Harry S. Dent Jr.'s Blog, page 110

May 27, 2016

Researchers at “X” Could Bring Internet to the World’s Population

The solution: really big balloons.

The solution: really big balloons.

It’s easy to take the Internet for granted. We carry most of the world’s information in our pockets and can access it with the swipe of a finger.

But we forget that two-thirds of the world’s population doesn’t have access to this marvel of human achievement!

Well, that might no longer be the case.

Highly secretive scientists at “X,” a subsidiary of Alphabet (NASDAQ: GOOGL) formerly known as “Google X,” are trying to fix this problem. They’re plugging away to make sure that the rest of the world’s population without Internet, gets it.

And instead of building cellular towers into the earth, they’re doing it by launching giant balloons that can reach these remote areas, wherever they happen to be.

Don’t worry about little Mikey shooting down this science project with his model rocket kit, though. These floating Internet gateways travel on the edge of space!

The project, called “Loon,” deploys a network of balloons that travel around in the stratosphere, or roughly twice as high as airplanes and the weather.

The balloons act as a mobile cellular tower, allowing phones and other cellular devices to connect and get Internet. It’s well-suited for areas where traditional cellular infrastructure isn’t available due to cost.

Remember when XM & Sirius satellite radio was the next big thing because you could get radio anywhere? Well, investors quickly forgot about the costs of deploying satellites which can range from $50-$400 million.

When 3G and 4G LTE cellular networks rolled out on much cheaper ground infrastructure, streaming radio services over the internet crushed the satellite radio industry. It’s still trying to recover today.

The only problem is that in rural and remote parts of the world, it isn’t cost effective for telecom companies to build ground infrastructure.

Large tech companies such as Microsoft and Facebook have rolled out programs to subsidize the access to internet in areas where it is less affordable.

How charitable, right?

Well, not exactly.

Facebook’s “Free Basics” program was recently blocked in India because it only offered access to a handful of sites (mainly their own), which violated net neutrality policies.

The Loon project, however, expects to receive approval in India soon, simply because it does not restrict access to only preferred sites.

Charity and neutrality aside, the end state for these large tech companies is clear.

It’s basically the new age golden rule. And I don’t mean the one about treating your neighbor as you’d want to be treated. I mean the other one: He who owns the gold, makes the rules.

In this case, just replace “gold” with “network infrastructure.”

The new 21st century currency is data, and those who own and control the infrastructure it rides over will have a considerable advantage in the marketplace over those who don’t.

In March, I wrote about the land rush going on where large tech companies are looking to set up their own high speed fiber infrastructure.

Like the NSA, these companies aren’t peering into your private conversation data (well, not officially at least).

However, they are collecting the “metadata” on your network usage in bulk to store, analyze, and re-sell.

Metadata doesn’t show your actual message or conversation. It’s all the information surrounding the message data that describes it. This can include the type of device it was sent from, the type of software on the device, your GPS location (if enabled), and timestamps on messages. And that’s just for starters.

With this data, large tech companies are able to apply behavioral analytics and determine tailored ad campaigns to send to specific people. The idea is that you’ll get an offer that seems too good to refuse.

Ever get a pop-up message on your smart phone from one of your apps offering a discount at a store you just happen to be near? You can thank metadata for that.

All the conspiracy theories aside, there is one constant. The amount of data we produce and consume is growing everyday, and tech companies are lining up around the block to make sure they’re providing it to us.

The market for data storage and infrastructure alone is sitting at $36 Billion. That’s expected to double by 2020.

Now I just need to figure out how to generate some metadata that blocks all political ads, and I’ll be set!

Ben Benoy

Editor, BioTech Intel Trader

May 26, 2016

The SEC’s Cracking Down on All This Adjusted Earnings B.S.

For the past several months, the Securities and Exchange Commission (SEC) has been working to crack down on the use of adjusted earnings practices.

For the past several months, the Securities and Exchange Commission (SEC) has been working to crack down on the use of adjusted earnings practices.

They’re threatening to tighten regulations and force companies to be more transparent.

That word always comes with a sting. Regulations – the dreaded “R” word. It’s perhaps the most hated word in all of finance.

Indeed, new regulations could pose a major problem for thousands of U.S. companies. Investors might finally realize the emperor has no clothes.

Last week, The Wall Street Journal published an article stating that the SEC will continue to expand its recent policy. Beyond the increased use of adjusted earnings per share, companies have also been relying on non-GAAP measures of accounting. The SEC realizes that’s got to stop.

GAAP stands for “generally accepted accounting principles.” So, non-GAAP basically stands for “free-for-all.”

Of course, what’s acceptable isn’t always easy to understand. Management teams have a lot of leeway in the presentation of quarterly results. This can make it difficult for investors to determine what factors actually drive the company’s reported results.

So when it comes to non-GAAP earnings, companies are deliberately masking expenses to paint a rosier picture of their performance.

Is anyone really surprised the SEC has a problem with this?

It’s the same reason why I’ve been harping on and on about the use of adjusted earnings. Non-GAAP, by definition, means using accounting principles that aren’t even standardized. Much of it is left to discretion. It makes it easier for companies to pull the wool over investors’ eyes.

Recently, I talked about how over 90% of companies are using these measures, compared with 70% in recent history.

I target many of these companies in my newsletter, Forensic Investor. I believe that every investor should know that earnings are being adjusted to better reflect on the company. These reports don’t necessarily include factors that are important for analyzing the company’s business.

But, in a day and age where we live in bite-sized bits of information of 140 characters or less, people often just look at the headline earnings report.

They don’t give due diligence to really understand what’s driving the company’s performance in a given quarter.

In fact, the earnings release is largely useless. There’s not a whole lot of meat on the bone. Yet it often coincides with when a stock goes up or down the most! That’s why it gets so much attention.

The good stuff doesn’t come out until weeks or even months after the earnings reports. All the juicy details are buried in the notes of the SEC filings. Sadly, very few people actually read these documents.

It’s this type of analysis we conduct in Forensic Investor.

It should be no surprise that management teams will adjust earnings to their benefit. A large part of their compensation is tied to keeping the stock prices headed in the right direction – that is, up. Wall Street is very short-term focused. Quarterly results hold huge consequences for a stock price, even though businesses should be managed for the long-term.

And the impact of non-GAAP earnings is huge. According to the Journal article, GAAP earnings didn’t grow from 2012 through 2015, while Non-GAAP earnings were up 14%!

So given the SEC’s increased focus on these adjusted measures, companies might get the carpet dragged out from under them. It could expose them for excluding items that should not have been excluded.

For example, if profits suffer due to extreme weather, companies might write that off as an anomaly, no matter if it actually affected their earnings. Opening a new store? It’s a one-time expense. Supposedly, it doesn’t reflect normal operating expenses. Investors don’t have to worry about it.

Right…

These expenses might be non-recurring in nature, but they’re still expenses. Yet, they’re excluded from non-GAAP earnings.

What remains to be seen is whether investors will continue to ignore these low-quality sources of reporting and buy into the non-GAAP measures…

Or, will more SEC scrutiny give investors cause to sell stocks.

Generally, investors tuck tail and run from a stock when the SEC is sniffing around…

Whichever way you look at it, earnings are coming under pressure. At this point, normal market forces could tighten the noose just as well as the SEC is threatening to tighten regulations. The market’s been artificially propped up. One way or another, it’s going down.

In the meantime, we’ll continue to expose low-quality sources of earnings in Forensic Investor, and catch management teams with their hand in the cookie jar.

John Del Vecchio

Editor, Forensic Investor

May 25, 2016

The Hidden Side of Wall Street’s “Mischief”

Wall Street gets a bad rap. Much of it is deserved, but not necessarily for the reasons you might expect.

Wall Street gets a bad rap. Much of it is deserved, but not necessarily for the reasons you might expect.

You see, to many, Wall Street’s suit-clad warriors appear to be nothing more than money-sucking leeches… draining the pockets of Americans’ hard-earned dollars through their fees, commissions and kick-backs.

Whether this is a fair characterization or not, Wall Street’s worst give haters plenty of ammo.

About this time last year, the United States Justice Department vowed to fine Wall Street banks something like $5.8 billion for rigging currency and interest rate markets.

A long scroll of instant message conversations confirmed that many Wall Street insiders were coordinating this mischief. The most arrogant of the bunch even went so far to pontificate:

“If you ain’t cheating, you ain’t trying.”

This is the “worst of the worst” of Wall Street’s notoriously bad actors. This is why people view Wall Street as permanently rife with scandal.

But there’s another aspect to this story, one that’s less overtly sinister…

Dan Ariely, Ph.D. is a Professor of Psychology and Behavioral Economics at Duke University. His extensive research on dishonesty provided the framework for a documentary titled Dishonesty: The Truth About Lies.

Basically, Dr. Ariely concluded that “dishonesty is almost always caused by a conflict of interest.”

People act rather predictably when we find ourselves in the middle of a conflict of interest. We want to tell the truth… but we don’t want to disappoint anyone either. So while the right thing to do is to respond with complete honesty, the natural response for many is to lie… to tell both parties: “There’s no conflict here.”

I can even think back to my time as a financial advisor, when I was expected to toe the company line, even though I knew of better strategies. Between doing right by my clients and serving my firm… I was caught in a conflict of interest.

As I see it, conflicts of interest explain most of the oft-cited disconnects between “Wall Street” and “Main Street” — outside of Wall Street’s most purposeful and villainous cheats.

You see, I actually believe that a majority of individuals who work in the Wall Street machine are good people.

They’re ambitious and hard-working… analytical and detail-oriented. They’re problem-solvers!

These traits, in and of themselves, are good things. And when focused toward a respectable goal, they can produce great, meaningful results.

The problem comes when Wall Street’s goal is not well-aligned with investors’ goal… a la conflicts of interest.

Arguably, regulators have tried their hardest to properly align the interests of investors and Wall Street.

For instance, Registered Investment Advisors (RIAs) are held to a higher standard than brokerage firms, in that they have a fiduciary duty to their clients. This means they must act solely in their client’s best interest.

Fiduciary duty prevents these advisors from putting clients into a high-fee product, when a low-fee product will suit them better.

That’s a great start… but I believe investors need to take one additional step to ensure they’re in a “no conflicts” relationship with their investments.

To be frank, this final step requires a fair amount of trial-and-error… and a great deal of work and determination.

Simply put: As an investor, you have to “find yourself.”

Are you aggressive or conservative?

Are you looking for income or capital appreciation?

Do you believe in diversification, or concentrated investments?

How do you react to losses? Do you have discipline, or are you quick to panic?

How much time can you make available to actively manage your portfolio?

There are dozens of questions like this. The point is, only YOU can decide what will work for YOU.

Personally, this is a journey I’ve been trekking for years…

I’ve learned I’m more successful operating “systematic” strategies than discretionary ones.

I’ve learned I’m better as an active trader than a passive investor.

I’ve learned I get better results when I’m able to quantify my probability of success, rather than assume my subjective feelings are a reliable gauge.

All told, I’ve learned — through the process of trial-and-error — what works for me (and what doesn’t).

To bring this home, my message today is simple: take ownership of your investment strategy.

Make the commitment to figure out what works for YOU, because only you can determine that.

Wall Street — whether villain or saint, biased or unbiased — can’t tell us the investment strategy best suited to you.

And in many ways… that is the ethos of Dent Research.

Our goal is to offer you a wide variety of unique investment strategies. We do this because we know that not every investment strategy will be a “perfect fit” for every investor. And they don’t have to be.

If we can provide an environment in which you can explore a number of approaches, allowing you to ultimately settle on a few that are well-suited for YOUR needs… then we’ve met our goal.

And I promise you this… once you’ve found an investment approach that fits you like a glove, you’ll be too successful to bother worrying about Wall Street.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

May 24, 2016

The Fact of the Matter Is, Greece Is Insolvent

If you lent a guy money and he failed to pay you back, would you lend to him a second time? How about a third time?

If you lent a guy money and he failed to pay you back, would you lend to him a second time? How about a third time?

That’s exactly what’s going on in Europe.

The European Central Bank (ECB), European Commission (EC), and the IMF – the three entities collectively known as the Troika – bailed out Greece in 2010… then again in 2012.

All told, Greece received 216 billion euros, and defaulted on a chunk of debt to private investors. Now the Greeks are back at the bailout door, hoping to finalize a deal before their next debt payment is due on July 1.

The ECB and EU have agreed to more austerity in Greece in exchange for just under 100 billion euros of bailout bucks, but the IMF is holding out. Officials at the international bank don’t think Greece can make good on the new promises. They want remaining creditors – like the ECB and central banks across Europe – to discount their Greek bonds instead of asking for budget cuts from the ailing country.

I’ve got a question. What difference does it make?

Even though Greek lawmakers agreed to more spending cuts and taxes over the weekend, it doesn’t change the facts on the ground.

Greece is insolvent.

The country generates a very small primary surplus, meaning it has a little bit of cash left over before it pays principal and interest on its debt. But the country owes more than 370 billion euros. That’s like saying you have a little bit of cash left over before you pay your mortgage or rent.

And why would the Greeks want more bailout bucks? Of the 216 billion euros they received from the first two rounds, a whopping 9.7 billion euros flowed to their coffers. A chunk of it, 90 billion, repaid old debt, and the rest flowed back to bondholders in the form of principal and interest payments.

So for 126 billion euros of net new debt, Greece received 9.7 billion of fiscal stimulus.

Brilliant!

The Troika, on the other hand, have no choice.

They must force another bailout, because they all own Greek bonds. Same with the central banks of Germany and other Northern European countries. They all need Greece to continue paying its debts, because they are the recipients of those principal and interest payments. If the Troika cuts Greece off, they’ll have a bankrupt nation on their hands that cannot continue to pay them.

No one in the Eurozone wants that.

As Charles recently noted, Brits will vote in late June on whether to stay in the European Community or cut their ties. The possibility of losing the financial capital of Europe is already sending tremors through the economic bloc. They don’t need another earthquake.

But Greece’s troubles aren’t going away. They’re just getting older.

A full 25% of the government’s budget goes toward pension payments. Since 2000, the government has spent over 175 billion euros on pensions, which is about half of its outstanding debt. If the country completely abandoned its current debt, it could just barely squeak by today.

But what about tomorrow? As more pensioners join the ranks, the problem will only get bigger.

As I’ve written many times, the country is already bankrupt. It’s just a matter of when everyone will acknowledge the fact and start working on real solutions.

Until then, expect more bailouts and Band-Aids as the Troika tries to keep Greece afloat so the Eurozone doesn’t splinter.

Rodney

May 23, 2016

Same Problem, Different People

“What am I supposed to do with my money right now?”

“What am I supposed to do with my money right now?”

I had dinner with a wealthy South American business magnate a few weeks ago. This gentleman ownsa bank – and a large one at that – among plenty of other business interests. He lives a life that most people would envy.

But what struck me was that this man has the exact same problems the rest of us do.

In an era of zero interest rates and expensive stock markets, he has no idea what to do with his idle savings.

He looked at me, shrugged his shoulders and made a gesture with his hands that looked of despair.

I get it.

There just aren’t that many great investments to stick your money in and leave it there.

Even if the Fed raises rates in June… and at every meeting for the rest of 2016… we’re still not going to see savings accounts or CDs offer reasonable returns any time soon.

Two years ago, former Fed Chairman Ben Bernanke commented that he didn’t expect to see the federal funds rate above 4% again in his lifetime.

So for lack of a better alternative, cash has made its way into the stock market.

But stocks come with their own set of risks.

Stocks face headwinds from a strong dollar, weak demand from abroad, and stagnant wages.

To add to the list of worries, stocks are sitting at very pricey levels.

They trade at a cyclically adjusted price/earnings ratio of 25.6. That might not sound like much in a vacuum, but it’s 53% higher than the long-term average of 16.7. And worse, it implies annual returns of about zero over the next eight years.

Stocks have no reason to be this expensive. The S&P 500 has seen its earnings decline for four consecutive quarters.

We’ve all known for a while that the Fed’s zero-interest-rate policy – excuse me, 0.25%-interest-rate policy – was juicing the market, inflating it to these heights.

But earlier this year, ValueBridge Advisors actually put a pencil to it – and found that the Fed’s monetary stimulus was fully responsible for 93% of the market’s gains since 2008.

Considering stocks have been trapped in a trading range for about two years now, it’s hard to see what could possibly push them much higher as the Fed slowly takes the punchbowl away.

So, we return to my South American friend’s question.

What are we supposed to do with our money right now?

Traditional buy-and-hold investments like stocks and bonds look like a lousy bet. But there are some decent buys out there if you know where to look.

I’ll share with you some of what we’re doing here at Dent Research…

As the Portfolio Manager for Boom & Bust, and like Adam before me, I turn Harry and Rodney’s demographic research into action, recommending trades that avoid the market’s various landmines and are likely to do well in our current market environment.

Rodney and I write Peak Income, a newsletter dedicated to finding income and value opportunities in closed-end funds. Our readers are collecting dividend checks every month while the market goes nowhere.

Rodney also writes Triple Play Strategy, a newsletter that runs a momentum-based model. Even in a sideways market, for every stock that’s down, there’s another one that’s up. Rodney’s model identifies them and rides them higher.

Lance has his own service called Treasury Profits Accelerator, where he capitalizes on relatively small moves in the interest rates of U.S. Treasury bonds. And he does it all using just two ETFs.

Adam runs two trading services. In Cycle 9 Alert, he uses proprietary statistical analyses that he’s developed to rank the market’s various sectors, guiding his readers into the hottest corners of the market. And in Max Profit Alert, he identifies stocks that have moved “too far, too fast,” then rides them back to their longer-term trend in a short, pullback trade.

Then there’s John Del Vecchio, our resident forensic accountant. I call John the “Horatio Caine of finance,” after the star of CSI Miami.

John knows where the bodies are buried in the financial statements, so to speak.

His newsletter, Forensic Investor, runs the sort of portfolio you might see in a hedge fund. John essentially runs a long/short strategy that recommends buying cheap stocks with good accounting and shorting expensive companies with dodgy accounting. With the market where it is today, he’s understandably been recommending more shorts than longs.

The fact is, there’s still plenty of money to be made in this market. Sometimes you have to get a little creative, and that’s what we do here at Dent Research. Any one of our approaches will do the trick. And if it means putting in a little bit of extra work to get there, it’s worth the effort.

Charles Sizemore

Editor, Dent 401K Advisor

May 20, 2016

June, You’re Up!

For months we’ve been asking: Are the markets too concerned about what the Fed says and what it plans to do, or is the Fed too concerned about the markets? Its officials have walked back and forth on their comments all year, and no one’s really been sure what they’re up to. The markets have been permanently on edge!

For months we’ve been asking: Are the markets too concerned about what the Fed says and what it plans to do, or is the Fed too concerned about the markets? Its officials have walked back and forth on their comments all year, and no one’s really been sure what they’re up to. The markets have been permanently on edge!

Well, from the Fed meeting minutes earlier this week, it looks much more likely that a June hike is now on the table.

The economic data isn’t great, but it has improved. Wages are up a bit. Retails sales came in strong last month. U.S. markets have been flying high for three months now. Maybe, if the Fed can get the markets thinking about a hike ahead of time, they won’t freak out again like they did in January. That’s the idea, anyway.

But I think the Fed recognizes they’ve lost credibility and need to act. In a recent New York Times interview, St. Louis Fed President James Bullard admitted that credibility is a major issue for central bankers right now.

No! Really?

The Fed raised rates in December after talking it up for over a year, said they’d hike four more times in 2016, changed it to two, and has gone almost six months without another move.

That doesn’t inspire confidence. All in all, the bond market’s not buying it, either.

Yields did shoot up on Wednesday after the Fed admitted that a June hike is now more likely. My Treasury Profits Accelerator readers sure liked that since I put them into a correlating trade a few weeks ago. Bondholders realized if the Fed’s going to raise rates, bond prices will take a hit. So, they dumped some of their exposure and yields went up.

But that hasn’t been the trend over the last several months.

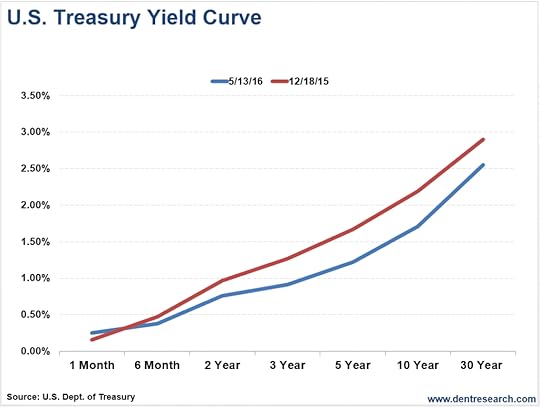

Investors have been more defensive as they’ve plowed into 30-Year Treasury bonds, which is about as defensive as you can get without going to cash. Hence, yields have been dropping all year. And if the economy weakens and maybe goes into a recession, they’ll drop more. The difference in short-term rates and long-term rates will narrow as the yield curve flattens.

I’ve discussed this before, but a flattening yield curve is a great sign that the economy’s not improving.

In fact, the yield curve looks worse than it did in December when the Fed last hiked rates.

Normally you’d expect to get paid a significant amount more putting your money in a 30-Year Treasury than the shortest-term bonds. But when yields drop this much, that no longer becomes the case.

That’s what we mean when the yield curve flattens. You get paid less for longer bonds relative to shorter ones. And since this is basically a measurement of investor sentiment, a flattening yield curve means the bond market is not forecasting a rosy picture of the economy.

If the bond market believed the economy was improving and more rate hikes were on the way, the blue line in the chart would be above the red line, not below it.

Only the very short-term rates, under six months, are higher today than they were after the rate hike last December. And that may simply be due to the fact the Fed raised the overnight rate. By comparison, that makes the 30-Year Treasury bond yield look even worse.

So basically, while the Fed promised multiple rate hikes this year after they hiked in December, the bond market’s just not buying it. It’s become less convinced in the Fed’s argument that the data’s improving.

That’s what the yield curve shows. And that’s why it’s such a great measure of economic health.

Still, the Fed’s made it clear that their preference is for a hike in June. A couple Fed officials also came out Wednesday saying there could be another two on top of that this year.

Perhaps its officials think the market won’t panic if a hike is somewhat priced in. The Fed wants to get back to a more normal interest rate setting, but doesn’t want to create another crisis by doing so.

Personally, I care a lot more about what the bond market says than these Fed officials who can’t seem to make up their minds. They’re flying by the seat of their pants based on any short-term data that supports their message. But by and large, investors are still defensive and the bond market just isn’t buying it. The Fed may hike in June. Beyond that, it’s just speculation.

Lance Gaitan

May 19, 2016

Look Out! The Market’s Last Line of Defense Is Crumbling

Two things about human nature are pretty predictable. The first is that humans have short memories. Second, they never learn from their mistakes.

Two things about human nature are pretty predictable. The first is that humans have short memories. Second, they never learn from their mistakes.

The same goes for investors. Markets change, the companies that dominate the markets change, technology changes, but human nature never changes.

Not that long ago we experienced a huge financial crisis where many people watched their 401(k) turn into a 201(k). While the markets rebounded to new highs in recent years, a lot of individual investors sold at the bottom and never got back in. Others who did, won’t know to sell until it’s too late.

Meanwhile, central banks have fueled yet another bubble. This one could be even bigger than the last, meaning that when it bursts, it will burst more violently. Carnage will ensue, and some companies will be more devastated than others.

That’s why I focus so much of my energy looking at earnings quality.

In my newsletter Forensic Investor, I publish stock recommendations betting against companies that use accounting shenanigans – basically, companies that have jimmied their earnings. Often, companies will resort to this funny business to mask deterioration in their business. I also design, develop, and test models to help spot financial chicanery and predict where earnings could be vulnerable to manipulation.

The problem today is that the whole market may be manipulated.

More and more companies use these “adjusted earnings” to report their financial results. They often exclude all sorts of stuff from the numbers to make them look a lot better than they actually are. Measures like EBITDA for example (or “earnings before interest, tax, depreciation and amortization) mask material weaknesses in the financials. Warren Buffet calls it: “earnings before the bad stuff.”

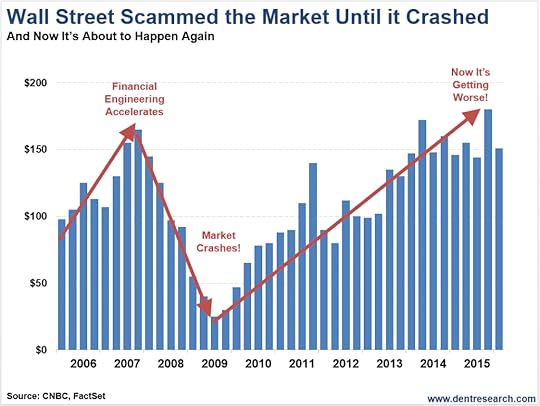

But the biggest prop to the market may be share buybacks.

Now, normally I’d say that buying back stock isn’t the kind of earnings manipulation trick that would cause the share price to sink. The share count is at the bottom of the income statement, and many other line items exist that management can use to generate income.

As an example, it’s far juicier if the company were cooking the books on the revenue line and overstating the demand for its product. That’s the sort of fancy maneuvering that causes a stock to implode.

But, we are not in normal times. The buybacks have gone berserk.

In fact, research from Wall Street’s biggest institutions suggests that almost all of the returns since 2009 have been driven by share buybacks.

I don’t believe that’s ever been the case before. That’s scary. But what’s scarier is knowing that after seven years, this bull market is very long in the tooth. Those buybacks have been propping up the market, stretching the cycle to the max. Take them away, and the entire market may collapse with them.

Take a look at the chart below:

Just prior to the last crisis, buybacks surged. Then the market tanked, and share buybacks dried up during the best buying opportunity in a generation. Now that the market has rallied sharply since 2009, buybacks have accelerated again and are at all-time highs.

But, it may have topped out. Buybacks have started to fall off sharply in 2016. According to research from TrimTabs, buyback announcements are running 35% below the pace of last year.

And just over the past five weeks, the value of shares bought back have fallen 42% year-over-year.

This could really lead to trouble for the markets.

What’s more is that those numbers would look worse if you removed Apple and Allergan, which accounted for 54% of the volume.

But that’s not even the worst of it. Where it gets really ugly is that a lot of companies accumulated boatloads of debt to fund the buybacks. In the end, they’ll have balance sheets bogged down with leverage, and a bunch of wasted cash that was used to buy back stock at inflated prices. Little to none of that cash was spent investing in projects that could fuel future growth.

This could be creating a perfect storm that leads to much lower equity prices in 2016.

But it could also present one of the greatest opportunities to profit for regular investors like you.

It’s based on the same strategy I’ve used to manage my hedge funds through the last two market crashes. The deluge that will result from these buybacks not could, but will present another major opportunity to profit on the downside.

That’s why now more than ever you need to actually look at what’s going on behind the numbers companies are reporting with their earnings. Some of it’s true, but a lot of it’s B.S. I’ve put it all together in this presentation you can watch right now.

We’ve had two major scares in the market over the past nine months. I don’t think it’s going to get any better than it is right now, and the next correction could be the big one. Watch this presentation now and you’ll understand why.

John Del Vecchio

Editor, Forensic Investor

May 18, 2016

This Could Easily Become the Worst Urban Crisis in History

Like our resident market P.I. John Del Vecchio, Kyle Bass is one of those hedge fund managers who profited in the last crash when he bought credit default swaps to short the housing market.

Like our resident market P.I. John Del Vecchio, Kyle Bass is one of those hedge fund managers who profited in the last crash when he bought credit default swaps to short the housing market.

He’s also one of the few financiers in the market today who says there’s a reasonable chance the U.S. will fall into a recession over the coming months. But he’s really on the money when it comes to China.

Mr. Bass estimates that China’s bad debt exposure is at least five times that of the subprime crisis in the U.S.

Think that’s enough to trigger the next global financial crisis and depression?

You bet it is!

Two things are happening now in China that most people aren’t fully aware of. The country’s on track to create $4 trillion in new debt this year alone, or nearly 40% of its GDP, building houses for no one, while rural migrants are declining for the first time in 30 years.

In other words, the very people it’s overbuilding all these condos and infrastructure for are leaving!

After decades of rapid urbanization, no one saw that coming.

In the first quarter of 2016, China added $1 trillion in new debt, which puts it on track to reach that $4 trillion figure. One trillion is about the same the U.S. did in QE in 2013. It’s the same the ECB did in 2014.

China’s done it in a single frickin’ quarter with an economy 60% our size!

Even if you take the highest level of QE that the U.S., Europe and Japan added in a single year, the most that would add up to is $3.3 trillion.

So at $4 trillion, China is set to rack up more debt in one year than these other major countries did at their peaks, combined.

And it’s mostly by creating money out of thin air.

Countries can do this in a couple of ways. They can expand their bank loans against 10% reserve deposits – basically issuing $10 million when they’ve only got $1 million in the bank – or they can use QE. It’s the difference between 90% money creation with the fractional reserve loans, or 100% for QE. It’s all crack to me!

The developed world has moved more and more to QE to keep the gravy train rolling. It hasn’t worked because we’d already reached saturated debt levels in the great boom into 2007 – what David Stockman who spoke at our last two Irrational Economic Summits calls “peak debt.”

China isn’t doing QE per se, but they’re issuing tons of government-backed loans to corporations at affordable rates, so they can build infrastructure they’ll never use with money they don’t actually have.

It’s like our monetary gods said, “thou shalt be money!”

They think they can keep wishing money into existence without ever having to pay the consequences.

When has a drug addict ever gotten over their addiction without a relapse?

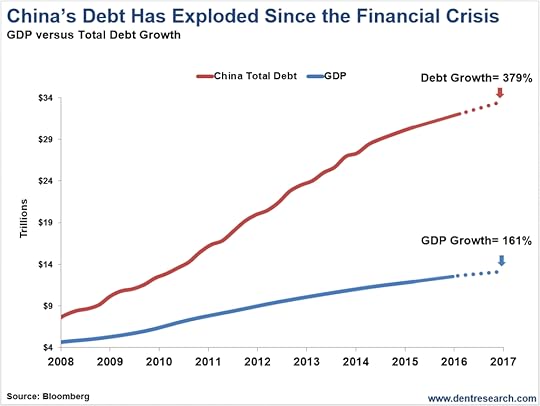

The chart below shows China has expanded their debt growth at 2.35 times their GDP growth since 2008.

China has expanded their total debt 4.8 times just since 2008 and 16.4 times since 2000. This is totally nuts. Debt growth is 379% while GDP growth is just 161% over that period.

Any economist who thinks China can have a soft landing after this is a blooming idiot!

At this rate China is looking at a debt-to-GDP ratio of 292% by year-end, or almost 3:1. Meanwhile, other large emerging countries typically run between 100% and 150%.

If this isn’t a train wreck coming, I don’t know what is.

The assumption is that China needs to keep expanding their infrastructure as more and more people move from the rice paddies to the cities. But like I said, the opposite is now happening!

Urbanization has come to a halt, with urban migrants declining by six million, from 253 million to 247 million in 2015. Why? Crazy real estate prices for one. Massive smog and traffic for another.

And the kicker – slowing jobs and wages. No thanks!

And what do you think a global depression will do to Chinese urbanization growth and job opportunities?

Simple – the greatest urban disaster in history.

If you think demographics will make the situation better now that China has abandoned their one-child policy, not so fast. Demographics make the situation worse as China’s age 15-64 workforce peaked in 2011. Since then, it’s declined by 30 million, from 941 million to 911 million (-3.2%).

Such rates of decline will accelerate after 2025, just when China finally works off the excess building of the past two decades.

Japan was never the same after 1989 due to predictable and rapid aging – and overinvestment and bubbles driven by a top-down government.

China’s drunken excess makes Japan look like a teetotaler.

So I’m with Kyle Bass on this one. China is going to fall like an elephant, making India the next big thing in the emerging world, dominating demographic growth in the next global boom after 2022.

The most affluent Chinese see it. They’re moving their money out of the country, buying real estate and businesses all over the world.

The handwriting’s on the wall. You just have to see it. It’s there.

Harry

May 17, 2016

The Last Time This Happened Was Right Before the Last Crisis

Everybody and their brother curses the Fed. It has snatched the “free” out of our “free markets,” and there’s nothing that makes us, as investors, more uncertain or uncomfortable. Right!?

Everybody and their brother curses the Fed. It has snatched the “free” out of our “free markets,” and there’s nothing that makes us, as investors, more uncertain or uncomfortable. Right!?

We know the Fed’s hand is heavier than ever, there’s no denying it… and we want you to know what the hell to do about it!

The experts we’ve collected to attend our annual Irrational Economic Summit this year have sharp, insightful thoughts about the Fed. It will be well worth your time to hear what they say about its effect, on us, as investors.

As I see it… the Fed is to blame for the next financial crisis (whatever shape that may take, and whenever it should finally appear).

But instead of crying about it… I’m more focused with profiting off the Fed’s intervention.

Essentially, you have two choices heading into the next global financial crisis.

You could do exactly what you did before the last crisis, in 2008.

Or, you can arm yourself with a far-superior “survival strategy.”

Mind you… I don’t actually know what you did ahead of 2008. And I don’t know exactly how you fared through that confusing, tumultuous period.

But I know what a majority of “typical” investors did… and I know that had they used my survival strategy then… well, they’d be a lot richer (and happier) now.

Let me show you what I mean…

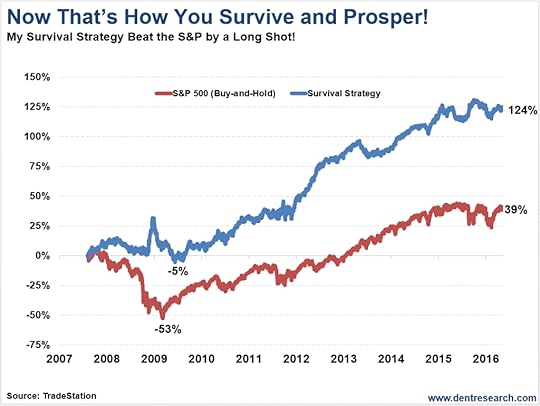

I want to share a chart that shows the power of this “survival strategy” I’m talking about.

And then I’ll explain how this strategy exploits a Fed-driven phenomenon – one that I spoke about publically at our Irrational Economic Summits, in both 2014 and 2015.

Here’s the chart:

Basically, if you made a $10,000 investment in the S&P 500 in August 2007, it would now be worth $13,900 – a total return of 39%. And you only would’ve gotten this return if you were willing to sit through a 53% drawdown!

Meanwhile, a $10,000 investment in my “survival strategy” would now be worth $22,400 – a 124% total return. And you could have gotten there quite smoothly, never losing more than 5% of your initial investment.

Pretty good deal, right?

Not only is my survival strategy able to weather the storm better than a passive investment in the stock market… it can generate stronger returns, with less volatility, over the long term.

And that’s all thanks to the Fed! Not despite it.

You see, back at our Irrational Economic Summit in 2014, I began talking about a policy divergence among the world’s central banks, where some will increase their interest rates… while others would continue pushing them lower.

And now, that day is here. While the Fed is on course to raise interest rates, almost all other central banks in the world are doing the opposite.

What’s more, I knew back in 2014 that this divergence in global monetary policy would likely have two effects:

It would confuse the snot out of people…

And it would set stock markets around the world on opposing paths – expanding the distance between the “big winners,” and the “big losers.”

It took a while for this theme to fully develop, but consider where we are today…

Over the last quarter, the best-performing stock market in the world is up 46%. And the worst-performing is up 6%. That’s a HUGE spread, at 40%! And it was even wider just a few weeks ago – at a whopping 63%!

The spread between top- and bottom-performing global stock markets hasn’t been this vast in a bull market since December 2007. And my research shows this is a warning sign of higher volatility and lower (buy-and-hold) returns ahead.

This is what I was talking about in my Irrational Economic Summit speeches – back in 2014, and again in 2015. And this is why I think you should consider a “survival strategy” approach ahead of the next financial crisis.

I’ll be speaking to the ins-and-outs of my strategy during this year’s conference. As far as I know, it’s the only strategy that’s able to capitalize on these central bank shenanigans (very safely).

You can bet plenty of “single-finger salutes” will be thrown the Fed’s way at our Irrational Economic Summit this October.

And while that’ll be a lot of fun… I want to make sure you’re prepared to profit off the Fed, too!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

May 16, 2016

No Wonder Why the Donald’s Campaign Has Taken Off

Years ago, I gave a speech in Texas for Rick Goodwin, a financial advisor. It was an election year, so he kicked off the meeting by discussing politics. He noted that the word comes from Greek, with “poli” meaning “many,” and “tics” meaning “blood-sucking bugs that are hard to get rid of.” Robin Williams used the same joke.

Years ago, I gave a speech in Texas for Rick Goodwin, a financial advisor. It was an election year, so he kicked off the meeting by discussing politics. He noted that the word comes from Greek, with “poli” meaning “many,” and “tics” meaning “blood-sucking bugs that are hard to get rid of.” Robin Williams used the same joke.

I can’t speak for others, but this is why I believe Donald Trump is the presumptive Republican nominee, even though he repels so many people. He points out what we all know – politicians regularly avoid hard questions, outright lie, and fail to follow through on much of what they promise.

We’re tired of it. For many people, the answer is “anyone but a current politician.”

That doesn’t make the Donald’s campaign right or wrong. It’s just a natural extension of where we’ve been for way too long. We live in a divided world. Not between the rich and poor, but between those that suffer consequences for their actions and words, and those that get off scot-free.

The free-pass list starts with politicians and appointees, and isn’t limited to one side of the aisle. We were lectured ad nauseam by former Treasury Secretary Tim Geitner about sharing the burden of the recession and how higher taxes were needed to rebuild the nation.

This is the guy who failed to pay his own taxes, blamed it on TurboTax, and got a free pass.

Funny, I can’t think of a single instance where anyone I know underpaid their taxes and wasn’t hit with penalties and interest by the IRS.

This pales in comparison with the cost of the Affordable Care Act (ACA), which politicians told us would be, as you might guess from the name, affordable.

Of course, they also said any legislation would be posted online for three days before Congress voted, giving all Americans a chance to read it and weigh in. That’s a far cry from former Speaker Nancy Pelosi’s declaration, “You’ll have to pass it to see what’s in it,” about the ACA.

Now we’ve had it for three years, and premiums have increased by more than 10% per year. Premiums are expected to jump by more than 11% in 2017. My own premium more than doubled since 2010, as my coverage declined. I can’t find a single politician who supported the Affordable Care Act who is willing to kick in for my insurance bill.

We can’t leave out the many contributors to the financial crisis. Sure, executives at banks that packaged trashy mortgages and sold them deserve a lot of blame, but there’s one group that holds singular responsibility for the mess – the rating agencies.

Standard & Poor’s and Moody’s are identified by the SEC as Nationally Recognized Statistical Rating Organizations (NRSRO’s), which allows other firms to rely on them for regulatory purposes. This gives the two companies enormous advantages in their market, which they used to make billions of dollars over the years.

But that wasn’t enough.

They slapped the highest ratings on a bunch of junk mortgage bonds to increase revenue. This is a fact, not a guess, as stated in court by several employees. When called out by companies that relied on their ratings, executives at the rating agencies claimed their ratings were mere opinions that are protected free speech. Not one of these cowards went to jail.

And then there are central bankers, the lovely group of bureaucrats who steal from savers daily with exceptionally low and even negative interest rates, all in the hopes of driving economies higher. It hasn’t worked for eight years, and has no prospect of working in the future, but hey, they’re still trying!

When do we get our money back? Unfortunately, I think I know the answer.

At least in the financial markets – absent government intervention, like we had with the auto industry and large banks – companies usually suffer for their bad acts.

That’s why I cheer on equity sleuths like John Del Vecchio, who spend their days rooting out firms that, while not technically lying to investors, are doing everything they can to stretch the truth about their financial results.

So many companies use stock buybacks to boost their earnings per share, or strip out what they call “one-time” costs from quarterly results to improve their numbers, that it’s hard to believe earnings when reported. With stock indexes near all-time highs, while GDP growth languishes near zero and rosy corporate earnings posting yet another decline, the time seems right for traders in John’s Forensic Investor to profit handsomely.

Finally, a consequence… and this one can actually deliver profits to investors.

Rodney