Harry S. Dent Jr.'s Blog, page 109

June 10, 2016

The Odds of A Yellen Rate Hike

I love Las Vegas! While I enjoy playing cards, I don’t really like throwing money away gambling on slots, rolling the dice, or even spinning a roulette wheel.

I love Las Vegas! While I enjoy playing cards, I don’t really like throwing money away gambling on slots, rolling the dice, or even spinning a roulette wheel.

Blackjack is fun, but casinos have cut the odds too deeply in their favor with multiple decks of cards and automatic shuffling machines. That’s why, when I’m visiting Vegas, you’ll find me at the poker table.

Odds makers look at known variables to calculate the probability of a winning hand. I analyze my cards, the other players at the table, and determine whether to bet on a particular hand… or whether I can bluff the other players. Poker is a game of skill, but some luck pulling cards will increase the odds of winning.

Courtesy: Creative Commons

Investors are surely interested in what the Fed will do and how Fed actions could affect investment returns. So, investors are the odds makers and their investments are their bets.

The market is always handicapping the probability of future Fed action. The odds change as the data changes.

Fed Chair Janet Yellen spoke earlier this week and gave us her final update before the Fed meets next week. Thankfully, there is a media blackout and we won’t hear from her or any other Fed members until after the fact next Wednesday!

The Fed is most concerned with employment and inflation because of their congressional dual mandate. They are concerned with wage growth along with employment, since it directly impacts consumer spending and spending is closely tied to inflation.

Last month, jobs created were a disappointment, but wages grew faster than expected. This jobs number was a huge disappointment, growing jobs by a measly 38,000 on the expectation of 158,000.

The rate of unemployment dropped to 4.7% because nearly a half million people are no longer considered technically “unemployed.” In order to be considered unemployed, you have to be out of work but also actively seeking it. So if you stop looking for a job… you’re no longer unemployed.

The bright spot of the report was that wages grew 0.2% as expected. The unemployment rate is falling and wages are rising, but new job creation is definitely slowing. In other words, employment is still a mixed bag for the Fed.

Janet Yellen cautioned that the weak jobs report was concerning, but maybe an outlier and that the wage growth was promising. So for now, the positives outweigh the negatives.

April’s Personal Income and Outlays data was pretty good. Personal income rose 0.4% as expected and consumer spending rose 1.0%, which surpassed expectations.

The Fed’s most important gauge of inflation also moved higher as expected, with the core PCE price index up 0.2% on the month and 1.6% for the year.

Overall, the Fed should be pleased despite the fact that its 2.0% target has not yet been met. Yellen says she’s confident we’ll reach her 2.0% target within “the next couple years.”

April retail sales were reported up 1.3% and, excluding autos, they were up 0.6%. Both figures were much stronger than expected. Again, Yellen stressed the positive here.

I’ve mentioned numerous times how vital new home sales are to the economy because of the multiplier effect it has with sales and employment in related sectors like appliances, furniture, etc.

April new home sales blazed higher by 16.6% and the median price was up 7.8% to $321,000! Janet Yellen underscored how that has helped individual consumer wealth, at least for those who own homes.

Manufacturing has been a weak component of our economy for months and weak energy prices haven’t helped. Earlier this week, May Institute for Supply Management’s (ISM) Manufacturing Index was a little stronger than expected, which maybe gives the Fed a little hope. Yellen didn’t specifically mention manufacturing but did mention persistently disappointing productivity output.

Courtesy: Creative Commons

April construction spending was off by 1.8% and was the weakest in nearly two years. Residential construction was up, mirroring strong new home sales, but manufacturing construction spending was off by 10% and the weakest component.

So in the last month or so, the data has been improving, with the exception of job creation. The first quarter of the year has been a stinker for corporate earnings, and GDP was only up 0.8%.

The Fed Chair also mentioned the weak GDP, but since the quarter-to-quarter figures can be quite volatile, she seemed to dismiss it as another outlier.

After all of the Fed fist-pounding insistence of a possible rate hike over the last couple weeks, the jobs report – and then Chair Yellen herself – put a damper on those expectations.

According to Bloomberg, the odds of a rate hike in June moved from 2% to 0%! The odds of a rate hike by December, however, is at about 50%.

So for now, don’t bet on a rate hike any time soon!

Whatever the Fed does or doesn’t do, doesn’t really matter. Overreaction to what they might do affects prices and yields in long-term Treasury bonds and is one way Treasury Profit Accelerator subscriber’s profit.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post The Odds of A Yellen Rate Hike appeared first on Economy and Markets.

June 9, 2016

7 Startling Reasons Why ‘The Donald’ May Become President Trump

By Harry S. Dent Jr., Senior Editor, Economy & Markets

By Harry S. Dent Jr., Senior Editor, Economy & Markets

November looks to provide U.S. voters with the two most polarizing and hated candidates for presidency we’ve ever seen.

Donald Trump and Hillary Clinton are approaching this year’s election with the worst nominee approval ratings for either party since 1992!

These ratings are SO unfavorable that we have to question what’s driving the popularity of a candidate like Donald Trump. What thrusts a man like that to the forefront of the Republican Party?

Simple… we, the people.

We’re witnessing a voter-revolt against the rich and the establishment.

The voters will be heard because they’re angry and want change!

With the deep-rooted dissatisfaction that’s spread among a large portion of our country’s middle class and the rising economic turmoil, Trump’s shot at the oval office suddenly looks realistic.

American workers are sick of losing their jobs to other countries and watching the few remaining U.S. jobs get snatched up by low-wage immigrants.

The vanishing middle class continues to lose ground. This makes outspoken Donald Trump a welcome advocate… and a very viable presidential candidate.

While the most current Pivit polls point to Hillary winning the presidency, this revolt will charge on, meaning Trump will continue to pose a legitimate threat… and his stock is only on the rise.

Our latest infographic below shows why Trump may be America’s contender…

Harry

Follow me on Twitter @harrydentjr

Infographic created by: Danny Sherbun, Dent Research

June 8, 2016

Dividends: Do Your Investments Know Who the Real Boss Is?

I like getting paid in cold, hard cash. And frankly, who doesn’t?

I like getting paid in cold, hard cash. And frankly, who doesn’t?

But stock dividends are more than just a quarterly paycheck. They are a way of doing things. I would go so far as to argue that they are a philosophy of life (or at least of business).

They are a way of correctly conducting business for a healthy company. A sound business philosophy begins with dividends…

That might sound a little kooky at first, but hear me out.

In the Wolf of Wall Street, Leonardo DiCaprio playing Jordan Belfort says that money does more than just buy you a better life; it also makes you a better person.

OK, so that’s debatable.

But I can assure you those dividend payments, that extra money, definitely makes for a better company.

This is why:

1. Dividends prove who the real boss actually is. It is important to remember that the bespoke CEO running the company is not the owner. He, or she, is just an employee, no different from a common assembly-line worker… aside from that obscenely engorged paycheck. We, the shareholders, own the company. Management lets us know they understand and respect this by regularly paying us, and by raising the quarterly dividend.

2. Dividends kill needless empire building. Listen, corporate CEOs aren’t any different from politicians. At the end of day, they’re spending other people’s cash on often wasteful projects that add zero value. Because growth – any growth – offers more power and control.

A regular dividend forces discipline on management. If half-corporate profits pay out as dividends, remaining cash will fall to growth projects chosen much more selectively. CEOs will have to focus on the most profitable and worthwhile and, by necessity, pass on the marginal ones.

3. Dividends foster more honest financial reporting. At one point or another, many (if not most) companies will… ahem… perhaps, be a little less than honest in their financial reporting.Outright fraud is rare, but accounting provisions allow for a decent bit of wiggle room in how revenues and profits hit the bottom line. Even professionals have a hard time figuring out what a company’s true financial position is if the numbers are fuzzy enough.

Incidentally, our resident forensic accountant John Del Vecchio has an entire trading service dedicated to uncovering accounting shenanigans. John lays out step-by-step how investors are getting taken for a ride while “blue chip” companies hand out multi-million dollar bonuses to executives, make foolish and ultimately worthless acquisitions and spend lavishly on expensive perks.

Well, while dodgy accounting can obfuscate revenues and profits, it’s a far-sight harder to fudge the numbers when it comes to cold, hard cash.

For a company to pay a dividend, it has to have the cash in the bank. So, while paying a good dividend is no guarantee a company isn’t being over-aggressive with its accounting, it definitely acts as an additional check/balance.

4. Share buybacks – the main alternative to cash dividends – never seem to work out as planned. Companies always buy their largest share repurchases when times are good, they’re flush with cash, and their stock is sitting near new highs.

But when the economy hits a rough patch, sales slow, and the stock price falls… the buybacks dry right up. And another (frankly insidious) motivation for buybacks is to “mop up” share dilution from executive stock options and employee stock purchase plans. The net effect is that a company buys their shares high and sells them back to employees and insiders low.

Call me crazy, but I thought the whole idea of investing was to buy low and sell high, not the other way around. A better and more consistent use of cash would be the payment of a cash dividend.

5. And finally, we get to stock returns. I’m not particularly excited about the stock market at today’s prices. Based on the cyclically adjusted price/earnings ratio, the S&P 500 will deliver annual returns of virtually zero over the next decade. But if you’re getting a dividend check (or two…) every quarter, you’ll still realize a respectable return, even if the market goes nowhere. And that return is real, in cold hard cash, and not ephemeral like paper capital gains.

Hey, not every great company pays a dividend. And younger companies struggling to raise capital to expand have no business paying out precious cash as a dividend, not when it might need to keep the lights on next month.

Seriously… for the bulk of your stock portfolio – the core positions that really make up the heart of your nest egg – look for companies that have a long history of paying and raising their dividends.

Charles Sizemore

Editor, Dent 401K Advisor

June 7, 2016

This $250 Million Condo Is a Sign Manhattan’s Real Estate Bubble Is Ready to Pop!

I’ve been doing a lot of traveling lately. Our lease ran up at our home in Tampa many weeks ago, and my wife and I have been staying at several of our favorite spots up and down the east coast.

I’ve been doing a lot of traveling lately. Our lease ran up at our home in Tampa many weeks ago, and my wife and I have been staying at several of our favorite spots up and down the east coast.

We’re in San Juan now, but last month I got a look at this new “billionaire’s row” that’s popped up on the south side of Central Park in New York.

Billionaire’s row is as ritzy and swanky as you can get. It’s right near the best shopping and restaurants, and you have a view of the entire park to the north from inside these buildings.

The skinny towers that line West 57th Street are altering Manhattan’s skyline. They’re far higher than any of the surrounding buildings, as new technology has allowed for these slender structures with small footprints to reach farther and farther into the sky.

Half a dozen are planned through the end of the decade, with the tallest at Central Park Tower set for 1,550 feet. That’ll make it the tallest residential building in the western hemisphere.

I was just flying a small plane over the Caribbean at that altitude, and that’s high.

I wrote about this back in February, but how can anyone not see the clear and obvious sign that this is a bubble?

And forget about Manhattan for a second – this bubble is reaching all over the globe, as Saudi Arabia and China are competing to see whose cloud-piercing tower can earn the title of “world’s tallest.”

A few years ago the story was about an 8,000 square-foot condo in New York that sold for $88 million – twice what the owner paid for it two years earlier.

Then in 2014, Manhattan first broke the $100 million mark when a condo sold just over that at the new 90-story One57 building, also on billionaire’s row.

But as they say, you ain’t seen nothing yet…

I just saw an article on CBS saying the penthouse at 220 Central Park South – a short walk away from the site for Central Park Tower – is under application to go for $250 million… the highest listing ever. The condo fees will come in at about $520,000 a year, with $675,000 in taxes.

And this isn’t just any old penthouse. Over the past few years an 8,000-10,000 square-foot penthouse might get listed for $100 million.

The one at 220 Central Park South pulled out all the stops.

At 23,000 square feet, it’s a virtual castle in the sky. It spans four floors with 16 bedrooms, 17 bathrooms and five balconies. With a $250 million price tag, that’s almost $11,000 a square foot!

In the first bubble that peaked in 2007, a very high-end apartment ran $2,000-plus per square foot.

In this second bubble, these new, super upscale condos broke $5,000-plus, easy.

Now, they’re heading toward $10,000-plus!

People can say: “So what, let the billionaires play.” But the high-end brings the broader market up with it. It’s gotten so out of hand that a typical, 1,350 square-foot condo in Manhattan now costs $2 million!

Your average one-bedroom there rents for $3,000 a month and has 750 square feet. The typical studio at 550 square feet costs $2,300. That’s insanity!

My wife has a friend that rents an 800 square-foot apartment for $5,000 a month! How many can afford to rent at that level!?

I saw a 1,600 square-foot apartment several blocks to the east side of Central Park that would rent for $12,000 a month if it weren’t for rent controls. That’s $7.5 per square foot per month. And it’s not even a scenic area.

In contrast, I’m leasing an ocean-front condo in San Juan in the hip Condado area for just $1.8 per square foot. It has a glorious view with quick access to all the great restaurants, stores and everything – and is very modern to boot.

The same condo in South Beach would cost me four times what I’m paying!

The question is – how much longer can this last?

Not long, as I see it.

I’d say this $250 million listing signals a top much sooner than later. Pretty much the only people buying these super expensive listings are foreigners trying to park large sums of cash outside their home countries.

But many of them are running into problems. Many currencies are falling versus the dollar due to falling oil prices, GDP growth and rising inflation.

The Russian ruble has fallen to record lows against the dollar earlier this year. An overpriced New York condo now costs twice as much to them.

Ditto for Brazil and most Middle Eastern countries! Brazil’s inflation rate is some 9.28%!

And at some point the Chinese government is going to clamp down on the most affluent laundering their money out of the country to avert the cash limits of $50,000 a year.

So yes, developers always overbuild.

But just like any Ponzi scheme or bubble, those who come in last have the most to lose. And this high-end, global bubble tops anything we have seen in modern history.

Remember: the bigger the bubble, the bigger the burst. Those poor billionaires won’t know what hit them.

Harry

Follow me on Twitter @harrydentjr

June 6, 2016

The Lone Star State Is Taking on the Entire Financial System

200 men against 1,500 enemy troops.

200 men against 1,500 enemy troops.

They were never going to win. They fought anyway. Everyone died. It’s a story that most Americans are vaguely aware of, but the tale of the Alamo is seared into the heart of every Texan.

In losing the battle in such heroic fashion, the defenders rallied others to the cause, helping the Tejanos defeat the Mexican army in 1836. Like that, the country of Texas was born. Nine years later, the young nation joined the United States, and became the only state to join the union by treaty.

These few facts provide a sense of how many Texans (including my wife) view the world.

Defend the home. Defend the community. Stick together.

As I’ve noted many times, I rarely see Floridians wearing t-shirts with the state flag, but every Texan I’ve ever met has a Texas flag t-shirt in his drawer. They want everyone to know where they come from.

Texans are also very welcoming… unless you try to impose new rules or views on them.

If people move to Texas and find something they don’t like, that’s fine. They’re free to leave. Even though they love their country, Texans fiercely hold on to their independence, both personally and as a state.

This goes a long way in explaining their latest endeavor – building their own gold depository.

The University of Texas endowment is worth $24 billion, and is run by the University of Texas Investment Management Co (UTIMCO). During the financial crisis, UTIMCO built a huge gold position, eventually amassing about $1 billion.

There are lots of ways to own gold, but most of them involve nothing more than a claim on a piece of paper. Apparently the UTIMCO officials weren’t comfortable with that arrangement. So, they did something unusual.

They took delivery of their gold. All 6,643 ounces of it.

The problem with delivering gold is that you have to find a place to store it. Putting a few ounces in your sock drawer, or holding a dozen or so ounces in a safe deposit box, is all well and good. But where do you put over 6,000 one-ounce bars?

Where everyone else does: in New York.

Or not.

That idea didn’t sit well with the Texans. The point of physical gold is to set it aside for any problems that might arise in a financial crisis. Having the actual metal on hand establishes clear ownership. Having it sort of on hand, 2,000 miles away, controlled by a bunch of bankers who caused the financial crisis in the first place, just seemed wrong.

So they did what anyone would do. They set about building their own gold depository.

If things go well, the physical location could be up and running within a year. The plan is to open up the depository to all Texans, not just the University investment fund. And it won’t be just a storage facility. The state legislature authorized a bullion depository that can receive and send fund transfers.

Suddenly, the Texas Bullion Depository looks a lot like a bank, with deposits backed by gold, which takes their independent streak to a whole new level. Apparently they aren’t just mad about paying banks in New York to store their gold. They’re mad at the whole darn system!

If Texas succeeds in setting up a metals-based bank, they will create one of the highest-profile alternatives to the traditional, fiat money banking system that we use today.

Yes, Bitcoin is once again riding high. But the digital money system suffers from one of the same weaknesses that plagues fiat cash – at the end of the day, there’s nothing behind it.

But Bitcoin and the Texas Bullion Depository do address one of the biggest problems in our current system. It’s open to manipulation by the government and central bank any time they feel like tinkering with it.

Government bureaucrats sitting in Washington (and areas across the country at regional Fed banks) can decide to take value from our hard-earned dollars and savings whenever they deem it appropriate.

When it comes to the Fed, we have absolutely zero control. We can’t fire them or vote them out. We work for our money, risk our capital on investments, pay our taxes, and yet are still beholden to a small group of people that can impair our personal wealth in the name of a greater good.

Some people like this. They believe the government should control the wealth of the country, pulling different levers to promote growth, inflation, or whatever else they think could be beneficial to the nation as a whole.

This implies that government officials know better than individuals how to use their funds, and that, if we would simply give the centralized government more control, they could solve our economic problems.

I don’t think many of these people are from Texas.

In keeping with their independent nature, Texans prefer a small government and localized control, allowing people to keep as much of what they earn as possible, making their own decisions about their wealth.

I think I’ve heard that before. It sounds a lot like the arguments made by another group who fought for their independence and drew up a document in Philadelphia to that end.

I hope the Texas Bullion Depository succeeds. In addition to being a great example of Texas, I think it’s a fine example of being American.

Rodney

Follow me on Twitter @RJHSDent

June 3, 2016

Valeant Pharmaceuticals: A Case Study in Ruining Your Business

For most of its existence, Valeant Pharmaceuticals International, Inc. (NYSE: VRX) has been anything but a household name.

For most of its existence, Valeant Pharmaceuticals International, Inc. (NYSE: VRX) has been anything but a household name.

But, add in a billionaire hedge fund manager, short sellers sniffing around like sharks who smell blood in the water, a management team under assault, and public concerns about drug pricing… and Valeant’s stock has had more drama recently than an episode of Real Housewives.

The great thing about the stock market is that there are more than 8,000 stocks to pick from. You can literally avoid thousands of stocks, and still have your pick of the litter. So when a stock like Valeant captures the public’s attention – and this was before it fell some 80-90% – it’s probably best to avoid it.

Just ask yourself this: Do you really need to own a stock with more questions than answers?

It came down to more than just a popularity contest, however. There were many other clues that Valeant’s stock was about to burst. Whether or not it was worth shorting is another story for another time.

Fact of the matter: there is a lot to learn from Valeant’s fall from glory.

I’ll just focus on one aspect of the stock’s recent demise, which I think makes for a great case study. It revolves around revenue, and specifically revenue recognition.

In my newsletter, Forensic Investor, we focus intently on the quality of revenue that companies report. They have more ways to manipulate revenue that you can possibly imagine.

And if they do, it’s usually because something went wrong. The quality of revenue has likely deteriorated.

That’s a huge concern for a business. Revenue is the key to financial performance. Everything flows down from the top line. Nowadays, companies will do whatever they can to sweep that stuff under the rug.

In an extreme case, if a company recorded fictitious revenue, then the entire financial model would be bogus.

At that point, who cares what the earnings per share are?

Valeant most certainly had concerns surrounding its revenue recognition. There was more than one red flag in this regard.

The easiest one to spot was the fact that it excluded Bausch & Lomb’s (B&L) generics revenue from its calculation of organic growth.

Valeant acquired the company for $8.7 billion in 2013 to get into the eye-health-product space. In 2014, Bausch & Lomb contributed over 40% of Valeant’s revenue. Then in 2015, they stopped disclosing the company’s contribution.

That’s a little weird. Why should you take any comfort knowing a company is providing less information?

But then the company went so far as to exclude Bausch & Lomb’s generics business from its calculation of organic growth. Turns out, its robust growth in 2014 became a major headwind in 2015.

By June 2015, the company was reporting organic growth for Bausch & Lomb (again, a big piece of its overall revenue) of 8%.

However, had they included the generics revenue in the calculation, the growth rate would have dropped to negative 1%.

With a single stroke of a pen, Valeant was able to make negative growth look like high single-digit growth.

They were able to make their organic growth rates seem better than they were.

That alone is enough to take a pass on a stock. It shouldn’t matter too much what other issues surrounded the company.

In the annals of red flags, excluding revenue from a certain part of your business ranks way at the top!

And remember, this is just one factor.

The company also had controversy surrounding its acquisition of Salix Pharmaceuticals… the departure of its CFO before the stock price imploded… inventory concerns… along with other revenue recognition changes.

So, the next time a company in the news captures your attention, and the Masters of the Universe are in a tug of war over the stock, do a little homework. Make sure the quality of earnings they’re reporting are true and sustainable.

If there’s even a remote question about the quality of the financials, take a pass. After all, there are thousands of other opportunities in front of you.

John Del Vecchio

Editor, Forensic Investor

June 2, 2016

Stock-Market Insurance That Actually Positions You For PROFITS

No one I know enjoys buying insurance.

No one I know enjoys buying insurance.

Sure, you get the “peace of mind” you were sold when you bought the policy. But beyond that, owning insurance is a pretty thankless endeavor. You watch the auto-debits hit your bank account each and every month… and for what!?

“I haven’t had a car accident in 10 years!” you think.

“I’m healthy – I passed my last health check with flying colors!”

Who needs all this stinking insurance, anyway!?

Worst of all, most insurance policies offer NOTHING in the way of potential “reward.”

At best, they’ll reimburse you if you wreck your car… or take care of your family if you pass away prematurely… but for most insurance policies, you’re not looking to make a profit.

Stock-market insurance, though, is a much better deal.

When you buy stock-market insurance (as I’ll show you how to do in a minute!), you face three potential outcomes. In order from worst to best:

You don’t end up needing it… and you waste your purchase money.

Your insurance policy “pays out”… but only enough to make you whole, by covering the losses in your stock portfolio.

Or, you PROFIT from your policy!

Only with stock-market insurance is scenario #3 even an option! Car and life insurance policies can’t hold a candle to that.

And last year… it’s the exact scenario that played out for my Cycle 9 Alert subscribers.

I recommended buying a specific insurance policy on May 26. And by September 1, I told them to “cash out” – locking in a net profit of 165%. That means for every $10,000 worth of insurance they purchased, they could’ve walked away with $26,500.

Mind you, Cycle 9 Alert subscribers were already having a profitable year by time the summer season rolled around, when many investors choose to “sell in May and go away.” But it’s my job to make sure readers protect those gains… and keep them positioned for windfall profits.

Turns out, that insurance policy boosted our profits by more than 40% last year!

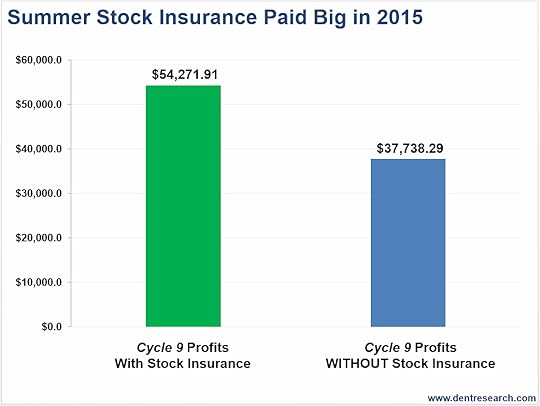

Here’s a simple chart that shows the profits Cycle 9 Alert subscribers could have accumulated in 2015 without the insurance policy ($37,700)… and with the insurance policy ($54,200). All figures assuming a $10,000 investment per position.

As you can see, that stock-market insurance policy was certainly worth buying – it paid out big last year!

Of course, it doesn’t always work out this nicely. But more times than not… it does.

You see, most people that buy insurance hold it for a full year or longer.

That might make sense for an auto policy – how can you predict which month you’re going to need it? You can’t!

But the stock market is far more predictable. I know because I’ve done the research…

For one, volatility tends to rear its ugly head during the summer months. My statistical analysis shows that volatility spikes of 30% or greater occur at a far greater frequency in June, July and August… than in any other month.

And when volatility does decide to make an appearance, the magnitude of volatility spikes are also much greater in June, July and August.

What this research is getting at is this…

It doesn’t necessarily pay to hold stock-market insurance the full year-round. For most months of the year, the reward-to-cost ratio isn’t all that favorable.

But buying stock market insurance for June, July and August is a much wiser move.

There’s no guarantee you’ll need it each and every year. But in the long run, it’s a prudent, cost-effective way to protect your stock portfolio through the rocky summer months. And you might even position yourself for a windfall profit!

I call this “targeted protection.”

You’re not paying for protection all 12 months of the year… just the three or so months that, historically, have warranted an added layer of safety.

One way to buy this stock-market insurance is by purchasing shares of the iPath S&P 500 Short-Term VIX ETF (ARCX: VXX). This is an ETF you can purchase in your regular brokerage account. It tracks the volatility index (aka, the “VIX”), which tends to shoot higher when stocks are falling.

Now, a word of warning: this vehicle is not without its drawbacks. And I do NOT recommend holding it for long periods.

But it does give you an easy way to buy stock-market protection for narrow windows of time.

This isn’t the exact stock-market insurance policy I recommended to Cycle 9 Alert readers last May (but it’s very similar).

And in full disclosure, I haven’t issued this year’s “insurance” recommendation just yet.

Those details are only available to Cycle 9 Alert members.

Still, if you’re heading into the summer with even an ounce of concern over your investment portfolio, I highly recommend “insuring” yourself for a potentially rocky road ahead.

Adam O’Dell, CMT

Chief Investment Strategist, Dent Research

June 1, 2016

Stuck in the Doldrums: The Markets Will Not Remain This Calm!

It’s only June 1, and it feels like the dog days of summer have arrived here in Florida. School is mostly out, humidity’s soaring, and we’ve already seen highs in the 90’s…

It’s only June 1, and it feels like the dog days of summer have arrived here in Florida. School is mostly out, humidity’s soaring, and we’ve already seen highs in the 90’s…

Even the markets seem to be treading water in ultra-calm seas. For instance, we didn’t really see the “sell in May and go away” phenomenon this year. Instead, the markets seem stagnant – stuck in the doldrums.

The “doldrums” is a maritime expression referring to a band of low-pressure that wraps around the equator and keeps the prevailing winds calm. The doldrums are also famous for periods of disappearing wind, leaving sailors stranded for days or weeks at a time on the high seas.

Can you imagine that? Stuck out there, watching your supplies dwindle and your skin blister… wondering if the winds will ever blow again…

Because that’s sure what it feels like to me in the markets rights now. We’ve seen a few periods like this in the past, but it has really been the case for the Treasury market this year.

Last week, several Fed officials let slip that a rate hike is still on the table later this month. That revelation barely nudged the long-term Treasury bond up from a 2.58% yield to 2.66%. Not a huge move.

Meanwhile, the Dow is trading just under 18,000 and the S&P 500 actually crossed back over the 2,100 level yesterday morning. Both are near all-time highs again.

Lately, it feels like the winds have deserted us!

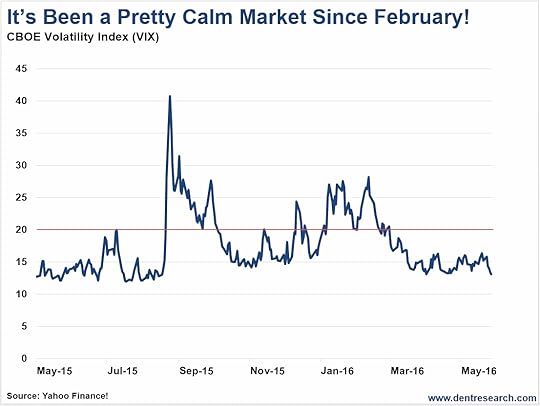

Just look at the CBOE Volatility Index, or VIX.

The VIX is a measure of volatility for stocks. Historically, it trades near a level of 20 during normal times.

Well, we’ve been well below that level for most of the past eight months, or so!

The VIX spiked above 40 during the August selloff, got back above 20 a couple times leading up to the correction earlier this year, then backed off.

Basically, the market seems to be holding its breath, waiting to see what the Fed does next.

The Fed desperately wants to get back to a more normal interest rate policy. It spent years trying to “fix” the economy with stimulation like QE, ZIRP and other measures, and now wants to ease back.

The Fed also knows that a wrong move can create chaos in the markets and that’s why doing anything differently, like raising rates, makes everyone nervous.

And the Fed understands its policy decisions ripple across the global markets, since the dollar affects, well, just about everything.

Generally speaking, a rate hike will likely strengthen the U.S. dollar. That makes goods and services from the U.S. more expensive for other countries and hurts U.S. corporate profits. It also has a major impact on all foreign currencies pegged to the dollar.

So, any attempts by the Fed to strengthen or weaken the dollar has an effect on those foreign countries. About 66 countries either peg their currency to the dollar or use it for legal tender!

China pegs its currency to the dollar because it exports a lot of goods here and gets paid in dollars. China has made headlines recently for unfairly weakening the yuan against the dollar. Basically, trying to gain an advantage in their U.S. exports.

Oil-exporting countries like Saudi Arabia have to peg to the dollar because their primary export is oil. Oil sells in dollars, so “oil” countries hold large amounts of our cash that they often invest in U.S. Treasury bonds.

Japan doesn’t peg to the dollar, but they also export a lot to the U.S. Japan’s central bank is also known for doing all it can to weaken the yen, in order to gain advantage here.

You get the picture. Since the U.S. dollar is the world’s reserve currency, there’s a lot of pressure on the Fed.

Fed officials know they could trigger a worldwide financial meltdown with the wrong move, and that’s why they’ve been so reluctant to act, so far.

Their credibility is now in question for not raising rates when some think they should, but the stakes are high, and the Fed knows it!

Lance Gaitan

May 31, 2016

The Dumb Money’s at It Again: Always the Last Sad Sack to the Party…

New home sales just went up a staggering 16.6% in April.

New home sales just went up a staggering 16.6% in April.

619,000 new homes were sold – the most since early 2008 just before the worst of the housing meltdown, and the highest rate of growth in 24 years.

So is this a sign that the economy is back on track?

Don’t count on it.

Home sales, like jobs, is a lagging indicator, not a leading one. It’s a sign of where we’ve been, not where we’re going. So this isn’t a big surprise to us.

In fact, this is just like stock indicators near a peak.

The dumb money is finally pouring in while the smart money is exiting. Except this time, it’s just in real estate.

Millennials have held back on buying homes for a variety of economic reasons since 2008. Tighter lending standards, for one. The concern that home prices could fall again, for another. And I’m sure $1.2 trillion dollars in student debt, falling real wages and higher unemployment for them (since more baby boomers are staying in the workforce longer) have something to do with it, as well.

So even while more millennials cross that 28 to 33 age timeframe when they’d normally buy a house… more and more of them have been opting out, choosing to stay at home with their parents, or rent. They’ve put off the biggest financial decision of their lives because they all know the worst could happen.

But, home prices have continued rising, and the inventory of homes for sale has been falling. Hence, new home sales keep advancing.

So last month, the most people in eight years decided that if they’re going to buy a new home, now’s the time to do it.

But how much longer can this trend continue?

Even with last month’s boost, new home sales aren’t anywhere close to where they were at the housing peak in 2005 when a million or more new homes were selling every month.

We’re not even close to where we were before the bubble started in 2000!

Just look at the reality of it in this chart, which adjusts new home sales for rising population growth:

The baby boomers carried us to new highs in the middle of last decade. After that, real estate suffered the most drastic fall in U.S. history.

The baby boomers carried us to new highs in the middle of last decade. After that, real estate suffered the most drastic fall in U.S. history.

The rise in new home sales since 2012 is nothing compared to that!

This one-month, 16.6% rise hardly even shows up!

A “dead cat bounce” is trader terminology for a very modest bounce that follows a substantial crash… meaning there’s more to come.

Do the bounces following major crashes in the early 1980s and early 1990s forward look like this one? Not hardly!

I warned of the bubble peak in housing prices in late 2005 before the bubble burst in early 2006.

And I’m warning now that the millennial generation will not carry the housing market to new highs the way the boomers did.

It’s not just the skittishness of these fragile new buyers. Their demand will simply not be enough to offset the retiring baby boomers who eventually die and become sellers by default.

And that’s why I’m predicting net housing demand will fall – even turning negative over the next two decades – especially starting later this year.

This critical demographic indicator shows it won’t turn positive again until after the year 2039 – 23 years from now. The same indicator explains why the echo boom in Japan never caused a bounce in housing, even 25 years after its all-time bubble highs and 60% crash.

What we’re seeing today is simply the “dumb money,” particularly the everyday household from the millennials, finally buying after holding back for years, now that they feel the risk of another housing downturn is waning.

Meanwhile, the “smart money” is retreating from the highest-end real estate in bubble cities like London, Manhattan and Miami – with more of them to follow.

The smart money is selling, like the richest family in China, and the everyday household is finally buying…

What does that tell you?

Harry

May 30, 2016

The TSA Totally Screwed This Up

My wife hates to fly. It’s not the planes that bother her, although she’s no fan of turbulence. It’s the security process. There’s something about passing through a low-level X-ray machine that can see through your clothes that gives her the willies. Who can blame her?

My wife hates to fly. It’s not the planes that bother her, although she’s no fan of turbulence. It’s the security process. There’s something about passing through a low-level X-ray machine that can see through your clothes that gives her the willies. Who can blame her?

And then there’s the Transportation Security Agency (TSA) agents themselves. Why is it that six or seven seem to be just hanging out while three of them work one security machine, as 200 people wait in line?

Whatever the reason, expect it to get worse this summer, and it’s the TSA’s fault.

Last summer, more than 220 million people took to the skies. This year, airlines estimate more than 230 million people will take off (and land, hopefully).

With so many people in the air, you’d think the TSA would be beefing up its staff, but the opposite is true. Since 2011, the TSA actually cut its staff by more than 10%, which makes for even longer security lines at the airport.

To be fair, the TSA didn’t pare down just to make life difficult for us.

They cut their personnel at the same time they rolled out the TSA PreCheck program, or TSAPre for short, which allows pre-screened passengers to use a faster screening service. They thought the new program would make up for the difference in employees.

The program started in 2011 and currently has about 9.3 million registered users. Unfortunately, the TSA figured that the program would have 25 million users by now. Clearly, they underestimated how many people are willing to wait through long security lines.

But it’s not that people love to be agitated or miss flights, or that they don’t want to sign up for TSA Pre. The agency just did a poor job of setting up the application process.

To qualify for TSA Pre, you must make an appointment at a local TSA office, have a short interview, provide documentation (passport, etc.), pay $85, and then wait a few days for your Known Traveler Number (KTN) to show up.

Granted, those who fly once or twice a year won’t go through the hassle or see the value of paying the money. But those who fly even four or five times a year would save hours of hassle if they used TSA Pre.

The problem is, people still have to go out of their way to sign up.

Who wants to make an appointment to go to a government office to pay money? I’ll admit, I did it, but I travel more than most people, although not nearly as much as I used to. Still, I love TSA Pre. I finally convinced my wife to go through the motions. The actual interview took less than seven minutes. But it was still a hassle.

If the TSA really wanted more sign-ups, they’d put the solution near the point of pain. They could put a kiosk just inside the security gates of airports, and hang a big sign that reads: “Want to avoid these long security lines next time you fly? Sign up for TSA Pre RIGHT NOW.”

Imagine how many people would spend the hour ahead of their flight signing up!

Unfortunately, government employees still think like government employees. They don’t consider the end user, just the most efficient way for the bureaucracy to implement a program, no matter how idiotic the result.

For those that still haven’t signed up for TSA Pre, don’t worry, the TSA has another program to help you out.

The agency has its own app, called My TSA. Using the app, you can see crowd-sourced wait times, in real time, in security lines at various airports around the country.

Sounds awesome, right? You can check the app as you get your stuff together, making sure that you leave enough time to get through security.

Or at least, that’s the theory. The reality is, well, more governmental than that.

The app works exactly as you’d expect, except for one, small detail. Users can enter wait times in blocks, but only up to 31 minutes. There is no way to enter longer wait times.

That makes the app basically useless.

Wait times of less than 20 minutes are tolerable. 20 to 30 minutes are a hassle. But the times over 30 minutes are what we all need to know. Is it 35 minutes, or an hour and 35 minutes? It could be the difference between making a flight, or ruining your travel plans.

If you intend to fly this summer, do yourself a favor. Make the appointment, join TSA Pre. The government’s never going to get better, so you might as well use the system to make your life as easy as possible. Then you can go back to worrying about other things, like turbulence, and who’s going to sit next to you on the flight.

Rodney