Harry S. Dent Jr.'s Blog, page 99

October 17, 2016

To Beat the Market, You Need a Winning Strategy

Long-time readers should know by now that I LOVE investment systems.

Long-time readers should know by now that I LOVE investment systems.

The benefits of a well-defined, data-driven, and rules-based investment strategy are many.

For one, it removes the emotional component of your decision-making process (and, at the same time, capitalizes on the inefficiencies created by other investors’ emotional decisions). You can also test and validate its effectiveness based on historical data. Plus, it allows for a depth and breadth of data processing that would otherwise be impossible if a human analyst were to do it on a manual, or discretionary, basis.

As Dent Research’s Chief Investment Strategist, I’ve spent the past five years pointing readers to the very best investment systems.

Because even as far back as 2011, the Dent team recognized the unprecedented and extraordinary influence that central bank policies were exerting on financial markets around the world. In many ways, economic theory has been practically useless alongside the Fed’s continuous easing.

And that’s precisely why I’ve been emphatic about using rules-based investment systems to navigate today’s wacky, Fed-driven markets.

Investment Strategies Don’t Have to be Difficult!

You see, most investors recognize that financial markets are complex beasts, which are more often than not very difficult to understand. But that doesn’t make finding a profitable investment solution any easier.

I’ve addressed this topic several times at past Irrational Economic Summits.

Last year I shared with attendees my view of complexity, and simplicity, as they relate to the world of investing. The take-home message was this:

Financial markets are complex. Yet, counter to the intuition of many, the most successful investment strategies are very simple.

The complex nature – or, at least, the perception of complexity – comes from the plethora of interconnections between markets and market-driving variables… and the unimaginably large number of data points which are nearly impossible to tease apart.

Yet, the simple nature of the best investment strategies comes from their ability to hone in on one specific (and exploitable) phenomenon – one which is ubiquitously present across markets, market participants and throughout time.

“Hype” can loosely be called one such phenomenon.

Investors are emotional beings. And with that comes all the trappings of wishful thinking and great expectations. Basically, we’re hard-wired to buy into the hype… the hope… for pots of gold, which sit, waiting to be discovered, just around the corner.

Reality, of course, tends to unfold a bit differently than our rosiest expectations. Often, it’s the seemingly “sure bet” that goes bust… and the “long shot” that, quietly, comes to fruition.

And while many market trends are rather steady and predictable (i.e. Coca-Cola’s revenue growth), others are volatile and wildly unpredictable.

Ironically, very little has changed in the last five years. The world is as complex as ever. The Fed is as opaque and confusing as ever. And shoot-from-the-hip investors – those who simply make educated guesses and gut-feel assessments about the market’s next move – well, they’re still getting jerked around like a plastic bag in a wind storm.

Don’t Trust Your Gut

Fortunately, for Dent Research subscribers… we offer you the “better way.”

When I partnered with Harry and Rodney five years ago, I was our group’s only investment analyst. But now our team has grown. And even though each of us approaches the market a bit differently, we all share one thing in common…

We all rely on investment systems – not gut feel – to deliver actionable investment advice to our readers.

Myself… I manage two investment system services, Cycle 9 Alert and Max Profit Alert.

Rodney Johnson employs a rules-based strategy via his Triple Play service. Essentially, he identified a small basket of stocks positioned to enjoy baby boomer demand… and then he uses a system to assess, each month, which three stocks are most likely to outperform.

Ben Benoy has a system, too, which monitors and analyzes social media data. Doing so, he’s able to hone in on opportunities based on market sentiment.

John Del Vecchio, Dent’s resident forensic accountant, has a system which ranks companies based on the strength (and shadiness) of their balance sheets. He uses his system to identify companies that will offer huge payouts in the future… and also companies that are thinly-veiled scams, due for a dirt nap.

Then there’s Lance Gaitan’s system, which plays the short- and long-term opportunities in interest rates. His service is called Treasury Profits Accelerator.

What to Expect from IES

All told, Dent Research runs on time-tested, rules-based investment systems.

These systems are very simple to implement, requiring of readers less than an hour of their time a week. And we feel these investment systems are, bar none, the very best way to navigate the complex financial world we live in.

Each of us will go into our own unique trading systems later this week at the Irrational Economic Summit. While we all may differ a bit in terms of what we look at, we all agree on following our systems through to the end – and leaving any hint of emotion (another way of saying vulnerability) at the door.

For those of you not joining us in person, there is another way to tune into all of the presentations that this year’s Summit has to offer. For more information about our LIVE Stream, go here.

See you at Palm Beach!

Adam O’Dell

Editor, Cycle 9 Alert

The post To Beat the Market, You Need a Winning Strategy appeared first on Economy and Markets.

October 14, 2016

What Declining Earnings Continue to Tell Us

‘Tis the season. Earnings season, that is, and I don’t think we’re getting any presents.

‘Tis the season. Earnings season, that is, and I don’t think we’re getting any presents.

This week Alcoa kicked off the third-quarter earnings announcement season. The next couple of weeks will bring an onslaught of numbers, excuses, deflections, and projections. Company spokesmen and CEOs will spend time explaining why their industry is soft, and how better times are just ahead.

If only we remove those sticky one-time events that seem to happen every quarter, they say, we’ll realize that the core business is quite healthy, and things are looking up!

I’ve got a better idea. Rather than listening to the talking heads, we should simply review the results.

Taken as a whole, things aren’t terrible. But they aren’t very promising, either. We’re struggling just to get back to where we were two years ago.

At the start of this year, the consensus estimate was for the earnings of the companies in the S&P 500 to turn positive in the second quarter. U.S. companies suffered a dismal fourth quarter in 2015 that carried over to the New Year, but surely things would get better in short order.

They have, but not by much.

Taking Two Steps Back

According to FactSet, we’re staring down the sixth consecutive quarter of lower year-over-year earnings. This marks the first time this has happened since the company began to track earnings in the third quarter of 2008.

Last year, energy companies contributed to much of the decline. With the price of oil falling out of bed through most of 2015 and fracking all but shut down, energy companies gushed red ink.

The carnage was supposed to stop when oil rebounded, but that hasn’t happened. Oil climbed more than 50% higher from the end of last year, and yet energy company earnings are expected to fall 63% this quarter.

But that’s not the only suffering sector. Analysts cut their earnings estimates for materials, real estate, and consumer discretionary companies.

If earnings are reported as expected, we will have climbed back to levels first seen in the summer of 2014.

It sounds dismal, because it is. Yet the equity markets are near all-time highs. It’s as if stock prices are celebrating, even though companies are struggling to make progress.

Recently Nike surprised the markets with better-than-expected earnings, but then disappointed with their forward guidance.

Essentially, the company said things seemed pretty good lately, and enjoyed a boost from the Rio Olympics. However, they didn’t think the good times would last. These are interesting words, coming from a retail company that typically does well in the fourth quarter due to holiday sales.

But don’t worry!

Everything is fine, right?

Analysts estimate earnings will pop 13% in 2017, so the good times will finally be here again.

I’ll believe it when I see it.

Nothing Can Last Forever

There’s also the little matter of stock buybacks. Once the province of failing companies that were eager to shore up their price-earnings ratios by taking shares out of the market, stock buybacks have been all the rage since the financial crisis of 2008.

Companies are using their cash stockpiles and debt (courtesy of exceptionally low interest rates) to retire stock by the truckload. In the first quarter of this year, companies in the S&P 500 spent more than $150 billion to buy back their shares. They have spent more than $2 trillion on their own stocks since 2011.

When dividends are included with stock buybacks, companies in the S&P 500 have paid investors 112% of what they made in the first half of 2016. To put it mildly, that’s unsustainable.

These three trends – falling earnings, stock buybacks, and equity market gains – make for an interesting paradox. Companies are telling us in no uncertain terms that growth remains elusive and they can’t find a good use for cash. Yet stock buyers keep pushing up share prices.

Once again, I’m reminded of the old quote by economist Herbert Stein: “If something cannot go on forever, it will stop.”

After seven years of growth based on shaky fundamentals, trillions of dollars in stock buybacks, and central bank action, equity markets are at risk. Make sure you have a plan for when that “something” that can’t go on forever, finally stops.

Rodney

Follow me on Twitter @RJHSDent

P.S. Don’t forget to join me, the Dent Research team and other financial luminaries like David Walker and Lacy Hunt next week at the Irrational Economic Summit in Palm Beach, FL. I look forward to seeing you there. And if you can’t make it to the PGA National Golf Resort from October 20-22 to take in our presentations and mingle in person, make sure to watch online via our LIVE Stream.

The post What Declining Earnings Continue to Tell Us appeared first on Economy and Markets.

October 13, 2016

Thanks for the Favor, Fed

Everybody and their brother curses the Fed, with good reason. They’ve essentially taken the “free” out of free markets – and there’s nothing that makes us, as investors, more uncertain or uncomfortable, right?

Everybody and their brother curses the Fed, with good reason. They’ve essentially taken the “free” out of free markets – and there’s nothing that makes us, as investors, more uncertain or uncomfortable, right?

We know the Fed’s hand is heavier than ever… but what the hell are we supposed to do about it!?

Many of the experts we’re bringing to our 4th annual Irrational Economic Summit next week have strong opinions about the Fed. It’ll be well worth your time to hear what they have to say.

As I see it… the Fed is to blame for the next financial crisis (whatever shape that may take, and whenever it should finally appear).

But instead of crying about it, I’m more concerned with profiting off the Fed’s intervention.

You see, you essentially have two choices heading into the next global financial crisis.

You could do exactly what you did ahead of the last global financial crisis, in 2008.

Or, you can arm yourself with a far-superior survival strategy – one that capitalizes on central bank intervention.

Mind you… I don’t actually know what you did ahead of 2008. And I don’t know exactly how you fared through that confusing, tumultuous period.

But I know what the majority of “typical” investors did, and I know that if they had used my survival strategy… well, they’d be a lot richer (and happier) today.

Let me show you what I mean…

This chart shows the power of the survival strategy I’m talking about. Take a good look at it, then I’ll explain how this strategy exploits a Fed-driven phenomenon – one that I spoke about publicly at our Irrational Economic Summits, in both 2014 and 2015.

A $10,000 investment in the S&P 500, made in August 2007, is now worth about $14,500 – a total return of 45%. But you only got this return if you were willing to sit through a 53% drawdown!

Meanwhile, a $10,000 investment using my survival strategy is now worth around $19,000 – a 90% total return. And you could have gotten there quite smoothly, never losing more than 5% of your initial investment.

Which would you rather have?

A 90% return, while suffering a 5% drawdown?

Or a 45% return, after suffering a 53% drawdown?

It’s a pretty obvious choice, I think!

Clearly, my survival strategy is able to weather the storm better than a passive investment in the stock market… it’s able to generate stronger returns, with less volatility, over the long run.

That’s all thanks to the Fed (not despite them)!

You see, the Fed is now on a course of raising interest rates. And they’re doing it while almost every other central bank in the world is lowering interest rates.

This is precisely the “central bank policy divergence” that I began speaking about at our Irrational Economic Summit in 2014. I knew the day would come… and now that day is here!

What’s more, I knew back in 2014 that this divergence in global monetary policy would likely have two effects.

It would confuse the snot out of people, for one. And it would set stock markets around the world on divergent paths – creating a wide spread between the “big winners” and “big losers.”

It took a while for this theme to fully develop. But consider where we are today…

Over the last quarter, the best-performing stock market in the world is up 24%. And the worst-performing stock market is up just 3%. That’s a fairly large spread, at 21%.

The spread between top- and bottom-performing global stock markets is being driven by the divergent policy actions of central banks around the world. And my research shows this metric is a predictive indicator for how risk-on and risk-off markets will perform.

This is what I was talking about in my Irrational Economic Summit speeches back in 2014, and again in 2015. And this is why I think you should consider a survival strategy approach ahead of the next financial crisis.

I’ll be covering the ins and outs of my strategy during this year’s conference next week. As far as I know, it’s the only strategy that’s able to safely capitalize on central bank shenanigans.

Adam O’Dell

Editor, Cycle 9 Alert

The post Thanks for the Favor, Fed appeared first on Economy and Markets.

October 12, 2016

China’s Orgasmic Real Estate Bubble

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

No question about it. China definitely takes the cake when it comes to bubble creation. The government encouraged everyday people to speculate in stocks in late 2014 and 2015 to help offset the slowdown in its gargantuan real estate bubble. The stock market bubbled 160% in one year and then crashed 50% (and you can be sure there’ll be more losses to come after a year of propping up a market that has merely gone sideways…)

Then to cushion that 2015 stock crash, the government made loans easier for real estate again. Bank loans surged by 7.5 trillion renminbi (RMB) in 2015 and are on track to surpass 15 trillion RMB by the end of this year. About half of these loans are in mortgages.

So what happened?

After flattening for three years, real estate prices went totally bananas again. They’re up 59% in the hottest large city, Shenzhen, since February 2015. They’re up 35% in Shanghai.

Just look at this bubble in Tier 1 cities. Real estate is up 48% since just February 2015! Since early 2010, it’s up 107%. That’s clearly the orgasmic phase of this bubble.

Shenzhen is the large industrial city outside of Hong Kong and it is now the next bubble city. Property prices there have surpassed Shanghai and Beijing prices for the first time.

But there are a number of Tier 2 cities that are bubbling even faster. Seven major cities have seen more than 50% growth in the square footage sold in the last year. These include:

The amount of square footage sold in Changzhou in the last year has increased by 138%.

Changsha saw an increase of 107%.

For Tianjin it’s 107%.

In Fosh, it’s 103%.

In Zhengzhou, 94%.

Hangzhou, 82%.

And Jinan, 65%.

Chinese billionaire Wang Jianlin calls it “the biggest bubble in history.” And the richest man in China, with a net worth of more than $30 billion, has been selling all of his real estate as fast as he can since early 2014. That’s what you call “the smart money!” Just like Baron Rothschild, selling a bit earlier rather than later is always prudent because bubbles tend to crash twice as fast as they build and real estate gets illiquid the fastest.

A Bubble Looking for a Pin

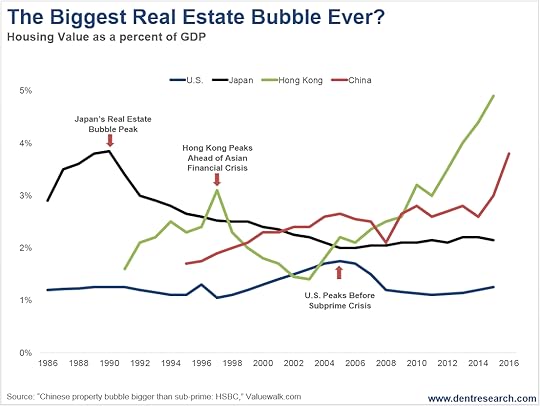

For more evidence of how bubbly China’s real estate is, look at this next chart from HSBC. It shows the total value of residential housing as a percentage of GDP, as is possibly the best measure of the situation over there.

China’s ratio (the red line) is currently 3.27 times GDP, and forecast to hit 3.72 times by year-end!

Japan’s great bubble (the black line) peaked in 1990 at 3.7 times GDP. Shortly after, property prices fell through the floor, losing 67%!

Hong Kong’s 1997 bubble peak (green line) was at 3.04 times.

The U.S. bubble peak (the blue line) in early 2006 was at 1.75 times.

And, as if that wasn’t bad enough, remember that China’s GDP per capita is only $8,240. It’s not nearly as rich as Japan ($44,647), Hong Kong ($36,117) or the U.S. ($56,000). It should not have debt or real estate at similar extreme values. Yet it does!

Hong Kong still holds the honors for the greatest bubble of all thanks to affluent Chinese laundering their money there, just like they are laundering it into other major English speaking cities around the world. Hong Kong’s housing value to GDP is now at 5.0 times and projected to go to around 5.5 by year-end.

Talk about a bubble looking for a pin!

Chinese property owners are in for a rude awakening ahead!

But let me leave you with the most absurd thing I’ve seen since 400 sq. ft. condos in Vancouver selling for $500,000…

The new trend in Shenzhen is 66 sq. ft. “closet condos,” with a fold down single bed, selling for $132,000. That’s $2,000 per sq. ft.! That’s pricier than Vancouver’s tiny condos, only in a city where the typical person earns a little less than $20,000 a year! It takes about seven times their income to buy a closet studio apartment.

If that ain’t a bubble, I don’t know what is!

Harry

Follow me on Twitter @harrydentjr

The post China’s Orgasmic Real Estate Bubble appeared first on Economy and Markets.

October 11, 2016

Nursebots: The Future of Healthcare

My lovely wife is contributing to one of the greatest supply and demand problems of our time – and doesn’t even know it.

My lovely wife is contributing to one of the greatest supply and demand problems of our time – and doesn’t even know it.

Let me explain before I get in too much hot water. My wife became a registered nurse since 2006, but currently takes care of our four eating machines (kids) full-time at home.

Though a blessing for our family, she represents one more RN out of the manpower-starved healthcare workforce.

The Bureau of Labor Statistics estimates that, by 2022, more than one million registered nursing jobs will be unfilled. This is even with 19% growth in the nursing labor force by that year.

What compounds this issue is that by 2030, 69 million people, or roughly 20% of the U.S. population, will be senior citizens.

So, we face a nursing shortage and more people to take care of. But what is there to do? There may be an answer brewing in the tech sector: Robots.

Yes, Japan already leverages nursing robots, where the number of people 65 years old or older accounts for a hair over 27% of the nation’s population.

Before you get all worried about a rogue nursing robot apocalypse, understand that right now these robotic marvels of technology only operate under the supervision of a trained human healthcare professional.

Helping Out with Every-Day Tasks

Currently, nursing robots perform basic functions…

I’m talking operating as a smart medical cart, delivering medicine, supplies, and retrieving records.

In nursing homes, so-called Nursebots remind patients to take their medicine, use the bathroom, and get ready for appointments. They even assist them getting into and out of beds and wheelchairs!

These robots don’t actually diagnose or treat patients yet. Their primary purpose is to free nurses from arduous tasks, allowing them to focus more on patient medical care.

Some robots, such as MantaroBot, Vgo, and Giraff, are more communication devices than physical helpers. They’re controlled through a computer, smartphone, or tablet and allow physicians and family members to remotely monitor patients.

Interested in striking up a conversation with grandma?

Well, you can configure most robot face screens to display your likeness, video conference-style.

A face-to-face with grandma is certainly the bee’s knees. However, the most interesting breakthrough in leveraging machines for healthcare took place in the field of artificial intelligence. 60 Minutes actually featured a piece on this Sunday night.

Healthcare Made Easier

Every day, physicians exploring the latest diagnosis and treatment options publish roughly 8,000 medical papers and journals.

No matter how good your doctor is, it’s damn-near impossible for them to keep up with the volume of latest discoveries and treatment options for diseases like cancer.

IBM (NYSE: IBM) has made this arduous task of data ingestion and discovery a bit easier by putting their Watson supercomputer on it.

Yes, that Jeopardy-winning computer is now using its artificial intelligence programing to process millions of data points in medical journals, imagery, and patient genome data to tee up treatment options for physicians to prescribe.

How good is Watson?

The UNC Lineberger Comprehensive Cancer Center discovered that by leveraging this technology, they found new potential treatment options in 30% of patients that would have been overlooked using traditional human-only review methods.

Simply put, robots and artificial intelligence are a game-changer for the healthcare community. These technologies are disrupting how physicians diagnose and treat patients, in a radically good way.

And they’re trends worth following, as we do at Dent Research. We hunt for the tech-world insights and market plays so you can profit… while medical patients around the world, thanks to robots and A.I., potentially do the same.

Ben Benoy

Editor, BioTech Intel Trader

The post Nursebots: The Future of Healthcare appeared first on Economy and Markets.

October 10, 2016

Financial Advice from a Loan-Sharking Gangster

I don’t make a habit of taking financial advice from loan-sharking gangsters.

I don’t make a habit of taking financial advice from loan-sharking gangsters.

In fact, I don’t know that I’ve ever actually had a conversation with a loan shark. And I value my kneecaps far too dearly to ever actually solicit their services. But once in a while, even a scumbag hustler can have a remarkable piece of insight.

In case you haven’t seen it, The Gambler, which came out two years ago, is really an underrated movie. Mark Wahlberg is the lead, but his character – a degenerate gambler that resorts to taking loans from the underworld to fund his habit – is such a miserable person, he’s actually hard to watch.

However, the real star of the show is John Goodman, who plays a gangster that threatens to murder Wahlberg’s family if his debts aren’t repaid. The interaction between the two is priceless… if perhaps a little salty… and actually has some of the best financial planning and risk management advice I’ve ever heard.

You see, Gangsters don’t exactly run your credit report at Experian before offering you a loan. But they do an assessment of sorts on their borrowers’ ability to repay. They are businessmen, after all… and the primitive forbearers of the modern banker.

So, as Wahlberg approaches Goodman hat in hand for the loan, their conversation goes like this:

Goodman: I need to know if you’ve got the f***ing brains to walk when it’s time to walk. People don’t, you know. Ball players that can’t play anymore. A**holes trying to maintain a standard of living that’s not possible anymore. A lot of those around. I’ve seen you half a million dollars up.

Wahlberg: I’ve been up two and a half million dollars.

Goodman: What you got on you?

Wahlberg: Nothing.

Goodman: What you put away?

Wahlberg: Nothing.

Goodman: You get up two and a half million dollars, any a**hole in the world knows what to do. You get a house with a 25-year roof… you put the rest into the system at 3-5% to pay your taxes and that’s your base, get me? That’s your fortress of f***ing solitude. That puts you, for the rest of your life, at a level of f*** you. Somebody wants you to do something, f*** you. Boss pisses you off, f*** you! Own your house. Have a couple bucks in the bank. Don’t drink. That’s all I have to say to anybody on any social level.

That’s remarkably sensible advice for a man that earns his living breaking the knees of people that don’t repay their loans.

Sticking it to the Man

Think about it.

When you owe money, you’re effectively a slave. No, Bank of America isn’t going to murder your family if you default on a loan. But the existence of that debt limits your choices. It may keep you at a job you hate and prevent you from pursuing your dreams. The stress of having bills to pay may affect your marriage and cause discord at home. It may even affect your health.

How many men literally worked themselves to death trying to pay for a “standard of living that’s not possible anymore”?

The truth is that you don’t have to have millions of dollars in the bank to have “f*** you money.”

In fact, wealthy neighborhoods are often full of high-income-earning people who are more miserable than the high school dropout making sandwiches at the Subway down the street, because no matter how much money they make, they can’t relax knowing they have very expensive bills to pay.

No, to have the power Goodman describes, you simply need to live within your means, get your house paid off and avoid bad lifestyle habits like excessive drinking.

Advice to Live By

My advice to you is this: with stock and bond prices looking elevated, don’t fixate solely on the stock market right now. Focus on generating income and use the excess cash flow to make accelerated payments on your mortgage. By making an extra payment now and then, you can turn a 30-year mortgage into a 20-year one… or even less.

Get out of debt and avoid the temptation to upgrade to a bigger house. At the end of the day, you don’t really need it. If a family of six could survive in a 1,900-square-foot house in the ’60s, your family of three can get by without 3,500 square feet to live in – and it just might keep you out of an early grave.

Follow Goodman’s advice. Pay off your debt. Avoid drinking to excess. And smugly give the middle-finger salute to the Man.

Charles Sizemore

Editor, Peak Income

P.S. I realize that in today’s low-yielding environment, bringing in extra cash to pay down your debt can seem impossible. But it’s not actually that hard if you know where to look for income. This is something I’ll go into detail about at the Irrational Economic Summit later this month. I look forward to meeting you then.

The post Financial Advice from a Loan-Sharking Gangster appeared first on Economy and Markets.

October 7, 2016

Central Banks: One Failed Attempt After Another

After a quiet summer in the markets, volatility finally picked up in both stocks and bonds. From early July through late August virtually no movement occurred in the Treasury market and stocks barely budged.

After a quiet summer in the markets, volatility finally picked up in both stocks and bonds. From early July through late August virtually no movement occurred in the Treasury market and stocks barely budged.

During this quiet period, central banks around the world sat on their hands.

They may have talked a lot, but they didn’t actually do anything.

Then again, what could they do…?

The Bank of Japan (BoJ) has tried just about every trick in the book to kick-start inflation and prompt lending, which would grow their economy. Nothing worked.

When it introduced a negative rate, the markets punished the decision by selling Japanese bonds and firming up the currency — the exact opposite of what they tried to accomplish.

For more than two decades now, the BoJ has tried to manipulate an economy suffering from poor demographics (shrinking and aging population) into a competitive world beater.

They’ve failed miserably…

One Failed Attempt After Another

Their problem is unfixable. An aging population spends less and doesn’t borrow.

Closer to home, the Fed has tried some of Japan’s tricks, like cutting the key interest rate to zero and then buying bonds or using quantitative easing (QE) to increase liquidity in the system.

It’s a mystery to me why they thought doing it in the U.S. would produce different results than those achieved in Japan, but be that as it may…

The Fed’s objective was to encourage spending, inflate asset prices, encourage borrowing and magically make the economy stronger.

Well surprise, surprise. That didn’t work here, either!

But apparently, running into a brick wall over and over again seems like a good idea. After all, what do us mere mortals not on a central bank board know?

Not long after the Fed threw trillions of dollars into QE, the Europeans decided it was their turn. The European Central Banks (ECB) implemented its own version of QE and many of their key interest rates are now negative.

Have the ECB stimulus programs worked to gear up their economies or stabilize prices or encourage lending?

No way! And in fact, it’s a disaster that’s starting to come unraveled.

Just look at the most stable economy in the Eurozone, Germany. Big banks like Deutsche Bank and Commerzbank have major problems. Will they get bailed out while Italian banks struggle? Unlikely, considering Angela Merkel has already said: “hell no!”

Still… central bankers around the globe continue to make bad decision after bad decision. And even though investor focus remains on what these geniuses will do next, their credibility is running on low.

Markets worldwide are coming to the realization that central banks don’t have the capacity to actually guide an economy. Besides, was that even why they were originally formed? And if they don’t have this all-powerful ability (intended or not), what now?

I’ll answer those questions at our Irrational Economic Summit later this month. The answers will surprise you!

I look forward to seeing you soon.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Central Banks: One Failed Attempt After Another appeared first on Economy and Markets.

October 6, 2016

Will We See a U.S. Split?

People don’t think I’m being serious when I say that this country could experience a split that makes Brexit look like a tempest in a teacup.

People don’t think I’m being serious when I say that this country could experience a split that makes Brexit look like a tempest in a teacup.

I’m talking about our country splitting in half (perhaps into even smaller segments) and I’m dead serious! While this isn’t a certainty, it’s clearly a possibility you should plan for.

There’s an ever-widening political/social gulf between the right and left. Any middle ground for compromise or agreement shrinks with every passing day. It’s like the Nothing in The Never Ending Story… dissent and social unrest this dark, ominous cloud devouring anything and everything in its path as it closes in on itself.

Of course, when I say “split,” that doesn’t necessarily mean the creation of totally separate nations (although that’s not totally out of the question), but the formation of clear red and blue zones, each with different social, regulatory and fiscal policies. And that could be as devastating as the North/South split coming into the Civil War.

Pew Research, the best general non-partisan research organization in my mind, shows the level of polarization in the U.S. today best in this chart…

Just look at the widening split between the median Democrat and the median Republican on a liberal-to-conservative scale of one to 10 between 1994 and 2004!

Now the divide has shifted from about 10% to 35%, favoring the Republican side a bit more.

But more important, among the politically engaged, the split is much wider! It’s closer to 55% apart, with the majority of both on the far left and far right!

In 1994, 64% of Republicans were more conservative than the median liberal. Today, that number is 92%.

Democrats shifted from 70% being more liberal than the median Republican to 94% between 1994 and 2014.

Thirty-six percent of Republicans see the Democratic Party as a threat to the nation’s well-being. Conversely, 26% of Democrats view the Republican party as such a threat.

The most surprising part is that most of this great divide has occurred since 2004, in just the last decade. In fact, political polarization wasn’t this extreme in the Roaring ’20s or Great Depression… a time when wealth and income inequality were as extreme as they are today.

And that makes today’s situation about as dangerous as the time leading up to the Civil War.

It’s not so much because of the extreme growth of the top 0.1% to 1% in income and wealth. That exploded in the second half of the 1990s and first peaked in 2000.

No. This is more about the destruction of the middle class… and that’s why Donald Trump got a larger following than Bernie Sanders, who was more about the revolt against the rich 1%. The civil unrest dividing the nation now could very well tear us apart.

There has also been a huge decline in the trust of the mass media, especially among Republicans – from a high of 52% in 1998 down to a mere 14% in 2016. Independents’ trust in the mass media peaked at 55% in 1999 and has fallen to 30%. Democrats’ trust fell from 70% in 2005 to 51%, currently.

This opens the way for a revolution in the media as well, especially on the Republican side.

And it’s why I see Donald Trump – love him or hate him – being more powerful if he loses this election and forms a new conservative media channel with his two partners, Roger Ailes (from Fox) and Stephen Bannon (from Breitbart News).

Such a new media push could continue to build this great polarization, especially from the Republican corner, where it’s already most extreme (and well-armed). It could well create a growing demand for a red/blue state split where we may have a single trading zone like the European Union, but two or more political institutions for social laws, fiscal policies and regulations.

The extreme economic decline I’m predicting will only feed such a split and greater civil unrest.

At this point, you need to not only make sure your capital is protected, but consider where you can live that will be the safest… areas like the middle of the country, exurban areas of larger cities and the Caribbean are good options.

Harry

Follow me on Twitter @harrydentjr

P.S. On October 11, at 1 p.m. EDT, you can watch the premiere of an exclusive interview I conducted recently on this exact topic. For the sake of your wealth and survival, I urge you to reserve your FREE viewing spot now.

The post Will We See a U.S. Split? appeared first on Economy and Markets.

October 5, 2016

The Green Light on Global Stock Buying

The American Association of Individual Investors (AAII) conducts a survey each week, simply asking investors: “Are you bullish, bearish or neutral?” Consider it an appraisal of the market’s mood. A mood ring, if you will.

The American Association of Individual Investors (AAII) conducts a survey each week, simply asking investors: “Are you bullish, bearish or neutral?” Consider it an appraisal of the market’s mood. A mood ring, if you will.

For 80 of the last 82 weeks, optimism has run below the survey’s long-term average. That’s a long stretch of pessimism.

Last week’s AAII survey shows that the market’s mood still falls on the negative side.

Currently…

37% of respondents labeled themselves “bearish” (an above-average reading).

39% labeled themselves as “neutral” (an above-average reading).

And only 24% called themselves “bullish” (a below-average reading).

Considering the mounting number of global risk factors, over-inflated stock valuations and our own forecast of economic trouble ahead, it’s not at all surprising to see investors gripped with doubt and fear.

Clearly, pessimism is the market’s dominant psychological trend.

Meanwhile, though, the dominant trend in stock prices is still positive.

I explained this to my Cycle 9 Alert readers last week, when I shared with them charts that show the majority of stock markets – both in the U.S. and abroad – are in long-term uptrends. (Note: Cycle 9 Alert is designed to hold positions for three months at a time, so “long-term” to me and my subscribers is about six months).

This sounds perverse, but it’s actually the way the stock market typically works. When investors are especially fearful, stock prices tend to rise. And when investors are especially confident, stock prices tend to fall.

And since most investors are currently pessimistic and fearful, I suspect they’re overlooking the bullish opportunity in global stocks today.

Not only are investors especially nervous about buying stocks today, they’ve long favored the relative safety of U.S. stocks.

For many reasons – good or bad – U.S. investors almost always feel safer buying U.S. stocks. It’s an illusion of course… but most U.S. investors feel like they understand, and can control the risks of investing in, companies based in the United States, relative to foreign companies.

The idea of investors’ home-country bias isn’t new. It’s a behavioral phenomenon that’s well-documented and pervasive. I suppose, for some investors, it’s a case of the devil you know is better than the devil you don’t.

Either way, home-country bias causes many investors to foolishly pass over investments that are best positioned for strong performance, in favor of investments that make them feel comfortable.

U.S. stocks have had a great run in recent years – outperforming almost every other country’s stock markets by a long run. But that trend of U.S. outperformance can’t last forever. And I’m currently seeing signs that suggest foreign stocks are likely to outperform in the months ahead.

According to Nautilus Research, an institutional quant shop, something unique happened last month: more than 15% of global stock market indices hit a new one-year high. This represents the global market’s strongest breadth in more than two years.

Historically, this global buy signal has led to consistent and strong performance of global stock markets.

On average, foreign stocks have gained 1.7%, 3.1%, 6.2% and 9.7% over the following one, three, six and 12 months, respectively. And those gains are far stronger than global stocks’ typical returns over the same time-frames (of 0.5%, 1.5%, 2.9% and 5.9%).

Now, I fully realize that buying any (global or foreign) stocks at today’s valuations is scary. The cyclically adjusted price-to-earnings ratio (CAPE) for U.S. stocks is sitting around 26.5, more than 65% above its long-run median of 16.

Yes, stocks are expensive!

But that doesn’t mean you should altogether avoid buying stocks!

History shows that, despite an “expensive” CAPE ratio, stocks can still move strongly higher. Consider a number of the historical global buy signals Nautilus Research identified.

The MSCI World Stock Index returned…

22% between January ’93 and ’94 (despite a CAPE of 20.3).

12% between July ’95 and ’96 (despite a CAPE of 23.4).

20% between October ’96 and ’97 (despite a CAPE of 26.5).

18% between February ’98 and ’99 (despite a CAPE of 34.7).

11% between April 1999 and 2000 (despite a CAPE of 42.7).

Do you see the trend?

Between 1993 and 2000, stock valuations grew increasingly expensive. Yet, world stock markets repeatedly offered investors double-digit annual gains.

To be fair, the CAPE ratio was designed to be an ultra-long-term valuation tool. Most investors don’t realize it has little to no value if your investment strategy calls for holding investments for less than five or 10 years.

Still, the CAPE ratio is one of the most-often cited valuation metrics in the financial media. And so I suspect more than a few investors psych themselves out of buying stocks at today’s valuations, for fear of turning into the proverbial “sucker” who buys the market’s last shares at nose-bleed prices.

I hope this misconception doesn’t deter you from finding the most profitable short-term investments in today’s market.

And I hope you’ll consider taking a look at my Cycle 9 Alert research service, which has consistently identified the market’s best short-term plays, since 2012.

Currently, foreign stock markets are both trending higher and showing market-beating momentum, according to my Cycle 9 Alert algorithm.

My system has triggered a number of buy signals on foreign markets in recent weeks, including: China (FXI), Hong Kong (EWH), South Korea (EWY), Australia (EWA), France (EWQ), Germany (EWG) and, most recently, Japan (EWJ).

This overwhelming convergence of buy signals in foreign stock markets is too strong to ignore. And I’ve recently given my Cycle 9 Alert readers a new recommendation for taking advantage of this unique situation.

We got into the trade only yesterday, so there’s still time to get in if you act fast.

Adam O’Dell

Editor, Cycle 9 Alert

P.S. I want to be absolutely clear here. I am in no way saying that a market crash isn’t likely. Nor am I contradicting Harry’s forecast in any way. The beauty of Harry’s and my work is that it is complementary. Harry looks at the long term. I look at the short term. Harry is warning passive investors to stay out of the market. I 100% agree with him. But Harry would be the first to tell you to grab opportunities in any market, as and when they present themselves.

In fact, that’s the major theme running through his latest best-seller, The Sale of a Lifetime. And again, I agree with him. And as the Dent Research Chief Investment Strategist, and creator and Editor of both Cycle 9 Alert and Max Profit Alert, it is my job to keep you actively and strategically invested in the opportunities that are out there.

The post The Green Light on Global Stock Buying appeared first on Economy and Markets.

October 4, 2016

You Need a Company That Pays You First

I’m really excited to head to Florida in a couple of weeks. But, I won’t be working on my tan or getting massages at the resort spa I’m staying at!

I’m really excited to head to Florida in a couple of weeks. But, I won’t be working on my tan or getting massages at the resort spa I’m staying at!

Instead, I’ll be attending and presenting at the Irrational Economic Summit in West Palm Beach, Florida. If you can’t get enough of me, I’ll actually be speaking twice.

I’ve been a participant at the last two Summit’s. Harry enjoyed my speech so much the first time around that he hired me to come onto Dent Research as the creator and editor of Forensic Investor.

I’m the team’s “Horatio Caine” of the investment world, uncovering all the dead bodies before anyone’s the wiser. The thrill! The profits! Pretty exciting stuff.

It’s the same with the Irrational Economic Summit. It’s not only about listening to and rubbing shoulders with some of the industry greats like Harry and David Walker. It’s also about meeting many of the folks who read our work. It’s an honor to do this work and interact with you. And I hope to see you there in the next three weeks. I’ve got some important stuff to share with you…

I’m mostly known as a bear, trading shorts for a living for the past 17 years. However, this year I’m mixing things up a little bit. We’re just a few weeks away from launching Hidden Profits, the first newsletter of its kind that seeks to identify companies that pay you first.

But why bother? Why should you care?

Well, we live in a world where corporate executives are highly incentivized to enrich themselves by propping up the stock price with funky accounting and other tricks. They don’t have your best interests in mind even though you own the company.

Since 2009, I’ve been using a model that I developed to identify companies undertaking aggressive accounting practices. I’ve used this to identify short sale candidates and profit from a decline in the stock for my Forensic Investor subscribers. But, in a twist, this very same model can be used to pick winners – especially by focusing on companies that pay you first.

In testing since 2000, these stocks are up 748%!

Virtually every investor is chasing yield in this low interest rate environment. That chase has led low-volatility, high-payout companies to record valuations. If you just buy high yielders, you’re going to get creamed in the coming years.

So, at 3:30 p.m. (EDT) on Friday, October 21, I’m going to show attendees (including LIVE Stream viewers) how to sift through the wheat from the chaff and identify companies with quality revenues, solid cash flows, and undervalued assets. Then we’ll look at the impact of what happens on stock returns when you buy the companies that pay you first.

After I catch my breath, I’ll then turn to the dark side and talk about shorting stocks and the market. Again, I hope you’ll be among the audience, hearing this all for yourself!

I firmly believe the next bear market is going to be one for the ages. Harry does as well.

I wouldn’t be surprised if the average stock gives back more than 60%-70% of the returns achieved since the beginning of the bull market in March 2009. The indexes may not go down as much, but many individual stocks will.

If you have a portfolio of $1 million, you’re staring a $500,000 to $600,000 loss right in the face.

Ouch.

The track record of Forensic Investor has held its own over nearly two years, despite virtually every headwind imaginable for shorting the market. But, once the environment becomes a bit friendlier to betting on stock declines, I truly think the opportunities for significant returns will be legendary.

That said, while a major bear market might take most stocks with it, many opportunities will be created to buy stocks at major discount values. In prior bear markets, hidden-profit-type stocks have held up well. That’s the benefit of big cash flows and strong balance sheets.

In both cases, you need to know how to capture the gains where and when they arise. I can help.

I look forward to seeing you in Florida!

John Del Vecchio

Editor, Forensic Investor

P.S. There are dozens of events on the burner right now that could blast open the doors for the bears to come streaming in. And on October 11, at 1 p.m. EDT, Harry will talk about these in an exclusive interview. Register to watch.

The post You Need a Company That Pays You First appeared first on Economy and Markets.