Tim Calkins's Blog, page 8

December 28, 2022

Looking Back at my 2022 Brands to Watch

There are just a few days left in 2022 so it is time to look back at my 2022 brands to watch.

Each year I identify a few brands that are worth following as they head into particularly interesting situations. I’ll publish my 2023 list next week.

Here is review of my 2022 picks, with some commentary on how the year worked out.

The OlympicsThe Beijing Winter Olympics were in early 2022. Really? It hardly seems possible, since so much has happened since that event.

I wondered about the Olympics brand given China’s lack of free speech and COVID lock-down policies. More important, I speculated that brands would try to walk a delicate line: supporting the athletes and the Olympics while playing down the connection to China.

This is how things played out. Brands showed up, which was a given since the deals had been signed much earlier. The advertising focused relentlessly on the athletes.

Nathan Chen emerged as the biggest star, with a remarkable story and performance.

The Olympics brand lost a bit of luster. In most years, athletes interact, there is a sense of joy and fun as people come together to marvel and cheer. That was gone in 2022.

PelotonOne of the most notable “COVID Brands,” Peloton started 2022 in disarray. I wondered if the brand would rebound.

It was indeed a lively year. CEO John Foley stepped down in February and the company began a series of massive layoffs.

The new leadership team has made big changes, retreating from certain areas like apparel and manufacturing, and investing in others.

The company has certainly not rebounded. When I wrote the post last year the stock was trading at $37. Today it trades at $8.

But there are some hopeful signs. People still love the brand, engagement remains high, and the company is focused on the core fitness class proposition. After a terrible 2022, I’m optimistic.

White ClawThe darling brand of hard seltzer was another of my brands to watch, as innovation sweeps through the alcoholic beverage industry.

I predicted that White Claw would stumble and the big players like AB InBev would regain some momentum.

That prediction was largely correct. It isn’t easy to get perfect data, since White Claw owner Mark Anthony is private. But AB InBev is doing better, with the stock price flat in 2022, vastly outperforming the broader market. Boston Beer Company, maker of Truly, has stumbled. The stock is down 35% this year and the company had to destroy thousands of cases of Truly.

Donald TrumpOnce again Donald Trump was a brand to watch. I predicted he would announce another run for the presidency. This was accurate.

However, I also projected that he would do so after a strong Republican showing in the mid-term elections, giving him considerable momentum. That has not happened.

Donald Trump leaves 2022 as a much-diminished brand. Momentum is key in the world of politics. Right now, Trump doesn’t have it and other players do.

RivianI anticipated electric-truck maker Rivian would stumble in 2022. That was something of an understatement. It has been a dreadful year for Rivian, with the stock down over 80%.

As the big industry players pivot to electric, it becomes harder and harder for a new player to break in. Tesla caught the auto industry by surprise and might survive. Rivian is facing huge companies determined to defend.

When big companies defend, small companies get squashed.

Look for my 2023 brands to watch next week. You can sign-up for the newsletter here.

The post Looking Back at my 2022 Brands to Watch appeared first on STRONGBRANDS.

December 13, 2022

Learning from a German Protest March

Last week I taught Marketing Strategy in the Kellogg-WHU Executive MBA program in Koblenz. It was great fun; the students were bright, diverse, and engaged.

One evening, after a day of teaching, I was wandering through the charming city of Koblenz and came across a protest march. There were banners, drums, horns and all the rest. It was a German sort of protest, so orderly and well-structured. There were police officers at the front and back to block the intersections and ensure all went well.

So, I joined the march.

I wasn’t sure exactly what we were protesting and my German is weak. I asked the person next to me.

We are protesting high inflation!

This was not unexpected, since inflation is a huge issue all over the world. It is perhaps a bigger issue in a place like Germany where many people put their savings in bank accounts earning very little in interest.

Still, protesting inflation seems a bit like protesting gravity or the tides, so I asked someone else.

We are protesting high energy prices!

I could follow this argument, since energy prices are a huge issue in Germany. I spoke with several Germans who reported that their heating bill was up by 4x. It is a dark time in Germany because the lights are usually off. Then I asked someone else.

We are protesting the boycotts from the war in Ukraine!

I didn’t see this one coming, but I suppose I should have. The core issue for many of the protestors: the Russian boycotts. These are leading to higher energy prices and a more difficult life in Germany.

I drifted away from the protest after hearing this news, since I support Ukraine and oppose the invasion. But it left me thinking. If people in Germany are connecting the Ukraine conflict to their personal financial struggles, there is a challenge ahead. How do you keep supporting the Ukrainians?

I am a marketing professor, so tend to see things in terms of benefits and costs. In the U.S., Ukraine seems like a good cause. There is no direct cost, and the benefit seems high. Who doesn’t want to support the feisty and spirited Ukrainians? This is an easy decision.

In Germany, the equation is different. The Ukraine war is creating significant personal costs. The benefits are far less clear. Wasn’t Ukraine always part of Russia? Why are we getting involved in that fight? Do we really want to provoke Russia, one of the world’s great powers and not far away?

I think there are two lessons.

First, don’t assume that your personal outlook is universal. I think many in the U.S. suffer from that. I certainly did on the Ukraine question. If it makes sense to us, then it must make sense to everyone, right?

Second, costs and benefits develop on an individual level. What are people seeing and hearing? What do they believe?

As I walked home that evening in the drizzle, I was left thinking that settling the Ukraine conflict is essential. Russia will take part of Ukraine, but not as much as Putin wanted. Ukraine will lose some territory but will survive.

The quicker we get to some resolution, the better.

The post Learning from a German Protest March appeared first on STRONGBRANDS.

November 22, 2022

Chaos at Twitter

Twitter is in complete disarray. Elon Musk, since purchasing the company for $44 billion, has made a series of moves ranging from strange to bizarre.

Will all this work out for Twitter and Elon? Perhaps. Twitter had been a somewhat stagnant brand for many years. Today, it is anything but. The company is making big changes and people are talking about it. There is excitement and interest, and activity is spiking. All of this is positive.

Still, you have to be worried about two things. First, the brand of Twitter is changing. It used to be a somewhat neutral place where people could comment on and discuss current events. It is now Elon Musk’s social media platform. Will everyone be happy supporting the Elon Musk platform? That is unclear.

Second, the company apparently fired 50% of the workers. Elon Musk told the rest that, "We will need to be extremely hardcore. This will mean working long hours at high intensity. Only exceptional performance will constitute a passing grade,” so many of them left.

Thinking that Twitter will continue to function well means believing that most of the people there were not adding significant value to the day-to-day operation. I find that hard to believe.

I’ve started receiving spam messages on Twitter in some foreign language for the first time that I can recall, which suggests that all is not well.

While the outcome isn’t clear, there are a few things we can learn from the chaos.

Things We Can LearnDon’t depend on one brand or network

Twitter might be imploding right before our eyes. The network could well crash or fade away without the infrastructure behind it. Certainly, advertisers are certainly fleeing along with the employees.

It is a good reminder not to rely on one network or one brand for a company, a career, or your self-identity. How can a brand or network get into trouble? Simple! A crazy billionaire buys it and implements strange policies.

This is one more reason not to get a tattoo of your favorite brand’s logo.

If you are working with multiple brands or platforms, you have some options should one get into trouble.

Keep your resume and network up to date

Thousands of people from Twitter are now looking for work, much to their surprise. They join thousands from Meta and Amazon. And quite a few from Tyson who aren’t excited about life in Arkansas.

That is the reality of life in the business world. You can be fired at any moment.

The best defense? Keep your resume up to date. More important, maintain your network. When you are in transition, your contacts are the key to your search process. So, check in with people. Make time to have a coffee or lunch. Be there in person and build a relationship.

Give people a reason to show up

Elon Musk apparently told people they would need to work long hours at high intensity and be in the office every day. What was less clear was the why.

If you want someone to work exceptionally hard, you need to give them a reason. Some people will work 20 hours a day inspired by a mission to make the world a better place. Other people will put in the hours to make a lot of money. Still others want to have an impact on a business or brand they care about.

Why work hard at Twitter? It isn’t clear. To make Elon wealthy? That isn’t particularly motivating. He already is wealthy. For a big bonus? To help the world? To have leave a legacy?

If you ask people to work hard but don’t explain why they should, people will leave. And that is what people have done at Twitter.

Be humble

If Elon fails at Twitter, it will largely be because he failed to listen. He walked in and started making decisions, many of which were bad decisions. He was arrogant, acting first and listening later.

This won’t work for most people. When starting in a new role, humility goes a long way. You have a lot to learn, and, in most cases, you can expect to be the least informed person in the room.

The OutlookIt is hard to bet against Elon Musk, but after his first days you have to wonder how things will work out.

The post Chaos at Twitter appeared first on STRONGBRANDS.

Learning from the Chaos at Twitter

Twitter is in complete disarray. Elon Musk, since purchasing the company for $44 billion, has made a series of moves ranging from strange to bizarre.

Will all this work out for Twitter and Elon? Perhaps. Twitter had been a somewhat stagnant brand for many years. Today, it is anything but. The company is making big changes and people are talking about it. There is excitement and interest, and activity is spiking. All of this is positive.

Still, you have to be worried about two things. First, the brand of Twitter is changing. It used to be a somewhat neutral place where people could comment on and discuss current events. It is now Elon Musk’s social media platform. Will everyone be happy supporting the Elon Musk platform? That is unclear.

Second, the company apparently fired 50% of the workers. Elon Musk told the rest that, "We will need to be extremely hardcore. This will mean working long hours at high intensity. Only exceptional performance will constitute a passing grade,” so many of them left.

Thinking that Twitter will continue to function well means believing that most of the people there were not adding significant value to the day-to-day operation. I find that hard to believe.

I’ve started receiving spam messages on Twitter in some foreign language for the first time that I can recall, which suggests that all is not well.

While the outcome isn’t clear, there are a few things we can learn from the chaos.

Things We Can LearnDon’t depend on one brand or network

Twitter might be imploding right before our eyes. The network could well crash or fade away without the infrastructure behind it. Certainly, advertisers are certainly fleeing along with the employees.

It is a good reminder not to rely on one network or one brand for a company, a career, or your self-identity. How can a brand or network get into trouble? Simple! A crazy billionaire buys it and implements strange policies.

This is one more reason not to get a tattoo of your favorite brand’s logo.

If you are working with multiple brands or platforms, you have some options should one get into trouble.

Keep your resume and network up to date

Thousands of people from Twitter are now looking for work, much to their surprise. They join thousands from Meta and Amazon. And quite a few from Tyson who aren’t excited about life in Arkansas.

That is the reality of life in the business world. You can be fired at any moment.

The best defense? Keep your resume up to date. More important, maintain your network. When you are in transition, your contacts are the key to your search process. So, check in with people. Make time to have a coffee or lunch. Be there in person and build a relationship.

Give people a reason to show up

Elon Musk apparently told people they would need to work long hours at high intensity and be in the office every day. What was less clear was the why.

If you want someone to work exceptionally hard, you need to give them a reason. Some people will work 20 hours a day inspired by a mission to make the world a better place. Other people will put in the hours to make a lot of money. Still others want to have an impact on a business or brand they care about.

Why work hard at Twitter? It isn’t clear. To make Elon wealthy? That isn’t particularly motivating. He already is wealthy. For a big bonus? To help the world? To have leave a legacy?

If you ask people to work hard but don’t explain why they should, people will leave. And that is what people have done at Twitter.

Be humble

If Elon fails at Twitter, it will largely be because he failed to listen. He walked in and started making decisions, many of which were bad decisions. He was arrogant, acting first and listening later.

This won’t work for most people. When starting in a new role, humility goes a long way. You have a lot to learn, and, in most cases, you can expect to be the least informed person in the room.

The OutlookIt is hard to bet against Elon Musk, but after his first days you have to wonder how things will work out.

The post Learning from the Chaos at Twitter appeared first on STRONGBRANDS.

November 11, 2022

A Stunning Spot from Ron DeSantis

The midterm elections are behind us, and the expected red wave fizzled out as voters punished the Republicans for limiting a woman's right to choose. Conservatives hoping to get elected in many parts of te country need to figure out how to communicate a reasonable approach on that issue.

The focus now shifts to the 2024 presidential contest. Florida Governor Ron DeSantis has opened things up with a stunning piece of advertising.

Last Friday, his campaigned released a new commercial: God Made a Fighter. If you haven't seen it, take a look at this spot.

https://www.youtube.com/watch?v=o8jz7...

StunningThis is a remarkable piece of advertising. It is unique in its bold suggestion that God created Ron DeSantis to be a political leader. DeSantis didn’t get there on his own, he didn’t fight and struggle, he was chosen by God.

Chosen by God?

Really?

The sheer hubris and arrogance of this spot is breathtaking.

The ImpactEqually amazing is just how well the spot works. It is a brilliant piece of film and brand positioning.

First, it grabs your attention and breaks through the clutter. In a sea of political ads, this one stands out. Part of this comes from its connection to conservative radio commentator Paul Harvey’s ode to the agrarian life with his famous speech “God made a farmer.” Ram used it a few years back in a Super Bowl spot.

Second, it communicates a benefit. Ron DeSantis? He fights for families and communities.

Third, it blends imagery and logic. The spot taps into some factual proof points, such as DeSantis keeping schools open during the pandemic. It also draws on emotion with scenes of families, police officers and first responders.

The StrategyA great brand is built on a tight positioning. Ron DeSantis has one. He is clearly targeting conservative votes; there isn’t much in this spot for liberals. There is nothing here about the environment or choice or inclusion. DeSantis has a clear frame of reference. Like Donald Trump, he is a strong, arrogant leader who champions conservative values.

The differentiating benefit? DeSantis can beat Joe Biden. He is an electable candidate: he is less polarizing than Trump. He doesn’t constantly talk about stolen elections. He isn't overtly crazy.

Of course, DeSantis has to move fast to stop Trump from seeming like the inevitable nominee. Releasing this spot at this moment is a smart move; it will get people talking and frame the Republican primary battle as a two-person race. The mixed success of Trump’s candidates in the mid-term election makes his coronation less certain. There is reason for Republican voters to consider alternatives.

DeSantis took a big risk with this spot, but it sets him up well.

Get ready for a spicy primary battle.

The post A Stunning Spot from Ron DeSantis appeared first on STRONGBRANDS.

October 28, 2022

The Joy of Inflation

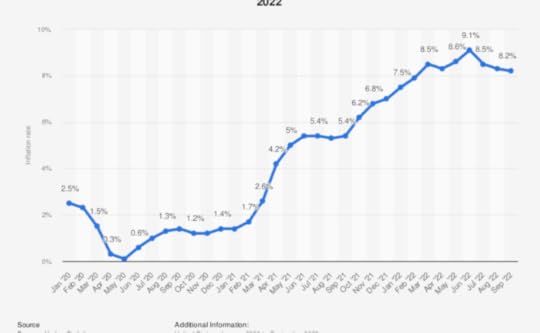

Happy Friday! Inflation is dominating the news these days. The Federal Reserve is boosting interest rates and reducing liquidity in an effort to slow the increase. Inflation is quickly becoming a dominant theme in the upcoming election, with Democrats being accused of sparking the rise with too much government stimulus.

There is no question that inflation is a problem. It is difficult for family budgets and the higher interest rates result in stock market declines, hurting pensions, 401k accounts and college savings. It is more difficult for people to buy a house.

For business leaders, however, inflation isn’t such a bad thing. Instead, in some ways a bit of inflation makes the task of leading a business much easier.

The Growth ChallengeAnyone leading a business faces the challenge of growth. Profit and cash flow must increase over time. This is certainly true for public companies; a company that isn’t going to grow will struggle to attract investors and its stock price will fall. It is also true for private companies. Private equity firms thrive on purchasing companies, quickly increasing the profit, and selling the firm for a healthy gain. Even family companies have to grow.

The problem is that growth isn’t easy. Incremental profits don’t just appear; they have to come from somewhere.

There are only a few options. If you simplify things a bit, you end up with just four potential sources of profit growth: market expansion, share growth, price increases and cost reductions.

These are all challenging. Market expansion, or category growth, is terrific, but it isn’t easy to find growing categories in developed areas like the U.S. and Western Europe. It is even harder in countries where the population is declining. Building market share is much easier said than done; competitors will fight hard to protect their share. Cutting costs is tough and it only gets harder over time. That leaves pricing.

In a world without inflation, price increases are difficult. Channel partners push back, saying “This is outrageous! How can you increase prices when your costs aren’t changing? This is just greed.” Competitors might not follow a price increase, resulting in share losses for the price leader. Customers might shift to brands that didn’t increase prices.

This has been the situation for the past decade. Profit growth was hard to find.

The Power of InflationWhen inflation is present, everything changes because a price increase becomes an easy and logical move. This pricing move can easily translate into profit growth.

Now with inflation, a portion of the price increase might be necessary to cover the higher cost of raw materials and wages. But part of the price increase will likely drop to profit. Even pricing up at just the rate of inflation will result in more profit; if costs are up by 5% and a company raises prices by 5% as a result, profits will grow.

Here is the math on that. Take a company selling 10 items for $10, which is $100 in revenue. Let’s say the cost of goods sold is $5 per unit, so $50 in total, with overhead of $30. That leaves a profit of $20.

Increase everything by 10% due to inflation. The price goes to $11, and revenues then go to $110. COGS increases to $55 and overhead increases to $33. Profits? Now $22, a 10% increase.

Things get better if you increase prices a little more than the rate of inflation. In the exercise above, push retail prices up by 15% and all of sudden profits are up by 35%.

For a manager responsible for delivering higher profits, inflation is transformational. Channel partners will understand the move. Competitors will follow the prices increase, because they are facing the same increase in costs. Customers won’t likely change behavior because everything is costing a little more.

Q3 EarningsCompanies are reporting earnings this week, and the story seems to be holding. Coke, for example, reported that profits grew more than expected as the company took prices up by 12%. KraftHeinz reported similarly positive news; through Q3, profits are up by 15.8% primarily due to price increases. Chipotle, too, reported that high price are helping build profits.

I was talking with one business leader recently and he reported that there was virtually no price elasticity. Prices were going up and volume was staying flat. Apparently since everyone expected inflation, they weren’t changing behavior with the higher prices.

The Bright SideWhen you hear people complain about inflation, remember that not everyone is sharing in that distress. Many business leaders are delighted.

All this is one more reason why inflation won’t drop to zero anytime soon.

The post The Joy of Inflation appeared first on STRONGBRANDS.

October 13, 2022

Tyson’s Bad Move

It is always interesting when a company does something that just doesn’t make sense. Tyson’s announcement that it was closing its Chicago office is one of those decisions.

The AnnouncementLast Wednesday, Tyson put out a press release announcing that it was closing its Chicago office and moving the positions to its global headquarters in Springdale, Arkansas. This affects about 500 people, including a large portion of Tyson’s marketing and innovation teams.

It is a big shift. Tyson has had a major presence in Illinois since it acquired Chicago-based Hillshire Brands in 2014.

The Official ReasonAccording to Tyson, the move is to accelerate innovation. In the press release, CEO Donnie King is quoted saying “Bringing our talented corporate team members and businesses together under one roof unlocks greater opportunities to share perspectives and ideas, while also enabling us to act quickly to solve problems and provide the innovative products solutions that our customers deserve and value.”

The official statement is gibberish.

The move won’t bring the team together, for the simple reason that most of the Chicago employees will quit. People used to the vibrant life of Chicago won’t be moving to Springdale, the fourth largest city in Arkansas. It is hard to get talented MBAs to move to the great city of Cincinnati. Springdale? No.

WhySo why did Tyson make this decision? It isn't because financial results are terribly weak. Tyson had operating income of $3.6 billion in the first 9 months of 2022, up dramatically from 2021. Let’s consider some other options.

To accelerate creativity and innovation

No. Moving to Arkansas is not going to accelerate creativity. When you think of creative places, Springdale doesn’t jump to mind. Creative types live in New York, LA, Chicago, London, Tokyo, Miami and other vibrant cities.

To attract better talent

No. If you put the company in Springdale, you limit your selection of talent. Tyson can now choose from all the business leaders that are open to living in Springdale.

The trend has been just the opposite; in recent years, companies have been moving to urban centers to attract talent. Kimberly-Clark, Kellogg, McDonalds, Whirlpool, Abbott and other firms have all expanded in Chicago.

To shift to a less troubled city

No. Chicago has tax and crime issues, but Tyson isn’t moving to another urban center, like Boeing and Caterpillar recently did. It is moving to Arkansas.

To embrace remote work

No. Tyson isn’t moving to a remote format. Indeed, the company is going the other way; the firm will be expanding and renovating its headquarters building, a clear move to embrace in-person work.

To save money

Yes. This move will save money. That is guaranteed. Many of Tyson’s Chicago employees will quit. Real estate is cheaper in Springdale. Salaries, too, are lower in Arkansas.

The OutlookWhatever way you look at it, this move suggests that Tyson’s outlook is grim. There are two possible scenarios.

If this is really a move to save money, then it indicates that Tyson is retreating from building brands with innovation and creativity and embracing life as a commodity meat producer focused on efficiency and low costs. This is a reasonable strategic choice, but it is not likely to lead to high margins and growth.

Of course, this might just be a bad decision, likely made by people who enjoy living in Arkansas and think the creative and dynamic business leaders of tomorrow will love that life, too.

If Tyson’s stock wasn’t already down so much this year I would sell.

The post Tyson’s Bad Move appeared first on STRONGBRANDS.

September 30, 2022

Investing in a Tumultous World

The financial world is falling apart. Stocks are slumping, bonds – the “safe investment” – are doing almost as poorly. Bitcoin is down. Even gold, which should definitely be rising at a time of war and disruption, isn’t doing a lot.

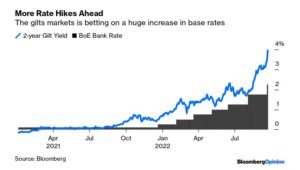

I was particularly struck by this chart from Bloomberg. Interest rates in the UK have absolutely soared in the past few days. It wasn't too long ago that interest rates were negative.

A Long Term LookI recently came across a spreadsheet showing what happened to a family member’s investment account over the past 28 years, from 1992 to 2021. The data included year-end account values, equity weighting and distributions; this account paid out the income from dividends and interest each year. Nothing was added to the account.

It is a fascinating document because it is real information. It isn’t a slick production from Merrill Lynch or Vanguard. It is just the actual results showing what happened to a small investment that was largely left alone for a long time.

The account was primarily invested in individual large-cap stocks. Not much happened; there was no effort to time the market or catch the next high-flying growth stock. The average equity weighting was 89.4%, with a high of 98.5% and a low of 86.0%.

The account provides some useful perspective at this unsettled time.

The ResultsHow did the account do? The overall results were amazing.

I won’t post the actual account values; let’s just adjust the starting value to $1,000. On 12/31/2021, the account was worth $6,128, which is an increase of more than 6x over the period.

Perhaps more impressive, the income distributions over that period totaled $1,100. Combined, the $1,000 investment turned into $7,228.

A Rocky RoadIt was not a story of steady growth. The account value declined in eight of the years, so 29% of the time. The biggest decline was a 31.9% fall in 2008. The more discouraging stretch was 2000-2002 when the account value fell three years in a row, down 0.9%, then 12.4%, then 17.3%. That must have been a grim phase.

The account hit a high mark in 2007 before getting clobbered in 2008. It didn’t get back to that level until the end of 2013.

Still, despite all the ups and downs, the account value increased an average of 7.8% per year.

ImplicationsThere are a few things we can learn from this account that can help us navigate these volatile days.

Buckle Up

If you want consistent returns, you shouldn’t be investing in stocks. Based on this account, you could say there is almost a 30% chance that you will lose money in any given year.

Turbulence is a necessary part of the stock market. If stocks always grew, then people would bid them up to crazy levels. The bumps create the returns. People are nervous about buying stocks and that makes prices reasonable and returns positive.

Have a Long-Term Horizon

If you need a pool of money anytime in the next few years, you shouldn’t put it in stocks. If you are getting ready to buy a house or pay college tuition, take those funds off the table.

Remember that 2008 decline of 31.9%. If you were planning to use that money to buy a house, well, you would find yourself looking for smaller homes.

For stock investments, think 10 years or more.

Get Some Dividends

Income is a beautiful thing. A small stream of dividends adds up over time. You might think a dividend yield of 2.3% is meaningless. Over 20 years that will turn into notable money.

Dividend stocks provide a level of stability that will help any account over the long-term.

Now WhatWe are heading for a notable year: stocks may well finish down 25%. This could be worse than 2008.

I suspect 2023 will be bad, too. When CDs start paying 5%, putting money in the stock market seems less appealing. Why go for a 2% dividend and a falling stock price? Just take the easy 5%!

But in 5 years, I believe stocks will have rebounded. Will they have reached new highs? I’m skeptical; I don’t think we will see negative interest rates anytime soon to propel equity valuations. But I’m very confident stocks will be generally moving up from the lows.

So, if you have investments that you don’t need right now, just ignore the news. Don’t open your statements. Keep investing a little if you have some extra cash.

If it really makes you ill to buy stocks, then it is probably the right moment to do just that.

The post Investing in a Tumultous World appeared first on STRONGBRANDS.

September 16, 2022

Branding Lessons from Queen Elizabeth

The world this week is mourning the death of Queen Elizabeth. People are piling flowers at Buckingham Palace and lining up for miles to view the casket.

There is much to be learned from the queen’s long and eventful reign. I will leave it to others to address questions of politics and the monarchy. Instead, I would like to consider what we can learn from the queen about building a brand.

I think there are five things.

1. Branding MattersMost people wouldn’t call Queen Elizabeth a brand manager, but she was that, and she seemed to relish the job. She was keenly aware of the importance and significance building and maintaining her brand, and the brand of the British monarchy more broadly.

Like all great brand managers, she carefully considered what to do. Here are some words that you won’t hear as people describe her style: impulsive, free-spirited, unexpected.

On the contrary, the queen understood that brands matter, and a brand manager’s role is to thoughtfully consider the optimal brand building moves.

2. Consistency is EverythingGreat brands are consistent. Brand associations form over time with repetition. That was a hallmark of the queen’s approach to branding. She was always the same. She looked the same, she acted the same.

One would never ask, “I wonder which queen will show up today? The grumpy one or the funny one?" No. The queen was the queen.

Variety is the spice of life, they say, but not when it comes to branding. The strongest brands show up day after day. Nike, Coke, Apple, Patagonia, Emirates: all of these have a remarkable sameness.

The queen was consistent even in her choice of dogs. She got her first corgi at 18 and had them throughout her life. She missed out on the joys of having a Havanese, but she was, as always, consistent.

3. Sometimes It Is Best to Say NothingThe most remarkable thing about the queen’s approach to the issues of the day is that she said nothing. How did the queen feel about the abortion debate? She never said. How about gun control? The price of pharmaceuticals? The treatment of pigs in factory farms? Prospects for the Buffalo Bills this year? The queen’s approach to controversial issues was simple: don’t say anything at all.

There is merit to this approach; if a controversial issue isn’t core to your brand’s purpose, then perhaps the best move is to stay silent. Should John Deere jump into the abortion debate? Probably not.

Now I suspect that in private the queen expressed more opinions. Over breakfast at Buckingham Palace, I imagine there were lively discussions about the affairs of the day. But the queen was careful not to voice these views in public.

4. Everything CommunicatesWhat builds a brand? Everything. Each sense has an impact on branding: sights, sounds, smells, tastes, touches.

Queen Elizabeth knew this and used everything to shape her brand. Every item she wore and everything she did created and reinforced her image. She favored bright colors, hats and small handbags. She said at point, “I can never wear beige because nobody will know who I am.” Vanessa Friedman wrote in the NYT this week, “She was so ubiquitous a pop culture presence that she was identifiable simply by her outline, the queen, a tiny woman in a hat with a handbag hanging off the crook of her arm, could be identified from her silhouette alone.”

She was particularly careful with visuals. As media outlets share photos of the queen taken over the course of her long reign, it is remarkable how almost each one reinforced positive brand perceptions. How many photos have you seen of the queen frolicking at the beach? The queen running? The queen with a spaghetti stain on her blouse? The queen exuberantly hugging someone?

5. Be PositiveThe queen was relentlessly positive. Her infrequent addresses had a hopeful note. Even when she addressed the nation in the difficult days of COVID, her message carried a positive spirit, “While we may have more still to endure, better days will return. We will be with our friends again. We will be with our families again. We will meet again.”

This is an important branding lesson. People like positivity. If your message is positive, then people will embrace you. It was one of the points I made last week in my talk to new Kellogg MBA students about branding.

The queen was positive in public. Behind the scenes? That might have been a completely different matter. She might have criticized Boris Johnson for drinking at a Downing Street party during COVID. She could have said, “A party in the middle of COVID, Boris? Have you lost your mind?” She might have even had some pointed words for Charles along the way. But these negative thoughts never made it out of the house.

The post Branding Lessons from Queen Elizabeth appeared first on STRONGBRANDS.

September 1, 2022

Advice for New MBAs: Build Your Personal Brand

This week I had the opportunity to speak to the incoming class of Kellogg MBAs about personal branding. It was a fun event; there is nothing like seeing 600+ young people embarking on a new life adventure.

I highlighted three things in my talk.

Your Personal Brand MattersBrands are the associations linked to a name, mark, or symbol. A brand is everything that pops into your head when you see something familiar. Brands are powerful in many ways, but the most important dynamic is that brands shape our perceptions. A brand with positive associations adds value. Put the name Tiffany on a necklace and it is transformed. Add the Patek brand to a nice watch and it becomes an heirloom to pass down through the generations.

People are brands, too, and these associations are just as powerful. Someone with a great brand at a company, a great reputation, will benefit. They will get the best projects, opportunities to shine. They will get the promotions and big bonuses. When they make a mistake, people will forgive them, if anyone finds the mistake at all.

People with negative associations have a different experience. They don’t get the great opportunities. People scrutinize their work, and then find mistakes. It all becomes reinforcing. It can be impossible to break out of a negative brand cycle.

You Have a Blank PageNew MBA students are in a remarkable position; they have few associations. They start at Kellogg as a brand with low awareness and low meaning.

Over time – and more quickly than you might think or wish – they will create brand associations.

During the summer internship, they will have another opportunity, and then when they start as a full-time employee there is yet another fresh start.

So, it is a time of branding opportunity.

If you can create any sort of personal brand, what might that be?

Four ThingsFor new students, it is important to be thoughtful about branding. I suggested they do four things.

-Show Up for the Academics

Kellogg is a learning institution. Everyone is trying to learn and grow. So, prioritizing the academics will enhance your brand. If you prepare for class, participate in a positive way, and bring enthusiasm to your teams you will learn a lot but also enhance your brand with your colleagues.

-Focus

It is easy to get distracted and unfocused at a place like Kellogg. There are so many fascinating clubs and activities, an enthusiastic student will soon find themselves spread thin. FOMO, the fear of missing out, leads people to take on far too much. This doesn’t lead to a great brand.

I recommend people push back on this and focus on a few important things, and then do those things exceptionally well. It is a bit like Stephen Covey’s rocks and sand. Figure out your priorities, your rocks, and focus on them first. Then let the other things, the other activities, the sand, fill the available space.

-Be Thoughtful

Everything we do and say contributes to our brand. It is important to be thoughtful. What you say, what you do, what you wear: all these things have an impact.

Authenticity is important; you want to act in a way that reflects your background and your values. Inauthenticity does not lead to great branding.

At the same time, you want to highlight the positive parts of your brand. I believe we all have two sides: our best selves, and our messy, stressed selves. When you build your brand, you want to focus on the positives. I interviewed a nice fellow for a job back when I was at Kraft. During the conversation they volunteered that the really weren’t very good with numbers. This was an authentic and honest answer. It also didn’t enhance their brand or lead to a job offer.

Social media is a particularly delicate area. My advice: be thoughtful and careful when posting.

-Keep It Positive

Negativity doesn’t lead to great branding, so be positive. It is so tempting to talk about the problems and the issues. The coffee was cold. It is raining. The presentation ran long. Talking about these things doesn’t reflect well on your brand.

A good piece of branding advice: if you say positive things, you enhance your brand. When I say that Birju Shah is a fabulous instructor and I am delighted that he has joined the ranks of Kellogg's marketing clinical professors (congratulations, by the way) I enhance his brand and my brand at the same time.

Here’s wishing the new students a terrific experience at Kellogg!

The post Advice for New MBAs: Build Your Personal Brand appeared first on STRONGBRANDS.