Marcel van Marrewijk's Blog, page 169

February 24, 2016

Seats2meet, The Ultimate YZ Facility (guest post)

I received a message from Gabi Nagy from Hungary. She wrote a post about Seats2meet on Facebook which is shared more than 4700 (!) times. It went viral, In Hungary. The weblog yzinsight.com picked it up, translated it to English and came with the following:

“Today, a post came to my attention from the country of the Netherlands. This place blows my mind, because it reflects pretty much everything that the majority of this generation of YZ people stand for and want the world to be. I would describe it in more detail, but… oh what the hell, let the post speak for itself.”

Original post by Gabi Nagy, available in Hungarian at: https://www.facebook.com/photo.php?fbid=10153832469641855&set=a.399055561854.177349.774506854&type=3&theater

— I cannot be accused of having become particularly fond of the Netherlands or the dutch, but today, my jaw actually dropped.

As I spend most of my days at home translating, despite my preference of solitude, at times I wish to be amongst people.

Yesterday, I googled “Utrecht for digital nomads”, and what I found exceeded any and all of my expectations.

I would have been completely satisfied with a quieter coffee house that provides free Wi-Fi, however I write now from such a co-working installation, where about a hundred people are working around me. There are tables for standing work, bean-bag chairs, round community table, chairs made of bicycle saddles, on which whoever wants to can drive two pedals. All tables have power sockets… the Wi-Fi is fast… At 13:00, the place transformed into a lunch buffet thanks to the corresponding coffee shop. The tables are stacked with fruits, fresh tomatoes, cucumbers, apples, cheese, bio yoghurt drinks, some cold collation, mixed salads with seeds, fresh bread and pastry with seeds, two kinds of soup and lemonade. Coffee and tea are available all day.

Oh, and, I haven’t even said the main point.

It’s all free.

Yes, you read it right. They didn’t ask a penny for the place, nor for the lunch.

Because here, you pay with your knowledge if someone requires it.

When reserving a spot online, you have to add your profession, what you are working on right now and what you can help others with.

If I want, I can ask for webdesign tips, language teaching, or PR help from those working here.

It only depends on who’s here and what they know.

I asked the receptionist how they pay for all of this.

The response: renting negotiation rooms and conference rooms is their main profile. That’s what generates profit. Paying clients pay for food as well. They “support” about a hundred nomads a day from the generated profit, and all they ask in return is to help each other.

This is Seats2Meet, and it exists in other towns/countries as well. —

The post Seats2meet, The Ultimate YZ Facility (guest post) appeared first on Seats2meet.

February 23, 2016

7 manieren waarop een boek je business versterkt

Marketing en pr zijn onmisbaar in elk bedrijf. Steeds meer ondernemers ontdekken de kracht van één slim marketingmiddel in het bijzonder: een eigen boek. Het levert je niet alleen naamsbekendheid op, maar ook onverwachte bijkomstigheden die je helpen je bedrijf te laten groeien. In dit artikel belichten we zeven ‘bijverschijnselen’ die ondernemers dankzij hun boek ondervonden.

Scherpere visie

Al tijdens het schrijven merken veel ondernemers wat een boek voor hun business betekent. Als schrijver moet je je boodschap en visie haarscherp voor ogen hebben om die goed over te brengen op de lezer. Heb je dat niet, dan merk je dat het schrijven niet goed lukt. Schrijven is een manier om je visie aan te scherpen.

Josien Sneek (De V-factor – Big Business Publishers): “Het nadenken over hoe ik met mijn boek het beste mijn lezersgroep bereik, vond ik boeiend en nuttig voor de ontwikkeling van mijn bedrijf.” Tijdens het schrijfproces besloot Josien bovendien haar bedrijfsnaam aan te passen om haar doelgroep meer aan te spreken.

Piet Vink (Succes met SharePoint! – Van Duuren Media): “Het leukste aan het schrijven van een boek vond ik de interviews met klanten en experts op het gebied van SharePoint. Daar heb ik veel van geleerd en daarmee kon ik mijn visie aanscherpen.”

Schrijfproces

Een boek schrijven is een intensief proces. Opeens moet je je gedachten exact onder woorden brengen, zodat ook een ander ze begrijpt. Je moet zaken helder uitleggen, voorbeelden geven en metaforen bedenken. Het schrijven brengt allerlei creatieve denkprocessen op gang die je helpen om je bedrijf nog beter te positioneren.

Harry van der Pol (Basisboek luisteren en spreken – Vanbinnenuit): “Schrijven is creatiever, meer scheppend, dan ik dacht. Het is niet een kwestie van opschrijven wat je denkt te weten, maar onderweg ontstaan nieuwe dingen. Voor mij als trainer/coach een heel mooie manier om mezelf (en nieuw materiaal) te ontwikkelen.”

Birgit Smit (Van doemscenario naar droombaan – LannooCampus): “Soms heeft iets tijd nodig om zich in je hoofd te ontwikkelen. Ik heb ieder hoofdstuk gemiddeld vijf keer in de prullenbak gegooid. Vond ik dat erg of zonde van mijn tijd? Nee, dit hoorde bij mijn proces om tot een manuscript te komen waar ik helemaal achter kan staan. Schroom dus niet om gewoon iets weg te doen, als je niet tevreden bent. Het hoort bij het schrijfproces en leidt uiteindelijk tot geweldige resultaten.”

Expertstatus

Je kunt wel zeggen dat je goed bent in je vak. Maar met een eigen boek krijgt het veel meer zeggingskracht. Het bewijs heb je nu in handen! Een boek heeft zelfs al vóór verschijnen een positieve uitwerking op je expertstatus.

Ine van Hofstraeten (Topverkoper in 20 weken – Uitgeverij Houtekiet): “Het heeft vooral mijn geloofwaardigheid als salesmanager versterkt. Mijn klanten zien meer de persoon achter de verkoper. Ik ben plots de expert, waardoor ik al ben uitgenodigd om een workshop te geven bij een opleiding toerisme/verkoop. En op internet verschijnen uitgebreide boekrecensies.”

Birgit Smit (Van doemscenario naar droombaan – LannooCampus): “Al voordat het boek verscheen, merkte ik het effect: het versterkt je expertstatus. Mensen denken: een boek schrijf je niet zomaar, dan heb je echt iets te vertellen. Dat effect werd nog sterker op het moment dat ik een contract kreeg aangeboden van uitgeverij LannooCampus. Mijn boek helpt me ook heel erg bij de acquisitie. Het legt gewicht in de schaal en opent deuren.”

Free publicity

Als ondernemer kom je niet zomaar in de krant. Dan moet je al echt iets gepresteerd hebben. Maar schrijf je een boek, dan vindt de pers jou! Met een boek word je veel sneller gevonden als expert, ook door de pers. Je staat bovenaan in zoekmachines omdat je boek in alle grote internetboekwinkels verkrijgbaar is. Maar maak ook zelf gebruik van de nieuwswaarde van je boek en stuur bij verschijnen een persbericht aan zo veel mogelijk relevante media. Voor je het weet kom je op de radio of tv!

Edwin de Haas (Sales beter de baas – Boom Nelissen): “Als je boek verschijnt ontploft je LinkedIn-profiel! De eerste dagen hebben honderden mensen mijn profiel bekeken. Ook word ik gebeld door tijdschriften met de vraag of ze een recensie-exemplaar mogen ontvangen. Ik dacht dat je daarom moest bedelen, maar als je een populair boek schrijft wordt de free publicity je zomaar aangeboden. Deuren gaan voor je open.”

Groeisprong

Wil je een flinke sprong maken met je bedrijf? Een boek kan zomaar het ideale opstapje vormen. Vooral in combinatie met het geven van lezingen werkt een eigen boek voor veel ondernemers als ideale springplank. Een boek als ware klantenmagneet.

Harry van der Pol (Basisboek luisteren en spreken – Vanbinnenuit): “Dankzij mijn boeken krijg ik veel aanvragen voor trainingen, workshop en gastcolleges.”

Richard de Leth (OERsterk – uitgeverij De Leth): “Dankzij mijn boek, dat inmiddels een bestseller is, is mijn praktijk voor integrale geneeskunde volgestroomd, word ik overal in het land voor lezingen uitgenodigd en ontmoet ik veel interessante nieuwe mensen. Kwamen er vroeger maar 5 of 10 personen naar mijn lezingen, dankzij mijn boek trek ik nu volle zalen, met soms wel 250 of 300 man.”

Richard heeft intussen meerdere boeken uitgegeven met een totale oplage van zo’n 60.000 exemplaren. En zijn lezingenkalender is voor een jaar vooruit volgeboekt. Denk je eens in wat dat voor jouw bedrijf zou betekenen…

Spin-off

Veel schrijvers kunnen het beamen: dankzij hun boek doen zich opeens veel nieuwe businesskansen voor. Een boek kan ook indirect heel veel voordelen bieden via lucratieve spin-off waarmee je je bedrijf nog beter onder de aandacht brengt bij de doelgroep.

Johan de Kruijf (Artsen zijn ook maar mensen – Uitgeverij Johan de Kruijf): “De experts die ik voor mijn boek interviewde, bleken een bijzonder waardevolle uitbreiding van mijn netwerk. Zo werd ik uitgenodigd om gastcolleges te geven aan de Erasmus Universiteit, gevraagd voor de denktank van de Stichting Veiligheidsdenken en als jurylid voor de ZorgVeiligPrijs van Achmea. Dit alles zorgt natuurlijk voor een enorme expertstatus in hartje doelgroep!”

Netwerk

Wat Johan de Kruijf al noemt: een boek zorgt ook voor een groter netwerk. Je komt bekend te staan als expert en mensen weten je te vinden. Sommige ondernemers helpen dat nog een handje door interessante zakelijke contacten te laten bijdragen aan hun boek, bijvoorbeeld door ze te interviewen over hun expertise of ervaring. Het netwerk van deze mensen ligt dan opeens ook onder jouw handbereik.

Mine van Wychen (Jij redt het wel – Scriptum): “Het feit dat Scriptum vertrouwen in mij had, was een bevestiging dat mijn verhaal bijzonder is. Dat merk ik in contacten met (potentiële) klanten en opdrachtgevers. Nog voor mijn boek in de winkel lag, merkte ik dat het mijn netwerk vergrootte. Alleen al dat mensen weten dat ik dit boek geschreven heb, geeft mij toegang tot platformen die ik voorheen niet had. Kortom: winst!”

Wil jij dit ook allemaal bereiken? Kun je wel wat hulp gebruiken? In onze masterclass Zo schrijf je een boek (1 dag) helpen we ondernemers en professionals op weg met het schrijven van een boek. Inclusief stijltips en een gratis tekstbeoordeling.

Tekst: Suzanna van der Laan (www.boekenbusiness.com)

The post 7 manieren waarop een boek je business versterkt appeared first on Seats2meet.

February 22, 2016

The New World: Come and Get It

Today marks exactly a week since a got here in The Netherlands to live new adventures, and work at the seat2meet .com, of course. I have to say that I don’t know exactly what my expectations were, but what I am living here on my day-by-day is totally beating them.

When you are living your traditional life working in a big company, as I was doing in Brazil, you have an idea that new things are happening, but you keep a distance from it. Something in you change when you actually go and experience them for yourself.

This new world I am referring to comes from the society 3.0 way of thinking. People are wiling to share their knowledge and also listen to you. From that you obviously get another’s point of view, and which is even better, you get to new conclusions yourself. This is how you have original ideas and meet relevant people. It’s the way to new opportunities.

After a week in this environment I can say that I saw more innovation happening and had more new ideas then in the whole year of 2015, I am not exaggerating.

So when people that work as a freelancer ask me “why would I go to a coworking space when I can just work home in my pajamas?” that is what a have to say to you: feel free to work in your pajamas, you can do that, but I challenge you to spend just one day in a seats2meet.com location.

Open your mind, look around, drink coffee, talk to people around you. Truth is I can give a million reasons why you should change your pajamas and go, but you will only truly understand it once you live it. There is a whole world of good ideas and opportunities and it welcomes everyone who wants to get in it, that is the future, and I promise you are going to love it.

The post The New World: Come and Get It appeared first on Seats2meet.

CUAsia – Ten visionaries, one future

To celebrate the partnership between S2M and Coworking Unconference (CUAsia) 2016, we are interviewing the keynote speakers of this remarkable event. In the series ‘Ten visionaries, one future’, today Mike LaRosa will share his vision on the future of work and live with us.

Mike LaRosa is one of the organizers of CUAsia taking place in Ubud, Bali on February 26-28. He is a big believer of accelerating serendipity, which is why he has invited Seats2meet to make the event even more relevant with the S2M for Events software. In the run-up to CUAsia we are working closely as a team, to make the event a big success. Mike is also founder & managing partner of Wayfarer Advisory Group and co-founder and publisher of Coworkaholic Omnimedia. We are proud to have Mike on board as an S2M Ambassador and have more partnerships in the making with him at the time of this interview.

What does the term ‘coworking’ mean to you specifically?

To me it means sharing space to share ideas and knowledge – there is something really magical about having someone come over and say “Hey sorry, I don’t mean to listen in on your conversation, but did you say you had _____ problem? I can help.”

How would you describe the development of coworking in Asia?

It’s a really unique juxtaposition of all ends of the coworking spectrum. All over the world there are emerging coworking trends: premium high end coworking spaces in Class A highrises in central business districts, spaces in the developing world that are positioning themselves as hubs of education, locations that are more geared for digital nomads or coworkations.

How does this development relate to the rest of the world?

Only in Asia do you have this whole melting pot of all different concepts. I think that in the next few years, Asia will really become the leader in this.

What do you think is the biggest challenge for the coworking movement worldwide?

Awareness – just getting the word out and having people learn more is key. Knowledge is power.

What type of people does it attract?

Those who are forward thinking, creative.

What is the importance for people of being part of bigger collective?

It’s all about community. We’re all yearning to find our tribe.

How do you envision the way we work in ten years from now?

I can’t even begin to imagine it. I think advances in mobile and wifi/internet technology will continue to allow us all to work anywhere. I think that Internet of things might really take our efficiency and productivity to heights we can’t even think about. It’s like 10 years ago who would have ever thought we’d stream media instead of still buy DVDs?

What specific role will the coworking movement have in this, according to you?

I think it will just help support those who are looking to work remotely.

If you had to pick one favorite place to work in this world, which would it be and why?

Betahaus in Berlin. I love the story of Betahaus; how it has grown into the building and how different floors were created for different needs. I’m a big fan of spaces that have food and beverage services – the open cafe, the private offices, event space, class rooms.

What is your life motto?

I’ve a few. #doyou | no regrets | sometimes you’ve just gotta say WTF

Want to know more about Mike and his activities?

Check www.mikelarosa.co or follow him on Twitter: @liveventi @thecoworkaholic

Mike will also attend the S2M Global Meetup at March 21-23, 2016 in Utrecht, The Netherlands

The post CUAsia – Ten visionaries, one future appeared first on Seats2meet.

The nature of money – Part 4: The alternatives

The year was 1932 and the small town of Wörgl in Austria was caught up in the great depression, just like the rest of the world.

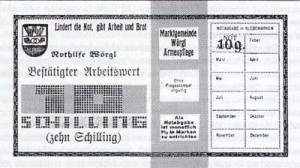

When Michael Unterguggenberger (1884-1936) was elected mayor of Wörgl, the city had 500 jobless people and another 1,000 in the immediate vicinity. Furthermore, 200 families were absolutely penniless. The mayor-with-the-long-name (as Professor Irving Fisher from Yale would call him) was familiar with Silvio Gesell‘s work and decided to put it to the test.

He had a long list of projects he wanted to accomplish (re-paving the streets, making the water distribution system available for the entire town, planting trees along the streets and other needed repairs) Many people were willing and able to do all of those things, but he had only 40,000 Austrian schillings in the bank, a pittance compared to what needed to be done.

Instead of spending the 40,000 schillings on starting the first of his long list of projects, he decided to put the money on deposit with a local savings bank as a guarantee for issuing Wörgl’s own 40,000 schilling’s worth of stamp scrip. He then used the stamp scrip to pay for his first project. Because a stamp needed to be applied each month (at 1% of face value) thereby devaluing the scrip, everybody who was paid with the stamp scrip made sure he or she was spending it quickly, automatically providing work for others. When people had run out of ideas of what to spend their stamp scrip on, they even decided to pay their taxes, early.

Wörgl was the first town in Austria which effectively managed to redress the extreme levels of unemployment. They not only re-paved the streets and rebuilt the water system and all of the other projects on Mayor Unterguggenberger’s long list, they even built new houses, a ski jump and a bridge with a plaque proudly reminding us that ‘This bridge was built with our own Free Money’. Six villages in the neighbourhood copied the system, one of which built the municipal swimming pool with the proceeds. Even the French Prime Minister, Édouard Dalladier, made a special visit to see first hand the “miracle of Wörgl.”

It is essential to understand that the majority of this additional employment was not due directly to the mayor’s projects as would be the case, for example, in Roosevelt’s contract work programmes. The bulk of the work was provided by the circulation of the stamp scrip after the first people contracted by the mayor spent it. In fact, every one of the schillings in stamp scrip created between 12 and 14 times more employment than the normal schillings circulating in parallel. The anti-hoarding device proved extremely effective as a spontaneous work-generating device.

It is essential to understand that the majority of this additional employment was not due directly to the mayor’s projects as would be the case, for example, in Roosevelt’s contract work programmes. The bulk of the work was provided by the circulation of the stamp scrip after the first people contracted by the mayor spent it. In fact, every one of the schillings in stamp scrip created between 12 and 14 times more employment than the normal schillings circulating in parallel. The anti-hoarding device proved extremely effective as a spontaneous work-generating device.

Wörgl’s demonstration was so successful that it was replicated, first in the neighboring city of Kirchbichl in January of 1933. In June of that year, Unterguggenberger addressed a meeting with representatives of 170 other towns and villages. Soon afterwards 200 townships in Austria wanted to copy it. It was at that point that the central bank panicked and decided to assert its monopoly rights. The people sued the central bank, but lost the case in November 1933. The case went to the Austrian Supreme Court, but was lost again. After that it became a criminal offence in Austria to issue “emergency currency.”

Story of Wörgl, as told on Bernard Lietaer’s site

Other types of money

A fact known by few people outside of Switzerland, and I guess maybe even in Switzerland, is that the Swiss Franc is not the only currency used in that country. Next to it they also have the WIR. The WIR started out as a kind of mutual credit system in 1934. Mutual credit systems create the money needed at the time of transaction. Say Mike and Sofie both have an account in a mutual credit system and both their balances are 0. When Sofie does something for Mike and gets payed 10 units for the work, Mike’s balance will be at -10 and Sofie’s at +10. The money has been created at the time of transaction.

The way the WIR works is similar with the exception that all the money is created against the central account of the WIR bank, i.e. by loans. When the WIR was created, these loans were interest free. Since 1950 though they started to charge interest on the loans, making the WIR now susceptible to some of the same problems that our regular, fiat based currencies suffer from. But because there is no interest on accounts, hoarding the currency is not incentivised, which is an advantage over our fiat currency. The WIR is most likely one of the reasons why the Swiss economy is as stable as it is. When there is a downturn in the economy, more WIR start circulating, thereby buffering for the effect of the downturn. When the economy perks up again, the circulation of WIR goes down again.

A couple of other examples of successful currencies that are in use are the Brixton pound in the UK, the Chiemgauer in Germany and the Charrua in Uruguay. The latter is remarkable because people can also pay their taxes with it, which makes it immediately trusted by everyone in the country, a problem that most complementary currencies struggle with.

Some currencies that are in use are very domain specific. In Japan for example, they have the Fureai Kippu, a currency that can be earned by and spent on elderly care. It’s use has improved the lives of both the elderly and their caretakers by creating meaningful and lasting bonds between them. At the same time it creates an incentive for younger people to tend to the elderly and it saves on cost in Yen for the services provided.

These are just a few examples of the thousands of complementary currencies in use today. Of these systems, LETS is probably the most widespread in use in local communities.

And the there are the complementary currencies almost every single one of us uses without even realizing it. These are your frequent flyer points, the stamps you collect on your loyalty at the local butcher, eco cheques issued by the government, coins on Swarm, … All these currencies are designed in a way that is different from our main currency system … and they all work and they are all used by millions of people. They also seem to be avoiding the problems of our main currency system. Ever heard of a financial crisis with your frequent flyer points? You could argue that it has to do with the scale of its use but looking at these statistics, that scale might be way bigger than you think.

Digital currencies

The first successful player in this field was BitCoin, which got created in 2008. Initially many thought of it as the future of currency but it’s not there yet and I believe it will never get there in its current form due to some serious problems it has.

The big advantage of BitCoin is that the system is owned and regulated by no one. Anyway, that’s the theory. It is very different from any other, centrally managed, monetary system though. BitCoins are generated by verifying transactions. This means that there is no central bank that is issuing new coins. Transactions are peer to peer so there is no middle man. Due to the block chain, a public ledger containing all transactions, it is also very fraud resistant because in order to alter the ledger one would have to hack into every copy of the ledger simultaneously. And there are a lot of copies out there. On top of that, the hacker would also have to alter it in such a way that it remains cryptographically intact. Considering that the ledger is in constant flux due to ongoing transactions, this is an impossible feat. And yet, someone may have found a way around it.

So, why is it not taking the world by storm? That has more to do with our human nature than with BitCoin itself. We are addicted to our current monetary system and instead of using BitCoin as a currency we started using it as a trading commodity. People will often, before buying something with BitCoins, first calculate what the equivalent value is in their government issued currency and then pay the equivalent amount in BitCoins. That would be the equivalent of me going to buy a coffee here in Australia and negotiating the price of that coffee based on the exchange rate with the Euro. That’s not how accepted currencies are used. And that is the first big problem BitCoin is dealing with.

The other problem I see with BitCoin also has to do with us being human. By definition, the amount of BitCoins that can be generated is limited to 21 million. That means that once the limit has been hit, that’s it. No more BitCoins to be added, ever. This means that, should we start using BitCoin as a real currency instead of a trade commodity, the price of products expressed in BitCoin could be pretty volatile. This depends on the size of the economy, expressed in value assets.

Take this simplified example. Say there is a production of 100 cups of coffee a day and we have 100 BitCoins available. If that were the entirety of our economy then a cup would cost 1 BitCoin. If we increase the production to 200 cups, the price would to down to 0.5 BitCoin since we don’t have 200 BitCoin to spend. That means that, depending on the size of the economy, what we pay for a cup of coffee or anything else might be fluctuating all over the place. And psychologically that’s hard to deal with for us humans.

The block chain that is behind BitCoin has big promise though and it is a solid technology to build next generation currencies on.

Sustainable money

Often people will say that money is the root of all evil. This is not true. The problem lies not with the fact that we use money in our day to day lives as a way to make trade easier, it lies in the fact that it is badly designed. If we make a car that guzzles 50 liters of fuel every 10 km and which needs to be turned off every 10 minutes, it doesn’t mean that all cars are crap, we just designed one that is crap. The good news is, we can design a better one. The same goes with our monetary system.

As explained before, our current mainstream monetary system is not sustainable. It works very well in one aspect, making financial traders rich. Enrichment of the few was also the goal of the original founders of our current banking system, the Rothschild family. And somehow we got lulled to the point that we now think that this is how money is supposed to work. I think we should have had enough financial crises by now to realize that there’s something wrong with it. But addictions can be hard to give up, especially if everyone around you is suffering from the same addiction as you are and we are all in deniance of the fact that there is even something wrong.

There is a better way though. We can construct monetary systems that work for us instead of us working for the monetary system, as is the case today. To do that we need to create them mindfully, with the intended goal of the monetary system in mind.

It has to be mathematically sound in a way that it is not designed with explosion build in. Compound interest inevitably leads to explosion.

It must not fight itself. Currently we have the hoarding incentive fighting the need for money to circulate in order to create a healthy economy.

There should be enough for everyone without creating insane inflation.

The system Wörgl created is good for creating a trade currency. Hoarding is disincentivized due to the demurrage fee and the speed of the economy can be regulated by how big the demurrage fee is. The demurrage fee also incentivises interest free loans. When I have 100 000 units in my account and you need 50 000 for a project, I’d be happy to lend those 50 000 to you interest free because that way I safeguard that money from the demurrage fee. This also increases the incentive to invest in long term projects, something that is disincentivised in our current monetary system. The fee could be brought to 0. People would then be able to save without fear of losing money but would still not be rewarded for it. It would lessen the incentive for interest free loans and long term investments though. Maybe a better option is to define a demurrage free amount everyone can hold on to.

Money creation – current implementations

The crucial point in any currency system is how it is created. There are a couple of options for this.

The LETS system, which has no demurrage fee, creates the money at the point of transaction. The balance between money and debt in this system is always 0. So in a way it works a bit like our current system by creating money out of debt but without the destructive compound interest on the debt and it is not issued by a central authority. Say the system is starting up and you and me are the first people making use of it. There is no money in the system at this stage. When you do something for me and we decide your work is worth 10 units of currency, let’s call them LETS dollars, I will pay you 10 LETS dollars. Now you have 10 LETS dollars and I have -10 LETS dollars. So I am in debt to the system, not to you, for 10 LETS dollars. If I do nothing for a year, I will still be in debt for 10 LETS dollars, my debt will not grow. Neither will your wealth if you don’t do anything. The money/debt balance always remains 0 and does not run out of hand. LETS systems are transparent to its users in order to keep people accountable. So everyone can see what you have in your account. When someone’s balance is heavily in the red, people will know. In LETS communities these people are not punished though. It creates an incentive for others to enlist their services to help them to get out of debt. This happens because there is no scarcity in currency. Because of this, there is also no real incentive to hoarding. The system’s success can actually be measured by how often people cross 0 in their account.

The Brixton pound is backed by the British pound. You can buy Brixton pounds on a 1 to 1 exchange rate and the British pounds are then held at the London Mutual Credit Union. So the number of Brixton pounds in circulation equals the number of pounds that have been bought by people. They are destroyed again when they are re converted to British pounds. Note that the Brixton pound does not have interest on its accounts, thereby making the real difference with the British pound and creating a higher incentive to make the currency circulate and make the economy work.

The stamp scrip in Wörgl was created in the same way as the Brixton pound, being backed by the 40 000 Austrian Shillings that were placed in the bank. Every time money exited the system through the demurrage fee, an equal amount could be injected into the system while still being backed up by the money in the bank. In essence, the Brixton pound can be considered as a currency with a demurrage fee of 0%.

Money creation – a new method

A system could be designed where money creation is coupled with a basic income. It would work like this:

Everyone who enters the monetary system is assigned a new account with money already on it, say 1000 units. At this point money has been created and the amount of money in the system automatically scales with the number of participants in the system. The number of people in an economy is one way to have a rudimentary measure of the size of the economy. Of course, this system needs to be protected against fraudulent behaviour like one person opening several accounts under different names and enriching themselves that way. I would propose to use Estonia’s e-residency, or a similar system, for identification purposes in order prevent this from happening.

In order to make sure that there is enough money supply, I’d also set up a central reserve. For every account that is added to the system, money would also be added to the central reserve, for simplicity, say this also equals 1000 units. Anyone can lend money from the central reserve interest free.

At the end of each month, money is deducted from each account as a demurrage fee. Say this demurrage fee is 1%. The fee could be calculated in terms of the average amount you had in your account in that month. All this money could then be collected by the central system and re distributed to every user in the system, essentially creating a basic income for everyone. People with negative balances on their account would not be charged demurrage fees because there is nothing to charge it on. On re distribution, an adjustment can be made in order to account for rounding errors so that, when the money is re injected in the system, the total amount would be the same, thereby keeping prices stable.

When people leave the system, the initial 1000 units that were created in their account and in the central reserve are removed from the system. If they have more than 1000 units in their account, the surplus is re distributed together with the collected demurrage fee. If they had less in their account, the difference is subtracted from the amount that is re distributed after collecting the demurrage fee. In order to avoid people to drain their accounts under 0 and then leave the system a penalty could be implemented. As long as our current monetary system is still the ruling one, a monetary fee equal to the negative balance could be an option. This money could then also be distributed amongst the users of the system.

The numbers used are for illustration only. Upon real world implementation of the system they would have to be looked into. A decision would also have to be made whether or not a demurrage free amount is to be defined. In case this is so, more money than the demurrage free amount needs to be created in order for the re distribution system to work.

Also note that, even though there is a central reserve, that does not mean the currency system needs to be managed by a central authority. It could be implemented as a distributed system like BitCoin and have its security based on a block chain.

Co existing currencies

As Bernard Lietaer describes in his book Rethinking Money, we do not necessarily have to design just 1 currency. We can have multiple currencies co existing next to each other. In fact, we already do. There are all the national currencies, Switzerland has its WIR and there are all the complementary currencies that are already being used. As the WIR in Switzerland proves, multiple co existing currencies provide the diversity needed to buffer the shock of one of these currencies failing. For that they need to be designed differently and each with their specific goals, otherwise they will just all fail together, as the crises in our financial world prove so well. So we could have a currency for global business to business trade, local currencies, domain specific currencies (education, health care, …) all co existing and when one should fail, the others would be unaffected and act as a buffer against meltdown.

Moving forward

The question many of you probably have by now is: how could we make this happen? The real beauty of it all is that we don’t need to wait for our governments to implement these currencies in order to use them. We can do this all by ourselves. It is admittedly harder to do it without government backing but so was getting voting rights for women. Hard does not equal impossible.

What is needed for a currency to work is getting enough people on board. In essence, enough value needs to be accessible through the currency. This can happen in local communities or in active, connected networks. Imagine a network of service providers starting to accept an alternative currency in their network, at least partially. That would mean that network can now use that currency to access each other’s services, vastly increasing the productivity of the network (through a higher circulation of currency) and reducing the dollar cost (read broken money cost) of hiring someone in the network.

Will this attract the scrutiny of governments? I’m pretty sure it will as soon as a currency becomes successful enough. But that is not a problem, it would be an opportunity for dialogue and the start of some real restructuring of our society by changing the destructive system we have now into something that would work for all.

Non quantifiable currencies – a philosophical addendum

After talking to Bree Gaudette, a friend of mine who manages the School of Life next door to the place from where I work when I’m in Melbourne, I got the inspiration to write this addendum.

Apart from the quantifiable currencies that have been described in this series about money there are also a whole lot of non quantifiable currencies we use on a daily basis. Trust, companionship, sex, service, … could all be seen as a sort of currency. We use them in our social exchanges and they pay for strengthening relationships, one of the most valuable things we have in life. They can not be expressed in numbers, yet they matter enormously to all of us. In a society where there is a strong tendency to quantify everything I believe that we need to realize quantification can not and should not be applied to everything. That what makes us truly human can not be expressed in numbers. It can only be expressed in heartfelt compassion and love, which I believe are the true currencies of life.

Conclusion

It would be great if we could live in a world without money. A world where we share the available resources and all take care of each other. I think this might be possible but to create the necessary mind shift for that on a global scale will be nigh impossible in the short run. There is just too much fear of not having enough. Maybe one day we will get there but in the meantime I believe the solution lies in better monetary systems which create more collaborative and compassionate behaviour by the ones who use it.

And I am not the only one who believes this. There are organisations out there who are campaigning for this today. Here are some of them:

Positive Money (UK)

Vollgeld (Switzerland)

Ons geld (The Netherlands)

Beyond Money

Originally published on The Stand-Up Way

The post The nature of money – Part 4: The alternatives appeared first on Seats2meet.

February 19, 2016

Over Nieuwe Business Modellen en Nieuwe Economie

Op 12 november 2015 organiseerden het Lectoraat Innoverend Ondernemen en het Zwaartepunt Ondernemerschap en Innovatie van De Haagse Hogeschool een seminar over Nieuwe Business Modellen en Nieuwe Economie. Ronald van den Hoff, co-founder van Seats2meet sprak enthousiast over dit onderwerp. Een verslag vind je hieronder.

Kansen herkennen in een maatschappij die kantelt

De economie verandert in razend tempo. We kopen, verkopen en handelen steeds vaker via internet. Er ontwikkelt zich een ‘We-Conomy’ waarin toegang (delen of ruilen) belangrijker is dan bezit. Daarnaast wordt de economie in toenemende mate circulair: er ontstaat steeds meer aandacht voor het sluiten van kringlopen en hergebruik van grondstoffen (‘cradle to cradle’).

Wat betekenen deze ontwikkelingen voor het bedrijfsleven en de toekomst van bedrijven? Hoe kan het onderwijs oude denk- en organisatiepatronen loslaten en anticiperen op de arbeidsmarkt van de toekomst? Welke kennis en vaardigheden vraagt het beroepenveld? Tijdens het seminar ‘Nieuwe businessmodellen en nieuwe economie’ aan De Haagse Hogeschool stonden deze vragen centraal. Zo’n 200 deelnemers (studenten, docenten en geïnteresseerden uit het bedrijfsleven) gingen op zoek naar nieuwe economische perspectieven en lieten zich inspireren door businessmodellen van de toekomst.

If it is to be, it is up to me!

“Nieuwe businessmodellen en innovatie vormen de corebusiness van onze opleiding Small Business & Retail Management”, vertelt dagvoorzitter en docent Ronald Visser tijdens zijn welkomstwoord in de Speakers’ Corner. “Onze ondernemende studenten willen de status quo uitdagen, de gevestigde orde ter discussie stellen en hun plekje op de nieuwe markt verdienen.” Visser haalt hoogleraar transitiekunde Jan Rotmans aan. “Die stelt dat we niet leven in een tijdperk van verandering, maar in een verandering van tijdperk. Waar verandering vroeger stapsgewijs verliep, gaat het anno 2015 vlugger. Dat kan zomaar betekenen dat je ‘out of business’ bent; natuurlijk het laatste wat je als organisatie wilt. Dat vraagt niet alleen om nieuwe businessmodellen, maar vooral om een andere mindset. Twee weken geleden stond ik hier met een groepje eerstejaarsstudenten. We bespraken wat vandaag de dag het belangrijkste businessmotto zou moeten zijn. Die les is te vatten in tien woorden van maar twee letters: ‘If it is to be, it is up to me’. Met andere woorden: je wilt geen speelbal zijn, maar speler. Het heft in handen nemen, zelf je koers bepalen. Dat kan alleen door eerst scherp te kijken naar je eigen businessmodel en naar wat de nieuwe economie voor je in petto heeft.”

Netwerkhogeschool

De Haagse heeft de ambitie uit te groeien tot een netwerkhogeschool, vertelt Simone Fredriksz, directeur van de faculteit Business, Finance & Marketing. “Wat dat precies is, zijn we aan het uitvinden. In elk geval willen we met onderwijs, onderzoek en het delen van kennis een belangrijke bijdrage leveren aan praktijkinnovatie. De verbinding met onze partners uit de samenleving – met name de beroepspraktijk – staat daarbij centraal. Er ontstaat een complexe, hybride samenleving waar grenzen vervagen en zekerheid en voorspelbaarheid verdwijnen. Zijn wij ook in staat, wetende dat alles zo snel gaat, op een andere manier naar onszelf te kijken? Dat is een grote uitdaging voor ons onderwijs: om open te zijn, zelfkritisch en een beetje kwetsbaar.”

Nederland kantelt

“Het is vandaag al eerder gezegd: Nederland kantelt en we bevinden ons op een historisch breukvlak”, zegt dr. Gertrud Blauwhof, lector Innoverend Ondernemen. “Nieuwe businessmodellen zijn van enorm belang voor de beroepspraktijk en het onderwijs. Door onderzoek vergroten we de kennis over nieuwe businessmodellen. Die kennis willen we ook delen en samen doorontwikkelen met bedrijven. Tijdens dit seminar agenderen we nieuwe trends en werken we aan een nieuw perspectief.”

i-Conomy: ‘We have moved to eBay’

Blauwhof leidt de deelnemers langs een aantal belangrijke veranderingen in het economisch landschap, te beginnen bij de informatie-economie. Op de achtergrond foto’s van een lege etalage met de boodschap ‘We have moved to eBay’ en een verdwaald winkelkarretje aan de kant van de weg. “Leegstaand vastgoed: een beeld dat je vandaag de dag in veel steden aantreft.” Nieuwkomers omarmen moderne technologieën en gaan in allerlei markten de strijd aan met gevestigde organisaties. Als voorbeeld van deze ‘disruptive innovation’ noemt Blauwhof Über, dat de complete taxibranche op zijn kop zet. “De kracht van Über zit ‘m in de smartphone. Wie had tien jaar geleden gedacht dat iedereen zo’n smartphone zou hebben?” Bedrijven uit de oude economie leggen het loodje of komen in nieuwe handen. “Deze week was in het nieuws dat John de Mol investeert in een bijna failliet postorderbedrijf. Al die pakketjes die wij op internet bestellen moeten immers ook bezorgd worden.”

We-Conomy: auto huren bij de buren

Een tweede variant van de nieuwe economie die Blauwhof noemt is de We-Conomy: die van ruilen, delen en cocreëren. “Zie Snappcar, dat het mogelijk maakt de auto van je buurman of wijkgenoot te huren. En dankzij Airbnb, de Über van de hotelsector, kun je overal ter wereld een kamer boeken bij particulieren thuis.”

C-Conomy: cradle to cradle

Blauwhof introduceert de derde variant – de circulaire economie – met een citaat van architect Thomas Rau: ‘De aarde is een gesloten systeem. Wat er niet is, is er niet. Wat er wel is, zullen we moeten behouden.’ Blauwhof: “We krijgen een economie waarin we zaken niet meer bezitten, maar gebruiken. Het is een economie waarin afval niet langer bestaat. Een drinkwaterbedrijf kan zijn kalk (een restproduct) kwijt aan een tapijtfabrikant, die het als input voor zijn productieproces kan gebruiken. Een win-winsituatie.”

Seats2meet: voor niets gaat meer dan alleen de zon op…

Wie koploper wil zijn, pakt de regie, gooit de luiken open en kijkt goed naar wat de wereld te bieden heeft, benadrukt dagvoorzitter Ronald Visser nog eens. “De toekomst is wijdverspreid. Als je goed om je heen kijkt, zie je her en der al glimpen van de nieuwe economie en bijbehorende businessmodellen.” Jaren geleden was hij nog een jonge onderzoeker bij Nyenrode. Met een aantal collega’s had hij een afspraak bij Seats2Meet. “We zaten daar lekker te vergaderen, koffie te drinken en te lunchen. Wie gaat dit betalen, vroegen we ons af… Aan het eind van onze sessie maakten we een potje, totdat iemand zei dat het allemaal gratis was.” Onder het mom van ‘vraag niet hoe het kan, maar profiteer ervan’ liet Visser het erbij zitten. “Terwijl ik juist kritische vragen had moeten stellen: wat zie ik hier eigenlijk gebeuren?”

Gelukkig is Ronald van den Hoff, oprichter van Seats2Meet, vanmiddag hoogstpersoonlijk aanwezig om het S2M-concept uitgebreid toe te lichten. In een wervelende presentatie neemt hij de deelnemers mee naar de businessmodellen van de toekomst en ‘Society 3.0’.

Hybride ondernemer

Van student aan de hogere hotelschool groeide Ronald van den Hoff uit tot de innovatieve duizendpoot die hij nu is. “Tien jaar geleden was het leven nog heel overzichtelijk en inzichtelijk. Destijds kon ik nog simpel zeggen dat ik vergader- en congrescentra exploiteerde. Tegenwoordig moet ik iedereen uitleggen wat ik allemaal wel niet aan het doen ben. En dat verandert elke dag.” Als ondernemer kijkt hij elke dag naar buiten. Dat betekent dat hij ook een soort trendwatcher is geworden. Van den Hoff is een van de grondleggers van de jaarlijkse Trendrede, coacht mensen, investeert in bedrijven, heeft een eigen uitgeverij en zet zich in voor goede doelen.

Gevangen in oude systemen

Alsof het niet genoeg is, kruipt Van den Hoff vandaag ook even in de rol van geschiedenisdocent. Hij neemt de zaal mee naar de Industriële Revolutie. “Vroeger had je vaste, hiërarchische organisatiestructuren en lagen functies duidelijk vast. Dat stamt nog uit de tijd van de uitvinding van de stoommachine. We zijn ons bestuur anders gaan inrichten en ons land in vakjes gaan indelen: daar moet je wonen (in een huis in een woonwijk), daar moet je werken (dat heet fabriek). Als je een boek wilt hebben, ga je naar een gebouw waar bibliotheek op staat. Winkelen doe je in de winkelstraat. Dat stukje groen daar is een park en je kunt er recreëren op zondag.” Die planmatige en geordende aanpak was ooit een zegen, want daarvoor was het een rotzooitje en woonden mensen naast chemische fabrieken, benadrukt Van den Hoff. “Maar wanneer we een overschot krijgen aan bepaalde factoren – zoals kantoorruimte – doen we er niets mee en zitten we gevangen in ons eigen systeem.”

‘We leiden op voor beroepen die over vijf jaar niet meer bestaan’

Ook het fundament van ons onderwijssysteem is gedateerd, stelt hij. “We leiden op voor beroepen die over vijf jaar niet meer bestaan. Sterker nog: studenten worden – ook hier – opgeleid voor beroepen die in mijn organisatie al niet meer bestaan…” Onderwijsvernieuwing wordt naar zijn idee niet hoog genoeg ingestoken. “Het onderwijs van de toekomst, hebben we daar eigenlijk nog wel scholen voor nodig? Of zijn er andere manieren om kennis en informatie aan te bieden? Natuurlijk moeten we basistalenten ontwikkelen. Maar stel: we hebben over vijf jaar een chip die rechtstreeks met de hersenen in verbinding staat. Misschien hoef je dan niet eens meer te kunnen lezen, maar moeten we de focus leggen op leren samenwerken… Kortom, we moeten ons telkens afvragen wat de minimale randvoorwaarden zijn.”

Trends op weg naar Society 3.0

De moderne samenleving transformeert veel sneller dan ten tijde van de Industriële Revolutie. Van den Hoff: “Tegenwoordig lijkt het wel alsof er iedere dag een stoommachine wordt uitgevonden.” Aan de hand van enkele trends geeft hij een inkijkje in de Nieuwe Tijd, die hij de werktitel ‘Society 3.0’ heeft meegegeven.

Toegang wordt belangrijker dan bezit

“Als ik van A naar B wil, heb ik toegang nodig tot vervoer; ik hoef geen eigenaar te zijn van een auto. En om een schilderij op te hangen, hoef ik geen boormachine in de garage te hebben liggen. Die kan ik ook lenen van een buurtgenoot via Peerby. Achmea verzekert dat al. Op die manier wordt een boormachine langer gebruikt dan nu, want de gemiddelde gebruiksduur is nu maar twaalf minuten.”

The Internet of Things

Onze omgeving wordt slimmer dan wijzelf, voorspelt Van den Hoff. Tientallen miljarden apparaten raken verbonden. “Over vijf jaar weet dit gebouw wie u bent, waar u vandaan komt, wat u hier komt doen, met wie u een afspraak heeft en waarmee u bezig bent. Willen we dat? Dat is iets om over na te denken, maar het zit er wel aan te komen.”

Kennis delen zonder tussenkomst van bedrijven

Niet alleen onze devices zijn aan elkaar verbonden. Onder invloed van internet kunnen we ook onze kennis makkelijker uitwisselen. Kennis waarmee je economische waarde kunt creëren is niet langer exclusief in handen van formele organisaties, maar wordt ook toegankelijk voor netwerken van verbonden mensen. Van den Hoff: “Als gevestigde organisatie moet je dus je stinkende best doen om in verbinding te blijven.”

Meer mensen leven in grote steden

Hoewel we over de hele wereld met elkaar kunnen werken en verbonden zijn, zien we toch een trek naar grote steden. “Grote steden worden steeds groter”, stelt Van den Hoff vast. “En dan heb ik het over megasteden tussen de 20 en de 50 miljoen inwoners. Daarvan schijnen er in China al meer dan zestig te zijn, waarvan wij er ook al vier kennen. Dat geeft al iets aan. Nederland is – helaas voor ons – niet groter dan een lullig provinciestadje met een paar parkjes ertussen. De havens van Rotterdam, Antwerpen en Hamburg zijn voor het buitenland één. Het wordt dan ook tijd dat we anders gaan nadenken over samenwerken en landgrensoverstijgend denken.”

Opkomst van nieuwe platformen

We hebben allemaal een smartphone op zak en toegang tot wifi lijkt af en toe wel een primaire levensbehoefte. Die online revolutie maakt de weg vrij voor nieuwe platformen. Van den Hoff: “Über is bijna het grootste vervoersbedrijf ter wereld, terwijl het geen taxiauto in eigendom heeft. Airbnb – in feite de grootste hotelketen ter wereld – bezit geen steen. Alibaba is op dit moment de grootste retailer ter wereld zonder ook maar één fysieke winkel. En Facebook maakt geen enkel stukje content, maar is mondiaal wel de grootste contentprovider.”

De toekomst: gedeeld eigenaarschap

Platformen als Airbnb en Über zijn goed bezien geen zuivere vertegenwoordigers van de nieuwe economie, nuanceert Van den Hoff direct. Ze markeren overgangsfases. “Airbnb en Über maken de overvloed zichtbaar en maken delen mogelijk, maar zijn nog heel traditioneel gefinancierd. Het zijn gewoon beursgenoteerde ondernemingen. Wat je meteen ziet, is de klassieke tegenstelling tussen de kortetermijn- (focus op aandeelhouders en winstbelang) en langetermijndenken (focus op overige stakeholders).” Het zijn volgens Van den Hoff geen duurzame modellen en het is slechts wachten op alternatieven. “Op dit moment wordt in Israël alweer de ‘killer-app’ voor Über gebouwd. Daar is zelfs sprake van gedeeld eigenaarschap. Hoe meer je gebruikmaakt van het systeem, hoe meer je te vertellen krijgt. Naar die vorm gaan we toe.”

Gamingindustrie

Een ander platform dat zich op een ongelooflijke manier ontwikkelt, is de gamingindustrie, signaleert Van den Hoff. “Gaming is groter dan sport. Dat kunnen we ons haast niet voorstellen. De Messi van de gamingwereld heeft miljoenen volgers. Er zijn complete landencompetities, EK’s en WK’s… Vijftig- tot honderdduizend mensen gaan in een stadion zitten kijken naar kinderen die op schermpjes bezig zijn met virtuele spelletjes. Virtualiteit en realiteit lopen daar door elkaar heen. Het is eigenlijk niet te volgen, maar er gaan enorme bedragen in om. Werkelijk fascinerend om te zien.”

E-stonia

In het meest extreme geval kan zelfs een land een nieuw platform vormen. Wat als onze ‘digitale zelf’ ergens kon leven met alle rechten, plichten en priviliges die daarbij horen? In Estland is het al mogelijk: de eerste e-residents zijn daar een feit. Van den Hoff is één van de nieuwe virtuele inwoners van de ambitieuze Baltische staat. “Estland wil het grootste land ter wereld worden. In de vorige eeuw ging je dan oorlog voeren met je buurland en met een leger binnenvallen. In het geval van Estland – met de Russen als buren – is dat een beetje lastig… Als e-resident kun je in Estland een bankrekening openen en zakendoen, zonder dat je er ooit bent geweest. Hoe het werkt? Je meldt je aan via een formulier en betaalt 55 euro. Vervolgens controleren ze je identiteit en of je niet op een Interpol-lijst staat. Dan krijg je een uitnodiging om bij de Estse ambassade in Den Haag langs te komen. Ze maken een foto, nemen vingerafdrukken af, checken je paspoort en je identiteit is gevalideerd. Als je zakendoet als e-resident, ben je dus echt wie je zegt dat je bent. En dat wordt in de toekomst natuurlijk erg belangrijk. Het eerste doel is om 25 miljoen mensen te registreren en het eerste miljoen is al in zicht. Het gaat dacht ik ongeveer acht keer zo snel als dat ze gepland hadden. Werkelijk fantastisch!”

Minder banen door automatisering

Ook fysieke platformen veranderen, vervolgt Van den Hoff. “De fabriek van de toekomst telt nog maar twee werknemers: een man en een hond. De man is er om de hond te eten te geven, de hond zorgt ervoor dat de man met z’n vingers van de apparatuur afblijft. De rest gebeurt volkomen geautomatiseerd.” Door de jaren slanken organisaties steeds verder af, ziet Van den Hoff. “In 1964 had AT&T een omzet van 267 miljard en 760.000 mensen in dienst. Google heeft tegenwoordig een veel hogere omzet, maar telt nog maar 55.000 medewerkers… Organisaties worden steeds kleiner, terwijl de overheid banen wil creëren. Welke banen? De overheid blijft hangen in haar oude mantra’s. We hebben het ook allemaal zo geleerd: je wilt iets en daarvoor heb je geld nodig. Dus je hebt een baan nodig om salaris te verdienen. Maar als die baan er simpelweg niet is, houdt het op. Wat dat betreft wordt het hoog tijd dat we het basisinkomen eens gaan bespreken. Want het aantal banen is eindig, heel simpel.”

3D-printer

De uitvinding van de 3D-printer is misschien nog een belangrijkere doorbraak dan het internet, verwacht Van den Hoff. “3D Hubs biedt al toegang tot ruim 24.000 printlocaties wereldwijd. Alles wat we niet kunnen delen of ruilen, gaan we op den duur zelf maken. Dat betekent ook dat ook een groot deel van de transportindustrie verdwijnt. Je ontvangt geen schoenen meer, maar software om die schoenen lokaal uit te printen. Ze kunnen alles printen, hè? Laat daar geen misverstand over bestaan. Wapens, huizen, auto’s, huizen, bruggen in Amsterdam… Vanochtend stond in de krant dat artsen al open ruggetjes van baby’s in de baarmoeder kunnen dichten met 3D-printertechnologie. Dat wordt enorm groot. Als je geld hebt, ga je naar het Van Gogh Museum en bestel je voor 25.000 euro een 3D-geprinte Van Gogh. En het aardige is: die krengen zijn niet van echt te onderscheiden. Want het schilderij is niet plat, maar 3D-geprint. Dus je ziet de penseelstroken van de master himself. Het schilderij ruikt alleen nieuw; dat is nog het enige dilemma… En dan koopt onze overheid twee Rembrandts voor 160 miljoen. U snapt wel wat mijn oplossing was geweest…”

Minder botsingen, minder banen

BMW eindigt als een derderangs autoleverancier, voorspelt Van den Hoff. “Want het draait straks om de software en het maakt helemaal niet meer uit wat voor motor erin zit.” Zoals we onze smartphones af en toe een update geven, doen we dat in de toekomst met onze auto’s. “Vorige week is de Tesla nog geüpgraded en in de toekomst zijn hun modellen zelfrijdend. Als we onze auto’s dan ook nog gaan delen, hebben we veel minder auto’s en parkeerplekken nodig. Maar ja, wel jammer als je werkt voor een verzekeraar, herstelschadebedrijf of op de EHBO. Want die zelfsturende elektrische auto’s botsen veel minder dan mensen.”

Big Brother is watching you?

Kunstmatige intelligentie heeft ook zijn keerzijde: we kunnen er niet blind op vertrouwen dat partijen zorgvuldig met onze persoonsgegevens en privacy omspringen. Van den Hoff kijkt bijvoorbeeld kritisch naar energieleveranciers die hun klanten gratis voorzien van een slimme thermostaat. “We hangen ze allemaal aan de muur. Leuk en aardig, maar ik verzeker u: ik heb ze niet in huis, terwijl ik innovatie van alle kanten omarm. Zo’n thermostaat kan aan uw energieverbruik zien hoeveel mensen uw huishouden telt. Nou is dat op zichzelf nog niet zo erg, maar als die gegevens worden gekoppeld aan de Gemeentelijke Basisadministratie… Stel: u heeft een uitkering. U zegt dat u alleen woont, maar u gebruikt energie voor twee. Dan krijgt u huiscontrole inclusief badkamerbezoek. Een ander voorbeeld: Samsung heeft tv’s gemaakt die gesprekken in de huiskamer kunnen volgen; waarop ze vervolgens de reclame-inhoud kunnen afstemmen. Dat gebeurt allemaal onder het mom van wetenschappelijk onderzoek… De persoonlijke robot Pepper komt per batches van duizend op de markt en wordt in Japan al gebruikt. Die robots zijn zo slim, ze lezen aan de vorm van je gezicht af dat je Aziaat bent en beginnen vervolgens in het Japans tegen je te beppen. Er zit zelflerende software in en ze staan met elkaar in verbinding. Dus als één zo’n Pepper het kunstje leert, hebben alle Peppers ter wereld het in no time onder de knie. En nou wordt-ie interessant, want als er eentje wordt gehackt… Je ziet ‘m al hangen natuurlijk. En daar zijn we ons nog nauwelijks van bewust.”

Streven naar het nieuwe Google of de kracht van klein?

Van den Hoff zet zijn vraagtekens bij de huidige hausse aan regionale start-upprogramma’s. “Een hype. Elke regio wil de nieuwe start-updelta worden en het nieuwe Google voortbrengen. Dus wat doen we? We maken van alle kleintjes weer een middelgroot winkeltje, want pas dan is het succesvol. Allemaal geldbelang en kortetermijndenken. Terwijl een start-up juist lokaal erg sterk kan zijn en veel kan betekenen. Wat is er mis met een kleinschalige start-up in een bepaalde wijk? Dan kunnen ze in een volgende wijk iets anders doen. En misschien delen ze hun kennis wel. Sterker nog: misschien gaan al die kleine platformpjes wel samenwerken. En als je ze met elkaar gaat verbinden, ontstaat er pas écht een groot platform.”

Nieuw evenwicht

“Ik denk dat we uiteindelijk een nieuw soort balans krijgen tussen de Facebooks en Googles van deze wereld en een aantal netwerken waarin we lokaal met elkaar verbonden zijn. Daarmee kunnen we een prachtig tegenwicht bieden. Ik noem het wel de ‘interdependente economie’: een economie van samenhang”, vertelt Van den Hoff. “Denk aan het online platform Thuisafgehaald, dat al 9.500 thuiskoks heeft. Het principe is simpel: je koopt voor tien, kookt voor tien, eet twee porties zelf op en verkoopt acht porties aan buurtgenoten. En ik heb Horeca Nederland nog niet horen roepen: hé, dat is illegale catering! Ze zitten wat dat betreft nog half te slapen. Het brengt ook nieuwe vragen met zich mee. Hoever moet je daarmee doorgaan? Kun je het überhaupt tegenhouden? Wat gaat de Nederlandse Voedsel- en Warenwetautoriteit doen? Elke avond duizenden locaties af? Er werken nog maar een paar honderd controleurs, want de rest is allemaal al wegbezuinigd…”

Mesh economy: van global naar glocal

Van den Hoff ziet tal van lokale netwerken ontstaan die voor nieuwe bedrijvigheid en diensten zorgen. “Neem het fenomeen Airbnb. Buitenlandse toeristen komen hierdoor vanzelf in verbinding met allerlei lokale netwerken. Want ze willen ook een citytour maken, fiets huren of (thuis)maaltijd afhalen. Derden springen in dat gat. Complete wijken gaan ‘hotelletje spelen’ en nieuwe bedrijvigheid en samenwerkingsverbanden ontstaan: sleuteladressen en conciërgeservices, schoonmaakdiensten, reparatieservices en dat soort zaken. Global wordt glocal: een combinatie van globaal en lokaal. Deze ‘mesh economy’ zorgt voor een totaal ander economisch perspectief. Je bent niet van Airbnb, maar initieert wel een activiteit binnen de ‘Airbnb-mesh’, waarmee de mesh weer sterker wordt. En dan alles ‘chaordisch’: tegelijkertijd en door elkaar heen, bijna niet te vatten, niet altijd even zichtbaar en zeker niet te meten, managen, controleren of af te bakenen. Traditionele bedrijfstakken gaan op een gegeven moment verbinding zoeken met al die lokale netwerken, want ze moeten wel.”

Het draait niet om euro’s, maar om sociaal kapitaal

Van den Hoff: “Slechts vijf procent van de totale wereldgeldvoorraad wordt op dit moment gebruikt zoals ooit bedoeld: ter bevordering van de ruilhandel. Met die andere 95 procent zijn we heel andere dingen gaan doen. Als de economie stagneert, hebben politici en economen vaak maar één antwoord: geld erin. En tot op de dag van vandaag is dat eigenlijk het enige kunstje om de zaak aan de gang te houden: nog meer geld in het systeem pompen.” Met Seats2Meet geeft Van den Hoff vorm aan de nieuwe economie, onder het mom ‘practise what you preach’. “Alles altijd maar terugrekenen naar geld is niet duurzaam en werkt gewoon niet meer. Wat dan? Denkend vanuit overvloed hebben we gezegd: iedere locatie heeft wel een paar meters te delen. Kijk maar eens naar die prachtige entreehal hier. Die kun je delen met mensen die hier willen werken. En laat ze nou eens niet betalen met geld, maar met de bereidheid om kennis te delen met anderen. Op die manier bouw je eigenlijk een soort interne markt op, die volkomen gebaseerd is op wederkerigheid, op sociaal kapitaal.”

Gevestigde orde in verbinding met vernieuwers

Steeds meer organisaties sluiten zich aan op het S2M-systeem en delen hun overvloed aan werkplekken. Waarom die bedrijven dat willen? Van den Hoff: “Dat is hun kans om in verbinding te komen met vernieuwers. In Nederland heten ze zzp’ers (zelfstandigen zonder personeel), want als calvinisten zijn we altijd heel goed in benoemen wat je niet bent of niet hebt. Wij noemen het zelf zp’ers: zelfstandige professionals. Mooie, actieve mensen met een hoge mate van verbondenheid met de nieuwe wereld. Bij ons zijn ze van harte welkom, bij Hilton komen ze de lobby niet eens binnen. Traditionele organisaties zetten hun eigen mensen daartussen en op die manier ontstaat er innovatie in die bedrijven. Niet ‘gestartupt’ of gesubsidieerd. Het ontstaat heel natuurlijk, van onderaf en daarmee is het – denken we – heel erg duurzaam.”

Serendipity Machine Dashboard

De nieuwe economie is gebaseerd op cirkels: makerscirkels, kenniscirkels, hospitalitycirkels… Gelegenheidsformaties die economische waarde gaan creëren. Mensen kennen elkaar en zijn verbonden via netwerken als Facebook, Twitter en LinkedIn. Maar als er netwerken zijn van mensen die we al kennen, is er ook behoefte aan netwerken van mensen die we nog niet kennen, bedacht Van den Hoff. “Seats2Meet is een plek waar je juist de mensen tegenkomt die je nog niet kent. Daarmee geven we inhoud aan sociaal kapitaal: je komt binnen, boekt je werkplek, vertelt wat je te delen hebt en met welke projecten je bezig bent. Onze software maakt daar sleutelbegrippen van, zoekt er verbanden tussen en gaat mensen ‘matchen’. Dat betekent dat onze locaties bovengemiddeld spannend zijn: je gaat er altijd beter en rijker naar buiten dan je binnenkwam. Hoe het ontstaat weet je niet, maar de mensen die je tegenkomt zijn op dat moment heel relevant voor jou. Daar was je nou net naar op zoek! Serendipiteit wordt dat ook wel genoemd, de onverwachte relevantie van dingen. Misschien hebben we wel de grootste datingmachine van de toekomst gebouwd. Als dat zo is, kom ik dat u over vijf jaar weer vertellen.”

Steeds betere ‘matches’

Seats2Meet laat het effect van zijn formule permanent onderzoeken door de Erasmus Universiteit. “In 2013 gaf 60 procent van onze bezoekers aan dat ze de ‘serendipity experience’ hadden. Dat is in 2015 al gestegen naar 80 procent. Met onze zelflerende software maken we namelijk steeds slimmere matches. Hierdoor worden ontmoetingen op onze locaties steeds waardevoller. Eén op de zes bezoekers die een maand in ons ecosysteem zit, heeft een baan gevonden, is een eigen bedrijf begonnen of is betrokken geraakt bij een project. We zeggen altijd: onze succes rate is veel hoger dan die van het UWV. En we hebben geen subsidie.” Ook zijn eigen onverwachte ontmoetingen helpen hem regelmatig een stap verder, vertelt Van den Hoff. “Laatst kwam er een knulletje van 19 uit Antwerpen op me af: ‘Awel meneer, bent u die man van Seats2Meet?’ Ik zeg: ‘Ja, dat ben ik.’ Hij zegt: ‘Die software: leuk hoor, maar dat kan allemaal veel beter.’ Wat bleek? Hij studeerde artificial intelligence en heeft ons uiteindelijk een maand lang geholpen met zijn kennis. Zo ontstaat en werkt dat.”

Exponentiële organisatie

Seats2meet is inmiddels in acht landen actief, vertelt Van den Hoff. “Opeens zijn we multinational geworden, zoals dat in de oude wereld heet.” Begin november sloot S2M nog een deal met La Place, waardoor het aantal locaties in Nederland in één dag verdubbelde. Ondanks deze groeispurt blijft hij met een bescheiden organisatie werken. “We hebben geen project- of researchafdeling, maar ‘gewoon’ een netwerk van mensen om ons heen. Dat noem je een exponentiële organisatie: we kunnen veel meer dan vroeger en hebben veel meer capaciteit, maar ons bedrijf is veel kleiner. Seats2Meet International bestaat slechts uit zes mensen: twee medewerkers die verstand hebben van ICT, twee medewerkers van communicatie en twee ondernemers (mijn compagnon en ik). Zo simpel kan het leven zijn. Dat is natuurlijk lullig wanneer je met je diploma salesmanager bij ons aanklopt, want die hebben we niet. Er wordt wel aan sales gedaan, maar dat gebeurt informeel, in die netwerken. Dat is niet meer verbonden aan een functie of afdeling.”

Grootste helpdesk van Europa

Bijkomend voordeel van zo’n netwerkorganisatie is dat mensen bij vragen of problemen onmiddellijk hulp of advies krijgen, vertelt Van den Hoff. “Zelfstandige professionals zijn bijna permanent online, dat is immers hun bestaansrecht. Als iemand vraagt of Seats2Meet Eindhoven op zondag open is, geeft er gelijk iemand uit Eindhoven antwoord. Dus we hebben toegang tot de grootste helpdesk van Europa, maar het is niet onze helpdesk. We hoeven dat niet meer te bezitten; het zijn onze werknemers niet. De grootste helpdesk en we horen gewoon bij de ‘m’ van het mkb.”

‘Hoe meer we delen, hoe meer we terugkrijgen’

Seats2Meet is gebaseerd op de principes van wederkerigheid en sociaal kapitaal, maar dat betekent niet dat harde valuta geen enkele rol spelen, maakt Van den Hoff duidelijk. “Het versterkt elkaar. Als het onze zp’ers goed gaat, kunnen ze behoefte krijgen aan nieuwe producten en diensten. Ze kunnen bij ons bijvoorbeeld ook vergaderzalen en kantoorruimtes huren tegen ‘ouderwetse’ euro’s. Vanuit sociaal kapitaal delen we in 2015 85.000 stoelen. Daar komen ongeveer drie betaalde stoelen voor terug. Hoe meer we weggeven en delen, hoe meer we terugkrijgen. Dat is eigenlijk heel raar om te merken en volkomen tegenstrijdig aan alles wat we geleerd hebben. Ik moet er mezelf en onze mensen ook nog iedere dag in trainen.”

Gelijkwaardigheid staat voorop

Businessmodellen zijn dynamisch en je bestaansrecht moet je als organisatie verdienen, besluit Van den Hoff. “Wat voor businessmodel je ook kiest: let goed op lokale ontwikkelingen, ga denken vanuit gelijkwaardigheid en staar je niet blind. Wat vandaag goed was, is morgen weer achterhaald. Besef goed dat je als bedrijf een onderdeel bent van een ‘mesh’; je bent niet leidend of de eigenaar. Je zal als organisatie je stinkende best moeten doen om onderdeel te blijven van die ‘mesh’, anders gaan stakeholders je passeren. Ons hogere doel is om onze stakeholders slimmer te maken dan wijzelf zijn. Daarmee maken we de S2M-locaties relevant en dat is weer goed voor onze operators. En vervolgens geeft ons dat bestaansrecht. Gelijkwaardigheid in een netwerk staat voorop. Het is niet mijn netwerk, ik heb er toegang toe. Als je daar goed mee om kunt gaan, geeft dat heel veel rust: geen beoordelingsgesprekken, minder ziekte. Het is eigenlijk een veel leuker systeem om mee te werken!”

The post Over Nieuwe Business Modellen en Nieuwe Economie appeared first on Seats2meet.

February 18, 2016

Afschaffing van de VAR: zes dingen die je nu moet weten over de wet DBA

Te midden van de hevige discussie en alle veranderingen omtrent belastingen voor zzp’ers is het goed even alle feiten op een rijtje te krijgen. Dit interessante artikel geschreven door Marianne Driessen geeft een goed overzicht. Voor de originele tekst klik hier.

Vorige week was ik op een bijeenkomst georganiseerd door seats2meet samen met FNV. De VAR wordt met ingang van 1 mei afgeschaft en vervangen door de wet DBA. In veel vormen van samenwerking zal de VAR worden vervangen door een modelovereenkomst. Ik had een paar mensen uit mijn netwerk en coachees beloofd de belangrijkste punten van deze presentatie aan hun door te geven. Heb er maar een longpost van gemaakt. Dit is wat ik heb onthouden en welke conclusies ik heb getrokken; mijn persoonlijke interpretatie van twee uur objectieve en doorwrochte informatieverschaffing.

1. Er is een overgangsperiode: wacht met stressen tot 2017

Er is een overgangsperiode waarin je alles kunt uitzoeken. Daarna wordt er pas echt gehandhaafd (tenzij je al eerder echt fraudeert). De overgangsperiode duurt van mei 2016 tot mei 2017. Dus wacht met serieus stressen tot eind 2016.

2. Veel is nog onduidelijk. Niks aan te doen.

Je kunt nu niet alles weten en voorbereiden: het is gewoon nog echt niet bekend op dit moment. De belastingdienst weet ook nog niet alles. Per sector worden er in de komende tijd afspraken gemaakt. Wacht rustig af en houd relevante sites voor jouw vakgebied in de gaten.

3. Modelovereenkomsten

Er zijn nu al meer dan 100 modelovereenkomsten. Het werken met modelovereenkomsten is niet verplicht. En je kunt ze zelf aanpassen. Kijk wat voor jou t.z.t. het beste uitkomt.

4. Fouten in de overeenkomsten

In de modelovereenkomsten die nu circuleren staan fouten. Laat je er niet op vastpinnen en doe dat ook niet met anderen. Het is niet nodig.

5. Gebruik je bedrijf niet om goedkoop “loondienstje” te spelen

Heb je een serieus bedrijf (en wat dat is weet je best wel) dan valt dit allemaal wel mee. Als je voor 1 opdrachtgever werkt en het lijkt nogal veel op een betaalde baan krijg je wellicht problemen. Regel dus een inschrijving KVK, website, kaartjes en zorg voor voldoende klanten. Neem je acquisitie serieus. Haal niet driekwart van je omzet bij 1 opdrachtgever. Ga niet werken bij een organisatie als de opdracht heel veel op een (parttime of fulltime) baan lijkt. Neem alleen klussen aan die over inhoud gaan en die een heldere einddatum hebben.

6. Zorg voor een strakke rechtsbijstandsverzekering

Verwacht wordt dat intermediairs zich met onfatsoenlijke contracten enorm gaan indekken. Ook met overeenkomsten die niet volgens de wet zijn. Zorg ervoor dat als je problemen hebt, je kunt terugvallen op rechtsbijstand. In mijn ervaring is dreigen vaak al voldoende om problemen op te lossen. Je kunt ook overwegen lid te worden van de FNV.

Meer weten: https://fnvzzp.nl/lobby/wet-dba

Het grootste deel van de bijeenkomst werd verzorgd door Josien van Breda. Wat een genoegen om zo’n goeie spreekster aan het werk te zien. Deskundig, relaxt, helder, perfecte tijdscontrole, fijne stem. Maar dat is een ander verhaal

The post Afschaffing van de VAR: zes dingen die je nu moet weten over de wet DBA appeared first on Seats2meet.

The nature of money – Part 3: How money is created

Now that we established what money actually is is and what it costs us, the next question beckons: where does it come from and how does the monetary system actually work?

The source of money

Where does money come from? Where is it actually created?

I’ve posed this question to a lot of people. It’s a hard one. I’ve even had a discussion with a banker and an economist about it and neither of them could actually answer it. Not for want of trying. But every time we came to the point where I wanted an answer to what the actual source of money was, where new money comes into existence, I got a blank.

Part of the money is created by the central banks but this is only a very tiny fraction, about 3% in our current day economy. The vast majority of the money that is created today comes from private banks and it is created from debt … out of nothing. That means that in today’s world, private banks hold the power to create as much or as little money as they see fit. And that power has minimal limitations.

You might think that in order to lend money you would also need to have it in the first place. That holds true for most of us but not so for banks. Banks only need to hold a fraction of the money they give out in reserve, which is known in the financial sector as fractional-reserve banking. Today that fraction stands at about 10%.

This means we have to make a distinction between 2 types of money:

‘Real money’, which does not create debt when it comes into existence. This is the 3% of money created by governments.

‘Virtual money’, which is created from debt. This kind of money is called a deposit in the financial world. All the money you have in your bank account is deposit money. It is only a promise from the bank that they will pay you that money when you ask for it. It is not ‘real money’.

Both of these types of money are expressed in the same currencies however, thereby blurring which is which. From now on, I will only talk about deposit money for simplicity and because it makes up the vast majority of the money in circulation today. That means that for the money you have in your bank account, someone is in debt for it.

What is the implication of fractional-reserve banking? And how does it create money out of nothing?

Say a bank has $10000, the money that resides in your account. With a 10% obligatory reserve for that $10000, this means it can lend out the other 90% or $9000 to someone else, creating a 9000$ debt alongside it. That $9000 can be deposited somewhere else, say at another bank. That allows that bank to lend out $8100 to someone alongside with a $8100 debt. By now, from the original $10000 we have already created an extra $17100, amounting to a total of $27100. When we continue this process, the original amount can be multiplied by 10, resulting in a total amount of $100000 that is now circulating in our economy. Remember, all this money has a debt on the other side of the balance sheet, with an interest on it. I’ll come back to that interest later on.

All that money is only temporary though because it gets destroyed when debt is payed back.

Now with fractional-reserve banking there is still some regulation on how much money can be created. By changing the fraction that needs to be kept in reserve, the multiplier effect can be controlled. If the obligatory reserve is raised to 20%, the multiplier becomes 5 instead of 10. The problem we are seeing today though is that banks first create the deposits by lending money first and then go look for the reserves afterwards. When they can’t find these reserves they borrow them from the central bank.

A word about interest

As mentioned before, money is largely created from debt through banks giving out loans. There is an interest on this debt, which means more money needs to be payed back than has been borrowed. Where does that extra money come from? In short, from new loans.

You might argue that it comes from value creation but value does not create money. When you bake a bread, money does not appear out of nowhere because you have created something of value. That money needs to come from an institution that can inject extra Dollars into someone’s account so he/she can then pay you for that bread. In other words, the money comes from the banks who have created it from debt. The money to pay off the interest comes from the same source.

This means that we need to inject ever more money into our economic system in order to pay of the debts. With that new money comes more debt, which means money always plays catch up with debt. There is currently about 3 times as much debt in the world as there is money.

When new money is created, new value needs to be generated alongside it in order to justify its existence. Otherwise the currency’s value would deflate. A fine example of this was Zimbabwe in the 90’s. The salary you received in the morning would not even buy you a loaf of bread by nightfall.

This creates the vicious debt cycle that holds our entire economy in a death grip of enforced growth. We need to create money to pay of the interest on the debts of existing loans. That new money creates new debts, on which there is again an interest. This cycle only pushes to problem forward in time because these new debts need to be payed off too, leading to the need of more money and thus more debt to be created. This ever increasing money generation cycle needs to go hand in hand with value creation in order to minimise the devaluation of the currency. This means our economy needs to keep growing for the system to work. When it stops growing we get something like in 2008.

The ever growing debt pool acts like a vacuum cleaner on the available amount of money, sucking it in and destroying it. With the current system, the only way to make sure there is still money left is to create more. The problem is that this also grows the debt pool, thereby increasing the power of the vacuum cleaner that sucks in the money. On top of that, due to the interest and due to the fact that new money is created from debt, we have the added problem that the debt pool is always larger and grows faster than the available money, thereby pushing our economy into obligatory exponential growth.

As mentioned earlier, this system has led to a debt pool that is now roughly 3 times as large as the pool of available money. Roughly $70 trillion in money vs $220 trillion in debt, give or take a couple of trillions. You might think this could be resolved like in the story below: