Harry S. Dent Jr.'s Blog, page 19

August 9, 2019

Gold Had A Big Week

Well, the markets rolled over last Friday, and opened this week in a bloodbath. But gold continued to surge, creeping up past the $1,500 mark.

We’re at critical points with all our bonds, which are making new lows. Which has made gold’s current position even more remarkable. I thought gold would begin to flatline around $1,428, but that didn’t happen. Analysts now expect it to move up to $1,530.

If gold can break through that sort of figure, expect it to continue to move higher. I don’t believe we’ll see new all-time highs, but it could break through its current standing.

So what’s that mean for the Dark Window? We’ve seen a mini-megaphone pattern, and slightly higher highs since January of 2018. That means the bubble might be peaking, which is the resistance we’ve been predicting for quite a while.

I have more on gold and what its surge means for the markets in general in this week’s video.

August 8, 2019

Dealing With Falling Real Estate

I don’t mind moving, but the process of selling and buying homes is no fun. Keeping the home clean, inspections, appraisals, work orders… it’s all exhausting. But we’re doing it.

As I’ve written, my wife and I moved back to Texas a couple of years ago. We found a beautiful home on the water. It’s a little bigger than we need, but the location is fabulous.

Then Came Hurricane Harvey

We didn’t get flooded, but many neighbors did. Then came flood insurance. It’s manageable today, but the national flood insurance program will increase rates to market rates in April, and start charging market rates next October.

My home wasn’t cheap, so there’s no way that my insurance costs will drop.

And then there are taxes. I often write about shrinking your taxable footprint so that your city or state can’t tag you with rising costs to pay for failing services and over-burdened pensions. Today my taxes are at a reasonable percentage because we have two big box stores within the city limits.

But nearby communities are growing away from us, moving the population density further south. Those box stores won’t stay here forever, and when the sales tax goes away, the city will need someone to pick up the slack.

Finally, there’s real estate itself. Harry’s been screaming from the rooftops that real estate will roll over, and we’ve seen prices get mushy at the top end in many states around the country. The S&P CoreLogic Case-Shiller Home Price Index increased by a mere 2.4% in May over last year, down from 6% gains in 2018. It looks like price growth is decelerating, moving close to zero, if not through it.

On The Market

When I wrote about my situation months ago, several of you wrote back with a simple message – move.

You were right. The reasoning is sound, and we’re flexible enough to be able to do so.

But my wife isn’t keen on renting, so instead of staying on the sidelines, we’ll simply buy a less expensive home… and we already have one picked out.

If all goes as planned, we’ll move from open water to a golf course. The home is 30 years old and has good bones, but needs a lot of updating. It’s on the cheap side. We’re paying less than half the cost of the one we’re selling, and it’s for a weird reason… It’s big.

With Boomers trying to downsize and Millennials not yet purchasing for growing families, there’s little demand for 4,000 square foot homes. We were able to come to terms on one that had been on the market for seven months, empty, even though it sits on the tee box of the first hole, walking distance from the clubhouse, on a very nice golf course. The home is in a preferred zone, so no need for extra or higher-priced flood insurance, and by the time we’re ready to sell there should be many Millennials looking for more room for the kids.

I am certain that everything I’ve laid out, from higher flood insurance, to higher taxes, to falling real estate prices, won’t happen just the way I’ve forecast. But I think enough of it will to make this move the right thing to do.

Now, if we can just live through the process… and the remodeling.

August 7, 2019

Boomers Are The Fastest Growing Renters?

I am speaking at Brad Sumrok’s national conference for Apartment Rentals in Dallas this Saturday, so I’ve been brushing up on my demographic research in that arena of real estate. There’ve been some interesting new insights.

The Millennial Impact

My consumer life cycle for real estate starts with apartments and multi-family homes for renters; that typically peaks around the age of marriage, which used to be age 26 for the Boomers and now is age 28 (and rising) for Millennials.

That has been one of the best segments in a roller-coaster bubble housing market that has made owning a home look much riskier, largely due to the rise of the Millennials born by my rising wave of births definition, from 1976 into 1990. That would create a rising wave of new households and renters from 2003 into 2018.

But they aren’t peaking yet – and maybe won’t for quite a while.

First thing to note is that this younger group will extend the rental cycle in the downturn I’m anticipating from around 2020 to 2023 or 2024 as they get even more scared to buy than young folks were during the Great Recession. Under 35 buyers have to date bought at substantially lower rates than Boomers and Gen X did during the same ages. And Millennials will only find themselves trailing the older generations even more as loans get harder to get and the markets swing downside again for a few years.

It’s The Boomers

But more important, there is currently a new gang of renters riding into town: Aging Boomers. They have not saved enough for retirement, are increasingly down-sizing from larger homes now that they are empty nesters, and have seen scary volatility in housing markets for the first time in their life.

Look at this chart of growth in renters by age groups.

Damn… who would have thought. Renters 60 and older have grown the fastest, at 43% over the last decade. From 2017 to 2035 they will double from 9.4 to 18.6 million, growing faster than the 35–59 age group, and even more so than the slowing rate of those younger than 35.

By 2035 seniors will grow to 33% of the rental market and under 35 will fall from 34% to 27%. Older people have different needs, like no stairs! Don’t make them get one of those tacky stair sliding seat units… Please!

And where would you find the highest growth in such old fart retirees? In Arizona, Nevada, Florida and Texas – affordable and warmer retirement areas. But they are everywhere, as they have always been the biggest force at any age that their massive wave has moved into.

I’ll be giving a lot more info about this at Brad Sumrok’s conference in Dallas on August 10, at the Dallas Sheraton. My friend and colleague Robert Kyosaki will be headlining. We do interviews together numerous times a year.

You can still get tickets as low as $197. If you want to learn more, go to bradsumrok.com. Then at top of the page go to “Live Events” and “AIMNATCON Annual Conference.”

Hope to see you there.

August 6, 2019

The U.S.-China Trade War Will Hit Home

I’m in the Colorado mountains this week. yet, I must note the significance of the reports this morning that Chinese companies have put a stop to purchases of U.S. agriculture products, moving the lengthy trade war into new territory.

I’ll turn the rest of today’s column to my colleague Chris Scott, an expert on international economics, particularly with regard to China. And will rejoin the conversation when I’m back at my desk on Thursday. – Rodney

Markets attempted on Tuesday to scrape back some of this year’s gains. Markets were cut nearly in half since last week, when trade talks with China fell apart.

But the modest dead-cat bounce – buoyed by signals that China would support the yuan at its current level of 7 to the dollar – has proved just that. And there’s every reason to believe that this standoff will continue to weigh on investor confidence. At least until the Federal Reserve swoops in with another save.

China’s decided to let its currency cross the psychologically important line of 7 on Sunday. And that was a carefully calculated signal that Beijing officials have given up on a trade deal coming together some time soon.

The Effect on U.S Farmers

That was made all the more apparent Tuesday via official announcement that Chinese companies will halt purchases from U.S. farmers. China had previously agreed to restart importing U.S. agriculture products when President Trump met with Chinese President Xi Jinping. They met earlier this summer and the two decided to restart negotiations.

In response, Trump suggested in a tweet on Tuesday that he is prepared to bail out American farmers with more subsidies. But those farmers remain the soft underbelly of the trade war. And have little cause for hope in the near term.

The Chinese side is now prepared to wait on the outcome of the 2020 presidential election. This is understandable; Democratic frontrunner Joe Biden, who currently polls well against Trump, has signaled anything but a hard line against the country. Simplistic, perhaps, but that’s the 6,900 mile viewpoint from Beijing.

Trump issued a threat of additional tariffs just last week-the catalyst for this new escalation. The president has calculated that the political benefits of beating up on the far east powerhouse outweighs the standoff’s domestic casualties.

So What Will The Fed Do?

Some went so far as to speculate that Trump short-circuited trade talks because of disappointment in Fed Chair Jerome Powell’s suggestion last week. Powell suggested that the rate cut was just a “mid-cycle adjustment” and didn’t necessarily portend aggressive easing.

For now, the prospect that the Fed will come to the rescue in the face of more trade uncertainty offers little comfort. If it does (and it probably will), it will come on the heels of more market turmoil. Or signs that consequences of the trade war are showing up in economic data.

The U.S. has weathered the trade conflict while maintaining a strong economy. But cracks might start to show if Trump follows through on the threat of new tariffs. Which will be the first to really ensnare consumer goods.

August 5, 2019

The Cycle Variation That Points to a 2023 Bottom

When I last met with Richard Mogey years ago, past director of The Foundation for the Study of Cycles, the topic of sunspot cycles came up. Mogey was the first person who totally got it. He had been following these cycles for a long time and understood their impact on the business cycle and agriculture.

The Gravitational Pull

While we chatted, he said something interesting. He and his wife had determined what caused the substantial variances in that approximate 10-year cycle. It was the gravitational pull of the larger planets on the sun. We’re talking from Jupiter on out.

Gravity is of course a CORE principle in physics.

When doing my normal overview of scientists’ forecasts for when this current sunspot cycle is most likely to bottom, I found that the consensus was for December 2019 to early 2020. But there was one group that was forecasting late 2020, citing the “gravitational” factor.

That’s when I remembered that conversation with Richard… and I started favoring the forecasts of these “gravity” guys.

Downside Cycle in 2023

I have recently done my own poking around. I found that down waves in the Sunspot Cycle have been increasing in length and as a percentage of the cycles after the last major peak in intensity in 1957. Ever since that year, sunspot cycles have peaked lower and taken longer to bottom.

I applied the average ratio of up and down waves since 1957. And the upside of this cycle into mid-2014 (at 4.4 years up) would project a downside cycle of 8.8 years and a bottom way out in mid-2023.

If that turns out to be the case, the traditional scientific experts would be far off in their forecast for the first time. And this scenario would correlate perfectly with my hierarchy of four primary cycles that suggests the worst for stocks between 2020 and 2022. And for the economy into 2023.

Here’s what the middle path would look like… (this is merely an intuitive correlation with the last cycle, which was the longest in history.)

My experience with much cycle analysis has taught me that the intuitive correlations tend to be better than the more analytical ones.

My Economic Forecast

This projection would say that the worst for stocks and the economy would hit between 2020 and 2021. That’s right in Trump’s re-election campaign – or just after if he wins. If I were running for president, I would rather lose due to a stock crash that I could blame on the Fed than get re-elected. And then get hammered and fully blamed for the next great depression!

Following this middle path, it also means that the economy could still be weak into 2022 or 2023, as my primary cycles continue to project.

That said, I wouldn’t be surprised to see the more extreme projection unfold, giving us a bottom in 2023. That would also be consistent with more lengthy bottoming processes in the last period of three low sunspot intensity cycles in the early 1800s. It’s called the “Dalton Minimum” where they stay at near zero for three to five years before turning up.

I’ll keep you updated. But I’m more confident betting against the traditional experts this time, although they are close to right most of the time. The falling intensity and lengthening of cycles here isn’t typical. And that’s where a cycle guy like me can see something the scientists don’t.

August 2, 2019

A Look at the 2nd Democratic Debates

All the focus this week, after the Fed rate cut on Wednesday, was on the Democratic debates, and I gotta tell ya… they have been on the disappointing side. One clear trend is that Elizabeth Warren is steadily rising in popularity. Another is that Independents are more powerful than most realize.

So today let’s talk about these debates. Let’s talk about Bernie Sanders and Elizabeth Warren and Pete Buttigieg. Let’s look at who’s affecting the Independents most. Most important, let’s look at what the most important issue will be into the 2020 election.

Watch this week’s video now.

Disappointing Democratic Debates

Get Harry’s take on this week’s political bouts, from Biden to Warren & everyone in between. Plus, find out how the economy could play a decisive role in the upcoming election. Watch now to get the latest market news.In Harry's latest book, he looks at the long standing relationship between political and economic cycles and when the next convergence is set to hit: https://pro.dentresearch.com/p/BNBZER...

Posted by Economy and Markets on Friday, August 2, 2019

August 1, 2019

Harley-Davidson’s Future as an Investment

At the end of July, Harley-Davidson reported second-quarter results, and it was a bloodbath. Sales slid and profits suffered a 20% drop.

None of this is surprising to Harry and me. In fact, we knew well before 2006 that the company would fall from grace because we knew its target audience and what they would be doing over the coming years.

As we’d forecast during the 1990s and early 2000s, in 2006, when Baby Boomers were mostly done with their midlife crises, Harley Davidson rolled over. Since then, the company has struggled to find its way. It’s targeted new audiences, international audiences, younger audiences, even women, in an effort to regain traction.

All to no avail. It has been like fighting a tidal wave with a bucket.

Will they eventually win or lose?

Listen to today’s video to see whether Harley-Davidson might be about to see a change in fortune once again.

July 31, 2019

Mexico, Gold, Reverse Mortgages, and Bonds

It’s been too long since we’ve shared our Q&As with our readers. So, today we remedy that. Here’s what readers have been asking Rodney and me… and how we answered them.

Remember, if you have any questions we don’t answer below, write to us at economyandmarkets@dentresearch.com.

Karen S. Emailed The Following…

I have been an avid follower of yours since 2000… I was just 33 years old then. I bought all of your books and read and reread them many times. I am Canadian, and when the Great Recession hit in the U.S., it got real for my husband and me. We sold our house and bought a boat. We got out with a small profit and were pleased.

Canada never had the correction the U.S. did, and had we waited to sell our house eight years later, we’d have made another million dollars. I wouldn’t change a thing we did though. A million dollars would have prevented us from an incredible adventure on our boat (seven best years of our life) as well as saving enough money to finally retire two years ago, at age 49.

Learning to release ourselves from debt so we could experience life is invaluable.

We have now settled in Merida Mexico for retirement… leaving Canada and its health care behind. High taxes and long wait times are now behind us. We love it here and will never look back. Vacations in Canada are incredible, but I want to live here.

My question to you: How is Mexico going to fair in this coming downturn?

Properties here typically don’t (or can’t) have a mortgage, so defaulting isn’t common, but having to sell because you need the cash is. Does this new government help of hinder Mexico in recovering from this upcoming depression?

Lastly, thank you for sharing your knowledge and experience. Your advice pointed us in the right direction and I am forever grateful.

To Karen, Rodney Replied…

Thank you for your continued support! It sounds like you carved out a great life.

As far as Mexico goes, that country is dependent on the success of the U.S. As we go, they go, because so much of their output ends up here. They will go through a pretty significant downturn along with us. The AMLO Government is doing good work rooting out corruption, but his tendency to nationalize could hurt. So far, he hasn’t gone it, but that was part of his platform for years before taking office. If he tries to nationalize industries during a downturn, it will make matters worse.

I Added…

Mexico does have better demographic trends and less overall debt compared to GDP than the U.S. While they may endure a significant downturn when we do, I think their economy will still fair better than ours. Properties there are also not as overvalued. You got out of Canada at the right time. Property there faces a painful crash… worse than what we can expect State side.

Roy H. and Bradley N. both wrote in to ask about gold.

Roy Specifically Asked…

Bill Bonner and Doug Casey have always said, and keep saying, “Buy Gold!!!” Why do you disagree?

My Answer To That Is Simple…

In the very short term, gold is in a bullish pattern. But, but the middle of next year, it should be falling again. It could dip near, or even through, $750 an ounce in the depth of the downturn ahead. After that, say by 2025, it should be moving higher again, and be in an upward patter for years after that.

The thing is, Bill and Doug view gold as an inflationary hedge and see the potential for hyperinflation due to money printing. The difference between us is that I don’t see any inflation in the near future. In fact, I see the opposite. When the crisis hits early to mid-2020, deflation is going to become a serious problem… and deflation is very bad news for gold.

Gold correlates with one thing over the long term: inflation. If it correlated with financial crises, it would have gone up rather than down in late 2008. Rather, the dollar proved to be the safe haven during the Great Recession, and it will prove to be the same in the coming crisis.

Ken And Carol Emailed…

We are both in our 70s and don’t want to sell our home and downsize yet. Should we look at a reverse mortgage before home prices drop?

My Response Was…

This is a good question. I always say it’s better to sell now, before the largest fall in real estate prices likely in your lifetime. Optimally, sell now and rebuy in a few years. Rent or take a trip around the world, in the meantime. A second option is to downsize now rather than in a few years’ time. If you wait, you may suffer a much larger loss on your present home.

Rodney added…

Reverse mortgages tend to be very specific to a person’s situation. They are typically for people who intend to stay in their homes as long as possible, and aren’t considered a safeguard, or put option, against the price of the home. If a person intends to say in the home for as much of their lifetime as possible, now would be a good time to consider it, when values are high.

And Wayne H. wrote asking Rodney…

Where do think bond futures are heading?

To which Rodney answered:

I think bond prices are going higher and rates are heading lower. The Fed will pull down the short end, and I think we’re looking at a global slowdown over the next several months, which will weigh on the long end. I think the whole curve moves down a bit.

Thank you to those who emailed. Remember, if you have questions, ask us. Or if you just want to send a note, we always love hearing from you. Again, you can reach us at economyandmarkets@dentresearch.com.

July 30, 2019

What’s More Important: Privacy or Investment Gains?

I know it’s in vain, but I keep Location Services turned off on my phone when I’m not using Uber or some other mapping app. In my head, this reduces the number of apps that can track my movements, and thereby removes just a bit more of my personal information from the amorphous cloud.

Sadly, I Am Completely Wrong

In 2018, researchers showed that by using readings like time zone and air pressure, they could approximate the location of almost any phone. Because these readings aren’t considered private and only represent a tiny amount of data, they aren’t protected.

Now add to that all the data I simply give away, such as friends on Facebook, shopping preferences on Amazon, and viewing habits on Netflix. Each platform provides a “pass through” service of a sort, but then uses many characteristics about me to make money by selling ads and tailoring offerings.

Funny, they never drop a check into my account to share the revenue.

Now We’re Going Further

As more people spit into a tube and mail it off to DNA-testing firms like 23andMe, we’re adding our genetic sequencing to national databases… and we’re paying for it!

Even when firms agree to keep our data private, like Facebook, we know it’s a lie. The company just agreed to pay a $5 billion fine to the Federal Trade Commission for improperly handling user data. CEO and Founder Mark Zuckerberg posted that the company will revamp its privacy policy and better safeguard data, but do you believe him?

Besides… $5 billion? It’s a drop in the bucket.

And companies that “anonymize” data aren’t helping, either. Medical organizations often share data to further research. But before sending it along they strip out information that could identify the patient. The only problem is, it doesn’t work.

Recently a group of researchers figured out how to re-identify individuals using just a few characteristics from anonymized data.

As the New York Times reported:

Scientists at Imperial College London and Université Catholique de Louvain, in Belgium, reported in the journal Nature Communications that they had devised a computer algorithm that can identify 99.98 percent of Americans from almost any available data set with as few as 15 attributes, such as gender, ZIP code, or marital status.

After figuring out how, the researchers did something unusual…

They Published The Algorithm

So that anyone could use it for free.

Their goal was to allow all entities that develop data sets to test their systems to see if they were vulnerable. That’s noble and all, but it also allows anyone with a data set to figure out who the people are!

Even the low-fi rewards cards at the grocery store track you!

As the case against Facebook shows, there’s a growing backlash among consumers about their lack of privacy. But you can’t put that genie back in the bottle.

Some, including me, have called for Facebook and others to create paid versions of their platforms where we can opt out of ads, tracking, and the general lack of privacy. One estimate shows that Facebook makes $82 per year from each account in North America, so considering its user base, $6.95 per month ought to cover it.

We Need A Paycheck

But how about we go forward instead of trying to go backward? Each entity selling our data gets paid. They need to pay us… and it won’t be cheap.

I don’t care if it’s a third of a cent per medical record impression, or six cents on a digital ad. Those sound like small numbers, but after a while, they add up.

If I’m so valuable to Facebook and other sites like it, then they should be paying that revenue forward. Sure, I might have to pay for services then, but that would be fine. At least I’ll be able to regain at least some control over my information, even if I can’t keep it private.

All Of This Does Have A Down Side.

With the FTC and other agencies investigating big tech firms, and individuals demanding more accountability in protecting their privacy, companies like Facebook could soon find themselves with diminishing revenue from advertisers. It hasn’t happened yet, but it’s possible. If Amazon, Facebook, Netflix, and Alphabet take a hit, the equity markets will suffer.

At that point, we’d have to consider whether we’d like to control our data, or keep booking gains in our investment accounts. Write to me at economyandmarkets@dentresearch.com and let me know which one of those two things you’d prefer. Unfortunately, we can’t have both.

July 29, 2019

Why King Dollar Won’t Be Dethroned Anytime Soon

Is there no end to talk of how the U.S. dollar will soon be replaced as the world reserve currency by the euro or the yuan or a basket of currencies or gold or bitcoin or Libra? Even Michael Cembalest at JP Morgan is the latest to predict the dollar’s rapid demise.

The reality is, the U.S dollar will remain the global reserve currency for longer than anyone expects. In fact, as we head into the next financial crisis, the dollar is going to soar.

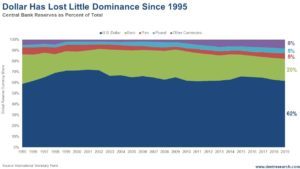

Look at this chart.

Despite all the naysayers, the U.S dollar still rules.

It was the one major currency that appreciated in the worst of the 2008 crisis when Lehman collapsed and everything started falling apart before QE. In the second half of 2008 it appreciated 27% while gold crashed 33%.

And yes, since then we’ve printed trillions. But the ECB has printed more relatively speaking, and Japan has printed much more. Japan’s balance sheet is now over 101% of GDP, while Europe’s is 40%. The U.S. is a mere 19% after minor quantitative tightening.

What all these experts seem to miss – which is insane because it’s blindingly obvious – is that…

All currencies trade relative to each other. The currency of the best house in a bad neighborhood will reign… no matter what.

Besides, it’s just easier to have one dominant standard. We don’t have to be perfect, just better than the rest, as we continue to be on almost all fronts.

The euro has gained a little ground, and the yuan included in “other” in this chart is still inconsequential. Who trusts China’s top-down communist government anyway? Besides, the European Union and euro is still an experiment. They’re fragile and not looking too good. “Coma-economy” Japan isn’t even a consideration. And the pound sank to its lower value in two years this morning.

Then there’s bitcoin, which is still both too small in capitalization and off-the-charts volatile to be anywhere near close to threatening the dollar’s seat. That could be a different story 10 or 20 years from now, as could a basket of currencies. But that’s a long way off.

Then there’s libra from Facebook, which is clearly more an alternative payment system. It’s based on, and must be backed by, a basket of currencies to have any value or credibility. Such states that back it are not likely to let libra become a freewheeling global medium of exchange, especially if it jeopardizes anti-money laundering efforts.

Sanctions against Iran and Venezuela are causing some diversions of trade out of the dollar, but that’s also not remotely significant.

The biggest threat to the U.S dollar is the Donald stacking the Fed with his ass-kissing, money-printing cronies. But even he can’t offset the international trends in favor of the dollar.

As we go out 20 to 50 years, the continued rise of Asia (on my 165-year East-West Cycle) will dictate that the reserve currency position shifts towards China or an Asian basket – if a state-backed reserve currency is still necessary. Cembalest at JP Morgan is right about one thing: Reserve currencies don’t last much more than 100 years longer term…

But the U.S dollar will definitely be the safe haven in the next financial crisis between 2020 and 2023, just as it was in the one between 2008 and 2009 and through the euro crisis of 2010 and 2012…

And you know my position on gold: It’s a hedge against inflation, not deflation. You don’t want to poison your portfolio with much at this point.

Ray Dalio is going to be wrong about that one. His recent gold recommendation may be the last boost to gold’s rally and a sign of a top building before the next fall to $700 or so.

It’s king dollar for now. Love it or not!