogeneity, while the inland Southeast is very high on ethnic diversity. As a general rule, birds of a feather tend to get along better, a reality that became all-too-stark since my Geopolitical Cycle turned negative in 2001, with 9/11 sparking a tense 16 years filled with terrorist events, civil wars, mass shootings, protests, Brexit, Trump, and a resurgence of isolationist and nationalistic views…

Besides the cycle involved in this phenomenon, there’s a demographic element as well…

Who Are the Sad Sacks?

Recently I was watching Dr. Sanjay Gupta on Fareed Zakaria’s CNN show “GPS.” If you watch one show on geopolitics, his is definitely the most objective and factual…

Gupta noticed that the rising unhappiness is largely found in one particular sect of our economy: white, working-class males, especially between the ages of 45 and 54.

Gen Exers.

They’re faring worse in a declining economy brought on by their own declining numbers. Immigration, automation, and foreign competition, especially in manufacturing jobs, has made their experiences so much worse.

The U.S. has 5% of the world population and 80% of the opioid prescription abuse. Guess which generation dominates that epidemic! And guess where these people are concentrated: in the Southeast and Midwest… surprise, surprise.

These are the voters who went overwhelmingly for Trump and helped elect him, against all expectations and odds. These are the voters who are the most anti-immigrant, anti-foreign workers, and anti-Muslim.

All of this is to show you that my Geopolitical cycle has been dead on.

It All Comes Back to the Cycle

Like I said earlier, this cycle turned negative around the time of 9/11, with radical Islamic terrorist attacks in the U.S. and Europe.

But in recent years, 70% of such terrorist attacks have been from white supremacists. The devastating mass murder in New Zealand last Friday is just the latest example… and that’s in a country that’s peaceful and pro-immigration/diversity.

New Zealand’s Prime Minister immediately declared that they would change their gun laws. (The U.S. has only succeeded in theorizing on such change, like a broken record, after each of our mass slayings.) That is a sign of progress and that this cycle is coming to an end soon, as originally forecast around 2020.

But there is much more to come from this populist backlash against globalization.

The simple truth is that it’s the global and domestic people that have fallen behind in the massive job and technological revolution of the past decades that are the most unhappy and fighting back. In Zero Hour, I warn of a broader political revolution on a 250-year and 84-year cycle that is just coming to a head and from which we’ll see more changes in the years ahead.

The disenfranchised in the West have reacted against the radical Muslim and foreign worker threats. Now more of us are reacting against the white supremacists who are reacting with terror against that. Most of us are sick of both sides.

My view has always been that we will have to realign our political structures around more common cultures within countries and within global regions. Countries like Iraq and Syria, with strong Sunni and Shia populations. just can’t get along. That’s increasingly true of the blue versus red states in this country and in the northern versus southern regions of Europe.

Unhappy people cause political and social revolutions… it’s that simple. And there are plenty of them to be found around the world today. And my proven cycles saw it coming well ahead.

Harry

Follow me on Twitter @harrydentjr

March 15, 2019

The College Admissions Scandal is Part of the Cycle

Imagine that?! Parents cheating to get their kids into a good school. I couldn’t be less surprised at the recently exposed college admissions scandal. The education system is broken. Has been for decades now. Tuition is unaffordable to all but the upper class. Everyone else must drown in debt if they want to get a college degree.

One of the things that once made the U.S. such a great country was how our education system fueled upward mobility. Other countries tried to copy us and made great strides in their economies. Then, slowly but surely, our system perverted to what we have today.

The thing is, it’s cyclical. Everything is cyclical. That’s why I place so much emphasis on cycles in my research. They influence every aspect of our lives… and they’re predictable. Every positive cycle, will, at some point, turn negative. This is not just human nature. It’s the nature of nature.

Our education system was one of our strengths. Now it has become a liability. I discuss this in more details in today’s video. Listen now and then share your thoughts and comments.

Three discretionary consumer expenditures have bubbled to insane levels. Now they are negatively impacting our daily lives. Listen today to find out how and what this means to you… and what comes next.

Three discretionary consumer expenditures have bubbled to insane levels. Now they are negatively impacting our daily lives. Listen today to find out how and what this means to you… and what comes next.

Harry

Follow me on Twitter @harrydentjr

P.S. I’ll let you in on a little personal secret about how I got into Harvard Business School. Listen to find out.

P.P.S. Consider reading William J. Bennett’s book from a few years ago, Is College Worth It? It’s a damn good question, and a particularly important one to consider in light of the great reset we face into early 2020.

March 14, 2019

The Worst Is Yet to Come For This Economic Winter Season

Last Friday I talked about how we have been in a muted Economic Winter Season. We may have had the greatest stock market bubble ever, but our economic “recovery” has been the weakest on record, despite the strongest, globally-concerted stimulus ever.

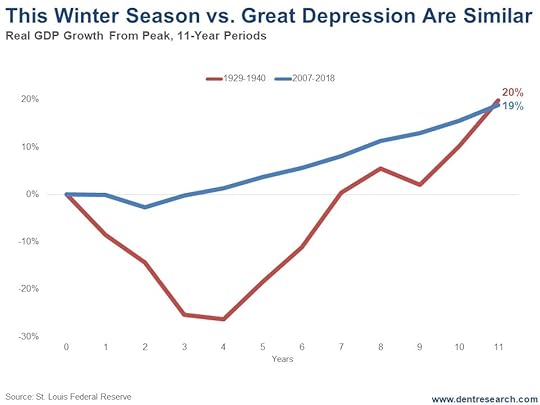

Here’s a chart comparing the real GDP for the 11 years from the 1929 top through the 1940 bottom to the 11 years from 2007 to 2018.

Notice how the cumulative GDP growth since 2007 is 19%? It was 20% from 1929 through 1940. That means this period has actually been slightly worse.

Notice how the cumulative GDP growth since 2007 is 19%? It was 20% from 1929 through 1940. That means this period has actually been slightly worse.

How could this be?

The clear difference is that the Great Depression started with the greatest crash in U.S. history, with stocks down 89%, 25% unemployment, and a GDP fall of 30% between 1929 and 1933.

Think of it like the Big Bang. The explosion came at the beginning and everything took shape from there.

The current Economic Winter Season also started with a stock crash and high unemployment: 54% loss in the markets, near 11% unemployment, and a GDP fall of 4.3%.

Mild in comparison…

But the recovery from 1933 to 1937 saw average real GDP growth of a whopping 9% per year. We’ve managed to eke out just 2% per year. Then there was a less severe crash and mini-depression or great recession in 1938 that lingered into 1942. Stocks bottomed in 1942 and the next great long-term bull market began.

What does this mean?

The next chart shows real GDP on a 10-year moving average to smooth out the trends.

Look at that remarkable difference: The period after 2007, with an average of 2% GDP, has already been lower than the extended recession and inflation trends of the Economic Summer Season from 1968 to 1982.

Look at that remarkable difference: The period after 2007, with an average of 2% GDP, has already been lower than the extended recession and inflation trends of the Economic Summer Season from 1968 to 1982.

This tells me that this Economic Winter Season will go out with a bang (as opposed to beginning with one, like with the Great Depression).

A final deep depression, debt deleveraging and economic crisis will see a 20%-plus fall in GDP, 15%-plus unemployment, and a stock crash that could rival that -89% for the Nasdaq and maybe even the Dow.

Talk about ass-backward.

The good news…

The good news is that my four key fundamental indicators are generally at their worst between 2020 and 2023 and turn up one by one after 2020. The Geopolitical Cycle turns up after 2020 as does the sunspot-driven Boom/Bust Cycle. The U.S. Generational Spending Wave turns up in 2023, making the 45-year Technology Cycle the last to flip, around 2032.

Hence, the worst of the next great crash is likely to occur by late 2020, and we won’t come out of it until 2023 or so.

After that, we should enjoy a stronger recovery and quick reforms that actually deal with the debt crisis this time.

Still, we won’t see as strong a recovery as that from 1933 forward because we face weaker demographic trends in the U.S. and developed world. The outstanding growth will occur in the emerging world, especially places like India and Southeast Asia.

I don’t expect that the central banks can create another heroic turnaround this time when their last “something for nothing” stimulus program fails so miserably. They didn’t deal with the debt and financial bubbles last time, so expect the worst ahead after this final bubble peaks later this year, or early 2020 at the latest.

Harry

Follow me on Twitter @harrydentjr

March 13, 2019

Consumers: Make More, Spend More

Last week was “risk-off” for stocks. This week, not so much.

Despite Boeing’s (NYSE: BA) 10% drop, initially pulling the Dow Jones down with it, stocks rebounded nicely on Monday and ended a five-day losing streak.

I’ve been saying volatility was going to rise, and last week it did across all sectors. But at this week’s open, that volatility has since backed off.

Most of what drove stocks lower over the past few months was doubt over the U.S. trade deal with China. And it doesn’t help that their economy has been slowing down.

We’re also seeing a slowdown in Europe. The uncertainty with Brexit is destabilizing. That uncertainty seems to be the only certainty, according to Britain’s Prime Minister Theresa May.

Economies in the major industrialized nations are naturally linked by trade. So, when one major economy falters, other major trading partners are likely to follow. It serves as an indicator to things to come. If China and Europe are already slowing, the U.S. economy is bound to slow as well.

In fact, we’re already seeing signs of slowing…

January Retail Sales…

The Census Bureau is still catching up on updating retail sales figures.

Consumer spending comprises nearly two-thirds of our economy and retail sales makes up half of all consumer spending. When spending slows, it stands to reason our economy will slow. Remember the horrific December sales report?

I’ll remind you that sales were reportedly down 1.2%. Headline sales were revised even lower in the latest report – down 1.6%. And when autos and gasoline were taken out, sales were adjusted lower from down 1.4% to 1.6%.

Some analysts, including myself, thought that the Census may have just gotten it wrong when they reported the dismal December sales and indeed they did! Only it wasn’t better than expected… it was worse.

So, Monday’s update of January retail sales was technically better than expected – up 0.2% on the expectation of a 0.1% increase. Excluding autos and gas, sales were up 1.2%, doubling the expected 0.6% rise.

But we can’t get all that excited if we take December and January together.

I blame poor retail sales on the government shutdown. If people aren’t earning money, how can they spend money? And if wages don’t rise, spending can’t increase. See the connection?

February sales will be reported on April Fool’s Day. We’ll have to wait until then for the punchline…

New Jobs Sparse While Wages Jump

Nonfarm jobs were expected to rise by about 175,000 in February, but only added 20,000. Stocks initially sold off sharply due to the news…

The unemployment rate dropped to 3.8% from 4% because of furloughed federal workers returning after the shutdown.

Earnings were expected to rise 0.3%. Instead, earnings jumped up by 0.4% after moving up by only 0.1% in January. Year over year earnings rose 3.4% – higher than the 3.3% analysts expected. Despite that jump in earnings, traders seem to be focused on the disappointment in new jobs created. Stocks ended lower for the fifth day straight.

Treasury yields are also slightly lower as money is flowing into the safety of bonds. Long-term Treasury yields sit at about 3.04%. The low end of the recent range is down around 2.99%. Despite last Monday’s stock rally, Treasury yields didn’t move all that much. And yesterday was a mixed bag. The S&P 500 and the Nasdaq surged again while Treasury yields fell back under 3%.

It goes to show that stock traders are looking ahead for some good news – like a trade deal with China. On the other hand, it highlights the uncertainty Treasury bond traders may be experiencing. When yields fall, investors are nervously buying bonds as a safety net for whatever is ahead for the economy.

We’ll see who’s right soon enough and we’ll see how the Federal Reserve sees the economy in just a few days.

Next week, the Federal Reserve will meet to update economic forecasts and decide if its course to hold steady on interest rates is still appropriate. Despite how cautious the Fed tries to be, its decisions – and sometimes just the comments alone – tend to move the markets.

Lance

March 12, 2019

The Debatable Cost of Climate Change

The Green New Deal article I published last week (“The Green New Deal Has Already Worked,” March 5) struck a nerve, particularly the part about climate change. I received a ton of feedback, some of which I’ll put at the end of this article (so read it through!).

Many of you agreed with my view of the Green New Deal (GND) plan as both unworkable and not the main point, while others noted we’ve got to address climate change starting now.

Several of you took me to task for not offering a solution. Well, let’s do that today.

I’ve studied climate change for some time, and while the space constraints of Economy & Markets won’t allow me to fully air the research, I can give a sense of it.

How Warm Will it Get?

The best temperature modeling came together in the late 1990s, and we started tracking temperature with these models in 2000.

Since that time, only one has been accurate, model INM-CM4, so let’s follow what that one has to say about the future. This model calls for temperatures to increase modestly over the next 80 years if we do nothing. The average temperature has remained well below the average estimate of all the models combined.

There’s no question it’s warmer than before the Industrial Revolution, but the most accurate model over the 20 years we’ve been focused on this is not calling for dramatically higher temperatures.

We need to determine why the forecasts have been wrong, and what makes this one model accurate.

What’s in the Assumptions?

The International Panel on Climate Change (IPCC) and the National Climate Assessment (NCA) use an emission assessment from 2007 that doesn’t account for the move from coal to natural gas, a move that has already started in earnest.

As this trend continues, societies will mitigate some of the estimated climate change because it is cheap and efficient to do so, not because of government mandates.

Going At It Alone Won’t Work

Most countries that signed onto the Paris Agreement aren’t anywhere close to their targets, and it’s already been four years. The U.S. accounts for only 15% of new greenhouse gas emissions, so our efforts at curbing emissions are just one-sixth of any possible solution. Countries like China and India, with more than 2.5 billion people between them, would have to dramatically shift their energy structure over the next 12 years for the efforts in the U.S. to bring about the changes discussed in the GND and elsewhere.

The Cost of Mitigation is Astronomical

The total U.S. cost of mitigating climate change is somewhere between $1.3 trillion and $14 trillion, depending on whom you ask. Just as with any spending, we should ask if the outcome is worth the investment. Or if there is a less expensive option that provides a substantial amount of the desired result.

What if We Don’t?

Per the IPCC and the NCA, if the temperature rises as forecast, U.S. GDP would expand by 385% instead of 400%. Granted, that doesn’t speak to localized effects in low-lying coastal areas, but there is zero question that as the temperature increases, people will adapt.

Prices for land in low areas will decline over time, and populations will move. They won’t wait for 81 years to look out the window and then be surprised to see water.

The point is that populations have always adapted as the environment has changed, and this will be no different.

Is Climate Change the Best Use of Funds?

The Copenhagen Consensus asks economists to list the major challenges facing humanity, assign a cost, and then prioritize how to spend the world’s limited funds. Climate change makes the list… at number six.

In terms of improving the lot of humanity, other initiatives like eradicating malnutrition in pre-schoolers, eradicating malaria, wider immunizations, and de-worming children would have a much greater positive effect for the dollars spent.

What We Can Do

In the U.S., we can continue down the path we’re on, replacing coal-fired plants with natural gas plants. We could also dramatically reduce our carbon footprint by re-evaluating nuclear energy, which remains the most reliable, low-carbon, and safest source of reliable energy available, even with accidents around the world.

We can use Miami as an example of how coastal communities can work to abate some of the effects of rising sea levels by implementing new building codes and developing new drainage systems.

We can also explore geo-engineering approaches that might ease some of the expected warming.

One approach is to create clouds of water vapor over parts of the ocean simulating low-lying clouds, which would stop the ocean beneath from absorbing as much sunlight. If the project created unintended bad consequences, it could be stopped immediately and the vapor would disappear rapidly.

Geo-engineering gets a bad rap because if it works, then people will be less inclined to move away from fossil fuels. This goes back to determining the goals before we start measuring and attacking the problem.

Is this about improving the lot of humanity while being good stewards of the environment? Or is it about moving away from fossil fuels at any cost and redistributing assets from wealthy countries to poorer nations?

Before we can agree on solutions, we have to agree on the problem.

Now, let me share some of the feedback I received. I don’t have space here to include all the messages.

Norton S. wrote:

You do a good job of bashing the GND, but do not present an alternative. As you say, a carbon tax is a drop in the bucket. Even a massive energy infrastructure program is not the answer. We face a constellation of interacting issues, many related to climate, but others such as resource depletion, over fishing, land erosion, toxic chemicals. Not to mention debt and a political system that has lost its legitimacy and ability to govern effectively.

We live in an illusory world, pretending that we are divorced from the ecosystem that supports us. … It seems to be a flaw in the human psyche. Every civilization that has gone before us has collapsed, some like the Mayan Culture disappeared completely, others like the British Empire merely contracted by 95%. But as far we know no country foresaw the collapse and planned for the transition.

We have a choice to make the transition in an orderly way or let events dictate the path. Is the GND a step in that direction? Yes, but not nearly radical enough to be effective. By the time it is diluted by the legislative process it will be more or less meaningless.

Donald W. said,

[The GND] is pure unadulterated garbage. It’s a ploy to gain more control over the citizenry as well as extract hundreds of billions of dollars in new asinine taxes. Anyone who votes for this pile of horse dung is a blithering idiot.

Craig H. was succinct,

Spot on description. It is terrifying on the surface and disastrous in reality.

Rob A. said,

Wow, your article hit home. Our new Democratic governor here in Michigan is doing the same thing, pushing for a 45 cent a gallon tax increase to pay for roads, the mea teachers union and other largess. So we the tax payers are getting played again by this governor and all the other politicians who like to spend OPM other people’s money…

This will not end well. First market crash, then Federal Reserve will really start printing QEing trillions to pay all the debt, and we get inflation and high interest rates like the 1970s. Stagflation.

Finally, Thomas S. wrote,

Dear Mr. Johnson,

You seem to have missed the point on climate change. Certainly we will have to do things to mitigate the effects of climate change, however you miss the science that shows climate change is accelerating in a cascade effect. The warming that has already happened is causing the release of even more greenhouse gasses that, until now, have been sequestered in places like the Alaskan and Siberian tundras.

Every day that we delay taking action to slow the emission of greenhouse gasses makes the problem worse. If we don’t take action to slow it down, no amount of mitigation will make it possible for human beings to live on this planet. It’s not an either/or proposition. It’s a matter of prioritization. We are capable of walking and chewing gum at the same time.

Again, thank you to all who responded. I appreciate your feedback!

Keep the conversation going at economyandmarkets@dentresearch.com, or on our social media channels.

Rodney

March 11, 2019

We’re Overdosing on the Debt Opioid

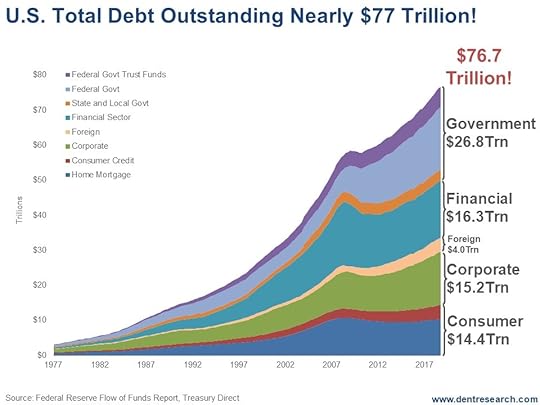

On Friday, I talked about how the last 11 years have been no better than cumulative GDP during the Great Depression (1929-1940). I’ll talk more about that on Thursday. Today I want to point out the biggest difference between this Economic Winter Season and the one 80 years ago…

That is: Central banks!

Thanks to their interference, our massive debt bubble didn’t deleverage as it should have!

Total debt peaked at $58.4 trillion, or four times GDP, in the first quarter of 2009 and just barely deleveraged in the financial and consumer sectors during the Great Recession.

But massive money printing and cowardly suspension of mark-to-market policies for loans let the banks off the hook.

The Economic Winter Season’s primary purpose is to flush out unproductive debt and deleverage financial asset bubbles that are weighing down the economy and stoking income inequality.

The Economic Winter Season’s primary purpose is to flush out unproductive debt and deleverage financial asset bubbles that are weighing down the economy and stoking income inequality.

It forces businesses to cut excessive costs and get more efficient.

All of this makes the economy much more productive and ignites a strong recovery, like the one we saw from 1933 to 1937… and for decades to follow.

Well… no detox means no strong recovery!

Japan is the poster child for a comatose economy three decades after their great crash.

Our poor GDP numbers over the last 11 years is evidence closer to home.

Still, our debt continues to grow. Government debt leads the way, with corporate debt close on its heels.

Federal government debt has exploded from $7.8 trillion to $17.9. That’s a 129% increase.

Federal government debt has exploded from $7.8 trillion to $17.9. That’s a 129% increase.

The government debt has been doubling about every two administrations or every eight years. Counting the trust funds like Social Security (sitting around) $5.9 trillion, we’re up to $23.8 trillion.

Overall government debt, including state and local, is now at $26.8 trillion; up 77%.

Foreign debt is up the most: 152%, to $4 trillion… but it is the smallest sector.

The other big sector is corporate debt. It has grown from $10.6 trillion to $15.2 trillion. That’s an increase of 44%. And the majority of that debt is BBB rated or lower… just one step above junk.

The whole world went on a corporate debt spree. What with low interest rates it was a no-brainer.

In the U.S., much of that cheap money went to buying back stock to leverage earnings; a move that will look stupid when companies most need cash to survive the greatest shake-out of our lifetimes during the next several years.

Consumer debt is only marginally higher than it was at the 2009 peak, with mortgage debt down 2%. But consumer credit – cards and car loans – are up 53%. And a subprime auto credit crisis is rearing its ugly head, with defaults a major – and growing – concern.

Financial debt is down 9%… but this was the most toxic and out-of-whack sector in the 2008 meltdown. The fact that it’s still this high 11 years later is actually terrifying.

The implications are clear and simple: We’ll have to finally see debt deleverage from higher levels in the next crisis, which is clearly due between 2020 and 2023 by my most important cycles.

It won’t be pretty. In fact, it’ll look like 1930 to 1933. Only this time, rather than having the crash at the beginning of the Economic Winter Season, like we saw at the start of the Great Depression, we’ll have the crisis at the end.

2008 to 2023 will go down in history as the Economic Winter Season central banks couldn’t stop.

Harry

Follow me on Twitter @harrydentjr