Harry S. Dent Jr.'s Blog, page 97

November 8, 2016

No One is Talking About Our Debt, Of Course

I’m beaten down.

I’m beaten down.

Worn out.

Punch drunk.

I’m not moonlighting as a cage fighter. I’m a registered voter in a swing state.

For those of you who don’t live in Florida, Ohio, or Pennsylvania, just imagine your phones (mobile and land lines) ringing off the hook between 7 a.m. and 10 p.m. with “surveys,” “polls,” and recorded messages. My good ole fashioned mailbox has looked like a political polling station, jammed full of glossy flyers explaining why one candidate or the other is “right” for me and the country.

I’ve been barraged with leading questions about emails, sexually explicit statements, and the candidates’ various positions on domestic social programs and intervention in foreign lands. It’s been a swirling mess of message and misdirection, and no one’s happier than me that the entire, wretched affair is just about over.

But through it all, I wish I heard more about one thing.

Amidst all the conversation about historical statements, innuendos, and fluffy talk on values, no one ever discussed a real issue that the next president could actually address: the U.S. debt. It’s near $20 trillion, and counting.

The candidates made passing reference to the debt, claiming their programs wouldn’t add to the totals, but that’s not my point. No one spoke seriously about not only ending deficit spending, but also paying down the debt we currently owe.

Without such a conversation, we’re doomed to watch our debt explode.

It won’t haunt us today with interest rates hovering at exceptionally low levels…

But the 2020s are just around the corner. And with the new decade, we’re likely to enter an era of normalized interest rates, which will cause our annual interest cost to soar, crowding out other spending, and leading to, you guessed it… more debt!

Whoever takes the oath of office as the 45th president of the United States early next year, that person will preside over an expected budget deficit just greater than $500 billion, which will push our national debt above $20 trillion.

Government agencies and departments like Social Security hold roughly $5 trillion of this debt, leaving a little less than $15 trillion in public hands. Currently the average interest rate on U.S. government debt sits under 2% and our net interest cost was $223 billion last year. Sticking with round numbers, the federal budget for this fiscal year is about $4 trillion, so interest payments eat up 5% of the budget.

Over the next four years, debt outstanding will grow…

Social Security and Medicare both run deficits, so these programs are selling their U.S. Treasury bonds, not buying more, increasing the share held by the public. Overall, the Congressional Budget Office expects the public holdings to reach $16.7 trillion by 2020.

I think this is overly optimistic, since it also assumes that GDP will grow faster than 3% (even though it hasn’t in 11 years) and that Congress won’t keep extending idiotic, one-off, tax relief programs.

But for amusement, let’s stick with their numbers.

If the average interest rate on our debt holds at 2%, we’ll pay $324 billion in interest. If rates jump to 3%, the cost goes to roughly half a trillion dollars a year, for just interest. And if the average interest rate climbs to 4%, a level that was considered exceptionally low from the 1960s through the mid-2000s, we’ll pay over $650 billion per year in interest.

The increase in interest cost, from $223 billion to more than $600 billion, will eat up between 5% and 10% more of the overall budget, at the same time that we’re dealing with higher costs for Social Security, Medicare and the Affordable Care Act.

The time to do something about this is now, not when the costs are already spiraling out of control.

We need a leader, a chief executive, who will take control of the administration of this nation, setting us on the right path for economic prosperity in the years to come.

Nothing in the election process that just occurred makes me think we’ll have such a leader.

Instead, we’ll get more of the same. More promises about things the president can’t control, more platitudes about helping people through ever-bigger spending programs, and no consideration whatsoever about putting our nation on a sustainable fiscal path.

This isn’t about one candidate or the other. As I said, neither one touched on the subject beyond a throwaway line here or there. This is about what we demand of our elected officials, and what we let them ignore.

Politics is a reactionary environment, where politicians reflect the worries and wants of their constituents. If that’s the case, then Trump and Clinton rightly chose to take a pass on this issue, because we as voters did not demand answers.

We ignore the debt at our peril. When it rises to haunt us, it will be too late.

Rodney Johnson

The post No One is Talking About Our Debt, Of Course appeared first on Economy and Markets.

November 7, 2016

Premium Healthcare Increases Spell Death for 2017

My tan from my recent trip to Florida has started to fade, but the impressions from several of the great speeches I attended at the Irrational Economic Summit have stayed with me.

My tan from my recent trip to Florida has started to fade, but the impressions from several of the great speeches I attended at the Irrational Economic Summit have stayed with me.

One such speech was a by Raoul Pal, who gave a talk about major economic trends.

Pal is a former hedge fund manager from one of the premier firms in the industry. He looks at macroeconomic factors and uses the Business Cycle as a major role in his investment themes.

He suggested that, based on his analysis of the Institute for Supply Management’s (ISM) survey, we’re quite late in the Business Cycle. In fact, we could already be in a recession (as numbers get revised downward in later periods this would become apparent) or, if not now, than most certainly by Q1 of next year.

Pal also stated that, over the last 100 years, every president-elect that’s succeeded a two-term president has been met with a recession. That’s not good news for either Clinton or Trump.

While watching the presentation, and for a few days after, I thought about what might cause this recession. Then the answer hit me last Thursday.

Healthcare.

A friend of mine received his notice for increased premiums for 2017 last Thursday. His rates are rising 40%. That means about $4,000 will be picked from his pocket next year and siphoned off to pay healthcare premiums.

That’s $4,000 that doesn’t get spent on dining out, vacations, music lessons for their daughter and other activities that improve quality of life. It’s also $4,000 that doesn’t filter through the economy.

See, when you spend $100 for a night out on the town, the servers spend their tips, the restaurant pays their suppliers who then buy more inventories, and the virtuous cycle of the dollar filtering through the economy revs up growth.

This is called the velocity of money.

With healthcare premiums, it goes into a big, black sinkhole with very little benefit to almost no one. A quick look at the St. Louis Federal Reserve shows that the velocity of money is in a death spiral.

That’s very bad news.

Of course, my friend isn’t the only one affected by this. During a conversation with an insurance agent, I realized my friend got off relatively easily. Others are seeing much more dramatic increases of 60%-80%.

How do people feel about it? According to the agent, who has been accustomed to being yelled at a lot recently, they’re “pissed.”

This could have implications for the presidential election depending on how many people receive their notices and become angry in response, and any nasty surprises on November 8 could roil the markets.

But it has broader implications way beyond the election. This could be the growth killer in 2017.

I haven’t received my notices yet, but I already know I’m getting hosed. My insurance company is pulling out of the state. So, I’ll have the double pleasure of changing healthcare providers (again!) and paying more money for the privilege.

If you believe the government, healthcare costs are rising modestly. The healthcare inflation rate is 4.89%. That’s actually below the long-term average of 5.41% according to government statistics!

Does hat make any sense to you?

To steal a phrase from George W. Bush in the 2000 election, it’s “fuzzy math.”

Back in the real world, my own healthcare costs have risen 400% since I struck out on my own in business six years ago. While I’ll pay the premium increase I ultimately receive for 2017, the money has to come from somewhere. The result? I’m in complete hunker-down mode.

These increases, all while the quality of healthcare is going down, have severe implications for not only my family, but also millions of Americans in this country.

It’s going to spell death for 2017.

John

The post Premium Healthcare Increases Spell Death for 2017 appeared first on Economy and Markets.

November 4, 2016

Happy Guy Fawkes Day

Remember, remember the Fifth of November,

The Gunpowder Treason and Plot,

I know of no reason

Why the Gunpowder Treason.

Should ever be forgot.

Guy Fawkes, Guy Fawkes, ’twas his intent

To blow up the King and Parli’ment.

Three-score barrels of powder below

To prove old England’s overthrow;

By God’s mercy he was catch’d

With a dark lantern and burning match.

Hulloa boys, Hulloa boys, let the bells ring.

Hulloa boys, hulloa boys, God save the King!

–Traditional English nursery rhyme

Tomorrow, November 5, is Guy Fawkes Day. While it doesn’t get a lot of press on this side of the Atlantic, it really should. It’s the day that the English remember one of their most notorious villains (or one of their most celebrated heroes, depending on their mood or ideological leaning).

In the early hours of November 5, 1605, Fawkes was found hiding under the House of Lords with a cache of gunpowder large enough to level the entire building. He had planned to take out the entire English government — king, ministers, parliament and all — during the State Opening of Parliament. Now that’s one way to cut government spending!

Fawkes was tortured and executed, of course. Kings tend to frown on attempted assassinations, after all. But he is remembered, in typically dry English humor, as “the last man to enter parliament with honest intentions.”

Today, the English celebrate Guy Fawkes Night with fireworks displays and by burning effigies of Fawkes or of contemporary political figures… but it’s always a little ambiguous as to whether they’re celebrating the foiling of the gunpowder plot or the spirit of rebellion behind it.

More than anything, it’s an excuse to get blind drunk and light things on fire… something that every red-blooded American should appreciate.

In just a few days, we’ll have a new president elect. I don’t know who will win, but I can say with absolute confidence that they will take office as the least popular president in history.

Hillary Clinton set an all-time record this year for “strongly unfavorable” ratings from voters… only to have Donald Trump break her record!

This means that our two candidates are quite literally the two most hated political figures in modern history. Few Americans are actually voting for a person they like… they’re voting for someone they despise marginally less.

As tempting as it might be, I’m not going to recommend that you follow Guy Fawkes’ lead by putting barrels of gunpowder under Washington D.C. and then lighting them on fire. That’s the sort of thing that will get you locked up in Guantanamo for the rest of your life.

But I do encourage you to take a step back and keep this comedy show in perspective. Whoever wins on November 8, we’re still going to have to go to work the next day, and we’re still going to have portfolios to manage.

And while I can’t stand either candidate, most of their policy points are actually fairly harmless. For all the hysterics, neither is a budding dictator, and the more extreme policy proposals will never survive negotiations with Congress.

In the end, fundamental factors like demographics have a much greater influence on investment returns than politics does.

So, let’s do this…

Tomorrow night, light up your fire pit if you have one, and pour yourself a drink. In English style, make an effigy of whichever candidate you hate more and throw them on the fire. But be happy that, whichever truly despicable person gets elected in a few days, you still live in a free country, and that’s not going to change.

And on Wednesday, the day after this awful election, we’ll get back to the business of making money.

A very happy Guy Fawkes Day to all of the libertarians, anarchists and other assorted good-hearted ne’er-do-wells out there. Don’t get in too much trouble.

Charles

The post Happy Guy Fawkes Day appeared first on Economy and Markets.

November 3, 2016

Pre-Election Jitters? No Thanks

I’ve got good news! The U.S. election is finally reaching a conclusion next week.

I’ve got good news! The U.S. election is finally reaching a conclusion next week.

While many foreigners are particularly interested in the outcome, mostly because Trump wants stronger U.S. borders and the world less dependent on our aid, and Clinton wants to open up our borders, the mainstream media is trying to give everyone the jitters!

The Financial Times, Japanese-owned and headquartered in London, recently endorsed Clinton, saying she has experience. They denounced Trump, complaining that he’s arrogant.

The thing is, it’s not just The Financial Times. Most mainstream media are trying to scare people into believing that President Trump could be game over for the economy.

But, is Hillary Clinton any better?

She’s promised to hike taxes, expand Obamacare and other social programs, all of which will certainly put the brakes on our already slow-growth economy… and then there’s her desire to line her pockets while in the White House.

The thing is, the media and all the polls were wrong about the outcome of the Brexit vote. They may very well be wrong about our election as well! So, we shouldn’t pay them any attention. What we need to consider is the impact on the market…

A Trump win could shake up the markets, as happened following the Brexit vote… but a Clinton win could mean disaster down the road with her continuation of Obama’s policies. And if Clinton wins and Republicans also lose the House, the markets will certainly not like that option, either.

The thinking is that Trump is an uncertainty, and as Adam and Charles explained to Boom & Bust subscribers on Monday in their 5 Day Forecast email, the markets hate uncertainty. Clinton’s policies, on the other hand, are more of the same. But if Democrats win the House, the markets won’t like the threat of tax hikes and increased regulation.

Then there’s Trump’s threat to fire Janet Yellen if he wins the election…

I’m not sure if that would make a difference to their ineffectiveness. Still, the Fed has tried to be extra quiet this election. They held their scheduled policy meeting this week and, as expected, left rates unchanged. There really was no chance they’d make any moves the week before the election.

Despite trying to lay low, the Fed has been accused of being political. Since those on the Board of Governors are appointed by the President and confirmed by Congress, it seems logical that they are.

Nevertheless, the Fed does send the U.S. Treasury billions of dollars (nearly $100 billion in 2014 and 2015) every year in interest payments on the bonds they hold on their balance sheet. Maybe that’s why politicians are slow to take control of the fiscal budget.

But more important than the election outcome or the Fed’s political stance is one simple fact: Central banks, including the Fed, have tried everything in the book to prop up the markets. But none of it has worked. And now they have no more tools in their chest, even though their talking suggests otherwise.

Interest rates around the world climbed last week as markets started to price in the risk that central banks have done all they can.

After years of stimulus without real economic improvement, the markets are waking up to the fact that central banks are irrelevant when it comes to guiding economies through booms and busts. They could have saved time and money if they’d just listened to Harry.

Take a look at comparable 10-year rates around the world over the last month:

Most of the spike in yields happened in the last couple weeks.

Most of the spike in yields happened in the last couple weeks.

Interestingly, all major central banks around the world left monetary policy unchanged at their most recent meetings.

The Bank of Japan (BoJ) left policy unchanged on Tuesday and warned that economic activity and prices look to be lower for some time. It’s used the most stimulus over the longest period of time (nearly two decades), and it finally seems to be throwing in the towel. Quantitative easing, including stock buying, negative interest rates and yield curve management have all failed to produce results.

The Federal Reserve, European Central Bank and Bank of England also held steady on policy. Similar policy, similar results, similar failure.

Whoever wins the election next week, the editors at Dent Research are well prepared to take advantage of either outcome in the financial markets.

And whatever the Fed does or doesn’t do, doesn’t really matter. Overreaction to what happens at the Fed or after the election affects prices and yields in long-term Treasury bonds and Treasury Profits Accelerator subscribers will be ready to profit. Will you be?

Lance

The post Pre-Election Jitters? No Thanks appeared first on Economy and Markets.

November 2, 2016

Balancing the Tightrope of Risk and Return

My wife is generally a play-it-safe type of person.

My wife is generally a play-it-safe type of person.

One of my favorite stories she tells is of when she was around five years old.

Her parents took her on vacation to the beach, but before she would agree to touch a toe in the ocean (albeit while sitting safely atop her dad’s shoulders)… she asked: “Dad, what’s the scariest animal in this water and what’s the worst thing it could do to me?”

I’ve always thought that’s a funny, somewhat morbid, question from a five-year-old. But a wise one, nonetheless.

Given my wife’s innate risk-aversion, you might imagine how our conversation went when she curiously asked me about stock options.

“What happens if you’re wrong,” she asked.

“I’ll lose money,” I replied.

“How much,” she followed.

“Potentially all of it,” I admitted.

And that’s about where our conversation ended.

Of course, there’s more to this story. And today I want to walk you through one of the most important concepts in investing – particularly, the type of investing that I do in my Cycle 9 Alert research service.

The concept is the asymmetry of risk and return.

See, my success with Cycle 9 Alert, now five years running, comes down to three simple concepts. I’ll discuss the first two with you today, but the third is a bit more complex, and needs more space to be explained so look out for that in my article next week.

Let’s jump into the first two concepts…

Better Than a Coin Toss

Economist Lacy Hunt, Ph.D. gave another brilliant talk at our Irrational Economic Summit this year. During his Q&A session, he talked about how the Federal Reserve’s economic forecasts have missed by a wide margin for seven of the last seven years. And that’s despite the Fed ponying up the largest research expenditure of any financial institution in the world.

Dr. Hunt quipped that the Fed could immediately improve its forecasting ability… get this… simply by flipping a coin. If heads, the economy will grow… if tails, it’ll contract.

It’s a preposterous idea. But it holds an interesting insight. That is… with so many complex and moving parts, predicting anything in financial markets – with results better than a coin toss – is actually extremely challenging.

Now, as a practical matter, it’s absolutely possible to make money over time even while winning fewer than 50% of your trades. But psychologically speaking, I’ve learned that very few investors have the stomach to trade a strategy that wins less than half the time.

That’s why I’ve always favored investment methodologies with win-rates better than 50%.

Cycle 9 Alert, I’m proud to say, sports a win-rate of 68%. That means that for every 10 trades we make, we win about seven of them and lose about three.

This is a very favorable win-rate. And it’s not just a fluke… my subscribers have earned this win-rate record after making more than 100 trades spanning the last five years.

Bottom line: Since we win more often than we lose in Cycle 9 Alert, my strategy is fully able to absorb and overcome the losses we may suffer when a trade sours.

Our Winners Are Bigger Than Our Losers

The second factor that explains Cycle 9’s success has to do with the size of our wins (when we win)… relative to the size of our losses (when we lose).

Recall that I mentioned it’s possible to make money over time, even if you win fewer than half of your trades. That’s true… but only if your strategy captures BIG winners, relative to the size of your losers. Otherwise, the math simply can’t work in your favor.

For example, if you run a strategy that only wins 33% of the time, your winning trades have to be TWICE as large as your losing trades, just to break even.

Now, Cycle 9 Alert is NOT that type of low win-rate strategy. Since our win-rate is well above 50%, we could, in theory, take “small” winners and “larger” losses.

But here again… we’re able to do better. Since inception, Cycle 9 Alert’s average winner has resulted in a 77% profit, while the average loser has amounted to a 67% loss.

These two variables, combined, explain the success that my service has had over the last five years:

• We WIN more often than we LOSE; and

• Our average PROFIT is BIGGER than our average loss.

Taken together, this is how my strategy continues to pull profits from the market year after year, and with a similar strategy, so can you.

There’s one more factor, related to the asymmetry of risk and return, which explains the long-running success of Cycle 9 Alert. That is, our ability to invest with completely limited risk. Again, I’ll dive into that subject when I write to you next week.

In the meantime, take a closer look at the inner workings of my Cycle 9 Alert strategy here to see how it could help you.

To good profits,

Adam O’Dell

Editor, Cycle 9 Alert

The post Balancing the Tightrope of Risk and Return appeared first on Economy and Markets.

November 1, 2016

What Killed the Middle Class?

Our middle class has been shrinking substantially since the 1960s and ’70s. Today, their share of wealth is the lowest in the world, at a mere 19.6%!

But what exactly is to blame for the demise of the middle class?

Could it be the outsourcing of manufacturing jobs to China and other Asian countries?

Maybe the flood of illegal and legal immigrants into U.S. jobs?

Or possibly the growing wealth of the top 1%, and the insatiable greed on Wall Street?

All are viable candidates to take the blame. But most other developed countries face the same competition from the emerging world, and many have some degree of influx of lower-skill immigrants and most are also seeing their rich get richer… yet they haven’t been losing nearly as much of their middle class.

So, what gives in the U.S.?

Extreme political polarization and income inequality! We’re the highest on both.

Today real incomes of the middle class are 5% lower than they were in 1970 and 12.4% lower than in 2000… when they peaked!

Here’s the big insight: When we take out the affluent 10%, we see the bottom 90% average only $32,352 in income per year. The top 10% skew the overall average dramatically, so the $55,132 you hear about isn’t accurate.

In the meantime, the top 0.1% have seen their share of wealth go up four times, since 1975! And, since 1970, the “super elite” 0.01% has seen their incomes grow a whopping 628%!

Along with the most extreme political divide between red and blue parties, which makes it difficult to pass any effective legislation that would bring relief to the middle class, it’s no wonder we face massive civil unrest ahead and surprisingly strong candidacies from Trump and Sanders.

For a closer look at all of these numbers, what’s been fueling this middle-class revolt, and the dangers ahead, check out our latest infographic, What Killed the Middle Class?

Harry

Follow me on Twitter @harrydentjr

The post What Killed the Middle Class? appeared first on Economy and Markets.

October 31, 2016

The Japanese Economic Twilight Zone

It wasn’t supposed to be like this.

It wasn’t supposed to be like this.

As I learned in my MBA studies in the early 1990s, the sun was setting on the U.S. as a global economic power, just as it had on the British Empire 80 years before. The Land of the Rising Sun was ascending, and our job was to manage the decline of the U.S. as effectively as possible. There was even a book from famed McKinsey consultant Kenichi Ohmae on the subject, Triad Power.

The idea of Japan taking over the world infiltrated many parts of life. Japanese investors bought Rockefeller Center in New York, and Pebble Beach golf course in California. There was a “yellow fever” fear that, as owners of our government debt, the Japanese would effectively call the shots in Washington.

Looking back, it all sounds overblown.

Few people had Harry Dent’s insight, recognizing that while the U.S. enjoyed the early years of the greatest growth spurt in history, the Japanese were on the verge of a long, difficult economic fall.

Despite all the textbook theories and politicians’ grand plans, bureaucrats couldn’t do anything to turn the tide.

It was all about people back then.

It remains all about people today.

The Japanese had a baby boom after WWII, but it only lasted a few years. By the early 1950s, government officials demanded that citizens do their patriotic duty, limiting families to two children at most.

The goal was to keep population growth in check, focusing instead on rebuilding the country’s industrial base. It worked.

Birth rates plummeted while those in the developed world shot higher. Japan, Inc. came on with a vengeance, capturing global market share and sending wealth back home. More dollars chasing goods drove up costs, as real estate reached dizzying heights. By the early 1990s, there were bubbles in Japanese stocks, real estate, and debt. And then it all crashed.

Bubbles burst… that’s no surprise. But the Japanese economy and equity markets never recovered. They remain hobbled more than two decades later.

Some of the wounds were self-inflicted, like keeping bad debts on corporate books for a decade, hoping things would turn around. However, the bigger problem was closer to home, or to be precise, in the bedroom. They don’t have children at a rate necessary to maintain their population, much less grow.

The Japanese still suffer from exceptionally low birth rates, robbing the country of a productive working-age population, and starving the country of needed family expenditures.

One-fourth of the nation is over 65. The population of 127 million people is expected to shrink by 87 million, or 68%, by 2060. That’s just 53 years from now.

In the face of such daunting demographic challenges, there aren’t many options. One is to encourage immigration, but that’s widely frowned upon. The country has a mere 2% foreign-born population. The government recently made it easier for immigrants to work in Japan, but there are no programs of a size that would change their economic future.

In light of their cultural views, the challenge of creating economic growth has fallen to the politicians and the central bankers. The current Prime Minister, Shinzo Abe, famously announced his strategy of combining quantitative easing, introducing new money through the central bank, with regulatory reform of hiring and firing, as well as increased government spending.

The government certainly spent more, and the central bank printed more yen, but the regulatory reform never went anywhere. So far, the country’s more in debt, but still suffering low inflation or even deflation. And it’s no closer to its goals of consistent GDP growth and sustained inflation.

All of this leaves the Bank of Japan (BoJ) in a pickle.

Per economic theory, if the central bank lowers interest rates, then borrowers of all stripes will borrow more money (since it costs less). When the new credit is spent, the economy will pick up. Well, interest rates are now below zero, and the BoJ has pledged to keep 10-year government bond rates up at zero, and yet no one’s very interested in borrowing.

Someone forgot to tell economists that borrowers and spenders are people, who have greater concerns than the cost of funds. They want to know that they have enough money to stay out of poverty for the rest of their lives. With few children to care for them, the 25% of the nation in retirement is on its own. Lower interest rates mean lower earnings on savings, making it even harder to make ends meet. There is no reason to borrow. No desire for loans.

And much to the BoJ’s chagrin, even though the central bank prints more yen than the government issues in bonds each year and buys equities, the country’s currency is strengthening, not weakening, causing more deflationary pain at home.

The BoJ is between a rock (the country’s aging population) and a hard place (interest rates are already negative even though QE continues). But the current path, with a strong yen and the risk of deflation, is untenable. The country might try “helicopter money,” sending cash directly to consumers to spur spending, but that is a fiscal policy from the government, not a central bank operation.

BoJ governors must come up with more creative initiatives.

Now that they invest in equities, they could become activists, taking seats on boards and forcing higher wages. They could also demand higher dividend payments. Both moves would try to put more cash in the hands of consumers.

As for interest rates, the slight move into negative territory backfired. But a much bigger move, perhaps matching the -0.40% of the European Central Bank, might cause the sort of disruption the BoJ needs.

If they can’t force lending and borrowing, they must force down the value of the yen. This will cause inflation at home, pushing up the value of hard assets, and possibly enticing companies with full coffers to boost wages.

Whatever the BoJ governors decide to do, it will have to be something massive to move the markets – and therein lies the problem.

Not big enough, and the country suffers more of the same.

Too big, and the central bank risks losing control of both interest rates and the currency.

Finding the right balance will be difficult, although probably easier than convincing the citizens to either have more children, or accept more immigrants.

Rodney

Follow me on Twitter @RJHSDent

The post The Japanese Economic Twilight Zone appeared first on Economy and Markets.

October 28, 2016

A Tangled Web of Cyber Attacks

If you had any issues browsing some of your favorite websites last week you weren’t alone! Access to Amazon, Twitter, PayPal and Spotify, just to name a few, was totally cut off on Friday.

If you had any issues browsing some of your favorite websites last week you weren’t alone! Access to Amazon, Twitter, PayPal and Spotify, just to name a few, was totally cut off on Friday.

How could this happen?

Industry professionals call it a distributed denial-of-service, or DDoS, attack. In other words, a whole bunch of devices connected to the Internet sent a lot of data to machines (servers) that made them crash. Hackers did it, though exactly who remains in question.

The attack vector, though, is definitely known. Websites were not actually attacked. Instead, the suspects targeted the path that 99.9% of people use to get to the websites.

A bunch of online machines called domain name system servers, or DNS servers for short, help the Internet work. They allow regular folks like you and me to type in a website name and get there.

Behind the scenes, these DNS servers link the website name that you type to an IP address. So, the home address of the website, instead of 231 Main St., USA, is usually something like 198.51.100.24.

Remembering complex numbers like this isn’t the strong suit of most humans, so we hit the easy button and leverage the simplicity of the DNS servers. At least until they’re massively attacked and taken offline.

This recent attack has brought to light concerns of a possible new attack 10 days from now…

With Election Day less than two weeks away, some folks are worried that key information may not make its way to voters if we see another DDoS attack.

In Hong Kong in 2014, a DDoS attack took down a key election website during a big vote. It affected the information flow during the campaign.

So now the pay-for-protection business model is booming.

It’s something I follow as part of my MarketVOX Trader service. Disruptive technologies could help solve some cyber security problems, and I look at ways to actually profit from them.

You see, if you want major protection from a DDoS attack, you have to pay a major protection service provider to employ a massive online infrastructure to safeguard your precious site.

It’s kind of like paying your local “Union Rep,” Uncle Vito, to operate your store in his territory under his protection, whether you like it or not.

DDoS attacks are just the tip of the iceberg when it comes to threats. There are a ton of far worse events that can occur from the mischievous minds operating online.

Plain theft has been the biggest issue in recent years. Yes, getting your company’s credit card payment system hacked into is a problem, but imagine having all of your company’s intellectual property stolen.

Intellectual property (IP) includes everything from drawings, plans, training materials, trade secrets, and, of course, research and development projects.

According to a new survey from Deloitte, one-fifth of the 2,500 professionals surveyed suspect that employees and other insiders steal company IP. In the automotive industry, one-third held this suspicion!

That’s a big problem when, across the S&P 500 in 2015, companies’ total value consisted of 87% intellectual property and only 13% tangible assets.

One technique companies employ to lockdown IP theft is role-based access control on their networks. If you don’t have a critical role on a program, your access to the data associated with that program is restricted.

Role-based network identities, though, are usually accessed by… a username and password. The problem with usernames and passwords is that hackers can easily steal and leverage them to download the guarded information.

Some companies have swapped to biometrics for access, which include fingerprints, iris scans and other bodily identifiers. But what happens when the biometric data eventually gets stolen?

Most people just reset their password when it’s compromised. But resetting your fingerprint or eyeball is tough, even for a guy like Jason Bourne.

One New York City-based startup company called HYPR Corp. is working to solve the problem of biometric theft with novel solutions that involve decentralizing the data and encrypting it. HYPR recently closed a $3 million seed round to make its cybersecurity products widely-known.

Bottom line: cyber security and protection continue to be a growing and profitable business sector. The problem is that no one really respects it or is willing to pay for it until they’re the ones compromised.

It really is a tangled web of cyber security. Appropriate, with Halloween fast approaching.

Ben

P.S. Hidden Profits editor, John Del Vecchio, just released a new book on Wednesday. It’s called The Rule of 72: Compound Your Money and Uncover Hidden Stock Profits. It reveals the “legalized” lies that corporations are telling to drive up stock prices. And how they put your hard-earned money at risk. Get your copy on Amazon today or go to www.BuyRuleof72.com.

The post A Tangled Web of Cyber Attacks appeared first on Economy and Markets.

October 27, 2016

The Paradox of Thrift

My housekeeper has a nicer car than me.

My housekeeper has a nicer car than me.

Now, granted, 75% of America probably has a nicer car than me. I’m driving a car that, while only four years old, looks like it’s going on 20 because my kids have utterly destroyed it. The entire backseat looks like a Jackson Pollock painting of assorted stains and magic marker doodling.

On the flip side, the car is paid for so I refuse to pay a single nickel to get it fixed up until my kids are older. I don’t even like paying to have it cleaned because I know that it will be filthy again by the end of the day.

So I wouldn’t necessarily find it odd that my housekeeper has a nicer car than me… except for the fact that she drives a black Mercedes-Benz (the only color a Mercedes should ever be!).

Now, I’ll never fault a person for having good taste in cars. I rather like Mercedes… and I might buy one for myself once my kids are at an age where bodily excretions are no longer likely to soil the upholstery.

But I’ve done the back-of-the-envelope math, and I also know that the monthly payment on that car consumes a huge chunk of her income. It’s phenomenally bad for her personal finances to own a Benz… but it’s great for the dealership that sold it.

And that brings me to one of the more interesting concepts in economics:

The paradox of thrift.

In a nutshell, it’s good for an individual family to be frugal. You have more savings to tide you over when times get tough, and you build wealth for the future. But if everyone gets frugal at the same time, the economy grinds to a halt and there’s less wealth for everyone.

(For the wonks out there, this is an extension of the fallacy of composition, the error of assuming that what is good for the individual must also be good for the group.)

I save a little over a third of my after-tax income. That’s fantastic for me and my family. We’re a lot less likely to get booted out of our house or be denied credit if or when we need it, and I’m able to sleep a lot better at night.

But if everyone did what I did, our economy would probably be back to the Stone Age. Every cable company would be out of business (I cut the cord years ago). And there wouldn’t be a lot of people shopping at the Mercedes dealership either.

The problem is, there are a lot more people like me these days, either by choice or necessity, which is a big reason why the economy has been stalled out in a slow-growth funk for the past decade.

Roughly 10,000 baby boomers enter retirement age with every passing day, and most of them aren’t even remotely close to prepared for it.

According to the Federal Reserve’s latest Survey of Consumer Finances, the median American household, with the head of the household aged 65-74, has a net worth of only $232,000, which would include home equity. (Interestingly, the same survey reported that only 53% of American households save any money at all; the rest apparently live paycheck to paycheck.)

$232,000 isn’t going to get you very far in retirement, as Rodney discussed in the October issue of Boom & Bust (he also offered some solutions to boost your personal savings, and I added an income gem to the model portfolio).

Assuming the standard 4% annual withdrawal, you’d be looking at an annual income of $9,280. The boomers know this, which goes a long way to explaining why their spending isn’t what it used to be.

But their children, the millennials, aren’t exactly big spenders, either. Entering their careers with mountains of student debt, they’re marrying and buying cars and homes much later in life than the generations that came before them.

Again, all of these people are doing the right things on an individual level. It makes sense to pay down debts and to save for retirement. But collectively, this tightfistedness throws a massive wet blanket over the economy… which is why we’ve had years of aggressive monetary policy by the Fed, and political movements to raise the minimum wage and to forgive student loan debt.

Now, I’m not here to bash anyone’s pet political issue. But let’s just say I wouldn’t expect any policy move to have much of an impact on consumer growth. Raising the minimum wage by a couple of bucks or forgiving some portion of student debt isn’t going to compensate for the retirement of 10,000 people per day.

So we need to set realistic expectations.

The economy has grown at about 1.8% per year since 2009. That’s probably about what we should expect for the next several years as well, and that’s assuming we have no major crises (on which point, I wouldn’t hold my breath if I were you).

So back to that whole “paradox of thrift” thing… I recommend you stay frugal and focus on debt reduction over the next few years.

It’s bad for the rest of us… but it’s a lot better for you.

Charles Sizemore

Editor, Peak Income

P.S. My colleague and friend, John Del Vecchio, released his new book on Amazon yesterday. It’s called The Rule of 72 and it offers fantastic insights into how to improve your investing successes while reducing the risks. It debunks commonly held myths and exposes companies as the manipulators that most of them are. It’s definitely a must read for any investor (regardless of your level of experience). Get your copy here.

The post The Paradox of Thrift appeared first on Economy and Markets.

October 26, 2016

Unacceptable Cures for the Days Ahead

We’ve held four Irrational Economic Summits so far. Feedback after each has always been very positive.

We’ve held four Irrational Economic Summits so far. Feedback after each has always been very positive.

This year, we outdid ourselves!

George Gilder, co-founder of the Discovery Institute, literally walked onto stage, threw his arms into the air, and proclaimed: “This is the best conference ever!” And rumor has it that every morning he’d rush down to the conference hall early so he could grab a front-row seat!

And from the feedback our conference director, Amanda Klein, is reading on the evaluation forms, it’s safe to say that attendees loved this year’s conference as much as the speakers did.

Here are a few comments…

“Exceeded my expectations! Can’t wait until next year.”

“Best meeting I have ever attended. Impressed with the knowledge of the Dent team. Entire staff made me feel comfortable and important. Joining Dent Research was the best thing I have done in my 72 years.”

“This was my first IES… and I feel very fortunate to associate with the Dent organization. This was a fabulous experience for myself and my wife. We have felt for a while that the world economy was on the verge of a GIANT collapse… Fear would be the emotion of the day. But the IES meeting, along with all of the help sent out weekly on trading and market conditions, is very encouraging. We feel like we have some valuable ‘tools’ to not only avoid loss of our personal wealth… but to profit from the next ‘reset.’ We enjoyed the PGA resort… the food… the sessions… the speakers… and meeting some very fascinating people. Great experience… and thanks to all at Dent Research. See you in Nashville!!”

Really great feedback!

And there certainly was more than enough reason for it…

I kicked us off on Thursday, talking about the sale of a lifetime that’s just ahead of us. After that (a workshop presentation, book signing and panel discussion), I got to enjoy what our speakers had to offer.

The highlights for me included Dan Mitchell, senior fellow at The Cato Institute, who talked about the growing cancer of the welfare state – something we all know, but don’t fully admit.

David Walker, the preeminent expert on our government’s finances and budget deficits (federal and municipal) showed how the mandatory portion of our federal budget has taken over and we’re set for deficits to rise, even in a better economy. Not good! He presented a plan to set us on the right course, but it requires leadership, and as he said: “Leadership is this country’s greatest deficit!”

During the panel session with David and me, I had to insist that we must delay retirement by 10 years, and then continue to delay it for longer and longer to account for our increasing life expectancies. If we don’t, there’s no way to correct the ever-growing mandatory payments for healthcare and retirement.

Of course, no one liked hearing it. Unfortunately, only a major financial crisis will wake us up to the reality that there are no alternatives to these “unacceptable” cures.

Another of my favorites was George Gilder, who took a double-barreled look at how little our politicians and economists know about technologies and our free market capitalist system. It’s not about incentives – which these monkeys always manipulate. It’s about building knowledge and how our bottoms-up capitalist system so expertly leverages that if we just support it.

I’ve been following George since the mid-1990s. He’s a rare visionary for combining the logic of the new information economy into a new paradigm for economics.

Rodney gave a comprehensive case for why every attack on the dollar has failed. And Raoul Pal from Real Vision TV showed why a rise in the dollar was inevitable, as was a recession just ahead.

Then Dr. Lacy Hunt took the stage…

As I was telling Boom & Bust subscribers in their 5 Day Forecast email on Monday, he’s the only economist (outside of Steve Keen from Australia, who’s currently in hibernation in London) that I recommend you to follow.

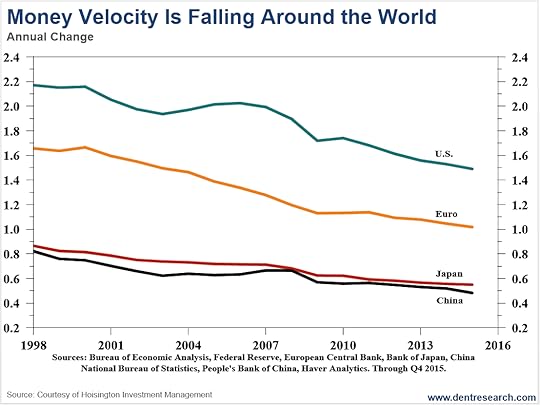

He’s classically trained and deeply knowledgeable, and goes beyond the theoretical nature of his chosen field. He understands how debt and financial bubbles build and deleverage, a rarity among economists today. And he has possibly the best explanation of money velocity. Basically, it’s a sign of how productive investment in the economy is. Productive investment creates more profits, jobs and expansion, and hence, greater M2 velocity. Speculation, stock buybacks or empty buildings do not.

His money velocity chart was my favorite of the conference. (There were so many great ones it was a tough choice!)

With this single chart, Lacy shows the level and falling trends for money velocity across the U.S., Europe, Japan and China. And as you can see, the most unproductive investment is in China!

See, solid proof from perhaps the most competent economist in America! Building stuff for no one isn’t productive for the economy.

This is the most concrete proof yet of something that should be obvious. Despite 6-10% growth rates, China’s money velocity is even lower than Japan’s most dismal “coma economy” that is surviving solely on endless QE as they age and see exponential growth in debt levels… Do you get this? China is worse than Japan when you reflect the truth of money velocity.

You can also see why we are the best house in a bad neighborhood. Our money velocity, despite continually slowing since 2000, is 50% stronger than the euro and three times that of Japan and China.

Thank you Lacy!

And finally, the top of the conference highlights for me was being out-cycled by my close friend, Andy Pancholi of the Market Timing Report (markettimingreport.com).

He not only had a shorter-term model for likely turning points in key markets (ranging from stocks to gold) that more than 50 attendees signed up for, but he also showed a series of surprisingly accurate (down to the year) long-term cycles for major tops or crashes.

Andy didn’t stop there. He had cycles of 45 years, 72 years, 100 years and 144 years that showed a clear convergence into – you guessed it, 2017 (and again in 2019)… right smack in the danger zone of my four key macroeconomic cycles.

He even dared to warn the audiences’ kids and grandkids that 2073 would see a major crash!

My longer-term indicators, using totally different cycles except for one, also point to the next global depression in the early to mid-2070s.

But man! Talk about cycles!

Without a doubt, this was our best Irrational Economic Summit yet.

If you missed it, get the Digital Replay Kit now (doors close again at midnight tonight). Do it now and I’ll throw in a special recording for you. It’s of the Network-only presentation I gave on why Brexit is the beginning of the end of globalization. I’m still hearing from members who got to listen about how mind-blowing that talk was for them!

Harry

Follow me on Twitter @harrydentjr

The post Unacceptable Cures for the Days Ahead appeared first on Economy and Markets.