Michael C. Taylor's Blog, page 8

August 16, 2021

The NFT Revolution

NOTE: This one ran in the San Antonio Express News back in May 2021, and its being posted a bit late. 1

San Antonio-based graphic and web designer Ron Garcia works at the intersection of technology and art. On May 8th he and his fellow members of RePublic Arts Collaborative will host a gathering “The Revolution Will Be Digitized,” in a near-downtown studio, featuring physical art as well as digital art at auction in the form of NFTs.

Non-fungible tokens (NFTs), as you may know, are THE art trend of 2021. Collectors can purchase individual copies of digital art, verified and authenticated with their NFT certifying ownership. If the NFT-linked art ever changes hands between collectors, that will be tracked, and artists can collect a commission on the sale.

Warning, a brief word salad ahead:

Garcia’s preparation for the show includes teaching artists how to upload the digital files of their work to the Ethereum blockchain. He also coaches them on how to create a digital wallet, linking their regular bank accounts to Coinbase, which serves as a place to store cryptocurrency. As part of the link of art pieces to an NFT, artists will need to pay the “gas fee” needed to mine a unique Ethereum coin that will serve as the NFT.

Are you with me so far? Not really? I’ll spend the rest of this space unpacking that word salad above.

Blockchain is the term for distributed computer networks that create a permanent database (like a fancy spreadsheet!) that allows anonymous participants to verify storage of data and transactions without any central authority. The point of linking an NFT to digital art is to offer a permanent certificate of authenticity as well as a way of tracking the art’s authorship and the collector’s ownership.

NBA TopShots kicked off the mainstream NFT market

NBA TopShots kicked off the mainstream NFT marketGarcia purchased an early NFT released by the National Basketball Association, which pioneered the issuance of blockchain collectibles with something called NBA Topshots. NBA Topshots are digital video clips with stats – basically like online playing cards – first released in October 2020. Garcia bought one for $14 and later reports flipping it for $1,000. That experience opened his eyes to the possibility of NFTs for artists. Why couldn’t his fellow artists participate in and benefit from this emerging technology?

Garcia – like others attracted to the NFT market – foresee the increasing importance of the Metaverse, a virtual reality that exists either apart from or alongside physical reality. In the Metaverse, humans will need to populate their living areas with video or static digital art. When you observe young humans like my teen and pre-teen constantly interacting with their friends via screens, I think the Metaverse is not far away. It’s actually kind of here already.

“Society is changing to a whole new form,” says Garcia. “All these different things are happening. I saw that NFTs are part of that whole turning. We’re going from the physical space to the virtual space,” he continued.

Digital art NFTs use the blockchain associated with the cryptocurrency Ethereum, making that preferred medium of exchange for art-linked NFTs. The Ethereum blockchain works similarly to, but does not interact directly with, the better-known Bitcoin blockchain.

Coinbase is a company that facilitates blockchain transactions, charging fees for services like offering a digital cryptocurrency “wallet” to individuals. Coinbase Global Inc went public on the NASDAQ stock exchange with a direct listing in mid-April.

With a market capitalization above $60 billion, Coinbase is evidence that some investors believe in the staying power of blockchain transactions, as well as the fees that Coinbase can charge cryptocurrency participants.

Garcia views the fees from Coinbase as high, but hopefully someday soon will come down through competition.

Let’s now review the good, the weird, and the bad of NFTs.

The unquestionably good: Artists who work in digital media – including video and music – have a new tool for creating and selling limited-quantity or individual pieces that collectors can own.

When Napster made music incredibly easy to reproduce and pirate illegally around the year 2000, musicians lost their ability to earn music royalties. Music streaming services have since gone a long way to solving that problem.

NFTs may, analogously, allow artists to earn money through the sale of their work that otherwise might be infinitely reproducible and pirate-able. Earning additional commissions each time a piece of art changes hands has so far been generally impossible with physical art. So NFTs are maybe a helpful leap forward for digital artists.

As a technology, NFTs represent the first blockchain application that I think solves a real problem – specifically, the problem of verification and authentication of art and ongoing payments to artists.

Here are as couple of weird NFT outliers that happened in March 2021, as these things exploded in popularity.

So damned meta

So damned metaNew York Times business columnist Kevin Roose arranged the NFT auction of a digital image of his printed newspaper column about NFTs, which sold for the equivalent of $560,000.

The big weird one, the one that conferred global art legitimacy on NFTs, was from Beeple.

A digital artist named yes, Beeple, sold an NFT via auction house Christy’s a digital montage of his images named “Everydays: The First 5,000 Days,” for $69 million.

As a result of these outliers, and as a responsible finance guy, I feel obligated to attach a warning sticker on this new thing. NFT art is not worse than signed baseballs or rare stamps or first edition books. It’s not even necessarily worse than paying $100 million for a physical Van Gogh or Picasso, if that’s the scale you operate at, financially.

Beeple’s Everydays

Beeple’s EverydaysBut they are also not suitable as investments.

As art? Sure. As a neat technology? Definitely. As an expression of your values? Very cool, I love it. But only burn money on this that you would otherwise dedicate to collecting for non-financial reasons, please. Please don’t dedicate your money to this in the hopes of a quick flip. Turning $14 into $1000 quickly on an NFT flip, as Garcia did, should not be your financial expectation.

The emergence of NFTs this year exposes the different fundamental worldviews of different types of people. Technologists, of course, will embrace NFTs, for their clever deployment of blockchain to solve a problem. Artists, unquestionably, should welcome the emergence and adoption of NFTs.

“A lot of artists are afraid of technology. It goes against their artistic sentiment somehow,” adds Garcia. “On the local front that’s the biggest contribution I can make.”

Financial types – and I’m mostly in this camp – view NFTs with a combination of awe, worry, and shadenfreud-ish skepticism.

Of course as a business columnist I also cannot help but slow clap, nodding sagely in approval that someone somewhere would spend over $500,000 for a digital copy of a newspaper business column. I am absolutely on board with any reader of this column, for example, looking to create a collector’s item of my own work. Heck – you could even buy this from me at half price. Let’s say $250,000 as a starting amount, just to be fair all around. Hit me up, let’s collaborate.

Post read (3) times.

Since NFTs could very well disappear forever as a thing in the next month, or they could become the most important invention since sliced bread, I figured I should post it before people entirely forgot how crazy NFTs seemed in the Spring of 2021 ↩The post The NFT Revolution appeared first on Bankers Anonymous.

March 18, 2021

Me Hosting Local PBS-affiliate News Show

It’s been about 32 years since I hosted a TV news show…to be specific it was my high school weekly, called “Perspective.” Anyway…I guest hosted the PBS affiliate in San Antonio weekly show “On The Record.” Why not? It was fun for me. If you’re not a local San Antonio politics nerd, you may not find it as fun as I did.

And they do a Soundcloud version of the show, if you prefer your television as audio only for some reason.

On the Record, Michael Taylor as Guest Host

On the Record, Michael Taylor as Guest HostPost read (6) times.

The post Me Hosting Local PBS-affiliate News Show appeared first on Bankers Anonymous.

March 17, 2021

Pi Day Kickstarter

I’d like to wish all of you math nerds reading this on or around March 14 a “Happy Pi Day.”

Since 2010, my family has celebrated the 3.14 calendar date by hosting a neighborhood pie-eating blowout in my backyard.1

Pi Day also reminds me of the one and only time I participated in a Kickstarter campaign. Back in 2013, via Kickstarter, I pledged $15 in advance to a complete stranger on the internet who promised to manufacture metallic baking pans in the shape of the Pi symbol. Obviously I had to have one. A few months later, he delivered. I’ve been the happiest Pi Day nerd in the world ever since.

Kickstarter, originally launched in April 2009 – in the depths of the Great Recession – offered an entirely new way to fund creative ideas. “Kickstarter” quickly became a brand that sounds less like a company and more like a whole category of how to do things, kind of like Kleenex and Zipper started as brands but then just became the word for a thing that we all need.

But the company is real, not just a word. Kate Bernyk, Senior Director of Communications, says they have been profitable since the beginning, and currently count 90 employees.

The largest category of Kickstarter projects are games, followed by art, design, film, music, fashion, and comics. The typical person who raises money on Kickstarter is an artist, a musician, a builder/designer, or an author – someone who has something new and experimental to try, but not the funding to make it happen right now.

Kickstarter specifically does not allow backers to fund traditional businesses through a loan or ownership in a business.There are other online funding platforms for that. But many businesses use Kickstarter to experiment with new project ideas and new product lines.

Austin-based camping equipment marker Kammok launches product designs on Kickstarter, with nine successfully-funded products, from a 2-person tent to a hammock tent, to sleeping bags and quilts.

Necessity as the mother of invention led to a new use for Kickstarter in the past year. Bars turned to Kickstarter to market private-venue rental events, or to fund the creation of branded swag to keep the lights on, or to provide specific musical rewards for customers. The COVID-era version of projects on Kickstarter became known at the company as “LightsOn,” because that’s what businesses needed to do by necessity this past year.

Kickstarter does not do fundraising for purely philanthropic projects. There are other online funding platforms for that as well. And yet, a clear social-mission orientation drives a huge number of projects on the platform. Bernyk pointed me proudly to the company’s corporate charter as a Public Benefit Corporation. This is a state designation that I’d never heard of before, but indicates a kind of additional bottom-line beyond profit, to include social values, support for artists, transparency, and other “Don’t Be Evil”-type company practices.

That is not to say that people and businesses can’t make money with Kickstarter. I contacted the producer of the Pi Pan from 2013, not realizing originally that he’s actually from my hometown, San Antonio. Garrett Heath says he and his partners made money from Pi Pans. And, they continue to sell Pi Pans on Amazon, which he says provides him with a small but welcome income every year. He’s very enthusiastic about Kickstarter’s role in helping them fund a manufacturing mold and original large purchase order that otherwise they could not have funded.

Kickstarter charges 5 percent of the money raised by each project. That is, according to Bernyk, their entire revenue stream. They update their daily stats on their website, which include $5.08 billion raised in total, over 197,579 projects, and a 38.5 percent success rate on projects launched.

Since 2012, the company has successfully facilitated funding for between 18,000 and 22,000 projects per year. 524 projects have raised over a million dollars, including some high profile movies and documentaries.

The Hog Book: A Chef’s Guide to Hunting, Preparing and Cooking Wild Pigs got funded recently for a $45 pledge. It is scheduled for delivery in April 2021. The Hog Book is also a project coming out of Texas, because duh, obviously. I assume you’re going to want to order that book for Texas Hog Day, which happens in April every year?[2. Ok, I just made that last holiday up.[

Every Texan needs this book, obvs.

Every Texan needs this book, obvs.The defining characteristic of a Kickstarter project is that it’s a time-limited “project,” with a clear beginning, middle, and end.

Kickstarter’s success supports one of my counterintuitive but strongly held beliefs about money, namely: there is always more money available than there are good ideas to fund. Wealthy philanthropists know this. Venture capitalists and angel investors know this. They always suffer from too much money and too few good ideas to fund.

Now, I will admit, regular people mostly walk around with a scarcity mindset. I mean the “I wish I had more money,” mindset. Whenever I have a brilliant idea, my next follow-up idea is “Well, but where would I get the money for that?”

But see, that should not limit creative people. Since 2009 with Kickstarter, the money part has largely been taken care of, at least for certain types of creative projects.

For Heath, he’s pleased with the realization of his brilliant idea, made possible by Kickstarter. “It was a great experience. It opened up the doors to make something cool, and something relatable that people love. Those Pi Pie pans will be around for an irrationally long time.”

I see what he did there. Heath is officially invited to my next Pi Day Party, March 14, 2022. As are all of you. Entry fee: Bring a pie for every 3.14 guests. Extra props if you bake the pie in a pi-shaped pie pan.

A version of this post ran in the San Antonio Express News.

Post read (9) times.

Sadly, no pi party was held this year. #ThanksCOVID. ↩The post Pi Day Kickstarter appeared first on Bankers Anonymous.

March 12, 2021

Green Sustainable Organic Waste Business

The camera zooms on a young Dustin Hoffman-looking character receiving career advice from an older man about where “there’s a great future.” An avuncular hand thrown over his shoulder.

“I’ve got two words for you, kid. Are you listening?”

The confidential tone, poolside setting, sotto voce.

“Organic. Waste. There’s a great future in organic waste. Think about it.”

Palm raises. Index finger extends. “Will you think about it? Shh. Enough said.”

End scene.

Anyway, that’s a sneak peak at the draft of my new screenplay for the remake of “The Graduate, 2021.”

Everyone from households, food processors, restaurants, and even sewage processors want to pay to have their organic waste taken away on a daily or weekly basis. If you can get paid to remove that organic waste and turn it into useful saleable products – like mulch, ground-cover, feedstock, and enriched soil – you might have yourself an interesting business. Increasingly, corporations and governments are looking for providers who can do just that.

In January 2021, Denali Water Solutions LLC – a national organic waste processor – purchased New Earth, a division of San Antonio-based Leonard Holdings. Until December 2020, New Earth held the contract for processing household organic waste for the City of San Antonio.

New Earth, with locations in Katy, TX, Conroe, TX, and San Antonio, TX was the largest privately held organic waste and compost processor in the state. Denali needed to enter the Texas market and approached New Earth

Denali, owned by private equity giant TPG, is in acquisition mode.

Indicative of how Leonard Holdings, headed by third-generation CEO Neal Leonard, views the opportunity of organic waste, is how they decided to sell. They took most of the company’s sale proceeds in the form of a 7 percent stake in Denali.

“We went from 100 percent ownership of three processing locations in Texas to a 7 percent ownership in Denali’s 24 locations around the nation,” Leonard told me. Leonard essentially made a bet that organic waste is a growth business.

CEO Loenard said, “This transaction allows New Earth to achieve the scale and diversification necessary to continue as a pioneer of organics recycling. Our family is very excited to remain an investor going forward, in what we expect will be the national leader of organics recycling.”

Indeed, between our conversation and this writing, Denali acquired yet another company in mid-February 2021, Organix Recycling, described as “the largest pre-consumer food waste collector and recycler in the United States.”

With that transaction completed, Denali will have 1,400 employees in a vertically-integrated organic waste business.

Personally, I’ve been a bit obsessed with household organic recycling since receiving my green curbside bin from my city in 2016. In 2017 I visited the heaping, steaming mounds at the New Earth facility.

But that represents the large-scale opportunity of organic waste in 2021. My obsession recently brought me to a tinier-scale organic waste service company.

For Christmas this year my family bought me a monthly subscription to Compost Queens, a residential compost service. For $10 per month,1 I collect our kitchen’s food scraps into a sealable bucket and sprinkle them regularly with brown magic pixie dust. The dust begins the fermentation process and prevents odors. The magic pixie dust provided by Compost Queens is actually called “bokashi flakes,” and is a Japanese organic recycling process that introduces bacteria and fungi to catalyze the breakdown of food waste anaerobically.

After my bucket fills, I drop it off at a nearby convenience store. Then I collect a clean empty bucket. Whenever I run out of bokashi flakes, I pick up a fresh jar of the magic dust at the same store. It’s all included as part of my subscription plan.

The household bucket of Compost Queens

The household bucket of Compost QueensI still use my large green city-provided bin, primarily for yard clippings. The Compost Queens service has a few advantages over the green bin, however, that make it worth paying extra for. The first is smell, eliminated by the bokashi flakes. The second is ants, which really, really, like my green bin when it’s warm outside. The sealable lid and the fact that I store it on my screen porch keeps away critters.

Kate Jaceldo, the younger “Queen” of the mother-daughter founding duo, described to me their last four years of growth as well as their future plans. They grew from 60 residential subscribers in 2018, to 150 in 2019, to 300 now, in early 2021. Restaurant customers like Magnolia Pancake House (3 locations), Snooze (3 locations), and Pharm Table depend on Compost Queens to arrange commercial pickup in a truck. Compost Queens financed the truck purchase for commercial pickups by raising $13,000 through a 2019 Kickstarter campaign.

New Earth processes an average of 400,000 tons of organic waste each year, which translates to roughly 7,700 tons per week. Compost Queens handles less than one one-thousandth of that volume, collecting an estimated 7 tons of waste per week, according to Jaceldo. New Earth manages three facilities over 250 acres in Texas, while Compost Queens handles most of their compost production on a half-acre in partnership with Talking Tree Farm in Schertz, TX.

Still, Jaceldo sees potential for growth in her little business, just like Leonard of New Earth. She expects they will get to a sustainable financial scale on a subscription basis at 400 residential households, enough to pay her part-time workers a living wage. They target 1,000 residential subscribers in three years. Apartment dwellers and those outside city limits are a natural market for Compost Queens. Even city homeowners with the green bin, like myself, have found the service useful as well.

Compost Queens began selling its bags of processed “finished soil” for gardeners in December, as well as bags of bokashi flakes for households who plan to retain and create their own compost. Those sales, plus services such as delivery of soil enrichment for gardens and farms, are part of their ongoing mission around improving the local food cycle.

Will you think about it?

Will you think about it?Similar to many startups, Jaceldo describes the chicken-or-egg problem of scaling up to meet her commercial customer base, while enduring longish sales cycles. COVID disrupted their growth plans, as many businesses retrenched last year.

I define “green” and “sustainable” businesses as ones that are profitable, that can last and grow through the business cycle. New Earth got there. Compost Queens hopes to get there by year end.

At the high-end industrial end of the market, the Leonard family has shown the serious scale involved in organic waste. At the hyper-local end, I’m enjoying my own small contribution to a sustainable food cycle, with my family’s $10 per month subscription.

“Organic waste. Will you think about it? Shh. Enough said.”

Please see related posts:

On New Earth and organic recycling

On Recycling as a Commodities Business (Post 1 of 4!)

Post read (0) times.

The price went up to $15 per month a week after I wrote this! ↩The post Green Sustainable Organic Waste Business appeared first on Bankers Anonymous.

March 8, 2021

Backed The Wrong SPAC

Nominations are still open for the craziest frothy finance stories of 2021. Strong cases can be made (and I have made them!) for bitcoin and RedditBro GameStop short-squeezes. But maybe the uber example of frothy finances this year are SPACs.

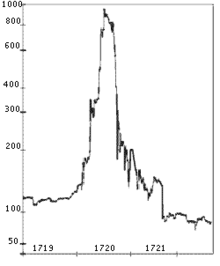

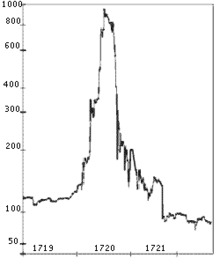

Picture of South Sea Bubble or really any SPAC you’d like it to be

Picture of South Sea Bubble or really any SPAC you’d like it to beSpecial Purpose Acquisition Companies (SPACs) existed before this current era, but really on the fringy margins of Wall Street. Now they are front and center.

SPACs are known as “blank-check” companies. You buy shares in a company that is just an empty shell. The shell sells 100 million shares for, say $10, raising a billion dollars. In the future – specifically, typically by next year – the managers of the SPAC promise to purchase a private company. At that point you find out what you, the shareholder, own!

Now, owning shares in a pile of cash worth approximately the pile of cash is ok, I guess.

You’re really trusting in the SPAC management’s private-company-purchasing skill. For that reason, SPAC managers like to put famous people on their team to build this trust. Former House Speaker Paul Ryan recently joined the management team of a SPAC run by Mitt Romney’s son. I have strong feelings about the trustworthiness of Paul Ryan, but that’s an earlier column.

Your favorite SPACbro, former House Speaker Paul Ryan

Your favorite SPACbro, former House Speaker Paul RyanThe weird thing that’s been happening sometimes lately is the fact that shares go up when they are just a pile of cash, without any company purchased yet. Sometimes they go up a little, which is ok if you really believe in the Paul Ryans of the world and their ability to buy undervalued private companies.

But sometimes they go up a lot. Which is nuts. A SPAC that just bought an electric vehicle startup Lucid Motors in mid-February – a company that incidentally has never delivered a single vehicle to a customer – briefly climbed from $10 a share to above $50 a share. The Venn diagram of overlapping investors who like speculative electric vehicle startups and blank check companies apparently produced this briefly delightful mad rush to own the SPAC at $50 per share, when the cash value of the empty shell was still $10 per share. (They should have put the name bitcoin in there somewhere so that shares would reach $90.)

For historians reviewing the South Sea Bubble era, a classic headslapper description of a proposed venture was that it was “an undertaking of great advantage, but nobody to know what it is.” Haha that’s always a great laugh for financial historians – and the description is possibly apocryphal – but it is also a true and precise definition of exactly what is a SPAC.

While SPACs are not entirely new, they are definitely the new new hotness on Wall Street this year. SPACInsider.com reports a total of 226 SPAC transactions in the eleven years between 2009 and 2019. It’s been a slow build, with the years 2016 to 2019 seeing upticks of 13, 34, 46, and 59 SPAC transactions per year, respectively.

In 2020, we saw 255 SPACs announced.

2021 is shaping up as the year of the SPAC, with 348 total announced in just the first two months of the year.

On February 26 2021, the final trading day of the month, 13 SPACs launched. That’s as many in one day last week as we saw in all of 2016. In 2021, everybody loves backing blank check companies, undertakings of great advantage but nobody to know what they are!

The interesting feature of the South Sea Bubbles of 1720 was that the English press of the time understood that many of the new speculative schemes were somewhere between frauds and lottery tickets. The investing crowd in its wisdom did not seem to care what the press thought. Can you blame them? There was too much money to be made.

From 2004 to 2007 a lot of smart guys enjoyed buying condos in Florida “on spec.” Not to live in, but to flip to another buyer. Sometimes these condos hadn’t even been built or finished yet, so a $25 thousand deposit got you the right to pay $400 thousand for the finished condo. But then those smart guys would flip their purchase option rights for $75 thousand and keep the quick profit because the end price of the unbuilt condo was upped to $450 thousand, and there was no need to wait for the condo to be built in order to cash in. Anyway, some people made money doing this for a while.

In the dotcom bubble of 2000 or the housing bubble of 2008 it is simply not true that people did not find the market ridiculous. On the contrary, people thought that Pets.com was stupid in 2000, as was flipping unbuilt Florida spec condos in early 2008. It doesn’t matter. Other people were making money on it. Up until the point when they didn’t make money anymore.

Now, some froth at the creative end of capitalism is arguably good. If we collectively torch $1 trillion in investment capital on electric vehicles but end up also igniting a technological revolution that slows climate change, that’s maybe fine, even if it is painful for the folks who backed the wrong SPAC. (Incidentally, “Backed The Wrong SPAC” is the title of the first poem in my new book of financial slam poetry/rap that I just started working on right now, today.)

The internet boom of 1999 and 2000 ended in tears for many, including backers of Pets.com and Webvan, but overall that episode of financial frothiness probably helped raise buckets of useful capital for scrappy startups like Amazon and Google.

The same capital obliterated by telecom failures WorldCom and Global Crossing may have helped spur a lot of excessive investment in fiber optic cable. That bandwidth is essential to watching the massive volume of cute cat videos on Reddit that we all now consume.

SPACs are ridiculous investments, but sometimes you have to wait and see whether some financial ridiculousness and tragedy for speculators ends up with a silver lining for the broader economy and society.

And by the way, please do not misinterpret me. Do I mean you should sell your stocks because everything is going to crash? Of course not, never sell. Take the multi-decade view.

But also, please, please don’t buy stupid things.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Bitcoin (hopefully for the last time)

Post read (5) times.

The post Backed The Wrong SPAC appeared first on Bankers Anonymous.

March 2, 2021

Your Bitcoin Warning

You’ve been writing me a lot lately, wondering about bitcoin. What is this technology? What is it used for? Should you get involved?

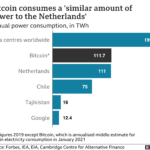

What is the right price for bitcoin? What are its uses?

What is the right price for bitcoin? What are its uses?But also, what is the right price for bitcoin? Is it a buy or a sell here? As of this writing, a bitcoin costs roughly $50,000, up from $10,000 a year ago. Could it go to $200,000? That’s only 200% up from now. It’s gone up 500% in the past year. So sure, why not? $200,000 sounds great.

That’s,,,not a prediction.

What do I think is the fundamental right price for bitcoin? I’d say, roughly, zero? I truly think zero is the fundamental correct price. But it could take a while to get there.

Now, blockchain – the innovative technology of which bitcoin is the best known example – may have real uses. I’m open to that idea. Blockchain allows for anonymous, distributed transactions which can be verified between parties that neither know nor trust each other. Theoretically, blockchain obviates the need for government regulation or third-party verification.

Applied to money, bitcoin – using blockchain technology – theoretically allows us to remove transactions from the purview or limitations of existing financial infrastructure.

Dollars, the theory goes, involve pesky government issuers, unreliable central banks, and the meddling institutions of the existing global finance system. To its proponents bitcoin – using blockchain technology – is like money unshackled by politics, regulators, and borders.

To be clear. I totally disagree with the need for unshackling. I think dollars are awesome. I even buy stuff and services with them! I’ve honestly never felt limited by dollars, except obviously by the amount of them that I control at any given time. By contrast, I believe bitcoins are – at their essence – useless. A useless fiction, and therefore a fraud. I prefer my fictions to be useful.

What is the real-world use of bitcoin? Bitcoin is not a useful store of value in the way that dollars are. Anything that can soar 500 percent in the past year – as Bitcoin has – can also drop 80 percent the following year. Or the following month. That makes it entirely inappropriate for “storing value.”

Could bitcoin be delightful as a pure gamble, like buying a lottery ticket? Sure. But no sensible person advocates lottery tickets as a store of value.

The South Sea Company was created by charter in 1711 with a mandate to engage in an implausible business, in a far off place, that none of its British investors had ever seen. It was just exotic and mysterious enough to capture the whiff and elan of possibly unlimited wealth. It enjoyed the imprimatur of the government of England, and for a time legitimately traded in English government bonds. Shares began at 100 British pounds, but reached 1,000 pounds a decade later. Fortunes were destroyed shortly thereafter, when the laws of financial gravity returned. We return to this cautionary financial story over and over because – while no two bubbles are alike – history does rhyme.

South Sea Stock (log scale)

South Sea Stock (log scale)Bitcoin has all the makings of collective financial madness. Magical thinking! A difficult-to-grasp mysterious technology! Breathless media coverage of its ever-increasing price! Celebrities who might be buying it!

Bitcoin’s only plausible real-world use cases – as a medium of exchange rather than a speculation – are tax evasion, foreign-exchange-control evasion, drug dealing, prostitution, child-pornography, assassinations, arms-dealing, illegal gambling, and ransomware for computer hackers. As I have yet to engage in any of these activities, I have yet to find an actual use for bitcoin in my own life. But your mileage may differ, no judgment.

Incidentally, bitcoin is probably not even anonymous. One of the features of the blockchain is that all transactions are infinitely traceable and reproducible. That’s the plausible key to blockchain technology’s usefulness in the future – that all transactions and counterparts create a permanent record, visible to all counterparts.

But that feature of permanence undermines anonymity. A blockchain-sophisticated FBI should be able to see exactly who sold you bitcoin, and who in turn you sold bitcoin to. Your drug deal or tax evasion with bitcoin was not as anonymous as you thought it was after all! Haven’t you ever watched movies? This is neither business nor legal advice, but do you know what is anonymous, instead? A suitcase full of unmarked, non-sequential dollar bills.

Should you take my word for it on bitcoin? I can only warn you about my similar strong feelings in the past and how that worked out.

In the one and only market call I have ever made in this space in 7.5 years, I said Tesla was a terrible stock in 2015.

It promptly quadrupled in value. So I reiterated my hatred for that stock’s price in early 2020.

My bold call clearly triggered the value of that stock to septuple over this past year. You’re welcome.

I just mention this to say, you should probably speculate in the opposite direction of whatever I advocate, including, especially, about things like bitcoin. Bitcoin is far, far, stupider than Tesla shares will ever be. Naturally, Tesla announced last month that it had speculated with its corporate cash by acquiring $1.5 billion in bitcoin. Because LOLs. And YOLO. And FOMO.

To be clear, I am *not* an investor, I am an engineer. I don’t even own any publicly traded stock besides Tesla.

— Elon Musk (@elonmusk) February 19, 2021

However, when fiat currency has negative real interest, only a fool wouldn’t look elsewhere.

Bitcoin is almost as bs as fiat money. The key word is “almost”.

Tesla CEO Elon Musk’s explanation for this speculation: “Bitcoin is almost as bs as fiat money. The key word is ‘almost’.”

[Ah, yes, such wisdom! What mysterious sagacity from 2021’s newest richest man in the world! Take all my money, please, you carnival-barking promoter of fictions!]

Bitcoin – Also not a very efficient use of power!

Bitcoin – Also not a very efficient use of power!Never underestimate the power of greed and magical thinking to keep things irrational longer than you can stay solvent. Welcome to the monkey house.

Cryptocurrency enthusiasts like to point out that traditional “fiat” money like dollars, unmoored from a metallic base like silver or gold, is based on a collective fiction. In that sense, would-be sophisticates (and Musk) argue, the collective fiction of bitcoin is no worse than dollars.

Rai Stones. Better than gold?

Rai Stones. Better than gold?Gold is also a collective fiction, albeit one a few thousand years old. Shells have made for a collective fiction in the past. The rai stones of Micronesia were a collective fiction. What even is money?

US dollars are also a collective fiction, except for the true fact that my government demands, and accepts, dollars for taxes. As far as I can tell, this is the basis for fundamental value in a currency. What my government accepts in taxes.

A convenient currency is more useful than barter. My local, state and federal governments do not currently accept extremely well-reasoned and delightfully funny finance writing as a means of discharging my tax obligations. I need to first convert finance columns to dollars, which my government then does accept.

When President Elon Musk declares in 2028 that we can and must make tax payments in bitcoin, then – and only then – will I agree that bitcoin has any fundamental value. It may well go to $200,000 (and beyond!) for all I know in the meantime. Unless and until Musk runs for President, I expect a zero value future for this particular collective fiction.

A version of this post ran in the San Antonio Express News.

Please see related posts:

Tesla is awful (January 2020 edition)

Tesla is not going to make it (2015 edition)

Hater’s Guide To Tesla (August 2020)

Bitcoin, Blockchain, and Bullocks

Post read (13) times.

The post Your Bitcoin Warning appeared first on Bankers Anonymous.

February 23, 2021

Ellavest – Roboadvisor for Women

Alma Aguilar, who works for a cloud-storage software firm in Austin, recently asked me what I thought about Ellavest. Aguilar had heard about the woman-oriented roboadvising software service after following founder Sallie Krawcheck’s short video offerings “Money in 60 Seconds.” Aguilar, married and the mother of a one year-old, wondered if she should branch out her investing activities beyond the 401(k) retirement plan she contributes to at work.

My confession to Aguilar: I’d never heard of it.

Ellavest has been growing and evolving since 2016. For those looking for an easy on-ramp to investing, my sense is this is worth checking out.

One of the clever features of roboadvising apps is that they enroll you in savings or investing right away from the initial interactions with the website or phone app. Like similar finance apps I use and recommend, such as Acorns, M1 Finance, and Qapital, Ellavest asked me for my name, zipcode, household income, and financial goals. Unlike those, Ellavest also asked about my gender and number of children.

Although Ellavest is targeted for women, the app allowed me to enroll online as a male.

As I type this, I imagine the Texas legislature is meeting to pass emergency laws to prevent me from entering a woman-oriented finance app as a male-bodied person. But that’s another story for another time.

Do women want, or need, an investment advisor targeted to them? I don’t know if most women do, but likely some will.

[image error]

Kathleen Burns Kingsbury, a Vermont-based consultant and wealth psychologist who literally wrote a book called How To Give Financial Advice To Women, is open to the idea that women approach their finances differently. She pointed me to research by Merrill Lynch, which found women nearly three times more likely than men to have had a negative gender stereotype experience with their financial advisor. The Merrill study also found that when a mixed-gender couple sits in front of an advisor, the man typically commands 60 percent of the advisor’s attention, compared to 40 percent for the woman.

As I enrolled, the Ellavest app asked about my financial goals, and also about what my biggest obstacles may be. The menu of choices include “navigate a career change,” “feel confident negotiating,” or “tackle imposter syndrome.” While these are universal human challenges, they also struck me as signals to women that the designers of this app understand their particular perspective.

Roboinvesting, by theory and design, means setting up an investment account that does not need to involve speaking to another human. Typically we interact with roboadvising software on our phones, with small initial dollar amounts, and receive simple investment plans automatically from a few data points about our goals, risk tolerance, income, time horizon, and life status.

I ascribe to the idea that – done correctly – the hardest part of investing is just getting started. For that reason alone, I am a proponent for setting up a simple plan with a roboadvisor, and then getting out of the way of our own tendency to mess with the plan. Ellavest appears solidly aligned with this goal and method.

What you should never do on your financial phone app – and I cannot emphasize this strongly enough – is daytrade Game Stop shares because anonymous poster u/FartStocks told you on a Reddit forum that you could stick it to some some imagined short-selling hedge fund. But I digress.

Ellavest’s stated goal of appealing to women as they ramp up investing seems laudable.

About her retirement programs at work, Aguilar told me “none of them have been easy to navigate or understand. Ellevest makes it easy and clear to get set up and start investing.”

Something about the educational content of Ellevest also appealed to her. As Aguilar told me “I quickly appreciated that the investment algorithm takes into account a woman’s issues such as the gender pay gap and longer life expectancy. They also do a great job at educating women about why it is important for them to take charge of their finances.”

Kingsbury pointed out that the right way to think about tailoring financial advice to women might be mis-stated. As Kingsbury says, “In the future, I think we will move to services that are more human-centric, rather than gendered.” Kingsbury noted that one person’s experience in the world may be quite different from someone else’s, so that a one-size fits all approach doesn’t work.

“That may be an argument for a woman-centered roboadvisor. It may also be an argument for a human investment advisor,” says Kingsbury.

In addition to clearly-stated and fixed monthly fees (which I like!) the Ellavest site offers coaching sessions, something that I happen to think is a highly useful financial service that most humans – however gendered – need.

The Ellavest signup presents plans for $1/month, $5/month, or $9/month with a heightened suite of services at the top price point. The $1/month cost is in line with other roboadvising services Once you’ve accumulated at least $1,000 or more, the fees become moderate. As with most investing costs, they come down as a % of assets as assets increase.

Also, given the gender pay gap, will the software would be content to receive on average 82 percent of what a male-oriented roboadvisor charges?

What? I’m just asking the question.

A version of this post ran in the San Antonio Express News.

Please see related posts on Roboadvisors:

About Qapital

About M1 Finance

About Acorns (This one is my favorite)

About Robinhood (This one is my least favorite)

Post read (3) times.

The post Ellavest – Roboadvisor for Women appeared first on Bankers Anonymous.

February 20, 2021

UGH – Robinhood is Not Your Friend

I didn’t want to do this. Talk about GameStop, Reddit, Stonks, short-squeezes, hedge funds and roaring kitties.

And yet, here we are.

GameStop Strip Mall Location

GameStop Strip Mall LocationI didn’t want to do this because part of what I hate about traditional financial journalism is that it focuses on the sensational and statistically improbable, such that the average reader may come away with a twisted sense of what is normal and probable. And therefore the average reader might set a course that is unwise, or cement beliefs that are untrue.

I didn’t want to do this, but then I kept reading the stories that celebrated all the sensational. I fielded questions like – “are short sellers bad? If not, please explain” and comments like “I bought GME, wish me luck.” So I can’t help myself.

My apologies for piling on.

Short-selling is not bad. Short-selling is a necessary market function. Institutional market makers, otherwise commonly known as brokers, go short in the ordinary course of their business to maintain orderly market flow. Other institutional investors have the ability to “go short,” by borrowing securities, selling them at today’s market price, and then hoping to buy them back at a lower price in the future. Sometimes this makes money, when the stock declines. Sometimes this loses money, when the stock price rises. There is no deeper moral meaning to this short selling activity.

Short-selling is part of the plumbing and wiring of financial markets. Short-selling is no more evil than copper wires are evil for lighting up your house. Should you, the non-licensed electrician, touch those copper wires? Hells NO! Step away from those wires. Do not short stocks yourself unless you want to get fried.

Institutional investors do sometimes short stocks. They also use borrowed money, engage in options strategies, and trade for short-term gains and losses. Retail investors should, probably, never do these things. I’m not saying it should be illegal for individuals to do this – we permit harmful vices all the time in a free society among consenting adults – but there should be warning labels and limits and deep discouragements and heavy taxes and all the speedbumps to prevent people from doing themselves much harm.

Robinhood app – I’m not a fan.

Robinhood app – I’m not a fan.Robinhood is a financial services app providing an easy-to-use onramp to retail investors. A seemingly-friendly accessible Main Street approach to Wall Street. It should be a morally neutral platform. Unfortunately, it appears to encourage all the worst investment behaviors that Main Street retail investors should not do. Behaviors like using leverage, options, trading individual stocks, short-termism. Robinhood is a menace because it’s going to cost people money, people who probably can’t afford to lose it. And lose they will.

Acorns, my favorite “democratizing investing” app

Acorns, my favorite “democratizing investing” appDespite the name, the Robinhood app does not favor the ‘everyman’ over the Wall Street sharps. On the contrary, to the extent it encourages leverage, options trading, individual stock trading and short-term trading, it will, over time, inevitably tend to transfer money away from the everyman toward Wall Street. All under the guise of “democratizing investing.” There are some great “democratizing investing” apps.1 Robinhood just is not one of them.

Reddit is cool. A couple of guys (I think they were mostly guys but on Reddit users can remain anonymous so permit me to just simplify genders here) found value in an unloved stock, GameStop. Many months ago. It was so unloved that many hedge funds had large short positions. In January, a mob of Redditors, and others, engaged in a buying frenzy, a storm-the-capitol type pile-on in that stock. It was as unwise, conspiratorially-fueled, and briefly successful as any shocking market move in recent memory.

To be clear, there is nothing new about a part of this. Attacking short-sellers and making them suffer is a time-honored blood sport among professional hedge fund investors.

What was new was Robinhood investors and Reddit Bros figured out a way to put on their viking caps, fur-trimmed coats and body armor to overwhelm the financial barricades to participate en masse, with the sheer weight of their bodies, (metaphorically, financially, speaking) causing mass hysteria in the stock.

This is unacceptable.

— Alexandria Ocasio-Cortez (@AOC) January 28, 2021

We now need to know more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit.

As a member of the Financial Services Cmte, I’d support a hearing if necessary. https://t.co/4Qyrolgzyt

Would-be populists, ranging from Senator Ted Cruz to Congresswoman Alexandria Ocasio-Cortez questioned attempts by regulators to slow down the GameStop frenzy. Their commentary was neither informed nor helpful.

We shouldn’t have one rule for rich hedge funds in Manhattan and a different set of rules for every other American.

— Ted Cruz (@tedcruz) February 1, 2021

For my full discussion about Robinhood and GameStop, click the link to watch the latest episode of #Verdict:https://t.co/y5hvvmCFei pic.twitter.com/3CLvDbWEbA

The slow downs, we now know, were designed not to quelch the mob nor to defend short-sellers, but to protect market makers – including especially Robinhood, from failing. They were the Capital Cops of this story trying to do their jobs. Nobody wins when they go down. Unless you are in favor of anarchy. Which I am not.

We also now know that much of the frenzy involved large institutional investors as well as the Reddit Robinhood and Reddit Bro crowd. The Wall Street Journal has reported on $700 million, $200 million, and $150 million gains by traditional hedge funds joining the pile-on in January. I just mention this because the simple David and Goliath story is always appealing in markets, but frequently wrong.

A few other thoughts. I recently argued that despite the fact that traditional inflation in the economy seems tame, that the run-up in real estate and stock markets generally should be understood as a specific form of inflation.

Protect yourself from the viking hats

Protect yourself from the viking hatsI cannot prove the following, but I believe it: The frenzy in GameStop, like the parallel ephemeral frenzies in stocks like Tesla and AMC, cryptocurrencies like Bitcoin and Dogecoin, and commodities like silver seem to share a mob-like desperate quality. My thesis – again just my belief – is that the easy monetary policy from the Federal Reserve (low interest rates, huge securities portfolio) has created an ocean of extra cash, sloshing around the capital markets. The excess liquidity sloshing around creates waves and then occasional rogue wave tsunamis. The appearance of these rogue waves in the markets are a kind of inflation.

They are dangerous and possibly destructive, but only if you put yourself in harm’s way. Stay inland, and defend your castle against the viking hats.

A version of this post ran in the San Antonio Express News.

Public Service Announcement: Please use better investing apps than Robinhood.

Like Acorns (my favorite)

or Like M1 Finance

or Like Qapital

Post read (6) times.

Specifically, I think Acorns is amazing and everyone should open an Acorns app right now ↩The post UGH – Robinhood is Not Your Friend appeared first on Bankers Anonymous.

February 15, 2021

Ask an Ex-Banker: How To Fight Upcoming Inflation?

A reader wrote me recently:

“Given the staggering debt of the United States and Congress’ seemingly laissez-faire attitude and impotence towards addressing it, I am starting to be concerned about the value of U.S. currency. Historically, wars and corrupt governments have led to hyperinflation in other countries where the costs of goods and services skyrocket. The likelihood of this happening in the U.S. may seem remote but it is not impossible. Are there ways for individuals to protect themselves from this?” — Dom D. From San Antonio

I really like this question. Dom recognizes our unprecedented current debt situation and the unfortunate parallels with other countries where hyperinflation followed. I have no idea what’s going to happen.

If it’s comforting, hyperinflation would require a failure by the Federal Reserve to do its job. The Fed withstood the last few years better than most institutions. But, yeah, increased inflation seems increasingly likely for the reasons Dom named. So what to do?

The Fed has to fail for hyperinflation to happen

The Fed has to fail for hyperinflation to happenSomething to remember about inflation is that if the underlying economy is unchanged but the amount of available currency doubles, it is reasonable to assume that the price of things approximately doubles. This is bad when we have to pay for things. It is not necessarily bad if the price doubles of things that we already own. Things that you could own, which should double in price if the supply of money doubles, include real estate and stocks. As a result, these make for very good inflation hedges.

So the first great way to hedge against inflation is to own a business, or preferably many businesses. Some insist on the hard way to do this.1 I would like to focus everyone’s attention on the lazy way – my preferred way – which is to own hundreds or even thousands of businesses through a single low-cost diversified stock mutual fund. In an inflationary environment, successful businesses raise prices in response to their higher costs. Successful businesses adjust dynamically to earn profits despite inflation.

Similarly it is reasonable to expect – all else being equal – that a stock worth $100 today will be worth $200 tomorrow, if the amount of currency doubles overnight. One explanation for the record rise of the stock market in the last few months – the one I find most plausible – is that the Fed has dramatically increased the supply of currency in the economy. The record stock market rise is probably a specific form of inflation hitting one very visible corner of the overall economy.

The second great hedge against inflation is to own real estate in advance of inflation. For starters, try to own your home. And then live in it for a long time. The price of your home should appreciate roughly at the rate of inflation. That’s the definition of a good hedge. Let’s say, for example, you own a home today worth $250,000. And then we suffer a patch of 10% annual inflation for ten years. Your house at the end of 10 years will be worth a little over 648 thousand dollars. Compound interest math uses the same formula as inflation math.

Homeownership is good

Homeownership is goodNow, here’s an even more interesting twist on inflation hedging via home ownership. The triple lindy inflation hedge, if you will. Are you ready for it?

Do you have a long-term fixed-rate (let’s say, 30-year) mortgage on your house?

Ta da! You did it. You are amazing. Have you ever thought about being a hedge fund manager?

Here’s why this is an amazing inflation-hedging tool. Using the previous example, as your home value leaps upward over 10 years of 10% annual inflation from $250K to $648K, your 30-year fixed rate mortgage decreases dramatically, both in nominal and real terms. Using a standard 30 year amortization schedule, your mortgage would pay down from $200K to $162K during the first ten years. At the end of ten years, a $162K amount of debt on a house worth $648K is actually pretty easy to handle. You moved from owning $50K in home equity to $486K in home equity, nearly a ten-times increase.

Also, just as money isn’t worth as much following inflation, debts are also not worth as much in an inflationary future, so $162K in debt is not as big a deal in that future as it would be today. In other words, being a borrower during an inflationary period is actually a powerful inflation hedge. (Provided, of course, your debt has a fixed rather than variable interest rate.)

By owning your home with a mortgage, you’re a fancy inflation hedger, and you didn’t even know it.

Next, what should you specifically not do if you anticipate future bouts of inflation?

Do not buy fixed income products for any investment purposes. Traditional fixed income investment products include bonds, bond funds, annuities, and CDs. Inflation absolutely wrecks the value of these fixed income investments. Even money market funds, savings accounts, and cash could be considered fixed income, just with an extremely short (same day) maturity date. If your net worth or income is in any of these fixed income products, inflation will unfortunately destroy your wealth.

Not an inflation hedge I endorse!

Not an inflation hedge I endorse!Next, do not buy gold as an inflation hedge. Gold is a pretty but useless metal sold by preying on the fears of unsophisticated financial minds. I understand you don’t believe me, because of all those plausible sales pitches on your video screens, but it’s true.

Also, do not buy bitcoin as an inflation hedge. Bitcoin is a fake currency, neither useful for buying beer nor paying taxes. It has no legal use case and produces no wealth, except for people hyping you to buy it, based on the greater fool theory of speculation.

In sum, own your own home, own some businesses either directly or through the stock market, and if you must borrow, then borrow at a fixed interest rate. Avoid the standard inflation-hedge scams.

Avoid Bitcoin

Avoid BitcoinWhat I really like about the previous two sentences is that in anticipation of heavy inflation – and I can not emphasize this strongly enough – you should pursue the exact same investment actions I would advise to anyone who is not anticipating a future bout of heavy inflation.

Did you catch that? It’s important. Do exactly the same prudent things you should always do.

Finally, is Dom’s scenario likely to come to pass? I don’t know. Neither does anyone. Pundits who predict the economic future with certainty are fools or confidence men to be deeply distrusted.

I have personally (but silently) expected significant inflation since aggressive interest rate drops in September 2001. I’ve been wrong every time.

Although, maybe not. Come to think of it, my home value and my stock index funds have suffered quite a bit of inflation over the past twenty years. Haven’t yours?

A version of this ran in the San Antonio Express News.

Please see related posts:

Homeownership is great, including as an inflation hedge

This guy…would have happily caused hyper inflation if he thought it served his short-term political or narcissistic interests

This guy…would have happily caused hyper inflation if he thought it served his short-term political or narcissistic interestsPost read (14) times.

Being an entrepreneur is the hard way. I’ve tried it. It’s…hard. ↩The post Ask an Ex-Banker: How To Fight Upcoming Inflation? appeared first on Bankers Anonymous.

February 9, 2021

Past Student Loan Forgiveness Failure

I do not expect President Biden to actually use executive powers to eliminate large chunks of student loan debt, although it appears from news reports that he’s strongly considering it. One in five Americans has student loan debt, and our $1.6 trillion collective balance is higher than our total credit card debt balances.

I neither expect it, nor do I favor it. My objections, briefly summarized:

Debt cancellation favors higher income folks, as high debt correlates with high income. It seems poorly targeted for eliminating inequalities. It is complicated by the obvious political perceptions of unfairness: People who already paid off their debts, people who never took out debt in the first place, and people who will take out debt in the future all have a potential complaint. That’s a lot of constituencies who may feel broad debt forgiveness is unfair to them.To state the obvious: When one in five Americans suffer under the burden of student loan debt, four in five do not.

The future “fairness” perceptions around debt forgiveness depends on whether forgiveness feels societally “earned.” A case can be made that public sector workers – think military, police, fire, educators – deserve a shot at forgiveness following a period of service. That feels less controversial.

Interestingly, programs already exist – in theory – for this type of public sector worker student loan forgiveness, primarily the Public Service Loan Forgiveness created in 2007 and the Temporary Expanded Public Service Loan Forgiveness program passed in 2018. The promise of the program was that borrowers who made ten straight years of on-time payments – and worked for ten years in public sector jobs – would have their remaining loan balances forgiven. The second program was passed by Congress in 2018 to make up for failures of the first program. Then the second program failed.

A study by the General Accounting Office (GAO) from 2019 attempted to explain why only 1 percent of applicants to the Temporary Expanded Public Service Loan Forgiveness Program received forgiveness.

The OMB found the application process confusing to the point of impossible. They cited the Education department’s outreach as insufficient. The department’s own website did not provide information on debt forgiveness. Private sector servicers were not obligated to provide information about loan forgiveness. These all likely contributed to the failure of the program.

Michael Lewis – author of Moneyball, Liar’s Poker, The Big Short and The Undoing Project among others – is probably our country’s best financial journalist.1 His podcast “Against The Rules,” offered an explanation on the failure of public sector loan forgiveness, even before that OMB report was issued.

[image error] [image error]

In Lewis’ second podcast episode, which first aired in April 2019, he explored the ways in which giant student loan-servicing company Navient steered borrowers away from qualifying for loan forgiveness.

Specifically, Navient encouraged borrowers to take advantage of forbearance if they experienced hardships. Unfortunately, forbearance meant that borrowers could no longer qualify for public service loan forgiveness at the end of ten years. The ten-years-of-payments clock would restart, a fact apparently not mentioned or emphasized by Navient employees.

In addition, Navient’s call center workers were highly discouraged from spending enough time to walk consumers through the complex steps they needed to follow. Lewis points out that Navient was paid per account, and would lose accounts if borrowers qualified for forgiveness. Also, spending too much time on the phone with borrowers cut into Navient’s profitability.

Technically, yes, public service sector workers could apply for loan forgiveness, but Navient’s own financial incentives were to not offer the best advice to borrowers.

Not a great reputation!

Not a great reputation!If you enjoy making yourself angry at a big consumer finance institution, you’ll want to listen to the podcast. These types of perverse incentives also probably explain a big part of why so few public sector employees qualified for loan forgiveness.

One obvious conclusion we could make is that if President Biden pursues loan forgiveness for public sector workers, or more universally, we should hope he either replaces or makes massive improvements to this failed program.

Like a lot of what happens with consumer finance, the issue is not so much that it is impossible to avoid traps and to properly navigate borrowing. The real issue is that the burden of doing the right thing has been shifted entirely to an unsophisticated consumer. Could that consumer do all the right things? Maybe. But it’s unlikely. Specifically, as we’ve seen, it’s about 1 percent likely.

As a starting point, I’m usually in favor of “personal responsibility” when it comes to our finances. We should learn what we can, and try our best to solve our own problems.

But when less than one percent of people qualify for an extraordinary benefit like loan forgiveness, it’s not right to make personal responsibility the watchword for navigating consumer finance. Instead, it’s probably a case for better design of the program. And better regulation. And for putting the burden of success on the companies and governments – who understand the products best – rather than on consumers, who understand financial products poorly.

Tony Isola, a money manager and consistently astute commentator on bad financial products, recently dubbed the student loan servicers the “murder hole of consumer finance.” That’s a pretty good turn of phrase.

The Trump administration extended the pause on mandatory student debt payments, initially passed through the April 2020 CARES Act, until January 31 20201. A $1.6 trillion debt reckoning is upon us.

A version of this post ran in the San Antonio Express News.

Please see related post

The Burden of Understanding Should Be On The Companies

See related book reviews of Michael Lewis books:

Post read (11) times.

Oh, stop it. You’re too kind. But, really, Lewis is the best. ↩The post Past Student Loan Forgiveness Failure appeared first on Bankers Anonymous.