Harry S. Dent Jr.'s Blog, page 101

September 19, 2016

Still Can’t Party Like it’s 1999

I came of age in the early ’80s, when Prince was king of the airwaves (pun intended). His smash hit “1999” had an end-of-days feel to it, asking everyone to “party like it’s 1999.”

I came of age in the early ’80s, when Prince was king of the airwaves (pun intended). His smash hit “1999” had an end-of-days feel to it, asking everyone to “party like it’s 1999.”

As time went on and the end of the century loomed, the world grew nervous about what would happen when we reached the year 2000, or Y2K. In the end, none of the doomsday predictions came true. The computers still worked, air traffic control still functioned, hospitals and banks carried on.

But one thing did stall after 1999… income. It turns out that real median household income peaked at the end of the 20th century. Last week the Census Bureau released the income figures for 2015, and while we made a bit of headway, we still can’t party like it’s 1999.

In the late 1990s, it seemed like just about everything was going right. Business was booming, the Internet was taking off, interest rates were dropping, and equity markets were reaching record highs.

Not surprisingly, real median household income also reached record levels. This statistic reflects the inflation-adjusted level of income that divides our households in half, meaning that 50% of all households earn less than this, and 50% earn more, which makes the measurement much more useful than a simple average that can be skewed by outliers.

But right after the turn of the century, the economy turned south.

The combination of pulling business forward to comply with Y2K technical specifications and a slowdown in the Internet frenzy combined to create a nasty selloff. As we marched into recession, real median income fell. The ensuing downturn was intensified by the attacks on 9/11, but soon afterward the economy started to grow.

From late 2002 through 2007, business picked up and GDP increased, driven in large part by the housing boom. Unfortunately, the typical American household never fully recovered from the selloff of the early 2000s.

Their home might have appreciated nicely, but their paycheck never made it back to the highs of the late 1990s, when the median household pulled down $57,843. After falling 4% from the top, the closest the median household came to earning more than that was in 2007, when median income reached $57,357. That’s only about $500 less than the 1999 level, but it’s eight years later.

Well, here we are again.

It’s been another eight years, and after watching income drop again, we’re oh-so-close to reaching the levels of 2007, and possibly even 2000.

It’s been a long wait!

You can see on the chart that, as the economy fell apart in 2008 and 2009, incomes followed suit. Only this time, the drop wasn’t by a mere 4% or so. It was closer to 10%, and lasted several years as we plodded our way through the financial crisis and the modest recovery.

After bottoming in 2011 and 2012, income finally moved higher in 2013, only to drop back a bit in 2014. But this year, there’s something to celebrate… sort of.

The Census Bureau reported that median household income grew 5.2% last year, the largest increase on record! Real median income now sits at $56,516, about $500 less than it was in 2007, and more than $1,300 below the level of 1999 (There is a question as to whether or not the big jump is due to a change in questions at the Census Bureau, but that’s an article for another day!).

This is a great development, but it’s not nearly enough to jumpstart the economy. There are a million reasons we’re stuck in low gear, including low productivity and a debt hangover from the growth years. But eventually it all comes back to one thing – slack demand.

The Fed (along with every other central bank) has printed trillions of dollars, trying to motivate consumers and businesses to spend. By either making money cheap to borrow or not worth it to save, the goal was to push both borrowers and savers to shop. Judging by our anemic GDP numbers, and by extension the modest income gains, it hasn’t worked. That’s no surprise.

The most influential group in our economy, the baby boomers, passed their peak spending years in 2008-2009, and now they are focused on saving for retirement.

Low interest rates don’t entice them to borrow money, it just makes it harder for them to grow their retirement accounts.

To fully get our groove back, we have to wait for the next large generation, the millennials, to form families en masse and start down their own spending path. This transition has been delayed a few years by the slow recovery from the financial crisis, but it will happen. And when it does, we’ll finally be able to party again… like it’s 1999.

Rodney

Follow me on Twitter @RJHSDent

P.S. In the years ahead, there will be many, many opportunities to increase your wealth, but you don’t have to wait around for the millennials to start generating it. Harry explores the possibilities ahead in his new book, The Sale of a Lifetime. Grab your copy today.

The post Still Can’t Party Like it’s 1999 appeared first on Economy and Markets.

September 16, 2016

London Bridge is Falling Down

I just got back from a seminar in London. I spoke there late last year for Graham Rowan, who heads the Elite Investor Club. This time, my promoters in Australia, Greg Owen and Steve and Corinna Essa, decided to team up with Graham to promote a two-day “Secure the Future” seminar in London.

I just got back from a seminar in London. I spoke there late last year for Graham Rowan, who heads the Elite Investor Club. This time, my promoters in Australia, Greg Owen and Steve and Corinna Essa, decided to team up with Graham to promote a two-day “Secure the Future” seminar in London.

I was more than happy to do that. I love London, even though it’s always cloudy and drizzly. But it was also a great opportunity to promote my new book, The Sale of a Lifetime (out now!), because it touches on many of the same themes I wanted to discuss with my British audience.

My first message to them was that the Brexit represents the peak of the massive globalization trend going back to the 1970s. Going forward, the UK is likely to become the safe haven of Europe because Germany’s demographic trends sink in the coming years – and the euro and Eurozone with it – just like Japan’s did in the 1990s.

In other words, the UK was smart to exit first!

The markets have already rewarded the FTSE stock market there versus the continued lagging markets in Germany (DAX) and broader Europe (The Stoxx 50 and 600).

But the main point is that Europe is going to continue disintegrating in the years ahead. I even think the social divide in the U.S. could cause a similar “Brexit” here, with Trump leading that – especially if he loses.

Travels in London

London really is a great city. This time around I got to see more of it thanks to several media appearances and dinners.

Andy Pancholi from markettimingreport.com is my favorite cycles guy there and will be speaking at our Irrational Economic Summit next month in Palm Beach, FL. A friend of his just happens to be my favorite actor there… James Cosmo. He’s the John Wayne of Scotland, starring in films such as Braveheart and Troy. He was even featured in the infamous Game of Thrones TV series.

I was lucky enough to sit down to dinner with him twice on this latest visit. And there were some other interesting entrepreneurs at the table with us. They included John Morris who runs a recruitment consultancy… Steve Briese of Smart Money Investor and his wife Jeanette… and Hamish Risk of the research firm Substantive Research, Ltd.

John is my idol in entrepreneurship. He’s always looking to invest in socially beneficial ventures like bringing low-cost Internet access to Africa and India – and he does it successfully. I know how hard that is, having lost much money myself doing similar investments.

Steve is an expert when it comes to analyzing the Commitment of Traders (COT) reports that the Commodity Futures Trading Commission (CFTC) releases. I’ve featured some of those same reports in recent articles to suggest that gold and T-bonds are about to turn down. (He and his wife now live in Malta. We compared notes on living there versus my new home in San Juan and Culebra, Puerto Rico.)

One of the Largest Real Estate Bubbles in the World

Many of your fellow subscribers came out to hear me speak at this London “Secure the Future” conference – and got an advanced electronic copy of The Sale of a Lifetime.

Besides telling them that the UK could likely be the cleanest dirty shirt in Europe in the deflationary spiral ahead, my main message regarded London’s real estate.

London is one of the largest real estate bubbles in the world – among all of the world’s great English-speaking cities. They attract affluent foreign buyers that are laundering their money from other countries, trying to escape their own bubbles, corrupt governments… or both.

London attracts more of the Russian and Arab buyers, but also the Chinese. And I’ve seen it firsthand.

The last time I was there, I stayed in Kensington. I was in a very nice boutique hotel, and almost all of the channels on the TV were in Arabic. Everyone there kept complaining that the Arabs and Russians had taken over downtown London.

At the conference, I showed the audience the following chart on London real estate:

Real estate there has gone up four times since 1999 and, using my new Bubble Model, I project that it will go down 64% or so. That’s actually a bit less compared to other markets like Manhattan, San Francisco and Shanghai.

Demographically speaking, the UK is actually a bit stronger than the U.S. longer-term, and much better than most of the rest of Europe outside of Scandinavia and France. Germany, of course, is the worst, along with all of Southern Europe and Austria.

And don’t even ask me about Russia and East Europe!

My view is that if Germany goes down like Japan did in the 1990s (with even worse demographic trends), there is no way that the euro and Eurozone holds up. This will make the pound the safe haven currency in Europe, while the U.S. dollar becomes the safe haven currency of the world. The same goes for their respective economies… at least in the early stage of the next great depression… as debt and financial assets deleverage.

Get Out Now

After seeing the greatest bubbles in debt and financial assets in modern history, we finally look due for a major correction – and worse.

This bubble is already showing signs of bursting in the high-ends of the leading cities – from London to Manhattan to Miami. Others, including Singapore and Vancouver, are already down 22% and 24%, respectively.

Italy is already bankrupt with bad bank loans at about 18%. It will likely default by early 2017…

China’s massive real estate bubble also looks dangerously close to bursting…

Major events like these will send a tidal wave around the world in the next year or so. And there’s nothing the central banks can do about it this time!

So, be like Baron Rothschild and get out a bit early. That way, you can preserve your capital when everything goes on sale.

And make sure you get my new book, The Sale of a Lifetime, today to get the complete story on bubbles and bubble bursts and why you need to prepare NOW for the wreckage ahead. It is both the best-written (with the help of my editor Teresa van den Barselaar at Dent Research) and the most-timely book I have ever written! It is officially available on Amazon now – get your copy.

Harry

Follow me on Twitter @harrydentjr

The post London Bridge is Falling Down appeared first on Economy and Markets.

September 15, 2016

Bubbles Don’t Correct, They Burst!

I keep going on the media and saying that we’re going to see the greatest bubble burst in modern history, after the greatest bubbles in history have clearly formed…

I keep going on the media and saying that we’re going to see the greatest bubble burst in modern history, after the greatest bubbles in history have clearly formed…

But everyone says this is not a bubble…

Because the central banks will keep supporting the economy and markets with more free money…

Because real estate is in tight supply and can only go up…

Because there is nowhere else to go but high-dividend stocks…

And because sovereign bond yields are going to negative, not just zero.

This is absolute BS!

Nothing lasts forever. You don’t get something for nothing, and that’s exactly what the central banks have created since late 2008 with their endless money printing and zero interest rate policies (which are now pushing desperately into negative territory) – neither of which has ever happened in history.

Doesn’t such desperation in policies make you wonder how weak the actual economy would be without such massive and never-ending stimulus?

The markets are so blind with free money and highly leveraged carry trades into bonds and stocks that they just don’t care about fundamentals anymore!

Earnings have been declining since late 2014, according to real GAAP or accounting standards. They have been declining for over three quarters even on the “funny money” standards… the ones that don’t count one-time losses, even though they keep occurring!

Productivity has been declining for years and is near zero. GDP has declined to just under 1% adjusted for inflation over the last three quarters… if it’s not actually lower. And the average wage has been declining since early 2000 and is close to what it was back in the early 1970s. No wonder the middle and lower-middle classes are pissed and supporting Trump and Sanders.

We’re already heading into a recession, if we’re not already in one. But the stock market is ignoring this because there’s simply nowhere else to go, as programmed by the Fed and central banks…

Just think – last Friday the Dow was off by nearly 400 points because one Fed governor said they might raise rates by a quarter frickin’ point in the coming months?

This is ridiculous!

It’s lemmings hurtling right over a cliff.

Do you want to be a sheep and follow the rest of these morons? Or do you want to preserve your wealth and have the unprecedented opportunity to cash in on The Sale of a Lifetime? That’s the title of my new book focusing on bubbles and why we never see them until it’s too late – and the extraordinary opportunity for those who can avoid the carnage.

The book is now available on Amazon starting today. Don’t miss it – and don’t be too late to sell at the top of this unprecedented global bubble in everything from stocks to real estate.

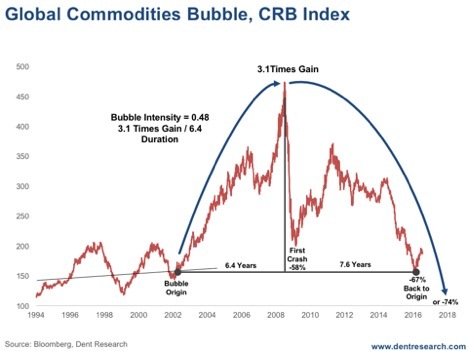

And if you don’t think bubbles can burst 80% or more in a matter of years, look at the commodity bubble that we predicted would burst many years back. Everything from oil to iron ore to corn to the general CRB Index is down 70% to 80%, with a bit more to come.

The commodity bubble proves that bubbles burst and don’t just correct.

And as it was the first to fall over the cliff… it may also be the first opportunity to reinvest in the years ahead …

Again, the sale of a lifetime is ahead if you preserve your wealth… and even grow it with our investment systems that have proven track records in both boom and bust periods.

After commodities, stocks will once again become a buy… and so will real estate.

But “buy and hold” has been dead since late 2007. It won’t be a safe bet until at least early 2020, and likely late 2022 in the next global boom – but that will be concentrated more in emerging countries like India and Southeast Asia, while the U.S. will still tend to be the “best house in a bad neighborhood” of slowing demographics and debt deleveraging.

Don’t listen to the never-ending army of pundits that are defending this bubble. It is the greatest, most pervasive, and most perverse in modern history, and it will destroy your wealth faster than you can imagine when it finally bursts – especially into late 2019/early 2020 when all four of my longer-term cycles bottom together.

Make sure you read my latest book, The Sale of a Lifetime, for the full story on how to avoid this head-on collision… and how to protect and even grow your wealth when financial assets go on sale.

Harry

Follow me on Twitter @harrydentjr

The post Bubbles Don’t Correct, They Burst! appeared first on Economy and Markets.

September 14, 2016

One Failed College, Two Big Lessons

I’ve always been fascinated by daytime television. It’s not the soap operas and Judge Whomever shows that captivate me, it’s the ads. To judge by what people are selling, there are millions of consumers at home all day who were hurt in auto accidents or have outstanding liens from the IRS. If only they can connect with the right lawyer or accounting firm, their lives will instantly change for the better!

I’ve always been fascinated by daytime television. It’s not the soap operas and Judge Whomever shows that captivate me, it’s the ads. To judge by what people are selling, there are millions of consumers at home all day who were hurt in auto accidents or have outstanding liens from the IRS. If only they can connect with the right lawyer or accounting firm, their lives will instantly change for the better!

In addition to this forlorn group, there are many others who, with the right training and certification, could transform their lives through higher earning potential and job satisfaction. Think of the vast, untapped productivity sitting on couches across America right now!

Unfortunately for the second group, their access to the good life just narrowed. The U.S. government killed off ITT Technical Institute, a for-profit college that was a staple of daytime television advertising.

Their demise is an example of a government program run amok and how, eventually, all misallocations of capital eventually fail.

I was never a fan of ITT. I don’t know much about the organization, but any learning institute that has to advertise seemed sketchy to me. Apparently several people at the Department of Education (DOE) got the same feeling. They’ve been on a witch hunt over the past two years, targeting for-profit colleges that receive the bulk of student tuition through federal student loans and have low graduation rates as well as high default rates.

ITT fits the bill… but it’s not alone.

The institute graduates a mere 19% of students, while 34% default on their loans after three years. However, Pueblo, CO Community College graduates only 18% and carries a 30% default rate. Louisiana State University at Alexandria confers degrees on 10% of its students while 17% don’t pay their loans. And closer to home for the DOE, only 12% of the students at the University of the District of Columbia graduate, but 14% default.

The numbers are similar, but apparently they don’t annoy the DOE like ITT and other for-profit colleges. Maybe it’s because ITT CEO Modany earned roughly $3 million last year. But then again, a professor at Columbia earned more than $4 million, and college football coaches regularly pull in more than $1 million. Instructors at ITT earn about $60,000, which is significantly less than tenured professors.

Whatever the reason, the DOE started questioning business practices at ITT and demanded a surety bond of $90 million in case the company went under and left student borrowers with federal loans high and dry. Then the DOE cut off all new federal student loans for ITT, and upped the surety bond to $230 million. The company earned less and had to pay more, so it died, which is apparently what the DOE wanted in the first place.

Keep in mind there’s been no trial, no finding of fault, just a concerted effort on the part of a government agency that wielded a mighty stick because of one thing – debt. Or, more specifically, government-sponsored debt.

If students at ITT didn’t have government-backed student loans, then the DOE would have to slay the company the old fashioned way, in court, proving its claims. But because the department controls the flow of funds, it wields incredible power over the institution, and just about every other institute of higher education in America.

The outcome should be sobering for everyone. I’m still not a fan of ITT, and maybe they did engage in deceptive practices and other nefarious activities as the DOE claims. But the government shouldn’t be able to pick winners and losers. It’s supposed to be a republic, where the laws apply equally to everyone.

This same fight is coming to every state in the nation, but it won’t be over private education. It will be about healthcare.

Through Medicaid and now Affordable Care Act subsidies, the government sends many billions of dollars to states that run their own programs. Costs are skyrocketing and care is getting harder to find. Eventually consumers will revolt, and the government will search for bad actors. They will find them, tucked among those states that had the audacity to run their own programs but also accepted federal funds. By taking the cash, whether they want to or not, they hand over some level of control.

In education, as will eventually occur in healthcare, it’s hard to see how any of this would have come up if costs and borrowing had grown at modest rates. This highlights the other big lesson from the ITT implosion – bubbles burst. And when they do, a lot of people get hurt.

This is analogous to the old quote from economist Herbert Stein, “If something cannot go on forever, it will stop,” which applies to many things in the financial world right now.

We have stock market records with exceptionally low growth. Students have borrowed over $1 trillion and the default rate is over 11% (I think it is much higher). Central banks are printing money and buying debt, forcing interest rates below zero in much of the world. Health insurance premiums are ratcheting up by double digits. Home prices are well above rates that are affordable given current levels of income.

All of these are situations that can’t go on forever… so they will stop. When they do, many will be financially hurt, but others will be waiting to pick up the fallen assets – bonds, stocks, homes, etc. – at bargain basement prices.

The key is knowing how to spot the bubble that’s about to pop, which is the subject of Harry Dent’s new book, The Sale of a Lifetime. Somewhere, investors are ready to pounce on the assets of ITT as it goes through liquidation in the weeks and months ahead. They are ready to profit from that bursting bubble. Our job is to recognize the bubbles all around us, get out of the way of the pain, and be ready to strike when the prices drop.

Harry’s book is available tomorrow on Amazon. Get your copy.

Rodney

Follow me on Twitter @RJHSDent

The post One Failed College, Two Big Lessons appeared first on Economy and Markets.

September 13, 2016

Retirement: You Won’t Enjoy It If You’re Broke

I walked to work today. Granted, the weather was nice and it was only about a mile and a half, so it wasn’t any major accomplishment. But for someone whose physical exercise over the past decade has mostly consisted of lifting the TV remote, it was a significant improvement from my routine.

I walked to work today. Granted, the weather was nice and it was only about a mile and a half, so it wasn’t any major accomplishment. But for someone whose physical exercise over the past decade has mostly consisted of lifting the TV remote, it was a significant improvement from my routine.

So, you might be wondering what inspired me to forgo the comfort of my car and put on my walking shoes.

It was my wife.

She’s been nagging me for months about taking better care of myself… and getting progressively meaner about it. The final blow that got me off my lazy ass was her comment that she was going to have a great time spending my life insurance money with her new cabana boy husband once I dropped dead and left her a widow.

Ouch.

Well, today I’m going to take a page out my wife’s playbook. I’m going to ruthlessly nag you, though thankfully not about exercise.

Listen to me: You need to max out your 401(k) plan.

Did you get that? You NEED to max out your 401(k) plan!

Social Security may not be around in another 20 years, or if it is, it will likely be available only to low-income seniors. And if you’re like most Americans, you probably don’t have access to a traditional pension plan. Frankly, even if you do, there’s no guarantee that yours will pay what was promised if your company falls on hard times.

So, you’re on your own. If you want anything better than life in a trailer park with ramen noodles for dinner, then you had best get to saving. And the best way to do that is via automatic investment into your 401(k) plan.

So max out your 401(k) plan.

I know, I know. Saving is hard, and you have bills to pay today. All of that might be true. But if you don’t start taking your 401(k) plan seriously, you’re not going to have enough money to retire, and you’re going to end up having to move in with your kids in your old age.

That’s a sobering thought. Not quite as sobering as thinking about your newly widowed wife blowing through your life savings with her new cabana boy husband, but sobering nonetheless. I don’t know about you, but I would be humiliated by having to look to my kids for financial support in retirement.

MAX OUT YOUR 401(k) PLAN!

So, let’s talk through this…

You can defer $18,000 of your salary per year into your company 401(k) plan, and that’s not including any company matching. If you’re 50 or older, you can contribute an additional $6,000. That gives you $24,000 in total per year. And again, that doesn’t include any employer matching. Depending on your salary and your employer’s generosity, matching can chip in several thousand more.

Most American workers take home 26 paychecks over the course of the year. So maxing out at $18,000 per year would put you at $643 per paycheck. That might sound like a lot of money, but it’s actually less than you think due to the tax benefits. If you’re in the 28% bracket, it actually equates to about $462 in take-home pay. That’s still not chump change, of course. But with a little discipline, you can squeeze it into your budget.

And if you can’t… well, it’s time to make some changes.

If you rent, consider getting a cheaper apartment or even taking on a roommate. If you own your house, consider firing your lawn crew and your housekeepers. Yes, your home and garden might not look quite as nice if you’re mowing your own grass and sweeping your own floors. But isn’t it better to tolerate a little dust and retire well than to have an immaculate house and be forced to eat cat food in your golden years because your savings ran out?

I’m not saying you must live like a pauper until you retire. But you should make maxing out your 401(k) plan a very high priority. The longer you wait to take your savings seriously, the more likely you’ll end up going to your own children with hat in hand.

Charles Sizemore

Editor, Dent 401K Advisor

P.S. The Q4 edition of Dent 401K Advisor will be released on September 30. In it, I’ll be giving you details of how to invest your 401(k) funds to maximize returns while minimizing risk. Make sure you get a copy.

The post Retirement: You Won’t Enjoy It If You’re Broke appeared first on Economy and Markets.

September 12, 2016

Finding Profits in this Low-Return Market

Stock returns have been harder to come by recently. Consider this…

Stock returns have been harder to come by recently. Consider this…

Between 2012 and August 2015, the S&P 500 gained 68% and didn’t suffer a single “correction” (defined as a drop of 10% or more). Those are the “steady Eddie” gains that long-only investors dream of.

But the gettin’ hasn’t been as good recently…

Between August 2015 and August 2016, the S&P 500 gained just 3%, after suffering two separate corrections – drops of 12% and 14%. That’s the “rocky” market that long-only investors get killed in.

Sadly, many investors bail out after a 10% drop… and then miss out on the rally, when they’re too scared to reinvest.

And that’s just U.S. stocks. Many foreign stock markets have suffered more dramatic declines over the last year.

Chinese stocks are down 6%…

UK stocks are down 13%…

And Italian stocks have lost nearly 30%.

No doubt, the past year has likely ripped a hole through traditional portfolios and investors’ business-as-usual mindsets. And worst of all, the future doesn’t look any better. Harry and I agree that the next few years will be torturous for wishful thinking “buy-and-hopers.”

But my message today is NOT one of doom, gloom or despair.

It’s one of hope and confidence.

Because it’s in exactly these environments that the actionable advice we share with Boom & Bust subscribers is so valuable. I’ll give you an example…

Back in September of 2014, before U.S. stocks took two nosedives, I was struggling through a nagging conflict in my mind.

Harry’s research was pointing toward weakening demographic drivers, weakening economic growth and weakening asset prices. He expected (and still does) that we’ll see the biggest wave of deflationary pressure since the 1930s… and in such an environment there are only two “safe” investments: high-quality U.S. debt and the U.S. dollar. (“That’s effing IT,” he’s often screamed in our meetings, except not censored like that.)

But that doesn’t mean those are the ONLY opportunities up for grabs.

You see, Harry’s job is to be ahead of the curve… to warn you of what’s to come, especially if no one’s talking about it yet. And clearly his research into demographics gives him, to quote his 1990-published book title, the power to predict.

But my job is different.

My job is to give you actionable investment advice for any environment. And my #1 rule has always been: trade WITH the trend, whether that’s up or down, like it or not!

So, as I saw it in September 2014, I had both an obligation to myself AND to Harry. I had to stick to my own proven investment methods… and I had to protect our readers from what Harry saw coming.

Ultimately, our obligation is to YOU. To both prepare you for what we see coming (Harry’s expertise) and to help you make money along the way (my expertise).

Eventually, I found a creative way to satisfy our shared goal and overcome my dilemma.

All About the U.S.

In the September 15, 2014 issue of Five Day Forecast, my weekly market note that comes complimentary with a subscription to Boom & Bust, I recommended an investment strategy, which I called our “All About the U.S.” trade.

Here’s how I introduced this unique, low-risk investment at the time:

Are you really an investor if you’re just sitting in cash?

Here’s another head-scratcher: if going to cash was completely out of the question, how would you invest in a toppy stock market?

Well, that’s the crux of the investor’s dilemma, today. U.S. stocks appear expensive and toppy after a five-year bull run. Yet, cash yields nothing. To top it off, the Federal Reserve continues to support risk assets, particularly U.S. stocks. And since the Fed’s intervention is artificial, it’s anyone’s guess when the music will stop.

The good news is that you don’t have to guess anymore! It’s no longer about finding the perfect time to yank your money out of U.S. stocks. Instead, it’s about finding a way to invest in U.S. stocks and protect yourself when they stumble. And that’s what we aim to help you do here at Dent Research.

(I’ve underlined the most important part of that introduction. But a quick aside: it’s so interesting how little has improved since 2014. Stocks are still expensive and toppy… cash still yields nothing… and the Fed is still artificially supporting asset prices, with no transparency regarding its next move!)

In that September 2014 alert, I gave Boom & Bust subscribers specific instructions on how to make a hedge-fund-like investment that was poised to benefit from the unsustainable imbalances that Harry and I were both seeing, through our own unique perspectives.

I gave clear instructions on what to buy and what to sell… tickers and all. And then we began tracking the performance of those, as we do with all Boom & Bust recommendations.

We recently closed this trade for a solid net gain of 10%. But the best part isn’t the final result, it’s that the position didn’t suffer a single “correction” (it never dropped below 10%) the entire time… even though the S&P 500 bounced up and down like a yo-yo.

Clearly, we were able to point subscribers toward these gains while cutting our risk to the bone, since our positions were market neutral (meaning, they didn’t require a bet on the outright direction of stocks.)

Instead, we positioned subscribers to take advantage of the relative performance of U.S. and foreign stocks because we were convinced that U.S. stocks would fare better than foreign stocks no matter what… whether stocks in general went up, down or sideways.

These nearly “sure bet” opportunities don’t last forever or come about too often. But when they do, they’re a great way to earn solid returns with far less volatility than the overall market.

We recently recommended to Boom & Bust subscribers that they close that “All About the U.S.” trade. We had already milked all the profits we could from it. Plus, we’ve identified a new opportunity to earn low-volatility returns.

This time around, we’re positioning ourselves for low-risk profits by playing two sub-sectors of the healthcare industry.

One healthcare niche has been unfairly punished recently, and is poised for a period of strong performance… while the other healthcare niche has enjoyed unbelievably favorable conditions for many years (conditions that are now ending).

All told, we can’t be 100% sure which direction stocks will move next. But we’re still finding creative and lucrative opportunities to earn low-risk returns in today’s crazy market environment.

Adam O’Dell

Editor, Cycle 9 Alert

The post Finding Profits in this Low-Return Market appeared first on Economy and Markets.

September 9, 2016

The Bubble Burst You Didn’t See Coming

I keep saying that in the next great crash, everything will get swept up in the onslaught – with virtually no exceptions.

I keep saying that in the next great crash, everything will get swept up in the onslaught – with virtually no exceptions.

And that goes too for what we eat!

The 30-Year Commodity Cycle peaked in mid-2008 and has been the first major bubble to crash and burn.

The CRB (Commodity) Index has been down as low as 67%, with the potential for 74% or lower in the next few years.

Among individual commodities, oil has been down as much as 82% in early 2016. It looks set to revisit its late 2011 low – $18, or down 88%. And meanwhile, iron ore and steel have been down 76% with a potential for 88%.

That all goes without saying. When my Commodity Cycle turns down, these are all likely to follow. And the commodity bubble proves that when bubbles burst, they don’t just correct in a gentlemanly manner – they crash and burn so that the downside is more like 80%, not 50% as in more normal, long-term corrections.

That said… I would have thought the last thing people would do in tough times is eat less!

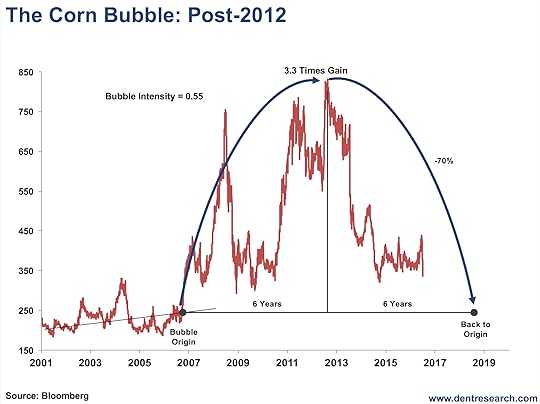

The biggest surprise in the commodity crash to me has been that even agricultural commodities like corn have crashed. It’s down 62% with a potential for 70%-plus.

Look at the chart on corn:

It’s dropped from a high of $832 in late 2012 to $318 recently!

Corn is literally everywhere. It goes in animal feed. It’s in our processed food. Cornstarch, corn syrup, ethanol… it’s everywhere. And it’s down across the board. Wheat has also fallen 61% and soybeans are down 52%.

But here’s the kicker…

You’d think with all these grains down so badly that the land they’re made on would be down as well.

But the thing is, they’re not…

Yet.

Farmland is still near its highs in many areas. In states like Indiana, Illinois and Ohio, farmland prices are still strong due to the upward pressure of suburban sprawl.

But the one state that has little suburban sprawl is Iowa, and corn is its biggest crop by far. I would know – I’ve been there several times. It seems to have more corn than people and produces more of it than most countries!

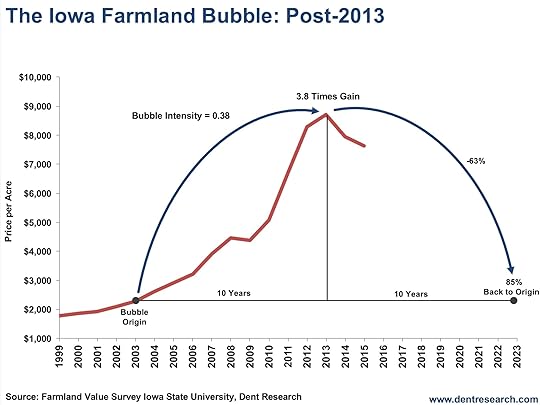

For that reason, it’s the purest state to get a feel for the farmland bubble. And the forecast isn’t pretty:

Farmland there has only fallen about 12% so far. It peaked shortly after corn in early 2013 at $8,716 per acre.

But before all’s said and done, I could see Iowa farmland crashing 63% when it bottoms out around early 2023. In general, real estate tends to fall back 85% towards its Bubble Origin as opposed to 100% in stocks and commodities.

And believe me – farmland will catch up to corn and continually lower agriculture prices in general. Whereas stocks typically crash in half the time it took for the bubble to build, commodities and real estate tend to take just as long to crash as they do to build. But the coming second and broader real estate crash will likely be what drives it over the ledge.

It’s what I’ve been saying for years: given enough time, bubbles always burst. Still, when I warn that major bubbles will crash some 63% – or more like 80% in most cases – people act like it just isn’t possible.

It’s simply because most people don’t understand bubbles! And that’s why I’ve written a new book on them.

This new book – The Sale of a Lifetime – is dedicated to documenting and explaining bubbles so there’s no excuse for being blindsided by them when they burst.

And bubbles. Always. Burst.

In the case of farmland, the chart above shows that there was indeed a bubble that took 10 years to build from early 2013. It wasn’t as steep as most residential bubbles around the world and only had a bubble intensity of 0.38 – more average for a real estate bubble.

But still high enough to trigger a 63% crash.

Again, this particular bubble peaked in early 2013. Since it took 10 years to build, it’ll take another 10 or so to burst – meaning we’ve still got about six or seven years to go with this one!

And you heard it here first!

The whole point of my new book is that bubbles are not black swan events. They are, in fact, highly predictable. Farmland may hold up a bit better than commercial and residential real estate, but it’s going down with everything else.

Once it does, farmers and investors should look for “the sale of a lifetime” in farmland around early 2023, and possibly earlier.

My book will be released next Thursday. You’ll find it on Amazon. Be sure to grab your copy.

Harry

Follow me on Twitter @harrydentjr

The post The Bubble Burst You Didn’t See Coming appeared first on Economy and Markets.

September 8, 2016

FOMC Members Hold Lofty Titles, but Little Experience

A few weeks ago I wrote to you about the Fed’s responsibilities as the central bank for the United States. Not long after, we had the Jackson Hole conference.

A few weeks ago I wrote to you about the Fed’s responsibilities as the central bank for the United States. Not long after, we had the Jackson Hole conference.

Well, we’re now just seven days away from hearing the results of their September policy meeting (9/20-9/21). Don’t hold your breath for a rate hike.

But while we wait for the Fed to do nothing… again… let’s take a look at some of the most powerful people on the planet… the people who are responsible for guiding the U.S. economy and influencing central banking across the globe.

First, a quick breakdown of what the Fed looks like…

The Federal Open Market Committee (FOMC) voting members are tasked with deciding any change to monetary policy. There are supposed to be twelve of them:

Seven (currently five) members of the Board of Governors,

The President of the Federal Reserve Bank of New York, and

Four of the 11 Reserve Bank presidents that rotate annually.

The President appoints the seven Board of Governors (BOG) and congress confirms the appointments. With all the political gridlock of late, it’s no surprise we’re currently short two board members.

These appointments run 14 years and governors that served a full term may not be reappointed.

The chair and vice-chair serve four-year terms and may be reappointed.

But who are these guys tasked with making monetary policy decisions?

What qualifies them to decide if savers get paid or punished with low-interest payments or if borrowers have access to loans with reasonable repayment terms?

Surely they’ve had extensive experience with business or Wall Street finance!

Ahem…

Janet Yellen became chairperson of the Federal Reserve in 2014.

She has an impressive Ivy League academic record at Brown, a Ph.D. from Yale and was on staff at Harvard, the London School of Economics and California Berkeley.

She served as an economist at the Federal Reserve BOG before taking leave from Berkeley to actually serve on the board.

She also served as Chair of the Economic Policy Committee of the OECD (Organization for Economic Cooperation and Development) and Chair of the Council of Economic Policy Advisers, the first being a White House adviser and the latter an international policy organization.

She then served as President and CEO of the Federal Reserve Bank of San Francisco until she was appointed to the BOG in 2010.

Hmm. While that’s an impressive career, there’s not much experience in business or on Wall Street there.

Stanley Fischer took office on the BOG in 2014 and was appointed vice-chair later that same year.

He received degrees from the London School of Economics and a Ph.D. from Massachusetts Institute of Technology (MIT). He was also a professor at MIT and the University of Chicago.

He worked at the World Bank, the International Monetary Fund (IMF) and then was Vice-chair of Citigroup until he served as governor of the Bank of Israel until he was appointed to the BOG.

Again, impressive.

Again, little to do or say with business or Wall Street.

How about Daniel Tarullo?

He took office on the Board of Governors in 2009. He went to Georgetown University, Duke University and then read for his law degree at University of Michigan.

He was a law professor at Georgetown Law, Harvard Law School and Princeton. After that he served in various government positions for the Clinton administration, Senator Edward Kennedy and the Department of Justice.

Lael Brainard took office at the BOG in 2014. Before that she was the Undersecretary of the U.S. Department of the Treasury along with a number of other government and think-tank positions.

She received degrees from Wesleyan and Harvard Universities and then was a professor at MIT’s Sloan School of Management. She worked in management consulting for a short time with McKinsey & Company after receiving her Ph.D. from Harvard.

Jerome Powell took office in 2012 to fill an unexpired term and then was reappointed in 2014. He received a degree in politics from Princeton and then his law degree from Georgetown University.

Powell served on many corporate, charitable and educational institution boards and worked as a lawyer and investment banker prior to serving as Undersecretary of the Treasury under President George H.W. Bush. He was a partner at The Carlyle Group prior to his appointment on the BOG.

Do you notice the pattern here?

Ivy League educations, heavy political connections, lofty academic backgrounds… but very little practical business experience. Two governors have law backgrounds but their political connections point directly to the White House.

The question is, does the pattern continue among the remaining committee members?

William Dudley is the President of the Federal Reserve Bank of New York and is a permanent member of the FOMC as long as he remains in this presidential role.

Mr. Dudley received degrees from New College and then his Ph.D. from UC Berkeley. He was an economist for the Federal Reserve Board and worked as a VP of Morgan Guarantee Trust until he joined Goldman Sachs. There he had a variety of roles until he became their chief U.S. economist, a position he held for a decade. He joined the Federal Reserve Bank of New York in 2007 and became president two years later.

James Bullard took office in 2008 as the President of the Federal Reserve Bank (FRB) of St. Louis. He has degrees from St. Cloud State University and his Ph.D. from Indiana University. He started as an economist for the FRB St. Louis in 1990 after graduating from IU and spent his entire career moving up the ranks.

Esther George is the President of the Federal Reserve Bank of Kansas City and took office in 2011. She has degrees from Missouri Western State University, University of Missouri-Kansas City and the American Bankers Association Stonier Graduate School of Banking and Stanford University. Ms. George has spent her entire career at the Bank, starting in the Division of Supervision and Risk Management and moving up the ranks.

Loretta Mester took office in 2014 as the President of the Federal Reserve Bank of Cleveland. She has degrees from Columbia and a Ph.D. from Princeton and is an adjunct professor at the Wharton School of the University of Pennsylvania. She also taught finance at New York University. Prior to being named President of the FRB of Cleveland, she spent 19 years at the Federal Reserve Bank of Philadelphia overseeing economists and analysts.

Eric Rosengren is the President of the Federal Reserve Bank of Boston. He took office in 2007. He holds a degree from Colby College and earned his Ph.D. from the University of Wisconsin. Since earning his Ph.D., he has spent his entire career with the FRB of Boston, starting in research and climbing the ladder to the top.

Currently, four of the five voting bank presidents spent their entire careers at a Federal Reserve Bank. Only Esther George was able to move up the ladder without her Ph.D., and only William Dudley has experience outside of the Bank.

Seven of the 10 voting members of the FOMC are Ph.D.s and only two in the group have business experience outside of the Bank.

All of the Board of Governors have government ties as advisors or held positions with government organizations prior to being appointed.

And all 10 current voting members of the FOMC have attained the pinnacle of power by being politically connected with government or through the Federal Reserve Bank. None of them were elected and few have worked in private enterprise, but they’re convinced that through all of their research and academic backgrounds, they can steer our economy, control inflation and create the right conditions for full employment and wage growth.

Are we to believe that this powerhouse of politically connected people is making their decisions free of political interference?

Can we be sure that their policies, like keeping the balance sheet full of bonds they bought during QE, isn’t politically motivated?

I don’t believe we can!

They’ve sent billions upon billions of dollars to the U.S. Treasury and nearly $100 billion from interest payments in 2015 alone!

They’ve kept interest rates artificially low for more than eight years!

That’s mighty helpful for the U.S. government when it comes to debt repayment.

Call me a skeptic, but this very powerful group tinkers with and manipulates our economy, the markets and ultimately our standard of living through nothing more than academic experiments that haven’t been proven. Some of these experiments have even outright failed, yet these people – who consider themselves economic scientists – simply respond by saying that not enough was done.

At what cost do we allow these people to continue their madness?

Harry mentioned in Economy & Markets just last week how our debt has exploded with these Fed policies and how asset bubble after asset bubble has been created.

This won’t end well, and who pays the price?

You got it…

You and me!

Lance Gaitan

Editor, Treasury Profits Accelerator

The post FOMC Members Hold Lofty Titles, but Little Experience appeared first on Economy and Markets.

September 7, 2016

The Future of the Man Cave

Every now and then the hair on the back of my neck stands up when I hear about a life-altering new technology on the horizon. Maybe I’m just a little too geeky, but connected-car technology has the potential to truly disrupt our standards for living.

Every now and then the hair on the back of my neck stands up when I hear about a life-altering new technology on the horizon. Maybe I’m just a little too geeky, but connected-car technology has the potential to truly disrupt our standards for living.

I’m not talking about just having a radio and GPS on-board your ride. I’m talking about your car becoming a mobile computing platform that’s connected to everything around you via the Internet… with all the same great capabilities of a smartphone, computer, data center, and cellular transmissions tower all rolled into one platform on wheels!

Sure, your smartphone can hail you a ride, but it can’t give you a ride. It can’t even provide its own power generation to broadcast a signal and act like a mobile cellular network!

Don’t get me wrong. I love my smartphone. But seriously! How much more productivity can we squeeze out of them by adding new software applications, updating the processing power and screen sizes, or extending battery life?

The answer is not as much as updating your car!

The key is in the size and capabilities of the platform. All new vehicles today already come with computers that enhance their basic functions, such as engine performance and drivability.

These computers are more focused on enhancing the capability of the vehicle rather than the passenger riding inside.

But automakers hope to flip that over the next several years by enhancing passenger-centric computing capabilities that are more similar to smartphones, tablets, and desktop computers connected to the Internet.

Driverless cars are already hitting the road across the country, which is the first key step in helping passengers turn their attention off the road and back onto themselves. Of course, safety is a major concern, so it’s paramount that driverless car technology become as robust, if not better, than a live driver. And this will be the case sooner rather than later.

Then comes connectivity…

In 2016 we hit a new milestone in Internet-connected devices. For the first time in history, net adds of connected cars (32%) rose above the net adds of smartphones (31%) to mobile networks. In other words, more cars connected to mobile networks than smartphones. And AT&T (NYSE: T) leads the world, with about eight million connected cars on its network.

When we blend autonomous driving and a fully networked vehicle, we get what I like to call “Star Wars” capabilities.

Hate wasting time taking your car in for maintenance?

How about it take itself in between meetings you have scheduled on your online calendar!?

Tired of staring at that small smartphone or laptop screen to watch a video or get work done?

Since you’re no longer driving, images could be displayed on your windshield or passenger windows like a monitor.

Forget curved 70-inch TVs for football season, I’d rather be surrounded by six panes of glass with 4K resolution, a 3D TV feed, and surround sound stereo!

I think you get the point. Cars will be your new man cave.

All of this tech won’t come cheap, however, but thanks to the already well-established car-finance industry, the average consumer will be able to finance these capabilities. The irony is that this will probably occur over an automated online application on their smartphone!

Of course, with anything connected to the Internet, security also becomes a major concern.

Beyond basic security measures and infrastructure, tech companies are starting to offer bounty programs to white-glove hackers who find holes in software.

Expect to see the industry for hacking or, as insiders call it, “testing” vehicle software to grow. Especially since the safety implications of breaking into a device carrying passengers at high speeds is far worse than breaking into a device in your pocket.

Connected cars will make a massive disruption in the auto and tech industries in the coming years. Count on your Dent Research team to provide you with the latest insights into technology that you can profit from when the time is right.

Ben Benoy

Editor, BioTech Intel Trader

The post The Future of the Man Cave appeared first on Economy and Markets.

September 6, 2016

Global Banks are Dead in the Water

Anyone who doesn’t recognize that we’re facing a serious debt and financial bubble has either been living under a rock, or has retreated into their own fantasy la-la-land to cope with just how bad central bankers and governments have let things get.

Anyone who doesn’t recognize that we’re facing a serious debt and financial bubble has either been living under a rock, or has retreated into their own fantasy la-la-land to cope with just how bad central bankers and governments have let things get.

News flash: they’ve gotten pretty damn terrible!

Banks have taken on too much bad debt that keeps turning into more non-performing loans, and we’re especially seeing that now in countries like Greece and Italy. But instead of restructuring those loans to let their stock and bondholders cover the losses, banks are resorting to what I call financial magic tricks.

Since 2008, the response to the global debt crisis has been to pump more free money and stimulus into the system to keep our financial institutions from imploding. That’s just crazy!

When will people learn that you can’t fight a debt problem with more debt!? And that restructuring debt is healthy long-term despite the short-term pain.

I see this all coming to a head, and much sooner rather than later.

The first trigger of the global debt crisis is going to come from Europe, where I see the banks and the economy being the weakest. Italy is the next Greece and it is simply too big to bail out. After that, it will be a domino effect. Then, when China finally blows… it’s game over! No stimulus plan will be able to cover that one.

Mark my words: the global banking crisis is here, and if you don’t start preparing for it now (or at the very least acknowledge that there’s a problem), you’re going to have your ass handed to you in the years ahead.

I’m not telling you this to scare you.

I’m telling you this because I’m determined to help you avoid the financial ruin that will befall the majority of investors in the next crash, and to help you take advantage of the opportunities that can arise in this chaotic environment.

What I refuse to do is sugar-coat the facts.

So, to get the full scope of this debt crisis, you’re going to want to read the infographic below…

Harry

Follow me on Twitter @harrydentjr

The post Global Banks are Dead in the Water appeared first on Economy and Markets.