Michael C. Taylor's Blog, page 6

June 11, 2022

Does Texas Believe in Free Speech?

Texas leaders need to go back to middle school.

My sixth grader recently learned, and then recited to me, the 10 Amendments to the Constitution, beginning with the first and best known: The freedoms of religion, assembly, petition, press, and speech. The key point of all of these is a limitation on what government can demand from private citizens and businesses. You’re welcome for the refresher.

In a special legislative session in September 2021, the Texas legislature passed HB 20, which empowered the Texas Attorney General to regulate large social media companies based on what messages they promote or discourage.

The point of the bill, made explicit at the time by Governor Abbott, was to redress a perceived imbalance in social media coverage of political voices. “Silencing conservative views is un-American, it’s un-Texan and it’s about to be illegal in Texas,” Abbot tweeted.

I joined @SenBryanHughes to announce a bill that would prevent social media companies like Twitter & Facebook from censoring conservative speech & beliefs.

— Greg Abbott (@GregAbbott_TX) March 6, 2021

Silencing conservative views is un-American, it's un-Texan and it's about to be illegal in Texas.https://t.co/JsPam2XyqD

Unfortunately, this is a grave misunderstanding of the First Amendment. As a constitutional matter, the government can not tell private companies what they can and cannot publish.

But don’t take it from me, a member of the fake news community. Take it from State Representative Giovanni Capriglione (R-Southlake). He was one of the few Republicans to vote against the bill.

The problem of regulating social media companies, as Capriglione told me, “It is a slippery slope when we let the government say what we can say and think. Unfortunately this bill broadens that. And we let the government get into editorial moderation.”

Immediately following passage of the bill, Net Choice and The Computer and Communications Industry Association (CCIA) – private advocacy groups that count these social media companies as clients – filed to stop the bill from going into effect, winning an injunction in December 2021.

So here’s what happened this past week. Texas Attorney General Ken Paxton’s office won on appeal, lifting the injunction, putting the HB20 back into effect. At least until the next move, the AG of Texas can regulate large social media companies for, in effect, not being conservative enough. All Texans, all Americans should be worried about this, both on the left and the right.

[image error] Computer Communications Industry Association, to take on the Texas law HB20Let’s remove this from traditional left/right politics. For example, you may personally prefer a better financial columnist in your paper each week. Your leaders in government may also want that. But your government does not have the right to regulate a media company just because the financial columnist is bad, and the better columnists are being “censored.” That’s not how it works. The First Amendment protects the media company from having any government regulate them based on a bad financial columnist. It’s as simple as that.

Matt Schruers is the President of the CCIA, which won in December, and then lost last week, the injunction against HB 20. They argue this is a basic First Amendment issue. “Ostensibly conservative officials are doing very unconservative things with respect to businesses that take positions that they do not like.”

I agree with Schruers and Capriglione. Private companies, like private citizens, get to express what they want. Government, in turn, does not get to force any particular message or messenger on private companies

Media companies in particular depend upon message curation, free from government dictates. Media curation free of government interference is a sacred part of the First Amendment.

All media companies engage in some curation, mostly to avoid their platforms becoming cesspools of spam, pornography, and disinformation. But also, media company control over what and who it allows on its platform is key to their function.

Capriglione says, “For me the conservative policy is that if the company isn’t doing what you like, you stop buying their product, or you create your own company. And you let the free market solve this. We don’t need the government to decide.”

As an example of what HB20 is aimed at versus what Capriglione says we need, look no further than recent headlines about Twitter, Elon Musk, and President Donald Trump.

A major thing that clearly inspired HB20 in the first place was the removal of Trump from Twitter, following the January 6, 2021 insurrection at the Capitol building.

Elon Musk, the presumptive incoming majority owner of Twitter (although on any given day who knows with him!?) has declared that deplatforming Trump was a mistake. Jack Dorsey, the founder of Twitter and a significant shareholder, says he agrees with Musk. It is reasonable to assume Trump will rejoin Twitter soon, and that’s fine. It should be up to Twitter to decide, not the government.

Trump’s team tried to build Truth Social as a new social media platform, which was mostly a grift and a failure. And that’s also fine. But the key point is that it would never be appropriate for the government to insist that Truth Social give equal voice to “progressive” voices. That’s not how we regulate media companies in this country! This is undoubtedly obvious to true conservatives, but somehow not yet to the Texas leadership that voted for and signed HB20, and the judge who lifted the injunction last week.

As a result, Capriglione continues, “I still think if you follow the constitution you can only come to one conclusion on how this should be done.”

Capriglione says, “Literally the beginning of the First Amendment is ‘The government shall pass no law…’”

Schruers said it well, “There are Republicans who regard that kind of government intrusion to be inappropriate. But there are other Republicans who would happily use the power of government to force private companies to disseminate the perspectives and viewpoints that they want.

I don’t think that’s particularly conservative, but there you have it.”

As Capriglione told me, “I’ve got an A+rating from the NRA. I’m 100% pro-life. I’m the one who wrote the bill to create the gold depository in Texas. [On HB20,] all you have to do is read the Constitution. It’s that simple.”

So what’s the next move? CCIA announced on May 13th that they and Net Choice filed an emergency appeal to the Supreme Court. A week later the Supreme Court granted a temporary pause, to allow another district court in Texas to address the rule.

Schruers commented as part of the filing: “It is unconstitutional for the government to dictate what speech a private company must disseminate whether it be a newspaper, TV show or online platform. The First Amendment is crucial to our democracy and the Supreme Court must now protect that principle from government actors who are too willing to sacrifice it on the altar of partisan posturing.”

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post

Texas joins recent trend to demand business be politically correct in Texas.

Post read (1) times.

The post Does Texas Believe in Free Speech? appeared first on Bankers Anonymous.

May 20, 2022

On Business and Political Speech

We seem to have lost the thread about businesses and political speech. Something has changed recently. Governments seem more willing these days to punish companies for political opinions which clash with current leaders’ politics. It’s a bad trend. It’s very likely anti-constitutional.

First Amendment begins “Congress shall make no law…” New TX laws violate this principle.

First Amendment begins “Congress shall make no law…” New TX laws violate this principle.Based on laws passed in the 2021 legislative session in Texas, any company entering a state contract worth $100,000 or more must certify certain “politically correct in Texas” stances. First, the company must pledge that it does not boycott fossil fuels. Second, that it does not boycott firearms. Third, that it does not boycott Israel. If you attempt any of these political things, apparently, your business is not welcome in Texas, by statute. The attorney general’s office and the comptroller’s office have issued letters to companies seeking certification statements from businesses to pledge allegiance to this political stance.

According to a report by National Public Radio, the actual implementation of these “politically correct” requirements in Texas is messy. Plenty of loopholes exist. It’s not working.

Nevertheless, the intent is to bully companies into agreeing to the politics of a particular place and particular party leadership in power now. Contrary to Texas lawmakers’ intent, this version of business political correctness should not make conservatives happy. This should make them very, very worried, from a constitutional standpoint.

This feels of a piece with Florida Governor Ron DeSantis’ moves in the past month to punish Disney for its supposed pro-LGBTQ messages.

I’m no First Amendment scholar, but here’s how I understand things. We start with the idea that there’s a big difference between whether you are a private citizen, a business, or the government.

As a quick reminder, private citizens get to say almost anything they like. They can’t incite violence or do the equivalent of yelling “Fire!” in a crowded theater for safety reasons, but most everything else – including quite offensive things – is fair game.

Private corporations and their owners and executives also get wide latitude to express political opinions, usually lImited by civil protections like employment law. Private businesses run the risk of a loss of business for unpopular opinions and politics, but generally they can say or express nearly anything as well.

Public officials and government entities, however, do not and should not have the ability to impose their own political views on individuals or companies. That’s the direction of autocrats, both of the left and the right. In our pro-market, anti-autocratic system, it’s been an important tradition that political leaders do not pressure companies to conform with their politics.

In this context, the San Antonip City Council vote a few years back crossed the line in explicitly deciding against letting Chick-fil-A open a restaurant in the municipal airport because of the fast food chain owners’ perceived hostility to gay marriage. If individual consumers want to shun chicken to punish Chick-fil-A for its politics, that’s their right. But when a city government imposes a political litmus test like this on a private company, it oversteps. The left-leaning city council rightfully reaped the whirlwind for its choice. This isn’t the right way for governments to treat private companies.

Meanwhile, Florida Governor Ron DeSantis has joined the trend set by the Texas legislature of punishing corporations for their left-leaning politics. He urged the Florida legislature to strip Disney of its special tax status, when Disney joined a letter condemning proposed legislation in Florida. DeSantis made clear this was personal, and his action retaliatory, saying “Disney thought they ruled Florida. They even tried to attack me to advance their woke agenda.”

Desantis’ bullying is clearly anti-constitutional

Desantis’ bullying is clearly anti-constitutionalOfficial government retaliation for protected speech is a violation of the First Amendment. I guess it goes to the courts next but this is really important: Our system depends on DeSantis getting slapped down for this attempt to retaliate for political speech.

Here’s how it should go. Disney gets to express any type of speech or political stance it wants. Within the bounds of employment law, of course. Private consumers for their part get to decide whether to buy more, the same, or fewer of Disney’s products as a result of Disney’s expressions. Disney is free to be as woke or as reactionary in their public utterances as they please, and then they can suffer the consequences. Cancel, or embrace, or just appreciate princess movies for what they are – it should be all the same under the law.

In a non left-right culture-war context, this may be easier to understand. If I run an ice house – serving beer and spirits – and I flip the bird to the mayor of my city or the county judge or the governor, that’s my absolute right. I’m an American, damnit! If the next week I get a visit from the Texas alcoholic beverage commission and learn my license to serve has been revoked for no other reason than I was being rude to the powers that be, that’s retaliatory and a violation of my rights. Governments and government officials are not allowed to act like precious snowflakes. Private citizens and businesses are protected in a way that governments are not.

Public officials and governments need to be circumscribed in their statements and actions. They don’t get to do and say what they want. That’s the whole point of the constitution. To protect us from the government. It is not ok for a public official to opine and then try to shape the politics of a private company. It is worse still to bring the power of the regulatory state to bear on a private company, as long as the company is acting within current law. To do what DeSantis has done in Florida is to make an important move toward an autocratic state. This should be equally clear to conservatives and progressives alike.

Forcing corporate allegiance to current office holders’ political stance is both anti-market and pro-autocrat. Punishing companies for their political stances is anti-American. It’s the stuff of Putin’s Russia.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post:

The anti-constitutional attempt to regulate speech in TX on social media platforms.

Post read (4) times.

The post On Business and Political Speech appeared first on Bankers Anonymous.

The Good Times

The US Financial Infotainment Industrial Complex needs to tell us bad, shocking, surprising, and emotionally arousing news. It is less good at pointing out the opposite. Like good news. Or, “things were less interesting or less frightening than we expected.” That stuff tends to get ignored in the media.

As financial news consumers we need a good dashboard for tracking the main indicators of economic health. Meanwhile, instead, financial media acts like a series of blinding strobe lights, flashing shocking inflation numbers or surprise jobless claims numbers, what stock dropped or jumped 25 percent this week, or which maniac billionaire tweeted an irrelevant weed joke yesterday.

The Financial Infotainment Industrial Complex does not want to discuss the boring things, or the good things. But I do, damnit.

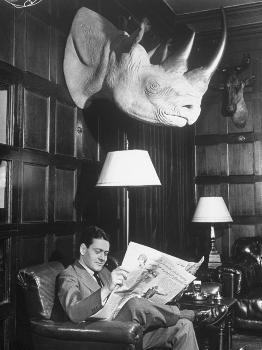

“Give me the boring, Taylor, and give it to me straight!” is how I imagine you exhort me when you open up your weekend paper, as we sit down together at The Club. (I like to pretend I’m a 19th Century English gentleman, so “The Club” is my preferred way to exchange boring financial news with friends.)

So, friends, let’s talk about inflation and employment in April 2021. And then a brief nod at the end toward taxes, assets, government debt, and economic growth.

Inflation

Data released on April 12 for the widely followed Consumer Price Index showed 8.5 percent inflation over the past year. The highest in 40 years.

This seems perverse to say, but I’m glad to see this inflation. Relieved. This feels to me…normal. Reassuring.

Why? Because during COVID the Federal Reserve explosively grew its balance sheet to $9 trillion. That was a jump up from $4 trillion for the extraordinary quantitative easing (QE2) period during the 2014 to 2020 era, which itself was a doubling from the $2 trillion post-Great Recession expanded balance sheet in 2009. And we have had a 20-year run of historically-low interest rates. I was sick of predicting inflation for 20 years in a row and being wrong every time. The absence of traditional consumer price inflation was weird.

If inflation hadn’t taken off in 2021, all economic laws of money supply theory would be out the window. Fortunately, the appearance of regular consumer inflation means that the fringe economic ideas of Modern Monetary Theory can be relegated to the footnotes of history.

Before 2022, we only saw inflation in indirect forms.

The cryptocurrency and NFT weirdness in 2021 was inflation. The positive S&P500 returns of 29, 16, and 27 percent in 2019, 2020 and 2021 respectively was inflation. Rapid home price appreciation over the last 3 years was inflation. We just didn’t see it so obviously in consumable goods. And now we do. Order is restored to the universe.

Also, the Federal Reserve will hike interest rates approximately 6 more times this year and will shrink the balance sheet. Inflation will revert to normal levels with normal policies. This is boring, and good.

Employment

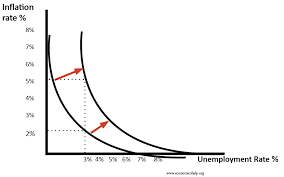

Classic economic theory links employment and inflation, in something called the Phillips Curve. The Phillips Curve is a picture of the following words: When unemployment goes down, prices go up. When unemployment goes up, prices go down. (or more accurately, prices go up more slowly).

The Phillips Curve is a bit dated, and debate continues about causality, magnitude of effects, secondary confounding factors, shape of the curve, etc, but the basic relationship between employment and inflation is considered real. Federal Reserve economists explicitly adopt this linkage, and try for a happy Goldilocks medium of moderate inflation (around 2 percent) and strong employment, understanding that helping one side may unintentionally hurt the other.

All of this is prelude to look at our dashboard metrics and to point out the following: You guys, employment has never been better than it is right now. The unemployment rate announced April 1st is 3.6 percent. Except for a few briefs months right before COVID hit, we’ve never measured unemployment this low. This is amazing, unabashedly, good news.

Complaints in financial media from the business community about the difficulty of hiring workers is a very negative spin on a very positive situation. Working people have pricing power. They can get jobs, and then they can negotiate to get a better job, because unemployment is so low. Unemployment at 3.6 percent is considered way better than standard models of the US economy would predict, because we’ve simply never had it this good.

Good news like this doesn’t make for exciting headlines but it doesn’t make it any less true. And also traditional models would suggest that when employment is this good, we should expect higher than normal inflation.

It doesn’t feel like it, you may not believe it, financial media won’t admit it, but: These are the good times.

Time for a lightning roundup on stocks, housing, tax collection, and economic growth to complete the dashboard review.

Stock Market and Housing

Big upward moves in stocks and home values between 2019 and 2021 were a form of inflation. But also, a form of wealth. The US stock market is about 8 percent off its all-time highs, but by any reasonable and historic metric has performed like an absolute racehorse in recent years. From a dashboard perspective, these asset markets are still booming. That’s usually considered good.

Taxes

Federal tax collection hit a record high last year. This is good news. You might think that’s bad news (because you don’t like taxes) but it is also good news because (hopefully) you also don’t like government debt. We have lots of debt, so it is good that we collect lots of taxes in order to stay current on the debt.

We collected a lot of taxes last year in part because over 96 percent of people who want a job have one, and also because an elevated stock market generates a tremendous amount of capital gains taxes.

Economic Growth

The US economy grew 5.7 percent in 2021, well above trend, nicely undoing the steep COVID recession of 2020 that shrunk the economy by 3.4 percent.

Financial media doesn’t want to admit it, but these are the good times, right now.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Please see related post:

Economic Theories – Hayek, Keynes, MMT

Post read (2) times.

The post The Good Times appeared first on Bankers Anonymous.

May 18, 2022

Book Review: The Contrarian by Max Chafkin

Now fully in the swing of the new Gilded Age, we are ruled by a class of philosopher kings who bestride the business and political worlds. Unelected and with few checks on their power, these philosopher kings – generally philosopher billionaires – wield tremendous influence over our lives. They typically receive hagiographic coverage from the business press.

Peter Thiel, Philosopher King

Peter Thiel, Philosopher KingMy New Years’ writing resolution for 2022 is to learn more about our Gilded Age tech and finance overlords through reading their biographies and their own writing. If I cannot prevent their leadership, at least as a citizen I can attempt to understand their leadership.

In this spirit I read Max Chaftin’s first major biography of one philosopher king, The Contrarian – Peter Thiel and Silicon Valley’s Pursuit Of Power, published in 2021. I also read Thiel’s own startup-advice book from 2014, Zero To One, co-authored with Blake Masters.

Thiel has also pursued a political philosophy of extreme libertarianism, which became more openly known when he was one of Silicon Valley’s few backers of Donald Trump’s candidacy, and then presidency.

[image error]

As an undergraduate and then law student at Stanford in the late 1980s and early 1990s, Thiel was 30 years ahead of his time in identifying, and then attacking, multiculturalism on college campuses as a unifying enemy of the Right. Thiel founded the Stanford Review in 1987 and authored Diversity Myth: Multiculturalism and Intolerance on Campus in 1995 – [LINK: https://amzn.to/3G65GBt] both publications laying the groundwork for today’s political fights about overly “woke” campus cultures and “critical race theory.” Agree or disagree with him about politics, he certainly is good at anticipating where things are headed, in both business and politics.

[image error]

What strikes me as most important to know about Peter Thiel from Max Chafkin‘s book is the following: Peter Thiel is not a good guy. He used ethically dubious – even devious – methods to cut out his partners in his original successful venture, PayPal. He would continue that pattern of short-changing early founders numerous times, including encouraging Mark Zuckerberg to undercut his own partners at Facebook. Defenders may see and justify this behavior as just the kind of ruthlessness needed to succeed at the scale at which Thiel has succeeded in business. For my part, Chafkin’s book makes me think Thiel is a philosopher king about whom we should be very, very, afraid.

He used his fortune to secretly sue, and ultimately bankrupt, online media company Gawker because of its unflattering coverage of him over the years. He has a more than 30-year track record of building network ties with right wing provocateurs who are not just conservative in the traditional sense, but anti-democratic in the most dangerous sense. He repeatedly backs and associates with figures on the alt-right fringe like Charles Johnson, Curtis Yarvin, and Milo Yiannopoulos. These aren’t conservative intellectuals and right-of-center public figures as much as they are provocateurs opposed to democratic norms.

“Peter’s not a Nazi,” Chafkin quotes Charles Johnson, speaking about Thiel, “Nazi-curious, maybe.” Johnson later softened that statement about his friend to imply that Thiel simply has wide-ranging intellectual interests. But the pattern of Thiel’s philosopher billionaire interests suggests that he has a kind of end-times, blow-up-the-system, anti-democratic approach to government.

He also has a clear preference for monopolies as a business strategy, and spends considerable time describing Google’s monopoly power in Zero To One.

The rest of Zero To One is fine as business book go, although like many others of its type is filled with sweeping generalizations stated with supreme confidence, relying on anecdote over data, with a preponderance of recency bias and stories about Thiel’s own business experience and network.

One of the clear lessons of Chafkin’s book is that Peter Thiel’s life and philosophy contains major contradictions. He is a self-described libertarian whose major tech holding Palantir depends on national-security government contracting. His other major tech investment, SpaceX, depends on NASA-related and military contracting.

Another weird contradiction between Thiel’s stated philosophy and life is that he expresses pessimism about the US technology and innovation scene, claiming that the 1950s to 19060s was some golden age of purposeful optimism, now lost. Political correctness and transfer payments have apparently killed the American dream. This is odd, considering the explosion in Silicon Valley power and innovation that he’s witnessed, and been part of, in his lifetime.

Although he professes an anti-government philosophy, he has certainly invested heavily in political campaigns. He became well-known for making timely and crucial donations to Ted Cruz’s Senate campaign in 2012 and Donald Trump’s presidential election in 2016. Palantir’s federal government contracting business soared under Trump, becoming the ultimate military-industrial complex contractor. This is odd for a self-professed libertarian, if he believed his own ideas.

Blake Masters is not only the coauthor of Thiel’s 2014 entrepreneur guidebook Zero To One, he is also running as a Republican primary candidate for Senate in Arizona in 2022. Another Thiel acolyte, J. D. Vance, is running as the Republican Senate candidate in Ohio, after working as part of Thiel’s venture capital firm Mithril. Vance received $10 million in PAC support from Thiel. This all feels like a philosopher king increasing his grip on the US Senate.

As a red-blooded capitalist, I can admire Thiel’s success as the ultimate builder and investor.

As an American and supporter of democracy there’s something profoundly troubling about the absolute concentration of power in the hands of the very few. A philosopher billionaire may have in a sense “earned” our respect through business accomplishments, but that does not mean the result is best for the rest of us. One point of living in a society that makes its own rules – one point of the freedom to choose our own leaders rather than have them chosen for us – is that we should not be overly subject to a king or a set of oligarchs.

I hasten to add that if you admire Thiel’s alt-right philosophy, you may cheer on his growing power and influence. Or you may point to the influence of another billionaire philosopher king like George Soros and claim that what’s fair for the goose is fair for the gander. I think this is missing the point of the danger. I don’t enjoy being subject to the unchecked power of philosopher kings at all, whatever their particular politics.

What is to be done? The current movement to curb Big Tech – a movement with equally enthusiastic support from conservative Missouri Senator Josh Hawley and progressive Massachusetts Senator Elizabeth Warren – seems one step to address this shared worry.

I should be encouraged by Senator Hawley’s interest in curbing the power of Big Tech – I want this as well. But when I read of Thiel’s $300 thousand contribution to Hawley’s first run for statewide office in Missouri, I worry instead about Hawley as a kind of cat’s paw for Thiel’s attempt to smash Google’s monopoly, to the benefit of Thiel’s own business interests.

We need a more robust way to curb the philosopher kings.

Thiel’s right wing provocateur activities predates his capitalist career. Before he was a billionaire, he was a right wing philosopher.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

All Bankers Anonymous Book Reviews in One Place

Post read (14) times.

The post Book Review: The Contrarian by Max Chafkin appeared first on Bankers Anonymous.

May 17, 2022

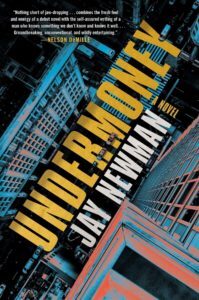

Book Review: Undermoney, by Jay Newman

This Spring, my top book recommendation is the zeitgeist-capturing financial thriller Undermoney, by first-time novelist Jay Newman.

This has everything you want.

Sociopathic billionaires. A beautiful adrenaline-junkie with the fighting skills of a special forces assassin. Deep State operatives conspiring to steal billions of US taxpayer money in order to buy an election and undo American malaise. Murderous Russian oligarchs deploying mercenary armies, serving Putin the puppet master. A Medici-descendent who controls a financial fortune to rival his descendents. Conspiracies within conspiracies.

Undermoney, by Jay Newman

Undermoney, by Jay NewmanIn his knowledgeable name-dropping of military specs on all geopolitical sides of war, Newman channels the Tom Clancy novels of the 1980s Cold War fiction. With his speculations into spycraft and double-dealing among competing military-industrial complexes, Newman nods to John LeCarre. Conspiracies hatch more intricate conspiracies, as baroque as anything from Dan Brown’s Da Vinci Code. If you enjoy financial/military/spy/conspiracy thriller books, you will love Undermoney.

Published in January 2022, the fictional description of Putin and his use of mercenaries to do his dirty work seems ripped straight from current headlines. The dark money fueling US hedge funds are equally nefarious. Newman understands how kleptocracy and oligarchic excess – both in Russia and in the West – repel and attract us in 2022. This is fun stuff and extremely of the moment.

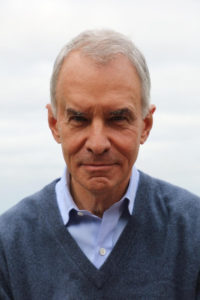

Jay Newman is not just any regular first-time novelist. Newman describes the world of the ultra rich and connected hedge funders because he worked, and fought, and emerged victorious from this world.

He himself holds a legendary place in the hedge fund world, having endured decades-long battles against countries unwilling to pay their debts. When he writes about big money, international political intrigue, maniacally-focused hedge funds managers, he has lived through it all.

Author and hedge funder Jay Newman

Author and hedge funder Jay NewmanIn 1999, Newman managed to win a court case and change international bond market precedent against countries that do not pay their debts to bondholders.

A brief interstitial financial history of sovereign debt: In the 1980s many Latin American countries defaulted on their debt to US and European lenders. In the 1990s, debt holders swapped their defaulted loans for “Brady Bonds,” named for for US Treasury Secretary James Brady. The new negotiated settlements allowed much of Latin America to rejoin international financial markets, even though debt holders had to accept less than full value to get back the Brady Bonds. I worked as a bond salesman at Goldman starting in 1997, focused on buying and selling Brady Bonds, so I lived and breathed this stuff for a few years.

Jay Newman, however, had purchased some Peruvian debt and withheld it from the Brady Bond debt swap. He joined forces with a very patient hedge fund named Elliott Associates. With Elliott, Newman sued for full payment of the debts from Peru. After years of legal appeals he eventually got a New York court to agree that Peru could not pay its Brady Bonds without settling Newman’s debt in full as well. For a few weeks in 1999 he threw the entire country into default, until he got paid. Newman became known as is the ultimate hard-ball negotiator of sovereign debt.

When Argentina had the largest sovereign debt default of all time in 2001, Newman deployed the same playbook. When the vast majority of debtholders turned in their defaulted Argentine debt for new bonds and accepted huge losses, Newman and Elliott held out for full payment. He sued Argentina. He made an absolute nuisance of himself in US courts and international courts.

Newman famously managed to seize an Argentine naval ship in Ghana with 200 sailors aboard, using a Ghanian court order. In this way he anticipated the current string of yacht-seizures happening across the globe this spring against Russian oligarchs.

Fifteen years after Argentina’s original default in 2001, with many twists and turns along the way, Newman and Elliott prevailed.

Usually, when I watch a successful financier turn out to be a great writer, I turn pickle-green with envy. I do not resent Newman, however, and maybe now is time for my own quick name-drop humblebrag.

[image error]

Newman was briefly a client of mine when I worked on the emerging market bond desk at Goldman. We followed along in real time as he engineered the Peruvian bond default.

I tried my darndest to sell him really cheap defaulted Argentine bonds in 2001, anticipating what his eventual strategy would be. It took him and Elliott 15 years to succeed, but eventually Newman prevailed with a $2.4 billion dollar settlement in 2016, an estimated 10x return on investment.

The word I kept returning to while reading Undermoney is prescient. Newman published Undermoney in January 2022, before most of the Western world had to reckon with Putin’s murderous kleptocratic regime. This guy sees the future.

Russian bonds will likely default in May, as Western bondholders have frozen reserves or blocked payments.

I haven’t spoken to Newman in 20 years. There’s a high probability he would not remember me, as I wasn’t a particularly good salesman and he barely needed Wall Street to do his thing. I may send him this article however, as I need to find out what he is going to write about in his next novel. He clearly anticipates the future better than anyone. That might make me money some day.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

All Bankers Anonymous Book Reviews in One Place

Hedge Fund as Pirate, seizes Argentine Naval Vessel

Post read (6) times.

The post Book Review: Undermoney, by Jay Newman appeared first on Bankers Anonymous.

January 5, 2022

The I Bond Solution

I learned about a timely investment tool from an article by Burton Malkiel in the Wall Street Journal this past month.

Timely, because observed, economy-wide inflation has finally hit us and prompted the Federal Reserve to acknowledge that “transitory” isn’t the right word for inflation anymore.

I don’t give investment advice here, nor should you ever take investment advice from a stranger who writes a blog or newspaper column. So this is not something you necessarily should do. Rather, I think it’s worth knowing about tools that may solve a particular worry of yours, particularly if it’s been nearly 40 years since we’ve actually experienced broad-based inflation.

Malkiel is best known as the author of one of my personal All Time Top Five Investing Books, A Random Walk Down Wall Street.

So for me – just like in those E.F. Hutton commercials that the over-50 crowd will remember – “when Burton Malkiel speaks, people listen.”

In his article, Malkiel introduced the US Treasury I bond as a tool that we should consider as part of their overall portfolio.

Here’s the part that makes I bonds quite sexy right now. Because the consumer price index jumped so much this Fall, the yield on I bonds is 7.12 percent. I bonds purchased in January 2022 will enjoy this fixed rate until July 1st. That is the highest interest rate that I bonds have offered since May 2000. The semi-annual yield reset will track the consumer price index in the future. After the next reset, the yield could very well go down, if inflation goes down. If it stays high, the I bond will keep a very nice yield, which is why it’s a plausible hedge against inflation. No matter what the inflation rate is in the future, the yield on I bonds can not go negative.

U.S. Treasury Series I Savings Bonds.

U.S. Treasury Series I Savings Bonds.Institutional investors – big funds and insurance companies and banks – typically have looked to TIPS (Treasury Inflation Protected Securities) when they worry about inflation. Since 1997, investors have been able to buy these bonds that pay a fixed interest but that adjust their principal upward in response to inflation, also as measured by the consumer price index.

The little guy has typically only been able to access TIPS through mutual funds. Because inflation has been so tame since 1997, TIPS have rarely been high yielding, but instead have offered a hedge against the “what if” scenario. And that “what if” has hardly shown up until recently. Returns over the past 10 years on a TIPS fund have been in the 3 percent annual range, before taxes, with the biggest boost to that performance hitting in the past two years.

Unlike TIPS, you would buy I bonds directly online from the US Treasury, without a brokerage company or mutual fund. They’re not saleable by a brokerage, nor by you. You buy them in increments from $25 up to $10,000 maximum per social social number, per year. They register in your name only, or the name of the trust or partnership buying it.

I bonds are designed for retail investors with a long time horizon, and do not work as well for a short-term trade. That’s because you will pay a 3-month interest penalty if you redeem after 1 year. Although they can’t be traded and are intended to be held for 30 years, you can redeem your I bond after 5 years without penalty.

A detailed comparison of TIPS and IBonds from the Treasury website

A detailed comparison of TIPS and IBonds from the Treasury websiteBecause interest accrues until maturity or redemption, you will pay income tax on the interest only at the end. The following fact is irrelevant for Texans, but the interest earned on I bonds is exempt from local and state income taxes, like traditional municipal bonds.

Speaking of traditional bonds, US Treasury or corporate bonds are the last thing you want to buy in an inflationary environment. In addition, US Treasury bonds offer a measly 0.5 percent to 1.8 percent right now. Even a basket of high-risk corporate bonds (what we’ve impolitely called junk bonds since the 1980s) only get you about a 4.5 percent annual yield. That’s unacceptable unless you enjoy locking in losses against the current observed rate of inflation.

Maybe another concluding thought about this particular investment tool is in order. I, personally, will not be purchasing inflation bonds, neither TIPS nor US Treasury I bonds. I’m not actually that worried about inflation in my life or in the economy. I think my combination of real estate (my home!) and stocks (my retirement accounts!) will serve me fine under medium-level inflation. But I have a different risk appetite from most – my appetite is quite high. And I have a longish time horizon. I’m turning 50 this year so I have another 80 or so years to live (if my math is correct?)

I’m not deviating from my plan (Buy 100% equity index funds, never sell) but I mention this I bond product so that you’re a more-informed investor.

Also, you should read Burton Malkiel’s classic A Random Walk Down Wall Street. That is my strongest investment recommendation. I wouldn’t recommend any particular stock or bond to buy, but reading a classic like Malkiel’s book is highly likely to make you richer in the long run.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Please see related posts:

Book Review: A Random Walk Down Wall Street by Burton Malkiel

Never Sell – A Disney and Churchill Mashup

Post read (17) times.

The post The I Bond Solution appeared first on Bankers Anonymous.

December 30, 2021

TPR Podcast Episode 3 – The Artist as Businessman

My friend Stuart Allen has strong ideas. Art and money can (must!) coexist. The myth of the starving artist does not serve artists or the art world well. Art school is great, but sometimes errs on the side of training art teachers rather than artists. Artists would do well to treat their practice like a small business.

I already admired Stuart’s art – we have a piece of his in our home. But his business sense is also quite admirable!

Stuart Allen

Stuart AllenI’m proud of this conversation we had for No Hill For A Climber, my new podcast with Texas Public Radio. You can even listen on Apple podcast and Spotify. And you should absolutely subscribe and rate it and comment and do all the things!

Post read (0) times.

The post TPR Podcast Episode 3 – The Artist as Businessman appeared first on Bankers Anonymous.

Revisiting Recycling in late 2021

The two biggest macroeconomic worries in the US right now are burgeoning inflation and supply chain issues. A plausible narrative for both is that the rolling global COVID pandemic has disrupted our ability to efficiently move products to markets, while loose money policies have ignited inflation.

These both sound bad. But with markets, sometimes good or bad results depend on who you are. A disrupted supply chain for one business is an opportunity for another business. And high prices? Well, in recycling commodity markets for example, it’s the best market they’ve seen in the last ten years.

Colored trash bins used to recycle paper, plastic and glass.

Colored trash bins used to recycle paper, plastic and glass.What does this mean? Recycled materials – in the big four categories of paper, metal, glass and plastic – all have secondary markets. The business goal of a recycling provider is to sort, package, and sell as cleanly as possible these four types of materials to the end user.

“Cardboard and paper prices are both on the rise. Plastic prices have skyrocketed compared to what they were, let’s say, five years ago,” Josephine Valencia, Deputy Director at the City of San Antonio Solid Waste Department, tells me. Her explanation points to the same macro trends we’re all worried about.

Valencia continues explaining high prices of recycled commodities, “In the past two years, and this is just my guess, it’s COVID-related supply shortages. There’s a shortage of just about everything these days. And I think that has really driven up the price of certain [recycled] commodities.”

So if you’re in the recycling business, these are the best of times.

If your personal subscription to the online newsletter “Resource Recycling” has recently lapsed, allow me to quote a few price changes for you.

Baled steel cans have risen from $78 per ton last year to $250 per ton.

Baled aluminum cans jumped from $0.45 a pound last year to $0.77 a pound last year.

On the paper side, corrugated containers trade for $171 per ton, up from $60 per ton last year. Another paper product, sorted residential paper, sells for $117 per ton compared to $38 per ton a year ago.

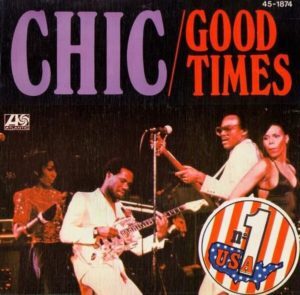

As the band Chic used to sing back in 1979, These. Are. The. Good. Times.

If you were hoping to have a disco-era earworm stuck in your head for the rest of the day, dating back to the last time we saw high inflation, you’re welcome.

For Recyclers

For RecyclersWhen last I checked in with the recycling markets in 2019, a few trends were made clear to me.

First, glass is infinitely recyclable but generally a money loser for recyclers unless it can be sorted by color and delivered to a nearby glass recycling operation. Second, paper and cardboard was in a multi-year decline because of the lack of demand for newsprint (RIP the newspaper industry!) and the awkward adjustment to a world in which ubiquitous Amazon cardboard didn’t fit traditional cardboard-sorting machines. Third, plastic prices were in freefall because China had begun refusing most deliveries. Fourth, metal was the only reliable money-maker.

But high prices in 2021 have swung recycling programs from losses two years ago back to a money maker. Things are a lot better now in San Antonio, for example, says Valencia.

I’m going to simplify the math a bit, but here’s the basic deal in my city. We pay approximately $50 a ton to dump recycled bins with the city’s provider, which currently is the large waste processor Republic Services. Republic sorts and processes the stuff, and then sells it in the secondary commodities market, and agrees to share half the resulting revenue with the city. If the revenue from sales generates $120 per ton, the city makes $60, and can count a “profit” of $10 per ton. That’s approximately the economics – admittedly simplified – right now.

In a bad year like 2019, the revenue share didn’t quite cover the upfront $50 cost to deliver, so the city had a “loss.” A bunch of other factors makes my explanation overly simple – they average out prices, contaminated commodities change the final revenue-sharing formula, losses can be carried forward – but Valencia endorsed my explanation as basically approximately true.

A factor which tempers the celebration of 2021 recycling profit is that – just like any business – the city’s costs are also affected by inflation. In the past year, the cost of purchasing new plastic household bins has increased from roughly $50 a barrel to $75 a barrel. Because they are made of plastic and plastic prices are way up. With a million barrels in circulation right now, that price increase affects the annual budget in a real way. And just as the price of new and used cars has increased, so too has the price of garbage trucks. In that past year, that’s gone up from $365 thousand per truck to $425 thousand per truck, says Valencia. Because of course trucks are made up of steel and plastic, all of which costs more now than last year.

“On the one side I can say, I’m excited as the city recycling revenues have gone up, so we’re making money. But on the other side, at the end of the day, we’re not sitting on a windfall because even though our revenues went up all our expenses went up as well,” continued Valencia.

Like any volatile financial market, hindsight is 20/20 and past performance is no guarantee of future results, included for recycled commodities. We don’t know what happens next.

By the way, the multi-generational fix that recycling experts would ideally have us do remains the same: Wean us off the big blue unsorted barrel of mixed commodity waste. We should all be sorting the multiple waste streams in our households into many different smaller homogenous-material barrels. Civilized countries (and by “civilized” I explicitly exclude here both the United States and the Republic of Texas) have figured out how to do this basic sorting at home. Everyone would recycle more stuff and make more money.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts

Recycling Markets were broken in 2019 – Part I

Post read (4) times.

The post Revisiting Recycling in late 2021 appeared first on Bankers Anonymous.

December 23, 2021

TPR Podcast Episode 2: Building a Better Pipeline

I have a conversation with Paula Harris, a woman who through the course of her career just absolutely upended expectations.

You can listen for free on the Texas Public Radio website. But also, as they say, you can and should subscribe on Apple podcasts or Spotify or wherever.

Post read (3) times.

The post TPR Podcast Episode 2: Building a Better Pipeline appeared first on Bankers Anonymous.

December 15, 2021

TPR Podcast Episode #1: I Had No Idea How Hard It Would Be

After years of trying to launch a proper podcast with proper professional help…a milestone unlocked for me! The first episode is titled “I Had No Idea How Hard It Would Be” and I think that is also a good description of me, over the past few years, trying to make this happen.

I am super pleased this show with Texas Public Radio has finally launched.

You can listen (you should listen!) here.

But also, you know, subscribe on Apple Podcast or Spotify or wherever, so you won’t miss an episode.

If you’d like to see a quick YouTube preview of the episode, check that out here:

Post read (3) times.

The post TPR Podcast Episode #1: I Had No Idea How Hard It Would Be appeared first on Bankers Anonymous.