Harry S. Dent Jr.'s Blog, page 114

April 1, 2016

Think the Market Will Reach a New High? Here’s Why We Don’t

Stocks are once again rallying after another “mini crash” at the start of the year. We’ve had three of these things since October 2014 without much to show for it. As Adam warned

Stocks are once again rallying after another “mini crash” at the start of the year. We’ve had three of these things since October 2014 without much to show for it. As Adam warned

March 31, 2016

The Finance Industry’s Most Prized Theory: Tarnished

Unless you live under a rock, I’m sure you’ve heard a variation of this investing maxim:

Unless you live under a rock, I’m sure you’ve heard a variation of this investing maxim:

“To earn high returns… you must assume high risk.”

There’s an ounce of truth to this saying… but it mostly leads investors astray.

Today, I want to show you how three specific low-risk investments helped my subscribers turn $20,000 into $40,010 – between January 19 and March 22 of this year.

Before I do that, though, let me explain where the “high risk = high returns” idea comes from. And then I’ll show you why, in some market environments, the relationship is exactly the opposite.

It all starts with the finance industry’s most-prized theory: the Capital Asset Pricing Model (CAPM).

Introduced in the 1960s, the Capital Asset Pricing Model was the first major theory to explain the relationship between investment risk and return.

The idea is simple…

If Stock “A” is twice as volatile as Stock “B”… then Stock “A” should provide investors twice the return as Stock “B.”

After all, why else would an investor suffer through twice the volatility… if they aren’t fairly compensated for the excess emotional torture?

The theory is surprisingly simple and intuitive – so much so that financial professionals and investors alike have “bought it” for the last several decades.

And even though a slew of research has since discredited the simplistic “low risk = low returns” relationship, most investors still think you can’t make big money in low-risk investments.

I’m here to tell you: YOU CAN!

Earlier this year, I recommended three low-risk stocks in my trading services. And even though these stocks were definitely “low risk,” they generated much bigger gains than the overall stock market – eventually turning a $20,000 investment into $40,010 in just two months.

By “low-risk,” I mean stocks that are less volatile than the overall stock market (i.e. the S&P 500), since, according to CAPM, volatility is synonymous with risk. Some stocks, such as Tiffany & Co. (NYSE: TIF), are almost twice as volatile as the S&P 500… while others, like Wal-Mart (NYSE: WMT), are only 23% as volatile.

So, according to the Capital Asset Pricing Model, Tiffany & Co. should return more than the S&P 500 (because it’s more volatile), and Wal-Mart should return less.

But that’s only in theory.

In reality, there are times when low-volatility stocks trounce the market.

Specifically, when investors are fearful… low-volatility stocks are a much better bet than the overall market.

And by my own proprietary measures, we’ve been in this fearful market environment since early January.

I’ve written about this before… so I won’t go into detail here. But essentially, when the stock market’s various sectors are producing similar returns, investors feel safe. But when there’s a large spread in the performance of sectors (i.e. some doing very well, some doing very poorly)… investors get fearful and skittish.

And during those environments – when the spread is high, and investors are fearful – low-volatility, “defensive” sectors tend to beat the overall market. Basically, investors put a premium on “safe” stocks during these times.

To be specific, two low-risk sectors have historically beaten the market during these environments: the utilities sector and the consumer staples sector.

And those are precisely the low-risk sectors that made my subscribers huge gains earlier this year.

Here’s exactly what we did…

Low-Risk Trade #1: Go Long the SPDR Utilities Sector ETF (NYSE: XLU)

On January 19, I recommended a specific bullish position on the SPDR Utilities Sector ETF (NYSE: XLU).

We stayed in that position until March 22, when we closed it out for a net gain of 86.3%.

Mind you, utilities stocks are much less volatile than the market – about 22% as volatile on average.

But even though this utilities sector ETF was “low-risk,” it easily beat the market while investors were fearful.

Low-Risk Trade #2: Go Long Kroger Co. (NYSE: KR)

On January 21, I recommended a specific bullish play on Kroger Co. (NYSE: KR), a consumer staples stock.

Kroger’s stock is only 78% as volatile as the broad market, but since investors were so fearful in January… they piled in and bid up the price.

Kroger returned twice what the S&P 500 did during our holding period. And that was enough to hand us a profit of 75% on this low-risk position. Lastly…

Low-Risk Trade #3: Go Long Duke Energy Corp. (NYSE: DUK)

On February 25, I recommended a specific bullish play on Duke Energy Corp. (NYSE: DUK), a low-risk utilities stock.

Get this… Duke’s stock is just 6% as volatile as the market, but it managed to beat the market’s return while we were in it.

All told, we were in this position for just 10 days… and we walked away with a 38.8% gain.

Putting it all together…

Investors have been especially fearful in 2016… and I’ve shown my subscribers how to take advantage of this environment, by making low-risk investments in ultra-safe stocks.

And even though the Capital Asset Pricing Model says my subscribers should have earned low or even measly returns from those low-risk investments… they actually have huge profits to show for them.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

March 30, 2016

Looking At Muted Returns? Your 401(k) Might Be Your Best Friend

If they’re not sick to their stomachs yet, they will be soon.

If they’re not sick to their stomachs yet, they will be soon.

First-quarter 401(k) account statements will be arriving in mail boxes in a few short weeks. When they do, a lot of Americans will wonder why they even bothered contributing. For all of the day-to-day noise, the market is going to finish the quarter pretty much where it started. And to think, the market

March 29, 2016

The Fed Thinks It Can Raise Rates With All This Going On!?

You’d think with all the geopolitical crises and a weak world economy that market fear and volatility would be high.

You’d think with all the geopolitical crises and a weak world economy that market fear and volatility would be high.

Instead, over the last month or so, we’ve seen a few fits and starts in the equity markets, but stock indices are still sitting close to all-time highs.

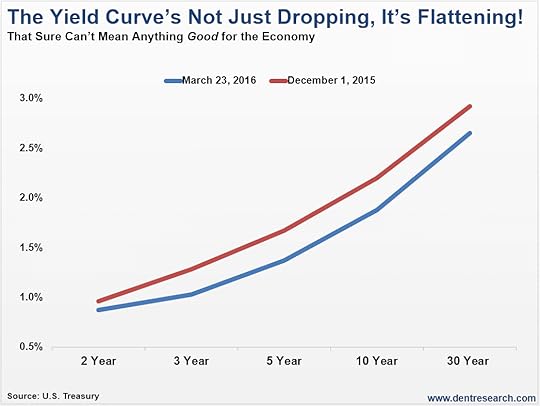

When the Fed raised rates last December, you would expect a yield curve that was getting steeper. That would signal an economy that’s getting stronger. The Fed would only raise rates if they thought the data supported it, right?

Wrong. The Fed raised rates because they were hell-bent on normalizing policy, not because the economy was getting stronger.

The Fed Chair, Janet Yellen, so much as said last month that the Fed isn’t really relying on economic data to make policy decisions. They’re reacting to risks from global economic developments.

Those global developments surely include what other central banks are doing.

That aside, the bond market shows that things may not be so great in the U.S. after all…

When there’s a steep yield curve, investors are speculating that strong economic conditions will spur inflation and that business is getting better. When investors buy longer-term bonds, they get paid a premium yield for the risk they’re holding. So when short-term rates go up, like when the Fed hikes the Fed funds rate, long-term rates usually go up even more in a normal market.

On the other hand, when the yield curve is getting flatter, it usually means that the economic outlook is bleak. Bank credit usually contracts and our economy just isn’t growing. A flat yield curve can even predict recession.

Let’s take a look at the yield curve from after the Fed hiked in December to now:

In the last three months, rates across the yield spectrum are lower. But the spread between short and long-term yields is more narrow, which means the yield curve is flattening. If a steeper yield curve foretells a strengthening economy, and the curve is actually flattening – are bonds foretelling recession?

Maybe, maybe not. But it sure isn’t predicting a rosier economy with higher prices or further rate hikes by the Fed!

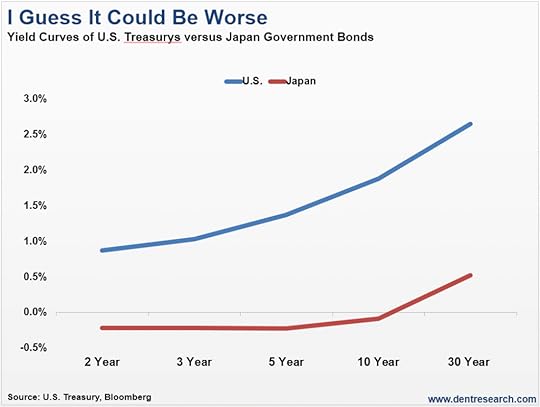

I’ve asked this before: how can the Fed think about raising rates when central banks around the globe are cutting rates, going negative and pumping up the stimulus? I mean, just look at the yield curve of Japan compared to the U.S below:

Japan barely even registers! And just look at how much their yield curve has flattened. There’s hardly a difference between their two-year and their 10-year.

Comparatively, the outlook for Japan is bleak. The Bank of Japan (BoJ) has been stimulating, cutting rates and buying bonds for decades. They’re fighting a shrinking and aging population (demographics) and consumers that just don’t want to spend. But how can the Fed keep raising rates with this going on?

The BoJ, the Europeans, Chinese and others are all trying to stimulate their economies and exports. They hope that by devaluing their currencies through rate cuts and recently even negative rates that they’ll be able to achieve this. This is a race to the bottom that no one will win.

The effectiveness of these central bank actions have less impact the further they go. Remember when Japan went negative in January? They wanted to goose stock prices and weaken their currency but the opposite happened. Oops!

For now, all of this central bank talk and action has taken a lot of the volatility out of the markets. Stocks are still trading near all-time highs. This won’t last too much longer.

When traders snap out of their central-bank-induced heroin highs, look out below!

I expect there to be plenty of market volatility soon, which means there will be plenty of opportunity to make money! Overreaction in long-term Treasury bond prices is one way my Treasury Profits Accelerator subscribers profit.

Trading Treasury bonds may not sound sexy, but earlier this month we closed a three-month position for about 56%, and another that earned us 70% in a single day. As volatility comes back into the market, I expect to see more trades like this.

Lance Gaitan

March 28, 2016

The BLS’ Inflation Figures Seem Far Removed From Reality…

March 25, 2016

Merger Madness: They Don’t Make Growth Like They Used To

This past Monday was another “Merger Monday,” or maybe we should call it “Merger Madness.” Or even “March Madness.” In any case, a total of three deals worth over

This past Monday was another “Merger Monday,” or maybe we should call it “Merger Madness.” Or even “March Madness.” In any case, a total of three deals worth over

March 24, 2016

The U.S. Is in for Much Greater Civil Unrest Ahead

I made a confession to our Boom & Bust subscribers last month. While I generally advise against owning most real estate, I have a secluded property in the Caribbean. It’s the only property I own (I rent my home in Tampa) and I know for a fact that its value will likely depreciate in the

I made a confession to our Boom & Bust subscribers last month. While I generally advise against owning most real estate, I have a secluded property in the Caribbean. It’s the only property I own (I rent my home in Tampa) and I know for a fact that its value will likely depreciate in the

March 23, 2016

Why I Quit My Job as a Financial Advisor

Our experiences shape us. We can agree on that, right?

Our experiences shape us. We can agree on that, right?

And as much as we’d like to think we learn from the mistakes of others, the truth is… most of us don’t. We learn “the hard way,” through our own personal trials and tribulations.

Financially, the lessons we learn from the school of hard knocks are costly!

I’m not only talking about dollars and cents. I mean “costly” in the sense that financial lessons learned the hard way often rob us of years, even decades, of our precious time. They set us back… prevent us from reaching our full potential… from living life to the fullest.

Most costly of all, financial lessons and mistakes will rob millions of Americans of the opportunity to retire and live comfortably through their golden years.

The stats are mind-blowingly dim…

“Thirty-six percent of American workers age 55 to 64 say they have less than $25,000 in retirement savings.” —

March 22, 2016

This Game’s Almost Over: Central Banks Are Running Out Of Options

Going into last week’s Fed meeting, the general consensus was that they would not raise rates. When they hiked rates by a quarter point in December, they projected there would be four additional quarter-point raises in 2016. That’s starting to look fishy as we’re almost a quarter of the way through the year and there’s still no hike.

Going into last week’s Fed meeting, the general consensus was that they would not raise rates. When they hiked rates by a quarter point in December, they projected there would be four additional quarter-point raises in 2016. That’s starting to look fishy as we’re almost a quarter of the way through the year and there’s still no hike.

Sure enough, the Fed left rates unchanged as expected last week, and revised their rate expectations lower through 2016. Now, they anticipate only hiking another half point by the end of the year.

But the most interesting part of their policy statement had to do with why they lowered their projections. Rather than citing economic developments here at home as a “data dependent” Fed should do, they referred to global economic developments that are posing risks.

That tells me that the Fed is really just reacting to global currency maneuvers. Right after the Fed statement announcement – where they projected to have only two rate hikes this year, down from four – the U.S. dollar fell sharply against foreign currencies.

It’s going to be hard for the Fed to raise rates here while foreign central banks are easing and going negative with their rates. Just before the Fed and the Bank of Japan (BoJ) met, the European Central Bank (ECB) increased QE and moved rates further negative. And the BoJ adopted negative rates in their January meeting.

Since the Fed and the BoJ announced monetary policy last week and the ECB the week before, it’s probably a good time to look at what’s ahead for central bankers, especially the Fed.

The BoJ didn’t change monetary policy at their meeting last Tuesday. They were probably a little gun-shy after having their last action backfire when they announced a surprise negative interest rate move. They wanted to weaken their currency and move stock higher and the opposite happened.

Then last week their currency got even stronger. The original thought was that by not increasing rates, the Fed wouldn’t pressure the yen. But the dollar fell against the yen and other currencies, making them stronger.

That’s when the BoJ intervened (again) by directly selling the yen in the open market, hoping to offset its earlier strength.

And the currency games continue…

The BoJ is probably running out of policy options. Despite decades of currency intervention, quantitative easing and now negative rates, they have failed to spur economic growth, consumer spending and inflation. Is this finally the end?

Japan started their monetary easing and quantitative easing decades ago. The Former Fed Chair Ben Bernanke followed suit in the wake of the financial crisis in 2008. Europe’s central bank tagged along later. China has been playing currency games for years.

While all of this central bank tinkering has affected some asset prices and currency valuations, there is no proof that it’s helped spur consumer spending, GDP growth or exports. In fact, China’s exports fell 25% over the last year while Japan was down 13%! Ouch!

Here at home, the Fed can claim that inflation is on track to hit 2% in the next year or so and can brag about low unemployment all it wants.

But those actually participating in the labor force have shrunk to levels not seen since the 1970s. The majority of the jobs growth has been in low-paying jobs, and wage growth has been non-existent.

Another important measure of our economic health is the manufacturing sector. The Institute for Supply Management’s (ISM) Manufacturing Index read below 50 for five straight months. That means an overall decline in orders, exports, employment and a lack in confidence in the business outlook. That’s deflation, folks.

Just like elsewhere in the world, there is no proof that central bank monetary policy actually works. It hasn’t helped to turn the tide in Japan, Europe, China or here at home. So why do central bankers keep doing something that they must know doesn’t work?

QE, bond buying, asset purchases, zero interest rates, negative interest rates, reserve selling, currency selling – all it achieves is to temporarily move some asset prices and currency valuations. But it has not spurred economic activity, employment, wage growth or even inflation.

Central banks are fighting losing battles. From aging and declining populations in Japan and elsewhere, to business cycles and bubbles, they’re dealing with forces beyond their control.

We are near the end though. Monetary policy tools have less and less impact. Central banks are running out of bonds to buy, interest rates can’t go too far below zero and outright currency manipulation will eventually lead to trade wars.

When central banks have shot their last policy bullets, maybe business will begin to normalize. Eventually, economies and wages will grow and lead consumers to spend, and we’ll reach a normal business cycle.

In the meantime, expect there to be plenty of market volatility, which means there will be plenty of opportunity to make money! Overreaction in long-term Treasury bond prices is one way Treasury Profits Accelerator readers profit. Click here to learn more about this system.

Lance Gaitan

Editor, Treasury Profits Accelerator

Recently the Bureau of Labor Statistics (BLS) released

Recently the Bureau of Labor Statistics (BLS) released  I follow income stocks pretty religiously, though I’ll admit it’s been a while since I’ve looked at

I follow income stocks pretty religiously, though I’ll admit it’s been a while since I’ve looked at