Jonathan Chait's Blog, page 5

August 22, 2011

Should We Fear Even Successful Military Interventions?

Reason editor Matt Welch warns of a "success curse" in foreign policy:

Today's Team Blue dethroning of a tinpot dictator lowers the bar for tomorrow's Team Red assault on Iran, which of course will be confirmation that when it comes to the Constitution, President Perry (should he wrest the nomination from the more deserving Texan) is worse than Nixon and Hitler combined. Team Blue will once again regain the White House on an "anti-dumb war" campaign; a scattering of Republicans will then exhume their deference to the War Powers Act, and the U.S. share of global responsibility and military spending will continue its inexorable climb toward 100 percent. This is why some people refer to the bipartisan political class as "The War Party," and with plenty of justification.

Let us recall how Bill Clinton's Kosovo War laid the groundwork for George W. Bush's Iraq...

This is a persuasive argument if you oppose all military interventions. If you don't, it basically boils down to the proposition that a successful military operation is bad because it will lead to unsuccessful military operations. You could make the same argument on social policy (if we allow gay marriage, it will make some even more liberal social reform possible.) And you could make it the other way, too -- liberals shouldn't be happy if welfare reform works, because that will just make it more likely that we disastrously privatize Social Security. Essentially he is making an argument for ignoring all evidence in favor of rigid a priori pro-state or anti-state biases.

Welch concludes, "few phenomena rot the brain more thoroughly than political tribalism." Well, yes, but there's also ideological fanaticism.

The World Hates The Weekly Standard

A few months ago, the Weekly Standard devoted a cover to portraying President Obama as a weak-kneed appeasenik. Unfortunately, the cover came out just as Obama announced the killing of Osama bin Laden.

So, a few months later, it seemed like it was safe to go back in the water, with this offering by former Bush administration Minister of Propaganda Pete Wehner:

The president’s foreign policy has been characterized by strained relations with our allies and weakness toward our enemies. He’s shown indifference to human rights and an eagerness to cede American sovereignty to international bodies. And he has been half-hearted in fighting the wars in Afghanistan, Iraq, and Libya.

There are a lot of people in Syria right now praying that the Standard uses its next issue to castigate Obama for having failed to depose Assad.

Rick Perry's Kinda-Sorta Texas Miracle: The Consensus Forms

Last week I argued that Texas really has had a pretty impressive economic performance under Rick Perry, but there's just no evidence that his story of why that happened is true:

Perry's right-wing policy cocktail closely resembles conservative governance in other Republican-run states. And yet we don't see a general trend of extraordinary job growth in states with low taxes, pro-business regulation, and so on.

Ross Douthat's column today makes essentially the same argument:

When Perry became governor, taxes were already low, regulations were light, and test scores were on their way up. He didn’t create the zoning rules that keep Texas real estate affordable, or the strict lending requirements that minimized the state’s housing bubble. Over all, the Texas model looks like something he inherited rather than a system he built.

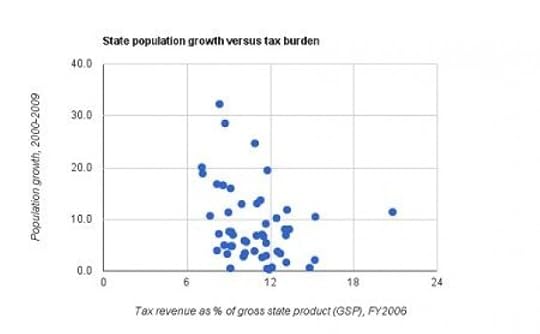

Meanwhile, Dylan Matthews brings the data to bolster the point I made -- that other low-tax states have not enjoyed particularly high growth:

This looks like a pretty solid consensus to me.

The GOP Isn't Bluffing On Taxes

Steve Benen thinks Republicans want to extend the payroll tax cut, but plan to hold it hostage to tax cuts for the rich:

If I had to guess, I’d say Republicans probably support an extension of the payroll tax cut, but just aren’t willing to say so. Why not? Because then they lose leverage — GOP officials know the White House wants this, and if they simply agree to pass the measure, they won’t get anything extra out of the deal. Hostage strategies have become an instinctual norm for Republicans.

I really don't think that's right. I don't think Republicans care at all about tax cuts for the middle class. Tax cuts for the middle class was the price the Bush administration and its GOP allies paid to get the tax cuts it really wanted in 2001. Then in 2003, when it had more leverage, the Republicans passed a tax cuts that benefited the rich almost exclusively.

Republicans have gone from viewing tax cuts for the middle class as a waste of money to viewing it as a positive threat. they have spent the last two years complaining that the bottom half of the income distribution doesn't pay enough taxes.

So, no I don't think GOP opposition to extending the payroll tax cut is a bluff. They really don't want to extend it. Now, whether they're willing to take the political heat for not extending it is another question. But they genuinely want to raise taxes on poor (and low-income) workers. Here's former American Enterprise Institute donor and former American Express CEO Harvey Golub complaining bitterly that some propose to raise his taxes while those freeloaders with low five figure income get off scot free:

What gets me most upset is two other things about this argument: the unfair way taxes are collected, and the violation of the implicit social contract between me and my government that my taxes will be spent—effectively and efficiently—on purposes that support the general needs of the country. Before you call me greedy, make sure you operate fairly on both fronts.

Today, top earners—the 250,000 people who earn $1 million or more—pay 20% of all income taxes, and the 3% who earn more than $200,000 pay almost half. Almost half of all filers pay no income taxes at all. Clearly they earn less and should pay less. But they should pay something and have a stake in our government spending their money too.

Later in the same op-ed, Golub argues that he shouldn't have to pay higher taxes as long as the government continues to have programs he doesn't deem necessary:

Why do we require that public projects pay above-market labor costs? Why do we spend billions on trains that no one will ride? Why do we keep post offices open in places no one lives? Why do we subsidize small airports in communities close to larger ones? Why do we pay government workers above-market rates and outlandish benefits? Do we really need an energy department or an education department at all?

Here's my message: Before you "ask" for more tax money from me and others, raise the $2.2 trillion you already collect each year more fairly and spend it more wisely. Then you'll need less of my money.

Or just raise taxes on those lazy freeloading slobs at the bottom half of the income distribution. No doubt they support every single thing the federal government does and are therefore obliged to pay more.

Meanwhile, here's the Daily Show brilliantly skewering the Republican obsession with "class warfare":

The Daily Show With Jon Stewart

Mon - Thurs 11p / 10c

World of Class Warfare - The Poor's Free Ride Is Over

www.thedailyshow.com

Daily Show Full Episodes

Political Humor & Satire Blog

The Daily Show on Facebook

The Cult Of The Presidency In Action

Gene Healy has written about what he calls "The Cult of the Presidency," and I've written about his concept as well. It is a pervasive mentality that views the president as a kind of national father, responsible for everything that goes well or ill. The fallacies of the mentality are that it fails, first, to distinguish problems that are amenable to political solution from those that are not, and second, that it fails to recognize even within the political realm that the presidency is but one co-equal branch of government.

If you looking for an anthropologically perfect sample of the cult of the presidency, check out the feature of the Sunday New York Times, entitled "If I Were President." The feature asks a series of leading lights to outline their vision for the country. But the entire concept makes no distinction between the notion of "if I were president" and "if I were king." If you were the president, of course, you would need a course of action that could be accomplished either through an executive order or that could be passed through both the House and Senate. The proposals generally make no allowance whatsoever for Congress:

I would invest in an infrastructure for civic renewal — not just roads and bridges, but schools, transit, playgrounds, parks, community centers, health clinics, libraries and national service. This would put people to work. And it would draw us out of our skyboxes and into the common spaces of democratic citizenship. ...

I’d grant the very rich the boon of helping them help others, as a form of gratitude for their good fortune. I’d also connect every creative writing program with a hospital, a school, a library, a prison, a neighborhood center ...

I would focus entirely on achieving what I think most Americans want: a stable and productive economy; an environmentally viable planet; a humane, efficient government capable of educating its young and protecting its vulnerable members. Americans are less selfish than some of our politicians believe (projection may be a factor here!) and will respond with reason and resilience to passionate clarity. ...

I would invest half of our defense budget in children, young people and in energy conservation.

I would expand the Peace Corps and AmeriCorps and grow both for the next 10 years. A benefit would be two years of free college for two years of service. I’d ask corporations to fund two years of college or a trade school for young women and men from homes stricken with poverty.

I would fund energy-saving improvements — insulation of houses, solar panels and replacement of inefficient furnaces for households making less than $30,000 a year and develop a sliding scale for those earning more than $30,000 a year. I would help small businesses retrofit their buildings.

I would require members of Congress to participate in a weeklong workshop on dialogue, negotiation and compromise before the next session. All sessions would begin with 10 minutes of silence.

Note that the last item I quoted not only imagines that the president can bypass Congress, as most of the others do, but also that she could require Congress to attend dialogue workshops.

I'm sure the editors who created the feature and the contributors to it are aware of the separation of powers -- they simply do not assimilate it int their conception of the presidency. Nor do any of them express even a tacit desire to alter our structure of government to replace it with parliamentary government, in which the majority party automatically assumes the capacity to impose its governing program. (I would favor that.) They instead seem to long for a monarch, and the longing is just as strong on the left as the right.

Eric Cantor's Chutzpah

Eric Cantor's op-ed laying out the Republican agenda is filled with the kind of distortions you'd expect, but this passage deserves special commendation. After decrying a National Labor Relations Board Ruling, he continues:

Eric Cantor's op-ed laying out the Republican agenda is filled with the kind of distortions you'd expect, but this passage deserves special commendation. After decrying a National Labor Relations Board Ruling, he continues:

Such behavior, coupled with the president’s insistence on raising the top tax rate paid by individuals and small businesses, has resulted in a lag in growth that has added to the debt crisis, contributing to our nation’s credit downgrade.

So Cantor is arguing that S&P downgraded U.S. debt because of President Obama's future plans to increase the top tax rate. That's such a mind-boggling claim that even Cantor cannot bring himself to put it in quite these terms. So instead he breaks it into a series of steps.

First, he claims that the future promise of upper-bracket tax hikes "has resulted" in a lag in growth. (Question: if the mere possibility of future tax hikes is enough to depress growth, why don't we go ahead and just raise taxes? If we're going to get the slower growth anyway, might as well get the revenue, right?)

Second, the lag in growth "caused" by hypothetical future tax hikes added to the debt crisis.

Third, the debt crisis contributed to the downgrading of the debt.

It's a fairly brilliant bit of rhetoric. After all, S&P specifically cited the Republican and Republican refusal to consider any tax increases as the cause of the downgrade. cantor has found a way to present Obama's support for higher taxes as the cause of the downgrade. That's so brazen I almost have to admire it.

Obama's New Message Takes Shape

A week ago, the New York Times reported that the Obama administration was divided over its strategy between advisers who wanted to emphasize accomplishments and those who wanted to emphasize pragmatic accomplishments and those who wanted to confront Congressional Republicans:

Mr. Obama’s senior adviser, David Plouffe, and his chief of staff, William M. Daley, want him to maintain a pragmatic strategy of appealing to independent voters by advocating ideas that can pass Congress, even if they may not have much economic impact. These include free trade agreements and improved patent protections for inventors.

But others, including Gene Sperling, Mr. Obama’s chief economic adviser, say public anger over the debt ceiling debate has weakened Republicans and created an opening for bigger ideas like tax incentives for businesses that hire more workers, according to Congressional Democrats who share that view. Democrats are also pushing the White House to help homeowners facing foreclosure.

Even if the ideas cannot pass Congress, they say, the president would gain a campaign issue by pushing for them.

The Plouffe/Daley argument was always incredibly strange. The notion that Republicans might cooperate in passing legislation that would serve as the thematic centerpiece of Obama's reelection campaign seemed to deliberately ignore every piece of information from the last two and a half years. Even if Republicans somehow could be persuaded to cooperate with Obama's reelection strategy, it's wildly naive to think Obama could run on any accomplishments in such an awful economic environment. Whatever it is he could say he worked together with Republicans to pass, the reply would be, it didn't work.

The only plausible reelection strategy has to revolve not around taking credit but of assigning blame. That is a tricky thing to do when voters abhor partisanship. What we've seen over the last week is Obama's answer. His theme is, I'm the reasonable man, and those other guys won't compromise. Here's David Axelrod hitting the partisan anti-partisanship theme:

David Axelrod said Sunday that when President Barack Obama unveils his new jobs plan in September, “There’s nothing in there that reasonable people shouldn’t be able to agree on.”...

Not surprisingly, Axelrod, talking to Jake Tapper on “This Week,” also hammered home recent points about the motives of the president’s opposition among Republican lawmakers and presidential candidates.

“When people don’t support plans that have in the past garnered bipartisan support, when people are willing to walk the country to the brink of default, when people, instead of saying where there’s a will, there’s a way, [say] it’s my way or the highway, you have to assume that politics is at play,” he said.

Axelrod said the middle class is being held hostage.

“It is unthinkable to me that the Republican Party would say we can’t touch — we can’t touch tax cuts for the wealthy, we can’t touch special interest corporate tax loopholes because that will hinder — hinder the economy, but we’ll allow a $1,000 tax increase on the average American come January. How could that be? The only explanation for it is politics,” he said.

And here's Obama hitting the same theme in his Saturday message:

The key thing to keep in mind about this strategy is that it doesn't really matter what Obama's plan would accomplish economically, because the plan is never going to pass. The point is to highlight popular proposals, especially middle-class tax cuts, that Republicans are blocking, and in so doing to assign them blame for economic conditions.

August 19, 2011

Conservatives, Nostalgia, and Racism

[Guest post by Isaac Chotiner]

Reihan Salam, in a column today:

One thing that is undeniably true is that American conservatives are overwhelmingly white in a country that is increasingly less so. As the number of Latinos and Asian-Americans has increased in coastal states like California, New York and New Jersey, many white Americans from these regions have moved inland or to the South. For at least some whites, particularly those over the age of 50, there is a sense that the country they grew up in is fading away, and that Americans with ancestors from Mexico or, as in my case, Bangladesh don’t share their religious, cultural and economic values. These white voters are looking for champions, for people who are unafraid to fight for the America they remember and love. It’s unfair to call this sentiment racist. But it does help explain at least some of our political divide. [Emphasis Mine]

Matt Yglesias, noting the higher tax rates and unionization of the 50s and 60s (which presumably conservatives do not miss), adds, "It’s difficult for me to evade the conclusion that on an emotional level, conservative nostalgics like Boehner are primarily driven by regret at the loss of social privilege by white men."

I would phrase it a little differently. Let's be generous and say that nostalgic conservatives are not driven by the regret Yglesias notes, but are rather longing for other, less problematic aspects of the past. My question for Salam is this: how racially insensitive does one have to be to prefer an America with segregation because he or she saw other advantages to 1950s society? What possibly could outweigh the disgusting racial status quo of the 1950s (I am leaving out the status of women and gays)? To wish for a return to that America, I would argue, one has to be so racially insensitive that bigoted seems like an apt descriptor. The alternative answer, of course, is complete solipsism.

&c

-- How gross is the water from the air conditioner?

-- If you need another WSJ editorial critique, here you go.

-- The case for interracial athlete comparisons.

-- What should a jobs agenda look like?

-- Stimulus fact and fiction from ProPublica.

-- “This paper examines the effects of deficits spending and work-creation on the Nazi recovery. Although deficits were substantial and full employment was reached within four years, archival data on public deficits suggest that their fiscal impulse was too small to account for the speed of recovery”

Rick Perry's Desire To Tax The Poor

Laura Bassett makes a great point here:

During his presidential campaign announcement speech last week, Texas Gov. Rick Perry lamented the "injustice" that nearly half of all Americans -- the poorest half -- "don't even pay any income tax." But in Texas, the tax burden is disproportionately shouldered by those families living below the poverty line, newly-released data from the Census Bureau show.

While Texas is generally considered a low-tax state since it doesn't impose a personal income tax, a new analysis by the Institute on Taxation and Economic Policy finds the state's tax laws are actually "redistribute income away from ordinary families and towards the richest Texans."

My only disagreement here is with the word "but." The Republican Party and the conservative movement overwhelmingly favor a more regressive tax system. They favor more regressive taxes at the national level and at the state level.

I understand what Bassett is trying to say here -- Perry thinks the poor are getting off easy at the federal level, but they're getting soaked at the state level. I don't think Perry sees this as a contradiction. The whole thrust of Rick Perry's presidential campaign is to make federal policy more closely resemble Texas policy. Texas has a regressive tax code, and Perry wants the federal gvernment to have a more regressive tax code.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers