Michael C. Taylor's Blog, page 7

December 13, 2021

UpCycled Entrepreneur

If food entrepreneurship were a series of races for prizes, Grain4Grain has proved itself a thoroughbred. They took third prize in the HEB Quest for Texas Best contest, winning $10,000 in 2019. In 2020 Grain4Grain won first prize and $50,000 in the Tech Fuel contest, sponsored by the City of San Antonio and Tech Block, a San Antonio-based technology advocacy group. In May of 2021 grocery-store giant Kroger’s Zero Waste Foundation selected them for funding and inclusion in a program for food innovators. This included a $100,000 grant, plus the chance for an additional $100,00 funding based on milestones achieved.

Their big idea, I have to admit, is pretty cool. The founders Yoni Medhin and Matthew Mechtly collect a waste product from local brewers – spent barley used for making beer – and apply a patent-pending drying process to produce flour and flour-based products like pancake and waffle mix.

Grain4Grain also checks off a lot boxes that are current “in the moment” consumer trends.

Medhin calls their specific form of organic recycling “upcycling,” a term I hadn’t heard before but which means turning a food waste product into a higher-end consumer food product. I’ve since learned there’s a whole upcycling mini-industry for turning waste products into highly processed foods, and it’s a big 2021 trendy food concept.

UpCycled Food Foundation certifies companies in the space

UpCycled Food Foundation certifies companies in the spaceFollowing the brewing process, the spent grains are naturally high in protein and fiber and low in carbohydrates, which allows Grain4Grain to market their flour for folks who seek a “low carb” or “keto” diet, so they’ve got that diet trend covered. They also advertise donating a pound of their pancake mix to food banks for every pound sold to customers, so they do good as they do well.

That’s a lot of different ways to appeal to folks.

Ryan Salts, the director of Launch SA, a small business and entrepreneurship center, recalls being impressed with the Grain4Grain founders and pushed them to enter the Tech Fuel contest. When he heard about the contest, “The first person I thought of was Yoni,” says Salts.

“Grain4Grain fits a diet requirement that is really popular, in the last five years, there’s been an uptick in healthier brands. And having a product that does really good things, it’s helpful,” adds Salts.

More important than prizes and a cool idea, of course, is having supermarket megastores like HEB and Kroger interested in your brand and willing to put your product on their shelves. There is no higher prize than that. In January 2021, the company announced its upcycled grain flour would be featured and used in HEB’s 140 bakeries throughout the state.

Eugen Simor runs Alamo Brewery, which along with local San Antonio breweries Freetail and Real Ale, supplies Grain4Grain’s spent barley product. Simor’s company allows Grain4Grain to pick it up for free, since it’s otherwise a cost to dispose of.

As Simor told me “They’re taking what would normally be a waste product for so many breweries. It would normally be hauled off to a rancher to feed cattle, or end up in a landfill.” The majority of Alamo’s grain still goes toward a local rancher who picks it up for free. But he was happy to find Grain4Grain developing another use for it.

“We did an Earth day for sustainability at Alamo Brewery and his product was one of the ones we featured. Yoni’s a really cool guy and I wanted to be part of it,” Simor says. “I was excited about having a low carb flour, and my kids like it too.”

Remember the Alamo Beer

Remember the Alamo BeerSalts’ particular passion is food-oriented startups, which he champions with his “Break Fast and Launch” program through Launch SA. In the food startup space, many companies struggle with trying to do both the production side and the marketing side. Many choose just one or the other.

Medhin has managed to partner with other packagers to solve most of his manufacturing problems, to get to the scale he needs to provide upcycled flour to HEB, large-scale bakeries, and hopefully someday soon, Kroger.

Like many entrepreneurs, Mehdin has already run the equivalent of many marathons to get this far. But in many ways his journey is still in its early days. The struggle to both sell a consumer-oriented retail product while at the same time building a manufacturing business to provide wholesale product at scale is really, really hard. He estimates they need another 6 months to solve their problem of getting to a large enough scale where he and his investors can start making money. His strategy in the future will depend more on providing bulk flour to the biggest food companies rather than direct-to-consumer sales. “Check back with me in June 2022,” he says.

I have a fascination with organic recycling. (My kids would call it an obsession, but what do kids know, anyway?)

Being eco friendly, low-carb friendly, and foodbank friendly are all amazing attributes. But Mehdin is more realist than idealist, when it comes to the needs of the consumer.

As Mehdin says, “customers don’t purchase altruistically. They say they do. But in reality for food products they purchase for taste, price, availability, texture, and health factors. You have to meet their immediate needs and you have to bring the product to the level of the traditional food products in the marketplace.”

This morning before writing this column I cooked up Grain4Grain pancakes based on their low-carb pancake and waffle mix. I can hereby certify: they were delicious. But it left me wondering whether pancakes slathered in butter, syrup, and blueberries still qualified as low-carb? I’m asking for a friend.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts

Psst … The Future is in Organic Waste, Kid

Organic Waste Program Rolls Out In My City

Post read (5) times.

The post UpCycled Entrepreneur appeared first on Bankers Anonymous.

December 8, 2021

New Podcast By Me

I’ve long nurtured a plan to do an interview style podcast for people in business. Its finally happening with the good folks of Texas Public Radio.

It will be on all the usual podcast channels. Here’s a link to the page on Texas Public Radio‘s website, but again, you can go to Apple Podcast or Stitcher or whatever and smash that “subscribe” button.

My hope is that these characters will be interesting to people who wouldn’t normally flip through the business section of the newspaper.

I’m not interested in a “Here’s my success, try to emulate me!” type of conversation. I’m interested in talking about surprising origin-stories, near-death-of-business stories, and just unexpected wisdom in common hours.

By the way, if you’re in Texas and I should be interviewing you for this show, please drop me a line!

Post read (5) times.

The post New Podcast By Me appeared first on Bankers Anonymous.

December 7, 2021

Book Review: The Delusions of Crowds by William Bernstein

My finance book of the year recommendation is one that perfectly matches the 2021 markets moment: William Bernstein’s The Delusions of Crowds: Why People Go Mad in Groups.

Over and over again this year I found myself describing developments in financial markets that seem, frankly, nuts. All I’ve done this year, it seems, is write about wacky finance trends.

If Bernstein’s investing book The Four Pillars of Investing is an all-time finance classic, his 2021 book is utterly timely, anticipating a year of financial delusions.

In The Delusions of Crowds, Bernstein toggles between stories of financial delusions and religious delusions. Both types of madness depend on two common human frailties. One he describes as the “Asch Effect,” based on a social psychological experiment which showed how humans can be convinced of obviously wrong things by the social pressure to conform to the opinions of others. When the religious leader or the financial whiz says something is true, and enough people around us agree, we tend to agree, despite evidence to the contrary.

Another common thread is our ability as humans, in the face of contradictory evidence, to completely discount one set of facts if they conflict with our pre-existing beliefs. When the apocalypse does not arrive on the prophesized date, Bernstein notes, true believers do not necessarily reject the prophet. Insteaed, we listen eagerly for the prophet’s update on the next plausible date for the End of Times, rather than settle our cognitive dissonance through doubt or disbelief. Contradictory evidence is merely an opportunity to double-down on our fervent faith, not change our beliefs. The South Sea bubble, railroad stocks in 1840 Britain, the stock pools of 1929. The Fifth Monarchy of 1666, the seventh-day adventism of 1843, the Y2K mania. Bernstein does not mention the QAnon phenomenon, but clearly this recent movement falls within Bernstein’s historical pattern.

For those looking for a pure financial wisdom book, I should warn that Bernstein spends considerable time on non-financial matters. Specifically, he digs deep into the clear connection between “End Times” prophecies from past centuries and powerful Evangelical movements today. Bible-inspired numerology and prophecy has entranced people for a millennium. Bernstein makes the case that this madness not only follows historic patterns but also represents a current threat. Apocalyptic beliefs linked to what he terms dispensationalist Protestantism infuses our current politics.

Personally, I am somewhat immune to the Asch Effect. On the other hand, I tend to redouble my strongest views in the face of contrary evidence, often to my embarrassment. Which I will now demonstrate for you, in the course of reviewing the goofiest financial trends of 2021. Those trends, with caveats.

Meme Stocks

The Robinhood app and Reddit-Bro inspired investing in “Meme Stocks” like Hertz, GameStop and AMC kicked off in January 2021 with a bang. We should have known then that the entire year would be an unending string of delusions and madness. Most of these rockets have yet to fall to earth as the year ends, again not what I would have expected.

Stop The Game. Stop.

Stop The Game. Stop.Caveat: Spotting undervalued companies unloved by institutional investors was the original plausible investment thesis behind some of these meme stocks. That’s cool but only accounted for the earliest movements toward stock appreciation, before the madness took over.

Cryptocurrency

These are closer to religion than financial bets or investments. The fundamental correct price of Bitcoin remains zero. That’s the same fundamental price as with all the other crypto currencies I’ve ever heard of. Anyway, hundreds of billions of smart investment capital disagree with me. Since approximately 2013, every time I talk to an audience of folks about investing the first question is always “should I/how can I invest in crypto?” My answer is always the same. Something to the effect of I would sooner recommend lighting one’s paper money on fire flying down the highway at 90 miles an hour. But again, I am clearly the idiot in the room. Up until now I have been wrong, wrong, and then wrong again about Bitcoin.

Kevin Roose thought he was joking at first

Kevin Roose thought he was joking at firstCaveat: I (kind of) understand blockchain technology might be the coolest tech since the invention of the selfie-stick. But cryptocurrencies are not the same as blockchain, and I will continue to disparage the former while being open to the future awesomeness of the latter.

SPACs

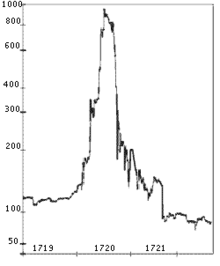

Shall we all invest in an enterprise best described as “an undertaking of great advantage, but nobody to know what it is?” That was the infamous published description of a speculative business advertised around the time of the South Sea Bubble of 1720, a phrase which equally applies to the Special Purpose Acquisition Companies (SPACs) that hit maximum popularity in early 2021.

Picture of South Sea Bubble or really any SPAC you’d like it to be

Picture of South Sea Bubble or really any SPAC you’d like it to beYou put your money into an empty vessel and hope that the named backer finds a private company to take public through purchase. Why wouldn’t you want to put your money into an unknown business that has A-Rod, Sammy Hagar, or Kevin Durant as its backer? Note: That’s both a rhetorical and a sarcastic question.

Caveat: SPAC investors typically get an option to request their money back once an acquisition target gets announced. So, it’s a bit like a free option for the original SPAC backers.

NFTs

Have people entirely lost their minds? You bought a digital thing and you value it highly because there can only be one copy (or a limited number of copies) of the digital thing? And this is worth $1 thousand or $1 million, or $50 million to you?

Caveat: Art collecting is always insane when viewed from a finance perspective. Probably best to just leave it to aesthetics and the phrase “There is no accounting for taste.”

Tesla

There are only so many times I can point out how stupid this stock has been in the past, is now in the present, and always will be in the future, for ever and ever, amen. And at each point in time, I have not only been proven wrong, but proven colossally wrong. Like, it’s the wrongest stock-picking call anyone has ever made in the history of making wrong market calls. I feel really great as Tesla shares have zoomed from a ridiculous $100 billion valuation to a ludicrous-mode $1 trillion market capitalization in less than 2 years. But still: Y’all are crazy. I feel extraordinary conviction on this.

Caveat: I understand the cars are great. I have no problem with the cars. Just the stock, and its price. And it’s bizarre owner, Elon Musk. Him I have a problem with. But again, I’m the idiot, I admit that.

The most common ending to human delusions, financial and religious, is heartbreak. In finance, however, some bubbles serve the purpose of creating the conditions for future economic innovation. After the wreckage of a burst bubble, we can often see in retrospect how the creative destruction was necessary, or at least that it seeded new growth. This will be useful to remember, when the current crazy ends in tears.

[image error] [image error]A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts:

All Bankers Anonymous Book Reviews in one place

Book Review: The Four Pillars of Investing, by William Bernstein

What If You Back The Wrong SPAC?

Post read (8) times.

The post Book Review: The Delusions of Crowds by William Bernstein appeared first on Bankers Anonymous.

December 1, 2021

Fairness in Auto Insurance

What’s a fair way to price auto insurance?

My question begins from a personal financial setback.

My 16 year-old got her driver’s license in August, which I just learned will double our household automobile insurance premiums. We previously paid $678 every six months but will now pay $1,276 every six months.

Yay.

Now I know where I’ll spend the automatic child tax credit that I was so happy about recently.

This new, egregious, pricing is typical for youthful drivers, who are guilty until proven innocent, from the perspective of insurance companies.

Another guilty until proven innocent factor used by auto insurance coverage is credit scores. The worse or thinner your credit, the more you pay for auto insurance. This feels unintuitive. Why should a person with a flawless driving record pay more for insurance if they were late on their credit card bill, or don’t have a credit record? Driving and using credit responsibly are clearly separate skills.

Using credit scoring in insurance products and pricing is an active debate at the federal and state level. New Jersey Senator Cory Booker has proposed banning credit scoring as a factor in auto insurance. Michigan Congresswoman Rashida Tlaib has done the same in the House.

The insurance industry maintains that the historic correlation between lower credit scores and a higher number of claims and a higher dollar value of damage claims justifies the use of credit scoring in pricing.

In June of this year entrepreneur Nestor Hugo Solari moved his startup auto-insurance company Sigo Seguros to Austin and launched a new program in the state, targeting the state’s Spanish-speaking population.

One of Sigo Seguros’ selling points is that they do not consider personal credit scores when underwriting auto insurance. They consider credit-scoring discriminatory, especially against Spanish-speaking Texans. To further appeal to his target audience, the company will not require a traditional state driver’s license either. Customers can provide a foreign driver’s license and still receive coverage from Sigo Seguros, without any surcharge.

The most typical customer for Sigo Seguros, according to Solari, seeks liability-only coverage, and may forgo collision coverage because they drive an older, less-valuable car.

I’ve previously written about this, but from a personal-finance perspective, I favor this flavor of auto insurance. We need solid protection against catastrophic liability. But we don’t need protection against car damage because, for personal finance reasons, people shouldn’t drive valuable cars. Especially, I hasten to add, with a new 16 year-old driver behind the wheel. I decline to insure against damage to my 2009 Hyundai, which has a trade-in value of maybe 2 thousand dollars. At that kind of value, what’s the point of damage insurance? The thing is nearly worthless, on purpose, just the way I like it. So I save a little by declining collision coverage, as do many Sigo Seguros customers.

I asked Solari what his issue was with credit scores. Solari pointed out to me that the Spanish-speaking Texans his company seeks to serve may have thin or no credit files because of recent immigration status or because the community is relatively under-banked, compared to native English-speakers in the state.

I confirmed with my own auto insurance company that they do consider personal credit as one of the factors determining my premiums. Texas insurance rules allow credit scoring as a factor for pricing, in a regulated way, and as long as it’s not the only factor considered. Some states, including California and Massachusetts, have banned personal credit as a factor because of their potentially discriminatory effects.

Other factors also always matter, such as miles driven, car-density as measured by zip code, and of course past driving record.

Nestor Solari

Nestor SolariIn theory, what is a fairer method for pricing auto insurance?

Critics of the use of credit scoring argue that observed driving behavior and driving record is what should count most. They have a point as well.

In recent years auto insurance companies have experimented with telematics, which provide data directly to the companies on your particular driving style, based on a mobile phone app that tracks everything from acceleration and hard-braking to late-night driving and texting-while-driving.

Sigo Seguros offers a discount for customers who sign up to its mobile-phone based telematic system, as a better way to measure driving risk.

I was interested to learn this because I had previously enrolled about a year ago in an app that offers me a discount for letting my insurer track my driving experience. My insurance company’s app even reports to me about my sudden braking as well as my phone use while driving. It’s probably tracking overall miles driven as well.

This kind of driving data strikes me as quite fair, since it measures factors that could increase the likelihood of auto accidents which credit scores, for example, do not. This is the ultimate goal – fairness in auto insurance – based on observed risky behaviors. And fairness is good.

The downside of telematics is that Big Brother – in the form of my auto insurance company – is totally watching me drive around everywhere.

This makes me paranoid about my ability to get away with doing crimes in the future, which is a real negative. On the plus side, I get 3 percent annual savings on my auto insurance premiums!

We are now paying through the nose because of my teen driver. Eventually I will need to rob banks just to pay for the auto insurance, but the auto insurance telematics will increase my likelihood of getting caught for this behavior. A classic Catch-22.1

A version of this post ran in the San Antonio Express News.

Please see related stories:

Yup, My 16 Year-old Got a Credit Card (Need to link here)

Auto Insurance and My Personal Finance Theories

Post read (6) times.

Speaking of Big Brother watching, and as a total aside, I have really enjoyed the idea that Bill Gates can track my every move, ever since I got the Pfizer vaccine against COVID. You know what’s nuts about that worry in particular? We all carry smartphones everywhere! That is the actual tracking device recording all of our movements, people! It’s not the vaccine. Please, for the love of McKenzie Scott and all that is beautiful in this world, get vaccinated if you haven’t already. ↩The post Fairness in Auto Insurance appeared first on Bankers Anonymous.

November 30, 2021

Book Review: The Four Pillars of Investing by William Bernstein

Note: I’m months late in posting this review, which was actually Summer Reading this year. A version of this post previously ran in the San Antonio Express News.

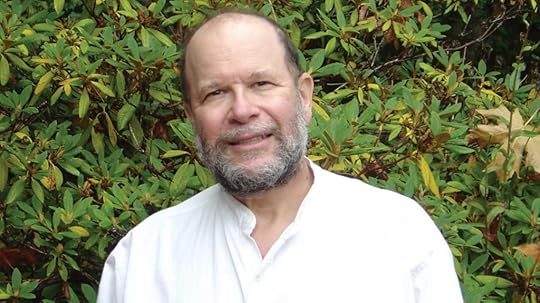

My summer reading book was The Four Pillars of Investing: Lessons For Building a Winning Portfolio by William Bernstein, which traditionally makes the top ten lists of best personal investing books, but which I had never read until this year.

[image error] [image error]Bernstein, a trained neurologist-turned-investment-writer-and-advisor, originally published The Four Pillars in 2002 and then updated it in 2010.

Although I had never read Bernstein’s Four Pillars before this week, I can honestly say that I have, over the years, 100 percent absorbed his philosophical approach to personal investing. There is almost no daylight between what he thinks we should do and what I think we should do. I guess that means I have read many of the other books or papers that underpin his approach. Or that I’ve been reading people influenced by Bernstein. Or maybe just that there is a single objectively best way to go about personal investing and we have independently arrived at the same place. (Honestly I’m sure it’s the first two options, not the third). So, if you were a blank slate and wondering what philosophical approach you should bring to investing – and you really trusted my judgment – then I would posit that you could read Bernstein and therefore know just what I would endorse.

The four pillars of Bernstein’s title are the theory, history, psychology, and business of investing. Bernstein offers a lightning round – a mere 200 pages – describing what you need to know about these four topics. In his fifth and final section he brings together a practical “how to” based on the earlier chapters. Spoiler alert: The “how to” is diversified index funds.

The prose is relatively easy – except maybe parts of the early chapters on investing theory – in which a bit of math could bog down casual readers.

On investing theory, Bernstein says you must expose yourself to risk in order to receive a positive return, markets are more efficient than you think, and that fundamental investing derives from valuing future cashflows with a mathematical calculation that tells you what those cash flows are worth today. All very solid stuff.

Knowing investment history is the key next step. I learned plenty about the development of mutual funds and the origin-stories of firms like Merrill Lynch, Fidelity, and Vanguard, plus deeper histories – always useful – about up-market manias and down-market busts. His history of Vanguard and its role in pioneering low-cost mutual funds is worth the price of admission.

I believe that understanding investing psychology – the problems coming from inside our own brain – is the key to succeeding as an individual investor. Berstein explains the pitfalls of misunderstanding risk, the classic errors of confusing luck and skill, being overinfluenced by the recent past, and finding patterns where there are none.

Finally, understanding the business of investing – the real way in which investment firms earn a living from us – is essential.

There are investment companies and there are marketing companies disguised as investment companies. Bernstein posits that ninety percent are really marketing companies while only 10 percent are investment companies. The majority of investment professionals are focused on sales, not investing. One way you can spot the marketing companies is because they sell high-fee mutual funds, load funds, variable annuities, and other insurance products.

Is The Four Pillars perfect? No.

Many of his stories read like they came from the early 2000s, in the sense of salient anecdotes from the financial world and references to events in the 80s and 90s that only older folks will remember vividly.

One area I disagree with Bernstein is on workplace retirement accounts like 401(k) plans, which he warns are disasters. In contrast I think they are quite beautiful and important.

He writes,

“The ascent of self-directed, defined-contribution plans – of which the 401(k) is the most common type – is a national catastrophe waiting to happen. The average employee, who is not familiar with the market basics outlined in this book, is no more able to competently direct his own investments than he is to remove his child’s appendix or build his own car.”

I worry that people reading his view that they are a disaster would then not take advantage of their tax-deferred workplace investment programs.

The author, William Bernstein

The author, William BernsteinBut I take his point that few people are prepared to maximize their opportunity or to efficiently manage their own investing. Reading one or two classic personal investing books – like his – would go a long way toward correcting this problem.1

Bernstein’s section on investment fees seems outdated to me, in that he’s referencing 2 percent investment advisor fees and the prevalence of front-loaded mutual funds. Don’t get me wrong, these still exist and Bernstein’s main point still stands, which is that traditionally the money management industry charges ridiculously high fees and delivers mediocre results. The trends have improved over the past 20 years and fees, thankfully, have been coming down in some – but not all! – areas of investing.

You could accurately call The Four Pillars a slightly dated book. In an important sense, however, a bit of mustiness enhances the credibility of a personal finance book, to me. It means the book has stood the test of time. It means something timeless and true is being taught, rather than timely but ephemeral.

My own personal Mount Rushmore of investing books were first published in 1999, 1978, 1973, and 1949. They are Simple Wealth, Inevitable Wealth by Nick Murray; The Only Investment Guide You’ll Ever Need by Andrew Tobias; A Random Walk Down Wall Street by Burton Malkiel; and The Intelligent Investor by Benjamin Graham, respectively.

You will gain more from reading one of those books than you possibly could learn in hundreds of hours watching videos, browsing online, or even – gasp! – reading this blog. Bernstein in The Four Pillars makes the correct observation that investment journalism has an inherent problem in that the correct thing to advocate – always and only invest in terribly boring index funds – is the dullest possible story. How can we write headlines with that message day after day? So instead we write endlessly about the improbable and the sensational – the cryptocurrencies and the billionaires. It’s much more interesting to write headlines about Dogecoin and GameStop, despite the fact that these are, or should be, deeply irrelevant to our lives.

I enjoy learning about other finance books I have yet to read, so please feel free to send me your top recommendation – something that improved your relationship with money and investing. Thanks!

ps. My secret ambition is that someday every else’s personal Mount Rushmore of Personal Finance books will include my book, The Financial Rules For New College Graduates.

Please see related posts:

All Bankers Anonymous Book Reviews in One Place!

Book Review: The Delusions of Crowds, by William Bernstein (pending)

Post read (7) times.

I have one other mild critique: I don’t love the way Bernstein explains the math of discounting cashflows. That happens to be an obsession of mine, so I may be overly critical, but nevertheless I didn’t think his math explanations were as clear as they could have been. ↩The post Book Review: The Four Pillars of Investing by William Bernstein appeared first on Bankers Anonymous.

November 29, 2021

Have Some Irony With Your SALT

The Build Back Better Act pushed by the Biden administration and passed by the House last week contains a provision to raise the SALT cap from $10 thousand to $80 thousand.

That’s how ironic it is

That’s how ironic it isThis, for me, is peak irony. Like, Alanis Morissette should henceforth substitute her “It’s like a black fly in your Chardonnay” lyric to instead croon “It’s like SAaaaaaaaLT in Biden’s BBB!” That’s the level of high irony we’re talking about here.

First, some explanation of the SALT cap, which stands for State And Local Taxes deductions cap. Before Trump’s 2017 Tax Cuts and Jobs Act, which is understood correctly as a tremendous tax cut for the wealthy, taxpayers could itemize state and local taxes that they had already paid, and have them deducted from their federal income.

One of the only tax hikes of the 2017 reform was a cap on SALT deductions at $10,000. Before the cap, for example, if a taxpayer had already paid $30,000 in a combination of property and state income taxes, then their federal income would be considered $30,000 lower, for tax purposes. Limiting the SALT deduction at $10,000 would effectively mean that taxpayer owed taxes on $20,000 more dollars. The difference between $30,000 and the $10,000 cap.

Owning the Libs

This was widely perceived at the time as a fiendishly clever way to both raise revenue while simultaneously owning the libs. The libs, the thinking went, pay high property taxes and high state and local income taxes in places like California, New York, New Jersey, and Connecticut. This cap on tax exemptions seemed highly targeted to blue states. Many people’s taxes – particularly affluent libs who pay alot of state and local income tax and property taxes – went up by a lot, starting in 2018.

Now that Democrats run the House, Senate, and White House, they get to write tax policy in 2021. And while the BBB is described as a social spending bill, it is primarily a tax policy document.

The BBB seeks anti-poverty, equality, and climate goals largely through tax policy. Spending on climate is largely through tax breaks for clean energy. Spending on reducing child poverty is through an expansion and changed criteria of the earned income tax credit and the child tax credit. A drive for equality comes through expanding taxes on upper 1 percent and 0.1 percent earners. It’s a tax law through and through.

Not surprisingly, one of the key priorities for Democratic representatives from California, New York, New Jersey, and Connecticut was repealing the SALT cap. It’s not a thing they shouted from the rooftops. But certain key constituents made it clear this needed to get done. Now that BBB passed the House, Republican representatives are shouting it from the rooftops, and they will continue to do so.

This all matters – as most tax issues do – more to higher income and higher wealth people.

If the SALT deduction is lifted from $10 thousand to $80 thousand in the final BBB legislation (all of this is pending a Senate vote) blue-state Congresspeople are happy because every single donor who matters will be affected. They will have delivered for their people.

But we can see a few ironies piling up about the SALT Cap hike.

The bottom line of repealing the SALT cap is that it would be a very big benefit to the wealthy. Substantively, it will cost $85 billion a year in tax revenue. The top 1 percent of taxpayers will get about half this benefit, while the next ten percent will enjoy 35 percent of the benefit. This is all extremely off-brand for the Democratic Party in 2021. It makes an easy attack line for Republicans. Texas Representative Kevin Brady – the ranking Republican on the House Ways and Means Committee and therefore GOP point person for tax policy – immediately began hammering BBB for the SALT cap benefits to the wealthy.

But in Red States Like Texas…

Let’s go further, however, into the ironies. Unmentioned in the critiques of the SALT cap boost are how this will affect Texans for example.

Texas is a very high property-tax rate state, because of the absence of state income tax. In my county, for example, I pay 2.7 percent of market value for my home every year. That means anyone who owns a home worth more than $370 thousand has filled their SALT exemption on property taxes alone. With median home prices now above $300 thousand in my not-particularly-wealthy county, the SALT cap hits a lot of people. A lot of Texas homeowners. While there is not a majority of homeowners who are affected, there will be a large plurality.

Texans pay high property taxes too!

Texans pay high property taxes too!All of this is to say that every Texas donor of means to Kevin Brady is also massively affected by the SALT cap. They are in that sense hoist upon their own petard. You just won’t hear Brady talking about it.

The SALT cap jockeying lays bare an uncomfortable fact of democracy. Namely, there’s a wide gulf between the “voter class” and the “donor class.” Lower income people, even in blue states, are not much affected by SALT caps. Higher income people and people who own valuable property, even in red states, are very affected by SALT.

For my part – my own valuable house and my hefty 2.7 percent property tax rate means I’m very affected. Even though the SALT cap hike is in that sense “fair to me” personally, I still think House Democrats should not have given me this tax break in the BBB.

Even if you revel in the “owning the libs” aspect of the SALT cap, there are further nuances at play. Namely, federalism.

Federalism

In the abstract, Republicans profess to believe more strongly in devolving power to states, versus Democrats who often seek to strengthen the central government at the expense of “states’ rights.” State and local taxation, however, is a key way in which citizens of a state exercise choice, engaging in the “50 laboratories of democracy” aspect of our federal system. When citizens of a state (small d) democratically choose higher taxes in order to, for example, improve health care access, that’s a valid choice. In the broadest sense, the SALT deduction serves as a mechanism for shifting spending and taxation power down to the state level. This again puts Democrats and Republicans in this SALT fight on the opposite side of where they usually land.

It’s just another ironic twist in the upside-down roles of SALT caps.

What happens next? A couple of Senators, Bernie Sanders (VT) and Robert Menendez (NJ), do not like the wealthy skew of the House SALT cap increase, and have plans to limit the benefits to those making less than $400,000 per year. I’m hoping Bernie saves the day.

Post read (7) times.

The post Have Some Irony With Your SALT appeared first on Bankers Anonymous.

November 28, 2021

Welcome to the Metaverse

From the distance of the future, we will remember 2021 as the year the metaverse began to take shape. As the building blocks of this new world come into focus let’s begin with the obvious and timely.

The ultimate Web 2.0 company, Facebook, rebranded itself as Meta this past month to signal that it intends to lead the charge into Web 3.0, aka the metaverse. Meta owns not only Facebook, Instagram, and WhatsApp, but also importantly virtual reality firm Oculus. So they’ve got a nice head start on building this around us.

One the one hand, the metaverse still feels quite science fiction-y. Science fiction writer Neal Stephenson, author of the 1992 novel Snow Crash (which I have not yet read) gets credit for inventing the word.

[image error] [image error]For a glimpse at this future, who among us did not love the movies Tron and The Matrix? And the books Neuromancer by William Gibson, or more recently Ready Player One by Ernest Cline? Sure, there were a few teensy-tiny issues in these fictional metaverses, but surely Zuckerberg will solve these problems on our behalf.

[image error] [image error]From the perspective of metaverse dwellers, what we might call “in real life” or “IRL,” this “flesh and blood” existence has a name. Our corporeal world, as distinguished from the metaverse, shall henceforth be known as the “meatverse.” Is this not perfect? Please, please, can we make the meatverse a thing?

If the virtual world will be called the #Metaverse will the real world be called the #Meatverse?

— Sean Gref(@IAmSeanGref) October 31, 2021

The key transformation from meatverse to metaverse (besides the movement of 1 letter) can be captured by the concept of dematerialization. Future production of goods and services need not be physical or material. They will be digital. We will mostly and increasingly live our whole lives in this digital world.

Long before renaming his company Meta, Zuckerberg was already on an acquisition tear to build our metaverse. He’s got not only a head start, but maybe has built a near-monopoly already. In 2021, Facebook/Meta bought virtual-reality game-maker BigBox VR, and game platform Unit 2 Games, which resembles the Roblox platform, a competing metaverse builder.

In 2019 Facebook bought Beat Games, the maker of the most popular virtual reality game on Oculus. In 2020 they bought Giphy, thought to be useful for building digital advertising. The company also acquired two other virtual reality game-makers Sanzaru Games and Ready at Dawn.

It’s not just the roll-up of VR businesses, but also the deepening and adoption of new technology in 2021 that mark the trend toward the metaverse.

Semi-buried beneath the 2021 hype about cryptocurrencies (which I hate) is the more significant application of blockchain technology (which I acknowledge is probably important.) Blockchains may be crucial infrastructure powering the coming metaverse.

Non-fungible tokens, better known as NFTs and based on crypto and blockchain technology, allow for permanent, private ownership of digital assets in the metaverse. This already means metaverse-ready artwork, which exploded in popularity and prices this past Spring.

All of the hype around extraordinary prices paid for digital NFT artwork indicate that the very real human need for social status and social connection will likely drive construction of the metaverse.

Status acquisition in the metaverse feels poised to only grow exponentially from here. For example, paying $4,000 for a digital (not physical) Gucci bag in the game Roblox isn’t cool, because it can’t be taken out of that single game. But maybe getting an NFT of a Gucci bag in the metaverse will be cool, because it’s transferable across platforms and can be permanently owned for life?

A Gucci bag in Roblox resold for 350,000 Robux or roughly $4,115. The same purse IRL costs $3,400.

— Alexis Ohanian 7⃣7⃣6⃣ (@alexisohanian) May 24, 2021

Remember: this Roblox purse is not an NFT and thus has no value/use/transferability outside the Roblox world-yet it's worth more than the physical one.

Watch this space. pic.twitter.com/m4WjfC1Eq1

To your question, apparently yes, somebody did pay more for a digital Gucci bag in the Roblox game than the cost of a real-life Gucci bag. This is only the beginning of the fun we’re going to have in the metaverse.

This will soon mean metaverse real estate. Will I be able to purchase the coolest meta-mansion and host the coolest meta-parties at an extraordinarily high cost in crypto? Undoubtedly, soon, yes.

But also, do I get to explore Mordor with the realest orcs and achieve my dream of climbing Mount Doom, all while laying safely on my couch? You’re darn right I’m going to do that on a Saturday night surrounded by all of my favorite hobbits. I’ll probably pay a lot in cryptocurrency for a live elven guide too. In a related story, a videogame company just bought Peter Jackson’s visual effects studio for $1.6 billion last week, explicitly to facilitate the building of the metaverse with Lord of the Rings nerds like me in mind.

As you read this, are you under the mistaken impression that none of this applies to you?

Once you understand the narrative and the trend, you will recognize more key elements of the metaverse are assembling before our very eyes. This past year in particular.

The metaverse took a great leap forward in 2021 because COVID forced everyone to interact virtually for months at a time. You wanted to see your friend? You needed to collaborate with your colleague? You had a therapy appointment? Everything we needed to do in person we realized we could do through our screens, virtually. And we have all adapted more or less quickly to it.

I bought a new car in September, a 2022 model Hyundai Elantra. It’s not even close to a high-end car, but the self-driving proto-metaverse features are actually amazing. Automatic steering-wheel nudges when I drift out of my lane. Automatic braking if I come up to close to the car ahead. Immersive sound. I play podcasts that take me anywhere in the outer world. That outer world is represented by a constantly changing 3-D street map on my screen. It’s just a whole different driving feel than my 2009 car of the same make and model. It is not a far leap to think that automated driving or semi-automated driving is just around the corner, extending the metaverse from my computer screen to my windshield.

Soon I will hardly need to interact with the meatverse at all.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Teaching my kid about stocks by talking about Roblox and the Metaverse

My Hyundai Elantra and talking about fund fees.

Post read (9) times.

The post Welcome to the Metaverse appeared first on Bankers Anonymous.

August 24, 2021

Breaking My Own Rules To Teach My Kid

NOTE: I wrote this back in March 2021, the week that Roblox did its direct listing. A version of the post ran in the San Antonio Express-News.

To research the hottest new tech stock, Roblox, I went straight to my highly plugged-in in-house analyst: my eleven year-old daughter. She sat me down on the couch with her iPad and patiently explained to me the user-generated games, the in-app purchases, and the revenues available to both gamers and creators on this gaming platform. After that, we arranged for a $50 investment of her money1 in shares on the first day they became available, Wednesday March 10th.

Roblox!

Roblox!Roblox listed 199 millions shares on the New York Stock Exchange last week2 but did it in a most unusual way: a direct listing, rather than an IPO.

There are at least two innovative things to know about this. One is about the company and the other is about this direct issuance, which I suspect we’ll see a lot more of in the future.

Most companies that list shares on stock exchanges first do an initial public offering (an IPO). An IPO involves investment bankers preparing a “road show” and a consulted negotiation around the issuance price that all new investors will pay. A company doing an IPO typically seeks to both raise new money for the business and to allow private investors to sell some of their stakes in the business.

A direct listing, by contrast, raises no new money for the company. It merely allows privately-held stakes to be floated on an exchange – The New York Stock Exchange in the case of Roblox – to allow insiders a chance to cash out and outsiders a chance to buy in.

Roblox didn’t need new money, in part because it secured $850 million in private financing in January of this year, solving the fundraising part of an IPO ahead of time. Roblox had already ended 2020 with close to a billion dollars on hand, further explaining why it skipped the fundraising part of an IPO. It also saw fourth quarter revenues jump 111 percent from 2019 to 2020, providing the kind of growth tech investors crave. Roblox had cash, name recognition, and buzzy growth, so the road show and fundraising parts of going public were unnecessary.

Until now, direct listings have been extremely rare. Spotify – the audio-streaming company founded in Sweden – is the highest-profile direct listing ever done previously, back in 2018. By direct listing rather than hiring a traditional Wall Street underwriter, a company can in theory save huge bucks, which typically runs between 3 and 7 percent of the money raised. A direct listing not only forgoes the support of a new issuance, it skips the marketing hype that accompanies a traditional roadshow. In the case of Spotify as well as Roblox, they didn’t need the marketing hype. Among their customers and within their own industry, they are dominant providers. And by all appearances, the shares didn’t do worse as a result of a direct listing rather than a traditional underwriting process. Roblox soared 54 percent from its initial listing price on the first day.

This direct listing method is all pretty new stuff.

The New York Stock Exchange moved in the direction of allowing more direct listings through a request to the SEC in 2019. In December 2020, the Securities and Exchange Commission approved direct listings (under certain conditions). The Roblox listing last week is the first high profile test of this way companies can reduce their Wall Street fees and, given its success, we should expect more companies going public to choose this route in the future.

Meanwhile, Roblox itself is innovating in other ways. For better and worse, they have mastered the art of capturing kids’ attention with their immersive-world game platform.

For the past year and a half – during COVID isolation from school and ordinary interactions with other humans – Roblox has occupied more of my daughter’s time than any other single activity, except maybe sleeping. Even the sleeping part is arguable when lined up next to Roblox time.

You may be curious, what does she do on Roblox? It’s virtual-reality games. Her favorite game, “Adopt Me,” is about adopting a pet. And then upgrading that pet into the most stylish and unique pet possible. Her latest acquisition last week, a golden unicorn via a hard-earned golden egg, was incredibly exciting, apparently. You had to be there. Other games within the virtual reality involve heists, escaping burning buildings, or avoiding a killer. Normal stuff kids are into, I guess.

The Roblox company, as a games platform, facilitates user-generated content, meaning gamers can invent their own games. For that, designers receive either virtual dollars or real dollars. In real dollar terms, over a thousand game designers have earned more than ten thousand dollars in the past year on the Roblox platform. That may not support a family, but to an eleven year old that amount of money seems incredibly enticing.

Through the course of this column, I have described breaking at least three of Mike’s Cardinal Rules of Investing, so I briefly just want to acknowledge these and then explain my rule transgressions.

First, I don’t recommend you buy individual stocks. For kids, however, I do think purchasing individual stocks is useful for teaching and learning purposes. Individual stocks for companies they know can get them excited about the magic of investing, capitalism, markets, and compound interest. It’s just too darn boring and abstract to explain low-cost diversified index funds to an eleven year-old, even though that is how all of us should always invest.

Second, I never write about individual stocks I own (or that my family owns) because I don’t generally own any and also I don’t want even the appearance of a conflict of interest between my writing and my family finances. So I broke that rule also today. To which, in my defense, I can only plead with you to believe that I have not sold my journalistic soul to shill and pump up my eleven year-old’s $50 stock investment. To be clear, in no way do I recommend Roblox shares for any of you. This thing is probably going to zero. Which would be a great educational outcome for her! She might cry, but I would be happy, because $50 is a very cheap lifelong lesson from Daddy on the risks of owning individual stocks!

Finally, I always recommend against buying new listings – traditionally IPOs – for a variety of prudent reasons having to do with information disadvantages, media hype, and the greedy exuberance of insiders selling to a credulous group of outsiders. Please excuse my rule transgressions today, they were each done with an educational purpose.

Please see related post:

Post read (7) times.

If you’re wondering how to invest just $50 in shares that each cost $65 on the first day of trading, the technical answer is the investing app known as M1 Finance, which allows for fractional ownership of shares and about which I wrote a thing here in December 2018. ↩ Again, not exactly last week, but in March 2021. ↩The post Breaking My Own Rules To Teach My Kid appeared first on Bankers Anonymous.

August 17, 2021

Precious Metals Investing Warning

The Texas State Securities Board notched a victory for the good guys this spring, and there was a April 30 deadline to file a claim if you’d been a customer of Metals.com.

I sincerely hope you were not a customer of that company – which also went by the names Barrick Capital, Tower Equity, and Chase Metals – and which since I last wrote about them has had a terrible, no good, very bad, year.

Texas began to blow the whistle on them in May 2019. Since then, 29 other state regulators and the federal commodities regulator filed an administrative action, causing Dallas federal court to shut them down last September. The court appointed Dallas-based receiver Kelly Crawford to liquidate assets to attempt to recover something for victims. Crawford has set the April 30th deadline.

According to the administrative action, the scheme involved at least 1,600 victims and $185 million, of which 1,300 were elderly and $140 million was from their retirement accounts.

Customers of Metals.com and related companies believed they were safeguarding their retirement by purchasing precious metals as investments. Representatives of the companies specifically tapped into fears among elderly retirees of imminent losses – due to government conspiracies, devalued currencies, and seized retirement accounts.

According to court filings, the companies sold precious metals at 100 to 200 percent markups, ensuring investors a huge loss upfront.

Regulators allege that when challenged on the value of their portfolios by clients, company representatives either lied about the precious metals’ resale value or claimed the difference in prices reflected some unusual scarcity of the particular metals in question. Unfortunately, investors had locked in losses from the very beginning.

Regulators allege, and previous investigations show, that the company chose their victims carefully.

“If someone says they don’t like Hannity just hang up”

“If someone says they don’t like Hannity just hang up”An online advertising pitch from the companies claimed “liberals are seeking to siphon money from successful Americans,” and misleadingly represented the companies’ affiliations with Fox News and the Republican Party. Phone pitches followed the collection of online leads.

Salespeople for the company, according to an earlier investigation by Quartz.com, would claim “I don’t know what your religious beliefs are, but I’m Christian. Did you know there are 700 references to gold and silver in the Bible?” According to an Alabama State Securities Commission filing, one investor found the Metals.com website through a website claiming that Fox television host Sean Hannity believed the stock market would decline. According to the Quartz investigation, a former salesperson for the company was told “if someone says they’re liberal or they don’t like Hannity, you just hang up.”

In this manner they carefully selected their victims, who became predisposed – via identity-affiliation – to believe in the precious-metals-as-investments pitch.

Travis J. Iles, Securities Commissioner for the TX State Securities Board, says Texas brought the first administrative action against the companies, in May 2019. “We really were the bellwether in identifying this issue and bringing it to the attention of other state and federal regulators.” From there, the Commodity Futures Trading Commission, the federal regulator for metals trading, coordinated with state regulators to track and prosecute the companies nationwide.

Iles is proud of Texas’ leadership in the matter, but he also emphasized that enforcement was a team sport involving the feds and 29 other states. Says Iles, “I’ve been doing this type of enforcement work for 20 years, and I can’t remember a more collaborative effort in an enforcement action. Texas is very proud to have had the opportunity to have raised the alert and to assist our teammates in this regulatory area.”

Although enforcement against the two individuals previously running the companies is not resolved yet, Iles noted that “the matter is ongoing as it relates to the individuals.”

“The receiver reports liquidating high-end automobiles, office equipment and recovering bank funds late last year from the primary owners of Metals.com. The receiver warns that customers will unlikely recover their full investment. Unofficially, they may only receive pennies on the dollar.

This may all sound like a boring and cruel scam. And it is. But if you’d like to liven up the narrative, you can see what one of the two named leaders of the Metals.com companies has been up to lately. Look up #LucasAsher on Instagram, and his postings under the further hashtag #OmertaComplexFamily. There you will see hints of where the money might have gone, although I’m admittedly speculating there. Maybe he has plenty of money from other sources, and isn’t spending any Metals.com money on the skydiving, Porsches, helicopter rides and the James Bond-lifestyle that he Instagrams about. 1

https://www.instagram.com/p/CDemPUFgkUF/?utm_source=ig_web_copy_link

What’s interesting to me about the Metals.com story is how closely it resembles non-criminal methods for selling the same products to similar audiences. The normal markups may “only” be 5 or 20 percent on precious metals, but the fear-mongering is similar. The way to sell these bad products is to tap into irrational fears, appeal to conspiracies, and lie about intentions. The idea that precious metals are an appropriate investment for individuals’ retirement accounts – or any investment account at all – is itself, essentially, a fraud.

The conspiracy theories and polarized identity-appeals are necessary because it is certainly not possible to pitch gold and silver on the merits of their long-term returns. Which are terrible.

To keep it simple, let’s look at annual returns of the most commonly cited precious metal, gold, versus a basket of stocks, the S&P500, and adjust for consumer price inflation in both cases. This allows for comparing “real” returns on investment.

Using these terms, the 10 year returns on gold and stocks are 15 percent and 257 percent respectively, from March 2011 to March 2021. That’s obviously terrible for gold. It gets worse.

The 30 year returns on gold and stocks are 174 percent and 1773 percent respectively.

The 50 year returns on gold and stocks are 654 percent and 15737 percent respectively. Essentially, in a little longer than my lifetime, you could have either turned your $1 into $6.54 or into $157.37. You choose! This does not take into account storage costs for gold, which would further erode its usefulness as an investment asset.

It is always possible with any volatile asset like precious metals to find temporary time periods of outperformance. The longest time frame is always best for evaluating an asset. The longest run return on gold is pathetic. Other precious metals will be similar, again allowing for short-term fluctuations.

In the Metals.com case they are alleged to have stolen the money upfront through massive markups in price. In the rest of the precious metals sales industry for gold and silver, they are siphoning your money over longer periods of time, as precious metals produce no wealth. Meanwhile you give up the opportunity to have invested in something real, that would grow your wealth over time.

When you buy precious metals from legal “legitimate” sellers there’s no receivership at the end that can partially reimburse you for your losses. There’s no civil enforcement action. You have only yourself to blame.

I realize I will convince precisely zero of you gold bugs of this view, but the long-run returns on precious metals are so obviously bad that the whole enterprise can only have been built on cynical salesmanship, conspiracy theories, and crackpottery.

A version of this post ran in March 2021 in the San Antonio Express News.

Please see related posts:

On Metals.com, the short con and the long con

Coins fine for collecting, terrible for investing

Texas builds it own Fort Knox to store gold because…Texas

Post read (9) times.

You should seriously click on the instagram link and spend some time on this fraudster’s supposed lifestyle. ↩The post Precious Metals Investing Warning appeared first on Bankers Anonymous.

The Great Biden YOLO

President Joe Biden pitched a pair of new federal spending and taxation bills on a scale rarely seen, intended to have transformative effects on the economy and the role of government in the economy.

The $2 trillion American Jobs Plan infrastructure spending plan includes rebuilding physical infrastructure such as roads and bridges along with federal boosts to workforce development, in-home care, and domestic manufacturing.

The $1.8 trillion American Families Plan includes targeted tax credits and education spending to benefit middle and lower earners as well as a plan to raise revenue through higher corporate taxes and taxes on higher earners and holders of wealth.

President Biden

President BidenIf the twin proposals pass with narrow Democratic majorities in the House and Senate, it will herald changes of a piece and on a scale with Lyndon Johnson’s Great Society.

I’m asking myself three questions about these plans. I figure I’m unlikely to sway your fixed opinions either way, but here goes. My three questions are:

Is massive federal government stimulus spending on infrastructure a good idea right now?

Are higher taxes on corporations and wealthy households, combined with targeted tax breaks on lower earners a good idea right now?

Is increasing the federal debt by an additional $4 trillion a good idea right now?

Each of these three questions can be further considered on economic terms, political terms, and moral terms. As a citizen, I’m interested in all of these questions, on all of these terms.

Let’s start with the plan for massive infrastructure spending at this moment in the economic cycle. It’s surprising.

What I mean is that in a sluggish, ailing economy – with let’s say above 10 percent unemployment like the Great Depression or even the Great Recession following 2008 – a massive government stimulus push makes tremendous sense. That’s basic Keynesian economics.

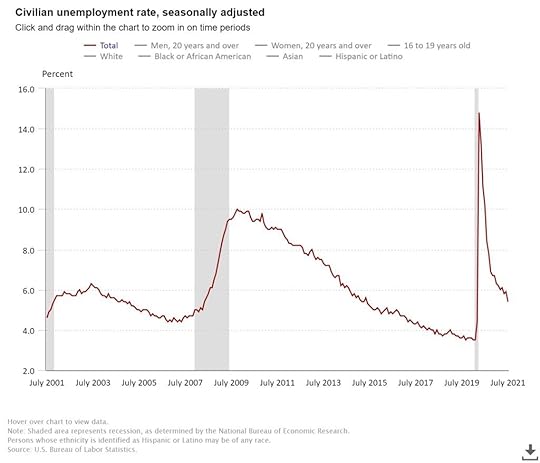

We’re not in that zone right now. The July 2021 unemployment rate was 5.4 percent. Yes, that unemployment rate is still worse than pre-COVID levels (3.5 percent unemployment in February 2020) but we also haven’t even fully re-opened the economy yet.

Vaccinations, herd immunity, and the resumption of economic normalcy may naturally get us back to the relatively roaring economy of pre-COVID February 2020, without any further federal stimulus. The stock market is hitting new highs every week. (Yes, I know the stock market is not the economy, but it is a highly visible leading indicator, which is why we refer to it). Real estate prices are, in general, on fire. (Yes, housing is also not the economy, but it is an important and visible subsector of it.) And the latest GDP number was 6.4 annual growth, higher than normal trend. A massive stimulus bill right now feels, at the very least, unprecedented. I harbor strong doubts about the size and the timing of this one.

Unemployment through July 2021

Unemployment through July 2021What about the American Family Plan for higher taxes on corporations, higher earners, and capital gains taxes? I am here for it. I mean this more as a moral statement than an economic statement, since inequality is a leading problem of our time. But I also think it’s ok economically. First, because we need the additional revenue. Second, because the tax changes merely roll us back to times when the economy also grew strongly under higher corporate and upper income rates. Third, because tax rates and tax policy should alleviate, not exacerbate, inequality.

And the child and family support measures? I believe in expanded pre-K and community college access both morally and as an economic measure. I think poverty alleviation similarly has both moral and economic benefits, and we need to do more of those as well. We’ll be both a richer society and a better society for it.

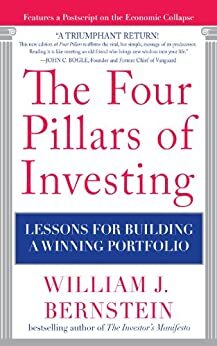

Finally, what about expanding federal debt by $4 trillion more right now? Phew. This is the craziest part of the conversation. A conversation that we’re kind of not even having. Republicans blew their authority and credibility on the issue of fiscal responsibility long ago.

If Biden gets this passed, it will mark a wholly different direction than the Clinton and Obama presidencies. Despite what critics said at the time and after, the Clinton administration prided itself on shrinking government. They actually balanced the federal budget and set a course for retiring federal debt. That seems forever ago but it was merely the year 2000. In that same spirit, Obama politically hamstrung his signature health care legislation by requiring that it pay for itself and not increase the federal deficit. In hindsight, this lack of generosity probably doomed it in the eyes of the many who needed it most.

After a career in Congress built on being a deficit hawk, Paul Ryan shepherded a unified Republican Congress and Executive Branch to pass a $1.5 trillion tax cut in 2017, a tax cut that overwhelmingly favored upper earners and corporations. This is the opposite move than a real deficit hawk would make, but Ryan just YOLOd his own reputation for those sweet tax cuts.

When the W. Bush and Trump administrations massively increased federal debt despite the Republican party’s claim to favor fiscal responsibility and limited government, Democrats seemed to have internalized a whole different approach to government debt. Democrats are no longer willing to self-limit as they did in the past. At this point they are daring the cowards and hypocrites in the Republican party to stop them.

I honestly don’t know what to think about $4 trillion in additional deficit spending. We’re in total YOLO territory. It feels like the Washington DC version of lots of things I don’t understand about money in 2021, like GameStop, Bitcoin, SPACs, and NFTs. The assumptions we long held about fundamentals and financial gravity don’t seem to hold anymore.

“It’s different this time” are frequently called the four most dangerous words in finance. It’s been different for a while when it comes to deficit spending, as the laws of financial physics are seemingly suspended. I don’t get it. I continue to worry about gravity.

A version of this post ran in May 2021 in the San Antonio Express News.

Please see related posts

Paul Ryan wrecks his reputation on the way out the door

Post read (5) times.

The post The Great Biden YOLO appeared first on Bankers Anonymous.