Harry S. Dent Jr.'s Blog, page 104

August 9, 2016

How to Shield Yourself From Housing Bubble 2.0

3315 Collins Avenue is one of many $20M+ Miami condominiums now listed around the city. The annual HOA fees for this $70K per square meter property are nearly $200,000.

Waiting out Bubble 1.0

Waiting out Bubble 1.0I moved to Florida in 2005, just before the housing bubble peaked. Believing that prices couldn’t remain high, we bought a smaller home than we otherwise would have. Renting would’ve been nice, but we couldn’t find a rental in a school district we liked.

Home prices marched higher for six months or so, and the S&P/Case-Shiller 20-City Home Price Index reached 206. Then things slowed down. By late 2006, it was obvious that the housing market had changed. We know what happened next.

By 2011, real estate was ugly and millions of people had lost their homes. That’s when I sold my house.

The timing on the sale wasn’t especially brilliant. I took a hit, no doubt. But I got a pretty good price in an otherwise terrible market because of the location, and the buyer paid 100% cash. I moved the family closer to the kids’ schools and rented… for a few months.

But, my wife isn’t cut out to rent. She wants the freedom to change, rearrange, renovate, and basically do as she sees fit. By the spring of 2012, we’d bought a small home in a nice neighborhood.

Our timing, or should I say my wife’s timing, was almost perfect. The housing market was bottoming. The Case-Shiller made a bottom in the spring of 2012, touching 114. That was a 45% drop from the top in 2006. Since then, prices have come roaring back. Our small home has appreciated rapidly. Recently the Case-Shiller was reported at 188, a 65% gain from the bottom.

This Miami penthouse at 321 Ocean hit the market at $53 million late last year. It was South Beach’s priciest residence available until the Faena House penthouse re-listed for $55 million (pictured below).

My wife isn’t cut out to rent…

Like many people my wife wants the freedom to change, rearrange, renovate, and basically do as she sees fit. By the spring of 2012, we’d bought a small home in a nice neighborhood.

Our timing, or should I say my wife’s timing, was almost perfect. The housing market was bottoming. The Case-Shiller made a bottom in the spring of 2012, touching 114. That was a 45% drop from the top in 2006. Since then, prices have come roaring back. Our small home has appreciated rapidly. Recently the Case-Shiller was reported at 188, a 65% gain from the bottom.

Now, I’m getting nervous again.

I’m not sold on the logic of “build it, and they will come.” And I don’t think homebuilders are willing to take such a chance either.

While builders are selling more units than in the last several years, we’re still a long way from the boom years. In June, we sold new homes at an annualized rate of 592,000. In 2006 we were selling more than one million a year. Following the financial crisis, that figure dropped below 300,000 and has been just creeping higher since then.

The most recent figure is just as it was in 2008 when sales were plummeting.

This is not Field of Dreams

The last time we sold 592,000 units when sales were trending higher was 1995. We’ve added tens of millions of people to our population since then, and yet we are selling the same number of new homes that we did before we used email or surfed the net!

The housing market is smaller on other metrics as well. As shown on the chart, since WWII residential fixed investment (home building) has typically represented 4% to 6% of GDP.

It fell below this level during the downturn of 1982 and again in 1990, but remained well above 3%.

In each case, housing made a V-shaped bottom, recovering quickly. After the financial crisis, housing dropped to just 2.5% of GDP, and languished below 3% for years.

It’s great that residential construction now adds more than 3% to the national economy, but the fact that we’ve recently risen to the same level we touched at the bottom of the 1990 downturn is not a cause for celebration.

It’s not just a bubble, it’s employment

The story is much the same for employment. Many middle-income jobs associated with home building, like plumbers, roofers, electricians, carpenters, etc., thrive along with residential construction. That’s one of the reasons Federal Reserve officials want to drive interest rates lower. If they could motivate more home buying, that should lead to more home building, and create more middle income jobs.

It happened, just not on a scale the Fed would like.

In 2006, the construction industry employed more than one million people. By 2011, this number had fallen to 557,000, or, down 43%. As the housing market rebounded, so did construction employment. Today there are just over 700,000 working in construction. That’s great, but it’s still 30% lower than where it was during the boom years.

Home prices keep pushing higher, with the median new home price above $300,000, a 6.1% gain over last year. The median sale price for existing homes is just under a quarter million dollars, up 4.7% over the past year.

The Faena House penthouse in Miami is a five-bedroom, 8,270-square-foot luxury space, listed earlier this year for $55 million. The most expensive Miami property listing.

Who’s movin’ on up?

With median household income at $54,000, how does the typical family afford a home? If wages aren’t moving up at a rapid clip, who will buy homes in the years ahead?

For the 64% of Americans that own their homes (including me), I’m glad home prices rebounded. But it looks like prices have moved far past our ability to support them, while housing remains subdued in terms of the number of homes sold, its contribution to GDP, and its effect on employment.

If this is the best we can do with interest rates at historic lows and unemployment below 5%, it’s much more likely that housing is topping out, not breaking out.

Anyone considering jumping into real estate for the first time should stress test their decision. What would happen if prices fell by 10%, or 20%? If they had to move for employment reasons, could they come up with the difference?

While we haven’t returned to the heady days of 2005, it does feel like the markets have gotten ahead of themselves. For those who absolutely must, or absolutely want to, buy a home, consider spending a little less than you can afford. Like it did for me, it could trim your losses if the market rolls over.

Rodney

Follow me on Twitter @RJHSDent

The post How to Shield Yourself From Housing Bubble 2.0 appeared first on Economy and Markets.

August 8, 2016

In This Market, You Gotta Get Off Your Lazy Butt

Charles Sizemore

If you’re a buy-and-hold investor, it’s getting harder to earn a buck out there. Stocks are expensive… as in really expensive… and pockets of the market cheap enough to consider are getting smaller by the day.

Consider the cyclically adjusted price/earnings ratio (CAPE), also called the Shiller P/E after Yale Professor Robert Shiller brought it mainstream.

The Shiller P/E compares current stock prices to a 10-year average of profits. The thinking being that in any single year, earnings might be unusually high or unusually low depending on where in the economic cycle you are. But in any 10-year window, you would have seen a boom, a bust and everything in between.

Well, you’re not going to find much hope for the future after today’s figures. The S&P 500 is trading at a CAPE of 27.2. That’s 63% higher than the long-term average of 16.7… and it suggests that stocks will actually lose money over the next eight years or so.

Even if stocks manage to defy the odds and eke out a profit over the next decade, it won’t look anything like the returns we’ve seen since this bull market started in 2009. So if you’re going to earn a respectable return, you’re going to have to do things a little differently. You’re going to take a more active approach to investing.

Even if the longer-term trend is sideways or down, there are plenty of shorter-term trends lasting weeks or months that can be profitably traded. And remember, the stock market is a market of stocks; even if the averages are drifting lower, there can be sectors of the market posting very respectable gains.

That was certainly the case for most of 2016. For the first six months of the year, the S&P 500 traded sideways. But the Consumer Staples Select SPDR ETF (NYSEArca: XLP) was up nearly 10% including dividends.

As my friend and colleague Adam O’Dell likes to put it: “There’s always a profitable trend, somewhere.”

And finding those trends is where my friend Adam really excels.

You see, he doesn’t spend a lot of time worrying about market valuations or what stocks “should” do. Instead, he focuses on what the market is actually doing. That’s the essence of Adam’s Cycle 9 Alert.

Adam’s system reduces the investment process to just two metrics: trend and momentum.

The trend is simple enough to find. Cycle 9’s algorithm asks one simple question: Is the price of a stock higher than it was three months ago? If not, it is tossed out of consideration. But if the price is indeed higher, Adam’s system asks a second question: Is the price showing upward momentum?

Here’s where it gets fun. Not only must the stock be in an uptrend, but the speed at which it is rising needs to be accelerating. I won’t reveal any of Adam’s “secret sauce,” or the precise ways that he calculates momentum, but you get the idea.

Adam looks for strong sectors growing stronger… regardless of what the market is doing… because those are the sectors that his research has proven likely to outperform over the following two to three months.

Then, to nail down even additional earnings potential, Adam takes one final step and selects an options contract to hold over that period that will pay off handsomely if and when the trend continues.

And guess what? It works.

Adam started Cycle 9 Alert in 2012 as a system-driven strategy designed to do well in both bull and bear markets. And the markets have had a wild ride over that period, having some impressive runs… and some gut-wrenching volatility. Yet through it all, 61.7% of Cycle 9 Alert’s trades were profitable with an average return of 15.59%.

I don’t know what the market will do over the next decade. No one does. But I do know what it is likely to do based on history, and it isn’t pretty. If you want to keep the odds on your side, and who doesn’t, now is the time when an active approach to your investing is essential.

In fact, next week, Adam is publishing a special webinar explaining how you can tilt the market’s odds in your favor – be it in a bull or bear market – using a tailored system like Cycle 9 Alert. Be on the lookout for how to sign up for that in the coming days.

I can guarantee you won’t find information like this anywhere else.

Charles Sizemore

Portfolio Manager, Boom & Bust

The post In This Market, You Gotta Get Off Your Lazy Butt appeared first on Economy and Markets.

You Suck Wind. We’re Here to Help.

Around Christmas 2012 I came into a chunky quarterly bonus about $5K more than I expected, which for me at the time was a small windfall. Just enough unexpected cash, I thought, to make it worth investing in French company Alcatel-Lucent that I’d been watching for a while. I purchased nearly 6,000 shares for around 84 cents apiece.

The stock continued rising through January, but a gradual descent pulled its share price from a New Year high of around a buck-thirty to just above a dollar in May 2013.

It was a roller coaster and after the money was sloshing around a bit, looking back at me from my trading account, it no longer felt so easy come, easy go.

I guess my stress finally peaked because then I sucked wind. I sold in May, about six months after buying, easing my self-doubt with the fact that a $900 profit was nothing to be ashamed of.

Sadly for me, if I’d sold in January, a month after my buy, I’d have pocketed $2,300. And if I’d held my shares until April 2015 and sold, I’d have banked nearly three times my bonus – and collected a $14,950 profit.

We suck wind so badly that even had I taken a blow to my head, lost my faculties and lay deep in a coma until now (the only way my nerves would have lasted holding this long) I’d be telling you from the hospital that I collected $13,250 on my $5,000 bet three years ago. Only because I couldn’t screw up the outcome.

You get my point.

It’s impossible to miss because it’s so true. We can’t be trusted with our emotions to act logically in these situations and that’s why Adam O’Dell’s Cycle 9 Alert is so popular, and so successful.

To better explain the simple ways investors can avoid the pitfalls that trip us up, and lose us money, Adam’s publishing a webinar on key concepts that can tilt the market’s odds back in your favor.

Because this information is normally part of our paid subscription services, we’re asking those of you who wish to join Adam for his webinar to sign up with us to ensure your spot, because this isn’t something we do often, and it’s likely something that you don’t want to miss. You can look out for how to do that next Wednesday.

In the meantime, here’s a look back at what we talked about at Dent Research this week…

Monday Harry re-visited his concerns over China’s ever-expanding real estate bubble. While he’d written previously about Shenzen’s 80% year-over-year residential property price increases and Shanghai’s slightly more modest 65% Yo-Yo rise, a new piece of analysis gave us pause. China’s bank losses could exceed those of the subprime crisis by about 400% – potentially requiring a $10 trillion bailout.

Tuesday it was Charles writing from Lima, Peru, where he’s now left his in-law’s horse ranch to spend the remaining summer in the city with family, who outlined how to go about preparing for investment in your kids’ college fund. With college tuition rising over 1100% for nearly 40 years… you’ll likely want one.

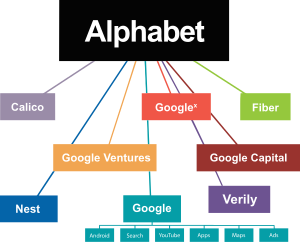

Wednesday from the frontlines, our in-house Marine officer, Ben Benoy, took note of a potentially disruptive alliance that may shake up the pharmaceutical industry. Google’s parent company Alphabet (Nasdaq: GOOGL) announced its partnership with GlaxoSmithKline to launch a new “bioelectronics medicine” company. A four-year, $710 million cash dispersion will get the new partners started.

Thursday Lance helped us firm up our understanding of the Fed’s actual Congressional mandate and the five general tasks it’s authorized to perform. Today’s type of shenanigans are nowhere to be found, at least not that I saw. Interpretations seem to have clearly gone askew.

Friday came more quickly than expected when John reminded us that not only are dividends sweet as Tupelo honey, but that not all dividends are equal. He offered some brilliant examples with a couple well-know companies. One does dividends right and another you’d never expect… clearly does not.

And that brought one more week of summer 2016 to an end. Thank you for spending some of that time with us here at Dent Research.

Play safe out there,

Robert Johnson

Editorial Director, Dent Research

The post You Suck Wind. We’re Here to Help. appeared first on Economy and Markets.

August 5, 2016

There’s a Dividend and There’s a Healthy Dividend

A god dividend doesn’t weigh you down, not like the anchor chain here to the newest U.S. carrier on the seas, the USS GERALD FORD. The people at Huntington Ingalls Shipbuilders in Norfolk, VA refused to provide an actual length, they did point out that each link weighs 360-pounds.

Since my fellow editors and I share the lineup here at Economy & Markets, I don’t speak with you as much as I’d like.

Since my fellow editors and I share the lineup here at Economy & Markets, I don’t speak with you as much as I’d like.

Because we don’t have time to dilly-dally about less important matters, today I’m again here to remind you that no matter what we do in this market, where nearly every company uses some financial chicanery to prop up its bottom line, we need proof that profits go to us, the shareholder – and that they go to us first.

Of course not every company is overly aggressive, but that is a definite warning sign to bail on a stock. I have seen that movie many times in my career. It’s a slasher flick and usually ends pretty badly.

Again, as a reminder, the proof that a company pays its investors first comes in the form of dividends. It’s a profit share check paid to you directly from the company in an amount determined by the number of shares, or percentage, you own in the company.

Going back over 40 years, companies that pay dividends vastly outperform companies that do not:

Another way to pay investors first is through share buybacks, but not all buybacks are the same. At Hidden Profits, we take great care to analyze the quality of the shareholder yield a company is providing, and that includes buybacks.

Buybacks could be used to boost earnings per share. In fact, buybacks have been the key driver of market returns in this bull market since 2009. That alone is a weak way to increase value.

Buybacks could also be used to fund executive compensation schemes. Management teams are highly incentivized to keep the stock price up to meet the short-term demands of Wall Street. This may not be the best capital allocation strategy.

Furthermore, the buybacks may come at inflated prices. Buying $1.00 for $1.10 never made much sense to me.

In a nutshell, there is good shareholder yield and bad shareholder yield.

At Hidden Profits, our methodology has fine-tuned the shareholder yield model to focus on good shareholder yield.

Take International Business Machines Corporation (NYSE: IBM), for example. The company’s management team has taken on billions of dollars in debt to buy back stock (at much higher prices), while the business itself implodes. IBM’s revenues have been in decline for years! The balance sheet has become bloated and the quality of cash flow has deteriorated.

Any sensible investor would question this capital allocation strategy. Does IBM’s management team have your best interests in mind? What are they doing to grow the business and generate higher earnings quality? What’s the point of buying back stock at much higher prices when the business is a melting ice cube?

On the other side of the playing field, consider auto goods retailer AutoZone, Inc. (NYSE: AZO). The company’s management team has bought back over $17 billion in stock over the last 18 years.

The company generates huge amounts of cash flow consistently from year to year. It easily exceeds net income, upping its earnings quality profile. While there is debt on the balance sheet, it’s only up fractionally in recent years. Meanwhile, the stock has gone to the moon.

At Hidden Profits, we want to buy companies like that – companies that pay us first. But, not at the expense of low-quality earnings or failure to reinvest in the business with an eye on future cash flows.

So, what’s the upshot?

Through testing and real-world experience we’ve found that, by focusing on management teams with investors’ best interests in mind, the returns are multiples of what is earned by buying and holding the S&P 500.

In this day and age of buyback mania, make sure the stocks you’re buying don’t use it as an accounting technique to mask a deteriorating business. Make sure the buyback plan is designed to return cash to you first from quality sources while the business can continue to thrive without the excess cash…

Just like we do at Hidden Profits.

John Del Vecchio

Editor, Forensic Investor

Hello, I'm John DelVecchio Try my Forensic Trading system for 90 days - risk free!

Hi I’m John DelVecchio, Author of What’s Behind The Numbers: A Guide To Exposing Financial Chicanery And Avoiding Huge Losses In Your Portfolio. Using my unique expertise as a forensic accountant, I’ve built a framework of algorithms and multi-factor grading systems to analyze winners and losers in the stock market. My unique trading system has made me one of the most successful short-sellers around.

For a limited time only, you’re invited to try my Forensic Trading System risk free for 90-days. See for yourself why hundreds of members subscribe to the Forensic Trading System.

Try Forensic Investor

More by John DelVecchio

The post There’s a Dividend and There’s a Healthy Dividend appeared first on Economy and Markets.

August 4, 2016

Don’t Worry America – The Fed Has Only Your Interests at Heart

I regularly write about the Fed, but I generally limit my focus to its policy decisions and their effect upon the broader markets.

I regularly write about the Fed, but I generally limit my focus to its policy decisions and their effect upon the broader markets.

The Fed, or more specifically, the Federal Open Market Committee (FOMC) meets every six weeks to discuss possible changes to monetary policies.

They base that decision on key data points – the same data points that I look at. The difference is that I’m watching for how the market reacts to the news.

But, of course, the Fed’s responsibilities extend far beyond dual mandate assigned by Congress.

The Federal Reserve System is the central bank of the United States. The system consists of 12 Federal Reserve Banks (Districts).

Congress overseas the Federal Reserve System but the Fed is an independent organization. This separation buffers the Fed against undue political influence. That means that the Fed’s decisions do not require approval by the Executive Branch.

The Fed performs five general tasks to promote the effective operation of the U.S. economy and, generally, the public interest.

I’m not even joking; that’s what they say!

Here’s the lowdown on the five tasks:

Conducts the nation’s monetary policy to promote maximum employment, stable prices and moderate long-term interest rates in the U.S. economy. Okay, Congress gave the Fed a dual mandate to promote max employment and stabilize prices. What that really did is give an organization power, beyond supposed influence, to do as they wish to manipulate the U.S. dollar. They do this by tinkering with interest rates, creating money out of thin air (bond purchases or QE) and telegraphing their actions into a public reaction.

Promotes the stability of the financial system to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad. I believe the Fed is most concerned with financial system stability. They saw the financial chaos in 2008. So when Fed officials talk about possible rate hikes, cuts or even stimulus action, their end goal is to promote stability or prop up the markets.

Promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system as a whole. The Fed supervises and regulates the federal banking system. This is a big joke… when supervision and regulation don’t work, they will just get Congress and the Treasury Department to bail them out. In 2008, hundreds of banks were bailed out to the tune of about $245 billion! That was about 40% of the total taxpayer bailout. Great job, Fed! Since the meltdown, new “stress” tests are now part of how the Fed assesses bank stability.

Fosters payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate U.S. dollar transactions and payments. This is a very important responsibility of the Fed. The Fed works with the U.S. Department of the Treasury and reports to Congress about the Automated Clearing House (ACH) system and other conduits that remit transfers to foreign countries, along with the U.S. payment system. Debit card processing, transaction fees, fraud-prevention and data security are all monitored and regulated by the Fed.

Promotes consumer protection and community development through consumer-focused supervision and examination, research and analysis of emerging consumer issues and trends, community economic development activities, and the administration of consumer laws and regulations. Okay, this is why the Federal Reserve System has hundreds of economists on their staff. The 12 Federal Reserve Districts study local business, lending, consumer issues and trend. Then, finally, it monitors bank compliance, consumer lending laws and regulations. The Fed’s studies focus on, and try and identify, the concerns of low and moderate-income people.

Anything remotely financially related like currency, banking, lending and regulation is touched by the Fed in some way, shape or form. They’re the banker for the U.S. Treasury but they’re not a fully governmental organization. The Federal Reserve Banks combine public and private elements in their organization and, as part of the Federal Reserve System, they are subject to oversight by Congress.

The Federal Reserve System is funded mainly by the interest it receives on U.S. government securities and on interest from foreign currency investments. They also receive fees for services provided to member depository institutions for check clearing, fund transfers, etc.

After expenses are paid, any remaining earnings are handed over to the U.S. Treasury.

The Fed reported that they paid the U.S. Treasury $97.7 billion in 2015! So, they are allowed to steal from us by printing money through QE, which devalues all our dollars, and then send the overage to the U.S. government… awesome.

That was an abbreviated look at what the Fed is responsible for. I mentioned that the Fed is independent and isn’t influenced by the government but, do you think they have some power over the government? I think close to $100 billion worth of it!

Whatever the Fed does or doesn’t do, doesn’t really matter. Overreaction to what happens or may happen affects prices and yields in long-term Treasury bonds and is one way Treasury Profits Accelerator subscribers profit.

Lance Gaitan

Editor, Treasury Profits Accelerator

The post Don’t Worry America – The Fed Has Only Your Interests at Heart appeared first on Economy and Markets.

August 3, 2016

Silicon Valley Takes on Big Pharma

Ben Benoy

I don’t think there’s anyone who likes popping pills for an ailment. Internal chemistry is a delicate cocktail, after all.

Well, a partnership between two tech and healthcare juggernauts may soon do their part to end the “better living through chemistry” motto and skip the pills by moving from chemistry to technology.

Google’s parent company Alphabet (Nasdaq: GOOGL) has partnered with leading British pharmaceutical firm GlaxoSmithKline (NYSE: GSK) to launch a new “bioelectronics medicine” company.

Bioelectric medicine is a new field of research focusing on tiny implanted devices that alter a person’s electrical nerve signal to treat chronic conditions like arthritis, diabetes, and asthma.

Economist Harry S. Dent Jr. now has indisputable evidence of precisely where gold is heading next.

A Pretty Big Bet

Laying their reputations on the line, both companies forecast this new technology will foster the next medical revolution. Called Galvani Bioelectronics, the joint venture will receive $715 million in funding over the next seven years.

Like all good risk-averse companies, GlaxoSmithKline (GSK) isn’t putting all their “tech eggs” in one basket solely with Alphabet. GSK announced the day before that they are also partnering with Apple (Nasdaq: AAPL) to leverage their medical research capability, called ResearchKit.

Apple, along with other traditional tech companies, are starting to diversify their portfolios into the healthcare industry. They’re focusing their deep knowledge of massive IT infrastructures, as well as computing, and applying this expertise to challenging medical issues.

As the healthcare industry goes digital, more medical breakthroughs occur through plain old computer data crunching.

Bigger Than an iPhone

With the data for a single human genome measuring roughly 100 gigabytes in size (average storage capacity for the top tier iPhone), medical companies simply require the data processing power associated with large IT companies.

By applying genome data with highly targeted treatment options and stats culled from a patient’s medical history, plus regional health/lifestyle data and a fitness tracker, providers hope to build a better and more complete health picture.

Physicians have an uphill battle leveraging this data fully with their current tools. Alphabet, Apple, and even Microsoft hope to change that by offering their infrastructure to crunch these massive data sets for precision medicine.

Data points to make our medicine options more precise are growing at an exponential rate.

Enough to Make Your Skin Tingle

Engineers at Tufts University have been integrating microfluidics, electronics, and nanoscale sensors into suture threads.

These threads contain high-end electronics designed to suture down through multiple layers of skin and tissue.

Once sutured, the threads would provide wireless information on underlying tissue, in real time, to alert doctors of possible infections or relevant healing data.

Results in the Journal of Microsystems & Nanoengineering look genuinely promising for use in a variety of specific cases.

Bottom line: this technology would add one more calculated data point to everything else we currently utilize to provide a whole health picture.

Bioelectronic treatments, smart sutures, and massive health data crunching will no doubt disrupt the current health and IT industries in the coming years.

Count on your Dent Research team to provide you the latest insights into technology that you can profit from for market plays.

Stay fierce,

Ben Benoy

Editor, BioTech Intel Trader

Hello, I'm Ben Benoy Try my BioTech Intel Trader system for 90 days - risk free!

Based on the same techniques used by the Department of Defense to monitor online chatter, the system – known as Social Media Collective Intelligence or SMCI – behind the new service has helped Ben pinpoint, through paper trading, 112 trades covering 45 positions over the last year, and achieved a win rate of 82.2%!

If you decide to try Ben’s Biotech Intel Trader, here’s what you’ll get:

• The Strategy Report: Profiting from the Social Buzz on Biotech Stocks, which introduces you to the core philosophy of this strategy.

• A year’s worth of alerts – sent via email every Monday – giving you up to 36 market beating recommendations.

• Buy and sell alerts as warranted.

Try BioTech Intel Trader

More by Ben Benoy

The Drones are Coming!

June 27, 2016: Commercial drone usage is exploding in the farming, mining, and real estate and construction industries…

Read More

Uber of the Oceans

June 14, 2016: Shipping freight is a convoluted and doglegged process and Flexport is changing that one ship at a time.

Read More

Web for the World

May 27, 2016: The solution: really big balloons. It’s easy to take the Internet for granted. We carry most of the world’s…

Read More

The post Silicon Valley Takes on Big Pharma appeared first on Economy and Markets.

August 2, 2016

Nobody Wants a Stupid Kid – Here’s How to Start a Proper College Fund

Nothing – and I mean nothing – will change your life as dramatically as the birth of your first child. It’s a wonderful moment and one that I hope everyone gets to experience. But it will turn your life upside down.

Nothing – and I mean nothing – will change your life as dramatically as the birth of your first child. It’s a wonderful moment and one that I hope everyone gets to experience. But it will turn your life upside down.

That chic apartment downtown no longer makes sense… nor does that sporty two-seater car. And enjoying that cappuccino on your patio after sleeping in late on Saturday? Yeah, maybe you can do that again in 18 years.

My wife and I decided to move to Peru, where she’s originally from, for the birth of our first son. And let me tell you, being a Peruvian dad is great. It’s like being an American dad circa 1950. For the first three months of my son’s life, I wasn’t even aware that babies could smell bad. He was always perfectly clean and presented to me like a trophy.

My, how it all went downhill when we moved back to Texas, had no more nannies, and my wife actually expected me to get off my lazy butt and help. Suddenly, it wasn’t “acceptable” for me to lounge around smoking cigars, chatting it up all day with the neighbors. Oh, well… It was great while it lasted.

An Open-Checkbook Kind of Thing

Perhaps more than anything, starting a family changes your financial priorities. Suddenly, you have expenses you never knew existed… and that massive looming liability of college education.

I routinely get questions from clients and prospects about financial priorities following the birth of a child, but without a doubt this is the most common:

Should I start a college fund?

Absolutely, you should start a college fund.

But only after you have already maxed out any 401(k) or IRA contributions for the year.

Ordinarily, you might look to Educational Savings Accounts (ESAs) and state 529 plans to put some of your income away for your child’s future. These are fantastic ways to save for college.

With them, your dividends, interest and capital gains grow tax-free, so long as you eventually use them for college expenses.

But unlike a traditional IRA or 401(k) plan, you get no tax break for the contribution itself.

Then there’s this dirty little secret: IRA funds can be withdrawn penalty-free to pay for the educational expenses of a child, though you may still owe taxes. If it is a traditional IRA, you would have to pay taxes on any withdrawals. And with a Roth IRA, you would only owe taxes on the part of the withdrawal that was considered “earnings.” In either case, there are no penalties.

Avoiding the Tax Man

As for your 401(k), these funds cannot be withdrawn penalty-free for educational expenses (unless you are age 59 ½ or older). But you can roll your 401(k) balance into a Rollover IRA and then use those funds, penalty-free, for your kids’ college expenses. And while I don’t generally recommend borrowing against your retirement plans, the option is there, and it would have the added bonus of not incurring any taxes.

But if ESA and 529 balances can be used tax-free, isn’t that still better than using IRA money?

Based on taxes alone, yes. But there are other factors to consider.

To start, you know you need money for retirement. This is an absolute certainty… as certain as death and taxes. But your son or daughter may or may not need money for college.

They may get a scholarship…

Or may choose to forgo college and start their own business…

Or join the military…

Or, for all you know, join a roving carnival circus!

Besides, at the rate things are changing, who knows if going to college will make economic sense 18 years from now. Or if, as is the case in most of the rest of the developed world, a university education becomes “free,” in the same sense that public high schools are free today. (OK, “free” means funded by the taxpayers – you and me – but you get my point.)

The fact is, there are a lot of unknowns when it comes to educational expenses, so it makes sense to prioritize your savings in your retirement plan first. And you also want to make sure you’re allocating those savings to the right funds. I run a service called Dent 401K Advisor designed to help you position your retirement given today’s questionable prospects for the stock market.

Once you’ve maxed out your 401(k) plan for the year (currently $18,000 in salary deferral) and taken advantage of any employer matching, save that next marginal dollar in an ESA or 529 plan. Both are fine savings vehicles. But again, they only make sense once you’ve exhausted your tax-advantaged retirement options.

Charles Sizemore

Portfolio Manager, Boom & Bust

P.S. IRA distributions are considered “income” and thus may affect your kids’ eligibility for financial aid. So, make sure you consider that when the time comes.

The post Nobody Wants a Stupid Kid – Here’s How to Start a Proper College Fund appeared first on Economy and Markets.

August 1, 2016

China’s Property Bubble Echoes Subprime Crisis

The menacing fury of economic triggers that began piling up after the Great Recession are only getting larger and we can’t do much but watch it unfold and stay alert.

I wrote about this in a letter late last year, but now here we are more than halfway through the year and it’s only getting worse. So much worse that the Chinese property bubble is now

The catalyst that will reset markets will likely be one large event that cascades across the globe. I’m convinced that what finally puts an end to central banker madness and the incessant stream of QE will be the Chinese real estate bubble.

Massive doesn’t even begin to describe the situation with China’s property market, but that’s somewhat expected with a population of 1.4 billion people.

And as the chart below shows, the bubble keeps on getting bigger!

See, China has stepped firmly into Japan’s slot as the economic force du jour of the Pacific Rim. In the 1980’s, at the peak of its post-war boom, Japan dominated global markets and dove deeply into U.S. real estate.

At the peak of its stock and real estate bubble, in 1989, the Japanese were buying expensive, high-visibility properties hand-over-fist, from Pebble Beach to Rockefeller Center.

Of course, when the economic realities of Japan’s demographic shift became impossible to ignore and its economy slowed drastically those properties sold to the highest bidder.

It was ugly and the end of a very impressive post-World War II boom. As bad as that was, the Chinese make the Japanese look prudent!

Chinese buyers are still bidding up the high end of the top coastal cities in English-speaking countries like prices will never go down and like they can’t get enough.

We’re talking all OVER the world from Sydney, Melbourne, Brisbane, Auckland, Singapore, San Francisco, L.A., Vancouver, Toronto, New York, to London…

These are considered the “Teflon-proof” markets, but they’re not! “Teflon-proof.” They’re not!

In fact, they’re some of the greatest bubbles that exist today. For the first quarter, residential prices in Shenzhen are up nearly 80% year-over-year, while those in Shanghai were up by roughly 65%, according to figures cited by Capital Economics analysts Mark Williams and Julian Evans-Pritchard in a recent note to clients.

Williams and Evans-Pritchard also point out that because of loosening lending standards introduced to keep the housing bubble going, China now looks alarmingly like the U.S. its before run-up to the subprime mortgage crisis.

Guess what happens when the bubble wealth in real estate that has built up in China finally collapses?

So does the capacity of the more affluent Chinese to buy real estate around the world. And these are the guys who have, by-and-large, been driving this global real estate bubble at the margin on the high end!

Bear in mind that Chinese real estate has been slowing and prices falling for over a year. That is precisely why China’s stock market bubbled up 160% in less than one year. When Chinese investors realized they could no longer make easy money in the real estate bubble, they turned to stocks. And after the dumb money piled in, the Shanghai Composite stock index fell 42% in just 2.5 months!

What did the Chinese government do? What any government in denial would do – buy its own stock market with hundreds of billions of dollars! That’s what the U.S. government did when its stock market crashed in late 1929. And sure enough, China’s stocks are following the same pattern to a tee:

After that first crash, Chinese investors pulled back on their speculation in markets like New York and London. When you doubt your own economy, you feel less okay about speculating in others. It’ll only get worse when their stock market drops dramatically again.

But broader, look at the steady decline in residential investment in China since 2010. This is the leading indicator of China’s slowdown and the CPC continues underestimating its government-manipulated statistics.

It’s gone from about 34% in 2010, down to near-zero at the start of the year.

China is going down. The China Beige Book (which is much more accurate) recently showed that, across the board, economic conditions are unraveling.

There will be no soft landing in China. It will bring down the entire world’s unprecedented debt and real estate bubble. And it’s only a matter of time…

Be on alert.

Harry

Follow me on Twitter @harrydentjr

Hello, I'm Harry Dent Try Boom & Bust now and save 25%

Each month Rodney Johnson, Adam O’Dell and myself uncover the next profitable investment… based on a boom or a bust.

Wall Street is preparing you for the wrong investment season. They’re telling you to stuff your portfolio with things like Chinese oil… Russian gas… Brazilian copper… wheat, corn, sugar, silver… foreign currencies. Benefit with us where others fail.

Try Boom & Bust

The post China’s Property Bubble Echoes Subprime Crisis appeared first on Economy and Markets.

July 29, 2016

If You’re At All Exposed to Muni Bonds, You Need to Read This

The housing bust was awful, particularly in Florida and other “sand states.” As the economy slowed, consumers lost their jobs, and when they couldn’t pay their mortgages, they then lost their homes.

The housing bust was awful, particularly in Florida and other “sand states.” As the economy slowed, consumers lost their jobs, and when they couldn’t pay their mortgages, they then lost their homes.

Even though that wrenching period happened almost a decade ago, it will live in our memories for years to come. I can recall much of the pain, but also other aspects of the moment. Some people were desperate for the relief that came their way; others were using it as cover to game the system.

We’re about to see the same thing happen again, but this time on a much larger scale. And the sucker on the other end of the line won’t be a bank or faceless mortgage company, it will be individual investors, and once again they’ll have government “help” to blame.

During the housing disaster, the government took a series of steps to ease the pain, including mortgage modification and relief from taxes on forgiven debt. At the time, government officials were looking for any tool that would stop the financial bleeding, and almost forcing the banks to write down loans seemed like a good way to do it.

Struggling homeowners able to modify their loans and stay in their homes were thrilled. Those that just wanted out of the trap went the short sale route and were also glad for a way forward. But another homeowner category rose to prominence, those looking to accrue ill-gotten gains.

These people simply stopped paying their mortgages, daring their lenders to foreclose and become stuck with the property.

At one point, foreclosure courts in Florida were running 600 days behind. Homeowners that chose not to pay knew that their lender couldn’t move on the property for almost two years. I know of people who stayed in their homes without paying for over four years, pocketing the cash that would have gone to the lender.

This wasn’t what the government had in mind, of course. Officials had a nice, happy plan where everyone plays by the amended rules and things come out well in the end.

It never happens that way, as we’re seeing today.

Puerto Rico is out of money. The Commonwealth begged Washington for debt relief, since the territorial laws of the U.S. and the island’s own constitution don’t allow for paying creditors less than they are owed.

The day before Puerto Rico owed $2 billion in principal and interest, Congress and the President approved a restructuring plan, called Promesa, that allows the Commonwealth to pay back less than it owes, as long as it agrees to a federal financial oversight board and follows certain rules.

The move was hailed as a great step forward for the struggling territory, and showed that the federal government wasn’t deaf to the fiscal woes of Puerto Ricans. Bondholders were furious. The Puerto Rican constitution demands bond principal and interest be paid first.

First, as in before any other expenses.

Instead, the federal government is allowing Puerto Rican officials to keep the lights on, paying civil salaries and meeting other essential obligations, even though they aren’t making good on their debts.

But it didn’t stop there.

Before the ink was dry on Promesa, Puerto Rican Governor Padilla unveiled his budget for fiscal 2017, which runs from July 1, 2016 through June 30, 2017. The document is a vivid example of putting politics ahead of contracts.

The governor approved the payment of half the debt service due in July, but not on the most senior, secured bonds. Instead, he authorized payment of junior bonds issued for the convention center and local roads that are more widely held by Puerto Ricans.

Beyond that, he authorized almost no debt service whatsoever for the entire year. He also approved moving $800 million to the public employee pension fund, which is $170 million more than would have been required during the year. Beyond the big-ticket items, the budget allocates $2.5 million for the Office of the First Lady to spend on incidentals, and money for the development of professional Puerto Rican athletes.

Investors went crazy when the governor presented the budget, and eventually filed a lawsuit to stop the Puerto Rican government from sucking all the money out of the system before any restructuring could happen.

Puerto Rican supporters claim investor fears aren’t justified. If the oversight board deems the payments unnecessary, they can just claw them back. Really?

How do you claw back money paid out as principal and interest on junior bonds? How do you unwind payments by the Office of the First Lady for daily expenses? What sort of legal fight would start if the Puerto Rican government tried to reclaim cash from its woefully underfunded pension system?

Those dollars are gone forever, and the investors know it.

Take this as an example of things to come. When states in dire financial straits, like Illinois, Kentucky, and Connecticut, start scraping the bottom of their financial barrels, they will look for someone to sacrifice.

They’ll eventually identify bondholders, claiming they couldn’t possibly cut expenses in their own state, even if that’s what the law requires. Eventually, the federal government will devise a plan for restructuring debt, but like Puerto Rico, there won’t be any good faith effort to send bondholders everything they are due.

Instead, state politicians will gobble up any lingering grace period, and any leeway they can find, shoveling money to the most expediential political places – like underfunded pensions.

Municipal bond investors should view this as a wake-up call. No one wants to wake up owning bonds issued by the next Detroit or Puerto Rico.

Now is the time to review your portfolio and identify the potential investment landmines, then dump them in an orderly fashion.

If you don’t, it’s possible the government will have a hand in deciding how much of your money you get back, and it’s a good bet you won’t be happy.

The post If You’re At All Exposed to Muni Bonds, You Need to Read This appeared first on Economy and Markets.

Is Everything Going to Hell or am I just Paranoid?

It has been almost three months since I started here at Dent Research. For several years, I’d been traveling a lot as an on-location photojournalist and writer. It was my dream job, but it proved exhausting. That thrill of the hunt out there for the story, the perfect shot at the right moment, talking to the right people, the occasional spot of “danger”… it was nothing if not interesting.

This was about as tame as Tahrir Square became during my two weeks in Cairo in the spring of 2013. The Muslim Brotherhood had just razed the string of tents and shanty’s before setting flame to whatever they could – before watching it burn.

I thought I’d miss it, but I really don’t

At my new job I quickly learned that I work with some really, really smart people and they all bring to the table a largely unique take on markets and the economy. What they all have in common, from Adam to Rodney, is that like me, they love the hunt. The right story, the perfect trade at the right moment… talking to the right people.

It’s a blast and I learn something new almost every day.

When Peak Income hit inboxes on Thursday, I felt Charles’ calm, steady demeanor slip away as he enthusiastically outlined his reasoning for an energy buy two-thirds into his newsletter and it finally hit me. Our editors also love the thrill of chasing down a good lead and delivering it fresh to our readers.

Trading may not be like dodging mobs and bullets in Tahrir Square, but I’m OK with that. It has its own thrills. And my wife, Jessica, isn’t complaining either.

Not that I would have heard her above the groans and mad scrambling from the HRC newscycle last weekend, as Hillary’s team took another hit by scandal that just keeps on giving.

She accepted her party’s nomination after another 30,000 hacked emails, pulled from her private server, got a new lease on life via Wikileaks Wikileaks and Julain Assange.

As the DNC went off beneath this fresh and fragrant cloud of fixed smiles and Pollyanna sound bites, all seemed about normal when, Lance began the week explaining how it just might be worth beating bonds at their own game and overcoming those pathetic yields.

The most extreme economic turning of the screw we can see at this point might be when central banks give up on the questionable benefits of quantitative easing and skip the intermediary by pumping fresh, hot currency straight into consumers’ pockets. Or, well, at least into their bank accounts.

Not that I ever needed to go as far as Africa to find trouble. This is from a once prominent, now abandoned, Detroit hospital. It wasn’t Cairo, but it didn’t feel all that much safer at 2 p.m. on a cold Thursday afternoon in January 2015.

That’s the danger: when the unthinkable becomes plausible… the new normal.

On Wednesday, the Hon. David Walker stepped in to explain our current Debt-to-GDP ratio is as much as 555%, when including unfunded obligations like pensions and healthcare. Terrifying and definitely worth a read.

On Thursday, Harry let us know that global corporate debt is on target to hit $75 trillion by 2020, an additional $24 trillion on top of to today’s record high $51 trillion. Not an ideal scenario considering that just over a week ago, the Wall Street Journal announced corporate profits sat poised to shrink for the fourth consecutive quarter.

And as another sweltering week ends here at Dent Research, Rodney closed the week off with some advice on municipal bonds: stay away from them. The craziness Puerto Rico is trying to pull in their default play is not encouraging and debt everywhere continues to mounts to historic records with no end in sight.

A stifling spell of hot weather here in Baltimore. Shot with an Inspire 1 UAV at Federal Hill, Inner Harbor, Baltimore.

As Rodney said: “No one wants to wake up owning bonds issued by the next Detroit or Puerto Rico.”

No kidding.

The post Is Everything Going to Hell or am I just Paranoid? appeared first on Economy and Markets.