Rodrigo Constantino's Blog, page 422

August 26, 2011

Senhor do Universo

Rodrigo Constantino, para o Instituto Liberal

Sexta-feira, dia de discurso de Ben Bernanke em Jackson Hole. O mundo todo aguarda ansiosamente o que o presidente do Fed irá dizer. Há cerca de um ano, foi neste mesmo evento, lá onde Judas perdeu as botas, que o barbudinho sinalizou sua segunda rodada de estímulos monetários. Os mercados vibraram eufóricos, jogando o preço dos ativos para a Lua. As bolsas dispararam, assim como as commodities. Todos ficaram felizes.

É verdade que, passado algum tempo, a espuma cedeu e quase toda a alta foi revertida. A injeção de liquidez serviu apenas para aumentar a inflação e criar uma bolha no ouro, ativo cuja oferta não depende do bel prazer de um homem. Mas isso não importa: muitos querem uma terceira rodada de liquidez, o QE3. "No longo prazo estaremos todos mortos", ensinou Keynes. Carpe diem! É preciso fazer a roda girar. O rabo tem que balançar o cachorro.

O prêmio Nobel Paul Krugman quer até gastos contra a hipotética invasão alienígena para aquecer a economia e gerar empregos. Um terremoto talvez não seja má idéia, pois a reconstrução cria empregos. E tudo isso, claro, alimentado pelas novas notas de dólar criadas do nada pelas fantásticas impressoras do Fed. Bernanke é o homem que controla o botão da impressora. Ele é o Todo-Poderoso num mundo dominado pela mentalidade hedonista, que confunde papel-moeda com riqueza.

E assim chegamos ao ponto máximo de insanidade, em que todos abandonam suas tarefas para acompanhar a decisão de um acadêmico que jamais trabalhou na economia real. Alguns o enxergam como uma espécie de He-Man, o senhor do universo com poderes mágicos e força hercúlea para nos livrar do perigo. Já eu, em linha com meus colegas "austríacos", vejo-o apenas como um fornecedor de drogas para viciados, que está destruindo o organismo destes de forma fatal. É este o herói do mundo moderno? Então pare o mundo que eu quero descer!

Published on August 26, 2011 06:53

August 25, 2011

Among the dinosaurs

France's Socialists have yet to come to terms with the modern world

The Economist

BLISS is it in a financial crisis to be a socialist. Or so it ought to be. In speculators and ratings agencies, Europe's left has a ready cast of villains and rogues. In simmering social discontent, it has an energising force. A recent issue of Paris-Match inadvertently captured the mood: page after full-colour page on Britain's rioting underclass were followed by gory visual detail of the bling yachts crowding into the bay near Saint-Tropez. Time, surely, to put social inclusion before defiant decadence.

The oddity is that almost everywhere the European left is in decline. Among the large countries, Socialist parties rule only in Spain, where they look likely to lose November's election. The only big place where the left has a good chance of returning to power is France, at next spring's presidential election. Yet France's Socialist Party also stands out as Europe's most unreconstructed. Hence the contorted spectacle of a party preparing for power at a time when the markets are challenging its every orthodoxy.

For a hint of French Socialist thinking, consider recent comments from some of the candidates who will contest a primary vote in October. Ségolène Royal, who lost the 2007 presidential election to Nicolas Sarkozy, argued this week that stock options and speculation on sovereign debt should be banned. Denouncing "anarchic globalisation", she called for human values to be imposed on financial ones, as a means of "carrying on the torch of a great country, France, which gave the world revolutionary principles about the emancipation of the people."

Ms Royal, believe it or not, is considered a moderate. To her left, Arnaud Montebourg, a younger, outwardly sensible sort, argues for "deglobalisation". He wants to forbid banks from "speculating with clients' deposits", and to abolish ratings agencies. Financial markets want "to turn us into their poodle", he lamented at a weekend fete in a bucolic village, celebrating the joys of la France profonde with copious bottles of burgundy. No one seems to have told him that there is a simple way to avoid the wrath of bond markets: balance your books and don't borrow.

Next to such patent nonsense, promises by the two front-running candidates, Martine Aubry and François Hollande, seem merely frozen in time, circa 1981. They want to return to retirement at the age of 60 (it has just been raised to 62), and to invent 300,000 public-sector youth jobs. Each supports Mr Sarkozy's deficit-reduction targets, but refuses to approve his plan to write a deficit rule into the constitution. More taxes, not less spending, is their underlying creed.

The party is not out of tune with public opinion. The French are almost uniquely hostile to the capitalist system that has made them one of the world's richest people. Fully 57% say France should single-handedly erect higher customs barriers. The same share judge that freer trade with India and China, whose consumers snap up French silk scarves and finely stitched leather handbags, has been "bad" for France. The right has held the presidency since 1995 partly by pandering to such sentiments.

The causes of French left-wingery are various, but a potent one is the lingering hold of Marxist thinking. Post-war politics on the left was for decades dominated by the Communist Party, which regularly scooped up a quarter of the votes. In the 1950s many intellectuals, including Jean-Paul Sartre, clung to pro-Soviet idealism even after the evils of Stalinism emerged. Others toyed with Trotskyism well into the 1970s. François Mitterrand, who mentored Ms Royal, Ms Aubry and Mr Hollande, was swept to the presidency in 1981 by offering a socialist Utopia as a third way between "the capitalist society which enslaves people" and the "communist society which stifles them".

Given such a tradition, it is possible that today's Socialist leaders believe what they say. At any rate, there is a debate to be had about the right amount of market regulation and fiscal consolidation. Yet the problem with their promises is this: for every bit of conviction, there is a shameful share of pure posturing.

In truth, France's Socialists have often had to be pragmatic in power. As prime minister between 1997 and 2002 Lionel Jospin, himself an ex-Trotskyist, privatised more assets than any of his right-wing predecessors. Even Mitterrand was forced to abandon nationalisation and embrace austerity. Should the Socialists win in 2012, it would take them "about a month, or maybe a week" to confess that they "have no choice but to keep the deficit under control", says one well-placed party figure. Retirement at 60? Nice idea but, quel dommage, we can't afford it.

Please allow us a moment of madness

All this requires heroic faith among centrists considering voting Socialist that reason will triumph over fiscal folly. Moreover, experience suggests that the Socialists, if elected, may feel compelled to introduce some signature policy as a sop to their disappointed base. Under Mitterrand, it was the wealth tax. Under Mr Jospin, it was Ms Aubry's 35-hour working week. With France's recovery fragile, the prospect of more such lunacy is chilling.

A further danger touches Europe, where France traditionally generates many ideas for integration. At a time when leaders are inching towards more economic co-ordination, with oversight of budgets and even tax harmonisation, a Socialist victory would put the shaping of such a project into uncertain hands.

With Dominique Strauss-Kahn out of the running there is just one French Socialist primary candidate who understands all this. Manuel Valls, a deputy and mayor with a refreshingly modern view of the left, says Socialists are not being straight by promising retirement at 60. He dares utter such truths as "we need to tell the French that the [budgetary] effort…will be as great as that achieved after Liberation". Alas, the 49-year-old Mr Valls is considered too young to be a serious contender. The day the paleo-Socialists of the Mitterrand generation allow such figures to emerge would be the dawn of a real revolution.

Published on August 25, 2011 16:07

What Austerity?

Editorial do WSJ

Federal spending will hit a new record this year

With the recovery sputtering, the White House and its allies have been blaming government spending cuts, or what the neo-Keynesians call "fiscal contraction." This is a dubious economic theory even if spending were being cut, but yesterday's mid-year report from the Congressional Budget Office shows definitively that there's been nothing close to contraction in Washington.

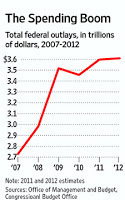

That's the real news in the CBO numbers, which show that spending in fiscal 2011 (which ends on September 30) will hit a new high of $3.6 trillion, up $141 billion from 2010. That's higher than the previous record in 2009 of $3.5 trillion, which was supposed to be the peak of the "temporary" stimulus spending.

As the nearby chart shows, that is also nearly $900 billion more spending than in 2007. Total federal outlays will have increased by roughly one third in a mere four years. This hasn't happened since the Great Inflation of the late 1970s.

Give President Obama and the two Pelosi Congresses credit for this much: They said they would spend our way out of recession, and they sure gave it the old Beltway try. The problem is that we got the spending without the promised economic growth.

This is the real cause of our current deficit and debt woes. As a share of the economy, spending will once again come in at nearly 23.8%, up from 20.7% as recently as 2008. Defense spending is expected to increase by only $14 billion to $703 billion in 2011, despite the surge in Afghanistan. The bigger increases are in Medicare, Medicaid, and the usual panoply of entitlements and other payments to individuals.

All of this means the deficit will roll in at nearly $1.3 trillion, or 8.5% of GDP this year. That's down a mere $10 billion from fiscal 2010, and we suppose taxpayers should be grateful for small fiscal favors.

The reason for this small deficit dip is that total tax revenues will climb in fiscal 2011 by about $150 billion. Individual income tax receipts will increase this year by about 21%, or $190 billion, though tax rates have stayed the same. Even with this good news, revenues will still come in at only 15.3% of GDP, which is far below the modern historical average of more than 18%.

Revenues would have been about $115 billion higher without the temporary payroll tax cut pressed by President Obama. But that tax cut hasn't provided any economic lift, and overall growth simply isn't fast enough to get revenues back to normal. Merely returning to an average economic expansion would reduce the deficit by 3% of GDP a year, or hundreds of billions of dollars.

Looking forward, CBO forecasts a sunnier fiscal picture, but it is based on assumptions that will never come true. The deficit is projected to fall to $973 billion in fiscal 2012, then fall again to $510 billion in 2013, and to a mere $265 billion in 2014.

But this assumes that federal spending will grow by only $12 billion in 2012, a level of spending control that even Ronald Reagan never achieved. President Obama wants much more spending next year and so does the Senate. Oh, and Medicare payments to doctors will fall by nearly 30% starting in 2012. Congress has been promising this cut in payments since 1997, but it never happens and would hurt medical care if it did.

The rest of CBO's fantasy forecast comes from what it says will be "the sharp increases in revenues that will occur when provisions of [the Bush era tax cuts extended last year] expire." So CBO estimates that federal taxes as a share of GDP will leap to 19% in 2013 and 20.2% in 2014 from 15.3% today. And we are supposed to believe that economic growth will soar to 4.4% and 5% in 2014 and 2015 after huge tax increases on capital gains, dividends, small businesses and workers in 2013. Beam us up, Scotty.

With these optimistic assumptions, CBO is able to forecast that federal debt held by the public will rise only to a peak of 73% in 2013 before falling to 67% in 2016. We think economist David Malpass is closer to the truth when he predicts a debt to GDP ratio closer to 85% in 2016 and 100% in 2021 without significant reform.

The real story told by the CBO report is that the federal government is still pursuing a very loose fiscal policy, despite lamentations from Democrats and the Keynesian economists who populate Wall Street. The best that House Republicans have been able to do so far is to battle Mr. Obama and Senate Democrats to a draw, delaying tax increases until 2013 and preventing even larger spending increases. To really control Washington's appetites, the voters are going to have to back up their message in 2010 with reinforcements in 2012.

Federal spending will hit a new record this year

With the recovery sputtering, the White House and its allies have been blaming government spending cuts, or what the neo-Keynesians call "fiscal contraction." This is a dubious economic theory even if spending were being cut, but yesterday's mid-year report from the Congressional Budget Office shows definitively that there's been nothing close to contraction in Washington.

That's the real news in the CBO numbers, which show that spending in fiscal 2011 (which ends on September 30) will hit a new high of $3.6 trillion, up $141 billion from 2010. That's higher than the previous record in 2009 of $3.5 trillion, which was supposed to be the peak of the "temporary" stimulus spending.

As the nearby chart shows, that is also nearly $900 billion more spending than in 2007. Total federal outlays will have increased by roughly one third in a mere four years. This hasn't happened since the Great Inflation of the late 1970s.

Give President Obama and the two Pelosi Congresses credit for this much: They said they would spend our way out of recession, and they sure gave it the old Beltway try. The problem is that we got the spending without the promised economic growth.

This is the real cause of our current deficit and debt woes. As a share of the economy, spending will once again come in at nearly 23.8%, up from 20.7% as recently as 2008. Defense spending is expected to increase by only $14 billion to $703 billion in 2011, despite the surge in Afghanistan. The bigger increases are in Medicare, Medicaid, and the usual panoply of entitlements and other payments to individuals.

All of this means the deficit will roll in at nearly $1.3 trillion, or 8.5% of GDP this year. That's down a mere $10 billion from fiscal 2010, and we suppose taxpayers should be grateful for small fiscal favors.

The reason for this small deficit dip is that total tax revenues will climb in fiscal 2011 by about $150 billion. Individual income tax receipts will increase this year by about 21%, or $190 billion, though tax rates have stayed the same. Even with this good news, revenues will still come in at only 15.3% of GDP, which is far below the modern historical average of more than 18%.

Revenues would have been about $115 billion higher without the temporary payroll tax cut pressed by President Obama. But that tax cut hasn't provided any economic lift, and overall growth simply isn't fast enough to get revenues back to normal. Merely returning to an average economic expansion would reduce the deficit by 3% of GDP a year, or hundreds of billions of dollars.

Looking forward, CBO forecasts a sunnier fiscal picture, but it is based on assumptions that will never come true. The deficit is projected to fall to $973 billion in fiscal 2012, then fall again to $510 billion in 2013, and to a mere $265 billion in 2014.

But this assumes that federal spending will grow by only $12 billion in 2012, a level of spending control that even Ronald Reagan never achieved. President Obama wants much more spending next year and so does the Senate. Oh, and Medicare payments to doctors will fall by nearly 30% starting in 2012. Congress has been promising this cut in payments since 1997, but it never happens and would hurt medical care if it did.

The rest of CBO's fantasy forecast comes from what it says will be "the sharp increases in revenues that will occur when provisions of [the Bush era tax cuts extended last year] expire." So CBO estimates that federal taxes as a share of GDP will leap to 19% in 2013 and 20.2% in 2014 from 15.3% today. And we are supposed to believe that economic growth will soar to 4.4% and 5% in 2014 and 2015 after huge tax increases on capital gains, dividends, small businesses and workers in 2013. Beam us up, Scotty.

With these optimistic assumptions, CBO is able to forecast that federal debt held by the public will rise only to a peak of 73% in 2013 before falling to 67% in 2016. We think economist David Malpass is closer to the truth when he predicts a debt to GDP ratio closer to 85% in 2016 and 100% in 2021 without significant reform.

The real story told by the CBO report is that the federal government is still pursuing a very loose fiscal policy, despite lamentations from Democrats and the Keynesian economists who populate Wall Street. The best that House Republicans have been able to do so far is to battle Mr. Obama and Senate Democrats to a draw, delaying tax increases until 2013 and preventing even larger spending increases. To really control Washington's appetites, the voters are going to have to back up their message in 2010 with reinforcements in 2012.

Published on August 25, 2011 06:46

August 22, 2011

Viva o contrabando!

Deu no G1:

A Secretaria da Receita Federal informou nesta segunda-feira (22) que o aumento do preço dos cigarros será de 20% em dezembro deste ano, caso os fabricantes repassem todo o aumento do Imposto Sobre Produtos Industrializados (IPI) autorizado pelo governo.

O Fisco anunciou ainda que a tributação dos cigarros continuará crescendo no futuro, com alíquotas maiores do IPI no início de cada ano. No começo de 2015, o preço médio dos cigarros, caso os reajustes do imposto sejam repassados pelos fabricantes, estará 55% maior, informou a Receita Federal.

[...]

Peso dos impostos

Atualmente, a carga tributária sobre os cigarros, incluindo tributos cobrados pelo governo federal e o ICMS dos estados, varia de 51% a 61%, de acordo com a classe e a embalagem, informou a Receita Federal. Atualmente, a tributação é fixa, e varia de R$ 0,764 a R$ 1,30 por maço de cigarro. Com a nova forma de tributação dos cigarros, o peso dos tributos na composição do preço final subirá para 60% a 72%. Deste modo, cerca de dois terços do preço do produto será composto por tributos federais e estaduais.

[...]

Ministério da Saúde aprova

O Ministério da Saúde informou que considera o aumento na tributação sobre os cigarros como "um avanço no combate ao tabagismo no país".

"A prevenção da iniciação ao tabagismo entre jovens é, hoje, um dos maiores desafios nacionais a serem enfrentados no âmbito da Política Nacional de Controle do Tabaco. Certamente, esse esforço representa um dos passos mais importantes do governo, nesse sentido", segundo avaliação deTania Cavalcante, secretária executiva da Comissão Nacional para a implementação da Convenção Quadro para o Controle do Tabaco (CONICQ).

O hábito de fumar, segundo o Ministério da Saúde, é um dos principais fatores de risco para o desenvolvimento de doenças crônicas, como o câncer e as enfermidades respiratórias. Por isso, medidas como o aumento na tributação sobre o cigarro fazem parte da proposta do Plano de Ações para Enfretamento das Doenças Crônicas não Transmissíveis, informou.

Comentário: o mercado negro de cigarros no Brasil já está na faixa dos 30%. Aumentar impostos apenas estimula este mercado paralelo. Ajuda os produtores do Paraguai, as fábricas de quintal, que produzem cigarros de pior qualidade, ainda mais prejudiciais à saúde. A Lei Seca americana provou que a proibição não elimina a demanda; apenas transfere a oferta para as mãos de criminosos como Al Capone. Notem ainda que o objetivo parece ser EXTIRPAR o cigarro. A ideia de "sin taxes" não é nova. O governo se coloca como guardião da saúde dos indivíduos. Com que direito? Eis a questão que permanece sem resposta. Não custa lembrar que os nazistas tinha o mesmo objetivo, em nome da "pureza" da raça e da saúde. Quantas coisas fazem mal à saúde? Fritura, gordura, álcool, ócio, tudo é perigoso, especialmente em altas doses (a diferença entre remédio e veneno muitas vezes é a dose). Mas ninguém deu ao governo o direito de interferir nas escolhas individuais dessa maneira. Em vez de ficar subindo impostos sobre cigarro, o governo deveria cortar drasticamente seus gastos inchados e reduzir os impostos gerais.

A Secretaria da Receita Federal informou nesta segunda-feira (22) que o aumento do preço dos cigarros será de 20% em dezembro deste ano, caso os fabricantes repassem todo o aumento do Imposto Sobre Produtos Industrializados (IPI) autorizado pelo governo.

O Fisco anunciou ainda que a tributação dos cigarros continuará crescendo no futuro, com alíquotas maiores do IPI no início de cada ano. No começo de 2015, o preço médio dos cigarros, caso os reajustes do imposto sejam repassados pelos fabricantes, estará 55% maior, informou a Receita Federal.

[...]

Peso dos impostos

Atualmente, a carga tributária sobre os cigarros, incluindo tributos cobrados pelo governo federal e o ICMS dos estados, varia de 51% a 61%, de acordo com a classe e a embalagem, informou a Receita Federal. Atualmente, a tributação é fixa, e varia de R$ 0,764 a R$ 1,30 por maço de cigarro. Com a nova forma de tributação dos cigarros, o peso dos tributos na composição do preço final subirá para 60% a 72%. Deste modo, cerca de dois terços do preço do produto será composto por tributos federais e estaduais.

[...]

Ministério da Saúde aprova

O Ministério da Saúde informou que considera o aumento na tributação sobre os cigarros como "um avanço no combate ao tabagismo no país".

"A prevenção da iniciação ao tabagismo entre jovens é, hoje, um dos maiores desafios nacionais a serem enfrentados no âmbito da Política Nacional de Controle do Tabaco. Certamente, esse esforço representa um dos passos mais importantes do governo, nesse sentido", segundo avaliação deTania Cavalcante, secretária executiva da Comissão Nacional para a implementação da Convenção Quadro para o Controle do Tabaco (CONICQ).

O hábito de fumar, segundo o Ministério da Saúde, é um dos principais fatores de risco para o desenvolvimento de doenças crônicas, como o câncer e as enfermidades respiratórias. Por isso, medidas como o aumento na tributação sobre o cigarro fazem parte da proposta do Plano de Ações para Enfretamento das Doenças Crônicas não Transmissíveis, informou.

Comentário: o mercado negro de cigarros no Brasil já está na faixa dos 30%. Aumentar impostos apenas estimula este mercado paralelo. Ajuda os produtores do Paraguai, as fábricas de quintal, que produzem cigarros de pior qualidade, ainda mais prejudiciais à saúde. A Lei Seca americana provou que a proibição não elimina a demanda; apenas transfere a oferta para as mãos de criminosos como Al Capone. Notem ainda que o objetivo parece ser EXTIRPAR o cigarro. A ideia de "sin taxes" não é nova. O governo se coloca como guardião da saúde dos indivíduos. Com que direito? Eis a questão que permanece sem resposta. Não custa lembrar que os nazistas tinha o mesmo objetivo, em nome da "pureza" da raça e da saúde. Quantas coisas fazem mal à saúde? Fritura, gordura, álcool, ócio, tudo é perigoso, especialmente em altas doses (a diferença entre remédio e veneno muitas vezes é a dose). Mas ninguém deu ao governo o direito de interferir nas escolhas individuais dessa maneira. Em vez de ficar subindo impostos sobre cigarro, o governo deveria cortar drasticamente seus gastos inchados e reduzir os impostos gerais.

Published on August 22, 2011 12:24

'We Are All Threatened by Contagion'

By Christian Reiermann, SPIEGEL Online

In an interview with SPIEGEL, Dutch Finance Minister Jan Kees de Jager calls on the German government to remain firm in its opposition to euro bonds. He also warns that even the fiscally solid nations of the euro zone will get into trouble if they keep having to increase the volume of the bailout fund.

SPIEGEL: Minister, an increasing number of voices in the EU are calling for euro bonds to be used to end the crisis in the euro zone. Are you among these advocates?

De Jager: No, absolutely not. Euro bonds are not the solution. You cannot end a debt crisis by introducing a new form of debt. Instead, the countries concerned have to tighten up their budgets and introduce reforms to get their economies back on track. Euro bonds are no alternative -- on the contrary, they would have a perverse effect.

SPIEGEL: How so?

De Jager: Euro bonds remove every incentive for ailing countries to return to sensible fiscal and economic policies. Since they offer lower interest rates than their previous government bonds, they induce governments to run up more debt instead of saving. I call that perverse.

SPIEGEL: Even billionaire investor George Soros is calling for euro bonds. Are you saying he doesn't know what he's talking about?

De Jager: He is at least not considering the long-term repercussions of his proposal. Over the short term, euro bonds might calm the markets. But if we don't change the general conditions, five years from now we will have the next crisis, which could be even worse than the present one because even healthy countries like Germany and the Netherlands would be much more in debt.

SPIEGEL: The German government also opposes euro bonds. How long do you think it will be able to maintain this position?

De Jager: I expect the German government to stick to this position. Euro bonds may be an option over the long term, but only if all member countries of the monetary union pursue the same financial policies. We still have a long way to go before we achieve that.

SPIEGEL: The only remaining source of short-term aid is the European Financial Stability Facility (EFSF) bailout fund, which the heads of state and government gave new powers to in late July, yet did not provide with more money. Shouldn't it be increased to remain credible?

De Jager: I'm not generally opposed to bolstering the EFSF, but even that is not a panacea. €440 billion ($632 billion) is not sparse. But if necessary, we're open to talking about it.

SPIEGEL: Wouldn't it make sense to go ahead and double the financial framework right now?

De Jager: That's easy to say, but such an operation has an impact on the creditworthiness of the donor countries. Germany and the Netherlands have a solid AAA rating from the rating agencies. That's not true for all countries with the highest rating …

SPIEGEL: You mean France.

De Jager: I'm not alluding to any particular country. Such countries are in danger of losing their top rating if they have to extend even more guarantees to the EFSF. Ultimately, we are all threatened by contagion. We cannot simply say that the last member of the currency union that still retains an AAA rating will guarantee the debt of all the remaining countries. The solution to the debt crisis is not to create more debt, but less.

SPIEGEL: Won't it be necessary to bolster the EFSF if Italy needs aid?

De Jager: Italy is a large country with debts of nearly €2 trillion. The sheer size of this figure shows that Italy must never be bailed out by the rescue fund. I am also firmly convinced that it won't come to that. The country's government has approved an austerity program and the budget deficit has not developed nearly as alarmingly as in some other countries.

SPIEGEL: What happens if Greece is not in a position to meet the requirements of the second bailout package -- will there be a third one?

De Jager: Should the Greek government not be in a position to fulfill the terms of the bailout program, then the Netherlands will refuse to provide any further aid. Then we will also block the next installment of the bailout package. The country has no choice but to continue to save and reform.

SPIEGEL: Finland wants collateral from the Greeks in return for additional aid. Isn't this unfair to the other donor countries?

De Jager: As far as we are concerned, no deal has been made. This is an issue that will have to be addressed by all the countries in the euro zone. Throughout the negotiations we have indicated that if Finland receives collateral, the Netherlands also wants the same treatment.

SPIEGEL: Do you think it's possible that the Greeks will leave the euro zone?

De Jager: No, I don't think so. This would make things even harder for the Greek population than they already are now. Failure is not an option for Greece.

SPIEGEL: Will there be a point where the rich and powerful countries say: We've had enough, we're opting out?

De Jager: No, such a step would lead to enormous turmoil, which would also cause more suffering to countries with stable finances than they face from the consequences of the bailout packages.

SPIEGEL: In addition to embattled fringe countries in the euro zone, now even France and Italy are introducing austerity programs. Aren't you afraid that this will stifle growth?

De Jager: It may be that the consolidation will cost us a bit of growth. But that is the lesser evil. If the debt crisis were to deepen and spark another financial crisis, this would be much worse because we would certainly slide into a recession.

SPIEGEL: The reason for the most recent turmoil is that the decisions made during the crisis summit were already being questioned after two weeks. What can be done about this cacophony in Europe?

De Jager: The only thing that helps is for everyone involved to practice verbal discipline. I would give the representatives of the 17 national governments a little more leeway since they have to justify their actions to their parliaments and their people. As for the representatives of European institutions like the Commission, I would recommend thinking very carefully about what impact their comments may have on the markets. A bit more restraint would sometimes be appropriate.

SPIEGEL: You are referring to Commission President José Manuel Barroso who, only two weeks after the summit, sent an open letter to EU leaders voicing his deep dissatisfaction with the effectiveness of the decisions.

De Jager: I'm not mentioning any names, but the guilty parties know who they are.

SPIEGEL: Doesn't the euro zone need institutional reforms to become more credible in the eyes of the markets?

De Jager: You are absolutely right. Tightening the Stability Pact has put us on the right track, but that's not enough. What we need above all are credible sanctioning mechanisms that take effect when rules are broken. We need more teamwork, more cooperation on economic policies, in short: more Europe to implement the agreed rules.

SPIEGEL: Who should impose the sanctions -- the member countries or the Commission?

De Jager: What I envision is an autonomous, independent institution that calls countries to order and imposes penalties. This could be affiliated with an existing institution. Independence is the most important aspect here. German Economy Minister Philipp Rösler proposed something similar under the name of a European Stability Council. I like the idea very much.

SPIEGEL: Who should make the decisions in this body?

De Jager: Academics and experts -- but no politicians.

In an interview with SPIEGEL, Dutch Finance Minister Jan Kees de Jager calls on the German government to remain firm in its opposition to euro bonds. He also warns that even the fiscally solid nations of the euro zone will get into trouble if they keep having to increase the volume of the bailout fund.

SPIEGEL: Minister, an increasing number of voices in the EU are calling for euro bonds to be used to end the crisis in the euro zone. Are you among these advocates?

De Jager: No, absolutely not. Euro bonds are not the solution. You cannot end a debt crisis by introducing a new form of debt. Instead, the countries concerned have to tighten up their budgets and introduce reforms to get their economies back on track. Euro bonds are no alternative -- on the contrary, they would have a perverse effect.

SPIEGEL: How so?

De Jager: Euro bonds remove every incentive for ailing countries to return to sensible fiscal and economic policies. Since they offer lower interest rates than their previous government bonds, they induce governments to run up more debt instead of saving. I call that perverse.

SPIEGEL: Even billionaire investor George Soros is calling for euro bonds. Are you saying he doesn't know what he's talking about?

De Jager: He is at least not considering the long-term repercussions of his proposal. Over the short term, euro bonds might calm the markets. But if we don't change the general conditions, five years from now we will have the next crisis, which could be even worse than the present one because even healthy countries like Germany and the Netherlands would be much more in debt.

SPIEGEL: The German government also opposes euro bonds. How long do you think it will be able to maintain this position?

De Jager: I expect the German government to stick to this position. Euro bonds may be an option over the long term, but only if all member countries of the monetary union pursue the same financial policies. We still have a long way to go before we achieve that.

SPIEGEL: The only remaining source of short-term aid is the European Financial Stability Facility (EFSF) bailout fund, which the heads of state and government gave new powers to in late July, yet did not provide with more money. Shouldn't it be increased to remain credible?

De Jager: I'm not generally opposed to bolstering the EFSF, but even that is not a panacea. €440 billion ($632 billion) is not sparse. But if necessary, we're open to talking about it.

SPIEGEL: Wouldn't it make sense to go ahead and double the financial framework right now?

De Jager: That's easy to say, but such an operation has an impact on the creditworthiness of the donor countries. Germany and the Netherlands have a solid AAA rating from the rating agencies. That's not true for all countries with the highest rating …

SPIEGEL: You mean France.

De Jager: I'm not alluding to any particular country. Such countries are in danger of losing their top rating if they have to extend even more guarantees to the EFSF. Ultimately, we are all threatened by contagion. We cannot simply say that the last member of the currency union that still retains an AAA rating will guarantee the debt of all the remaining countries. The solution to the debt crisis is not to create more debt, but less.

SPIEGEL: Won't it be necessary to bolster the EFSF if Italy needs aid?

De Jager: Italy is a large country with debts of nearly €2 trillion. The sheer size of this figure shows that Italy must never be bailed out by the rescue fund. I am also firmly convinced that it won't come to that. The country's government has approved an austerity program and the budget deficit has not developed nearly as alarmingly as in some other countries.

SPIEGEL: What happens if Greece is not in a position to meet the requirements of the second bailout package -- will there be a third one?

De Jager: Should the Greek government not be in a position to fulfill the terms of the bailout program, then the Netherlands will refuse to provide any further aid. Then we will also block the next installment of the bailout package. The country has no choice but to continue to save and reform.

SPIEGEL: Finland wants collateral from the Greeks in return for additional aid. Isn't this unfair to the other donor countries?

De Jager: As far as we are concerned, no deal has been made. This is an issue that will have to be addressed by all the countries in the euro zone. Throughout the negotiations we have indicated that if Finland receives collateral, the Netherlands also wants the same treatment.

SPIEGEL: Do you think it's possible that the Greeks will leave the euro zone?

De Jager: No, I don't think so. This would make things even harder for the Greek population than they already are now. Failure is not an option for Greece.

SPIEGEL: Will there be a point where the rich and powerful countries say: We've had enough, we're opting out?

De Jager: No, such a step would lead to enormous turmoil, which would also cause more suffering to countries with stable finances than they face from the consequences of the bailout packages.

SPIEGEL: In addition to embattled fringe countries in the euro zone, now even France and Italy are introducing austerity programs. Aren't you afraid that this will stifle growth?

De Jager: It may be that the consolidation will cost us a bit of growth. But that is the lesser evil. If the debt crisis were to deepen and spark another financial crisis, this would be much worse because we would certainly slide into a recession.

SPIEGEL: The reason for the most recent turmoil is that the decisions made during the crisis summit were already being questioned after two weeks. What can be done about this cacophony in Europe?

De Jager: The only thing that helps is for everyone involved to practice verbal discipline. I would give the representatives of the 17 national governments a little more leeway since they have to justify their actions to their parliaments and their people. As for the representatives of European institutions like the Commission, I would recommend thinking very carefully about what impact their comments may have on the markets. A bit more restraint would sometimes be appropriate.

SPIEGEL: You are referring to Commission President José Manuel Barroso who, only two weeks after the summit, sent an open letter to EU leaders voicing his deep dissatisfaction with the effectiveness of the decisions.

De Jager: I'm not mentioning any names, but the guilty parties know who they are.

SPIEGEL: Doesn't the euro zone need institutional reforms to become more credible in the eyes of the markets?

De Jager: You are absolutely right. Tightening the Stability Pact has put us on the right track, but that's not enough. What we need above all are credible sanctioning mechanisms that take effect when rules are broken. We need more teamwork, more cooperation on economic policies, in short: more Europe to implement the agreed rules.

SPIEGEL: Who should impose the sanctions -- the member countries or the Commission?

De Jager: What I envision is an autonomous, independent institution that calls countries to order and imposes penalties. This could be affiliated with an existing institution. Independence is the most important aspect here. German Economy Minister Philipp Rösler proposed something similar under the name of a European Stability Council. I like the idea very much.

SPIEGEL: Who should make the decisions in this body?

De Jager: Academics and experts -- but no politicians.

Published on August 22, 2011 11:14

How Not to Grow an Economy

Editorial do WSJ

Financial markets are in turmoil, investors are fleeing to safe havens, and the chances of another recession are rising. This would seem to be a moment when government should be especially careful to do no harm, to talk and walk softly, and to reassure business that Washington wants more private investment and hiring.

But this is not how our current government behaves. Day after day brings headlines of another legislative, regulatory or enforcement action that gives CEOs and investors reason to hunker down, retain as much cash as possible and ride out whatever storms are ahead. This is not the way to nurture an already fragile recovery, much less help the economy to endure shocks from Europe, natural disasters or a big bank failure.

Consider the headlines only from last week, a slow week by Washington standards, with Congress out of session and President Obama campaigning for three days before going on vacation. Even in the dog days of August, your government was hard at work undermining economic confidence.

• Monday: "Warren Buffett right about taxes, says Obama." The week began with a one-two tax punch from Warren Buffett and President Obama. The Omaha stock-picker wrote an op-ed begging Congress to raise taxes on millions of Americans who make less than he does, and the President used the first stop of his bus tour, in Cannon Falls, Minnesota, to agree.

"I put a deal before the Speaker of the House, John Boehner, that would have solved this problem," Mr. Obama said, "and he walked away because his belief was we can't ask anything of millionaires and billionaires and big corporations in order to close our deficit." So America's main job creators are still on notice that a tax increase is in their future in 2013, if not sooner.

• Tuesday: "Federal mortgage role to be preserved: Obama is working to develop new housing policy." A Washington Post story reported that Mr. Obama has directed a White House team to develop a housing plan that would keep the feds deeply involved in mortgage markets, with subsidies and loan guarantees, perhaps even preserving Fannie Mae and Freddie Mac.

This contradicts the Treasury's February white paper recommending a much smaller government role in housing without Fan and Fred. A Treasury official responded that the white paper is still guiding policy, but private investors who might want to get into housing finance know the Post story came from someone in authority and have another reason to stay on the sidelines.

• Thursday: "Justice Inquiry Is Said to Focus on S.&P. Ratings." Barely two weeks after Standard & Poor's downgraded U.S. debt over White House protests, we learn that the feds are going after the firm for its ratings on mortgage securities before the financial crisis. The feds say the probe was underway before the downgrade, but the credit rater's mortgage mistakes have been known for years. And why not Moody's or Fitch?

The message: If you disagree with this Administration, you'd better lawyer-up.

• Thursday: "Exxon, U.S. Government Duel Over Huge Oil Find." Exxon has made the biggest oil discoveries ever in the Gulf of Mexico at some one billion barrels, but the feds have taken the extraordinary action of denying the oil company what had long been routine oil lease extensions. So Exxon and a Norwegian firm are suing the feds to be able to drill on the leases, spending money on lawyers for permission to create jobs and increase domestic oil production.

• Thursday: "Fed Eyes European Banks: Regulators Scrutinize Ability of Institutions' U.S. Units to Fund Themselves." The Wall Street Journal quotes Federal Reserve Bank of New York officials as saying they're worried about the condition of European banks and are on the job making sure that any problems don't damage American banks. It's nice to know U.S. regulators are earning their pay, but the spectacle of regulators publicly broadcasting troubles at European banks does nothing to calm already jittery interbank markets.

• Thursday: "Obama to push stimulus plan." The President signals more government fiscal action, to be unveiled after Labor Day. Ideas on the table: New spending on roads and a tax credit for companies that hire workers.

The thinking, say aides, is to pressure Republicans to pass these proposals or look indifferent to high unemployment. So even as he proposes to reduce deficits far into the future in ways that will depend on decisions by future Congresses, the President will fight to increase spending immediately. Americans may conclude they've heard this cognitive dissonance before.

None of these stories by themselves—or even a week of them—is enough to undermine a recovery. But the cascade of such stories day after day—about new regulations, new prosecutions or fines against business, new obstacles to investment, more spending and higher taxes—contributes to the larger lack of business and consumer confidence.

It's impossible to quantify the impact of such policies on lost GDP or lost job creation, but everyone in the real economy understands how such signals work. The great tragedy of the Obama nonrecovery is that this Administration still doesn't realize the damage it is doing.

Financial markets are in turmoil, investors are fleeing to safe havens, and the chances of another recession are rising. This would seem to be a moment when government should be especially careful to do no harm, to talk and walk softly, and to reassure business that Washington wants more private investment and hiring.

But this is not how our current government behaves. Day after day brings headlines of another legislative, regulatory or enforcement action that gives CEOs and investors reason to hunker down, retain as much cash as possible and ride out whatever storms are ahead. This is not the way to nurture an already fragile recovery, much less help the economy to endure shocks from Europe, natural disasters or a big bank failure.

Consider the headlines only from last week, a slow week by Washington standards, with Congress out of session and President Obama campaigning for three days before going on vacation. Even in the dog days of August, your government was hard at work undermining economic confidence.

• Monday: "Warren Buffett right about taxes, says Obama." The week began with a one-two tax punch from Warren Buffett and President Obama. The Omaha stock-picker wrote an op-ed begging Congress to raise taxes on millions of Americans who make less than he does, and the President used the first stop of his bus tour, in Cannon Falls, Minnesota, to agree.

"I put a deal before the Speaker of the House, John Boehner, that would have solved this problem," Mr. Obama said, "and he walked away because his belief was we can't ask anything of millionaires and billionaires and big corporations in order to close our deficit." So America's main job creators are still on notice that a tax increase is in their future in 2013, if not sooner.

• Tuesday: "Federal mortgage role to be preserved: Obama is working to develop new housing policy." A Washington Post story reported that Mr. Obama has directed a White House team to develop a housing plan that would keep the feds deeply involved in mortgage markets, with subsidies and loan guarantees, perhaps even preserving Fannie Mae and Freddie Mac.

This contradicts the Treasury's February white paper recommending a much smaller government role in housing without Fan and Fred. A Treasury official responded that the white paper is still guiding policy, but private investors who might want to get into housing finance know the Post story came from someone in authority and have another reason to stay on the sidelines.

• Thursday: "Justice Inquiry Is Said to Focus on S.&P. Ratings." Barely two weeks after Standard & Poor's downgraded U.S. debt over White House protests, we learn that the feds are going after the firm for its ratings on mortgage securities before the financial crisis. The feds say the probe was underway before the downgrade, but the credit rater's mortgage mistakes have been known for years. And why not Moody's or Fitch?

The message: If you disagree with this Administration, you'd better lawyer-up.

• Thursday: "Exxon, U.S. Government Duel Over Huge Oil Find." Exxon has made the biggest oil discoveries ever in the Gulf of Mexico at some one billion barrels, but the feds have taken the extraordinary action of denying the oil company what had long been routine oil lease extensions. So Exxon and a Norwegian firm are suing the feds to be able to drill on the leases, spending money on lawyers for permission to create jobs and increase domestic oil production.

• Thursday: "Fed Eyes European Banks: Regulators Scrutinize Ability of Institutions' U.S. Units to Fund Themselves." The Wall Street Journal quotes Federal Reserve Bank of New York officials as saying they're worried about the condition of European banks and are on the job making sure that any problems don't damage American banks. It's nice to know U.S. regulators are earning their pay, but the spectacle of regulators publicly broadcasting troubles at European banks does nothing to calm already jittery interbank markets.

• Thursday: "Obama to push stimulus plan." The President signals more government fiscal action, to be unveiled after Labor Day. Ideas on the table: New spending on roads and a tax credit for companies that hire workers.

The thinking, say aides, is to pressure Republicans to pass these proposals or look indifferent to high unemployment. So even as he proposes to reduce deficits far into the future in ways that will depend on decisions by future Congresses, the President will fight to increase spending immediately. Americans may conclude they've heard this cognitive dissonance before.

None of these stories by themselves—or even a week of them—is enough to undermine a recovery. But the cascade of such stories day after day—about new regulations, new prosecutions or fines against business, new obstacles to investment, more spending and higher taxes—contributes to the larger lack of business and consumer confidence.

It's impossible to quantify the impact of such policies on lost GDP or lost job creation, but everyone in the real economy understands how such signals work. The great tragedy of the Obama nonrecovery is that this Administration still doesn't realize the damage it is doing.

Published on August 22, 2011 09:52

My Response To Buffett And Obama

By HARVEY GOLUB, WSJ

Over the years, I have paid a significant portion of my income to the various federal, state and local jurisdictions in which I have lived, and I deeply resent that President Obama has decided that I don't need all the money I've not paid in taxes over the years, or that I should leave less for my children and grandchildren and give more to him to spend as he thinks fit. I also resent that Warren Buffett and others who have created massive wealth for themselves think I'm "coddled" because they believe they should pay more in taxes. I certainly don't feel "coddled" because these various governments have not imposed a higher income tax. After all, I did earn it.

Now that I'm 72 years old, I can look forward to paying a significant portion of my accumulated wealth in estate taxes to the federal government and, depending on the state I live in at the time, to that state government as well. Of my current income this year, I expect to pay 80%-90% in federal income taxes, state income taxes, Social Security and Medicare taxes, and federal and state estate taxes. Isn't that enough?

Others could pay higher taxes if they choose. They could voluntarily write a check or they could advocate that their gifts to foundations should be made with after-tax dollars and not be deductible. They could also pay higher taxes if they were not allowed to set up foundations to avoid capital gains and estate taxes.

What gets me most upset is two other things about this argument: the unfair way taxes are collected, and the violation of the implicit social contract between me and my government that my taxes will be spent—effectively and efficiently—on purposes that support the general needs of the country. Before you call me greedy, make sure you operate fairly on both fronts.

Today, top earners—the 250,000 people who earn $1 million or more—pay 20% of all income taxes, and the 3% who earn more than $200,000 pay almost half. Almost half of all filers pay no income taxes at all. Clearly they earn less and should pay less. But they should pay something and have a stake in our government spending their money too.

In addition, the extraordinarily complex tax code is replete with favors to various interest groups and industries, favors granted by politicians seeking to retain power. Mortgage interest deductions support the private housing industry at the expense of renters. Generous fringe benefits are not taxed at all, in order to support union and government workers at the expense of people who buy their own insurance with after-tax dollars. Gifts to charities are deductible but gifts to grandchildren are not. That's just a short list, and all of it is unfair.

Governments have an obligation to spend our tax money on programs that work. They fail at this fundamental task. Do we really need dozens of retraining programs with no measure of performance or results? Do we really need to spend money on solar panels, windmills and battery-operated cars when we have ample energy supplies in this country? Do we really need all the regulations that put an estimated $2 trillion burden on our economy by raising the price of things we buy? Do we really need subsidies for domestic sugar farmers and ethanol producers?

Why do we require that public projects pay above-market labor costs? Why do we spend billions on trains that no one will ride? Why do we keep post offices open in places no one lives? Why do we subsidize small airports in communities close to larger ones? Why do we pay government workers above-market rates and outlandish benefits? Do we really need an energy department or an education department at all?

Here's my message: Before you "ask" for more tax money from me and others, raise the $2.2 trillion you already collect each year more fairly and spend it more wisely. Then you'll need less of my money.

Mr. Golub, a former chairman and CEO of American Express, currently serves on the executive committee of the American Enterprise Institute.

Over the years, I have paid a significant portion of my income to the various federal, state and local jurisdictions in which I have lived, and I deeply resent that President Obama has decided that I don't need all the money I've not paid in taxes over the years, or that I should leave less for my children and grandchildren and give more to him to spend as he thinks fit. I also resent that Warren Buffett and others who have created massive wealth for themselves think I'm "coddled" because they believe they should pay more in taxes. I certainly don't feel "coddled" because these various governments have not imposed a higher income tax. After all, I did earn it.

Now that I'm 72 years old, I can look forward to paying a significant portion of my accumulated wealth in estate taxes to the federal government and, depending on the state I live in at the time, to that state government as well. Of my current income this year, I expect to pay 80%-90% in federal income taxes, state income taxes, Social Security and Medicare taxes, and federal and state estate taxes. Isn't that enough?

Others could pay higher taxes if they choose. They could voluntarily write a check or they could advocate that their gifts to foundations should be made with after-tax dollars and not be deductible. They could also pay higher taxes if they were not allowed to set up foundations to avoid capital gains and estate taxes.

What gets me most upset is two other things about this argument: the unfair way taxes are collected, and the violation of the implicit social contract between me and my government that my taxes will be spent—effectively and efficiently—on purposes that support the general needs of the country. Before you call me greedy, make sure you operate fairly on both fronts.

Today, top earners—the 250,000 people who earn $1 million or more—pay 20% of all income taxes, and the 3% who earn more than $200,000 pay almost half. Almost half of all filers pay no income taxes at all. Clearly they earn less and should pay less. But they should pay something and have a stake in our government spending their money too.

In addition, the extraordinarily complex tax code is replete with favors to various interest groups and industries, favors granted by politicians seeking to retain power. Mortgage interest deductions support the private housing industry at the expense of renters. Generous fringe benefits are not taxed at all, in order to support union and government workers at the expense of people who buy their own insurance with after-tax dollars. Gifts to charities are deductible but gifts to grandchildren are not. That's just a short list, and all of it is unfair.

Governments have an obligation to spend our tax money on programs that work. They fail at this fundamental task. Do we really need dozens of retraining programs with no measure of performance or results? Do we really need to spend money on solar panels, windmills and battery-operated cars when we have ample energy supplies in this country? Do we really need all the regulations that put an estimated $2 trillion burden on our economy by raising the price of things we buy? Do we really need subsidies for domestic sugar farmers and ethanol producers?

Why do we require that public projects pay above-market labor costs? Why do we spend billions on trains that no one will ride? Why do we keep post offices open in places no one lives? Why do we subsidize small airports in communities close to larger ones? Why do we pay government workers above-market rates and outlandish benefits? Do we really need an energy department or an education department at all?

Here's my message: Before you "ask" for more tax money from me and others, raise the $2.2 trillion you already collect each year more fairly and spend it more wisely. Then you'll need less of my money.

Mr. Golub, a former chairman and CEO of American Express, currently serves on the executive committee of the American Enterprise Institute.

Published on August 22, 2011 08:45

Os sem-iPad

LUIZ FELIPE PONDÉ, Folha de SP

A "culpa" do que ocorre em Londres não é do consumo. Muitos se acostumaram a ser tratados como bebês

Você sabia que agora existe em Londres o movimento dos sem-iPad? Coitadinhos deles. Quebram tudo porque a malvada sociedade do consumo os obriga a desejar iPads... No passado todo mundo era "obrigado" a desejar cavalos, tecidos de seda, especiarias, facas, tambores, ouro, mulheres...

Como ficam as pessoas que desejam, não têm, mas nem por isso saqueiam lojas, mas sim trabalham duro? Seriam estes uns idiotas por saberem que nem tudo que queremos podemos ter e que a vida sempre foi dura?

Esta questão é moral. Dizer que não é moral é não saber o que é moral, ou apenas oportunismo... moral. Resistir ao desejo é um problema de caráter. Um dos pecados do pensamento público hoje é não reconhecer o conceito de caráter.

Logo existirão os "sem-Ferrari", os "sem-Blackberry", os "sem-Prada" também? Que tal um "bolsa Blackberry"? Devemos criar um imposto para os "sem-Blackberry"?

Na Inglaterra, dizem, existem famílias que nunca trabalharam vivendo graças ao governo há gerações. É, tem gente que ainda não aprendeu que não existe almoço de graça.

Mas esse fenômeno de querer desculpar todo mundo da responsabilidade moral do que faz não é invenção de quem hoje justifica a violência em Londres clamando por justiça social na distribuição de iPads.

É conhecida a passagem na qual o "homem do subsolo" no livro "Memórias do Subsolo", de Dostoiévski, abre suas confissões dizendo que é um homem amargo. Em seguida, alude à teoria comum de que ele assim o seria por sofrer do fígado. Logo, a culpa por ele ser amargo seria do fígado.

Ele recusa tal desculpa para sua personalidade insuportável e prefere assumir que é mesmo um homem mau. Eis um homem de caráter, coisa rara hoje em dia.

Agora, todo mundo gosta de "algum fígado" (a sociedade de consumo, o patriarcalismo, a Apple) que justifique suas misérias morais.

O profeta russo percebeu que as ciências preparavam uma série de teorias que tirariam a responsabilidade do homem pelos seus atos.

A moda pegou nos jantares inteligentes e hoje temos vários tipos de "teorias do fígado" para justificar nossas misérias morais.

Uma delas é a teoria de que somos construídos socialmente.

Dito de outra forma: O "sujeito é um constructo social". Logo, quebro loja em Londres porque fui "construído" para enlouquecer se não tenho um iPad. Tadinho...

Tem gente por aí que tem verdadeiro orgasmo com essa bobagem.

Não resta dúvida de que há algo verdadeiro na ideia de que somos influenciados pelo meio em que vivemos.

Por exemplo, se você nasce numa favela, isso não vai passar "desapercebido" nos seus modos à mesa, no seu comportamento cotidiano e nas suas expectativas e possibilidades na vida.

Mas aí dizer que "o sujeito é um constructo social" é pura picaretagem intelectual. Ninguém consegue ou conseguirá provar isso nunca, mas quem precisa de "provas" quando o que está em jogo são as ciências humanas, que de "ciência" não têm nada.

Esse blábláblá não só exime o sujeito da responsabilidade moral, como abre a porta para todo tipo de "experimento" psicossocial, político ou justificativa moral, que, na realidade, serve pra qualquer um inventar todo tipo de conversa fiada em ciências humanas "práticas".

Por que tanta gente adora essa teoria? Suponho que, antes de tudo, o alivie de ser você e coloque a "culpa" de você ser você no pai, na mãe, na escola, na vizinha, na sociedade, no consumo, na igreja, no patriarcalismo, no machismo, na cama de casal, no iPad, no diabo a quatro. Menos em você.

Temos aí uma prova de que grande parte das ciências humanas não reconhece o conceito de caráter.

Moral é exatamente você resistir a impulsos que outras pessoas, sem caráter, não resistem. Já leu Aristóteles? Kant?

A "culpa" do que hoje acontece em Londres não é do consumo. Homens sempre quebram coisas de vez em quando e querem coisas sem esforço. As causas podem variar. Hoje em dia, seguramente, uma delas é que muita gente está acostumada a um Estado de bem estar social que os trata como bebês.

A preguiça, sim, é um traço universal do ser humano.

A "culpa" do que ocorre em Londres não é do consumo. Muitos se acostumaram a ser tratados como bebês

Você sabia que agora existe em Londres o movimento dos sem-iPad? Coitadinhos deles. Quebram tudo porque a malvada sociedade do consumo os obriga a desejar iPads... No passado todo mundo era "obrigado" a desejar cavalos, tecidos de seda, especiarias, facas, tambores, ouro, mulheres...

Como ficam as pessoas que desejam, não têm, mas nem por isso saqueiam lojas, mas sim trabalham duro? Seriam estes uns idiotas por saberem que nem tudo que queremos podemos ter e que a vida sempre foi dura?

Esta questão é moral. Dizer que não é moral é não saber o que é moral, ou apenas oportunismo... moral. Resistir ao desejo é um problema de caráter. Um dos pecados do pensamento público hoje é não reconhecer o conceito de caráter.

Logo existirão os "sem-Ferrari", os "sem-Blackberry", os "sem-Prada" também? Que tal um "bolsa Blackberry"? Devemos criar um imposto para os "sem-Blackberry"?

Na Inglaterra, dizem, existem famílias que nunca trabalharam vivendo graças ao governo há gerações. É, tem gente que ainda não aprendeu que não existe almoço de graça.

Mas esse fenômeno de querer desculpar todo mundo da responsabilidade moral do que faz não é invenção de quem hoje justifica a violência em Londres clamando por justiça social na distribuição de iPads.

É conhecida a passagem na qual o "homem do subsolo" no livro "Memórias do Subsolo", de Dostoiévski, abre suas confissões dizendo que é um homem amargo. Em seguida, alude à teoria comum de que ele assim o seria por sofrer do fígado. Logo, a culpa por ele ser amargo seria do fígado.

Ele recusa tal desculpa para sua personalidade insuportável e prefere assumir que é mesmo um homem mau. Eis um homem de caráter, coisa rara hoje em dia.

Agora, todo mundo gosta de "algum fígado" (a sociedade de consumo, o patriarcalismo, a Apple) que justifique suas misérias morais.

O profeta russo percebeu que as ciências preparavam uma série de teorias que tirariam a responsabilidade do homem pelos seus atos.

A moda pegou nos jantares inteligentes e hoje temos vários tipos de "teorias do fígado" para justificar nossas misérias morais.

Uma delas é a teoria de que somos construídos socialmente.

Dito de outra forma: O "sujeito é um constructo social". Logo, quebro loja em Londres porque fui "construído" para enlouquecer se não tenho um iPad. Tadinho...

Tem gente por aí que tem verdadeiro orgasmo com essa bobagem.

Não resta dúvida de que há algo verdadeiro na ideia de que somos influenciados pelo meio em que vivemos.

Por exemplo, se você nasce numa favela, isso não vai passar "desapercebido" nos seus modos à mesa, no seu comportamento cotidiano e nas suas expectativas e possibilidades na vida.

Mas aí dizer que "o sujeito é um constructo social" é pura picaretagem intelectual. Ninguém consegue ou conseguirá provar isso nunca, mas quem precisa de "provas" quando o que está em jogo são as ciências humanas, que de "ciência" não têm nada.

Esse blábláblá não só exime o sujeito da responsabilidade moral, como abre a porta para todo tipo de "experimento" psicossocial, político ou justificativa moral, que, na realidade, serve pra qualquer um inventar todo tipo de conversa fiada em ciências humanas "práticas".

Por que tanta gente adora essa teoria? Suponho que, antes de tudo, o alivie de ser você e coloque a "culpa" de você ser você no pai, na mãe, na escola, na vizinha, na sociedade, no consumo, na igreja, no patriarcalismo, no machismo, na cama de casal, no iPad, no diabo a quatro. Menos em você.

Temos aí uma prova de que grande parte das ciências humanas não reconhece o conceito de caráter.

Moral é exatamente você resistir a impulsos que outras pessoas, sem caráter, não resistem. Já leu Aristóteles? Kant?

A "culpa" do que hoje acontece em Londres não é do consumo. Homens sempre quebram coisas de vez em quando e querem coisas sem esforço. As causas podem variar. Hoje em dia, seguramente, uma delas é que muita gente está acostumada a um Estado de bem estar social que os trata como bebês.

A preguiça, sim, é um traço universal do ser humano.

Published on August 22, 2011 06:42

A tragédia do euro

Rodrigo Constantino, para a revista Banco de Ideias - IL

A escalada da crise européia coloca em dúvida a própria sobrevivência do euro. Será que Milton Friedman estava certo ao prever que a moeda comum não suportaria sua primeira grande crise? O livro "The Tragedy of the Euro", de Philipp Bagus, ajuda a lançar luz sobre este debate.

Para o autor, existiam na época da criação do euro duas visões distintas da Europa. De um lado, a visão liberal clássica, que defendia a livre circulação de bens, serviços, capital e mão de obra. Do outro, a visão socialista, com foco na harmonização da regulação social, cuja padronização poderia ameaçar os trabalhadores de países menos competitivos.

A França, devastada após a ocupação nazista e seus fracassos coloniais, encontrou na Comunidade Européia um meio para recuperar sua influência e orgulho. Um Estado centralizado parecia adequado para sua elite governante, e uma moeda comum seria um importante passo nesta direção. A Alemanha, afinal, possuía uma arma muito poderosa que precisava ser desativada: o marco.

Com a criação de uma moeda comum, os países menos competitivos acabaram tendo problemas. É o pretexto perfeito para uma centralização de políticas fiscais, com harmonização tributária. Trata-se de uma forma de acabar com a competição entre governos, que força menos impostos. Todos acabam pressionados para elevar seus tributos ao patamar mais alto. O fim do euro, ao contrário do que alegam os alarmistas, não seria o fim da idéia européia; apenas o fim de sua versão socialista.

Bancos centrais inflacionistas representam o mais poderoso aliado de governos irresponsáveis. O Bundesbank era um obstáculo a esta política inflacionária na região. A Alemanha viveu o inferno da hiperinflação e aprendeu com a experiência. Seu banco central era a pedra no sapato daqueles governos sedentos por mais gastos, mas ávidos por quebrar o termômetro que mostrava a febre do doente. A desvalorização das demais moedas frente ao marco era humilhante. Era preciso se livrar da "tirania" do Bundesbank.

Uma moeda única controlada por um Banco Central Europeu (BCE) era a solução final para os governos com ambições inflacionárias. Esta solução representava a abolição do espírito e força do Bundesbank. Por isso seus principais membros foram totalmente contrários à criação do euro. E por isso seu presidente, Alex Weber, decidiu renunciar há pouco tempo, quando o óbito do Bundesbank foi finalmente decretado após o BCE rasgar sua tradição ortodoxa para salvar governos deficitários.

Hoje se discute um Euro Bond ou uma atuação ainda mais ativa do BCE na compra de títulos dos governos falidos. São eufemismos para uma "transfer union", um mecanismo de redistribuição de riqueza dos mais produtivos para os mais ineficientes. O plano da moeda comum contou com o empolgado apoio de Jacques Delors, com longa carreira nas políticas socialistas francesas. Parece que seus ideais estão finalmente se tornando realidade.

O Tratado de Maastricht, assinado em 1991, teoricamente impediria posturas muito irresponsáveis dos membros do euro. O déficit fiscal não poderia superar 3% do PIB, e a dívida pública ficaria limitada a 60% do PIB. Estes limites foram ultrapassados com margem folgada, mas não houve punição alguma. Ao contrário, a pressão crescente é para que o BCE atue como salvador, usando sua varinha mágica inflacionária. A Alemanha foi seduzida a este acordo com o discurso ameaçador de que o euro era necessário para preservar a paz na região. O sentimento de culpa após o nazismo fez o resto.

Em suma, o euro é um projeto político, que visa à centralização do poder na região. Os alemães de classe média poderão ser obrigados a sustentar a farra dos gregos, italianos, espanhóis e até franceses mais irresponsáveis. Essa é justamente a visão socialista de mundo. E ela nunca deu certo.

Published on August 22, 2011 05:47

August 20, 2011

A faxina da Dilma parece piada de português

Guilherme Fiuza, Revista ÉPOCA

A faxina de Dilma se parece com a história da queda do avião no cemitério português. Trata-se de humor negro e preconceituoso, mas ilustra bem a atual cena política brasileira. Segundo a anedota, as equipes de resgate lusitanas fizeram a operação mais longa da história dos acidentes aéreos: após uma semana de buscas por corpos na área do cemitério onde o avião caíra, as autoridades portuguesas concluíram que havia mais de 1.000 passageiros a bordo. E anunciavam que as escavações continuariam até que a última vítima fosse localizada.

A piada é pura implicância com nossos colonizadores, mas expressa com exatidão a suposta cruzada de Dilma contra a corrupção em seu próprio governo. Quem transformou o Estado em moeda de troca política foi o partido da presidente. Seria cômica, se não fosse trágica, a imagem de Dilma desenterrando aqui e ali as ossadas do fisiologismo que estão por toda parte – como se ela não tivesse nada com isso. É a vez dos portugueses de contar a anedota dos brasileiros que vibram com a faxina de quem fez a lambança.

Wagner Rossi, da Agricultura, é mais um ministro que cai coberto de elogios da presidente. Assim como Palocci e Alfredo Nascimento, Rossi mereceu todos os votos de confiança de Dilma até o último momento. É como se sua cabeça tivesse rolado por um acidente natural, um capricho do destino. O próprio ministro demitido, em nota oficial, declarou que nada foi provado contra ele, que as denúncias são mera intriga da oposição, que se orgulha do seu trabalho etc. Só mesmo um fenômeno da natureza pode explicar que um ministro tão orgulhoso e seguro de si resolva pedir o boné.

Pelo menos essa turma é transparente. Respondendo à imprensa – sempre ela, importunando a privacidade dos homens de bem –, Wagner Rossi declarou que viajou, de fato, no avião de uma empresa cliente do seu ministério. A empresa em questão conseguiu, depois que Rossi entrou no governo, um aumento de 3.000% no valor dos financiamentos públicos para seus projetos de agronegócios. O então ministro da Agricultura não viu nenhum problema em embarcar no jatinho dessa próspera empresa.

Os termos usados por Rossi em sua explicação denotam toda a inocência e a doçura de sua relação com a tal empresa: "Informo que, em raras ocasiões, utilizei como carona o avião citado na reportagem". Que fique, portanto, esclarecido aos maliciosos de plantão: não houve nada demais, só um empresário dando carona a um ministro. Uma questão de solidariedade.

Se todos os ministros demitidos do governo popular tivessem essa clareza e espontaneidade, talvez Dilma pudesse ter economizado detergente e água sanitária. Antonio Palocci, por exemplo, poderia ter dito que "utilizou como carona" seu status de coordenador da campanha presidencial e de ex-ministro da Fazenda para prestar consultoria privada. Ninguém duvidaria da sua inocência. Alfredo Nascimento poderia ter declarado que "utilizou como carona" o Ministério dos Transportes para que o pessoal do PR montasse a farra orçamentária do Dnit. E assim por diante, calando essa mídia golpista que vê maldade em tudo.

Vejam o caso do senador maranhense José Sarney, que utilizou como carona o Estado do Amapá para se perpetuar em Brasília. Apesar do escândalo no Ministério do Turismo (da cota pessoal de Sarney), envolvendo uma ONG de fachada que drenou milhões de reais para projetos fantasmas no Amapá, o senador permanece imune em sua cadeira na presidência do Congresso. O secretário executivo do ministério – aquele flagrado ensinando um empresário a montar convênio pirata com o governo – é afilhado político de Sarney. Por que a faxina não chega a ele?

Porque Sarney é dono de uma das capitanias hereditárias do fisiologismo, dessas que Lula e Dilma utilizaram como carona para se agarrar ao poder. Faxina contra a corrupção? Melhor contar piada de português.

A faxina de Dilma se parece com a história da queda do avião no cemitério português. Trata-se de humor negro e preconceituoso, mas ilustra bem a atual cena política brasileira. Segundo a anedota, as equipes de resgate lusitanas fizeram a operação mais longa da história dos acidentes aéreos: após uma semana de buscas por corpos na área do cemitério onde o avião caíra, as autoridades portuguesas concluíram que havia mais de 1.000 passageiros a bordo. E anunciavam que as escavações continuariam até que a última vítima fosse localizada.

A piada é pura implicância com nossos colonizadores, mas expressa com exatidão a suposta cruzada de Dilma contra a corrupção em seu próprio governo. Quem transformou o Estado em moeda de troca política foi o partido da presidente. Seria cômica, se não fosse trágica, a imagem de Dilma desenterrando aqui e ali as ossadas do fisiologismo que estão por toda parte – como se ela não tivesse nada com isso. É a vez dos portugueses de contar a anedota dos brasileiros que vibram com a faxina de quem fez a lambança.

Wagner Rossi, da Agricultura, é mais um ministro que cai coberto de elogios da presidente. Assim como Palocci e Alfredo Nascimento, Rossi mereceu todos os votos de confiança de Dilma até o último momento. É como se sua cabeça tivesse rolado por um acidente natural, um capricho do destino. O próprio ministro demitido, em nota oficial, declarou que nada foi provado contra ele, que as denúncias são mera intriga da oposição, que se orgulha do seu trabalho etc. Só mesmo um fenômeno da natureza pode explicar que um ministro tão orgulhoso e seguro de si resolva pedir o boné.

Pelo menos essa turma é transparente. Respondendo à imprensa – sempre ela, importunando a privacidade dos homens de bem –, Wagner Rossi declarou que viajou, de fato, no avião de uma empresa cliente do seu ministério. A empresa em questão conseguiu, depois que Rossi entrou no governo, um aumento de 3.000% no valor dos financiamentos públicos para seus projetos de agronegócios. O então ministro da Agricultura não viu nenhum problema em embarcar no jatinho dessa próspera empresa.

Os termos usados por Rossi em sua explicação denotam toda a inocência e a doçura de sua relação com a tal empresa: "Informo que, em raras ocasiões, utilizei como carona o avião citado na reportagem". Que fique, portanto, esclarecido aos maliciosos de plantão: não houve nada demais, só um empresário dando carona a um ministro. Uma questão de solidariedade.

Se todos os ministros demitidos do governo popular tivessem essa clareza e espontaneidade, talvez Dilma pudesse ter economizado detergente e água sanitária. Antonio Palocci, por exemplo, poderia ter dito que "utilizou como carona" seu status de coordenador da campanha presidencial e de ex-ministro da Fazenda para prestar consultoria privada. Ninguém duvidaria da sua inocência. Alfredo Nascimento poderia ter declarado que "utilizou como carona" o Ministério dos Transportes para que o pessoal do PR montasse a farra orçamentária do Dnit. E assim por diante, calando essa mídia golpista que vê maldade em tudo.

Vejam o caso do senador maranhense José Sarney, que utilizou como carona o Estado do Amapá para se perpetuar em Brasília. Apesar do escândalo no Ministério do Turismo (da cota pessoal de Sarney), envolvendo uma ONG de fachada que drenou milhões de reais para projetos fantasmas no Amapá, o senador permanece imune em sua cadeira na presidência do Congresso. O secretário executivo do ministério – aquele flagrado ensinando um empresário a montar convênio pirata com o governo – é afilhado político de Sarney. Por que a faxina não chega a ele?

Porque Sarney é dono de uma das capitanias hereditárias do fisiologismo, dessas que Lula e Dilma utilizaram como carona para se agarrar ao poder. Faxina contra a corrupção? Melhor contar piada de português.

Published on August 20, 2011 17:47

Rodrigo Constantino's Blog

- Rodrigo Constantino's profile

- 32 followers

Rodrigo Constantino isn't a Goodreads Author

(yet),

but they

do have a blog,

so here are some recent posts imported from

their feed.