Harry S. Dent Jr.'s Blog, page 107

July 6, 2016

U.S. Treasury Rates Have Crashed to Historic Lows: Here’s What It Means

The story for the past week or so has been about how the surprise Brexit vote ravaged the world’s financial markets, sending investors running for cover.

The story for the past week or so has been about how the surprise Brexit vote ravaged the world’s financial markets, sending investors running for cover.

It might seem a moot point in the U.S., as large cap indices like the Dow quickly came back to within a few points of their pre-Brexit highs.

The bond market, however, is telling a different story…

While Britain’s vote to exit the European Union has come and gone, the exit itself – and all the uncertainty surrounding it – won’t be sorted out for maybe a couple years.

Already, the Bank of England (BOE) is bracing for trouble.

Yesterday, the Bank’s Financial Policy Committee eased reserve requirements for banks. This just means that in a potential crisis, banks will have a greater ability to lend.

After that announcement, yields tumbled again and made new all-time lows.

Clearly, the Bank of England is preparing for the possibility of a downturn in the near future.

But bad news is good news for the stock market. When talk of a downturn arises, investors expect more central bank stimulus to carry the market higher. And that’s what the market’s anticipating ahead of the Bank of England’s monetary committee meeting. So too with the ECB, and maybe even the Fed.

Treasury bonds, on the other hand, aren’t buying the “all is well” scenario just yet.

Yields made historic lows late last week and again yesterday. Even though stocks rebounded, those investors who moved to safety aren’t moving out of long-term bonds.

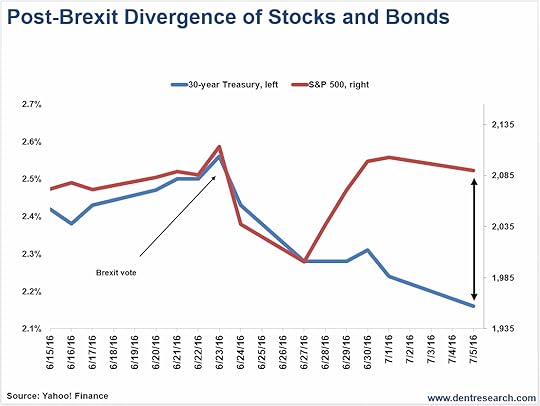

Take a look at the chart comparing the S&P 500 to long-term Treasury yields over the last couple weeks. What’s really interesting is what happened after the Brexit vote:

As you can see in the chart above, stocks moved lower and piled into bonds following the vote. But after the markets sniffed more central bank stimulus, stocks and bonds decoupled.

There is usually a pretty high negative correlation of stocks to bonds. When stocks move higher, bond prices move lower and yields go higher.

But the way stocks and yields have diverged over the past week shows we’re not out of the woods just yet. Investors are still feeling the jitters. In fact, stocks have been slumping again after rebounding most of last week.

Even some encouraging data over the past week couldn’t shake the markets of their fear.

Last week, the final adjustment to first quarter GDP was a little better than expected, with residential investment being a big contributor.

May Personal Income and Outlays, another the Fed watches very closely, was mostly positive. Consumer spending came in strong again, but personal income didn’t rise as much as expected. The Fed’s main inflation guide was unchanged across the board.

All in all, the recent data’s been decent. But instead of all that, the markets are focusing on the likelihood of new central bank easing – and any reason they have to turn on the stimulus spigots.

Take Friday’s upcoming jobs report, for example.

Last month’s pitiful report stopped any thought of a rate hike in its tracks. The economy added just 38,000 jobs after expecting 162,000. Another report like that will probably get the Fed talking about some possible action. Conversely, a surprise surge in jobs or wages would be a huge comfort. So we’ll see what the Fed does or says after Friday.

But even if they decide to act, I doubt it will make much of a difference.

On Bloomberg T.V. last week, James Bullard, the St. Louis Fed President, said the Fed has plenty of policy tools to use if necessary (compared to other central banks).

He actually cited forward guidance or Fed jawboning as an effective tool! He also mentioned additional QE as a possibility and downplayed negative rates.

I about fell out of my chair when he said that!

He admitted that just “talking” about future policy is a tool they can use to manage sentiment and run the economy. He flat-out confessed that the Fed’s all talk!

But that’s what global equity markets are counting on – more talk – and why stocks have shot higher over the past week.

They all think stocks will get a boost when central banks announce new or potential rate cuts, bond purchases, or even just talk about it. Bond traders are also looking to capitalize on the safety of Treasury bonds, since falling yields will give them huge capital gains.

The problem is and has been the same.

Central bank policy has kept the financial markets afloat but for most people has failed to turn the economy around, spark employment and wage growth, or battle deflation.

So when the dominoes start falling, companies start failing, recession hits, and real crisis strikes, it will finally be game over for central bank manipulation.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post U.S. Treasury Rates Have Crashed to Historic Lows: Here’s What It Means appeared first on Economy and Markets.

July 5, 2016

Defining Brexit: What Exactly Is a Black Swan, Anyway?

There is near universal agreement that the Brexit – and the walloping it gave the market – was a black swan event. But actually defining what a black swan is can be a challenge.

There is near universal agreement that the Brexit – and the walloping it gave the market – was a black swan event. But actually defining what a black swan is can be a challenge.

I thought to mention this today because everyone and their dog has been throwing the term around like candy lately, and they seem to have the wrong idea of what it actually is. So let’s clear this up right now…

A black swan event is NOT a market crash… or something else generally bad. This seems to be the general consensus. Instead, a black swan is simply an event that no one saw coming… that also has a large, outsized impact.

Yet most investors equate a black swan with a market crash. But that’s putting the cart before the horse. The market crash is what happens because of a black swan.

A meteor falling out of the sky and hitting your house would be a black swan event. But so would an inheritance check for a million dollars from an aunt you never knew you had. Both would be completely unexpected… and both would have major impacts on your life.

Trader, Professor and financial writer Nassim Nicholas Taleb made “black swan” a household word (at least in households that regularly debate financial topics… like mine) and gave it its current meaning. But the expression has been around a lot longer…

The first recorded use of black swan as this kind of metaphor dates to the Roman Empire, and it was a common expression in 1500’s London.

Until 1636 – when European exploration of Australia was underway – all swans were presumed to be white. No one had ever seen a black swan, so it was presumed that none existed.

The black swan is an example of the problem of induction, or trying to draw general conclusions from specific observations. In plain English, seeing a thousand white swans and not a single black swan doesn’t “prove” that no black swans exist. And just because something has never happened before doesn’t mean it can never happen.

Up until March of 2000, it was popularly believed to be impossible for a tornado to hit a major, urban area. The thinking was that the skyscrapers affected the wind patterns in such a way as to make a tornado touchdown impossible.

Well, on March 28, 2000, an F3 tornado touched down on downtown Fort Worth’s Main Street and proceeded to obliterate one of the largest skyscrapers in the city. (I was living in Fort Worth at the time, and distinctly remember cowering in the basement of the building I was in…)

Just because it’s never happened, doesn’t mean it can’t…

In black swans of the financial variety, Taleb says you need to have three conditions in place:

The event must be a surprise, or a “statistical outlier” in finance-speak.

It must have an extreme impact.

And despite it being unpredictable, once it’s happened we spin a story that makes it seem completely predictable in hindsight.

No country has ever left the European Union… and no opinion poll or betting market suggested it was possible. So the financial markets assumed a UK vote to leave to be impossible.

Only, it turned out to be entirely possible and the impact was definitely outsized. No one knew at the time – or knows now – what the full impact of Brexit will be once all is said and done. And as for the narrative, after the fact it became “obvious” that Brexit would happen because of the dissatisfaction of older, blue-collar British voters, the rise of Donald Trump in America or any number of other reasons.

So, Brexit does indeed make the cut as a black swan… just not for the reasons many media pundits have been touting!

All of this is fine and good, but if black swans are always unpredictable and obvious only after the fact… what’s the point of even talking about them?

The thing is, even if you can’t anticipate individual black swans, you can definitely take a few simple steps to “black swan proof” your portfolio… or at least come close.

First, don’t make the assumption that something can’t happen simply because it hasn’t happened yet. Don’t be overconfident based on your limited observations.

Second, always have a little portfolio insurance. That can mean different things to different investors, but as a general rule it means you should have a few assets in your portfolio that zig when the market zags. Taleb himself made enough money in a single day to walk away from Wall Street forever. He was “long volatility” on the day of the 1987 stock market crash, and scooped up millions when the market cratered.

Finally, beware of debt. Excessive debt has been the death of many a good trader. The people who ran Long-Term Capital Management were geniuses. They were quite literally the men who wrote the books on quantitative finance, a who’s who list of brilliant academics. And in 1998, their hedge fund blew up in spectacular fashion when a black swan hit. Russia defaulted on its debts, which was something no one expected. It caused investors to dump everything related to emerging markets and run for the hills.

We’re here to help. We have a team of experts whose sole purpose is to develop and perfect strategies that will help you make money… and help you lose less!

Charles Sizemore

Portfolio Manager, Boom & Bust

The post Defining Brexit: What Exactly Is a Black Swan, Anyway? appeared first on Economy and Markets.

July 4, 2016

This Fourth of July, Realize You’re Only Human

I make a lot of mistakes. I choose the wrong lane in traffic jams. I pick the wrong lottery numbers. And yes, I even go in the wrong direction from time to time. These are small decisions.

I make a lot of mistakes. I choose the wrong lane in traffic jams. I pick the wrong lottery numbers. And yes, I even go in the wrong direction from time to time. These are small decisions.

Sometimes I mess up in bigger ways. I’ve made business moves that took years to unwind, and sometimes I wish I’d pursued a different major in college, although I’m thrilled with my career.

But all of these choices have one thing in common: they were mine. I made them on my own, after considering, and often ignoring, all the advice and input of others. I get to live with the consequences, enjoying the successes and hopefully learning from the failures. I pass no blame.

I wouldn’t have it any other way… and that’s part of what makes me a proud American.

Our country is based on the premise that we’re all entitled to screw up our lives. We can choose to drop out of high school at 16, major in obscure topics in college, or spend every nickel we make on whatever weird hobby catches our attention.

We can say what we want, go where we want, and join groups with whomever we want. Along the way, we know that everyone will do something stupid. We’re only human. We’re prone to poor judgment based on limited information, where we typically give too much weight to the latest data point.

Maybe our decisions will work out. Maybe not.

But as bad as an individual’s judgment might be from time to time, it pales in comparison to the alternative – letting others make decisions for us. I bristle at the very notion of giving someone else control… which is also part of being American.

I don’t want someone a thousand miles away, or down the hall for that matter, making decisions that affect my life, even though I know that sometimes it has to be this way.

We hand off decisions on national security, international trade, and a host of other things to elected officials. But I don’t like it very much, and I’d prefer to keep as much responsibility as possible close to home.

It’s not that I think politicians are bad, or out to take advantage of me. It’s that I know something about them. They’re only human, too. They might know more about individual topics, but they’re just as prone to bad decision-making as the rest of us.

The U.S. is built on the foundation that we’re equal. Some are smarter, some are faster, and some are better looking. But no one has a higher claim to pursue his vision of the world than anyone else, particularly if that means forcing decisions on others.

If through free association and agreement we determine a course of action, so be it, but don’t tell us that we should do something because it’s “good” for us when we don’t agree. It’s bound to start a fight.

For almost a decade, the federal government and central bank have been handing down dictates, telling us we’ll be better off if we simply conform. The worst of the financial crisis passed, but everyday life hasn’t improved much. Some asset values are much higher, but wages are still stagnant and the true cost of living – health care, rent, and education, not TVs and home phones – is through the roof.

At this point, most Americans don’t think the next generation will have the same opportunities as previous generations, or a higher standard of living.

It could be that things really are different this time, and there are no choices that will change our economic path.

Maybe, but I don’t think so.

I think if we scaled back the amount of government involvement in our daily lives, from punishing interest rate policies to crushing regulations and offensive asset forfeiture, we could at least be optimistic about the future for our children.

If we give small businesses a chance, instead of requiring permits to be landscape workers or makeup artists, then perhaps more people will strike out on their own.

In short, if we take back the freedom to make decisions, good or bad, then perhaps we can put the country back on the right path. Whether that turns out to be true or not, at least we would know one thing for sure – we were true to our heritage of giving everyone the right to determine their own path.

And that’s the most American thing of all. Happy Fourth of July!

Rodney

Follow me on Twitter @RJHSDent

The post This Fourth of July, Realize You’re Only Human appeared first on Economy and Markets.

July 1, 2016

Europe Has a Bigger Problem Than Brexit

The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets on June 23. After two days though, markets are marching back up again.

The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets on June 23. After two days though, markets are marching back up again.

That’s just like markets on “crack!” They react to political events, but totally miss the fundamentals.

Yes, Brexit is important. Years from now it will be recognized as the beginning of the end for the great Eurozone experiment.

It isn’t just about the renegotiations on trade agreements with Britain and initial slowing of GDP. It’s also about the threat that more countries will choose to exit the economic bloc. The euro and Eurozone have 40%-plus unfavorable ratings in polls in France, the Netherlands and Italy. That many areas within countries will break free of their overlord. And then this rush for nationalism will spread across the globe like wildfire.

But here’s the 800-pound elephant in the room (I talked about this in detail in the February issue of The Leading Edge). The one Wall Street seems blind to at the moment…

Italy is the next Greece!

It’s bad – non-performing bank loans have risen to 18%.

At 10%, most banks are technically bankrupt. That’s the percentage of capital and pledged deposits they have against bad loans. Our pledged deposits, not theirs.

At 18%, they’re no longer “technically” bankrupt. They ARE bankrupt!

Greece still has bad or non-performing bank loans of 34%, Ireland 19% and Portugal 12%. And we haven’t seen the next serious financial crisis yet.

Yet nothing has been done to seriously restructure debt in southern Europe. The EU just bailed out Greece to stop the dominoes from hitting other countries. They’re pumping in heavy doses of QE to keep the banks and economy temporarily liquid and solvent.

But the problems are growing even worse. The blood is getting harder to hide…

Just look at Deutsche Bank. It had its largest loss in history in the fourth quarter of 2015: $7 trillion, without any help from the next financial crisis!

Its stock is now down 89% from its early 2008 high, and 62% from its 2015 high.

It’s the largest bank in Germany.

Why is Wall Street ignoring this!?

UniCredit is the largest bank in Italy. Its stock is down 94% since the 2008 high, and 71% since its 2015 high.

Banca Carige, another major Italian bank, is down over 99% from its high in 2008.

HSBC in the UK lost 15% since Brexit, while the Royal Bank of Scotland dropped 40% and Barclays bled 41%.

Investors in these stocks are suffering tortures no investor should ever endure. And there’s more pain to come.

Depositors in these banks are willingly settling their heads into the guillotine!

But here is the worst part…

To raise capital after the 2008 global financial crisis, Deutsche Bank issued CoCo bonds. They didn’t want to dilute their shareholders or their senior bond holders, so they issued a new B.S. bond that ranked just below senior level. But – and this is a pretty significant “but” – the 6% coupon only gets paid if the bank has sufficient cash flow… and any missed payments don’t have to be made up. If they continue to miss payments, the bonds get converted to stock. And there’s nothing the bond holder can do about it!

These should have been called Coo-Coo, not Co-Co, bonds!

The yields have now spiked above 12% and the bonds have been devalued substantially already…

And again, we haven’t even seen the next real financial crisis yet.

If Deutsche Bank is in this much trouble, you know many other major banks are.

Before the Brexit vote, most of these guys were trading at well below book value, while the broad markets trade at 2-times-plus book value. Italy’s Banca Carige is trading at just 3% of book value. Citibank is at 54%, Spain’s Banco Santander is at 58%, Deutsche Bank is at 59%, Credit Suisse is at 63%, and HSBC is trading at 69% of book value. Since then, they’ve gotten worse.

And the bank with the highest exposure to the most leveraged and toxic of all assets – credit default swaps (largely mortgage derivatives) – is Deutsche Bank! It holds 10% of this $550 trillion nuclear bomb. Not billion. Not million. Trillion!

At 10%, that means Deutsche Bank has $54.7 trillion credit default swamps on its books. JPMorgan isn’t far behind, with $51.9 trillion. Citibank has $51.2 trillion, Goldman Sachs has $43.6 trillion and the Bank of America has $27.8 trillion.

Markets should be much more worried about the coming default in Italy.

They should be much more worried about the largest banks in the world failing… and they will fail.

Yet they seem more concerned about political factors like Brexit, or when Janet Yellen will raise the fed funds rate 0.25%.

Investors are going to get their asses handed to them.

Mark my words: a major collapse is bearing down on us. Don’t be among the blind investors flattened when it arrives!

Harry

Follow me on Twitter @harrydentjr

P.S. It is my sole purpose to help you through this (and anything else – good or bad – that we face down the road). It’s what I live for, so I thank you for the opportunity! And I congratulate you on your bravery to step out of the crowd and take control of your business, financial and investment success.

The post Europe Has a Bigger Problem Than Brexit appeared first on Economy and Markets.

June 30, 2016

3 Ways to Survive the Next Crash

There are plenty of misconceptions about investment systems. It’s an esoteric field, so I’m not surprised. Most on the outside tend to think of systems as mysterious, robot-driven, “black box” investment things. But the reality isn’t that mysterious or complicated.

There are plenty of misconceptions about investment systems. It’s an esoteric field, so I’m not surprised. Most on the outside tend to think of systems as mysterious, robot-driven, “black box” investment things. But the reality isn’t that mysterious or complicated.

A systematic investment strategy starts with an idea… which turns into a hypothesis… which is then proven or disproven.

The idea can be as simple as: “I think cheap stocks beat expensive stocks in the long run.” That value investing hypothesis has been studied and tested for decades now and has proved to be worthwhile.

Of course, a keen observation about the markets can prove invaluable, but it’s no systematic strategy. Take Kyle Bass, founder of Hayman Capital in Dallas. In 2006, he created a hedge fund to exploit a single hypothesis: that the U.S. subprime mortgage market would implode.

That market did implode. And Mr. Bass made a ton of money. He’ll need to come up with a new great idea for his next fund, though.

Unless you’re Kyle Bass in the making, or he’s your mentor, you’d do better to adopt a systematic investment strategy that exploits events that occur over and over with a good deal of regularity.

Today I’ll help you with that…

Cliff Asness of AQR Capital Management (a quantitative/systematic hedge fund) explained why a strategic investment system is important. During an interview with Steve Forbes, he said (paraphrased):

With systems, you’re leveraging an idea… that cheap always beats expensive, or that low-volatility always beats high-volatility. And you’re applying that idea across hundreds of symbols… so that, in the long run, you’re exploiting the mathematical edge that’s contained in your idea.

THAT’S the essence of a system. That’s what I aim to do with Cycle 9 Alert and Max Profit Alert.

The idea behind Cycle 9 Alert is simple: everything cycles through periods of underperformance and outperformance.

That idea applies to sectors within the stock market… to individual stocks within sectors… and also to asset classes outside of equity markets, like commodities, currencies and bonds.

And that’s important to pay attention to. I don’t just focus on stocks. If I did, it would be a surefire way to miss out on great opportunities elsewhere.

The stock market’s not the be-all and end-all. Sure, it’s had a great run since early 2009. But the bull market won’t last forever. In fact, now more than ever, it looks to be under serious threat.

At best, the risk-adjusted returns the U.S. equity markets could produce over the next five years are likely to pale in comparison to the last five years. At worst, any number of global risks could trigger a repeat of the 2008 stock market crash. It’s too early to tell… but the recent Brexit surprise could do it.

Either way, looking for Cycle 9-style opportunities outside the stock market is a must. It should be a requirement in any investment strategy you decide to go with.

The good news is: a careful study of historical stock market crashes reveals which asset classes are safe haven plays in times of crisis.

Here’s a sampling of three, non-equity investments that did quite well to cushion the blow of a plummeting stock market in 2008. These are the three ways you can survive the next crash.

First, a currency…

1) Japanese Yen (CurrencyShares Japanese Yen ETF: FXY)

Between September and December 2008, FXY gained 16%, while the S&P 500 (SPY) lost 29%.

That’s due to the fact that the yen, along with the U.S. dollar, is a safe-haven currency that goes up when everything else in the investment world is going down.

Next, a bond fund…

2) 2-Year Treasury Bonds (via ETF: SHY)

My Cycle 9 system generated four buy signals on the Barclays Low Duration Treasury ETF (NYSE: SHY) between July 2007 and January 2009. Each one was profitable… because, like with the yen, the dollar is a safe haven currency, so investors tend to clamor for U.S. Treasury bonds when it seems as if the world is ending.

Finally, a basket of commodities…

3) PowerShares DB Commodity Index (NYSE: DBC)

Commodities sold off alongside equities during the second half of 2008. But that doesn’t mean there weren’t any gains to be had buying commodities in the first half of the year. The two trades triggered by my Cycle 9 system between October 2007 and March 2008 netted a combined 22% gain.

The most important point to take away from today is this…

Whenever stocks crash, we’ll be ready… and you can be too!

As I mentioned, it’s too early to know, for sure, whether last week’s Brexit surprise will end up being a relatively minor “blip” on the radar… or the proverbial “straw” that breaks the camel’s back. Only time will tell…

Interestingly, though, a number of safe haven assets – just like the ones above – have shot higher over the last three days.

On the currency front, the Japanese yen (FXY) is up 2.5%… and the U.S. dollar (UUP) is up 1.7%.

Gold (GLD) surged 4.3% higher.

And, of course, high-quality U.S. Treasury bonds (TLT) are up 1.7%.

These moves are to be expected, given just how off-balance many investors found themselves in the wake of the Brexit vote. And the moves could be short-lived, if investors calm down and carry on in the weeks ahead.

But if the ugly heads of uncertainty and volatility persist, we’ll be taking a closer look at investing in some safe haven assets, outside the stock market.

Click here to make sure you’re on the list to receive my latest research and recommendations.

Adam O’Dell

Chief Investment Strategist, Dent Research

The post 3 Ways to Survive the Next Crash appeared first on Economy and Markets.

June 29, 2016

Drones: The Brave New World of Data Collection

Move over Christopher Columbus, it’s a brave new world.

Move over Christopher Columbus, it’s a brave new world.

The drones are coming!

Commercial drone use and their associated data collection capabilities are starting to explode in the farming, mining, and construction industries.

Expanded capabilities coupled with ever-decreasing hardware costs are ratcheting up the use of drones for functions previously done via other, very expensive means.

Several years ago, commercial drones with surveillance capabilities ran between $10,000 and $20,000. Now, most companies can get very similar capabilities with new drone hardware that costs between $800 and $1,500!

Just a snapshot of what these things can currently do includes:

• Real-time crop pictures for farmers to see how their plants are growing over hundreds of acres.

• Precision measuring and site layout for the mining and construction industry.

• Inspection of pipe, bridge, and road infrastructure spanning hundreds of miles.

• Real Estate photos of those hidden property gems.

• Monitoring of wildfires.

• Geographic analysis and topographic mapping.

This type of information is called aerial intelligence.

Until drones came along, intelligence of this kind was collected via very expensive platforms, such as satellites and traditional piloted planes outfitted with cameras. If you didn’t have the cash for planes or satellite imagery, you were stuck doing assessments the plain old fashion way, manually on the ground!

As you can imagine, surveying crop status or checking for potholes on a 600-mile road can get pretty tedious if you’re stuck on the ground.

But now, with drone technology, we can survey large areas in hours, not days. And the real-time surveillance data that’s uploaded allows us to take immediate action!

That’s all great, but what if you don’t know how to fly a drone yourself? Well, now there’s a solution for that, too!

Companies are popping up left and right to offer “Drones-As-A-Service,” or just DaaS. These companies connect businesses with qualified drone pilots and their associated hardware and software for a fee. Simply call them up, set up a consulting appointment to tell them what aerial intelligence you want and they do the rest.

One startup called Drone Deploy even offers custom software that automates drone flights and crunches the aerial intelligence data directly on your smart phone!

This past week, the Federal Aviation Administration finalized new rules that make it easier for commercial companies to leverage unmanned aircraft systems commercially.

But wait until you hear this…

If you’re worried about flying your drone onto a government facility and having the secret service come kick down your door, underwater drones are the way to go.

A startup called OpenROV provides an open-source, low-cost underwater robot kit for exploration and education. Its Unmanned Underwater Vehicles, UUVs for short, operate off of open-source software that is completely customizable for your own Hunt for Red October mission.

Now before you get too excited, these underwater beasts come with a 100-meter tether and two to three-hour battery life, but it’s still a lot more productive for your young adolescent than staring at SpongeBob SquarePants on the TV. He can now see him underwater!

Commercial drones, whether aerial or underwater, are here to stay. These mighty contraptions are making quite the splash (no pun intended) as they disrupt industries that need to do business faster, more efficiently, at a fraction of the cost.

As such, I plan to make sure my BioTech Intel Trader subscribers are positioned to profit from this trend.

Now… if I can just get a drone to keep the birds from leaving “gifts” on my yard fence, I’ll be good!

Ben Benoy

Editor, BioTech Intel Trader

The post Drones: The Brave New World of Data Collection appeared first on Economy and Markets.

June 28, 2016

A Weird Outcome of the Fed’s Money Printing

I keep reading that the U.S. debt is out of control. That we’re spiraling toward a certain financial death, evidenced by the fact that we now owe more than 100% of annual GDP.

According to a recent study by Rogoff and Reinhart, this is well beyond the threshold of where economies struggle. And we’re not alone. Several other countries have the same high level of debt outstanding, and Japan is at the top of the list, owing almost 250% of GDP. Clearly, we’re all going to die.

The only problem is, we’re still kicking.

Markets still function, ATMs still work, and inflation remains tame. It’s possible these things could change. We could hit a point in our debt load where things suddenly become unbearable, the U.S. dollar and other currencies become unhinged, and prices soar as currencies implode.

But I don’t think that’s going to happen, and we have an unlikely group to thank – central bankers.

I’m no fan of the Fed, the Bank of Japan, the ECB, or most any other central bank for that matter. I think their misguided policies, especially quantitative easing, have done more economic harm than good, stealing money from savers while pushing on a rope to encourage spending.

But one weird outcome of money printing is that the government owes less debt.

Small, unstable countries typically print more money when the government is unable to borrow in foreign markets. To keep paying their bills, they print more currency, which causes everyone – domestic and foreign – to run for the exits. The outcome is predictable. The currency falls faster, leading to runaway inflation.

But when large, stable countries, such as the U.S. and Japan, print money, it’s for a different reason. We have no trouble borrowing, a function of the Treasury, which is obvious given our extremely low interest rates.

Instead, our central banks print money to battle a lack of inflation, and even outright deflation, which has nothing to do with treasury actions. However, the central banks are affecting the government coffers because of what they choose to buy, and what happens after the purchase.

Typically, central banks buy assets to put more cash in the economy, which is supposed to drive down interest rates and make loans easier to get. These are the main reasons for quantitative easing.

At some point in the future, when inflation is ticking higher, central bankers are expected to sell the bonds they’ve purchased. This will take cash out of the economy and drive interest rates higher.

But what if they don’t?

The Federal Reserve owns $2.5 trillion in U.S. Treasury bonds. There is no law or regulation stipulating the bonds must be sold. Instead, the Fed can hold them to maturity… and then send the cash right back to the U.S. government.

Since the Fed sends all extra cash back to the U.S. Treasury, then any U.S. bond the Fed buys and holds to maturity can be thought of as forgiven debt. The U.S. Treasury will pay the interest and principal to the Fed, but the Fed will send it right back a few days later.

If the Fed holds all of its U.S. Treasury bonds to maturity, and remits the funds to the U.S. Treasury instead of buying more bonds, then effectively the central bank has reduced our debt load by $2.5 trillion, or roughly 13%.

For other countries, the effect is even bigger. The Bank of England holds 15% of Great Britain’s outstanding debt, and the Bank of Japan owns a full 25% of all Japanese government debt.

When these amounts are removed from our debt calculations, the numbers get a bit more manageable. U.S. debt outstanding drops from 110% of GDP to 95%, while Japan’s debt falls from 250% of GDP to 187%.

Currently, the U.S. federal budget deficit stands at around $517 billion. Based on this relationship, in which the Fed can hold bonds to maturity and send the cash to the U.S. government, the Fed could effectively “print” $517 billion, and viola. Zero new net debt is added.

The problem with this approach is that it probably would not survive the extreme bound of the logic.

If we were able to attack our government debt through money printing, then why not have the Fed print another $16.5 trillion, buy it all, and be done with it?

At that point, we might lose the one thing that keeps all current currencies afloat – confidence. Without any tangible backing, currencies have value only because investors and citizens have confidence that they will not be excessively devalued through government or central bank action.

In developed countries where central banks are trying to create inflation, how much printing is too much?

There is no answer. It’s only knowable after the fact. Given the horrible social consequences of a failed currency, it’s not something I’d like to see tested in the U.S., or anywhere else for that matter. So even though money printing might have an odd positive attribute (lowering government debt outstanding), it’s not worth the risk.

Instead, we should reduce our government debt the old-fashioned way, by living within our means. Unfortunately, that policy has no chance in our current political climate.

That could change with another financial crisis.

While the Fed could hypothetically print half a trillion dollars to stop debt from rising further, that won’t be possible if the economy takes another nosedive, and annual deficits quickly climb back to $1 trillion, as Harry argues in our Boom & Bust for July. In 2009, the deficit actually reached $1.4 trillion.

At that point – when deficits balloon out of control, and debt rises dramatically with no end in sight – government will have to make some cuts.

Rodney

Follow me on Twitter @RJHSDent

The post A Weird Outcome of the Fed’s Money Printing appeared first on Economy and Markets.

June 27, 2016

Surviving in a Post-Brexit World

Well, that was a doozy. I woke up a little later than usual on Friday to see that the futures markets were getting creamed, European banks hit multi-decade lows in some cases, and the British Pound plunged.

Well, that was a doozy. I woke up a little later than usual on Friday to see that the futures markets were getting creamed, European banks hit multi-decade lows in some cases, and the British Pound plunged.

Since I was heavily short, I hit the snooze button and went back to bed for nine minutes.

Votes are funny things. You never know what will happen. A WWE wrestler famous for wearing a pink boa constrictor becomes Governor of Minnesota, a reality TV star becomes the presumptive nominee of the Republican Party, and Britain decides to leave the European Union.

So, what’s next? Probably more Brexits. Or, at least the threat of more Brexits.

Britain’s exit from the European Union will take a long time to complete. But this vote will strengthen the resolve of other groups that want to decouple from the European Union. Nationalism is on the rise around the globe. And there are more than a few countries that could use a cheap (or cheaper) currency too. They may take advantage of the opportunity this vote presents.

That will lead to more uncertainty going forward… and uncertainty means more volatile financial markets.

As long as I have been writing in this space, I have stated that volatility is likely to be significantly higher than what investors have seen in recent years.

In my experience, most people are scared of volatility. But, in my mind it’s a good thing. Volatile markets can lead to outsized returns if you play it right. And it doesn’t matter so much whether the markets are experiencing greater-than-normal volatility. It’s how you’re positioned that matters.

In Forensic Investor, we are heavily positioned to the short side. In fact, in 18 months I have only recommended three long positions. Two have been closed, and both with a profit. The rest have been bets on the downside.

And I don’t see our positioning changing.

The stock market remains grossly overvalued, and in recent months investors were way too optimistic regarding expected returns. I think sentiment will start to swing back a bit to the bearish side as the Brexit vote begins to settle in. Investors will realize there could be more surprises around the corner. And that’s why I think it’s prudent to maintain a more bearish positioning.

So, what are some steps you can take to deal with this predicament?

First, cash sleeps softly at night. U.S. dollars are a good asset to hold in times of turmoil. For all of the U.S.’ problems like low economic growth, stagnant wages, and a declining standard of living, the U.S. dollar is still the world’s reserve currency.

In fact, I think the dollar could rise as much as 40% in the next 18 months if equity markets tank and investors from all corners of the globe seek a flight to safety.

Second, you could look to invest outside of the U.S.

It might sound counterintuitive to say you should own dollars in one breath and to look outside the U.S. in another.

But, the last time the pound plunged this much, famed hedge fund investor George Soros made a billion dollars in a day. Sir John Templeton also made billions looking beyond our shores for markets that got stretched too far, too fast. Sometimes, it pays to invest when there’s blood in the streets.

The point is, there will be overreactions, and that will create opportunity beyond just the U.S. markets. Think of the markets as a rubber band. They get stretched too far in one direction. Then something occurs to change the consensus view, and it leads to a snapback reaction in the other direction.

Finally, use alternative investments.

Mind you, alternatives have been a horrible place to be in recent years. For example, I’ve read that as much as $500 billion will come out of hedge funds this year. Performance has been terrible.

But, I think that alternatives could be a boon in the years ahead. For the most part, the stock market has been straight up since 2009. Hedges don’t help much in a low-volatility environment when markets quietly go up, and up, and up.

Instead, they help in times of turmoil.

And what makes them best isn’t higher returns. Rather, they provide a smoother equity curve. If you’re reading this and you’re – I don’t know, human – you probably prefer a smoother ride to investment success than huge swings up and down.

So, while you won’t keep up with the market using alternatives if it’s up 32% in a year, you most likely won’t be down 50% when the market tanks, either.

The $500 billion in redemptions and mass exodus of big institutions from alternative investments tells me that it’s time to start looking at them as a contrarian play. And the good news is that fees are going down, too.

I think these three plays can help your portfolio in the coming years.

But whatever you do, buckle up. It’s going to be a wild ride.

John Del Vecchio

Editor, Forensic Investor

The post Surviving in a Post-Brexit World appeared first on Economy and Markets.

June 24, 2016

Brexit: The Good News, and the Not So Good News

Well, they did it. Brits have voted to leave the European Union. Now what?

Well, they did it. Brits have voted to leave the European Union. Now what?

I wrote last month that Brexit could take a wrecking ball to your portfolio. And judging by the carnage in the markets last night and this morning, that wasn’t an understatement. The pound sterling was down as much as 12% in overnight trading, and stock markets around the world plummeted.

So the question now is: what happens next… and how will it affect your portfolio?

I’ll start with the controversial statement that I think Britain herself will get out of this relatively unscathed. Yes, the pound is in freefall. But considering that central banks all around the world are competitively cheapening their currencies as a way of spurring exports, I don’t really see that as a bad thing.

If anything, it will probably boost tourism… and might encourage even more foreign buying of real estate.

Yes, there is a good chance that Britain has at least a mild recession. Companies that were planning to expand in the UK as their European beachhead might put those plans on hold for a while.

But as Britain’s new relationship with the EU starts to take shape, I think something close to the status quo will reassert itself. Europe has no viable financial capital other than London… which has managed to maintain its position, even though the UK never adopted the euro.

So, that’s the good news. The UK won’t be sliding off into the north Atlantic.

Now for the bad news…

While Britain will probably be fine once the dust settles, I can’t say the same about the European Union.

Europe is losing its biggest military and diplomatic power, the world’s fifth largest economy and one of its biggest free-market champions.

Said another way: Europe without Britain is a nightmare. It’s all of the headache and regulation of an overbearing central government but without the push for free trade… which was frankly the only thing that made the enterprise worth doing to begin with.

But that’s a long-term issue. What happens now?

Things are moving fast, but this is the scenario I worry about: while England and Wales voted strongly for Brexit, Scotland voted overwhelmingly to stay in Europe. So Scotland will probably have another independence referendum within the next year that will actually pass this time.

And that’s where things can really go south.

Catalonia has been agitating for independence from Spain for a while… as has the Basque Country. Will they see Scotland leave and then seize their moment?

Then what? What happens to the euro when one of its largest member states splits up?

Remember back in 2010 when the financial world went mad over whether Spain and Italy would remain in the Eurozone? Six years later, we’re right back where we started.

ECB President Mario Draghi said he’d do “whatever it takes” to save the Eurozone. But will “whatever it takes” be enough? Or is this the beginning of the end for the euro as a currency?

In the immediate short term, all of this points to one thing: uncertainty. And markets hate uncertainty.

It may take days… or weeks… for the market to handicap what the real risk is here. And that means we’re likely to see major volatility. There will be major down days… and major up days. It will be enough to give you whiplash.

Think back to 2008, when Lehman Brothers cratered. We had some of the worst single-day selloffs in history. But we also had some of the largest single-day rallies in history.

Now, I’m not necessarily expecting another 2008. I think it’s very likely that the central banks will collectively dump liquidity into the currency and bond markets to keep the bottom from completely falling out. But I do expect a lot of wild trading without much in the way of a trend. So tread carefully!

If you want to trade this, your best bet is probably to play “snap-back” rallies. And in fact, Lance alerted us to just this kind of opportunity this week in Treasury Profits Accelerator.

As volatility picked up last week ahead of the Brexit vote, U.S. Treasury bond yields fell too far, too fast as investors fled to safety. Lance’s system triggered one of his short-term, snap-back trades to ride yields back up.

Sure enough, the markets became complacent as the likelihood of Brexit waned, and yields roared back. Lance exited that trade yesterday for a 75% gain in one week! And with the way yields fell again today, he may issue such another trade alert in the days to come.

Ben Benoy also positioned his BioTech Intel Trader subscribers yesterday with what Rodney’s calling one of the smartest trades of the year.

In fact, all the experts on our team are helping their subscribers profit (and stay safe) during all this craziness. We held an Emergency Summit call earlier in the day for subscribers. You can watch that now.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post Brexit: The Good News, and the Not So Good News appeared first on Economy and Markets.

June 23, 2016

U.S. Home Prices Are Hitting Peak Bubble Territory

Two weeks ago, I wrote about an upcoming New York City condominium listing for $250 million. I mention this because, as I’ve explained before, it’s always the tallest buildings and priciest condos to get hit during major downturns.

Two weeks ago, I wrote about an upcoming New York City condominium listing for $250 million. I mention this because, as I’ve explained before, it’s always the tallest buildings and priciest condos to get hit during major downturns.

Just look at the early 1930s and mid-1970s marking peak bubbles if you don’t believe me!

You’ll understand, then, why I smiled when I saw a Forbes slideshow called “The Little Black Book of Billionaire Secrets,” featuring the most expensive homes in each of the 51 states, including Washington D.C.

North Dakota held the honor of the least expensive home, at just under three million dollars, now that the fracking boom has burst. The most expensive home was not in Manhattan, but in Florida – Palm Beach – at $159 million.

That’s a wide range of values, where the top house is 57.2 times the lowest of the high!

A number of top homes in the $4 million to $11 million range, not surprisingly, were found in the Midwest and Southeast – from Ohio and Indiana to Alabama, Mississippi and Arkansas.

I was surprised that D.C. only came in at $12 million, given the exorbitant cost of homes there and the government bubble in hiring. I thought top lobbyists could afford more!

South Carolina, my home state, came in at a very substantial $24 million, with Virginia a bit higher at $25 million.

Texas has always been a lower-cost state, but it attracts major corporate headquarters and the very affluent due to its zero state income tax and more affordable housing. Its top home came in at $28.5 million.

Arizona is a haven for wealthy Californians and its top home was $32 million, as is Hawaii at $35 million.

If we look at the top 10 most expensive states by real estate listing, as you can see in the chart above, it starts with Massachusetts at $35 million, then Washington State at $43 million – likely a software mogul. Next comes Georgia – another city for multinational corporate headquarters like Coca-Cola – with the top home listed for $48 million in an otherwise affordable city, and then New Jersey (no surprise there) at $48.88 million.

Then we get into the heavyweights: Connecticut, perhaps the most beautiful of New York suburbs, is ranked as a big step up in price, at $65 million. Nevada is a bit of a surprise at $69 million – likely carrying an appeal to foreign buyers.

Colorado, not surprisingly, holds some of the most expensive listings at $80 million, which almost have to be in Aspen or Snowmass.

The top three break the ultimate $100 million barrier, starting with New York at $120 million. That is the most expensive condo in Manhattan listed in 2016, after a number have gone for $100 million-plus since 2014. But it has that $250 million listing coming up that will make all others before it look like chump change if it sells. California is not surprising at $150 million, likely in the Hollywood Hills.

But the top spot goes to the zero state income tax Florida and its billionaire haven in Palm Beach… at a cool $159 million.

My bet is that this unprecedented real estate bubble will burst long before that $250 million condo makes it on the listings (if it ever does) at that price.

It’s clearly time to be a seller rather than a buyer, especially in the higher end where prices are going the most nuts!

Harry

Follow me on Twitter @harrydentjr

See more of our top stories on Facebook >>

The post U.S. Home Prices Are Hitting Peak Bubble Territory appeared first on Economy and Markets.