Harry S. Dent Jr.'s Blog, page 100

October 3, 2016

You’re Stuck with the Middleman, Like it or Not

I own five cars, which feels like too many. They aren’t the fun ones, like sports cars and “mudders,” but they do run the gamut from a zippy little sedan to a 4×4 SuperCrew pickup.

I own five cars, which feels like too many. They aren’t the fun ones, like sports cars and “mudders,” but they do run the gamut from a zippy little sedan to a 4×4 SuperCrew pickup.

While it’s true that I technically own them, I only drive one. Each vehicle in my fleet is dedicated to a certain driver in the family, including my wife and our three young-adult children. Maintaining all of that rolling steel means paying attention to oil changes and tires, and of course cringing when my insurance is up for renewal.

In the process of buying the cars, I gained a lot of knowledge, and soon came to an interesting realization.

I don’t need car salesmen.

By the time I get to the lot, I know more about the vehicle I’m interested in than they do. In their defense, the deck was stacked against them. I have the power of the Internet, and time.

I start my car search by estimating our needs and wants, and then developing a list of potential vehicles. Then I go through countless online reviews by professional sites, such as Edmunds.com, as well as scrolling through consumer feedback. The process gives me incredibly detailed information on what’s available on different models, as well as common problems.

Once I’ve zeroed in on a particular vehicle, then the game turns to pricing and availability. I’ve bought cars locally in Florida, but also from California, Minnesota, and Michigan. Each time I brought to bear many hours of research and evaluation on the purchase as I weighed all the options, availability, prices, and shipping costs when determining the right mix for me.

Contrast that with the salesman’s approach.

He goes to work and finds hundreds of cars on his lot. Typically, the dealership will specialize in one or two brands, but there are many different models available. To get paid, the salesman spends his time with different clients, estimating their needs and financial ability, trying to match them with appropriate vehicles, and then guiding them through the purchase process. Beyond a cursory understanding of each vehicle, it would make no sense for him to learn all the features of every car.

At this point, we have a problem.

The salesman wants to be needed, but I’ve replaced him with the Internet. I have more information at my fingertips than he could possibly possess. As time goes on and more consumers become comfortable shopping for cars online, the role of the salesman will diminish more, which is where the fight starts.

Just about every state requires carmakers to work through local salesmen. More specifically, it’s the law that they have a network of independent dealerships ‑ franchises ‑ to sell cars in those states, which of course means salesmen. Even if consumers don’t want them, or nearly as many of them, they are required.

The history of dealership protection comes from the mid-twentieth century, when carmakers had considerable bargaining power over small dealers. The laws regulate the existence of independent franchises to the point of outlining how, and when, they can be terminated.

But the carmakers aren’t pushing to get rid of their franchises. In fact, they’re fighting to keep them, and the laws, fully in force. This isn’t for the good of the companies and consumers, it’s all about killing one firm – Tesla.

The electric vehicle maker doesn’t have independent dealers. In fact, it has few dealerships at all. Instead, the company sells online, or through small storefronts. Carmakers and dealerships of all kinds are crying foul to their legislators, who are protecting the existing industry.

Old line car companies and their dealers claim that car owners deserve the ability to bring their vehicle to a physical dealership for maintenance and repairs, and to correct any warranty issues. If Tesla is allowed to bypass this regulation, then untold numbers of Tesla owners will be unfairly penalized when it comes time to have work performed on their cars.

It might just be me, but I’m having a hard time sympathizing with anyone buying an $80,000 vehicle who doesn’t think ahead of time about where it will be serviced. In fact, no one should care what kind of cars people choose and what sort of service arrangements they have, as long as the buyers weren’t coerced into the transactions.

But obviously that’s not the concern here. It’s all about sales and market share. No one wants Tesla in their backyard.

Recently the state of Michigan denied Tesla’s request for a dealership permit, noting that the carmaker didn’t have independent franchises. Dealership owners summed up the problem nicely. They noted that the auto maker would “unfairly” cut out the middleman with a business model that involves selling directly to customers.

Hello!? Isn’t that part of the beauty of the Internet?

By using online resources, we can cut out middlemen of all stripes, allowing customers to buy directly from manufacturers, thereby eliminating unnecessary steps and cost.

The Department of Justice estimates that the independent dealer network for cars adds between 5% and 10% to the cost of every new vehicle. That’s $1,000 to $2,000 for a $20,000 car, and $2,000 to $4,000 on a $40,000 car.

Is it worth it?

Before you answer, consider how much goes into new cars…

Many people want to see them and experience them before buying, and might be wavering between a couple of choices. Some people might need a lot of hand-holding to get through the process.

But then again, none of that matters. Because you don’t get to answer that question. The states have made the regulatory decision for you.

Independent franchises stay, and you’ll pay for them, whether you want to use them or not. Middlemen must be protected, as long as they’re from the right industry, with the right lobbyists.

It’s time that our governments join the 21st century. Let consumers decide how to spend their money.

Rodney

Follow me on Twitter @RJHSDent

The post You’re Stuck with the Middleman, Like it or Not appeared first on Economy and Markets.

September 30, 2016

How Deutsche Bank Could Take Down Germany

The first bad news broke following the third quarter of 2015. Deutsche Bank reported a loss of $7 billion. The news just keeps coming with low or negative earnings thanks to bad loans in Germany and abroad.

In my February 19, 2016 edition of The Leading Edge, I issued a clear and stern warning about Deutsche Bank and about a second banking crisis looming. I explicitly said…

The Telegraph ran an article yesterday asking if Deutsche was the next Lehman. Is there an echo in the room?

Without a doubt, things are coming to a head at the bank. It’s heavily exposed to the fracking industry in the U.S., which is sure to see continued rising defaults ahead. It has the largest derivatives exposure of any bank, at $54.7 trillion (and that’s not a typo) out of the worldwide total of $550 trillion. And now, the U.S. Justice Department is slapping on a $14 billion fine for fraud in mortgage security sales.

Deutsche’s market value is now only $16 billion. How can it afford to raise capital to pay this fine or to cover future large losses?

Even worse, the hard line that Merkel has taken against bailing out Italian banks (requiring bail-ins by larger depositors instead) has forced her into declaring that there can be no bail-out or assistance for Deutsche Bank, either.

She’s obviously between a rock and a hard place. If she helps bail out Deutsche it would damage the euro. If she doesn’t it could take the country down, and her along with it.

Evidence keeps mounting that Deutsche Bank could very well be the riskiest bank in the world (something I’ve been saying for months now).

The table below shows that Deutsche only has capital that is 2.68% of its assets – the worst of all major global banks. A healthy bank requires a level of 10% or more.

So much for how well capitalized the banks are after 2008!

The best bank of this risky bunch is Wells Fargo, with capital that is 8.01% of its assets. But it faces fraud problems of its own.

The riskiest top seven banks are all in Europe.

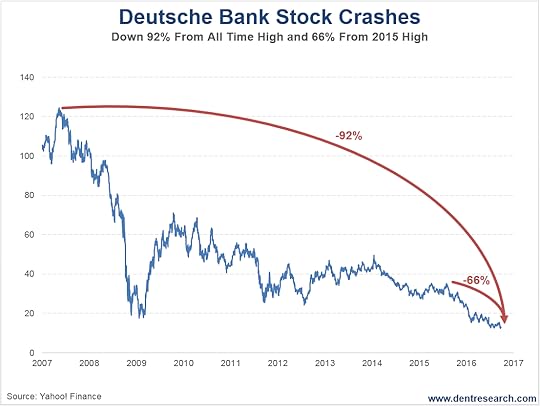

Unsurprisingly, Deutsche Bank’s stock dropped another 6% on Monday, when Merkel declined aid. That puts it down 92% from its 2007, all-time high and 66% since August 2015!

How is it possible that Deutsche Bank – and most global banks for that matter – have seen stock prices decline massively in the last year, while the broader stock markets keep edging up?

Quite frankly, it isn’t!

If the U.S. large-cap markets haven’t already topped in early September, I say they’ll do so before year-end… most likely in early December when the Fed comes back up against raising rates or losing all credibility.

And by then, Italy’s 18% (and rising) non-performing loans and Deutsche Bank’s $14 billion fraud fine will likely have come to a head.

Deutsche Bank and Italy look to be the most likely triggers for the next crash – one that will be far worse than the subprime crisis in the U.S. in 2008.

It won’t be hard to bring down Germany given it has the worst demographic trends in the world into 2022! All we need is a trigger to reveal the underlying weakness created by the greatest debt bubble in history and the most irresponsible monetary policies ever, and this house of cards will collapse.

It looks to me like the fuse is lit…

Harry

Follow me on Twitter @harrydentjr

The post How Deutsche Bank Could Take Down Germany appeared first on Economy and Markets.

September 29, 2016

A Love Affair with Volatility

Risk means different things to different investors.

Risk means different things to different investors.

Some calculate how much of their total portfolio they have invested in any given asset. Some look at the beta of a stock (which quantifies how volatile it is, relative to the S&P 500).

Me…?

I consider time when I think about risk.

Think about it…

If your investment strategy requires you to hold positions for five to 10 years… how much could change – or worse, how much could go wrong – during that time?

I’d say “a LOT” and “too much” – particularly when compared to an investment strategy that only requires you to hold positions for two to three months.

Conventional wisdom suggests that “traditional” investors are in it for the long haul. They buy and hold for years, even decades.

This strategy can work. But it leaves passive investors without anything to do when markets “misbehave,” so to speak. When volatility hits, buy-and-hold investors see it as the enemy. They simply can’t do anything to adjust their sails, so they just have to wait out the storm and hope for the best.

Psychologically, weathering volatility as a buy-and-hold investor is torturous. And studies show that most investors can’t handle volatility. We reach our “uncle” point too soon… we panic sell… and we severely underperform what buy and hold should have provided us.

But for flexible investors… volatility is a GOOD thing! Let me explain…

Until recently, stock market prices moved with very little volatility.

For weeks, market analysts on social media had been commenting about how quiet the stock market was. First, it was “30 days without a move greater than 1% on the S&P 500,” they noted. And then it was 35 days without a big move… and then 40 days…

The day-by-day countdown – “nothing scary happened again, today” – was a bit unsettling. It was almost as if these analysts were taunting the market gods.

And then Fed President Eric Rosengren warned that “financial instability” is at risk if interest rates are kept anchored for too long. (Thanks, but I’m pretty sure everyone’s known that for quite a while now!)

Despite his comments being in line with the Fed’s typical modus operandi – that is, warning the market of a rate hike… but not doing it – financial markets around the globe sold off in unison as fair-weather bulls rushed for the exits.

All told, the S&P 500 closed down 2.5% that day (September 9).

And with that, the financial media proclaimed: “Volatility has returned!”

Remember, buy-and-hold investors hate volatility. To them, volatility is the enemy. Volatile = “risk.”

But here’s the thing…

For flexible, short-term investors… sharp sell-offs and spikes in volatility are actually great buying opportunities!

Three of my Cycle 9 Alert research studies show that the recent uptick in volatility is a GOOD thing for stock prices. The statistics suggest we should see outsized stock gains in the months ahead.

Study #1 – Following a one-day sell-off worse than 2.5%

The S&P 500 lost 2.5% on Friday, September 9. Going back 25 years, a one-day sell-off of that magnitude has happened 50 times, or twice a year on average.

If you had bought the S&P 500 after each one of those -2.5% days, you could have earned an average profit of 2.1% over the next month… 3.7% over two months… and 4.5% over three months.

Those gains trounce the market’s average one-, two- and three-month returns (of 0.6%, 1.0% and 1.9%).

Study #2 – Following a VIX spike of 50% or more

On September 9, the Volatility Index (VIX) spiked 57% above its three-month low. That’s happened about 85 times in the last 25 years, or 3.5 times a year on average.

And while a volatility spike of that magnitude is certainly scary and painful to live through, buying stocks immediately after a spike has historically been the right thing to do.

Stocks have tended to gain 0.9%, 1.7% and 2.2% in the one, two and three months following large VIX spikes. Again, these stock gains beat the market’s average tendency, showing it generally paying to be bullish after short-term bursts of volatility.

Study #3 – More than 80% of stocks are below their 10-day moving average

As I said earlier, more than 70% of all stocks are still firmly above their 200-day moving averages. That means their longer-term trends are still positive.

But the opposite is the case for shorter-term trends. Currently, more than 80% of all stocks are below their 10-day moving averages. Historically, that’s a signal that investors are too pessimistic… and that stocks have sold off too far, in the short-term.

Stock market gains of 2.2%, 3.2% and 3.5% have followed this signal over one, two and three months.

So no matter how you slice it, the historical statistical evidence is clear: it generally pays to be bullish following short-term market sell-offs and large spikes in volatility.

Here’s a chart that shows this conclusion graphically:

For the signal returns above, I’ve simply averaged the result of each of the three studies I discussed. This shows the result of buying stocks after large sell-offs and volatility spikes.

As you can see, stocks generally bounce back strongly after these short-term market routs. Not always… but usually.

I wish I could say that it will get easier from here… or less volatile… or more certain. But those would be empty and unfulfillable promises. That’s just not how investing works.

For sure, heightened uncertainly over the Fed’s next move (or next speech)… over the U.S. presidential election… over any number of unforeseen “risk factors”… may continue to percolate through financial markets. But really, that’s par for the course.

My job is not to predict the market’s next move – up or down. My job is to stick to the systematic investment strategy that’s proven itself over time.

For now, the dominant trend in a majority of stocks is bullish… and so that’s where our bias remains.

Adam O’Dell

Editor, Cycle 9 Alert

The post A Love Affair with Volatility appeared first on Economy and Markets.

September 28, 2016

CRISPR-Edited Crops Save Millions of Dollars

Last week, agriculture giant Monsanto (NYSE: MON) just licensed the most important biotech breakthrough of the 21st century…and no one blinked an eye.

Last week, agriculture giant Monsanto (NYSE: MON) just licensed the most important biotech breakthrough of the 21st century…and no one blinked an eye.

You may remember Monsanto being called “Monsatan” or “Frankenfood” for its production of genetically modified seeds and agricultural products. Well, the company is turning over a new leaf (no pun intended), and has acquired the rights to the CRISPR gene-editing tool from the Broad Institute of MIT and Harvard.

CRISPR (or Clustered Regularly Interspaced Short Palindromic Repeats) was developed several years back to go through a string of DNA and selectively delete or repair any problems found. In certain circumstances, it can even make an addition to make the DNA stronger.

So what does Monsanto want with it?

In the fight to make crops more resistant to drought and disease, Monsanto’s main tactic over the years was to combine different species of plants together to create super crops.

Under current U.S. federal law, combining multiple species of plants together qualifies the end product as a Genetically Modified Organism, or GMO.

Depending on what side of the grocery store aisle you shop on, buying GMO food can be viewed as a great value for the whole family, or the equivalent of smoking two packs of cigarettes per day.

Despite the raging debate over leveraging the technology, GMO engineering has proven to be extremely time consuming and expensive. A survey completed in 2011 found the cost of discovery, development and authorization of a new plant biotechnology trait introduced between 2008 and 2012 was $136 million.

On average, about a quarter of those costs ($35.1 million) were incurred as part of the regulatory testing and registration process. The same study found that the average time from initiation of a discovery project to commercial launch is about 13 years.

That’s a lot of money. And a long time.

Part of the cost problem is that three separate government agencies regulate GMOs: the Environmental Protection Agency (EPA), the Food and Drug Administration (FDA), and the U.S. Department of Agriculture (USDA).

Here comes the kicker…

Editing the genes of individual species of plants using the CRISPR tool doesn’t actually make the end product a GMO under current federal laws.

This is because different species of plants aren’t actually being mashed together in a petri dish to make a better product. When leveraging CRISPR, only a single species is edited to remove defects.

The debate is still out on how long it will take U.S. lawmakers and regulators to catch up to this new technology. But Monsanto isn’t waiting to find out.

With CRISPR, the company just cut its plant engineering cycle time by years and is saving at least $35 million per trait on all CRISPR-edited crops.

In our eyes, this was a smart move.

Ben Benoy

Editor, BioTech Intel Trader

P.S. As Harry will tell you, we’re currently in the plateau of the 45-Year Innovation Cycle. Can you imagine the breakthroughs we’ll see when this cycle turns back up again? Harry gives you some ideas of what to expect, and when, in his latest book, The Sale of a Lifetime, available now.

The post CRISPR-Edited Crops Save Millions of Dollars appeared first on Economy and Markets.

September 27, 2016

Income was Too Good to be True

The Census Bureau reported that median income jumped 5.2% last year. As I pointed out last week, that’s a solid increase, but still leaves us short of the record in 1999.

The Census Bureau reported that median income jumped 5.2% last year. As I pointed out last week, that’s a solid increase, but still leaves us short of the record in 1999.

Still, something about the gains struck me as wrong. Even with cities, states, and some businesses bumping up their minimum wage, 5.2% seemed like a lot.

So I went digging. And the more I dug, the more disappointed and frustrated I became. As usual, the source of my angst was the federal government.

Long-time readers know my ongoing annoyance with the Bureau of Labor Statistics (BLS) when it comes to unemployment figures and their birth/death adjustment. Now the Census Bureau is getting in on the act, estimating numbers where respondents don’t give answers.

But the bureaucrats don’t stop there. In addition to filling in blanks, they’re also double counting income from previous years, and the problem is about to get much worse.

In previous surveys, respondents were asked if they held certain types of accounts or received different streams of income, including wages, interest, pensions, government assistance, etc. The details provided were pretty good, but the statisticians suspected they were missing some buckets of cash.

So in 2013 they tested a new set of questions, and compared the answers to the traditional survey. Sure enough, there was more money! By their calculations, incomes were a full 3% higher than had previously been estimated.

The median American family didn’t bring in $51,939 as reported. Instead, that household actually received $53,514. An extra $130 per month could help a lot of families – from those with kids to retirees – make ends meet… if only it was real cash.

To arrive at the higher figure, the Census Bureau parsed questions on items like interest income to figure out if consumers held any interest bearing accounts. Then surveyors would circle back and ask respondents how much they earned on each account. If respondents didn’t know, or refused to answer, the Census Bureau would ask the size of their assets, and then estimate the interest they should have earned.

According to their calculations, by changing the questions the number of Americans earning interest shot up from 86 million to 122 million, and the total interest received in 2013 increased from $187 billion to $387 billion.

The new calculation shows 41% more people earning interest, and 49% more interest earned. Imagine the government’s surprise to find that we’d been holding out on $200 billion in interest income!

To put it mildly, I’m a bit suspect of the government’s new estimate.

But I have a bigger problem with how they’re treating retirement accounts, and what it means for future reports.

Using the old methodology, in 2013 the Census Bureau reported that one million people received income from a retirement account, totaling $18 billion. With the new approach, these numbers jump to 5.2 million people and $60 billion. The higher numbers make more sense to me, given that our over-70 population keeps growing, but all the funds withdrawn aren’t income.

The government asks if funds withdrawn are reinvested elsewhere, taking care of that part of the equation. My issue has to do with the original money.

The survey counts as earnings all wages, salaries, and money from almost every source that isn’t borrowed, or insurance proceeds before paying taxes, contributing to pensions, paying union dues, etc. So the money workers earn before contributing to a retirement plan is counted as income in the year it was received. And then it’s counted again in the year it’s withdrawn from the retirement account.

Hmmm.

With so many boomers funding retirement accounts over the years and now retiring in large numbers, this problem is going to get worse. We’ll have the Census Bureau telling us that income is on the rise, when it’s really just savers withdrawing the funds they contributed.

Interestingly, this is not how the bureau treats other accounts. Funds withdrawn from savings accounts aren’t counted as income, just the interest is, which makes sense. The original deposits were earned at some previous point.

The obvious solution for the double counting is to calculate how much of the funds withdrawn from retirement accounts represent earnings and how much represents investment and interest income.

Obviously that’s a big, hairy question, but hey, I’m not the one double counting, they are.

Then again, I’d imagine the government has no interest in a “solution.” They’ve already found one. Their redesigned survey shows income moving upward and onward, and a positive impression is all that matters, right?

Rodney

Follow me on Twitter @RJHSDent

P.S. No matter how you count it, millions of baby boomers face a retirement of penny pinching, as I explain in the October Boom & Bust. It doesn’t have to be that way. There are things you can do now to boost the funds you have available in retirement. You’re already ahead of the curve with your subscription to Economy & Markets. Take the next big step forward and read Harry’s latest book, The Sale of a Lifetime.

The post Income was Too Good to be True appeared first on Economy and Markets.

September 26, 2016

Get Ready to Ignore November

As I’m writing this, the Mexican peso has rolled over and died.

As I’m writing this, the Mexican peso has rolled over and died.

And what caused the currency to stumble like a drunken borracho who had one too many shots of tequila?

Bloomberg released a poll that showed Donald Trump leading Hillary Clinton in Ohio, a critical battleground state, and The Donald’s relationship with Mexico is… shall we say… complicado.

Over the past several months, the peso’s fortunes have waxed and waned with Trump’s polling numbers. The thinking is that a Trump America would be less open to free trade… and America is Mexico’s most important trading partner. So a Trump win would be no bueno for Mexico.

Or at least that’s the narrative…

I’m not the biggest fan of either candidate this election, though I don’t think either will be as apocalyptic as their opponents might think.

Hillary Clinton represents the status quo, which I don’t consider good. But if the next four years look like the last eight, it won’t be the end of the world. We’ll grumble about it. We might not like it. But life will go on.

The thing is, I could say the exact same about a Trump administration. For all of his talk, I really don’t see The Donald being an extremist or a revolutionary in practice. Sure, he talks big, particularly about protectionism, and might very well slap a token tariff or two on foreign imports. (News flash: both Barack Obama and George W. Bush slapped on a few tariffs of their own while in the White House. Sadly, it scores political points.)

Trump might even build his wall along the Mexican border… and might, through some accounting gimmickry, claim that Mexico paid for it. But I don’t see a Trump White House taking a page out of Herbert Hoover’s playbook and taking a wrecking ball to global free trade. I don’t think he has the stones to do it and face the fallout that would follow.

Sure, the proposed Trans Pacific Partnership (between the U.S. and much of Asia and Latin America) and the Transatlantic Trade and Investment Partnership (between the U.S. and Europe) will probably be dead on arrival. But frankly, given today’s political climate, I wouldn’t see Hillary Clinton getting the deals done, either. Neither George W. Bush nor Barack Obama had much success on that front.

And I don’t see Trump dismantling existing trade deals like NAFTA. It wouldn’t be successful in bringing back American manufacturing jobs (more of those are lost to automation than to foreign labor), and Trump is smart enough to know that. He’ll make noise about renegotiating the terms. But make no mistake, it will be noise.

In short, in a Trump administration, I would see mostly a continuation of the status quo as well.

So, I’d recommend you tune out the political news this fall. Whichever way the election goes, I don’t see it having much of a long-term impact, good or bad, on your investment portfolios.

But this isn’t to say you should just buy and hold and hope for the best. If the candidate of your choice wins (or loses), it won’t change the fact that stocks are extremely expensive at current prices.

Based on the Cyclically-Adjusted Price-to-Earnings (P/E) Ratio, the S&P 500 is nearly 60% more expensive than its long-term average and is priced to deliver returns of approximately zero over the next decade.

If you’re going to eke out a respectable return in the years ahead, you’ll need to do things a little differently. As I wrote a few weeks ago in Economy & Markets, taking a more active approach to investing will at least give you a fighting chance.

You can also manufacture returns of sorts by effective tax management. Dumping money into your company 401(k) gives you an immediate tax break. If you’re in the 28% bracket, you effectively “earn” $28 for every $100 you put into your 401(k) plan, and that doesn’t include employer matching.

You should also focus on generating current income. Whether the market goes up, down or sideways, funds paid out as a dividend represent a tangible, realized return that you can actually spend, unlike capital gains that can evaporate in a single trading day.

Charles Sizemore

Editor, Peak Income

The post Get Ready to Ignore November appeared first on Economy and Markets.

September 23, 2016

You’re Focusing on the Wrong Interest Rate

I am sick of hearing about the Federal Reserve. It’s the Fed this. The Fed that. The Fed, Fed, Fed.

I am sick of hearing about the Federal Reserve. It’s the Fed this. The Fed that. The Fed, Fed, Fed.

It’s amazing to me how talking heads on TV practically hyperventilate on air mid-sentence talking about what the Fed might or might not do.

Everyone is so focused on interest rates. Too focused. The thing is, they’re focused on the wrong interest rate.

While the federal funds rate has seen little movement and may not budge much for the rest of the year, three-month LIBOR is at multi-year highs!

LIBOR stands for the London Interbank Offered Rate. It’s a really, really important interest rate.

Here’s why…

When investors borrow money and use their portfolio as collateral, the loan is often priced at LIBOR plus some base interest rate. For example, the loan might be priced at LIBOR plus 2%. These loans are NOT priced based on the federal funds rate.

Now that LIBOR is rising steadily to multi-year highs, these loans are getting more expensive to maintain.

Recently, I took out a LIBOR line of credit and used it to buy a house for my elderly father so that he could be closer to family and better attended to.

I’ve never used a line of credit before. I come from a family where I was raised to pay in cash. If I don’t have the money and can’t pay cash, then I don’t get it.

No one gets rich paying 18% on a credit card with money they don’t have for stuff they don’t need. I have never paid a dime of interest on a credit card.

But this was a unique situation. I could access 60% of my liquid assets with a credit line and borrow the money very cheaply. It was way cheaper than getting a mortgage.

The other benefit is that this is cash, so when I shopped around for a house for my Dad, I could immediately make a cash offer. This leads to better deals because there are fewer contingencies. The seller will almost always take less.

Unlike most people, I also intend to pay off the credit line quickly. I gave myself a year to wind it down and in four months I have reduced the leverage by 60%.

That’s not what most people do, and here’s where it gets a bit sticky.

A major Wall Street firm extended the credit line to me. Yet, no one ever asked me what I was going to do with the money borrowed from the credit line.

I could have told them I need $500,000 because I’m going to Montreal for the weekend and I’m going to have a lot of fun!

The money would have been wired immediately.

That’s a big problem.

You see, people with portfolios of liquid assets get access to these credit lines. That means people who own stocks. You often must have more than $1 million in stocks and bonds to get access to LIBOR-plus loans. They can buy a new house like I did or finance a large purchase of an illiquid asset by using their portfolio as collateral. These assets might be boats, planes, fine art, or investable wine. You name it.

The problem is, as interest rates creep up and more portfolios have been used as collateral to finance asset purchases, it could create a huge storm if stocks and bonds take even a minor dip.

If stock prices slide, the borrower could get margin calls. Then they have to sell stock. But, they also have to reduce their leverage because you can only borrow so much against the portfolio. The assets bought are often illiquid and can’t be easily sold. So, everything unravels at once. This accelerates the selling pressure.

There are trillions of dollars of these credit lines that investors have tapped. Rising LIBOR and any sort of snafu in the market could be the catalyst for a major decline.

While everyone has their eye on the Federal Reserve, it’s really the inching up of LIBOR that should be scaring market observers.

John Del Vecchio

Editor, Forensic Investor

P.S. Regardless of what brings the market down, the fallout will present you with some life-changing opportunities. Harry gives you the details of these in his new book, The Sale of a Lifetime. Get it now so you can prepare.

P.P.S. Join Harry on Facebook, Wednesday, September 28 at 11 a.m. EDT for a Q&A session. Be sure to send your questions to Harry via Facebook at https://www.facebook.com/EconomyMarkets/ or tweet @harrydentjr and use #saleofalifetime.

The post You’re Focusing on the Wrong Interest Rate appeared first on Economy and Markets.

September 22, 2016

The Fed: All Talk and No Action

A meme went around the office yesterday, shortly after the Fed meeting…

Really, that says it all.

Joking aside, the time for central bank tinkering has finally coming to an end!

Zero interest rates, negative interest rates, bond-buying, money-printing and other forms of Ludacris experiments to devalue currencies have ALL failed at growing economies, inflating prices and creating jobs.

Sure, it’s been easier for companies to borrow money to buy back their own stock, which inflates financial asset prices, but that hasn’t translated into higher corporate revenues, profits or investments.

The Bank of Japan (BoJ) shocked the markets in January when they adopted negative interest rates. I saw the move as sheer desperation, which back-fired on them. The BoJ was hoping for a weaker yen but saw it strengthen, despite their best efforts. And Japanese bonds have seen a recent selloff. Their 10-year bond was yielding -0.10%. It moved up to a -0.05% yield.

As is normal for central bankers everywhere, if a plan doesn’t work, just do more of it. According to Prime Minister Shinzo Abe, the benefits of negative interest rates include encouraging corporate debt issuance and lowering mortgage rates, along with fighting deflation.

But their negative rates aren’t flowing down to consumers and commercial banks are taking a hit in their earnings.

But who cares?

Government borrowing costs are lower.

Yesterday, the markets were looking for more stimulus in the form of deeper negative interest rates, or more bond-buying or quantitative easing. Instead, the BoJ disappointed the markets by trying to control the yield curve… basically printing the same amount of yen but keeping the 10-year bond at around the same yield while buying shorter maturities and longer maturities.

My guess is that the BoJ had to do something or the financial markets would have punished them again by strengthening the yen, so they decided to keep current stimulus as is, with a twist.

Japan’s stock market moved higher, but so did their currency, which is not what they wanted to happen. We’ll have to keep an eye on this for a while, but so far, it looks like they failed again.

Later, the Fed, to no one’s surprise, announced no change to the interest rate policy. The federal funds rate stays at 0.25-0.50% for another two months, at least. They went on to say that the case to increase rates strengthened but, for the time being, they’ll wait to see further progress on the inflation front and the economic outlook.

(Interestingly, the Fed meets a few days before the November election, but there is practically zero chance of a rate hike at that meeting, so all eyes are focused on December.)

That said, there is growing dissent amongst the Federal Open Market Committee (FOMC) voters.

No one on the Board of Governors (political appointees) voted for a hike, but three of the five Regional Bank presidents did. Seems to me that not hiking now is more a political move than not.

Actually, Fed Chair Janet Yellen responded to a question specifically about an accusation by a presidential candidate that rates have been kept low to appease the current administration. She said that the Fed doesn’t discuss or take into account politics when making monetary policy decisions… that Congress set up the Bank as an independent agency.

Right…

Regardless, I’ve been saying for a long time (as has Harry) that eventually central banks would run out of tools to continue their experiments. So far, everything they’ve tried has failed to inflate prices and especially grow their economies. Japan has been the most desperate – willing to experiment with radical measures that have so far failed.

The Fed hasn’t done anything since last December except talk a lot about being dependent on the data. They’ve talked all year about possibly hiking rates multiple times. Numerous Fed officials have spoken about their opinions as to whether rates should go higher or not in an effort to keep the markets guessing.

For the better part of the year, we’ve seen a lot of talk and no action, little inflation, puny wage growth and stunted economic growth.

The big question that looms is: what will central banks do in the next crisis, since nothing they’ve done so far has worked?

We know one thing for certain: they’ll definitely spew a lot more hot air.

Lance Gaitan

Editor, Treasury Profits Accelerator

P.S. Tomorrow, John Del Vecchio, our resident Forensic Account, is going to tell you about an interest rate that could have a far greater impact on you and your wealth than the fed funds rate. Watch your inbox tomorrow around 4 p.m. for his email.

The post The Fed: All Talk and No Action appeared first on Economy and Markets.

September 21, 2016

This Crash and Recession Indicator Warns: Extreme Danger

When it comes to spotting danger periods for recessions, and especially major crashes, the Boom/Bust Cycle lets us see when stock crashes and recessions are most likely to occur. As my fourth key macroeconomic cycle, this makes it the most important one I have innovated since the Generational Spending Wave in 1988.

When it comes to spotting danger periods for recessions, and especially major crashes, the Boom/Bust Cycle lets us see when stock crashes and recessions are most likely to occur. As my fourth key macroeconomic cycle, this makes it the most important one I have innovated since the Generational Spending Wave in 1988.

It explains why Ned Davis’ Decennial Cycle failed in 2010 – 2012, and why his cycle is more variable than clock-like. And right now it’s flashing a warning sign of extreme danger into 2019!

What gives this cycle an edge is that it’s based on sunspot activity, and scientists have measured this accurately since the mid-1700s. As such, they can now project it fairly accurately, as you can see for yourself in this first chart…

Dave Okenquist, my research analyst, found data on recessions back to 1850 and added the grey shadings to indicate these on the chart. That shows us that 88% of such recessions occurred in the downward leg of this Boom/Bust Sunspot Cycle.

That’s an astounding and irrefutable correlation!

Anyone who thinks this is too weird to pay attention to does so at their own expense.

In the last Boom/Bust Sunspot Cycle, we experienced the tech crash from right at the top in March 2000 into October 2002, exactly within the first three years of the downward trend – as Ned Davis’ cycle would have predicted.

Then we had the 2008/09 crash and great recession right into the cycle’s bottom in August of 2009. That’s not something Davis’ cycle would have predicted.

How’s that for a forecasting tool?

The most recent cycle was the most extreme in hundreds of years. It stretched out to 13.9 years instead of the average 10! It only peaked and began to turn down in February 2014, not the more typical early decade setback we’ve seen in the past since the 1960s.

Now, look at this table. It lists the major financial crashes, crises and depressions as they correlate with downturns in sunspot cycles all the way back to the early 1800s.

That’s 11 out of 11 major financial crises right over two decades – a 100% batting average!

So what does the current cycle say?

It tells us that the greatest danger zone is right ahead, from 2017 into early 2020!

Andy Pancholi of markettimingreport.com will be speaking at our IES conference on October 20-22. In addition to his near-term turning point models, he saw major connections with longer-term crashes, like the one we saw in 2008. He sees this happening again in 2017 and 2019. This adds weight to the warning that the worst is just ahead.

Central banks are fighting this tooth and nail and they may just succeed in delaying a crash a bit longer. But despite such extreme efforts, the markets have gone nowhere since late 2014, shortly after this Sunspot Cycle turned down. Passive investors would be silly to risk staying in this market.

The best scientists are my secret weapon here and they project that this Sunspot Cycle bottoms around late 2019/early 2020 (investors who still follow Ned Davis’ Decennial Cycle will likely continue to be way off track on this).

In short: all four of my powerful macroeconomic cycles point down together into early 2020.

The most critical demographic cycle doesn’t turn back up until late 2022 forward. But the Geopolitical Cycle and Boom/Bust Sunspot Cycle both turn up around early 2020. Each one represents the most comprehensive, but still simple, view of the dimensions that shape our economy over time, giving you a window into future years.

And what they’re all saying is that we’ll soon see the sale of a lifetime, when stocks, real estate, businesses, and even gold will be going for pennies on the dollar… and where those who understand what and why it’s happening can take advantage!

For those that haven’t already, get my new book, The Sale of a Lifetime, at amazon.com. It recently hit #36 on the bestseller list just five days after being released, and we expect it to climb higher in the days ahead.

Harry

Follow me on Twitter @harrydentjr

The post This Crash and Recession Indicator Warns: Extreme Danger appeared first on Economy and Markets.

September 20, 2016

Apple’s New iOS App Revolutionizes Home Automation

Last week Apple (Nasdaq: AAPL) rolled out iOS 10, which is tech talk for their tenth major software operating system for mobile devices.

Last week Apple (Nasdaq: AAPL) rolled out iOS 10, which is tech talk for their tenth major software operating system for mobile devices.

Don’t worry if you didn’t order the new iPhone 7; this operating system is free for download on all existing Apple mobile devices.

Apple hasn’t disappointed with this milestone rollout, with tons of new convenience features, including “quick action widgets” and Apple Maps recommending locations and routes based upon your meeting invites.

While convenience features are cool, it’s the brand new apps that Apple rolls out on each major new release that really give us a glimpse into our tech futures…

Several years back, for iOS 8, Apple rolled out the HealthKit app that uses sensors in your phone to automatically track steps and flights climbed without even having to turn the app on. If you tie a fitness tracker, smart watch, or smart scale to your phone, you can track sleep, weight, and even vitals!

All of this information is called “lifestyle data,” and it’s turning into big business for companies to collect and sell to health insurance and medical research companies. This data can also help give your physician a better snapshot of your whole health picture.

Before the rollout of iOS 8, Apple had the foresight to realize how valuable this data was, so it designed the iPhone hardware and software around capturing it.

Now, for iOS 10, Apple has built a home automation app called HomeKit.

Chances are, you probably already have some form of proprietary home automation app on your phone that controls your security system, lights, or even doorbell camera. HomeKit, though, can be considered the mother of them all, integrating all connected home automation under one roof (no pun intended).

Apple has taken roughly two years to crack this complex nut, but what’s been delivered is simply out of this world.

For connected lighting products, it’s now possible to automatically control lumination levels based upon room location and mood.

Yep, I said mood!

There’s actually a button in the app that can adjust your home lighting to a dimmer, more relaxed state if you’re so inclined.

Now we just need to make sure our home speakers are connected online as well, so you can have a one-stop shop, Ladies-Man living room button, hold the Courvoisier.

Apple can do all of this through a concept called geo-fencing, which allows users to group together different home automation products by different rooms.

Users have the capability to now develop “scenes” that will turn on or adjust any connected product based upon timing and location.

My personal favorite combo is the shade opening, lights on, coffee maker brewing, stereo Metallica-rocking, wake-up alarm.

Gone are the days of traditional burglar alarms and automatic light timers. Now you can check your locks, turn on your lights, and blast your television or stereo music to keep the burglars away… all from wherever you and your phone are.

This is just the start, though. As the Internet of Things (IoT) revolution continues to connect more and more products online, your phone will eventually turn into your own Starship command center.

Apple’s HomeKit is making a massive disruption in the home automation industry as we know it. Count on your Dent Research team to provide you the latest insights into technology that you can profit from.

Ben Benoy

Editor, BioTech Intel Trader

P.S. Much of the opportunity lying in wait for us in the tech field is being driven by what Harry calls the 45-Year Innovation Wave. He details this, and several other vital cycles impacting our world right now, and in the foreseeable future, in his latest book The Sale of a Lifetime. Get your copy on Amazon now.

The post Apple’s New iOS App Revolutionizes Home Automation appeared first on Economy and Markets.