Harry S. Dent Jr.'s Blog, page 21

July 17, 2019

You Need Flexible, Systematic Investment Systems in This Ultra-Volatile Period

Most financial advisors have a simple religion: Invest for the long term, diversify, buy and hold, and don’t try to time the markets… The truth is, that works most of the time. It would have worked very well from 1942 to 1968, and again from 1982 to early 2000. Those were the best of the two demographic bubble booms since the Great Depression.

But in this last and “greatest bull market in history,” which I first called in 1988, something changed. Stocks keep going to new highs, for now… but with dollops of extreme volatility on the upside and downside. Just look at this…

The Fall Bubble Boom

Late 1982 started the Fall Bubble Boom Season in my model. The first mini-bubble from 1984 into 1987 crashed 40%, but so briefly that most couldn’t even react. Then we saw the first great tech-stock-driven bubble, culminating with the extreme internet bubble into early 2000.

From late 1982 into early 2000, buy-and-hold investing and the traditional rules would have worked just fine – with the Baby Boom Generational Spending Wave and the Information Revolution as the wind driving your sails.

Then the Dow crashed 39% in the 2000-2002 crash. The bubble-leading Nasdaq lost 93%!

Still, demographic trends continued into late 2007, as I predicted, inflating a mini-bubble. Then the Dow endured a 54% crash. Everyone asked: Is the great bull market over?

History proved it wasn’t. It also proved that 2000 was the start of a new bubble phase where we’d see higher highs and lower lows as breath taking and stomach churning as any good roller coaster worth the wait in line!

At That Point, Buy-And-Hold Investing Died.

This is why fewer everyday investors are participating in this unprecedented bull market. They’ve been scared out of the market by major crashes, which would never have happened during demographic booms like the one from 1942 into 1968. But bubble booms are an entirely different beast. One that average investors are ill equipped to tame.

So they miss much or all of the ever-increasing upside… driven away by fear of the increasingly terrifying downsides and a lack of understanding of the incredible investment strategies at their fingertips.

But that trend will come to an end as well, and very, very likely in the next crash and rebound. After that, NO more higher highs for a long time. And when that happens, investors will need to find a new investment strategy again. We’ll deal with that in 2022 forward.

For now, understand that, despite slowing demographic trends and rising debt levels, we have the greatest bubble in modern history. This is occurring in the Economic Winter Season similar to 1930-1942.

I’m projecting the Dow could go as high as 33,000 before peaking. And then what? The biggest crash yet… as much as 85% in the Dow and 89%-plus in the Nasdaq, similar to the unprecedented 1929-1932 crash.

All of this is to say that this environment is not one that everyday investors can handle alone, nor should they.

You Don’t Have To Do This Alone

That’s why I have brought together a number of disciplined, systematic investments systems, from higher to lower risk for this era. Each member of my team has developed unique systems that work in up and down markets.

The two best examples are Adam O’Dell’s Cycle 9 Alert, which is a higher-risk/higher-return strategy, and Rodney Johnson’s Fortune Hunter, which is more on the medium risk side. And now Adam’s turning his system towards the pot industry, where his backtesting has yielded almost too-good-to-believe results. You can believe them though because Adam is not one to promise the undeliverable.

What sets Adam apart from any other investment researcher I’ve ever met is his trading methodology, which is infused with the discipline of a monk and the emotional detachment of Spock.

Rodney’s system is equally unique, seeking out companies others are not… companies in their own predictable level of early emergence that go largely unnoticed.

Even with the extensive economic knowledge I have, and the leaked data I found, there is no way I could even approach doing what these two carefully-developed systems do.

And a diversified portfolio of several systems, like Adam’s and Rodney’s, is your best bet to profit during this unprecedented bubble boom and bust era, where being the lone wolf in the wilderness will ensure only one thing: a brutal goring by the bulls and bears.

July 16, 2019

Clash of the Titans: Amazon vs. the Fed

I’m tempted to glance at Amazon today. I don’t need anything, but that’s not the point. Surely there’s a new gadget or doohickey that will make my life immediately better, even if I don’t know that it exists. Once I see it, I’ll have to have it – chances are that Amazon is offering it for a song.

The End of Black Friday

Today marks the end of what has become Black Friday in July: Amazon Prime Day, an online event that’s grown so grandiose that it now stretches to two days. The e-commerce behemoth created the marketing gimmick several years ago to give its Prime members access to incredible sales on thousands of items, hopefully motivating non-Prime members to join the fun.

The day became so popular that Amazon expanded the event to cover two, and other retailers jumped into the fray, attempting in vain to defend what remained of their market share.

This year, a record 250 retailers will offer their own sales online as they try to pry some eyeballs away from Amazon. We don’t know the totals yet, but last year U.S. retailers booked $447 billion in July sales.

That was $4 billion more than retailers booked in December, which is why so many competitors are jockeying for attention this year. Consumers only have so many shopping dollars. If they use a bunch of them in the middle of July on Amazon Prime Day, they’ll have fewer to use on back-to-school sales, Labor Day sales, Black Friday sales, and during the holidays in general.

And all of this exemplifies a classic “race to the bottom.” Online retailers that offer the lowest prices on comparable goods are likely to get the most sales, which drives them to give customers the best deals.

Shoppers win the price wars, but…

The economy loses the inflation game… which is what’s driving the Fed nuts.

More Bang for the Buck

Amazon is the champion of deflation. Since its inception, the company has focused on giving consumers the chance to buy goods from many sellers, while also offering comparable and substitute-level goods. This gives shoppers the best chance to find what fits their needs at the best intersection of price and product quality, and squeezes out the inefficiencies of limited selection and limited sellers.

We get more bang for the buck, allowing us to keep the part of our consumption funds that used to be spent on those inefficiencies.

But if we don’t spend those saved pennies somewhere else, then the economy suffers a bit, and that’s a situation the Fed can’t stand. This partially explains why the Fed kept making newly printed bucks available to the economy by purchasing bonds and driving interest rates lower. If we weren’t willing to splurge on assets, then by golly the Fed would make their value increase by changing the terms of valuation!

Changing interest rates affects anything with a cash flow component – be it steady payments, like dividends and interest, or debt that’s owed. By lowering rates, the Fed makes steady payments more expensive to receive, and debt cheaper to carry.

They’ve been yelling at us to “Buy Stuff!” for a decade. We’re doing our best, but we keep choosing the cheapest alternatives when possible, setting up this epic clash.

The Fed is desperately promoting inflation, while Amazon keeps depressing prices.

They’re locked in a battle, but there’s no doubt who will win.

Apples and Oranges, or Jordan and Bill Gates

It’s like the old meme about Michael Jordan and Bill Gates. In his prime, on average Michael Jordan made $178,100 per day, every day of the year, which is about $7,415 per hour. Search the internet and you’ll find an article listing out how much he made per minute, or during the time it would take to play a round of golf or have a meal. For the time, that was outrageous.

But at the very end of that meme, the story went that Jordan would have to earn that much for 270 years before he accumulated the wealth held by Bill Gates.

They both might make a lot of money and be wealthy, but they were clearly operating on different planes.

In the first quarter of this year, Amazon recorded $59.7 billion in revenue, and $3.6 billion in net income. The company is currently worth just under $1 trillion. Those are great numbers.

But the Fed – well, it’s the Fed. The pseudo-government agency can crank up the printing press anytime and create its own wealth. Currently the central bank holds $3.8 trillion in assets, and during 2018 it gave away $62 billion in excess earnings to the U.S. Treasury, or about $15.5 billion per quarter.

And while Amazon does everything it can to increase business and grab more clients, the Fed does a bit of a kabuki dance trying not to affect the $21 trillion U.S. economy too much.

Technology – with Amazon at its face – is consistently pushing the deflationary efforts of the past decade, but ultimately the Fed will win the fight. We can only hope that we, as investors and holders of capital, don’t get crushed as a result.

Imagine Predicting Exactly Where Shoppers Will Shop Next…?

Accurately predicting where people will shop next… what they’ll be buying… and how much demand there will be for that particular item…

That’s investment power, right there.

And now you can grab that power with both hands, right here.

With it, it doesn’t matter who wins in this clash of the titans… your investment dollars will be in prime position.

July 15, 2019

How the Gov’t Hides This Incredible Data

Markets across the board seemed under the weather this morning.

Still, the Nasdaq is just 1,760 points away from my Dark Window 10,000 forecast. While that might seem like a lot, think about it this way: Six months ago – at the beginning of the year – the Nasdaq was at 6,506… 1,737 points lower than today…

We are in a Megaphone pattern that could see markets dip or pop, but everything still points to that final Dark Window blowout finale into the end of the year. That Nasdaq 10,000 is closer than you think. So now is the time to make hay while the sun shines.

Trade, Trade, Trade

I don’t mean buy and hold. I mean trade.

Follow the work our quant is doing in the Cannabis space.

Go fortune hunting with Rodney.

Or go where the data points are. Data that the government all but hides from you… but that I’ve been able to decipher.

For example, there are 11 sectors heading into a boom phase right now. You’ve just got to know where to look. But considering the raw government data is useless. Instead, we’ve got your back because I’ve deciphered the “code.”

So today, I’ll share details on one of those sectors. But before I do, a caveat…

Be Prepared For The Dark Window

Yes, this Dark Window presents an incredible opportunity.

Yes, the 11 sectors I’ve hinted at will benefit from this scenario.

BUT, at the end of this Dark Window is a major crisis that will reset all financial assets. I expect we’ll see this unfold between 2020 and 2023. During that time, your profit opportunities will be of a different kind, and again, my team and I will guide you through.

Then, once the decks are clear, the 11 sectors currently in take-off mode will resume their course upward because they’re driven by an unstoppable force.

It’s literally, all, life changing.

Now, let’s look at one of those sectors to set your sites on… in the near term AND long term…

Going From Do-It-Myself to Do-It-For-Me

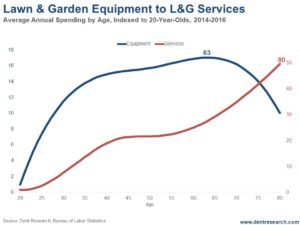

Baby Boomers aren’t getting any younger. But they’re not quite “old” yet. Right now, they’re still walking up to the peak of their Spending Wave in the lawn and gardening sector. Until they’re 63 years old, they’ll want to push those mowers, swing those weed eaters, and turn that flowerbed soil for themselves. For many Baby Boomers, gardening is a source of inspiration and invigoration.

As the bulk of the Baby Boomers move up to that age, investing in do-it-yourself garden equipment will be a profitable move. Think Lowes and Home Depot.

You can expect this to be the case until around 2025

After that, age catches up with us and our knees begin to ache from the bending… our backs begin to hurt more from pushing that lawnmower in sweltering heat… our fingers are more bent from arthritis.

Shortly after that peak at 63, Baby Boomers begin to wonder what the hell they’re thinking. Thoughts of, “I’m too old for this shit!” become louder. The natural trend is an acceleration toward lawn and garden services. Pay someone else to do the hard work. As you can see in the chart (the red line), the demand for garden services doesn’t peak until age 80.

This makes it the perfect business to get your kids into. Not only are they the perfect age to handle the physical labor when starting out, but they can eventually grow (pun intended) into managing the business.

That’s the thing: When you’ve decoded the data, it’s like you suddenly have a road map to the most unexpected opportunities. The government hides the opportunities in plain sight, with data in raw form. But with the refined data, which is an expensive endeavor that I have undertaken for you, the world can become your investing garden.

It’s like getting road maps through more than 200 categories.

I’ll share some more of the details in the coming weeks, so stay tuned.

July 12, 2019

Did You Hear About the Billionaire Who Lost 90% of His Wealth?

Do you remember Ted Turner, the media mogul who founded CNN? At the turn of this century, he lost 90% of his wealth, leaving him with just $1 billion. “Boo hoo!” you might say. “He was still a billionaire.” That is true, but no matter how much wealth you have, losing that much money is a punch to the gut.

And it’s about to happen again, to a whole lot more millionaires and billionaires. In fact, it’s already started happening. A recent survey of 2,500 millionaires revealed how their net worth fell by $2 trillion in 2018. The hardest hit were those in China and the U.K.

The big question is: Is this loss an anomaly, or are we staring at the canary in the coalmine?

I answer that question, and another, more important one – why you should even care? – in today’s video.

Harry Dent: Pay Attention to the Canary in the Coal Mine

Looking at a recent survey of 2,500 millionaires reveals their networth has dropped for the first time since 2011. How are their financial losses going to affect the rest of the world? Harry shares his thoughts and takes on a few questions from subscribers…

Posted by Economy and Markets on Friday, July 12, 2019

I also answer a question from a 70-year old subscriber. Ken and Carol are wondering what they should do with their house: reverse mortgage or sell?

Watch today’s video to hear what I think about that situation.

July 11, 2019

Come Back, Ross Perot!

In 2008, the mother of one of my best friends died. I flew to Dallas, Texas, to attend the funeral, and found my way to the chapel at the funeral home. After I sat down, an older gentleman and a middle-aged woman sat behind me. Soon after that, a woman came out to sing a hymn. When she finished, the man behind me said, “That was real nice. She’s got a real nice voice. But the music was too loud! I couldn’t hear her that good.”

The voice was unmistakable. It belonged to H. Ross Perot.

My friend’s brother-in-law worked for Perot for decades. In fact, the brother-in-law made all the flip charts that became part of the great Texan’s lore. I listened to Perot’s occasional commentary through the funeral, and then afterwards watched him drive himself away… in a Ford Crown Victoria.

He always drove a General Motors car, until the debacle of selling his company to GM, then buying it back. Then he swore he’d never drive another GM.

I’d love to see a person like Perot on the political scene today. He was quirky, but you didn’t have to guess where he stood. Fiscal discipline, good jobs, personal responsibility. But don’t call him a conservative… or a liberal.

He hated NAFTA, calling it a job-sucking program that would move industry south of the border. Clearly that happened, but on the flip side, Americans enjoyed much cheaper goods. Is it worth it? That argument is as old as Adam Smith’s Wealth of Nations, and still hasn’t been answered. If I’m buying a car made in Mexico, I’m glad it cost 25% less than it would if it had been made in the U.S. If I worked for Whirlpool, I’m not happy to see my good-paying job leave the country.

Perot was reluctantly pro-choice. He called for Medicare for All. He wanted to greatly expand education, lengthening the school year from 180 days to 210, and absolutely disallowing any student from playing any sport if they didn’t have passing grades. Remember, he was living in Dallas, Texas… sort of the high school football epicenter of the universe. These were fighting words!

He wanted merit pay for teachers and term limits for Congress based on performance. Perot called for ending government pork and reducing staff.

Of course, he also wanted to ban the Electoral College, put disadvantaged kids in government-funded homes, and institute a $0.50 per gallon tax to pay off the federal deficit. Not every idea he had was a winner, and not every strategy would work. He famously said that we could wait out China because their leaders were very old, implying that the nation would turn more democratic as the leadership passed.

But the man was so genuine as to be magnetic!

After two of his executives were falsely accused of bribery in Iran just before the revolution, Perot put together a strike team to break them out of the prison. It worked, and author Ken Follett wrote a best-selling book about it that was made into a film, On Eagle’s Wings. Perot also told employees that, at his company, adultery was grounds for immediate dismissal.

Now, as in 1992, I can’t imagine a Ross Perot character winning a presidential election. They would be too realistic in their projections, calling for the nation to make sacrifices to achieve what we claim are our goals – reducing debt, caring for the needy, providing basic health services for all, and improving education.

But if we could get more Perots, both men and women, to make their voices heard… perhaps we can at least bend the political curve that seems to point our deficits to the sky without commensurate progress.

At least we might get Congressional term limits.

As we say goodbye to Ross Perot – the short, successful man with big ideas – I’ll leave you with a few of his best quotes:

The activist is not the man who says the river is dirty. The activist is the man who cleans up the river.

Which one of these three candidates would you want your daughter to marry?

And my favorite:

When you see a snake, kill the snake. Don’t appoint a committee on snakes.

Here’s to hoping that the political leaders of tomorrow channel their inner Ross Perot and kill a lot more snakes, rather than simply appointing more committees.

But I’m not holding my breath.

July 10, 2019

What If Venezuela and Iran Can’t Access Oil?

We’re hyper-focused on politics at the moment because, well, Trump. If he weren’t the president, with unshakeable support from one faction while inducing loathing from another, then the 2020 election cycle might be a touch less fanatical. But he is the president, and we’ve got Democratic hopefuls pummeling each other as they move to the left, promising many new programs with questionable funding sources.

It’s as if the laws of supply and demand have been suspended.

Maybe they have when it comes to politics, but back in the real world, supply and demand do matter. And this cold reality could put the energy market in the deep freeze over the next 12 months.

Energy On Ice

It’s a matter of production.

The International Energy Agency predicted that global oil demand would rise 1.3 million barrels per day (bpd) in 2019, soaking up most of the expected increase in U.S. production. But over the last couple of months, analysts have been trimming their demand forecasts, noting weaker economies around the world. Instead of bumping demand by 1.3 million bpd, we might see an annual increase of just 1.0 million bpd.

And yet the U.S. energy complex continues to pump out record amounts of oil.

In June of 2018, the U.S. recovered 10.6 million bpd, double the amount it produced in 2009. A mere 12 months later, we produced 12.16 million bpd, an increase of 1.56 million bpd, which is more than the entire increase in global demand expected this year.

But there are other factors at work.

Sanctions On Oil

While the U.S. has put more oil on the international market, other nations have cut supply, but not by choice.

U.S. sanctions and inept management have cut Venezuelan oil supply from 1.48 million bpd at the beginning of the year to 1.05 million bpd, the lowest level since records began in the early 1970s.

U.S. sanctions have trimmed Iranian oil supply from 3.8 million bpd to 2.37 million bpd over the last 12 months, the lowest daily rate since 1989. Combined, these two countries cut global oil supply by 1.8 million bpd over the last year.

OPEC and the Russian coalition, together called OPEC+, have orchestrated supply quotas to keep oil prices steady in the mid $60s.

International Pain Points

What happens when fortunes turn for Venezuela and Iran?

Both countries rely on oil exports for hard currency, which is then used to buy food and necessities from other countries. They need to sell as much oil as possible to reverse their terrible economic fortunes. It’s difficult to see how either country would abide by a supply quota when they face such dire conditions at home.

At the same time, U.S. energy production continues to grow. We already produce more oil than at any time in the history of the country. And we are expected to pump around 18 million bpd by 2025.

The laws of supply and demand are clear. Either OPEC+ will have to reduce supply quotas while allowing Iran and Venezuela to pump oil to fund their national budgets. That will essentially cede market share to the U.S. Or the market will be awash in oil, driving prices back toward the lows of the 2010s, just under $30 per barrel.

Neither option is attractive for oil producers. Perhaps OPEC+ splits the difference, allowing some increased production with an equivalent moderate drop in price. However, it still means lower energy prices.

The pain in the U.S. will ripple through the energy industry, driving more producers into bankruptcy, as Harry has long predicted. In other countries, the pain will be felt in the government because oil is controlled by nationalized organizations.

There are some caveats

If sanctions against Iran or Venezuela remain in place, then some of their oil production will remain offline. Also, if tensions with Iran escalate, then oil transport through the Strait of Hormuz could be disrupted. Which will send prices sharply higher.

But those possibilities seem temporary. The long-term trend is for oil production to outpace demand growth. That’s a situation that should keep prices under control for years to come. And could drive prices sharply lower over the next year.

Don’t be surprised to look away from the political circus one day to find that oil prices have dipped to the $30s.

July 9, 2019

Why You Should Care About New Prime Minister of Greece

Yesterday, Greece got a new Prime Minister, after its New Democracy party won the weekend election. A center-right party. That’s significant, as I explain in the video I recorded for you today to discuss this important event.

The promise: We’re going to make Greece great again.

But can they deliver?

Can they turn their county around so that it’s no longer the problem child of Europe?

While they plan to go in the right direction, I think the challenges they face – particularly demographic and debt – are almost insurmountable. I elaborate in today’s video.

Around the 2:30 mark, I explain the more important lesson we should take away from what’s happening in Greece… particularly with the 2020 tipping point bearing down on us.

I also offer a forecast about where Greece will likely be in a few years, and which party will be in control.

Harry Dent: Greece Takes A Step Toward Reform

What does the landslide election of the New Democracy Party in Greece mean for the world economy? Harry speculates on the future of their tax system, debt, & the country’s populist movement.

Posted by Economy and Markets on Tuesday, July 9, 2019

July 8, 2019

The Tipping Point: Could Trump Win 2020 Election?

I hate politics. I hate that it’s inescapable. What I don’t hate is the investment opportunities the 2020 election will present us.

So I hate, and then embrace…

And with the 2020 election fast approaching, we face a major tipping point… economically, politically, historically.

That means NOW is the time to prepare to protect your business endeavors and investments.

NOW is the time to position to profit.

The million-dollar question is: How?

Well, let’s take a look…

Presidential Contestants Poll Scores

The latest polls from ABC and The Washington Post show The Donald at his best since taking office, with a 44% approval rating overall. That’s up sharply from 39% in April.

Still, he has a whopping 53% disapproval rating (54% in April). That’s the worst showing at this point in the first term of any president since Eisenhower.

Kennedy enjoyed 72% approval and 15% disapproval. The two Bushes and Eisenhower all had a 69% to 71% approval rating. The next worse was Ford, with just 47% approval and 37% disapproval.

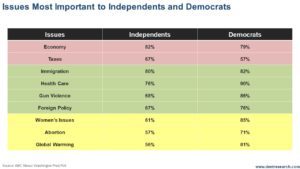

That means that capturing that 53% disapproval group is key to the 2020 elections. The contestants (and I call them that because, really, this is like a reality TV game show) must win more than a majority of the independents, who stand at 43% approval versus 54% disapproval, very close to mimicking the overall ratings.

Independents For The Win

Independents are the swing vote this time. They’re smack in the middle, not on the far right as it was when The Donald took the win in 2016.

This is why so many critics warn that too many Democratic candidates are leaning too far left… and why Joe Biden still polls the best against Trump.

Biden gets 55% versus The Donald’s 41%, while Sanders, Warren, and Harris all get 51% with Trump ranging from 45% against Sanders to 43% against Harris.

Although the far-left component of the Democratic party has grown like the far right of the Republican party, it’s not quite as extreme. But the “socialist” image is still the biggest negative among the broader public. Also not a positive is that Trump, Biden, and Sanders are all over the age of 70!

And these polls don’t consider that registered voters tend to be older, whiter, and more republican.

The 18 – 29 age group is 64% registered. For those in the 50-plus group, 92% are registered. Nonwhite versus white registered voters are 71% and 89% respectively.

Hence, Trump will do better than indicated here unless Democrats embark on a campaign to get younger and nonwhite voters registered for the 2020 election.

But, as the latest polls show, Biden has faded right off the bat after the first debate. He’s a bit senile and living in the past. He’s simply sailing on being more moderate and more known. That is not likely to last.

Trump gets the highest rating on the economy at 51%. That’s important across the board to all voters. And it’s the biggest reason for his recent rise to 44% approval overall. It’s also the hardest place for the Democrats to attack him.

Only 37% favor impeachment with a rising 59% that don’t – so, as Pelosi reminds us, that is clearly not the place to focus either.

Instead, the focus needs to be on what the Independents value most and where that also intersects with the Democrats to turn out more of them.

Since the economy and taxes are more Trump’s strong points and the hardest to attack (red), the categories that most address the independents’ priorities and are also strong with the democrats (green) are in order: immigration, health care, gun violence, and foreign policy.

Women’s issues and global warming (yellow) are less important to the independents.

In short, watch out for the democratic candidates that are a bit on the moderate side and not branded as socialists. That hurts Sanders the most and why Harris and Warren are rising.

Warren For President

And my favorite of a motley and not that appealing group? Surprisingly: Elizabeth Warren.

Why?

Because I see a greater financial crisis between 2020 and 2023 than the one we had between 2008 and 2009. We are also in the time in the Economic Winter Season, where serious financial reforms are overdue, especially in the financial and banking sectors.

No one has more knowledge and passion there than Warren. She wants to reform capitalism, not KILL it like the most left-leaning members of her party.

But her problem is that she’s not that likeable… Then again, neither was Winston Churchill before he got elected in 1940 and proved his mettle in World War II.

I also talked last week about Trump likely having to face that first sharp 40%-plus stock crash and recession in early to mid-2020. That is his biggest challenge from my view, and I don’t doubt he will fight that with everything he has – maybe even pushing to send households checks in the mail as the last stimulus ploy.

The truth is: We need a leader with vision and the ability to roll up his or her sleeves and create quick and effective reforms, including immigration and entitlements – which are the biggest two issues for dealing with our aging demographic trends. Trump clearly does not get good grades on those two points.

We need a Churchill, Thatcher, Lincoln, or FDR…

And I don’t see any of those amongst the presidential hopefuls yet. A crisis starting next year by my best calculation would help bring those qualities more into light and focus.

Along the way, we’ll help prepare you to protect and grow your wealth into Tipping Point 2020.

July 5, 2019

Confusion Reigns While Stimulus Options Dwindle

As I discussed on Monday and Wednesday this week, markets are following my Dark Window scenario… but now there is a fly in the ointment. So today, I explain further why the Megaphone Pattern I’m watching is troubling… and what needs to happen for us to get a clear signal of the markets’ next move. Will it be 25% higher or 25% lower, the question I posed on Wednesday?

Watch today’s new video to find out. And while you’re at it, you’ll also hear…

What I think the Fed is likely to do at its next meeting later this month…

Where we’re getting people to employ, after the latest employment numbers were released this morning (particularly given the fact that Baby Boomers are retiring and future productivity prospects look grim)…

And why The Donald may decide to send everyone in the U.S. a $5,000 check next year in the run up to elections and the run down to recession…

Watch now…

As to that “who are we employing in the economy” question, I have two theories, one of which David Stockman considers as well. David was once President Ronald Reagan’s top economic advisor. He was also once the National Budget Director. This is a man who has been deep inside the system. He knows and has seen things that most of us could only guess at. Listen to the video today to hear what he thinks is one of the two sources of employees making it into payroll when we’re at full employment. And be sure you don’t miss him at our Irrational Economic Summit this year in D.C.

July 4, 2019

Loving the British on the Fourth of July

Yes, yes, we all know that this is the day the American colonists declared their intent to separate from England by adopting the Declaration of Independence at the Continental Congress. And yes, there was a nasty five-year war after that in which we squared off against the redcoats… and then they smacked us around a bit in 1812.

But, at the heart of it, we love the British.

Face it, English accents are sexy, and so are Jaguars. (And yes, I know the Indian company Tata Motors bought Jaguar Land Rover, but I try to ignore that fact.)

Let me explain…

Declaration of Independence Influencers

For many years after the adoption of the Declaration of Independence, Thomas Jefferson wasn’t given credit for drafting the document. Which, at least for a bit, suited him just fine. Jefferson claimed there weren’t any new ideas in the Declaration.

He pointed to John Locke, the English philosopher who is often called the “Father of Liberalism,” as a main source of inspiration. And many of the concepts in the Declaration can be found in Locke’s work. In his Two Treatises of Government, Locke defended the claim that men are by nature free and equal. And he argued that people have rights, such as the right to life, liberty, and property. Those words are strikingly similar to the first lines of the Declaration of Independence. Which claims that all men are created equal and have the right to life, liberty, and the pursuit of happiness.

Other influences were Montesquieu and the Scottish Enlightenment. The document even begins with “We the People,” not we the delegates of the Congress, or any other identification. This shows that it’s meant to be all-inclusive, using the same terms as Locke and others when discussing universal truths and rights.

As time wore on, Jefferson began accepting credit, especially as the nation grew in importance, much to the chagrin of John Adams, who called Jefferson’s actions grand theater.

Hats Off To The British

Beyond the main ideas behind the Declaration of Independence, we’ve taken a lot of other things from the Brits. For instance, television shows such as “Whose Line Is It, Anyway?,” “Who Wants to be a Millionaire?,” and “The Office.” For “American Idol” we took not just the show’s template but also one of the British original’s judges, Simon Cowell.

So as you enjoy your Fourth and toast our fabulous nation, take a minute to raise a pint for the British. We might have freed ourselves from the Kingdom, but they still seem like family.