Harry S. Dent Jr.'s Blog, page 22

July 3, 2019

Surge 25% or Fall 25%?

I sent a market update to Boom & Bust subscribers in our 5 Day Forecast last Monday. I explained that stocks saw their biggest correction since late 2011, which makes that a 4th wave correction leading into a 5th wave final blow-off rally… what I have been calling the Dark Window scenario. My target is around 10,000 on the leading index, the Nasdaq, and around 33,000 on the Dow.

It’s likely we saw the first wave up into early May with two more strong surges ahead. We have just made new highs on the Dow and S&P 500, with the Nasdaq coming close to a new high.

Is this a breakout in the next wave up?

I think it’s likely…

But there is a pattern that still warrants near-term caution…

Note that this megaphone pattern sees higher highs and lower lows until the final breakdown projected to about 20,000 on the Dow. The top trend-line would be around 27,300 on the Dow and 3,025 on the S&P 500, just a little over 1% above the market’s projected open today.

The Final Dark Window

This pattern does not have to play out on the downside. But if it does, it would suggest a new correction of as high as 27% in the Dow. That could take the Nasdaq down to its “line in the sand” at around 5,700. That’s down about 30%. (I covered that original analysis and forecast from early this year on Monday).

If that level holds, we could still see that final Dark Window blow-off rally, but to more like 9,600 – that would be a near 70% rally in just several months, instead of the 25% rally projected from here, and 30%-plus after a minor correction ahead.

If there is another total breakdown in the China trade deal, and perhaps some dangerous tensions with Iran, we could see this steeper correction in the next few months.

A More Likely Forecast

However, the more likely scenario is that this pattern of slightly higher highs simply creates resistance near term and a more minor correction into mid-July and then we see that next strong surge up on the way to Dow 33,000 and Nasdaq 10,000-plus, likely into January of 2020, or March at the latest.

The first crash after that is likely to be 40%-plus in two or three months, or a Nasdaq back around 6,000 or lower. That would break the line in the sand and will throw a monkey wrench into the election!

A pullback and then a clear break above this top trendline would be the sign that we are on our way up.

A sharper correction nearer-term and follow-through into August on the downside would suggest the stronger-correction scenario.

Adam O’Dell’s indicators are still supporting the bull market for now. So, the bullish breakout after a minor correction is still the more likely scenario…

And bitcoin still looks to be rocketing towards $32,000, after hitting near $14,000 recently. This pullback is not likely to last long.

July 2, 2019

Millennials Will Decide The 2020 Election

The recent Democratic presidential primary debates were a lot of fun… said no one.

As the process unfolds, I vote that Andrew Yang gets the first question at every debate, since he was given all of three minutes out of 120 on Thursday night. And Marianne Williamson gets to interject anytime she wants, because she’s so off the wall as to be entertaining during an otherwise dreadful affair. If she ever sings “All You Need Is Love,” a Capella on the debate stage, I’ll strongly consider giving her my vote.

But back to the debates…

Positions of Presidential Candidates

It’s not the positions of the candidates that makes political debates so hard to watch. It’s the way the candidates pander as they use their time to puff up their chests and fake outrage at whatever crosses their minds. We don’t learn much about their policies and proposals. We just get a glimpse of who’s a better street fighter and quick with a pithy response.

We know – or rather can guess (because who really knows?) – President Trump’s views as we march toward 2020. And we’ve got a fair idea of how the leading Democratic challengers view the world. Senators Bernie Sanders and Elizabeth Warren want to repeal the recent tax reform, add wealth taxes and higher income taxes. And they want to add regulations and bureaucracy in an effort to make education, health, wealth, and opportunity fair. Joe Biden will do some of the same, although not quite to the same extent. Great goals, but such programs typically fail when we add that fallible ingredient to the mix… people.

It turns out that the people determining what’s “fair” always have a different idea about it than those who are identified as the main source of new revenue. A certain group of billionaires raising their hands to be taxed notwithstanding.

Millennial Voters

The most interesting group that will sway the 2020 election wasn’t onstage. They were watching from home.

They are Millennial voters, and their political tastes are dramatically different from their parents and grandparents.

The Pew Research Center conducts an annual survey of likely U.S. voters, tracking their political leanings by age and sex. Men lean more conservative than women, and older voters are more conservative than younger voters. Pew divides voters into four generations: the Silent Generation, Boomers, Gen-X, and Millennials.

To get a sense of the spread among voters, consider that 57% of Silent Generation men vote conservative, while only 41% of Millennial men lean to the right, a difference of 16%. Among women, 48% of the Silent Generation are conservative, while just 23% of Millennial women identify on the right, a 25% drop.

A full 70% of Millennial women identify as Democrat or lean Democrat, the highest percentage of any category, men or women, young or old.

And there’s a lot of Millennials…

In 2018, the younger generations of the Millennials and Gen-X outvoted the older generations of the Silent Generation and Boomers. The count was 62.2 million to 60.1 million. The younger group increased its voter count by more than 20 million from 2014 to 2016.

And only more have progressed to voting age.

By the time the presidential election rolls around, the Boomers and Silent Generation will be less than 40% of the electorate. The youngest group, Gen-Z, will make up 10%; the rest will be Millennials and Gen-X.

A New Generational Divide

The growing younger voting class has less wealth and income than their parents did at the same age; they own fewer homes and have started fewer families.

But they do far outpace the older set in two areas: more education and more debt. And they got both at the same time.

About 40% of Millennials and Gen-Z finish college, well ahead of the numbers for even Gen-X. With that education comes mountains of student loan debt, and yet their earnings aren’t growing like they did for their parents.

And don’t forget the 60% that didn’t get a college degree. About one-third of that group tried college but didn’t graduate. Those who took some classes, and took on some debt but didn’t earn the piece of paper, suffer the most with loans because their earnings typically remain low.

We’re setting up for yet another generational divide, with older and younger voters split on how they prioritize issues. This isn’t new, but it’s intensifying given the mounting financial pressures young Americans face.

Maybe President Trump pulls out another victory, riding an economic wave and stock market boom. But by 2022, those issues will quickly fade as political drivers, because the influence of older voters is fading and the rising generations have a very different view of what’s important. And if the economy and markets follow Harry’s forecasts, then few voters of any generation will be happy.

Changes are coming, including higher taxes and greater wealth redistribution. It’s just a matter of whether the young voters usher in the new era in 2020, or 2022.

Make sure you’re prepared before it happens.

July 1, 2019

Good News, Bad News, Markets Don’t Care

Markets popped higher this morning after a weekend of good news: The Donald and Xi Jinping have agreed to a temporary truce in the U.S.-China trade war. The Donald has eased trade restrictions on Huawei. And The Donald made nice with North Korea.

On Friday, I explained that markets were at that critical point where they could either roll over and die or zoom to the moon. Today’s market action shows we’re clearly following the Dark Window that I forecast back in January already. I hope you’re taking advantage of it.

I first mentioned the Dark Window opportunity in January. While I’ve updated you on the market’s progress along this scenario many times since then, it’s been a long time since I spelled out my forecast. So, in light of today’s market madness, let’s take a trip down memory lane and re-read an email I sent you on January 9th.

I’ve added some highlighted notes below to account for events we’ve seen since this was published.

How the Nasdaq Could Reach 10,000 in 2019

Who would have thought I would be forecasting that the Nasdaq could zoom to 10,000 this year? [Up until this point, I was known as the market bear with nothing but doom and gloom predictions…]

Two things have changed my perspective in recent months: The Q4 2018 crash didn’t approach the typical 40% loss in the first two to three months, as was typical of most major bubbles… and my newer 90-Year Bubble Buster Cycle.

That 90-year Cycle is a “double variation’ of my proven 45-Year Innovation Cycle. It has marked the greatest bubble peaks and “resets” since the Industrial Revolution (1837 to 1842 and 1929 to 1932).

If the current correction doesn’t crash down much harder by early February – which doesn’t look likely at this point [and it didn’t] – then a final blow-off rally would be most consistent with past major bubbles, especially the ones that hit on this 90-year cycle.

What I’ve Been Looking At…

I’ve been looking at the finally bubble rallies on all the key indices: The S&P 500, the Dow, and especially the Nasdaq because it’s the lead bubble of the lot.

What I am noticing is that the best support on the final rallies since early 2009 come from a linear trend-line through the bottoms, but the best rally and upside targets come from exponential trend-lines through the tops.

Here’s my best chart for the leading Nasdaq…

What This Chart Is Telling Us…

First note that bottom linear trend-line. It comes through at around 5,500 in early February [and currently that line in the sand is 5,700 – 5,800 just ahead].

The same trend-line on the S&P 500 comes through around 2,300 currently and will be hit first, and hence, be the first warning, if broken, that this Nasdaq support line could be hit. Again, the Nasdaq is the trump card here.

Next note the progressive nature of the rally.

The first wave into 2011 was more normal.

The next wave into 2015 was more exponential.

What Does This Mean?

If the markets can hold key support ahead, especially by early February, the next rally would project to around 9,500 on an exponential trend, or as high as 10,000 if it makes similar point gains to the last rally in 38% of the time. That takes us into late 2019/early 2020. [Of course, the markets did hold key support, and while they have had a hiccup here and there since January, they remain on track for this target on the Nasdaq by year end.]

From the recent lows of 6,190, that’s a 53% to 62% gain.

From the bottom trend-line of 5,500 if reached, that’s 73% to 82%!

If we can hold the 2,300 level on the S&P 500 in the next month, this bullish scenario becomes much more likely.

Should we hold the bottom trend-line on the Nasdaq, around 5,500 currently, it could still follow this extremely bullish scenario.

If the S&P breaks 2,300 substantially suggesting a top in late 2018, then it could just retest its highs, while the Nasdaq rings the big bell with major new highs, assuming it holds 5,500. That would also be consistent with past bubble tops.

I cover the most basic bullish and bearish scenarios in the January edition of Boom & Bust. Don’t miss that issue and keep it handy as I’ll refer to it in updates in the weeks and months ahead. [If you missed it, go back and read it… or get your hands on it.]

One way or the other, 2019 looks to be very different than what many on Wall Street expect. It’s very likely to either be very bullish or very bearish. Not the middle ground they’re suggestion. And I’m still favoring the bullish scenario unless proven otherwise.

We will keep you updated.

I’ll add that, over the last several months, stories in the mainstream media have shifted from being pessimistic to more greed oriented. I’m seeing with increasing frequency the call to get ready for the markets to delivery huge gains in short order. As you encounter these articles, just remember: you heard it here first.

[image error]

June 28, 2019

Stock Markets Are In A Crucial Place

I’m coming to you today from Myrtle Beach, where my entire family gets together for their annual reunion. It doesn’t matter where I am though, I watch the stock markets like a hawk. And right now, the markets are in a crucial place…

We’re back to testing the highs and things can go either way here. Stock Markets could break down 25% in the near term… or they could shoot up 25% in the next several months in the final blow off Dark Window rally before the big crash.

But today, while I touch on my market targets for the rest of the year, I really want to talk to you more about the unusual activity we’re seeing in bitcoin and bond yields… and even more so, the two wild cards hanging over the markets right now.

We all know the U.S.-China trade deal is one of those wild cards… but the second one is much newer and potentially far worse.

Watch now to get all the details…

When you’re done, do yourself a favor and check out Charles Sizemore’s new “Flex-10 Index.” His 20-year back test shows how this custom index tracking a basket of 10 stocks could have crushed every major benchmark index, despite market corrections and crashes along the way. Click here for the details.

June 27, 2019

If It’s Free, It’s Going to Cost You

The Democratic debates are underway, so if you’re a masochist with no hobbies, you now have something to watch at night.

This isn’t a knock on a particular political party. Watching the Democrats today is just as unenlightening and boring as watching the Republican debates in 2016. Moderators ask candidates questions and they fail to answer and go on long screeds about whatever they happen to champion or hate.

Accountability Please

As with everything else related to politics, there should be a mechanism for accountability. During the debates, which typically include an audience, people should be able to vote after every answer as to whether or not the candidate addressed the question. They get their full time on the next question if they score more than 50%. If they get 25% to 49%, they get two-thirds of their time for the next question. If they drop below 25% on an answer, they only get 40% of the regular time for their next answer.

The extra time won’t be re-distributed to anyone else; it will be removed from the debate, effectively giving it back to us, the viewers, as a thank you for having suffered through the show.

None of this will happen because networks want more airtime and everyone likes to hear themselves talk. And accountability? Please. That’s a four-letter word in Washington that can be summed up as “cost.”

As the candidates walk through their ways to save us from ourselves, you should keep that word in mind. “Cost.” They won’t use it. They’ll use another four-letter word, “free.” When a political candidate uses the word “free,” we should reach for our collective wallets.

And we’ve got a slew of “free” programs to talk about with this group!

Primary Pipe Dreams

Senator Elizabeth Warren has a plan to make college free, and will even erase student loan debt on a sliding scale for everyone with up to $250,000 in income.

Bernie Sanders has a plan to erase all college debt and to make all public two- and four-year colleges free forever.

Most of the contenders have a plan to offer a public health care option, sort of a Medicare-for-All, which will be free to many, while a few want to make it mandatory and get rid of private health insurance. Andrew Yang is promoting a Universal Basic Income, which provides a monthly stipend to every working-age adult in the country, and Marianne Williamson is promoting reparations to the black community for slavery. Among the candidates there are various proposals for family leave and child care.

And then there’s the big one… climate change. The candidates won’t be so bold as to claim that reducing greenhouse gas emissions will be free, but they’ll definitely point out that average Americans won’t pay for it.

Which is, as President Harry Truman used to say, a bunch of manure.

When it comes to governments, they spend everything and pay for nothing. Taxpayers foot the bill, one way or another. And when the taxes are levied on businesses, the pain passes through to consumers in the form of higher prices. If we follow the bouncing ball to the end, we find that consumers and taxpayers pay for all social programs, no matter how politicians claim they will spread the cost.

Bearing the Burden

Unfortunately, the taxpayers and consumers are the same people, you and me.

I’m not arguing for or against more social spending. I’m pointing out that any new spending by the government will take money out of our pockets. Those are dollars we could have used supporting our families, planning for retirement, or any other goal of our choice. And once the government starts handing out money for things, it’s really hard to stop.

This notion isn’t lost on investors. It’s why the markets sagged as we limped toward the 2016 elections. The world thought Hillary Clinton would win and ratchet up government taxing and spending. When Trump surprised everyone, the markets exploded.

We’re going down the same road in 2020, but the programs are bigger, which makes the stakes higher. So every time you hear a candidate talk about “free,” or how a new initiative will be paid for by a “small group,” remember that it never works out that way. The burden always comes back to the average American as a taxpayer or a consumer. Is it worth it? That’s something you get to decide in the voting booth next year.

June 26, 2019

What Makes Canada, Scandinavia, and Finland Good Investments

We live in a world where we wake up to news (and a shocking image) of a drowned father and daughter on the banks of the Rio Grande and threats from North Koreans about not letting the U.S. “bring them to their knees.” Tensions between the U.S. and Iran are rising all the while politicians continue to waste time and energy on irrelevant shit like Mueller testifying publicly.

It all makes me want to escape to the beach where I can soak up the sun and cool off in a turquoise ocean oasis. Escape doesn’t take the problems away or resolve them… but the beach…

Wouldn’t you agree?!

The Colder The Happier

Granted, I live in Puerto Rico and have a house on the island Culebra. Escape is literally on my door step…

But did you know that, while most of us developed-world citizens dream of and seek moments of peace in a warm environment, it turns out that heat is bad for our happiness.

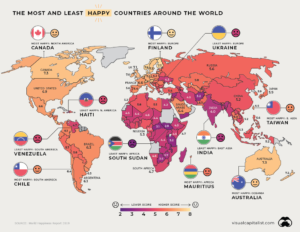

The World Happiness Report 2019 produced this colorful and intuitive map of the world rated by the happiest and unhappiest countries.

A few simple insights stand out to me…

The coldest countries tend to be the happiest. Seriously. Cold, harsh weather is one of the first things that creates unhappiness for me… one big reason why I’m in Puerto Rico where the year-round average hi-low temperature range in San Juan is 75 to 87 degrees. But then I’m known for being an odd duck.

The highest happiness ratings are in the northern zone, from Canada through Scandinavia… with Finland the highest at 7.7. Other rare 7-plus ratings are in numerical order: Norway, Sweden, Canada, U.K., Ireland, and Germany.

Then other happiest 7-plus countries are deep below the equator: Australia and New Zealand. The Latin American countries way down south, like Chile and Uruguay, also tend to be happier.

The thing is, it isn’t the temperatures themselves that make us happy or unhappy, but what the recorded degrees on the thermometer force us to do.

It’s not the cold weather that makes people happier – obviously. It’s that a cold environment requires more innovation and evolution, which in turn results good investments and greater wealth.

Forging Toward Challenges

When humans began to populate the world, there were three massive migration cycles “Out of Africa:” 70,000 to 80,000 years ago around the India Ocean, 30,000 to 50,000 ago into Northern Europe and Russia, and 10,000 to 20,000 years ago into North and South America after the last ice age.

The migrants that went into colder climates faced greater challenges and hence were forced to innovate and urbanize more – and innovation drives wealth, as I discussed on Monday.

Even in similar southerly climates, many Asian countries are more productive than in Latin America and Africa simply from higher population density and competition after the last ice age pushed masses of humanity into southern Asia – i.e. southern China, Southeast Asia, and India – the clear growth regions into the future.

The Correlation Between Wealth and Happiness

Happiness has proven in psychological studies to increase markedly up to about $75,000 in income – upper middle class. After that there’s little measurable gains, except bragging rights about your wealth. The wealthiest western and east Asian countries tend to range largely from $40,000 GDP per capita PPP (purchasing power adjusted) to $60,000. The U.S. is on the highest side of that with happiness ratings of 6.9. High income inequality works against us a bit, and of course, Canada is colder.

I have always said that there’s a band that contains most of the affluent countries in the world. It spans roughly from Toronto to Miami through Northern and Southern Europe and through Saudi Arabia, northern India, Thailand, and China. They are the up-and coming wealthy nations of the world.

Taiwan at 6.5 is the happiest in Asia as it’s the wealthiest and most urban. India is the least happy currently as it’s one of the poorest in Asia and as slow to urbanize as Sub-Saharan Africa.

That northern cooler band is so dominant because it has the largest and most parallel land mass. And it’s where innovations, especially in agriculture, could be adopted in similar climates with less transportation barriers. Jared Diamond first explained that brilliantly in his best-selling book: Guns, Germs and Steel.

The northern countries tend to be more technologically-sophisticated and urban. The southern hemisphere countries tend to be more focused on commodity exports, which is lower value-added: Africa and South America. But then there is the cooler band from Chile and Uruguay through South Africa and Australia/New Zealand that is more-affluent and happy.

Affluence Asia

Another global trend: The leading edge of affluence has moved systematically westward from Europe to North America to East Asia. And increasingly into the rest of Asia. Africa will be the last to urbanize and become middle class, but with the least rewards as the first to innovate get the rewards and greater cumulative learning curve.

The paradox is that the initial innovators of the human race came exclusively out of Africa. And now Africa is the poorest as the ones who stayed and faced the least challenges and innovation.

Lighting the Way

If you ever look at the global map of “lights” from satellite images, it’s startling how dark Africa is… and then South America. Higher light correlates with electricity, urbanization… and higher affluence.

If you look at the Caribbean, Puerto Rico is the brightest bulb in that tropical sphere, another reason I am here. I could not live full-time in a city that did not have first world infrastructures, restaurants, and entertainment (I do have to overlook the potholes). In the last 30 years GDP per capita PPP in Puerto Rico, at $40,000, has caught up with Spain and Italy and has surpassed Portugal and Greece. It is 2.5 times higher than its neighbor, the Dominican Republic.

There is always a reason for trends. A simple understanding of history most often offers explanations. Regardless, seeing the trends means you can make good investments. And profitable investments are always something to be happy about.

June 25, 2019

Time To Pack Your Equity Market “Go Bag”

Late last week, on the first day of summer, I watched the news and weather for a few minutes before my morning run. It was 85 degrees with 97% humidity. It was 4:40am. The meteorologist said the “feel like” temperature was 99 degrees.

I ran anyway. It was awful. Such is life on the Gulf Coast this time of year. We can count on a lot of things, including heat, storms, and mosquitoes. And we watch out for bigger things that are possible if not certain, like hurricanes.

I’ve lived through my fair share of the latter living on both sides of the Gulf. We have “go bags,” backpacks filled with a few essentials, and we’ve identified what we’d take in terms of files, photo albums, and computers. We’ve never implemented the plan, but I don’t mind spending the time and money on it because the cost/benefit analysis is compelling.

This year I’ve got a few more things to worry about, like our new golf cart rental business on the coast. In the event of a storm, we’ll need to get 30 golf carts over to storage, which is no easy task. And I’ve got my house on the market. If you’re not a coastal dweller, you might not know that insurance companies won’t write new coverage on a home if there’s a named storm swirling around. It could be 1,000 miles away, but that doesn’t matter.

This is where the old axiom about separating what you can control from what you can’t comes to mind, and it brings me to the markets.

Current State Of The Markets

We’re in a protracted trade spat with China, but the Chinese economy was already slowing before that started. U.S. manufacturing has eased back to almost even between expansion and contraction, and both the Federal Reserve and ECB are signaling easy money ahead.

Banks earn about 2.37% lending to each other overnight, which is more than the 2.01% they can earn if they bought 10-year Treasury bonds. The yield curve is partially inverted.

The initial bump from tax reform is fading. The Atlanta Fed’s GDPNow model shows GDP growth falling from 3.1% in the first quarter to 2.0% in the second.

Earnings season is almost here. Corporate earnings fell 2.3% in the first quarter and, in March, analysts expected second-quarter earnings to decline 0.4%. They’ve now revised that number lower, to -2.6%. Third quarter earnings estimates have been revised from a slight gain to a slight decline.

And the equity markets are near all-time highs.

One of these things seems glaringly out of place…

I’m far from knowing exactly when the markets will top, roll over, or zoom ahead. Those calls fall into the “I can’t control” category. But I can make well-educated forecasts borne out of research and experience.

And that’s why I believe it’s time to make sure your equity market “go bag” is packed and ready. It will cost you something, but it could save you a bundle.

Your Equity Market “Go Bag” Inventory

I’ve reminded people repeatedly to stick to their trading strategies, like we do in Boom & Bust. Stop loss levels can save you from enormous pain, so tighten those up. But in terms of overall market insurance, nothing beats a simple put option strategy meant to overlay your broad accounts, including your retirement accounts.

I just checked on the SPDR S&P 500 ETF, trading at $294.40. I can buy a December 2019 put with a 294-strike price for $11.38, or 3.8%.

Here’s the problem: If the markets keep climbing, this option will lose value. If the markets remain flat, this option will lose value. If the markets fall, the option will gain intrinsic value, but it will still lose time premium.

It sure sounds like a lose-lose-lose! Unless the equity markets fall more than 3% or so in the next couple of months…

Luckily, options don’t lose time premium in a straight line. They tend to lose the most time premium in the last 60 days before they expire, so this would be in November and December, or if the underlying asset (the S&P 500) has moved substantially away from the strike price.

If the markets rocket higher, then this option will lose value quickly, but your equities will be moving higher. On the flip side, if the markets roll over in the normally difficult months between July and October, you’ve got protection.

It could mean the difference between holding on to double digit gains for the year or riding the markets back near the flat line.

No matter what happens, the reason to buy a December contract is so that you don’t have to hold it all the way to expiration and live through the last month or two when time premium decays so quickly. Instead, you can protect yourself during late summer and early fall, and then sell the option while it still has some time left.

Just like insuring your car, health, or home, you can face a little bit of financial pain today and hopefully stave off a lot of potential pain in the future.

June 24, 2019

What Tech Unicorn IPOs Tell Us About Our Humanity

2019 has turned into the Year of Tech IPOs. Lyft. Pinterest. Zoom. Uber. Fiverr. Slack. And we’re only half way through the year. Airbnb, Palantir, Robinhood, and several others have plans to go public before year’s end.

Some of these fresh listings have been bad (ahem… Uber). Others have shot to the moon (like Slack). Like any IPO, it’s a crapshoot which way things will go, a point that is especially true with all these new tech listings because their products are so… well… nebulous. There is a much more “scientific” way to hunt for your fortunes in the stock market, as Rodney has shown.

Keeping Up With The Radical Innovators

I monitor all of these tech developments as they relate to my 45-year Innovation Cycle (and it’s double, the 90-year Bubble Buster). And, as I’ve learned, the most unique talent in the world, economically speaking, comes down to the “radical innovators.” That’s the tiny percent of people who start new S-Curves… that then get improved and adopted in a predictable progression by the rest of society, and ultimately the world.

These are the people that think out of the box and take the greatest risk early on. They also experience the greatest failure rate. But they must take that risk: no new S-Curves means no longer-term innovation… which means no human progress.

The distinguishing intelligence of human beings over the next most intelligent mammal is our limitation of successful behavior. We’re very good at adopting and improving once someone creates “the next cool or big thing.”

A scientific experiment showed how even chimpanzees will observe another experimenting with opening a closed jar to get a banana out of it… but they don’t learn from watching that behavior. When it’s their turn to open that jar, they start from the beginning, like they never saw another chimp just go through the same motions.

That’s clearly not the case with human beings. Once someone invents something cool, or useful, or profitable, we’re quick to imitate and improve on it. But it has to start with those early radical innovators that truly create something new and different.

The S-Curve reflects this imitation and progressive adoption that has made us so successful as a species. It takes as long to go from the 0.1% adoption to 1% as it does from 1% to 10%. It takes the same time to get from 10% to 90% as it did to just get to 10%. That’s the “tipping point” or acceleration phase, when new innovations go mainstream and have the biggest impact on growth, income, and productivity… but not on wealth.

The Early Bird Gets The Wealth

Today in the U.S., the top 0.1% garners 20% of the wealth, the top 1% holds 40%, and the top 10% holds 80%. In short, the early bird gets the worm.

Most wealth isn’t inherited. It’s earned by the most innovative among us who that start new companies and technologies.

The U.S. and Canada also clearly lead the world in such innovation. Look at this chart:

Of the 37.1 million globally that are worth $1 million to $5 million, North America has 15.7 million or 42.4%. Just three years ago, it was 48.0%. Europe is a distant second, with 30.7%.

Mighty China, with its population that dwarfs both Europe and the U.S. is a mere 8.3%, is up from 3.0% three years ago.

Of the ultra-rich, those with $5 million to $10 million net worth, North America has a whopping 58.6% compared to Europe’s mere 20.9% and China’s 7.2%.

We may be regarded as a bunch of rich rednecks with little class by much of the developed world, but this is why I like this country. I am an entrepreneur, and there couldn’t be a better place to be that!

Finally, look at this broader chart.

Here we again see the clear dominance of North America in millionaire-plus net worth. Europe dominates the next tier of $100,000 to $1 million, China the next, from $10,000 to $100,ooo, and the broader Asia-Pacific and India dominate the smallest tier.

The fastest growth sectors will obviously be the smaller ones, dominated by Asia.

The Million-Dollar Questions…

The million-dollar question is: how long can the U.S. and Canada dominate innovation and wealth given our slowing demographics? I say not nearly as much after the next global boom peaking in 2036-37.

Another is, as China’s urbanization and demographic trends slow, and India’s accelerate, who will see the greatest growth in wealth in the decades ahead? China is clearly in the second spot and likely to move to #1 a decade or two from now after a devastating fall from grace ahead. But, by watching India’s slow, yet steady and more productive urbanization progress, I see it very likely passing China in the second half of this century. And they’re the next big thing globally after this crash and great reset ahead!

Far too many economists will miss this critical trend because they’re “closet extrapolators.” We’re not. We won’t miss it. Nor will you if you keep reading.

June 21, 2019

The Libra Win-Win and the Markets’ Third Wave

If you don’t know by now that Facebook released its libra whitepaper on Tuesday, you’re living under a rock. What you may not know is that bitcoin shot up on the news. That’s because libra gives credibility to the cryptocurrency market, much like AOL did when it first brought email and the internet to the masses.

But that doesn’t mean it’s going to be all sunshine and flowers from here on out. Just like AOL, Facebook faces a storm of lash backs and push backs from across the board. Regulators. Governments. Central banks. Cryptocurrency players. Citizens concerned with Facebook’s growing involvement in every aspect of our lives.

Ultimately though, libra will be a win-win and bitcoin will likely hit my target of $32,000 this year or early next year still… a forecast that Fundstrat Global Advisors co-founder Tom Lee concurs with.

So, in today’s video, I discuss why I believe libra is a positive and what I expect we’ll see next in this arena. I also explore what’s going on with the Fed’s latest rate decision (to stand pat), and why I believe we’re entering the third wave of the Dark Window.

Watch now…

I will be emailing Boom & Bust subscribers on Monday with an update on the current shallow correction, and where we stand in the two possible scenarios ahead. Make sure you don’t miss it.

This is a big week in The Rich Investor. Chief Retirement Strategist Charles Sizemore will be talking about the potential end of the bull market… why big tech stocks are the key… and how to build a recession-proof portfolio for when it does happen.

Charles kicked off the week with a great Q&A video discussing how things are starting to change and what you can do about it.

If you missed this video, click here to watch it now. Then tune in all week to The Rich Investor, usually hitting your email inbox before 11am ET.

June 20, 2019

If You’re Not Watching Puerto Rico, You’re Missing a Glimpse of the Future

They lie, cheat, and steal? No way!

In 2014, Puerto Rico issued $3.5 billion in bonds backed by the full faith and credit of the Commonwealth. Now the island’s fiscal managers, a group known as the PROMESA board, an entity that Congress created, claims those bonds are worthless.

While investors put down their hard-earned cash to buy the bonds, the board members have claimed in court that, because the debt issuance put the island over its legal debt limit, the debt should be canceled.

Note that the board isn’t asking to reverse the transaction – as in, give investors their money back. They are lobbying to erase the debt so that the Puerto Rican government keeps the funds and the investors get stiffed.

Investors are fighting back, but chances are the oversight board will win.

Detroit did the same thing in 2014, and Chicago looks like it could be next on the hit list.

The oversight board claims that zeroing out these investors while paying others $0.45 to $0.55 on the dollar is the way to bring Puerto Rico back to financial stability.

But debt isn’t their only problem.

They have pension problems that make Illinois look like a good actor.

Puerto Rico owes roughly $45 billion to its pension fund. These are payments due to almost 170,000 retirees that mostly live on the island and count on the cash to live. The government has zero, nada, zip in the pension account.

After running out of money a couple of years ago, Puerto Rico went to a pay-as-you-go system. It ditched all of the pension scheme payment programs for public companies, utilities, the courts, municipal governments, and other covered entities, and came up with a simple percentage of payroll that must be paid in to cover current pensions payments due.

The approach puts nothing away for the future, and therefore doesn’t amass funds that can earn investment returns.

But Puerto Rico can’t even manage to get this right.

The Financial Oversight and Management Board for Puerto Rico, an organization tasked with maintaining funding benefits for all retirees, recently issued a report in which it commented:

It is very troubling that 20 municipalities and seven public corporations are also not remitting individual employee payroll withholdings for that employee’s defined contribution retirement account.

The deadbeats include the city of San Juan, which owes $72 million; the Puerto Rico Aqueducts and Sewer Authority (PRASA), which owes $67 million; and the Puerto Rico Ports Authority, which owes $31 million. All in all, the debtors owe the Commonwealth government pension program more than $300 million.

The program that the Puerto Rican government ran into the ground by stealing the money and using it for other purposes is now even further behind as participants refuse to pay.

The report goes on:

Continued payment of retirement benefits without reimbursement from these employees is an unauthorized expenditure under the certified budget and every effort must be taken to collect these delinquent debts or offset these incremental unbudgeted expenses within other areas of the budget.

Wow. So, it’s a problem when entities won’t pay the government, but when the government doesn’t make good, it can simply walk away?

The point of the story is straightforward. There is a bag. The bag was created by profligate politicians who over-promised and over-spent for years, leaving pensions woefully underfunded and city and state governments teetering on the brink of bankruptcy. They will not be held accountable. They went on to lucrative lobbying jobs.

The bag will not be held by the government because it is nothing but a pass-through funded by taxes. It will not be held by pensioners who hold sway over politicians at the ballot box through unions.

The bag will be handed to investors who purchased bonds that will be declared worthless and taxpayers who will be required to fund huge deficits.

I’ve covered the list of problem children many times, and will keep pointing them out. From Chicago and the state of Illinois to Stamford and the state of Connecticut, there are many cities and states that will use the everything-is-fine-until-it-isn’t routine to steal money from investors and then extort money from taxpayers.

Sell their bonds, move away from their jurisdictions.

Don’t be left holding the bag.