Harry S. Dent Jr.'s Blog, page 102

September 5, 2016

The Workforce is Its Own Form of Education

I lied to get my first job.

I lied to get my first job.

The minimum required age was 15, and I was only 13. Luckily, I was 5’ 10” at the time, so I could pass for a couple of years older. I proudly drew my first paycheck as a fry cook at the Dairy Bar, a local burger joint in Southeast Texas. I learned a lot more on the job than just how to flip burgers.

On this Labor Day, I was reminded of my days on the food line… and that celebrity hashtag theme #firstsevenjobs that began trending recently. She listed her early employment history and many of her followers have since followed suit.

As I’m sure you’re doing right now, I immediately thought of my personal list of first seven jobs, which are listed below:

Fry Cook

Dishwasher

Busboy

Car Washer

Shipyard Oiler

Grocery Stocker

Hotel Front Desk Clerk

It’s notable that I held all of these positions before I went to college.

That’s the rub.

As others following this trending theme have noted, fewer kids are working these days. They aren’t gaining the skills that come from those first jobs until they’re in their 20s, which goes a long way to explaining the millennial attitudes showing up in the workplace. It puts them at a tremendous disadvantage when they start their “real” careers. It also affects our workforce as a whole.

Some of the on-the-job-training is obvious. You have to show up on time and actually do the work, or you risk getting fired. Such rules can be new to people whose only commitments were in school, where the institution is required to keep you at least through age 15, and through age 18 as long as you want to hang around.

Then there’s the issue of your boss.

At 13, my supervisor was a lady about 35 years old. She had attained the rank of Kitchen Manager of this tiny fast food outlet. This was her sole means of support, and even at my young age I recognized her working life had plateaued at a very modest level. But my trajectory – presumably through high school, then college and beyond – compared with hers didn’t matter one bit.

What counted was that she knew how to run the kitchen, and my job was to show up and follow her instructions. Period. This wasn’t a democracy, or even a meritocracy. It was an autocracy, and the owner of the place set the rules as he saw fit. If I wanted to remain employed, I had to work within the rules.

On the plus side, I wasn’t always lumped with my co-workers, as was the case in school. There were no “group projects” at work. If I did well, I was rewarded with continued employment and extra shifts. If my co-workers chose to goof off or show up late, they were fired. Each of us was assessed on our individual merits.

And the education didn’t stop at the front door. When I received my first paycheck it took me a while to figure out who FICA was, and why he got so much of my money. Then I had to deal with opening a bank account, depositing and writing checks, and eventually, W-2s and taxes.

It wasn’t the coddled world of education. Employment could be mind-numbingly boring, fast-paced, infuriating, rewarding, and even depressing. But learning to navigate the workplace early allowed me to develop interpersonal skills and understand employment dynamics long before I started my career. Apparently I wasn’t alone.

After spiking above 25% after the downturn, unemployment among teens from 16 to 19 dropped back near its long-term average of 16%.

But that doesn’t tell the whole story.

Unemployment statistics only apply to those who want to work. A better way to understand the change that took place is by considering the labor force participation rate of those from 16 to 19 years old. This statistic counts how many people are either working or looking for work compared with the entire population in that age range.

As the chart below shows, from the 1970s through the 1990s, more than half of all teens were in the labor force. But since 2000, things have changed dramatically. Only about one-third of our teens are either working or looking for work.

I don’t think all the others are sitting at home playing video games, although some certainly are. Many are probably involved in sports, camps, band, or a myriad of other activities. That’s great, and I know that such interests are beneficial. But there’s a world of education that can’t be obtained anywhere but the workforce, and waiting until your 20s just slows down the process for the workers as well as the employers that have to deal with them.

And now we have another hurdle to teen employment – rising minimum wage.

Forcing companies to pay more will only shrink the limited employment opportunities that are available to this age group.

As more cities and states increase what employers must pay at the bottom rung of the work ladder, it will make more sense for companies to automate. We’ll see more kiosks for ordering at fast food restaurants, and more tap-to-pay systems at retail stores. Such changes might keep companies competitive, but they’ll also limit the employment opportunities for teens, so even fewer of them will have the menial jobs of our youth that paid so little, but taught so much.

Rodney

Follow me on Twitter @RJHSDent

The post The Workforce is Its Own Form of Education appeared first on Economy and Markets.

September 2, 2016

Why We Won 30% Short-Selling GIII Apparel

I’m very superstitious. It’s almost to the point of being a bit off the wall.

I’m very superstitious. It’s almost to the point of being a bit off the wall.

When it comes to the markets, I rarely trade the same stock twice, especially if I made a big profit the first time around. When the Market Gods give you a nice winner, take it and move on. I fear that if I touch the stove too many times I might burn a finger.

But back in April I re-entered a short position that I made a big profit on previously in Forensic Investor.

The stock ranked among the worst of my earnings quality model. It was too hard to ignore.

That stock was GIII Apparel Group, Inc. (Nasdaq: GIII).

GIII was creamed this week as the company missed sales and earnings estimates badly. And, the forward guidance was even worse. The stock has gone from about $45 to $30 during our short trade.

Initially the trade went against us, which it seems like almost all of them do! But eventually the fundamentals play out.

The anatomy of the GIII short trade was very straightforward. Here are the six factors that piqued my interest in re-entering the trade…

#1: Insiders are huge sellers.

Last fall, there were a bunch of stock sales from insiders. The stock wasn’t much higher then than it is today. A net of over 320,000 shares have been sold over the last 12 months and outpaced purchases by about three to one.

#2: The stock chart looks vulnerable.

If you printed out the stock chart, taped it to the wall, and looked at it from about five feet away, you’d see that the uptrend is clearly broken.

Upon closer inspections, you can see that, in 2016, the rally off the lows was pretty weak. Not a single time was the weekly volume above the 20-week average. Yet, when the stock sells off, it sells on higher volume. Over the last 50 days, down volume has been about 1.5-times higher than up volume. So, sellers are in control.

And, the stock has no momentum. Its relative strength rating is just 16, meaning it’s significantly lagging the broader market.

#3: Revenue growth has imploded.

GIII was a key growth stock for a lot of money managers. But growth is starting to fade. In January, its revenue grew just 3% year-over-year. But a year ago the company was growing at 9%. Slowing growth weakens the rationale for growth managers to hold the stock.

There’s still over 450 funds that own shares of GIII. But, while the stock has been pounded, it’s not a value idea either. Shares still trade at a premium to the S&P 500.

#4: Inventory levels are increasing.

Whenever I see slowing growth and building inventory levels, I get concerned. Inventory is up on an absolute basis and on a days-basis is at 127 days. That’s up seven days year-over-year. It means that stock is sitting in the warehouse for seven days longer than it did last year… and last year it was taking about four months to move. My concern is that the company will have to heavily discount merchandise to sell it. As a result, profit margins get crushed.

#5: It’s taking the company longer to convert the sales process to cash.

The build-up of inventory doesn’t help because inventory eats up cash flow until it’s liquidated. But, GIII’s whole cash flow picture is poor when accounting for all of the working capital. The cash conversion cycle is up 16 days year-over-year to 120 days in January. The cash conversion cycle is the number of days it takes to convert the sales cycle into cash. So, the longer it takes, the more risk there is. It’s also up year-over-year in each of the past four quarters. This increases the risk of earnings pressure in the future. It’s a big red flag.

#6: Short interest is building.

The bears are closing in and have ramped up their short positions in recent months. In 2015, short interest was about 2.7-3.1 million shares. In 2016, it increased to 3.2 million… then 3.3 million. Just recently it hit 4.1 million shares! The bears must smell blood in the water.

The combination of slowing growth, rich valuations, a lot of funds owning the stock and short sellers circling the wagon gave me comfort that the odds favored a new leg down.

So, I instructed my Forensic Investor subscribers to short the stock. Yesterday, I followed up with instructions to cover their shorts. We banked a healthy 30% profit on this play!

By watching earnings quality and cash flow, you can identify plenty of opportunities to short stocks. The environment may be even more ripe considering stretched valuations and optimistic investor sentiment.

If you don’t want to do it alone, consider joining us at Forensic Investor. Our most actionable idea right now is still a live trade – meaning you still have time to get in and make some money – and if it plays out like I think it will, it could lead to a bumper crop of a year on the short side!

John Del Vecchio

Editor, Forensic Investor

The post Why We Won 30% Short-Selling GIII Apparel appeared first on Economy and Markets.

September 1, 2016

Don’t Trust Your Gut: Trust a System

In August of 1971, Ray Dalio – now one of the most respected hedge fund billionaires on Wall Street – was a lowly clerk working on the Street. By coincidence, Dalio was starting his career during one of history’s critical turning points. President Nixon had just taken the dollar off of the gold standard.

In August of 1971, Ray Dalio – now one of the most respected hedge fund billionaires on Wall Street – was a lowly clerk working on the Street. By coincidence, Dalio was starting his career during one of history’s critical turning points. President Nixon had just taken the dollar off of the gold standard.

Dalio’s gut told him the market would crash the next day. Instead, it rallied. Hard! The Dow finished the day almost 4% higher.

It’s not much of a stretch to compare then to now… Back then – as now – you had central banks meddling in the markets. And back then – as now – you had unexpected results.

Dalio learned a lesson from his experience. He realized that the market has a knack for doing what you least expect it to do… and he reached the conclusion that, rather than trying to guess what happens next, the better course was to simply build a portfolio that would perform well in any environment… no matter what happened. So he launched his All Weather portfolio, and the rest is history.

I’m not necessarily recommending you run out and invest with Dalio. Even if you wanted to, you wouldn’t meet the minimums. You’d need $5 billion in investable assets to get in the door.

But I do recommend that you take a few plays out of his playbook…

First, ask yourself the same question he did: what kinds of strategies can I implement that will work in any market, bull or bear?

With stock prices at all-time highs – and with the Fed’s next move anyone’s guess – you need to be confident that your strategy will handle the unexpected.

And as you look for answers, be systematic.

Set your trading rules in advance and follow them – verbatim. If you’ve done proper back-testing, then you should have faith in your system to do its job once a storm hits. If you don’t have faith in your system, then you have no business investing with it.

And perhaps most importantly, do not let your emotions cloud your judgment and push you to override your model.

Your emotions will betray you every time!

The most successful traders are those that either have a super-human ability to control their emotions (which is exceptionally rare) or they simply take their emotions out of the equation altogether.

That’s how my friend and colleague Adam O’Dell invests with Cycle 9 Alert. I have never – as in not once – heard Adam tell me how he feels about the market or about what he thinks will happen next. He removes himself from the equation entirely. He builds systems and his systems tell him what is probable based on past experience.

Adam’s Cycle 9 Alert system is designed to work in any market because, unlike a traditional buy-and-hold strategy, he isn’t always invested. He only buys when the sector he’s eyeing is in a pronounced uptrend and starting to show momentum. And he also has the ability to bet the other way… actually shorting sectors that are in a downtrend.

Cycle 9 Alert’s system works because, as Sir Isaac Newton himself put it, an object in motion stays in motion.

Adam’s research has shown that outperforming sectors tend to continue outperforming over the following two to three months, so he structures his investments to fit within that timeframe.

Whether the longer-term trend is bullish or bearish, Cycle 9 readers stand to profit from the intermediate-term moves.

I have no way of knowing precisely when the next market crash will be. But I can say with a lot of confidence that when it hits, most investors will respond the wrong way. They’ll hold on too long and then end up selling at the bottom, right before it starts to rally again.

They will do this because they will let their emotions get the better of them.

Don’t do that.

Learn from Ray Dalio… and from my friend Adam.

Stick to a mechanical system and follow your rules.

Charles Sizemore

Portfolio Manager, Boom & Bust

P.S. For the next couple of days only, you can get a free one-year’s subscription to Adam’s Cycle 9 Alert. Why not put it through its paces and see the results for yourself? Details here.

The post Don’t Trust Your Gut: Trust a System appeared first on Economy and Markets.

August 31, 2016

We’ve Reached the Zero Point of Debt Creation

Forty-five years and counting.

Forty-five years and counting.

We’ve been on a debt spree since the early 1970s when we went off the gold standard, covering every possible angle. Trade deficits, government deficits, unfunded entitlements, private debt – you name it! Our total debt has grown 2.5-times GDP since 1971.

How could economists not see this as a problem? How is this the least bit sustainable?

It isn’t. We’re hurdling toward a massive financial crisis, and all we have to show for it are financial asset bubbles destined to burst. And when they do, they’ll wipe out the artificial wealth they’ve created for many decades… in just a few years, as they did from late 1929 into late 1932!

The chart below shows the common-sense truth.

As with any drug – and debt is a financially enhancing drug – it takes more and more to create less and less of an effect. Eventually, you reach the “zero point” where there is no effect and the drug kills you from its very strain and toxicity.

We’re rapidly approaching that zero point, after every dollar of debt has produced less and less GDP steadily since 1966:

Note that the anomaly in the chart after 2008 was due to the impact of unprecedented QE. Ever since that disruption, the trends have pointed back down – making a beeline toward that zero point again.

Back in 2002, Swiss investor and market prognosticator Marc Faber published a similar chart. His findings showed the zero point for debt creation would occur around 2015. With updated data, we now see that the zero point will hit around the beginning of 2017.

In other words – right about NOW!

This is why central banks around the world have failed to spurn inflation despite endless money-printing. The more money they print, the less effect it has.

Just ask Japan. They’ve been doing this since 1997 with zero GDP growth and zero inflation, on average. Lately it seems like any time they get out of a recession they’re thrown right back into one!

But there is another ramification to all this money-printing…

When central banks create money out of thin air – through the fractional reserve banking system and through QE – it has to go somewhere.

When the economy is so indebted that consumers and companies can’t take on any new debts, the money can’t go there. So, it winds up going into financial speculation, especially as investment firms can lever up at little cost due to zero or negative interest rates. Stock prices bubble instead of inflation as the economy keeps sucking wind!

Sure enough, this next chart shows that debt and equity prices go hand-in-hand:

In the 20 years between 1995 and 2015, debt grew at a rate of 4.2-times GDP, and stock prices followed at 4.3-times. Total U.S. sector debt now stands at 348% of GDP, with stocks at 214%.

All told, these two combined are 588% of GDP, far more than any time in history.

Is this a bubble burst waiting to happen or what?

Count on 2017 marking the beginning of the greatest crash we’ve seen since 1929-1932. And I have a new book coming out to commemorate this occasion.

This new book, The Sale of a Lifetime, will hit shelves on September 15. I couldn’t have picked a better time to release it. It’s coming out at the height of the greatest bubble in modern history… and I wrote it to examine financial bubbles more than any book that came before it.

In this book, I’ll show why we shouldn’t expect to see a bottom in stocks until at least late 2019 or possibly early 2020, when all four of my key cycles continue to point down together – a rare event. The markets are likely to be rocky into late 2022 when three of these four cycles finally turn back up together again. Around that time, the next global boom will arise from predictable demographic trends and continued urbanization in emerging countries. And surprisingly – China will not be one of them.

We’re simply running out of time.

Be in cash or get trashed. If you’re not sitting on the sidelines, make sure you’re using an investment system like the ones we publish at Dent Research. Adam created his Cycle 9 Alert, for one, to be profitable in both bull and bear markets, and its track record speaks for itself. Adam has the details for you right here.

Harry

Follow me on Twitter @harrydentjr

The post We’ve Reached the Zero Point of Debt Creation appeared first on Economy and Markets.

August 30, 2016

Killing Us with Healthcare

I’ve never heard anyone brag about what they spend for a medical procedure. Healthcare isn’t like housing or transportation. People are proud to shell out big bucks for a big house, and many drivers can’t wait to show off their expensive set of wheels.

I’ve never heard anyone brag about what they spend for a medical procedure. Healthcare isn’t like housing or transportation. People are proud to shell out big bucks for a big house, and many drivers can’t wait to show off their expensive set of wheels.

But when it comes to healthcare, we’re only smiling when we save money, not spend it, which makes the current trend so much more difficult.

While government officials point to slower price increases and bray on about bending the healthcare cost curve, everyday people are watching more of their hard-earned dollars fly out the door to pay for care. Even though overall costs might be rising at a slower pace, the amount consumers have to pay is shooting to the moon.

And the pain doesn’t stop at the door to retirement. As the healthcare monster devours more dollars, we have less money to spend where we want, which adds to the misery in our economy, and will eventually add to a nasty financial setback.

Middle-income households now spend more on healthcare than any other cost outside of shelter. This part of their budget jumped more than 3% from 1984 to 2014, and now eats up 8.9% of their funds.

Most of the increase occurred in the last 10 years, as healthcare spending rose 25% from 2007 to 2014. As these families spent more on doctors and prescriptions, they spent less on food, housing, clothing, and transportation.

Keep in mind that this calculation ends just as the ironically named Affordable Care Act went into action. Since 2014 things have gotten much worse, not better.

Consumers who purchase insurance on the healthcare exchanges know about rising prices all too well. Premiums have increased by double digits every year for most buyers, and in 2017 prices will shoot higher by almost 30%.

In just a few short years, premium prices are up 50%, and that’s just for the privilege of buying insurance. Sure, there are subsidies out there for almost 90% of buyers, but that covers just the premium cost. Once you have insurance, there’s the small matter of the deductible.

Insurers have reconfigured policies to include higher deductibles to keep premium prices lower than they would have been. That’s nice in theory, but with premiums up by double digits each year, tacking several thousand dollars onto the deductible just adds insult to injury.

Deductibles of $5,000 and $6,850, on top of $1,000-per-month premiums, are common. This is also where workers who get their insurance through their employers are feeling the heat.

Firms still pay roughly 80% of insurance premiums for employees, but the plans are less generous, requiring more deductible payments. The effect, while not as pronounced, is the same. Consumers have less cash to spend on what they want.

For retirees, the math gets more complicated.

The government deducts Medicare Part B payments from Social Security checks. This year, the price of Medicare Part B is expected to climb more than 20%, or about $27 per month. But inflation has remained tame, so the Social Security Cost-of-Living Adjustment (COLA) could be as small as 0.2%, or even flat. For those receiving the average benefit of $1,335 per month, this equates to less than $3 per month. The increase in Medicare Part B will eat up all of that gain and then some.

Recent retirees might get some relief. If they earn less than average income, then the Hold Harmless Act would shield those who retired in the last year from a Medicare cost increase that would reduce their benefits below the prior year’s level.

Unfortunately, this only works once, and then the recipients must eat the cost. The price of Medicare Part B jumped 16.1% last year, so those who were able to avoid that price hike now have to pony up.

To make it even more of a puzzle, if the COLA ends up at 0%, then the Hold Harmless Act doesn’t apply, and all Social Security recipients will get hit with the full cost increase, thereby lowering their incomes.

The end result is that most everyone in America is paying significantly more for healthcare, either through premiums, deductibles, or a combination of the two. This leaves us with less money to spend on what we want. It’s harder for young families to afford having children or buying homes, while retirees can’t spend as much on maintaining their lifestyles. For those in the middle, saving for retirement and education is difficult.

The problem with healthcare is that it doesn’t fade with an economic downturn. When our economy resets and financial assets drop, healthcare costs will remain high, eating up more of our falling incomes, and creating a further drag on the economy.

And it doesn’t stop with consumers…

The premium subsidies for the health exchanges, and the makeup payments for the Hold Harmless Act, come from somewhere. Or, more to the point, from someone. That lucky person is the U.S. taxpayer, who is on the hook for ever-rising healthcare costs as the government declares bigger sections of the population eligible for assistance.

As equity markets reach new highs and consumer misery plumbs new depths, something’s got to give.

Don’t be left holding the bag when the markets roll over. Make sure you have enough left in your pocket to pay for your premiums… and your deductible.

Rodney

Follow me on Twitter @RJHSDent

The post Killing Us with Healthcare appeared first on Economy and Markets.

August 29, 2016

There’s Always A Buying Opportunity Somewhere

Love him or hate him, President Obama made one of the best stock market calls… ever!

Love him or hate him, President Obama made one of the best stock market calls… ever!

On March 3, 2009 he said, “Buying stocks is a potentially good deal.”

Just three days later – on March 6 – the S&P 500 bottomed out and has since marched 217% higher. In hindsight, we know his timing was nothing short of incredible!

But buying at the bottom – in real-time (and with real money) – is incredibly difficult to do. Very few investors have the emotional fortitude to buy aggressively when there’s blood in the streets and a call for Armageddon in the news cycle. And if you call the bottom too early, you’re toast!

That said, bear markets are incredible opportunities… if you have a proven strategy that tells you exactly when it’s time to buy.

Well, that’s exactly what my Cycle 9 Alert strategy is designed to do.

My Cycle 9 Alert approach plays sector-specific trends because, as I like to say, “There’s always a bull market somewhere.”

By the same token, “there’s always a bear market somewhere,” too.

And while you’ve probably been told that the market is either bullish or bearish – with no in-between – you’re limiting your profit opportunities if you’re stuck thinking of it that way.

Take the healthcare sector, for instance.

Beginning last September, two subsets of the healthcare sector slipped into a bear market, losing more than 20% from their recent highs. And the selling didn’t stop at 20%…

The pharmaceuticals sector (XPH) lost a full 43% between September and March. And the closely related biotech sector (XBI) lost 50% in even less time!

Meanwhile, in April, the S&P 500 was sitting just 2% below its all-time high.

Now, I fully realize it seems odd for entire sectors and industry groups to go through full-blown bear markets while, at the same time, the major stock indices are hitting new highs. But this is actually fairly common.

For various reasons, individual sectors can go through periods of dramatic underperformance. We’ve seen this recently in the energy sector. And before that, a bear market in the metals sector led my Cycle 9 Alert system to a hugely profitable opportunity.

Earlier this year, in January, metal-mining stocks were down a whopping 73% from their highs and nobody wanted to touch these stocks with a 10-foot pole.

But in February, my Cycle 9 Alert system triggered a buy signal on a left-for-dead silver miner from Canada – Pan American Silver Corp. I recommended the trade to my subscribers and two months later we walked away with a cool 225% profit!

Now, this may seem like an unusual result. But in fact, my research shows that some of the very best rally opportunities come from sectors that are crawling their way out of bear market territory.

In fact, the profit-per-trade of these bear market opportunities is three-times stronger!

These opportunities don’t come about every day. They’re certainly rarer than bull market opportunities (since stocks tend to spend more time rising than falling).

But if you’re patient, sector-specific bear market opportunities come about often enough to make some serious coin! Like the 225% I helped Cycle 9 Alert readers make between February and April this year, on Pan American Silver Corp.

And like the 100%-plus profits I’m targeting on our most recent sector-specific bear market opportunity… in a beaten-down niche of the healthcare sector.

For obvious reasons, I can’t divulge the full details of this trade (released just last week). But the investment I recommended is still trading within my suggested buy range, so there’s still time to get in.

You can access my Cycle 9 Alert system – and this particular trade – by clicking here.

In short, my research shows that you shouldn’t discount bear market buying opportunities. And you should stop looking at the market as one giant blob of (over-priced?) stocks.

With my sector-specific Cycle 9 Alert approach, there’s always an opportunity somewhere.

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

The post There’s Always A Buying Opportunity Somewhere appeared first on Economy and Markets.

August 26, 2016

The Global Real Estate Bubble Is OFFICIALY Bursting

It’s official.

It’s official.

The global real estate bubble is bursting.

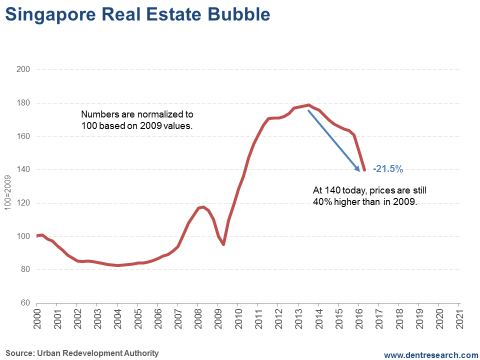

After imposing a hefty 26% tax on foreign buyers, and a 12% to 16% surcharge for buyers who flipped their house between one and two years, Singapore real estate has declined 21.5%.

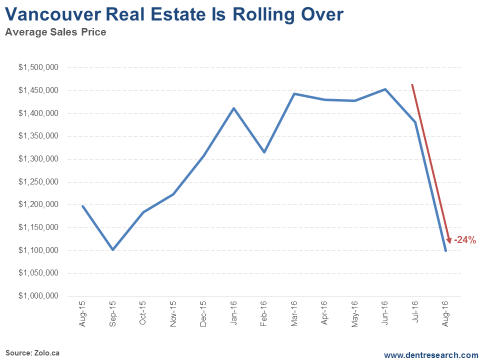

Vancouver has taken similar measures, and – surprise, surprise – its real estate is down 24% in just five months!

That’s what I mean when I say that when bubbles burst, they do so dramatically and rapidly.

But this is likely just the beginning…

I put Singapore into razor-sharp focus in February of last year when I noted it had some of the most expensive real estate in the world. It has the highest standard of living of any country in Asia – even higher than in the U.S.!

The problem is that the country is 100% urban and has limited land – making it incredibly susceptible to the kind of bubble that’s formed there.

And boy, has one ever.

Prior to this recent crash, real estate prices there had risen 68% since early 2009 following the global financial crisis…

And 110% since the 1999 low after the financial crisis across Southeast Asia.

Now, they’re down 21.5%:

Clearly, it was a bubble waiting to burst!

Eventually, there was public backlash against foreign buyers who were bidding up prices. After a certain point, the everyday, $60,000-a-year household couldn’t afford to live in its own city!

And now that the government has slapped a bunch of fines on those buyers, those foreigners aren’t buying like they used to – and Singapore’s prices are crashing down to earth!

Just like I said they would a year and a half ago.

I also covered Vancouver about a year ago prior to heading there for our third annual Irrational Economic Summit. (We’re hosting our fourth in less than two months in West Palm Beach, FL. (Click here for details.)

As I said at the time, Vancouver is my favorite city in North America… and is also one of the single bubbliest cities on the planet.

Like Singapore, its residents were getting fed up with foreign buyers – mostly Chinese in their case – jacking up prices across the city.

From the beginning of 2002 to when I reported last year, home prices had gone up 290%!

A bubble, plain and simple.

I warned they would likely start punishing foreign investors as well – and they did. The city slapped a 15% tax on them. And given that Vancouver was a prime location for Chinese investors laundering their money out of China, the city got hit hard – again, down 24% in just five months.

What did I say? Bubbles. Always. Burst. There are no exceptions in history.

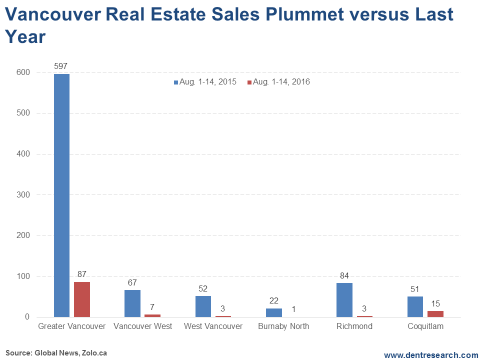

In greater Vancouver, sales have fallen from 597 in the first half of August last year to a mere fraction of that – 87 over the same timeframe. That’s an 85% crash, for crying out loud!

It gets worse. The most high-end part of the city, West Vancouver, dropped from 67 to seven – 90%.

And Vancouver West, the area across the bay with mostly upscale suburbs, which the Chinese love the most, is down from 52 to three, or a whopping 94%. The Richmond area got hit the hardest, falling from 84 to three, or 96%.

For now, buyers in Vancouver are staying put until they see how this shakes out.

But is this a crash in the making or what?

The question now is… who’s next?

My bet’s on London. I could see the highest-end falling off more rapidly after Brexit. Then San Francisco. And finally – the coup d’etat – Shanghai and China.

Let me make myself clear. This is the beginning of the greatest and most global real estate bust in all of modern history.

So I’ll ask again…

How much do you love your real estate?

Harry

Follow me on Twitter @harrydentjr

The post The Global Real Estate Bubble Is OFFICIALY Bursting appeared first on Economy and Markets.

August 25, 2016

Female Professionals are Changing Consumer Spending

I recently dropped off my youngest at college for her freshman year. She’s finally free of the prison rules of high school, and can explore life as a young adult. I’ve given her a few pointers. OK, maybe a few thousand tips on what to do and what to avoid over the next four years.

I recently dropped off my youngest at college for her freshman year. She’s finally free of the prison rules of high school, and can explore life as a young adult. I’ve given her a few pointers. OK, maybe a few thousand tips on what to do and what to avoid over the next four years.

I think I’m qualified. Her two older siblings are navigating college life just fine, with no police records and their online dignity still intact. I’m sure our parental guidance had a lot to do with this… or at least a little something.

However, there’s one area of life where I’m stumped. I can help with financial education, and picking classes, and I can even provide a little insight on selecting housing (off-campus, but adjacent property, is the bomb!). But when it comes to affairs of the heart, I go silent.

While I’d love for her to find a young man with vast earning potential, undying love and respect for her, and a healthy fear of her parents, these aren’t easy characteristics to tease out of texts and the occasional conversation. I have to trust that she’s developed her own judgment in this area, and hope that things turn out for the best. About all I have to offer on this subject is: “Keep your eyes open!”

Unfortunately, the deck is stacked against her, and things are getting worse.

I was lucky enough to meet my wife in middle school. Yes, you read that correctly, middle school. My family moved often and my eventual bride and I attended different colleges. We dated off and on for a decade, and wed in our early 20s. That experience is highly unusual, to say the least.

Most college graduates meet their spouses after high school, with many making connections at university, which stands to reason. Kids going to college share an interest in continuing their education. Beyond that, they are free to seek out clubs and activities, presumably meeting like-minded people along the way. This seems like the perfect environment for identifying potential life partners.

Compare that with days at work.

When my daughter eventually finds herself in the workaday world, chances are she’ll take a job that employs a small group of people near her age with varying backgrounds. There will be employees older than her, and in the following years other groups younger than her. Among the rank and file will be married people and singles. In the span of a summer she will have moved from a veritable ocean swimming with available fish to a pond with just a few prospective guppies.

I’m not caught up in the idea that my daughter, or anyone for that matter, must seek out a person at least equal to her own intelligence and personal motivation. If those were criteria for marriage it would be a strange, stratified world! But I do want her to find a spouse and have all the joy and life benefits that come with marriage.

Her prospects are best while in college, but the competition’s getting fierce.

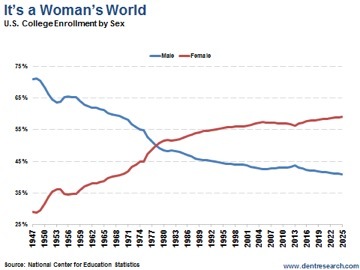

The National Center for Education Statistics (NCES) reports that in 1947, 70% of college students were male. By 1978, there was an even split between the sexes. After that, the growth rate of female students slowed a bit, but it didn’t stop. Every year, more women went to college than men.

Today, a full 57% of college students are women.

The NCES expects the gap to widen further over the next several years.

But of course, this goes beyond my daughter’s romantic prospects. The growing gender inequality among college students and graduates will affect our economy as a whole.

The change won’t be immediate, but over time there will be fewer men to fill professional roles throughout the nation. More of the posts requiring a college degree will be filled by women.

I’m not saying that’s good or bad. It just is. In a politically correct world that seems bent on curing every numerical ill, it’s interesting that this one receives so little attention.

But there are some clear repercussions in our economy.

As women fill more professional roles, they wait longer to have children, which pushes out the family formation cycle and changes consumer spending. Young, childless professionals still spend money, but they aren’t locked into spending in the same way as young families.

The good news is that the desire for children among young professionals doesn’t seem to have waned. We still expect more children in our economy, and all the required spending that comes with them. The only question left is where young couples will meet, given that colleges are so far out of balance.

Rodney

Follow me on Twitter @RJHSDent

The post Female Professionals are Changing Consumer Spending appeared first on Economy and Markets.

August 24, 2016

A Savvy Trader Asks Himself These Questions First

One of my favorite movies of all time is Trading Places with Eddie Murphy and Dan Aykroyd. It was a comedy that took place during the heyday of 1980s commodities trading.

One of my favorite movies of all time is Trading Places with Eddie Murphy and Dan Aykroyd. It was a comedy that took place during the heyday of 1980s commodities trading.

Winthorpe (Aykroyd) and Valentine (Murphy) are the subjects of a $1 bet by the Duke Brothers, who own a commodity trading firm. The bet is that Valentine can’t change his ways as a scam artist and successfully step into Winthorpe’s shoes as a wealthy commodity broker.

While the elaborate bet takes shape, the Dukes try to steal a crop report that would allow them to corner the market on frozen orange juice concentrate. However, the victims of the bet find out about the plot and turn the Duke scheme around.

They create a fake report, which the Dukes use to bid up the price as they watch the action on the trading floor and smile smugly. But, just as the buying reaches a crescendo, Valentine and Winthorpe move into the trading pit and start selling.

With the real report released, the price of orange juice futures collapses.

When all is said and done, the Dukes are left destitute, owing $394 million, while Valentine and Winthorpe make a fortune!

Trading Places was originally released in 1983, just as I was finishing my B.S. in finance. That movie is why I got my license as a commodity broker.

But while it was fun to watch, I don’t consider making a fortune on illegal inside-information or market manipulation a great trade. Instead, you need to enter EVERY trade with a plan (preferably one that doesn’t involve stealing a crop report).

A trading plan can be simple, as long as it includes a scenario for what happens when things don’t go quite according to plan. The more that can be measured, the better. In other words, if you know when you’ll take profits or cut your losses, the less emotional the trade gets.

That’s really the key. No matter what type of system or approach you take, whether it’s a trend-following system or a snap-back (reversion to the mean) system like my Treasury Profits Accelerator, you need a plan to implement it.

At the minimum, you need to answer a few questions before you put any of your hard-earned money at risk:

When do I buy (and then sell)? Specifically, what are the triggers? Is it a price? A technical measure? Something else entirely?Whatever your trigger might be, make sure it’s objective and unambiguous. Leave nothing to interpretation.

How much should I trade and how much can I afford to risk on each trade? What works for one trader might not work for another, but position sizing is an important part of risk management, so really give this question some thought.If you are unsure, it’s always better to be conservative and start with smaller positions.

Do I fully understand the strategy and the financial instruments used to execute the trade? Besides looking at a strategy’s track records, winning percentages, or average gains and losses, it also needs to make sense to you. Never trade anything – be it a stock, an options contract or anything else – if you don’t understand how it works and what your risks are.For example, in my Treasury Profits Accelerator strategy I use options on an ETF. So, you shouldn’t only understand what’s in the exchange-traded fund (stocks, bonds or derivatives) but also how options work. Having a good feel for how these instruments trade and how volume and liquidity affect pricing is helpful since those factors can sometimes move prices quickly and dramatically.

You should ask all of these questions before going into a trade.

But doing a good post-mortem is also important. Win or lose, every trade is an opportunity to learn and improve your system.

For example, in early 2015, I reviewed a losing trade within my strategy and determined that a tweak needed to be made.

I noticed that executing trades that were triggered during a low-volatility market weren’t likely to make big gains and, in fact, were more likely to lose money. After significant testing, I found a way to measure volatility and avoid periods of ultra-low volatility.

That small change keeps my subscribers out of potentially losing trades while we wait for higher volatility and profits!

I’ve had many great trades over the years. While running the Treasury Profits Accelerator strategy, I’ve recorded gains of 112% in five days, 98% in seven days, 85% in three days, and 76% in just one day, just to name a few!

All of them were executed following a solid plan.

So, next time you think about making a trade, ask yourself some questions and you could end up making the best trade ever!

Lance Gaitan

Editor, Treasury Profits Accelerator

The post A Savvy Trader Asks Himself These Questions First appeared first on Economy and Markets.

August 23, 2016

This New Technology Revolutionizes Automation

“Hey Ben, what’s the coolest tech around?”

“Hey Ben, what’s the coolest tech around?”

“Smart air conditioning, of course!”

Besides smart thermostats that connect to Wi-Fi so you can control the temperature in your house remotely using your smart phone, these tiny modern miracles are packed full of sensors that actually allow it to run itself on–demand, thereby minimizing your energy cost when you or Fido aren’t around.

How cool is that (pun intended!).

Cooler still is Toronto-based Ecobee, founded in 2007. It claims to have had the first Wi-Fi controlled smart thermostat on the market, but what really got my attention recently is the funding it just got: $35 million to continue their smart-home-technology development. The company controls roughly 24% of the U.S. market.

Then there’s Nest, which hit the big time when Google bought it out for $3.2 billion in 2014. Not too shabby for a thermostat company, right?

But does the value of these companies lie in their cool new technology alone? If it did, that would seem like a risky bet to make, wouldn’t you agree?

Well, I’m glad to say that I don’t think it does. I think their innovation is only part of their value. An even bigger component is their product’s ability to save energy costs.

Ecobee’s smart products save consumers an average of 23% on their household heating and cooling bills. Essentially, they can recoup their initial layout for the Ecobee system in 12 to 18 months. That’s not only smart technology, but a smart investment as well.

Even better… investors have enjoyed major growth in the company when it became obvious that Ecobee wasn’t stopping with smart thermostat technology.

A key part of their growth is tied to partnering with high-tech home automation systems, including Apple’s HomeKit, Amazon Echo and Samsung SmartThings, which allow users to also control things such as lighting, appliances and security, all over the Internet!

The best part is that these technologies come with a voice-activated artificial intelligence program, which essentially allows you to have a conversation with your house!

Yes! I’m geeking out over this stuff. But for good reason. There’s such potential here, not only for changing how we live, but for great investment opportunities as well. And this is one of my major fishing holes for my BioTech Intel Trader service. It’s not the only one, but it’s been good to us.

Alongside the biotech pond, we’ve been able to bank gains like 142%, 93%, 71%, 25% and 15% (listing only a few here). Of course, the unique system I’ve developed (mimicking the Department of Defense Command and Control systems) gives us an edge other investors don’t have… but the waters are teeming.

Of course, there’s something that all of these smart gadgets have in common: sensors! And lots of them.

The self-driving car-sensor startup called Quanergy just raised $90 million on a $1.59-billion valuation. Its sensor technology and artificial intelligence is similar to what’s used in smart-home systems, but the safety stakes are higher!

One key sensor technology being explored for self-driving cars is called light sensitive radar, or just LiDAR. This tech is already used in military jets and missiles, but is now available for your car!

LiDAR works by emitting millions of short pulses of lasers all around you, allowing software to create a real-time, high-definition 3-D image of your surroundings.

Thanks to advances in chip technology and processing, these systems have come down 10-fold in cost (from $80,000 to just $8,000), making them an option for use in vehicles now.

Smart sensing is disrupting the home automation and self-driving car industries as we know it. So it’s an area I’m keeping an Eagle-eye on for my BioTech Intel Trader subscribers.

You should keep an eye on it too.

Until then, stay plugged in!

Ben Benoy

Editor, BioTech Intel Trader

The post This New Technology Revolutionizes Automation appeared first on Economy and Markets.