Harry S. Dent Jr.'s Blog, page 103

August 22, 2016

If Trump Loses, Expect Civil War

Bernie Sanders may have conceded the democratic nomination to Hillary Clinton last month, but that doesn’t mean he’s going anywhere.

Bernie Sanders may have conceded the democratic nomination to Hillary Clinton last month, but that doesn’t mean he’s going anywhere.

Which I’ve been saying for months now. Win or lose, both Bernie Sanders and Donald Trump will have strong support groups for years to come. Especially when the economy turns south in the months and years ahead!

Days after endorsing Clinton, Sanders came out saying he’ll continue his “Revolution” with at least two new organizations. One called the “Sanders Institute” will push his political agenda… and another named “Our Revolution” will actually help put more progressive candidates into state and local office. He plans to endorse 100 candidates through the 2016 elections alone!

Like I said back in March – both men have effectively hijacked their respective political parties.

And even while Trump’s campaign for the presidency seems to be floundering as of late… don’t write him off just yet! Trump stands for something much greater at this point. And his movement’s still alive and kicking.

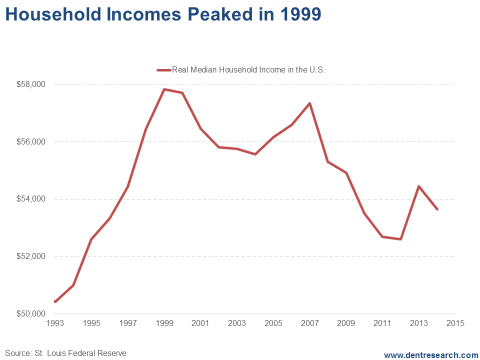

Trump’s movement is born out of a deep dissatisfaction among the middle and lower classes in this country. Their standard of living has gone nowhere since the early 1970s, and has actually gone down adjusted for inflation since 2000. Take a look:

As an electorate, you have a declining middle class split between the populist candidate on the Right… and the progressive one on the Left.

But lately, it almost seems like Trump doesn’t want to win. He completely refuses to listen to his campaign managers and voter feedback telling him to dial it back a notch. Which begs the question: Is he trying to lose?

I wouldn’t go that far. I do believe he may want to be president. But I don’t think that’s his ultimate strategy.

Hell, if he lost, it would bring credence to his claim that “the system is rigged!”

But no – his ultimate strategy is to win the hearts and minds of the suffering middle class of this country. He’s saying exactly what they’re feeling – without political correctness or shame. To them, it’s those “damn foreigners’” fault.

Namely, the cheating Chinese and Japanese in their trade policies…

The lower-wage legal and illegal immigrants alike who put downward pressure on wages…

And yes, the foreign buyers (mostly Chinese) that push real estate prices up in our largest cities.

So no matter what he says or does – no matter how stupid or brilliant – Trump has the almost unwavering support of somewhere between 30-40% of the electorate.

And it may not be enough to win…

But it may be enough to start the next civil war in this country.

There’s a recent article in The Atlantic with a subtitle that reads: “If Trump loses, his consolation prize may be a whole new right wing media juggernaut.”

He has recently entrusted his campaign to Stephen Bannon, the executive producer of the conservative media platform Breitbart News. And he’s also hired the now former Fox News boss, Roger Ailes (who’s shrouded in enough controversy of his own – like that matters to Trump and his supporters)!

Take this media-savvy trio… and you have the makings of a new conservative news station to rival Fox News – and continue delivering Trump’s message well after he’s lost the election!

Mark my words on that!

If Trump loses – and at this point it looks like he will – look for a new conservative media network led by the Donald himself!

But even so, this is only a drop in the bucket of the larger social revolution I see ahead.

When this next financial crisis unfolds, expect a wave of civil unrest that will split the country in half. I could see this beginning around the end of next year – during the worst economic storm we’ve seen since the dawn of the Great Depression!

After all, Trump has dubbed himself the “Brexit candidate” on more than one occasion. Don’t take that likely. No one thought the UK could actually vote to leave the EU – right up until it did. And we have just as bad if not worse social and political division in this country.

I could even see a large part of the southeast, southwest and Rockies secede from the country, at least in part. They’d still be a trade zone, just with their own social laws. Combined with their economic frustrations, one too many social issues have simply pushed them over the edge. I really think the “transgender” issue is the straw that broke the camel’s back – at least for the most conservative sector of this country. And this was right after the Supreme Court did the unthinkable and made gay marriage legal – even in their own backyard.

But the larger point is that major shifts in politics are simply part of the natural cycle in the winter season bubble burst (see my 80-Year Four Season Economic Cycle). After the top 1% ran away with the punch bowl in the fall bubble boom season and social policies got as loose as they can get (like in the Roaring 20s), the tide turns back toward favoring the middle class and those who were forgotten.

Trump sees the writing on the wall. He sees the shift coming, and he’s using it to further his cause. All of this is far more predictable than anyone would assume – except for clueless economists and political pundits.

This greatest crash of your lifetime will come with more than just financial and economic challenges. Together with the Honorary David Walker, we’ll discuss some of these challenges at this year’s Irrational Economic Summit at the PGA National Resort in Palm Beach, FL. Make sure you don’t miss it – we have plenty to discuss!

Harry

Follow me on Twitter @harrydentjr

The post If Trump Loses, Expect Civil War appeared first on Economy and Markets.

August 19, 2016

Come Out to Visit the Dent Research Team in Palm Beach

Whenever two Texans meet for the first time on neutral territory – and by neutral, I mean anywhere outside the Lone Star State – somehow, some way, the meeting inevitably becomes a contest to see whose Texan roots run deeper.

Whenever two Texans meet for the first time on neutral territory – and by neutral, I mean anywhere outside the Lone Star State – somehow, some way, the meeting inevitably becomes a contest to see whose Texan roots run deeper.

It’s the closest thing to a manhood-measuring contest I can imagine without a ruler.

At last year’s annual Irrational Economic Summit, I was once again measured… and fell far shorter than ever before against my new friend. It was a guest from the Houston area whose roots dug all the way back to before Texan statehood, the Republic of Texas and even Mexican rule.

She could trace her family’s Texan roots to a land grant by the King of Spain. Her ancestors had lived under all six of Texas’ flags.

I know when I’ve been beaten, so I tipped my hat (proverbially) and looked to console myself with a cold Shiner Bock… which was irritatingly tough to find in Vancouver.

But, it goes to show that you never know who you’re going to meet at IES. Attendees from around the world come to hear Harry and the rest of the gang speak. And, as often as not, the conversations you strike up in hallways, or at the bar, are equally insightful.

You will learn a lot from watching Harry on stage. But if you really want to know what he thinks about something, buy him a drink afterwards. You’ll have a conversation that you won’t soon forget.

We’re hosting this year’s Irrational Economic Summit in October at the PGA National Resort in sunny Palm Beach, Florida. The Honorable David Walker – previous Comptroller General of the United States and head of the U.S. Government Accountability Office (GAO) – will be our keynote speaker.

You won’t want to miss his speech. David – despite living in the corridors of power – never “drank the Kool-Aid” and became a Washington insider. He maintained his independent streak… and his knack for taking both Democrats and Republicans to task for their fiscal shenanigans.

Fellow Texan Dr. Lacy Hunt, who joined us last year in Vancouver, will also be returning this year. Lacy is one of the few economists out there who understood years ago that deflation rather than inflation would be the greatest economic challenge of the 2010s.

And he puts his money where his mouth is; Lacy runs a $4.5 billion money management practice specializing in fixed income portfolios. Given how heavily allocated I am with income investments in Peak Income, Dent 401K Advisor and Boom & Bust, I’m looking forward to what Lacy has to say.

You’ll also see some familiar faces from the Dent team taking the stage. Harry and Rodney will kick it off like always, but you’ll also get to hear from our resident forensic accountant John Del Vecchio.

John is a short seller by trade, and I’m willing to bet his speech is unlike anything you’ve ever heard. A lot of speakers will tell you how to buy stocks. John will show you his tricks on how to short ‘em.

Dent Research’s Chief Investment Strategist Adam O’Dell will also give his outlook. Adam gave his “sell everything” call at last year’s event… and I mean that literally. We exited most of our long positions in Boom & Bust based on an announcement Adam made during the summit.

And it was well-timed. Very shortly thereafter, the market went into a tailspin that didn’t let up until mid-February… nearly five months later. We’ll see what new insights Adam has cooking for us in October.

And naturally, I’ll be taking the stage as well, giving my recommendations for the investment minefield ahead. So if you’d like to chat in person, this is your chance. Also, be sure to buy Harry that drink. You won’t regret it – he’s a real force to meet in person.

Charles Sizemore

Portfolio Manager, Boom & Bust

P.S. There was a flurry of excitement this morning over how successful Adam’s webinar, Why Most Investors Suck Wind (And How to Guarantee YOU Don’t!), was and how positive the response has been to his trading methodology. Word came from our publisher that for a limited time, you can still get access to Adam’s “tricks of the trade” right here. Hurry though, because this information is hot – and it’s not going to be available for long.

The post Come Out to Visit the Dent Research Team in Palm Beach appeared first on Economy and Markets.

August 18, 2016

Beating the Market Comes Down to One Thing: Timing

The secret to beating the market is simple: just be in the right place, at the right time.

The secret to beating the market is simple: just be in the right place, at the right time.

I said simple, not easy. And if you’re still clenching academic theories, born decades ago, you probably think it’s impossible to time the market… more impossible still to beat the market. After all, that’s what the Efficient Market Hypothesis (EMH) says.

But I’m here today to tell you that the EMH theory is wrong. And I can prove it.

Consider the chart below.

It shows the difference between Buy-and-Hold and a Strategy (Right Place, Right Time) that’s based on a concept called “Seasonality,” which I’ll explain today.

But first, tell me… which investment strategy would you prefer to use?

Over the last 16 years, the S&P 500 has gained a measly 50%, turning $100,000 into around $150,000. And at one point, buy-and-hold investors suffered a gut-wrenching 57% drawdown.

This is the “efficient market” you’ve been told “can’t be beaten.”

But as the green line shows, you CAN beat the market. In fact, you can earn higher returns AND take less risk… by simply being in the right place at the right time.

So what exactly does that mean… being in the “right place at the right time”?

The concept is called “Seasonality.”

I wouldn’t be surprised if you’ve heard of Seasonality before. Plenty of stock market analysts throw the term around, even if they don’t know how to harness its power.

Have you heard the saying, “Sell in May and Go Away”?

That’s one of the most widely recognized sayings in the investment community. And it’s based on this idea of Seasonality, which is simply the fact that stocks tend to do better (or worse) during different “seasons” of the year.

But, to me, the advice “Sell in May and Go Away” is completely useless.

For one, I’m not a passive buy-and-hold investor. I use proven systems (like Cycle 9 Alert) to actively time and trade the markets.

What’s more, I don’t simply “buy the market” when my indicators tell me it’s a good time to be bullish. Instead, I hone in on the specific sectors that are poised to outperform the market – and then I put my money to work in those sectors.

Basically, I’ve found a far better way to harness the power of Seasonality… a strategy that keeps us in the right place at the right time.

When it’s Hot or Not

In Cycle 9 Alert, I track the price movements of nine market sector ETFs:

Consumer Staples (XLP)

Consumer Discretionary (XLY)

Healthcare (XLV)

Technology (XLK)

Financials (XLF)

Industrials (XLI)

Materials (XLB)

Energy (XLE)

Utilities (XLU)

Each of these sectors has its own seasonal pattern, revealing when the sector typically outperforms the broad market, and when it underperforms.

By studying these patterns, you can place yourself in the right place, at the right time. And then you can actively time, trade and beat the market.

Now, you should know that Seasonality is just one factor I use to deliver market-beating returns to Cycle 9 Alert subscribers. And when you understand how much of a difference just Seasonality can make, you’ll start to understand why my strategy is so powerful.

See, every month, there’s a good deal of “moving and shaking” between sectors. And the performance difference between the seasonally strongest and weakest sector each month is meaningful, with an average spread of 4.3%.

These seasonal patterns – which are unique to each of the nine market sectors – work to inform my Cycle 9 Alert algorithm about which sectors are poised to outperform the market, making them buys… and which sectors are poised to underperform the market, making them sells.

In about an hour, Jake Hoffberg and I will be hosting a special live event.

We’ll be giving live viewers even more details about this, but you must register to join us.

See you at 4 p.m. Eastern Time!

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

The post Beating the Market Comes Down to One Thing: Timing appeared first on Economy and Markets.

August 17, 2016

Harry Dent: You Gotta Have A System

As Adam likes to say: “Investors Suck Wind.” He has studies showing the average investor earns annual gains of 5.2% vs. the 9.9% returned on stocks overall – that’s just over half. And this is over the long-term bull markets like from 1983-2007.

As Adam likes to say: “Investors Suck Wind.” He has studies showing the average investor earns annual gains of 5.2% vs. the 9.9% returned on stocks overall – that’s just over half. And this is over the long-term bull markets like from 1983-2007.

When I was talking to a bunch of financial advisors in the mid-to-late 1990s, one of their favorite charts (other than my Spending Wave) was the Dalbar study showing investors made more like 4% profits instead of the 10%-plus average for stocks back then.

Why is this?

Most investors need to watch a trend long enough to muster up the nerve to jump in – that’s a nice way of saying they get in too late.

With corrections every four years on average and substantial corrections every 10, the first investors hang in too long hoping to get back to even. Then they finally panic and sell when stocks go down far enough to push their fear button.

Fear and greed are the two polar opposites that drive investing. The problem behavioral psychologists uncovered is that fear trumps greed. Most people need to see at least a potential gain 50% higher than the potential loss for them to go for it.

In other words: we value avoiding pain or loss more than getting pleasure or pain… that’s just human nature.

This is the same principle that marketers, and I, observe in consumer behavior when adopting new products, technologies or social values.

There is an S-Curve pattern of how we respond, as the chart below demonstrates:

The reason the top 0.1% to 1% control 50% of the wealth in this country is that they’re often the first to recognize a new trend, and that is risky. That’s why the 0.1% to 1% get labeled opinion leaders.

Then come the influential – more affluent and knowledgeable, between 1% and 10%. It is this sector that decides whether a new product is going to go mainstream or not. Malcolm Gladwell would term this “the tipping point.”

They provide the critical mass that causes the S-Curve acceleration and then, like a herd, the early majority adopt next. After the 50% adoption point the process slows down as finally… the late majority piles in.

From 90% forward things really slow down and we see the last to jump on board with the laggards and, finally, the die-hards…

Once that happens, demand shrivels up and declines.

These stages are predictable.

But most people don’t see that.

That’s the time frame of any investment– a short-term cycle for traders, or long-term bull and bear markets for investors. Like anything else, the early-birds get the worm and the latecomers pay higher prices and face greater risk.

And when the party begins winding down, who gets out first? Yup, it’s the same order all over again.

That’s a thought crossing most investors’ minds: “How can I always be the last person to get in before the market falls?” Though it may feel like that, the truth is that you have a lot of company since most people get in on the late side.

And the converse is true as well; the late-comers are also late to get out as they wait hoping to get back to even.

But here’s the worst thing about it, and this is downright sinister. The smart money, the big boys, the most adept traders… are watching you and all investors.

They watch the balance of buy orders and stop losses in order to know when the masses have piled in, like you, and then they short the market… and then they buy when everyone has panicked out. They have both the disposition and tools to do this that you don’t.

It should be obvious that if even longer-term investors greatly under-perform in good times, they would do worse in extended bad times like this winter season and even worse than that if they try to become shorter-term traders on their own.

I tell aspiring E-traders not to open that $50,000 account as they’ll lose it trading – unless they’re unusually gifted. You are a minnow swimming in a shark tank. You would be better off giving that $50,000 to charity and getting a 50% tax deduction!

My team’s Chief Investment Strategist and Editor of Cycle 9 Alert, Adam O’Dell, is one of these unusually gifted people with a unique system different from even the most seasoned traders out there. You can’t beat “the Street” without such a system to harness the emotions that kill most investors – and Adam’s constantly refining that methodology to hone in on even better trades.

In these increasingly volatile times – and my longer-term perspective is crystal clear that they are going to get much worse, sooner rather than later – you should have some portion of your portfolio positioned with a system like Cycle 9 Alert and the remainder in safer-than-normal areas.

That’s where understanding your risk tolerance comes in: how much can you afford to put in a higher-return system vs. how much does it take for you to be secure, sleep at night and stick with that system?

These are questions that all of us need to answer, but with someone like Adam on your side, it makes the process all the easier to bear.

Harry

P.S. This Thursday at 4 p.m. EST, Adam will be explaining his systematic approach to the markets in a free, live event called, Why Most Investors Suck Wind (And How to Guarantee YOU Don’t!). With a 68% win-rate for his Cycle 9 Alert service, Adam’s approach to investing is well worth your time to tune in and listen to. If you’d like to maximize your gains while minimizing your risk, sign up now for Adam’s special presentation.

The post Harry Dent: You Gotta Have A System appeared first on Economy and Markets.

August 16, 2016

Invest Actively – Easy Gains are Gone

The equity markets recently reached all-time highs. Did you celebrate? Because I didn’t, and as far as I can tell, neither did anyone else. No party hats or leftover confetti were found on the floor this time around, and that’s a problem.

The equity markets recently reached all-time highs. Did you celebrate? Because I didn’t, and as far as I can tell, neither did anyone else. No party hats or leftover confetti were found on the floor this time around, and that’s a problem.

Markets could fail for a million reasons. Most are very specific reasons that reflect real economic issues. On the economic front, for instance, the U.S. carries too much debt.

Productivity is low. Bank borrowing is off. Business capital investment is down.

Then there’s the problem of falling corporate revenue and profits over the past year. If the fundamental reasons aren’t enough, there remain technical reasons to panic, like nose-bleed high price-earnings ratios.

TINA – Invest Actively

As for staying invested, that’s a lot harder to defend. There’s the old “TINA” saw that stands for There Is No Alternative, implying that investors who need growth must remain in equities because bonds pay almost nothing and commodities have been in the dumps for years. That’s a nice sentiment, but it comes at the risk of losing a big chunk of your net worth.

There’s always the view that investors should jump into stocks because they’ve been going up in spite of all the problems in the world, but that’s like driving by looking in the rearview mirror. As long as the road ahead looks like where you’ve been, everything is fine. Unfortunately, you won’t see the upcoming curve in the road until you’re flying into the ditch.

So far, I’ve only touched on issues in the financial markets, but we all know that the financial world coexists uneasily with the political world.

Politically, we have Vladimir Putin creeping throughout the old U.S.S.R. playground, a refugee crisis spreading in Western Europe, an ugly political contest here at home, and central banks around the world desperately trying to affect change when their own governments are too timid.

Protesters gather outside Cologne Cathedral after New Year’s Eve sexual assaults in Germany, January 2016. In February 2016, the German government admitted that it had lost track of around 150,000 million registered asylum seekers because they never arrived where assigned. Many of the missing asylum seekers simply went to other European countries, while others continue to live illegally in Germany.

This results in the standoff we face now, where central banks can’t make more progress and government officials won’t offer up real solutions for sagging infrastructure, aging populations, and exploding benefit programs.

It’s enough to make any sane investor want to take his chips off the table and go home. But you can’t… or at least, you can’t stay out of the markets for long. Most of us need the growth. We need our assets to increase over time so we can afford the lifestyle we want in retirement.

Sitting on the sidelines might save us from an ugly downturn, but staying out too long, or waiting for just the right moment to jump back in, could cost us precious returns.

There is an alternative. We don’t have to leave our fortunes invested, hoping that the textbooks are right about equities going up “over time,” even though the situation looks bleak. And we don’t have to give up on growth, resigning ourselves to the paltry gains of CDs or corporate bond yields. It might be true that the “easy” gains of the market are past

If you’re not sweating you’re not trying

But that doesn’t mean that all the gains are gone. From here, it takes work.

And a system.

The equity markets reached their previous highs in the spring and early summer of 2015, then saw two ugly spells before regaining those highs in the last few weeks. Investors that remained through that might have seen profits for their pain, or not. The problem is that not all investments are equal.

Just 10 stocks are responsible for more than 70% of Nasdaq gains so far this year. If you don’t own those stocks, or hold them in significant sums, chances are your portfolio is lagging.

From here, Harry Dent expects the markets to take a turn for the worst, potentially dragging down equities and bond prices at the same time. It would be a cruel twist of fate for investors to take a big hit now after sticking it out through the craziness of the past year!

For protection, investors should ask themselves one simple question about each security they own… Why? Why do they own it?

Is it a “story” stock? Did it have a good run in months or years past, and romance you so that now you just can’t let it go? Did you read about it in the news? Or is there a specific, investable reason for holding that security today, with a target for selling it on the way up, as well as cutting your losses on the way down?

Cycle 9 Alert

In our own business, we use Adam O’Dell’s Cycle 9 Alert system to provide exactly that. Quantifiable risk, with identifiable rewards. He doesn’t buy the “market,” and he doesn’t hold investments for long.

The goal is to find opportunities that have the highest chance for success in a short period of time, so that we can make our money and move on. This approach has treated us and our readers well for five years, consistently beating the markets and chalking up several eye-popping returns along the way. It doesn’t mean every position is a winner, but most are, and we know why we hold every position.

So, as we go through what is typically the worst calendar quarter for equities, and we watch the markets dance around all-time highs that have made no one feel good, take some time to review your portfolio. Do you have a systematic approach? Do you know why you own each security?

If you answered, “Yes,” then great. But if you answered, “No,” then commit to the work of implementing a system that can potentially hand you gains while helping you avoid a likely nasty turn in the markets.

Rodney

P.S. This Thursday at 4 p.m. EST, Adam will be explaining his systematic approach to the markets in a free, live event called, Why Most Investors Suck Wind (And How to Guarantee YOU Don’t!). With a 68% win-rate for his Cycle 9 Alert service, Adam’s approach to investing is well worth your time to tune in and listen to. If you’d like to maximize your gains while minimizing your risk, sign up now for Adam’s special presentation.

The post Invest Actively – Easy Gains are Gone appeared first on Economy and Markets.

August 15, 2016

John Del Vecchio’s Stock Pick Trifecta

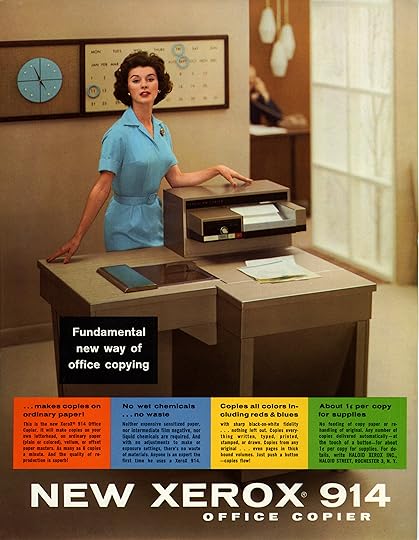

The 914 printer was a key driver of Xerox’s revenues in the mid-1960s – two-thirds revenue in 1965, with $243M income. The first commercial plain paper copier, in 1959, revolutionized the document-copying industry.

John Del Vecchio

When I’m on the hunt for an investment opportunity, I want a company that pays ME first!

In my last two pieces in Economy & Markets, I talked about the importance of dividends and quality share buy backs. Both are key indicators of quality shareholder yield.

Dividends may not be sexy, but companies that grow their dividends over time can be. This is what Johnson & Johnson (JNJ) did every year for 38 years between 1966 and 2008.

If you’d bought the stock in the early 1970s, the dividend yield that you would have earned between then and now on your initial shares would’ve grown approximately 12% annually. By 2004, your earnings from dividends alone would have given a 48% annual return on your initial shares!

These companies, like Johnson & Johnson, that grow their dividends over time, vastly out-perform those that don’t.

Buy backs can also be a source of returning cash to shareholders (although they can also be tools that executives use to manipulate the bottom line and fund their own compensation schemes).

We prefer the former to the latter, of course.

But the third way to create shareholder yield is to pay down high-interest debt. A company that does that essentially “pays” us well to own it. By paying down debt it saves cash because it’s not paying interest.

If a company has a huge debt load, it has big payments. There’s always a risk it won’t make the payments in a credit or economic crunch.

But a company with a diminished debt load is a different story. It’s balance sheet strengthens with each high-interest debt paid down and it can survive the storms that plague all companies.

Plus, it can refinance remaining debt at lower rates because lenders will compete for the now-better borrower – just like snaring better mortgage rates with a higher credit score!

Best of all, the company paying down its debt can use that cash to pay us in those two other ways: buying back cheap stock and starting or increasing dividends.

Let’s look at a couple of examples!

Cincinnati Bell (CBB)

The market is just now catching on to the debt pay down, and growing cash pile, at this boring telecom.

Because I look more closely than the general market does, let me tell you, the stock is far from boring. In fact, it’s a thrill-a-minute.

By spinning off a fast-growing but cash-guzzling division, Cincinnati Bell created cash out of thin air because the market awarded a great stock price to the new separate company.

Then, it sold off stock in the new company a bit at a time using the influx of cash to pay down debt – and, last quarter, the company used additional cash to buy back cheap shares.

Because telecoms typically need some debt to finance investment in high-speed Internet communications and the now-familiar triple play of fiber optic TV, Internet and phone, we don’t want the company to pay down all its debt – it does get tax deductions for the interest payments – but we want the debt to have low interest rates.

Fortunately, Cincinnati Bell is refinancing to save even more because lenders offer better interest rates as the company strengthens.

It’s a quiet little story where forensic accounting shows the way, before it winds up on every finance blog in the country.

Xerox (XRX)

The old Xerox has evolved into a very financially sound company and a large part of that is slicing away 42% – almost half! – of its long-term debt in the last five years. In addition, Xerox freed-up 50% of its short-term obligations in the last four years. This is phenomenal. It provided cash for the company to buy back a third of its cheap shares.

So what has the former copier giant, now services provider, done to pay us even more? Since the time it began mega-buybacks, Xerox has boosted the dividend every year for an 82% overall bump.

With a 3% yield and only a 30% payout ratio today, there is much more room to pay down debt, buy back more cheap shares – they are cheap – and hike the dividend.

The market hasn’t rewarded the stock yet – it’s watching numbers that don’t matter – but I see the future.

Use this shareholder yield trifecta to identify stocks that pay you first. Your investment portfolio will benefit!

John Del Vecchio

Editor, Forensic Investor

A September 1959 advertisement for the Xerox 914

The post John Del Vecchio’s Stock Pick Trifecta appeared first on Economy and Markets.

August 13, 2016

Inequality Killed Brazil and It’s Happening Here Too

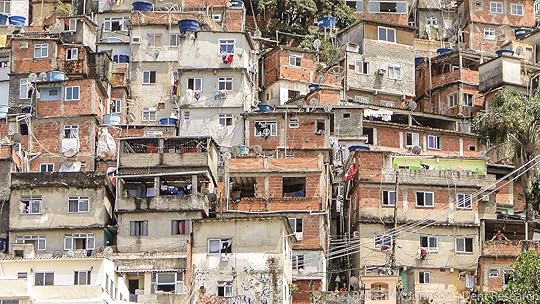

Inequality defines Brazilian life: Brazil currently has 12 million people living in favelas or slums. They generate (USD) $12 billion per year in economic activity, equivalent to the GDP of Bolivia. If a state, the favelas would form the fifth most populous Brazilian state; Rio de Janeiro’s favelas alone would comprise, together, the ninth largest city in the country.

There is no need to look any further than Brazil to understand how important navigating your own financial future is for you and your family. When the hinges come off the market and cities across the country struggle to make ends meet, who knows what might happen.

Besides the lack of control we have when things do go spectacularly wrong on a grand scale, we also face the all-too-human problem that we can’t be trusted with our emotions at times like that to act in our financial best interest.

That’s why Adam O’Dell’s Cycle 9 Alert is so popular, and so successful. It removes emotion from the investing equation and brings to bare some critical strategies. It ignores the headlines and instead looks at the information that REALLY counts.

There is no need to look any further than Brazil to understand how important navigating your own financial future is for you and your family. When the hinges come off the market and cities across the country struggle to make ends meet, who knows what might happen.

Drug use is highly concentrated in favelas run by local gangs where dealers host their own baile, or dance party, where many different social classes can be found. These drug sales make up to US$150 million per month.

He’ll be sharing the details with you on Thursday, August 18, at 4 p.m. Eastern Time. But, you must register to attend this webinar. You can do so here.

His aim, with this webinar, is to show you how the typical investor sucks wind, and then what you can do to change that in your own portfolio! Don’t miss it, especially because you need this information now more than ever before. Like I started off by saying, Brazil gives us some valuable insights…

The 2016 Summer Olympics kicked into high gear this week as we saw just how bad the situation in Brazil has become.

The country is a mess, there’s no other way to say it –from massive corruption, blistering scandals, a withering economy to basic lawlessness.

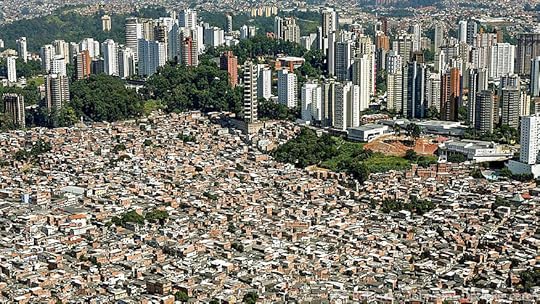

Rio’s Santa Teresa neighborhood features favelas (right) contrasted with affluent houses (left). The Christ the Redeemer, shrouded in clouds, is in the left background. 18-year-old Paula, married, mother of a 2-year-old girl in Santa Teresa, sums up the general feeling: “What I think is bad in the community is the shootings and trafficking, but I have always lived here and I want to stay here because my whole family is close by.”

Despite everything, Brazil has going for it and against it, and that’s a long list, there’s an underpinning of widespread inequality that’s tearing the country apart. Experts believe it is the defining issue for Brazil as it faces a genuinely uncertain future.This is a country with the world’s sixth-largest economy and until a few years ago, it was also one of the world’s fastest growing major markets.

Back home, we face the same crushing problem and Harry has been highlighting this for us over the last few months. In case you haven’t heard, U.S. income equality is already worse than in many Latin American countries.

In fact, 10 countries from the region have better income equality than the U.S. Brazil comes in five spots below the United State’s and the issue is getting nothing but worse here at home.

In preparation for the Rio Olympics, Brazil for several years has been infiltrating favelas with police and military pacification units. “There is no pacification here,” one resident says. “What we have is a war. Criminals against police, fighting over who are the more powerful the more influential. And who suffers? We do.”

As more and more of our choices are taken from us, it’s important to keep our hands on the tiller of our financial futures. Which is why it pays to register for Adam’s webinar, airing next Thursday (August 8)…and to check below for anything you missed on Economy & Markets with today’s weekly wrap-up.

Monday Charles began by saying what many of us already knew. It’s getting harder to earn a buck out there. Stocks are expensive. And while small pockets of value are getting smaller every day, it is still possible to turn a decent profit in the equities market. BUT, good investing requires a pro-active approach in this market and that’s why Charles, too, recommends Adam’s Cycle 9 Alert.

Tuesday it was Rodney writing about his déjà vu moment with the last housing bubble and today’s eerily similar housing bubble 2.0. Little different this time around, but the results are similar. Unfortunately, with stagnating wages and a median U.S. income of $54,000, few remaining Americans can come up with the $300,000 purchase price for the average new home. Rodney advises purchasing less home than you can if you’re buying anytime soon. Just in case, you wind up underwater on your mortgage.

Wednesday Adam O’Dell stepped in tell us how his Cycle 9 members banked a 225% profit in just two months and turned $5,000 into $16,250. And it came from the most unlikely of sources… “a left-for-dead silver miner that no one on Wall Street would touch with a 10-foot pole.” A fun story and definitely worth a read.

Thursday Harry wrote to us about the Treasury, dollars and gold… Oh my, he predicts a wild ride in the coming months. No place is safe, he says, well no place is safe to sit on the sidelines in the fiasco to come. Even the hedge funders are being slammed, so when Harry also mentions Adam’s Cycle 9 Alert, he thinks there’s value there you’ll not find anywhere else.

Friday[LINK] Ben Benoy peeled back the curtain on the Precision Medicine Initiative (PMI) that received more than $200 million from the White House to fast-track the research that could save the industry, and the country, billions. Using Precision Genome Medicine (PGM) a patient’s genome will tell doctors where to target treatment and eliminate wasted time, money and testing.

And that brought one more week of summer 2016 to an end. Thank you for spending some of that time with us here at Dent Research. Go U.S.A!

Play safe out there,

Robert Johnson

Editorial Director, dent Research

P.S. Just a reminder that Adam O’Dell will be at our Irrational Economics Summit in West Palm Beach, Florida October 20-22. He’ll be on hand to outline his Cycle 9 System with a long list of respectable speakers you may not see anywhere else. Certainly not together, and certainly not at a better time for you to prepare for the shakeout around November elections and whatever new brand of chaos lay spread waiting on us in 2017. But you don’t have to wait that long to hear from him. Register now for his webinar, entitled Why Most Investors Suck Wind (and How to Guarantee You Don’t!), on Thursday, August 18 at 4 p.m. Eastern Time.

Robert Johnson

Editorial Director, Dent Research

The post Inequality Killed Brazil and It’s Happening Here Too appeared first on Economy and Markets.

August 12, 2016

Invest in the Future of Medicine

It’s OK if you’ve never heard of Precision Medicine Initiative (PMI) until now. It was less than one year ago when President Obama gave the National Institutes of Health (NIH) more than $200 million to accelerate PMI… and you may have missed it.

When the White House starts throwing money at something, it can help to pay attention. This time, it looks like 1600 Pennsylvania Avenue was right on the money.

That’s because not one, but two big healthcare players just blew the lid off existing medical research. They did it by analyzing 450,000 human genomes and exposing a record number of our genes linked directly to depression.

Major depressive disorder (MDD) plagues over 350 million people worldwide with varying degrees of soul-crushing numbness and debilitating symptoms. Depression costs the U.S. about $1 billion a year in lost productivity, and that doesn’t include lowered work functioning, impaired productivity and decreased job retention.

Until now, the largest study conducted on MDD to uncover related human genes covered just 6,000 people.

Drug giant Pfizer teamed up with California company 23andMe, who sold 1.2 million clients’ DNA testing services.

Over 450,000 of those 1.2 million 23andMe clients had their genomes screened for outlier genes that may lead to MDD.

After some seriously major computer data crunching, the study found 15 human genome regions linked to serious depression. Because of smaller sample sizes, previous research was limited to finding just one to two genome regions.

Psychiatrist and gene researcher at Stanford University, Douglas Levinson, says: “The big story is that 23andMe got us over the inflection point for depression.”

Say “thank you” to those 1.2 million customers.

The Human Genome Project sequenced the first human genome in 2003 at a cost of $3 billion.

Now, 23andMe sells sequencing kits for $199.

We’ve come a long way, but we’re poised to leap forward even further in a short amount of time.

Most of the 1.2 million customers order their profile to discover their ethnic background and more than half allow their DNA for use in health research.

This is where the PMI comes into play. For 2016, the President earmarked $215 million to pioneer a new model of patient-powered research. The foundation for this will be massive data banks of DNA.

Volunteers will donate their DNA to large government and commercial industry databases. Alongside existing datasets from your medical record and lifestyle, this DNA test compares against key genes that cause you personal health issues and diseases.

As we discover additional genes, patients will receive custom medicine designed to block or destroy the effects of any harmful genetic cues in their genome.

Scientists have even developed technology that allows genes to be “edited” out of DNA completely. One of the frontrunners is a technique called CRISPR, leveraged by Editas Medicine (Nasdaq: EDIT), that recently went through an initial public offering in February.

Genome treatments are picking up major steam in the healthcare industry because they save costs. Hospital patients now receive a long list of “one-size-fits-all” tests for diagnosis of ailments and diseases. With precision genomic medicine, however, a patient’s genome would tell doctors where to target their treatment and eliminate wasted time, money and testing.

This cuts down on upfront diagnosis testing costs, and allows physicians to prescribe meds with greater accuracy.

Precision medicine is already disrupting the healthcare industry as we know it, and these latest technological insights could make for some interesting market plays down the line.

Now if only the military would adopt this technology so corpsman could stop prescribing two pills of 800mg Motrin for every single ailment at sick call!

Stay fierce,

Ben Benoy

Editor, BioTech Intel Trader

The post Invest in the Future of Medicine appeared first on Economy and Markets.

August 11, 2016

Be Nimble or Be Banished to History

If you want to sit on yours hands in this market, just go to Cuba. You’ll have all the time in the world.

Harry Dent

I wrote an article back on July 7 called “Bond Bubble to Burst.” It’s an important topic. I’ve been predicting for a long time that 10-year Treasury bond yields could spike back up to 3% (or higher). That would send a spike into stocks, into real estate and into the broader economy as a whole.

I’ve also been predicting that gold would bounce back towards $1,400 and then crash again in the next few years.

See, in the second half of 2008 almost everything went down – stocks, commodities, gold, real estate – everything except for Treasury bonds and the U.S. dollar. They were the only safe havens.

But now, if you haven’t noticed, everything has been going up since February: gold, T-bonds, commodities, stocks… even the damn yen. That just doesn’t happen!

What if, in the early stages of the next crash, EVERYTHING goes down together, even the U.S. dollar at first – and there is no safe haven. Not for a while.

Because that’s what the smart money is telling us right now!

The “commercials” are the smart money and real hedge funders. The large speculators are the trend-following hedge funders and traders. When the futures bets of these two diverge and go to extremes, there’s trouble coming.

Look at how net long the dumb money is on 30-Year Treasury bonds at the bottom of the chart below:

Yet, the smart money is equally net short… damn.

Long-Term Treasurys Set to Reverse

This would strongly suggest to me that the bond bubble may finally be over and that spike I have been looking for will happen much sooner rather than later. Once that happens, it will defeat the Fed once and for all and we’ll see a deflationary period that will bring bond yields back down and send bond prices back up.

And that’s when the trend-following hedge funds that have been piling into this “something for nothing” trading environment, facilitated by zero interest rate policies, will get wiped out along with the central banks.

It goes beyond Treasurys, though.

Gold Set to Resume Crash After Bear Market Rally

Look at the other extreme chart on gold. The dumb money is record long on the precious metals futures while the smart money is record short.

I’ve been predicting gold will rally back towards $1,400, but that would merely be a bear market rally before the next great crash. It’s hit $1,373 and could rally still to $1,400, but the smart money is not buying this rally any more than I am.

In late 2008 when the big crash set in, gold went down while bonds went up… looks like both will be down in the early stages of a bigger crash this time.

In addition to Treasurys and gold, the smart money is short everything: stocks, commodities, and even the dollar and yen to a lesser degree. The only remaining short-term bullish play would be on the euro and British pound… and that won’t last too long.

So what if everything goes down, at least in the early stages of the largest impending crash in our lifetimes?

You need to be out of passive investments NOW. That’s why we offer a broad array of trading systems that can make money in up and down markets, like Adam O’Dell’s Cycle 9 Alert.

This is most definitely not the time to be listening to your stock broker – or the gold bugs who say gold will protect you. Neither asset allocation nor gold worked at the worst of the crash in 2008.

And it won’t work this time around, either.

This crash will be deeper, longer and even more pervasive across sectors.

There will be nowhere to hide.

Harry

Follow me on Twitter @harrydentjr

P.S. Buy-and-hold strategies will continue to fail into 2022, which is why it’s so important to follow a proven trading system right now. I mentioned above that Adam’s Cycle 9 Alert can bank gains no matter what the market’s doing – and next Thursday at 4 p.m., he’ll host a webinar explaining how he’s been consistently beating the market. Space for this event is limited, so if you’d like to participate, sign up now while spots still remain.

The post Be Nimble or Be Banished to History appeared first on Economy and Markets.

August 10, 2016

A Goat or a Rockstar?

The Matchless Mine in Leadville, Colorado.

On top of the world

On top of the worldIt ended up being our best trade ever.

We banked a 225% profit in two months, turning $5,000 into $16,250.

That’s $11,250 in cold-cash profits.

And it came from the most unlikely of sources… a left-for-dead silver miner that no one on Wall Street would touch with a 10-foot pole.

It might seem strange that such an awful company could hand us the biggest single-trade profit we’ve booked in Cycle 9 Alert’s five-year history. But in reality, my system has delivered a total of 43 double-digit profits and 17 triple-digit profits since 2012… from all kinds of unlikely sources.

So today I want to show you how my Cycle 9 Alert system does it by sharing the story of the overlooked, silver miner money-maker…

I’ll start by showing you the email a colleague sent me, on February 16 – the day I told Cycle 9 readers to buy that silver miner.

“You’ll either be a rockstar or a goat after this trade!”

Clearly he thought I was crazy!

The trade was on Pan American Silver Corp. (Nasdaq: PAAS), which had been taking a beating in the market for months. To everyone else, it looked like the riskiest bet to make.

The system that tells you when to buy and sell

The company has suffered declining revenues and earnings for four straight years… leading to a net $1.4 billion in losses.

Despite all that, on February 16, my Cycle 9 Alert system triggered a buy alert – a GO signal – on Pan American’s stock. And two months later, I told Cycle 9 Alert readers to book their profits – $11,250 on a $5,000 investment.

But here’s the thing…

To me, the Pan American trade makes me neither a goat nor a rockstar.

Sure, it’s exciting when we hit on a great trade. I mean, it’s hard not to feel the thrill of growing money by 85%… 135%… 165%… and 225%… on a single trade (those are actual gains we’ve made of many, many others).

But I care most about Cycle 9 Alert’s average trade and lasting success.

You see, not all trades work out as nicely as Pan American. We hit on some duds and take our losses from time to time. So the excitement of locking in an $11,250 profit has to be balanced with the sting of losing $2,500… or $5,000… on a single trade.

Pssst… I’ll let you in on a little secret…

It’s not the single-trade profits, or losses, that matter.

What truly matters, if you care about lasting success over many years, is your investment strategy’s long-run averages.

On average… how often do you profit?

On average… how much profit do you make on each trade?

On average… how long does it take to make that profit?

It’s all well and good that Cycle 9 Alert readers made a 225% profit in two months from Pan American. But even though we’ve locked in 60 double- and triple-digit gains over the last five years, you can’t expect a 225% Pan American profit on every trade!

That’s why you should judge a strategy’s long-run averages, instead of getting excited about any one trade.

And this is what makes me so proud of Cycle 9 Alert…

Yes, that was 225% in two months

Since 2012, I’ve had the pleasure of sharing my time-tested (literally, I back-tested over a 15-year period) investment strategy with hundreds of Cycle 9 Alert readers… helping them achieve lasting success – five years running, at least!

I’ve shared with them nearly 100 investment recommendations…

We don’t win ‘em all… but my system has a long-run success rate of 68%. That means we’ve locked in about seven winners out of every 10 trades.

The average profit generated by of each of those 100 trades?

32%!

That means for every $10,000 invested in a Cycle 9 Alert trade, readers had the chance to walk away with $13,200 ($3,200 in pure profits, plus their initial $10,000 investment).

And it’s taken an average of 69 days – about two months – to lock in these profits.

Also, we’ve achieved these results since 2012, despite a number of volatile market shifts… a waning global economy… and continued bouts of corporate and geopolitical turmoil.

In part, that’s because my Cycle 9 Alert system found these money-makers in some of the most overlooked and unlikely sources – a tractor maker, a Canadian bank, a foreign oil producer, a grocery-store chain, a steel-maker…

And yes… my system found a serious money-maker in the little mining company called Pan American Silver Corp. – the trade that was supposed to make me either a goat, or a rockstar.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

P.S. Far too many investors suck wind because they’re in search of those one-off, big winners instead of looking for a system that produces the best average results over time, no matter the market. So I’m recording a webinar to really drive home the difference between those two approaches… to help you step out of the crowd of frustrated wind-suckers and into the warmth of investment success. Please join me on Thursday, August 18 at 4 p.m. Eastern Time. This webinar is by invitation only.

The post A Goat or a Rockstar? appeared first on Economy and Markets.

See larger image

See larger image