Harry S. Dent Jr.'s Blog, page 105

July 28, 2016

HARRY DENT: Central Bankers are Driving Us All Into the Dirt

One of the major triggers I’ve been warning about is already happening, even before we understand and/or admit that we are in a recession. Zero Hedge just picked up on an article from Jeff Cox at CNBC.

Global corporate debt now sits at a record $51 trillion and is poised to hit $75 trillion by 2020 – just four years away. If interest rates rise and the economy slows, it will be very hard for companies to roll these bonds over – and then we get what S&P Global Ratings is calling “Crexit.”

The bond markets dry up for corporate lending, especially higher-yield junk bonds. This would set off a chain of corporate defaults and bankruptcies that would cause central banks to start to lose control of the economy, as they did in 2008 forward.

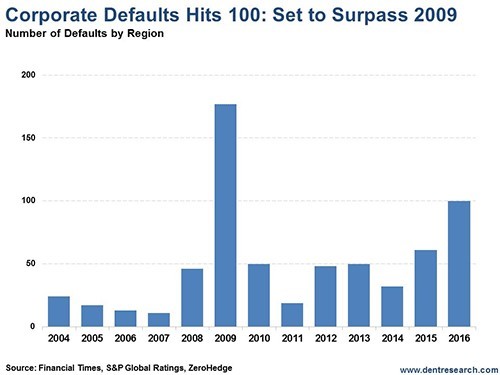

The simplest depiction of where we’re at comes from the chart below:

At the worst of the recession in 2009, we saw around 180 total corporate bond or loan defaults. As of the first half of 2016 alone, we just hit 100. That means 200+ by year-end… and we’re just at the beginning of the next financial crisis. Note that most of the 2009 defaults were in the U.S., as is the case again due to the energy “frackers.” But Europe has a bigger flurry coming this time.

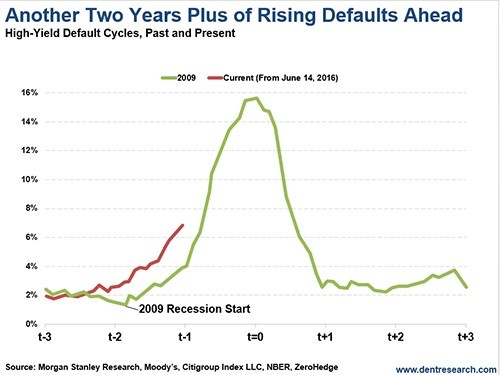

The next chart shows how that crisis is likely to progress:

We’re now nearing 5% default rates, as opposed to heights of 16% in 2009. Hence, we have a long way to go here – 300%+ or more, and I fully expect the next crisis to be much deeper than 2008/2009. After hitting $154 billion this year, we will see $100’s of billions of additional defaults in the years ahead.

S&P Global ratings consider a credit market correction inevitable; it’s just a matter of when.

So, how did this occur? It’s another product and cost of ZIRP and QE policies that appear to create something for nothing. Corporations lever up at such low rates and use that money to buy back stock and engineer mergers and acquisitions – all just re-arranging the pie, not growing it.

The entire fracking industry was a hugely bad investment in technologies that were not lower-cost, but higher. Only QE that pumped oil prices back up temporarily, and super-low-cost junk bond financing, made this industry viable. But no longer, with oil at sub $50 for years now… and many more to come, by my estimates.

When the economy slows and/or interest rates rise, to reflect default risks, then we get a negative spiral of more and more defaults. As I predicted, the (ex) frackers are leading this first round of defaults and we’ll see much more to come.

Bondholders and stockholders will lose, employees will lose, companies will disappear and we’ll face a deeper recession from not facing the last debt bubble… that’s the cost: you pathetic, douchebag, academic, never-had-sex-or-run-a-business central bankers!

And don’t even ask about pension funds’ and municipalities’ growing unfunded liabilities, with such low returns on their investments since 2008 and QE. To deal with unfunded pensions, some Chicago homeowners are seeing property tax increases of up to 300%… Holy crap Batman!

So, even homeowners lose with higher taxes and lower property values, as a result.

According to John Mauldin, states like Illinois, Connecticut, New Jersey, Kentucky and Massachusetts are just the first states that will face major defaults, as Puerto Rico is now.

Penalized by low-interest returns, investors will soon see corporate, municipal and even many sovereign bonds depreciate on top of that! Ditto even more for high-dividend stocks that are highly overvalued and that investors have also piled into during QE and ZIRP.

Harry

Follow me on Twitter @harrydentjr

P.S. Check out Part II of our infographic: 7 Reasons Why Donald Trump Could Be the Next U.S. President by clicking on the image below – Enjoy!

Hello, I'm Harry Dent Try Boom & Bust now and save 25%

Each month Rodney Johnson, Adam O’Dell and myself uncover the next profitable investment… based on a boom or a bust.

Wall Street is preparing you for the wrong investment season. They’re telling you to stuff your portfolio with things like Chinese oil… Russian gas… Brazilian copper… wheat, corn, sugar, silver… foreign currencies. Benefit with us where others fail.

Try Boom & Bust

More by Harry Dent

Our Money Velocity Sucks

July 13, 2016: Dr. Lacy Hunt has been featured more than any outside speaker at our IES conferences. Why? Because he’s…

Read More

INFOGRAPHIC: President Trump

July 20, 2016: Love him or hate him – those seem to be the two reactions to Republican nominee, Donald Trump…

Read More

Bigger Than Brexit!

July 19, 2016: The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets…

Read More

The post HARRY DENT: Central Bankers are Driving Us All Into the Dirt appeared first on Economy and Markets.

July 27, 2016

HON. DAVID WALKER: Hang In There Because Real US Debt-to-GDP is Terrifying

Managing Editor’s note: We’ve invited our Irrational Economic Summit keynote speaker, Senior Strategic Advisor for the public sector practice of PricewaterhouseCoopers (PwC), the Honorable David M. Walker, to write you today for insight on what he sees happening in today’s debt-laden economy.

Managing Editor’s note: We’ve invited our Irrational Economic Summit keynote speaker, Senior Strategic Advisor for the public sector practice of PricewaterhouseCoopers (PwC), the Honorable David M. Walker, to write you today for insight on what he sees happening in today’s debt-laden economy.

Mr. Walker brings an experienced perspective on the global economy, fostered through his position of guiding government transformations and making governments more economical, more efficient, more effective and more respected.

We are thrilled to have him speak at our October Irrational Economic Summit; be sure you don’t miss him.

By: Hon. David M. Walker, Senior Strategic Advisor, PwC

First, I want to thank all you Dent Research readers out there for taking the time to check in with us today. This is one of two posts I’ll be writing about geared toward the state of the economy, as we accumulate more and more national debt.

I know that Harry has already pointed out the United States holds about $19.4 trillion in outstanding debt, or about 104% of GDP. And though that number’s daily rise is a cause for concern, the U.S. government and most of our population is looking at the wrong number.

Nineteen-trillion-dollars-plus is just the tip of the iceberg. Looking at the consolidated financial statements of the U.S. government, we should add unfunded civilian and military pensions, retiree healthcare, environmental cleanup obligations and other traditional liabilities on top of that.

We also have to include some trillions in unfunded obligations for Social Security, about many trillions more in unfunded obligations for Medicare, and a range of other commitments and contingencies established through Generally Accepted Accounting Principles (GAAP) to total between $65 and $103 trillion depending on the time horizons you use… and counting.

________________________________________________

An Invitation to An Investor “Master Class”

Imagine an elite investor “Master Class” featuring some of the world’s top financial minds.

A faculty featuring former U.S. Comptroller General David Walker… Hoisington Investment Management Company VP Dr. Lacy Hunt… former Chief Economist for the Department of the Navy, Nayantara Hensel… internationally acclaimed economist Harry Dent… and many other financial luminaries… all there to show you how to protect and grow your wealth in the face of the coming economic storm.

It’s all happening Oct. 20-22 at the PGA National Resort in Palm Beach, Florida. Register now and save $500. Learn more here.

________________________________________________

With those figures and a current GDP of about $18.5 trillion, the U.S. currently maintains a burden ratio between 361% and 555%.

And so, what we have to focus on Friday from a fiscal perspective is not deficits, not debt, but debt as a percentage of the economy.

It’s too high now and it’s moving higher absent a change of course.

We need to get it down to a reasonable and sustainable level by around 2030 to 2035. And that means enacting pro-growth policies with fiscally responsible solutions.

It also means taking a candid look at healthcare and realizing that we cannot write a blank check for healthcare. We’re the only industrialized nation that does this, but it doesn’t make sense and it could bankrupt the country.

And you won’t have to take my word for it. It won’t matter that after 10 years as the United States Comptroller General, from 1998 to 2008, I’m as certain of this as I am that the sky is blue. Because we’ll see it eventually absent a change of course; it’s only a matter of when.

It’s clear that the Affordable Care Act (ACA) is not politically or economically sustainable in its present form. Already several Texas insurance companies, just for one example, are seeking premium hikes of up to 60%. Countless subsidies are falling away from the ACA and the initial “sticker shock” for many medical visits will quickly turn to more consumer debt, and more uninsured patients who’ll exacerbate our serious healthcare challenge.

Again, all of this is just the tip (on the tip) of the iceberg. But I believe that with pro-growth policy and fiscally responsible approaches, we can achieve fiscal sustainability by 2035. We need to do so, but it won’t be easy.

I’ll share details with you on this challenge, and how to address it, at the Irrational Economic Summit this October in Palm Beach, Florida.

Together with Dent Research, we’ll map out a few things and navigate a way forward together.

Trade wisely,

Hon. David M. Walker

ALSO: Click below to see why history could be favoring “The Donald”

Subscribe to Our Premium Monthly Newsletter

Will you be one of the millions of Americans devastated by the coming safe asset slaughter? As a subscriber to Boom & Bust, Harry Dent, Rodney Johnson and Adam O’Dell will make sure you’re not. In fact, they’ll help you profit from the chaos that lies ahead.

The post HON. DAVID WALKER: Hang In There Because Real US Debt-to-GDP is Terrifying appeared first on Economy and Markets.

July 26, 2016

Central Banks Might Just Crazy Enough for Helicopter Money

Central banks around the world have a common problem. They are failures. For the past eight years, central bankers worked tirelessly to generate economic activity. They pushed interest rates below zero and printed trillions of dollars.

And yet, the IMF recently cut its global growth forecast again.

Most economies are stuck in neutral while threats such as the debt crisis in Europe and deflation in Japan keep growing. Now central bankers are talking about a new tool – helicopter cash (free money distributed by a government agency). It won’t work either, but don’t expect that to stop the bankers from trying!

Milton Friedman:

“Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event, which will never be repeated.”

__________________________________________________________________________________

External Advertisement

Check Out the Threatening 4-Page Letter Our Affiliate Received on a Wednesday…

The letter was marked “PERSONAL AND CONFIDENTIAL.”

And was sent by one of the most powerful financial groups in America…

Why? Because of a secret they shared that allows Americans to collect anywhere from $400 – up to $4,700 per month… for life!

Check out the bizarre story here.

__________________________________________________________________________________

If sort-of free money drove economic growth and inflation, Japan would be on fire. In 1999, government officials created a plan to distribute $6 billion free to qualifying families and the elderly. Averaging about $170 in coupons, residents received coupons that they could spend at local establishments for goods and services, but not cash.

The program provided a brief economic bump, but quickly faded. The problem was that no one expected the free money to keep flowing. It was “once-and-done.”

We tried the same thing in the U.S.

In 2008, President Bush, working with a Democratic Congress, gave qualifying Americans a tax rebate capped at $600 per person, or $1,200 per household. The money flowed during the spring and early summer, and then the economy plummeted.

I’m not suggesting the small program in Japan, and certainly not the tiny tax rebate in the U.S., could have altered the course of economic history. The problems back then were simply too big to address with small amounts of cash distributed among millions of people. The same is true today.

Originally used by Friedman to show the effects of monetary policy on inflation and the costs of holding money, helicopter money is now discussed by economists as a serious alternative to monetary policy instruments such as quantitative easing.

The Japanese population is dying off. Companies keep older workers employed even when there is no work, which stifles upward mobility and kills productivity. European countries have a host of problems, including aging populations, rigid workforce rules, and banks loaded with non-performing loans.

The U.S. is in better shape than most, but we are in the worst economic season. The older generation, which has the money and the best jobs, wants to save for retirement. The younger generation wants to spend, but doesn’t have the cash.

A dose of free money will solve none of these issues. But that doesn’t mean such programs would not have an effect.

Taxpayer funds provided the kick in Japan in 1999 and the U.S. in 2008, so the cash programs implemented by the governments weren’t truly “helicopter money.” Today, the discussed programs would come from the central banks, either directly… or indirectly.

This small difference would have huge consequences, not because of the immediate effects, but because of how it would change perceptions.

Currently central banks still have a modicum of credibility, at least when it comes to maintaining the value of their currency. Their logic might be tortured, like in the Eurozone, but they’ve shied away from printing money simply to prop up governments or support populations.

This frayed but resilient thread keeps up the illusion that money remains scarce, and therefore has value. Once central bankers cut that thread, there’s no limitation on how far they can go in their efforts to drive economic change.

If a $20 billion plan in Japan, or $200 billion plan in the U.S. or Europe, doesn’t do the trick, what would the bankers do next? Admit that their logic was flawed and look for another way to address their problems, or double down… then triple down… then, well, you get the picture.

From around 2012 onward, some economists began advocating variants of helicopter drops, including ‘QE for the people’, and a ‘debt jubilee’ financed with the monetary base.

Citizens, investors, or anyone else tied to a currency subject to a helicopter-money program would instantly be fearful of serial cash printing and giveaways, and therefore long-term devaluation of their holdings.

The prudent move would be to exit the currency as quickly as possible. That might sound wonderful to a country like Japan, or even the U.S., where weaker currencies and inflation pressures would be welcome, but too much of anything is poisonous. There is no way to put the free-money genie back in the bottle. No one in their right mind would trust central bankers to self-regulate or admit failure.

In this sense, helicopter money is the nuclear option. It is without precedent in developed nations, has had disastrous effects in smaller economies when used to prop up governments, and there is no way to curb such programs once they begin.

So far, officials in Japan and elsewhere claim they aren’t seriously considering such moves. But that’s what they said about negative interest rates in years past. Let’s hope for our own sake that this time around they stick to their word.

Rodney

Follow me on Twitter @RJHSDent

Hello, I'm Rodney Johnson Try my Triple Play Strategy - risk free!

After 10 long years of work and thousands spent on research and development, I’m revealing what I consider the culmination of my career. I call it the Triple Play Strategy. It is, quite possibly, the only sensible way to safely profit in today’s “Economic Winter Season.”

Don’t believe me, see for yourself…

My Triple Play Strategy

More by Rodney Johnson

Even the Twinkie Had to Change

July 11, 2016: In 2004, Hostess Brands declared bankruptcy. At the time, Twinkies, Ho Hos, and Snoballs were suffering because of demographic…

Read More

The Fourth of July

July 4, 2016: I make a lot of mistakes. I choose the wrong lane in traffic jams. I pick the wrong lottery numbers And yes, I even go in the wrong direction…

Read More

Weirdness of Printing Money

June 28, 2016: I keep reading that the U.S. debt is out of control. That we’re spiraling toward a certain financial death, evidenced by the fact…

Read More

The post Central Banks Might Just Crazy Enough for Helicopter Money appeared first on Economy and Markets.

July 25, 2016

How to Beat Today’s BS Bond Yields

When you and I borrow for a car or a home, the bank we use to finance our purchase charges an interest rate that’s based on our credit history and our credit rating. This rating moves higher or lower based upon standards that speak to our ability to repay the loan.

Sovereign nation debts draw ratings based on a similar model, graded by rating agencies like S&P, Moody’s and Fitch.

Each of these agencies determine the health of a nation’s economy based on growth rates, exports, inflation, etc., as well as its level of outstanding debt, its ability to repay that debt, and its default history.

Party like it’s 1999

The sovereign ratings game is rigged from the start.

After considering all this, the agency will issue a rating from investment grade, AAA, to Baa3, or BBB- to in default (D).

But these rating agencies are neither timely nor very helpful to investors gauging their investment risk.

____________________________________________________________________________________

Fastest Profits You May Ever Make

I thought I’d seen everything in the world of investing — but I hadn’t come close. A colleague has just launched a new system that helps him pinpoint double- and triple-digit gain opportunities in four days on average, using the world’s most conservative investment! If you need cash now, you could get it in the next four days.

Go here for details.

_____________________________________________________________________________________

See, those rated pay for their rating, a system criticized since rating agencies gave top scores to mortgage-backed securities that lost heavily during the 2008 financial crisis, so it begins with a conflict of interest.

But, it’s interesting that so far in 2016, according to the Financial Times, there have been a record of downgrades to sovereign debt.

Some nations count on revenue from state-owned enterprises, like oil or other commodities, along with taxes. The fall of oil prices led to Russia’s debt default in 1998.

Fitch has downgraded the credit ratings on 14 nations, while S&P cut ratings on 16 nations and Moody’s cut ratings on 14 nations. Some downgrades were because of falling oil prices, as in Saudi Arabia, Nigeria and others. But overall, credit quality is weakening.

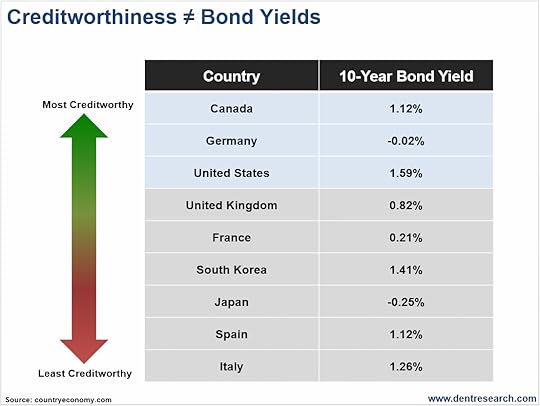

You would think that the higher a sovereign bond yields, the worse the credit quality. Kind of like consumers that have low credit scores generally pay higher interest rates to borrow. But, that’s not always the case, especially in developed nations.

Take a look at the table below:

Notice the yield on the U.S. 10-year Treasury note and the yields on the 10-year sovereign bonds below it. All of those listed below the U.S. have worse credit ratings than the U.S., but also yield less than the U.S. The table only shows developed nations with investment grade ratings (AAA to Baa3 or BBB-).

While governments are financing deficit spending at historically low rates, investors are still looking for low-risk investments that pay a decent yield.

Trillion, yes, that’s with a ‘T’

We currently have $13 trillion in negative sovereign bonds in circulation.

There is about $48 trillion in advanced economy sovereign debt and about $13 trillion of that is trading in negative territory.

That means bond buyers must pay nations to buy their debt!

We saw just about $11 trillion in negative-yielding debt prior to the Brexit vote and near zero just a couple of years ago. The more uncertainty in the world economy, the more investors pile into the safety of sovereign bonds and the more yields are pushed even lower.

The worse the credit quality, the higher the yield and the more attractive those yields are to investors.

Do you see a problem here?

Debt crises are nothing new; we’ve seen them due to wars, recessions or falling commodity prices. But today, because of massive central bank interventions or stimulus programs, investors seeking higher yields are going largely unrewarded for the risk.

When the bubble bursts, there will be nowhere to hide

While the constitution ensures the full faith and credit of the United States to tax and spend, and it does virtually guarantee the repayment of U.S. Treasury debt, it doesn’t mean that you won’t lose a ton of money investing in Treasury bonds.

That also applies to investing in sovereign bond debt of the U.S.

Whatever the Fed (or other central banks) does or doesn’t do, doesn’t really matter. And however Treasury bonds or sovereign bonds are rated doesn’t really matter to Treasury Profits Accelerator subscribers, either.

Overreaction to what happens, or may happen, affects prices and yields in long-term Treasury bonds and is one way subscribers profit.

Lance Gaitan

Editor, Treasury Profits Accelerator

Hello, I'm Lance Gaitan Try my Treasury Profits Accelerator

Leveraging the detailed economic information shared in our Treasury Profits Accelerator weekly newsletter,Treasury Profits Accelerator shows you how to generate healthy profits by trading options that capitalize on shifting interest rates on U.S treasury bonds.

I Want Treasury Bond “Micro-Moves” to Hand Me the Chance at $800 to $1,300 in The Next Four Days.

Access Treasury Profits Accelerator

More by Lance Gaitan

What's up With Low Rates?

July 6, 2016: The story for the past week or so has been about how the surprise Brexit vote ravaged the world’s financial markets, sending…

Read More

Brexit Fixation

June 22, 2016: With only one day separating us from the historic “Brexit” vote on the other side of the pond, the implications remain unclear…

Read More

Odds of a Yellen Hike

June 10, 2016: I love Las Vegas! While I enjoy playing cards, I don’t really like throwing money away gambling on slots, rolling the dice, or…

Read More

The post How to Beat Today’s BS Bond Yields appeared first on Economy and Markets.

July 23, 2016

Trump’s Nomination, Helicopter Money and More

It’s early Friday here at Dent Research as another week winds to a close. I came in a bit early to cruise the mainstream news cycle before writing you and it still pounds with chatter from the GOP National Convention.

We’ve had Trump’s nomination, the fast-and-loose speech by Ted Cruz and last night’s hotly awaited speech by theTrump Nomi new Republican nominee for President, himself — Donald Trump.

The New York Times, rather unsurprisingly, called Trump’s acceptance speech “dark… angry… grim… and ominous.”

Eric Garner Protests in Manhattan, December 2014 about 1:30 a.m. on a Thursday.

But, it’s a dark time in this country for a great many people and we face options ahead that Trump may best be equipped to address. It may not be terribly pretty, but there’s a solid chance he’ll be our next president.

And Harry on Wednesday laid out the reasons this may happen.

If you missed that, here it is again for you: 7 Reasons Why Donald Trump Could Be the Next U.S. President.

Click Here or above to see the Infographic Now >>>

Straight to the Heart… Before it’s too Late

Here’s a brief quote from Harry’s piece:

“[Trump] hit right to the heart of the broader middle class by acknowledging that it’s their wages that have been most hurt by foreign workers in Asia and legal and illegal immigrants here in the U.S.

“These people are mightily pissed and Trump speaks to exactly what they are feeling. These are the people working as hard as ever and getting absolutely nowhere. Real wages have been declining since 2000 and are back near 1973 levels.

It ain’t pretty”.

Eric Garner Protests in Manhattan, December 2014 about 1:30 a.m. on a Thursday.

Harry also this week pointed out it isn’t pretty in Europe right now either, following the nearly non-event that was the “Brexit”.

Starting in Italy, banks have a problem. Back when the old rules actually meant something, when a bank had 10% non-performing loans, it was technically bankrupt. That’s 10% of our pledged deposits against their bad loans.

Italy has 18% non-performing bank loans. They’re not technically bankrupt. They are bankrupt.

Greece has non-performing bank loans of 34%.

Ireland 19%.

Portugal 12%.

And we haven’t seen the next serious financial crisis yet.

Head in the Sand Syndrome – (HSS)

And it gets worse, as Harry points out:

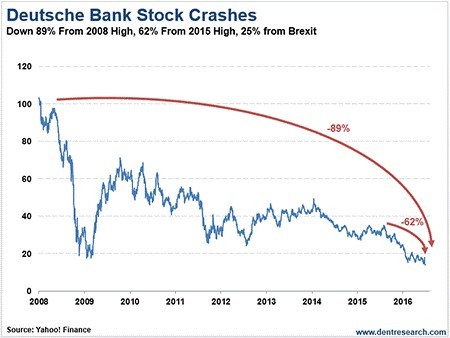

“Its stock is now down 89% from its early 2008 high, and 62% from its 2015 high. Just look at Deutsche Bank. It had its largest loss in history in the fourth quarter of 2015: $7 billion, without any help from the next financial crisis!

“Just look at Deutsche Bank. It had its largest loss in history in the fourth quarter of 2015: $7 billion, without any help from the next financial crisis! UniCredit is the largest bank in Italy. Its stock is down 94% since the 2008 high, and 71% since its 2015 high.”

Eric Garner Protests in Manhattan, December 2014 about 1:30 a.m. on a Thursday.

Maybe the reason mainstream media hasn’t focused on these concerns is because acknowledging the problem leads to the next question: what can we do to fix it?

But because the problem is so vast and deeply entrenched, and massive, in so many parts, a solution is hard to imagine. All officials have managed to come up with so far is: “We’ll do whatever it takes.” (aka Mario Draghi).

That drive to do whatever it takes is what brought Charles, Thursday, to write about Helicopter Money and its use as a last ditch effort to maintain the status quo.

Ben Bernanke last week visited Japan (we all heard) to secretly meet with Prime Minister Shinzo Abe Tuesday about last-ditch efforts to keep Japan’s lifeless economy ticking along.

Here Come the Helicopters

This is a Sikorsky Sea Stallion helicopter photographed from the deck of the USS PONCE about 70 miles from the Iranian Coast. It is about to release underwater mine-clearing gear. IMCMEX Exercise 2012 originally published at Business Insider.

“Bernanke reportedly suggested that the Japanese Government issue perpetual zero-coupon bonds that would be immediately snapped up by the Bank of Japan.

“Stop and think about that for a minute. Perpetual… and zero coupon. That means it is a bond that pays no interest and never has to be paid back. We have a word in English for that. It’s called a gift.

“What Bernanke is suggesting is about as close to real-life helicopter money as you can get. The Bank of Japan would be creating money out of nothing and essentially giving it to the Japanese government to finance its expenses.”

It’s uncharted economic waters ahead for the indefinite future. Stay tuned with us at Dent Research and we’ll continue to help you keep your bearings.

Play safe,

Robert Johnson

Editorial Director, Dent Research

P.S. Europe has a problem – a big problem – that Harry has been talking about since February, when he dedicated his elite-members-only newsletter, The Leading Edge, to unraveling the details of the disaster looming on the other side of the Atlantic. Yet, only now is the mainstream media starting to talk about this. Why? Why did it take them so long to see what Harry was able to see five months ago? On Harry’s instruction, we reran one of his Economy & Market pieces on this last week. We gave away that Leading Edge issue to anyone interested in seeing how bad this problem really is… and how Harry knew about it so far ahead of everyone else. Watch out for it next week.

P.P.S. Talk about being ahead of the curve. As I was wrapping up this letter to you, I came across this post at Seeking Alpha about lithium and Tesla. Rodney talked about this in June already, explaining to Boom & Bust subscribers what was going on. And Charles, the Boom & Bust Portfolio Manager, added a new play to the mix to take advantage of the incredible advancements in this area. Just sayin’ – it pays to keep us around

July 22, 2016

CHRIS GAFFNEY: China’s Shadow Banking is the One Thing It Cannot Control

Chris Gaffney

Managing Editor’s note: We’ve invited one of our Irrational Economic Summit speakers, EverBank’s Chris Gaffney, to write to you today to offer some insight on what he sees happening to China’s rapidly slowing economy right now, and what might be coming next.

Chris brings an experienced perspective to the global economy, gained through over 20 years of daily exposure to the markets. He’s been a Chartered Financial Analyst since 1994. And from the EverBank World Markets Desk, he has helped many clients achieve broader global diversification for their portfolios. We are pleased to have him speak at our October Irrational Economics Summit; be sure you don’t miss him.

By Chris Gaffney, SVP & Director of Sales for EverBank

The Fed, central banks and markets are unlike anything we’ve ever seen and our GDP is settling in solidly at around 1%. The times, they are a changin’ here in the U.S.

And just as Harry’s been saying for years, our demographics here in the states will not provide the growing population we’ve had driving this country’s economy since the end of the Second World War. But of course, we’re not the only player in the world markets and right now, it’s India and China that have the population to drive new economic engines.

And China’s where it’s all at right now.

I should know. I’ve been watching them like a hawk since their GDP rates began skyrocketing in the early 1990s. It’s been dancing with double-digit growth rates for more than 20 years, as it shed a state-run economy and opened up to global free-markets.

As with most emerging economies, China came out of the gate manufacturing. It used a tightly controlled currency to pay a low-wage work force that filled the world with manufactured products ranging from plastic spoons to semi-conductors.

The question on everyone’s mind right now though is: can they keep it up?

China has struggled over the past several years to emerge as a more advanced consumer-based economy. This requires the manufacturing portion of its people to save money and begin spending, igniting the consumer cycle. These folks are building up China’s expanding middle class. Only, they’re not so much igniting anything as they are slowly, but consistently simmering.

They will eventually reshape the emerging world. Already, the Chinese are investing in property so heavily that in some areas home ownership is at 200%. It’s just going to take longer than the Chinese government wants.

And there’s a problem…

China has a glut of housing because Chinese residents are steering clear of a volatile stock market and speculating in the housing market. We saw how well that worked in the U.S. back in 2008.

And this is just one of the dozens of bubbles China has inflated… all of them threatening to pop at any time.

In 2008, Americans could access easy credit and they took full advantage until the bubble exploded.

But in China, the government tightly controls Chinese banks. So the Chinese turned to the black market for money. If we see a black swan event, something that starts to burst that Chinese property bubble, it’ll come from this “shadow banking” sector. It’s the lighted fuse in the gunpowder keg.

I call it this just one, potential $8 billion black swan lurking within China’s banking industry.

Many of China’s state-owned banks are broke, like Hebei Financing Guarantee Group (HFGG), the largest loan guarantee company in the region of Hebei. Unfortunately, HFGG guaranteed about ¥50 billion in loans, more than $7.5 billion in today’s U.S. dollar. This is one bank that’s issued dozens of loans on shady financial packages that will largely vanish after the first default. HFGG’s former president was taken away in chains just a few months ago. It’s a bad situation.

Defaults are already well under way. In 2014, failed guaranteed loans swelled to 86%, at about $63 billion. Again, one spark in the right place, at the right time, and… boom.

I’ll share details on this with you closer to the Irrational Economic Summit this October in Palm Beach.

It’s an exciting time in the world as economies sail through uncharted lands of shadow banking, negative interest rates and stock markets completely disconnected with reality, but navigating the new normal requires learning fresh ways of looking at our economic future. That’s what we’ll help you do in October.

Chris Gaffney

The post CHRIS GAFFNEY: China’s Shadow Banking is the One Thing It Cannot Control appeared first on Economy and Markets.

July 21, 2016

A Real Look at Helicopter Money

Charles Sizemore

His detractors condescendingly called former Fed Chairman Ben Bernanke “Helicopter Ben”. This comes from an off-the-cuff comment Bernanke once made in a speech about deflation.

In a nutshell, Bernanke argued that prolonged price deflation was impossible because the government “has a technology, called a printing press that allows it to produce as many U.S. dollars as it wishes at no cost.”

He went on to say the government could go so far as to print money and then dump it out of helicopters if push came to shove, hence his nickname.

It’s been a while since I’ve seen the term “helicopter money” used in the financial press. But the expression is back with a vengeance after Mr. Bernanke’s recent visit to Japan.

You see, Japan is in a real mess. The country has been facing on-again / off-again deflation for going on three decades now. To put it in perspective, the last time Japan had sustained inflation Bill Clinton was still the governor of Arkansas.

That’s a long time to be fighting deflation.

And Japan really has been fighting. The Japanese equivalent of the Fed funds rate has been at zero or very close to zero since the mid-1990s. Japan invented quantitative easing, as we know it today, and has been a trailblazer in monetary shenanigans for as long as anyone can remember.

And yet none of it seems to be working. Japan remains stuck in a deflationary funk.

In the August issue of Boom & Bust, I get into some of the nitty gritty details on what is causing Japan’s deflationary malaise. But today I want to focus on what it was that Helicopter Ben suggested to his Japanese counterparts.

Bernanke reportedly suggested that the Japanese government issue perpetual zero-coupon bonds that would be immediately snapped up by the Bank of Japan.

Stop and think about that for a minute. Perpetual… and zero coupon. That means it’s a bond that pays no interest and never has to be paid back.

We have a word in English for that. It’s called a gift.

What Bernanke is suggesting is about as close to real-life helicopter money as you can get. The Bank of Japan would be creating money out of nothing and essentially giving it to the Japanese government to finance its expenses.

As investors, how can we play this? While it is likely to end badly, might there be some great money-making opportunities along the way?

The easiest way to directly profit is to short the Japanese yen, and I discuss how to do that in the August issue. But plenty of secondary opportunities exist as well.

Remember, money knows no borders in this day and age. Monetary stimulus created in one country sloshes around the world. So, a lot of helicopter money created in Japan will inevitably find its way into the American bond market. This means that our bond yields – which are already ridiculously low – could still go a lot lower.

Low bond yields mean high bond prices, of course. But they also mean higher prices for bond substitutes such as dividend paying stocks, REITs and closed-end funds (CEFs).

The closed-end fund angle is interesting to me.

So interesting, in fact, that I launched an entirely new newsletter to seek out opportunities in the closed-end space, Peak Income.

I expect to see closed-end funds as an asset class to make money for investors in three ways.

First, they tend to throw off a lot of income in the form of dividends. With bond yields low and probably getting lower, the high yields offered by closed-end funds is the sort of thing that makes you sit up and pay attention.

Secondly, because the assets that CEFs tend to buy are themselves high-yielding securities, the global hunt for yield should mean a bump in the prices of the underlying portfolio holdings.

And finally, I expect CEFs as a group to trade a lot closer to their NAVs. CEFs often trade at discounts or premiums to their NAVs. As an asset class, the discounts got a lot wider than usual in late 2015 and early 2016. The discounts have already started to shrink, but I expect that trend to continue as money continues to flood into this space.

If you’d like to know more about closed-end funds, Peak Income may be the service for you. I’ll look for a new opportunity in the close-end fund space each week.

Charles Sizemore

Dent Research

Hello, I'm Charles Sizemore Try Peak Income

Peak Income is specifically designed for those seeking steady, reliable income to boost retirement savings.

Rodney Johnson, along with myself, Dent senior analyst Charles Sizemore, have spent months exploring a hidden corner of the market that not only yields reliable monthly payments, but is practically untouched by other investors.

Together they’ll show you how to increase your monthly income by as much as 90%… with consistent discounted returns that could fast-track your retirement dreams years ahead of time!

Try Peak Income

More by Charles Sizemore

WTH Is a Black Swan, Anyway?

July 5, 2016: There is near universal agreement that the Brexit – and the walloping it gave the market – was a black…

Read More

The Brexit Breakdown

June 24, 2016: The great commodity bubble has been steadily bursting since mid-2008, but has taken a nose dive since…

Read More

Days of 60/40 Are Over

June 20, 2016: The traditional 60/40 stock/bond allocation, long the linchpin of portfolios, is broken, and it’s not coming back together…

Read More

The post A Real Look at Helicopter Money appeared first on Economy and Markets.

July 20, 2016

INFOGRAPHIC: 7 Reasons We’ll See “President Donald Trump” (Part II)

Harry Dent

Love him or hate him – those seem to be the two reactions to Republican nominee, Donald Trump. Only Hillary has higher negative ratings. But in “The Donald’s” case, his supporters are much stronger and much more loyal than the former first lady’s.

Current polls have Hillary leading by a couple of points in a two-way race, but then again experts have consistently underestimated Trump. So, anything is possible.

Everyone thought he would flame out early on. But he routed the entire rainbow of Republican candidates. Bernie did surprisingly well, but could not even come close to beating the entrenched establishment candidate, Clinton.

Both rising candidates have done a splendid job exploiting the deep dissatisfaction of the middle class, while Bernie campaigned against the 1% and Wall Streeters who have garnered the lion’s share of economic and financial gains in the last few decades.

But Trump, he tapped a larger vein.

Click Here to see Infographic Now >>>

He hit right to the heart of the broader middle class by acknowledging that it’s their wages that have been most hurt by foreign workers in Asia and legal and illegal immigrants here in the U.S.

These people are mightily pissed and Trump speaks to exactly what they are feeling. These are the people working as hard as ever and getting absolutely nowhere. Real wages have been declining since 2000 and are back near 1973 levels.

It ain’t pretty.

This broad middle and lower-middle-class group do not like immigrants, not even the legal ones, because what they see is one more unavailable job going to someone working for far less than they could.

They feel that countries like China and Japan have cheated them out of livelihoods through unfair trade practices. And they do not trust any Muslims.

Here’s my current take on Trump.

Click Here to see Infographic Now >>>

First, don’t count him out. If the economy sharply tanks in the second half of this year – as I anticipate – it will work against the establishment candidate, Clinton.

But, even more likely if he loses the November election, Trump will still have the solid support and loyalty of at least 30% – 40% of the voters.

This country has the most extremely polarized political tensions of any developed country. It’s at the highest level since the Civil War – even greater than during the Roaring 20s and the Great Depression, when the top 1% last garnered 50% of the wealth.

Trump is worth watching and not just for entertainment’s sake, and don’t be surprised if he ignites a movement that splits this country into two or three major factions – kind of a modern day “civil war.”

At least three U.S. regions have starkly different social and political values:

The broad Southeast, Southwest, Midwest and Rocky Mountains;

The Northeast and Upper Midwest (Illinois, Minnesota, etc.);

The Pacific West from California through Washington state.

Check out Part II of our infographic: 7 Reasons Why Donald Trump Could Be the Next U.S. President by clicking on the image below – Enjoy!

~ Harry

Hello, I'm Harry Dent Try Boom & Bust now and save 25%

Each month Rodney Johnson, Adam O’Dell and myself uncover the next profitable investment… based on a boom or a bust.

Wall Street is preparing you for the wrong investment season. They’re telling you to stuff your portfolio with things like Chinese oil… Russian gas… Brazilian copper… wheat, corn, sugar, silver… foreign currencies. Benefit with us where others fail.

Try Boom & Bust

More by Harry Dent

Our Money Velocity Sucks

July 13, 2016: Dr. Lacy Hunt has been featured more than any outside speaker at our IES conferences. Why? Because he’s…

Read More

Bond Bubble Ready to Burst

July 07, 2016: The great commodity bubble has been steadily bursting since mid-2008, but has taken a nose dive since Brexit…

Read More

Bigger Than Brexit!

July 19, 2016: The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets…

Read More

The post INFOGRAPHIC: 7 Reasons We’ll See “President Donald Trump” (Part II) appeared first on Economy and Markets.

July 19, 2016

Forget Brexit! EU Has Much Worse Problems

Harry Dent

The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets on June 23. After two days though, markets were marching back up again.

What happens when you take a Japanese cartoon franchise from the 1990s and turn it into an augmented reality scavenger hunt application on a smart phone?

That’s just like markets on “crack!” They react to political events, but totally miss the fundamentals.

Yes, Brexit is important. Years from now it will be recognized as the beginning of the end for the great Eurozone experiment.

It isn’t just about the renegotiations on trade agreements with Britain and initial slowing of GDP. It’s also about the threat that more countries will choose to exit the economic bloc. The euro and Eurozone have 40%-plus unfavorable ratings in polls in France, the Netherlands and Italy. That many areas within countries will break free of their overlord. And then this rush for nationalism will spread across the globe like wildfire.

But here’s the 800-pound elephant in the room (I talked about this in detail in the February issue of The Leading Edge). The one Wall Street seems blind to at the moment…

Italy is the next Greece!

It’s bad – non-performing bank loans have risen to 18%.

At 10%, most banks are technically bankrupt. That’s the percentage of capital and pledged deposits they have against bad loans. Our pledged deposits, not theirs.

At 18%, they’re no longer “technically” bankrupt. They ARE bankrupt!

Greece still has bad or non-performing bank loans of 34%, Ireland 19% and Portugal 12%. And we haven’t seen the next serious financial crisis yet.

Yet nothing has been done to seriously restructure debt in southern Europe. The EU just bailed out Greece to stop the dominoes from hitting other countries. They’re pumping in heavy doses of QE to keep the banks and economy temporarily liquid and solvent.

But the problems are growing even worse. The blood is getting harder to hide…

Just look at Deutsche Bank. It had its largest loss in history in the fourth quarter of 2015: $7 trillion, without any help from the next financial crisis!

Its stock is now down 89% from its early 2008 high, and 62% from its 2015 high.

It’s the largest bank in Germany.

Why is Wall Street ignoring this!?

UniCredit is the largest bank in Italy. Its stock is down 94% since the 2008 high, and 71% since its 2015 high.

Banca Carige, another major Italian bank, is down over 99% from its high in 2008.

HSBC in the UK lost 15% since Brexit, while the Royal Bank of Scotland dropped 40% and Barclays bled 41%.

Investors in these stocks are suffering tortures no investor should ever endure. And there’s more pain to come.

Depositors in these banks are willingly settling their heads into the guillotine!

But here is the worst part…

To raise capital after the 2008 global financial crisis, Deutsche Bank issued CoCo bonds. They didn’t want to dilute their shareholders or their senior bond holders, so they issued a new B.S. bond that ranked just below senior level. But – and this is a pretty significant “but” – the 6% coupon only gets paid if the bank has sufficient cash flow… and any missed payments don’t have to be made up. If they continue to miss payments, the bonds get converted to stock. And there’s nothing the bond holder can do about it!

These should have been called Coo-Coo, not Co-Co, bonds!

The yields have now spiked above 12% and the bonds have been devalued substantially already…

And again, we haven’t even seen the next real financial crisis yet.

If Deutsche Bank is in this much trouble, you know many other major banks are.

Before the Brexit vote, most of these guys were trading at well below book value, while the broad markets trade at 2-times-plus book value. Italy’s Banca Carige is trading at just 3% of book value. Citibank is at 54%, Spain’s Banco Santander is at 58%, Deutsche Bank is at 59%, Credit Suisse is at 63%, and HSBC is trading at 69% of book value. Since then, they’ve gotten worse.

And the bank with the highest exposure to the most leveraged and toxic of all assets – credit default swaps (largely mortgage derivatives) – is Deutsche Bank! It holds 10% of this $550 trillion nuclear bomb. Not billion. Not million. Trillion!

At 10%, that means Deutsche Bank has $54.7 trillion credit default swamps on its books. JPMorgan isn’t far behind, with $51.9 trillion. Citibank has $51.2 trillion, Goldman Sachs has $43.6 trillion and the Bank of America has $27.8 trillion.

Markets should be much more worried about the coming default in Italy.

They should be much more worried about the largest banks in the world failing… and they will fail.

Yet they seem more concerned about political factors like Brexit, or when Janet Yellen will raise the fed funds rate 0.25%.

Investors are going to get their asses handed to them.

Mark my words: a major collapse is bearing down on us. Don’t be among the blind investors flattened when it arrives!

Harry

Follow me on Twitter @harrydentjr

P.S. It is my sole purpose to help you through this (and anything else – good or bad – that we face down the road). It’s what I live for, so I thank you for the opportunity! And I congratulate you on your bravery to step out of the crowd and take control of your business, financial and investment success. Download your free issue of The Leading Edge now.

The post Forget Brexit! EU Has Much Worse Problems appeared first on Economy and Markets.

July 16, 2016

Here’s What You Missed This Week On Economy And Markets

I just can’t help but shake my head at yet another unfounded moment in the equities market. Almost every day this week, stocks reached new highs… when will the madness stop?

Blackrock CEO, Larry Fink, pointed out that by GAAP standards, the S&P500 now generates about $90 per share in earnings, giving the index a 24x P/E multiple. There’s no way that fundamentals are driving this move. But, the upcoming earnings season will tell its own tale.

In the meantime, we’ve had an exciting week at Dent Research with two of our Irrational Economics Summit speakers chiming in on how they see the world and what we should expect from them at our October 20-22 conference.

On Wednesday, I wrote a post based on our conversation with Dr. Lacy Hunt, of Hoisington Investment Management where he confirmed what Harry’s been saying for a while now. “Yes,” he told us, “the economy really is that bad, right now.”

And he proceeded to lay this sad truth on us in that post, as well:

“Unfortunately, the economy is performing so poorly that a lot of our college graduates are coming out and they have to settle for jobs that are not much better than what they would’ve received if they had gone directly into the labor force from high school.”

And while we already had an idea that was the case, Dr. Hunt illustrated some unique facets of the current economic crisis that we hadn’t heard before. It was a great conversation, and if you haven’t checked it out yet, it’s definitely worth a read. It will also be well worth your while to meet him and see him live – along with all the other experts on the panel – this October 20-22 at the Irrational Economic Summit in Palm Beach. We have a couple of discounted seats still available. Grab one here, before they’re gone.

We then heard something similar on Friday, when renowned investor and founder of Real Vision TV, Raoul Pal, wrote us a terrifically insightful piece on more economic specifics.

He agrees that we’re headed full bore into a 2016 recession, and there are so many fault lines out there right now that it’s impossible to predict which one will rip free and correct the markets.

As Raoul said:

“See, the business cycle is weakening and so the likelihood for the markets to encounter some sort of accident is quite high (and getting riskier by the day, especially now that markets have made all-time highs).

“The banking system is just one of dozens of dominoes tilting precariously. Something rotten is lurking in the shadows of the world’s largest banks. Banks in Italy, Germany, and Switzerland are all in a free-fall. This has already spilled over into the U.S. banking system, highlighting many weak banks that probably won’t survive a hard hit – like the one that may be coming.”

And lest you think it’s all doom and gloom and there’s no certainty in… anything, our own John DelVecchio branched out from his short trade advice.

He generously provided two stock tips for all of our readers in companies with solid financials that pay you, the stockholder first.

The following is from his Thursday piece:

“Prudent management teams can generate market-thumping returns. My own research into companies with “good shareholder yield” returned over 15x the S&P 500 since 2000.

Good shareholder yield is the focus of our coming newsletter Hidden Profits.

One of the most obvious ways to get paid first is to receive a dividend. Dividends rule. According to the data presented by Ned Davis Research, dividend initiators and growers have compounded at 9.8% since 1972. That would turn $100 into $6,467.”

Dividends are king, even to a forensic accounting expert like John.

And just like that, with all the mad-market craziness, the week is over and here we are on Saturday.

Stay tuned next week for more posts by our upcoming Irrational Economic Summit speakers and insights that you will find no place else, only at Dent Research.

Play safe,

Robert Johnson

Editorial Director, Dent Research

P.S. Europe has a problem – a big problem – that Harry has been talking about since February, when he dedicated his elite-members-only newsletter, The Leading Edge, to unraveling the details of the disaster looming on the other side of the Atlantic. Yet, only now is the mainstream media starting to talk about this. Why? Why did it take them so long to see what Harry was able to see five months ago? On Harry’s instruction, we’re going to rerun one of Harry’s Economy & Market pieces on this issue next week. We’ll be giving away that Leading Edge issue to anyone interested in seeing how bad this problem really is… and how Harry knew about it so far ahead of everyone else. Watch out for it next week.

The post Here’s What You Missed This Week On Economy And Markets appeared first on Economy and Markets.

See larger image

See larger image