Michael C. Taylor's Blog, page 14

October 21, 2019

Transparency part I – Texas Legislator Pay

I have a civics quiz for Texans: Do you know what your state representative or senator gets paid?

If you answered with the official $7,200 salary per year — only five states pay less — you only get partial credit.

If you added in the $190 per diem for 140 days while the Lege is in session every other year — which can add up to $13,300 per year — you’re getting warmer.

TX Capitol Building

TX Capitol BuildingTo find the real answer, you have to understand the fine print of their pensions, following retirement from the Legislature.

We’ll get to all that, but first, let’s acknowledge their pay is too low.

The five states with lower legislator salaries than Texas — New Mexico, New Hampshire, South Dakota, Vermont and Wyoming — have tiny populations. Houston and its surrounding suburbs have a higher population than those five states combined. In terms of budgetary power and economic decision-making by the Legislature, the low salary of Texas lawmakers makes little sense.

We all seem to be getting a deep discount on Texas legislators. I don’t think that’s a good thing.

When you systematically underpay, you often get one of two results, or both. Either you attract only wealthy people for the job — not a perfect result — or you attract people seeking to take financial advantage of their position — an even worse result. I think people should be paid fairly, in a straightforward way.

The lack of straightforwardness is the real problem in Texas.

So now we have to dig a bit deeper into how lawmakers get paid by unpacking the myth, the Texas Constitution and the reality.

Myth

First, the myth. This probably derives from some Jeffersonian ideal in which the gentleman rancher unbuckles his spurs, wipes the mud off his boots, and joins the august and deliberative bodies in Austin for four months every two years. In that world, which no longer exists — if it ever did, which it probably didn’t — pay is irrelevant to that rancher who derives his true living from the rich soil on the banks of the Brazos.

What TX Legislators would like you to picture: The Gentleman Rancher-Legislator

What TX Legislators would like you to picture: The Gentleman Rancher-LegislatorSecond, and more important, the Texas Constitution clearly states that pay raises for legislators must go to a public vote. Strategically speaking, lawmakers avoid making themselves an easy target for cranky Texans wanting to vote their displeasure with Big Gummint. As a result, lawmakers’ salaries stay low to avoid the risk of a public spanking.

Third, and here’s the real point, legislators are often paid quite generously, just in a roundabout, somewhat-hidden-from-voters kind of way.

You see, their real compensation is in the friends they make and the heartwarming lessons they learn along the way. Just kidding — that’s the moral of my imaginary children’s novel.

The Reality

Their real compensation is their pension, which is tied to the salary of state district judges, currently $140,000.

To be more specific, legislators qualify for guaranteed annual pension payments of 2.3 percent of $140,000 for every year served. They can also accrue years of service in other state pension systems, as well as for military service.

So, for example, eight years in the Legislature qualifies a retired state lawmaker for a guaranteed pension of $25,760 per year for life, starting at age 60. A 60-year-old woman has an average of 24.5 years of life remaining. By making some assumptions, including a 3 percent discount rate, a finance guy like me calculates that guaranteed annuity is today worth $436,259.

The financial deal is better if the legislator starts serving at an earlier age and retires earlier as well.

A 50-year-old man with 12 years of service in the Legislature could retire with a guaranteed $38,640 per year. Because, again, that’s 2.3 percent times $140,000 times 12. With a life expectancy of 29.6 years and a 3 percent discount rate, the 50-year-old former lawmaker could receive payments over the next 29 years with a present value of $816,534.

These aren’t outrageous windfalls, and I’m not saying it’s undeserved pay. But it’s not nothing, either. It’s fair pay — just paid after retirement rather than during service in the Legislature.

The ingenuity of tying retirement pay to state district judge pay is twofold. If legislators want to give themselves a pay raise in retirement, they just raise the salaries of judges, which they did in 2013 when they bumped them to $140,000 from $125,000. Second, that pay raise doesn’t have to go in front of Texas voters as the constitution mandates. Sneaky!

My main objection is that we end up with a myth of the citizen/legislator, without acknowledging this is a full-time job that requires full-time pay. Also, we should be able to look at a salary and understand what folks are actually paid.

In my view, the system isn’t necessarily overly generous — it’s just opaque. Opacity serves legislators well but the public poorly.Finally, since my kids go to public schools and public school teachers always go begging for more funds, I have a bomb-throwing legislative proposal for this session: Instead of tying legislator pensions to state district judge pay, we should tie their pensions to teachers’ salaries. Can we all take a moment to imagine what would happen?

This post previously ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Transparency Part II – Income Taxes

Transparency part III – Salary Transparency

Post read (4) times.

The post Transparency part I – Texas Legislator Pay appeared first on Bankers Anonymous.

October 18, 2019

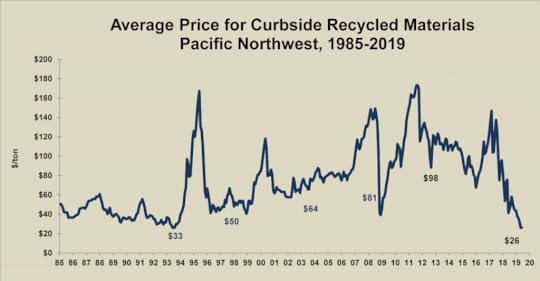

Broken Recycling Markets – Part II Commodity Prices

Industrial recyclers of household products such as paper, plastics, metal and glass are having a terrible, horrible, no good, very bad year.

Typically they get paid by cities to haul and process recyclable waste. But they also earn money from selling valuable commodities they extract from this household waste to industrial users. These commodity markets are in a slump.

A China policy change announced in 2017 – called the “National Sword” – banned a number of types of recyclables from importation. Mixed, and otherwise difficult-to-recycle paper, plastics and metals which US recyclers previously shipped across the Pacific Ocean nearly ceased, by 2019 dropping to about 1% of their previous volume. Without an easy market to sell to, parts of the US commodity markets have been in price free-fall, a period of re-adjustment, or just broken.

The effect of this slump for secondary commodity market is both financial and environmental.

Although much of the reporting on the China ban has focused on plastics, the biggest effect financially for the nation’s second largest recycler Republic Services has been on paper products, according to Peter Keller, Vice President of Recycling Markets for Republic.

Paper makes up 75% by volume of what Republic receives from household bins and traditionally sells to wholesalers. Partly because of China’s changes and other factors, this market has tanked in the past two years.

Recycled cardboard used to sell for $200 per ton but now goes for $30 per ton. In addition, households now recycle small cardboard boxes from Amazon, which many recyclers are ill equipped to process, compared to the flow of larger cardboard from retail stores just ten years ago. They recover less, and get paid less, for cardboard than in the past.

“Mixed paper,” a catch-all product that used to sell for $110 per ton in 2017 now costs negative $5 per ton. In other words, a recycler like Republic has to pay a wholesaler to take the tons off mixed paper they process off their hands. What used to be a source of profit is now a source of loss.

Interestingly, a third paper product used to be newsprint. With the national decline of the newspaper business, demand for newsprint has dried up. Your soon-to-be recycled newspaper – perhaps the paper you’re reading from now – now goes into the “mixed paper” stream, with limited-to-negative monetary value today.

I puzzled for a while over how to make a grim metaphor combining the challenges facing the newspaper industry, something about training your new puppy as the best secondary use of my newspaper columns, and overlaying that with the declining value of newsprint as a commodity. I couldn’t manage to make it funny though, so let’s move on.

Secondary metal continues to be a solid B+ student of an otherwise failing recycling class. Bundles of clean soup cans that contain steel command secondary prices like $120 per ton, down from $150 per ton a few years ago. Bundles of clean soda cans that contain aluminum command secondary prices like $1,050 per ton, down from $1,400 per ton in 2017. At these still-relatively high prices, even though soup and beverage cans do not make up the majority of your recycling bin, they can be a significant driver of the overall profitability of a recycling program.

Finally, there’s glass. For a long time now, glass has been the class trouble-maker of the four materials in a recycling bin. While glass is somewhat infinitely recyclable, producing new glass from scratch (well, sand) is generally cheaper than using recycled glass materials.

From a commodity-markets perspective, it is puzzling then that the City of Houston reintroduced curbside glass recycling after a three-year hiatus, to some fanfare, in the beginning of 2019.

Glass that comes through a traditional curbside bin has a negative value of $10 per ton, according to Keller.

Secondary glass is only financially viable as a recycled commodity when sorted carefully by color and somehow cheaply transported to a nearby glass manufacturer, if one exists. According to Keller, if the glass could be cleaned, color-sorted, and delivered to a manufacturer, it could fetch as much as $100/ton. But getting to that result costs too much money.

When glass comes in mixed from a household bin, by contrast, it’s not saleable for a profit, it costs a lot to move because of its weight, and it often contaminates other recycled materials. Think paper products with tiny glass shards. Now how much would you pay? So it’s a loss maker.

Sarah Mason, the Division Manager for Recycling at Houston’s Solid Waste Management Department, defended Houston’s decision to reintroduce glass to me, saying the City’s new recycling partner has custom-built its facility to handle glass more efficiently, hopefully reducing the contamination problem.

And then there’s plastics, which have garnered 95% of the headlines but which constitute about 7% of Republic’s revenue stream.

Even after the China policy change, three types of plastic still have a viable wholesale commodity market, and these markets track the plastic number you’ll find marked on your household plastics. In brief, numbers 1, 2, and 5 still command decent prices as long as they can be separated and processed cleanly. Plastic #1 – your basic single-use water bottle, can be sold for $250 per ton now, down from about $325 a few years ago. Plastic #5 – consisting of heavier plastics – has stayed steady at $150 per ton, while plastic #2 made up of milk jugs and detergent bottles is actually up slightly in some markets.

Other plastic numbers are virtually un-saleable at any price as a secondary commodity following China’s policy change, and will go to a landfill.

All of these prices should be understood as varying geographically as well as varying by purity. A recycling processor that can produce a homogenous ton of product will command high prices, while a mixed or contaminated product will sell for less, if it will sell at all.

Everyone I’ve spoken to in recent weeks expresses the hope that as technology and markets change, some of the broken parts of the recycling market can improve and heal. New and better sorting technology at the recycling processing plant can turn previous trash into viable secondary commodities, although it may take a combination of capital investments, time, and improved engineering to get there.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts

Recycling Commodity Market Slump Part I – The China Ban

Recycling Commodity Market Slump Part III – The Price of Commodities (upcoming)

Recycling Commodity Market Part IV – What is a Household to do? (upcoming)

Organic Recycling in my city – My new obsession

Post read (6) times.

The post Broken Recycling Markets – Part II Commodity Prices appeared first on Bankers Anonymous.

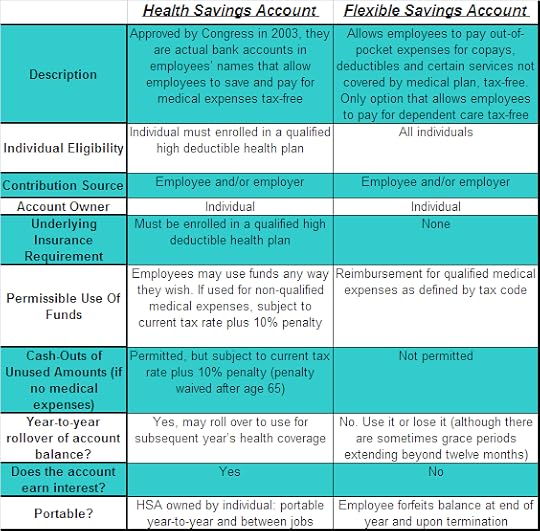

Health Savings Account For Super Savers

We’ve been doing this health savings account thing wrong for

a while. I’ll tell you about what we have been doing, but then also what I

learned about that I wish I could have been doing.

I realized all this recently when it came time to pay for my

14 year-old’s braces.

Our FSA account

Fortunately, I thought, we had some money contributed to my wife’s employer-sponsored flexible savings account.

The nice thing about the flexible savings account (FSA) is

that we contribute pre-tax money to the account, which ends up reducing our

family’s income tax bill. As the employer website explains, “In most cases you

save about 30% on your Federal taxes. The average tax savings for a person

earning $50,000 who contributes $2,000 into an FSA is approximately $600.” Now,

$600 is cool.

Not my actual daughter’s mouth

Not my actual daughter’s mouthBut then there’s the not-so-cool thing.

This account is labeled “use it or lose it.” That means we

have to spend it within a year, or the money is permanently lost. As the plan

says “Any amounts you do not use throughout the plan year…will be forfeited.” That

is…not cool.

Since we knew we had multi-thousand dollar orthodontist

expenses on the horizon, it made sense to contribute to the FSA account this

past year. Without that, or some other known multi-thousand dollar expense, it

would be hard to recommend the FSA.

This is the kind of complexity only bureaucrats locked in a

room who never see the light of day, or the way actual people think about money,

would appreciate.

“Use it or lose it” is a terrible way to save money and I

highly doubt we’ll go back to the FSA after this year, except I suppose in the

year when daughter number two needs her weird teeth fixed as well.

For the curious, I learned the reason for ‘use it or lose

it.’ Employers keep unused FSA funds to supplement occasional losses they incur

when employees pay for health expenses but then leave their employment before

fully repaying money spent. But even though I understand it, I don’t have to

like it.

Super Savers like the HSA

Super Savers like the HSABut in the course of learning about our not-so-great FSA plan, I got to learn about why sophisticated finance people swear by a different kind of tax-advantaged account used for health care costs.

The Account For Super Savers: HSA

Wise financial folks – especially a category we could call

“super-savers,” consider the Health Savings Account (HSA) a powerful

tax-advantaged savings tool, up there on par in the priority list for

tax-efficiency with things like Roth IRAs. I hadn’t previously understood why,

but now I know. Here’s what I learned.

For starters, you may only be eligible for an HSA with a

high-deductible health insurance policy. If you are eligible, you could

contribute up to $3,500 yourself, or $7,000 for your entire family, per year.

Contributions are considered “pre-tax,” meaning the up-to $7,000 reduces your

taxable income by that amount in the year you contributed. Not only that, but

in the fine print of HSAs you learn you get to save on FICA taxes (Social

Security and Medicare) as well for your contributions, which you can’t do with

IRAs contributions. So in that way at least it’s more tax-efficient than a

traditional IRA.

Side-by-side comparison of HSA and FSA accounts

Side-by-side comparison of HSA and FSA accountsContributed funds can be invested in a way similar to the

way IRAs can be invested. Like stocks and mutual funds and things like that.

But here’s where HSAs become more powerful than expected,

because of two rules. First, there’s no time limit on when you withdraw the

money. If you’re lucky and healthy and don’t need to withdraw funds for years

or even decades, it theoretically grows in your tax-protected account for all

that time. You can decide to pay for medical stuff this year, or you can

instead elect to pay for medical stuff with cash and allow your HSA balances to

grow. Just keep your receipts for later. You’ll see why that’s something to

consider, in just a moment.

Second, when you finally do withdraw funds for a medical

expense, withdrawn money is tax free again. This is big. That’s not how

retirement accounts like traditional IRAs work. With retirement accounts you pay

taxes either on the way in or on the way out. With HSAs, for qualified medical

expenses, you don’t pay any taxes on the way in or on the way out. That tax advantage

alone makes the HSAs, in their own small way, cooler than regular retirement

accounts.

Now, we can safely assume that we all have some medical

expenses in our elderly future, so we will likely be able to use the money in

the account some day.

A Hidden Retirement Account, But Better

But even if you don’t have many medical expenses, there are even more goodies. The HSA actually is a hidden retirement account. That’s because after age 65, you can withdraw funds for any reason at all, without penalty. You might want to just go back and read that phrase again. Any reason at all. So, after age 65, it is just like a traditional IRA. And if you withdraw after age 65 for medical expenses, it’s better than an IRA. What’s the downside? Basically none, except tracking medical receipts to match up account withdrawals with qualified expenses.

For super-savers, people who have plenty of income and want

to take full advantage of eligible tax reduction strategies, this is the way

they do it: They contribute the maximum amount to their HSAs, investing money

for the long run. As health costs come up, they pay out of pocket and

accumulate the receipts for expenses. Years later, even decades later in

retirement, they decide to make payments on the old receipts out of the HSA. Remember,

those withdrawals are tax free.

This HSA is triple tax free – tax-free on the way in,

tax-free growth for years, and tax-free on the way out. The more you contribute

and accumulate medical expenses that can be reimbursed, the more that lump sum

of money upon withdrawal can be a clever tax-reduction strategy for retirement.

For this reason, super savers believe you should maximize your HSA before you

maximize your 401(k) or 403(b) plan.

The HSA is a super-charged tax-advantaged account, not just

for health, but for retirement as well.

It turns out, my wife’s employer does not have a high-deductible health insurance plan, so we have not been eligible for an HSA this whole time. But if you’re eligible, now you know what to do.

A version of this post previously ran in the San Antonio Express News and Houston Chronicle.

Post read (9) times.

The post Health Savings Account For Super Savers appeared first on Bankers Anonymous.

October 17, 2019

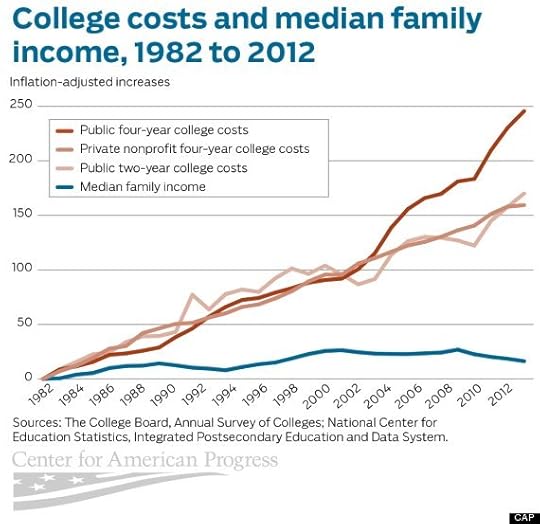

Free Community College Movement

My oldest daughter began 9th grade which means I have entered the parental demographic officially known as: “Sweet Mother of Mercy How Does Anyone Afford To Pay For Their Kids’ College?”

Some of my parent friends will only join this important

parental demographic when their own kid enters 12th grade. But I’m

precocious and forward-thinking about money. So I expect to breathe deeply into

this paper bag here, continuously, for the next four years.

Against what seems like unrelenting bad news about the rising cost of college education comes a new trend from cities and counties with a seemingly radical, yet practical, idea: What if community college – an Associates degree or the first two years towards a Bachelor’s degree – were free?

A Trend In States, Counties

In Texas, Dallas County Community College District first began a “Promise” program a few years ago to low- and medium-income families. The “promise” is that they could access “last dollar” funding to make college affordable, or even free. That means that after Federal and State tuition grants, for qualifying families the Dallas Community College District would promise to make up the difference. Two years of college in Dallas is suddenly affordable and free.

Dallas enrolled their first cohort in the Fall of 2018. Eric

Ban, the Managing Director for Dallas Promise, reports a 35% uptick in Dallas

Community College District enrollment following the rollout, a higher retention

rate from one semester to the next, and a 6% increase in enrollment by students

from the highest poverty high schools in Dallas County.

Dallas County was early onto a nationwide trend. David Deming, in his recent article for the New York Times “Tuition-Free College May Cost Less Than You Think” argued that shifting already-existing federal resources can make post-secondary education much more broadly affordable.

Free community college is not a small experiment happening

in a few cities, but a nationwide trend. Dallas’ Eric Ban says his program is

working with other major cities in Texas, including Houston, Fort Worth, and

Austin.

In my city of San Antonio, we’re about to learn whether leaders can achieve this radical yet practical mission of making the first two years of college free. Dr. Mike Flores, Chancellor of Alamo Colleges District, has studied the Dallas County example as well as trailblazers in Knoxville, Tennessee. His Alamo Promise plan aims to boost college enrollment and college completion rates while providing this gap funding to families that need it.

The really shocking financial number, based on the Alamo

Promise presentation, is how affordable this program is for cities and

counties. Year 1 would cost city and county budgets just over $300,000. Even

fully ramped up by Year 5, the Alamo Promise program would cost $7.5 million in

city and county funds, while serving an additional estimated 6,350 students.

For those of you at home who are quick at math, you’ll

notice the net local public cost per additional student is just over $1,100.

What fresh financial wizardry is this? That seems way too low!

The Surprising Affordability

I’ll let you in on the magic trick. The Alamo Promise plan – like the Dallas and Knoxville plans – leverages federal and state dollars to the maximum. It pays for the ‘last dollar’ needed by families, who will have already qualified for up to $6,000 in federal Pell grants and Texas Public Education Grant (TPEG) money. By doing this, the community colleges can legitimately tell prospective high school graduates: College is free. Please apply.

San Antonio Mayor Ron Nirenberg says the city supports Alamo Promise.

Says Nirenberg, “the plans we are working on are to identify

funding that will be sustainable and allow Alamo Promise to be perpetual. It

will take commitment from the public and private sector, but even at full

flight, its relative expense is pennies compared to investments we made as a

community routinely.”

A key point of announcing free community college in Dallas

and San Antonio and other cities is clearly signaling. Specifically, they are

sending a message to low- and middle- income families that funds are available,

that this is doable, and that the city and county and the community colleges

will make up a family’s funding gap.

A major barrier to a college education – likely the biggest

barrier – is money. And by money, I actually mean in at least two ways: First,

the reality, and next the perception.

The reality is that a four-year college education has become

incredibly expensive to pay for, either outright, or through crushing student loans.

Perception also matters because high school students, and

just as importantly parents, look at the stated price of college and just give

up early because of the money.

My kids’ public school district, one of the target districts of the Alamo Colleges proposal, scored graduates at 34% “College Ready” according to the in the 2017-2018 school year.

Part of improving these rates is that high school graduates

need to see a viable financial path to enrolling in and graduating from

college.

Ban, Flores, and Nirenberg all describe the Promise program

as a workforce readiness investment. In Dallas, 37% of adults have a

post-secondary credential, while 65% of jobs require one. Among Dallas County

high school graduates, only 28% achieve a post-secondary degree. Clearly,

there’s a need to improve completion rates from an economic development

perspective.

San Antonio’s Nirenberg says, “Whether or not San Antonio

competes in that 21st century landscape depends on ensuring our

workforce is a capable and available workforce, equipped with skills to meet

the demand of the jobs we seek to grow and attract.” Flores points to the

lifetime annual boost of $9,400 per year in income for graduates who achieve a

higher degree.

Clearly, as ambitious as free community college sounds, it is only the beginning. In an ideal world, a two-year Associates degree can be for many the stepping-stone to complete a four-year degree. Many higher-paid jobs require a four-year degree, but that aspiration may become within reach with this free on-ramp to higher education for families that wouldn’t otherwise consider it.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Please see related post

Do you want to see something really scary?

Post read (11) times.

The post Free Community College Movement appeared first on Bankers Anonymous.

October 9, 2019

Pinning President Trump

Like everyone, I honestly don’t know what’s going to happen with Trump. I have a grim theory, which I lay out at the end of this post.

In the spirit of a diary entry, I wanted to record my thoughts in October 2019. Impeachment has begun, but the outcome seems highly uncertain. I did this once before. In the month following the November 2016 elections I speculated on Trump’s future effect on authoritarianism, security crises, the economy, constitutional and democratic norms, and his fellow Republicans. On balance, versus those speculations, my worst fears about his authoritarian instincts have come to pass, and principled Republican opposition has been weaker than I even expected.1 We have not had a security crisis,2 nor a true economic crisis, thank goodness. In October 2019 we are, however, in the midst of the constitutional crisis I feared.

McConnell and the Senate “Red Wall” keep Trump in office, despite his obvious destructiveness to the Republic

McConnell and the Senate “Red Wall” keep Trump in office, despite his obvious destructiveness to the RepublicIf nothing changes from where we are now in mid-October 2019, it seems that the Republican red wall in the Senate will keep Trump in office, even after a Democratic House impeachment vote. I see the effect of that red wall as signalling a reward for Trump’s corruption, flouting of constitutional norms around separate of powers and checks and balances, traitorous foreign policy, feckless and reckless financial and trade policy. Not to mention his general rapey approach to women and disgusting view of people living in or immigrating from Central America or Africa (or any place outside of Northern Europe.) And not just a reward, but a vindication of his style and an open invitation to do more crimes, more corruption, more subverting of our political system. Expect more rapeyness, more white nationalism, more inhumane treatment of immigrants. Why not? His party won’t abandon him.

As he famously said, he could shoot someone on 5th Avenue in broad daylight and get away with it. The puzzling challenge of Trump is that he commits the most brazen crimes in the open – profiting from his office through his hotel business, inviting corrupt authoritarian governments to destroy his domestic enemies, urging violence on the media and political opponents, siding with dictators, undermining our intelligence agents, wrecking global alliances built over generations – and we can’t quite believe our own eyes and ears. Surely he’s joking, right? Does he really mean that? Yes, he really does.

Given what we already know about Donald Trump as President, what would be required to alter Mitch McConnell and other Senate Republican’s views on impeachment? It’s hard to imagine what more in America he could fuck up.

Does the stock market have to go into free fall? Does Russia have to declare it is taking back Alaska and Trump says that’s fine, because Alaska is kind of a frozen shithole place and Fairbanks is no good for building gold-plated hotels anyway? Would that do it?

A few other thoughts.

The Nixon resignation/impeachment experience signals that Republican supporters may stay strong up until the last minute, but that when the flip, they flip quickly and all at once. What causes that – beyond what we’ve already seen from the Trump administration, like Ukraine/China/Russia foreign policy treachery – I can’t really imagine. For them not to flip on Trump already at this point, but to flip at some further traitorous action…well, I guess things have to be even darker than they are today, which isn’t something to exactly look forward to.The Clinton non-resignation/impeachment experience signals that a President who has little personal shame and decides to just “stick it out” against his political adversaries will likely survive an impeachment vote in the Senate. All evidence suggests Trump has even less sense of personal shame than Clinton. So he’ll go the distance as long as he can. He’ll never resign if Republican Senators don’t turn on him.

My prediction: This comes down to what the people in uniform decide to do, when ordered by the courts

My prediction: This comes down to what the people in uniform decide to do, when ordered by the courtsMy own grim feeling about where we are headed at this point, given the lengths Trump and his supporters are willing to go to subvert the rule of law and to obstruct justice:

At some point removing Trump from office will come down to a choice made by the people who literally wear the uniforms and carry the badges indicating they have a monopoly on the legitimate use of force in our society.3 The uniformed folks will receive a set of orders from a court to arrest him, his family, or members of his inner circle, and he will shout to countermand those orders and to instead arrest Pelosi, Schiff, Nadler, AOC, or whomever comes to mind in his addled brain at that time.

Whether or not he is removed from office at that point will come down to whether the people in those uniforms feel they owe loyalty to an abstract set of constitutional ideals, or whether they feel they owe loyalty to the Commander in Chief shouting and bullying them and resisting arrest. I wish I were kidding that that’s where I think this is headed.

I wish I felt more secure that the people in the uniforms will make the right choice.

Post read (62) times.

Paul Ryan caved. Rand Paul flipped. John McCain died. Lindsay Graham did whatever he did, with zero evidence of personal pride or consistency. Mitt Romney furrowed his brow and has expressed “concern.” If we were waiting for unified and principled Republican leadership as a check on the President, as I had hoped for in December 2016, we are officially fucked. ↩ I would say the daily & weekly mass-shootings & gun terrorism is a form of a security crisis, but not one that the Trump administration has exploited for consolidating its power, in the way it might if the daily & weekly gunmen were Islamic terrorists. Which they are not. ↩ I mean the police, the army, the secret service. ↩

The post Pinning President Trump appeared first on Bankers Anonymous.

October 1, 2019

Broken Recycling Markets – Part I

For the past year my kids cluck disapprovingly whenever they see me drinking through a plastic straw and ask, “why do you hate turtles so much?” The connection, for those of you who don’t speak teen girl, is they are signaling to me their concern for unnecessary plastic waste, especially as it shows up dumped in our waterways and oceans, presumably hurting Tommy the Turtle (a fictional character I made up just now.)

Since plastic straws represent just 0.03% of American plastic waste that ends up in the ocean, according to a brief by Rachel Meidl of Rice University’s Baker institute for Public Policy, my kids’ concern is focused on the wrong thing. Because, you know, kids.

On the other hand, there is a global financial and environment crisis going on in recyclables. In this column and a few to follow, I will describe what – beyond the plastic straw and Tommy the Turtle – we should know about that global crisis and its linkages to the complex financial markets of recycling.

We tend to think of recycling as interesting to households who want to reduce carbon emissions and protest over-logging of the rainforest.

But another important way – maybe the more sophisticated way – of understanding recycling is to see it fundamentally as a commodities market. Professionals in the recycling industry operate their businesses in a sophisticated financial market for generating four physical commodities, which happen to be second-hand paper, metal, plastic and glass.

The old Chicago Mercantile Exchange

The old Chicago Mercantile ExchangeTo the extent we think about commodities markets, we might conjure an image of aggressive guys in trading pits in the Chicago Mercantile Exchange shouting and signaling to each other as pork belly futures crash or soybeans soar, or maybe as quantitative traders at their computers bid up the price of West Texas Intermediate Crude following a drone attack on Saudi refineries.

I’m less interested in a cartoon Tommy the Turtle than I am in the financial linkages between sophisticated commodities markets and the big municipal bin I set out on my curb once a week.

The metal straw probably isn’t saving the planet. sksksksksksksksk

The metal straw probably isn’t saving the planet. skskskskskskskskIn speaking with experts in the past few weeks, I wanted to learn about how at the global and national level these commodity markets have evolved in recent years, and also at my household level what I’ve been missing when it comes to my bin. And also about the municipal contracts and programs that link my curbside bin to government revenue and then further link to global markets. In this column and a few to come, I’ll pass on what I’ve learned.

But first, the global market for recyclable commodities got a massive shock at the end of 2017, with the situation still evolving in September 2019.

China announced a new program called “National Sword” in 2017 in which it would not import 24 types of waste, including many mixed paper and plastic products, starting in March 2018. A further list of 16 more items, including many metals, will be banned from import by the end of 2019. This ban meant that a huge proportion of the recyclable commodity producers in the US and Europe suddenly lost their primary buyer.

Mountains of Plastic

Mountains of PlasticThe China bans allow for the importation of “clean” plastics and metals, but ceased the importation of what people in the industry call contaminated commodities, or mixed materials.

Even after the 2017 policy change, China remained open to highly pure or homogenous paper, plastics and metals, but not the mixed, dirty and hard to handle stuff it had previously bought from the United States and Europe.

Underlying this China ban is a first key lesson of the economics of the recycling industry: Demand, and prices, are highly driven by the purity of the commodity.

Purity in this market means the homogenous consistency of one type of resource. If a recycler can cleanly separate any second-hand material – whether it be plastic, metal, paper, or even glass – industrial buyers will pay a premium for that commodity’s purity.

Mixed materials by contrast, whether blended with other materials types or contaminated by non-recyclables or worse, go for the lowest prices, if they will be bought at all. By 2019 the tons of scrap plastic imported to China fell to less than 1% of 2017 levels.

Imports of plastic waste from the US and Europe to Indonesia, Malaysia, Philippines, Thailand, and Vietnam briefly quadrupled in 2018, as plastic exporters scrambled to find alternatives to the China market. But those alternative Southeast Asian markets have proven unable to handle the volumes coming from the US and Europe. Recyclers in the US are now awash in secondary dirty plastic, with no market-based outlet for their commodity. Much of that is headed for landfills.

The price of products like cardboard and what the industry calls “mixed paper” has also plummeted.

Recycling experts draw a straight line between the 2017 China ban and a fundamentally altered US municipal recycling market, compared to just two or three years ago. While not the only cause, the ban provided a major shock to the system.

Some headline effects:

US cities that used to earn a profit on their recycling programs a few years ago now lose money every month. Some cities have either cut back part of their programs already, or are considering cutting back on their programs. All cities will be forced to reckon with a greatly altered financial consequence of having a recycling program, since what used to help the bottom line now loses money.

Far more waste in the US is headed for landfills or the incinerator compared to just two years ago.

In a subsequent column I’ll describe the specific financial effects on Texas cities like Houston and San Antonio and other cities in Texas.

Later, I’ll also describe all the things I’ve been doing wrong with my own recycling bin, and maybe you have been as well.

When we get it wrong, we contaminate or reduce the value of the natural stream of secondary commodities our households produce. Millions are at stake for our city’s budgets, and billions for the country.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts

Recycling Part II – Commodity Market Price Drops (forthcoming)

Recycling Part III – Municipal Contract (forthcoming)

Recycling Part IV – Household Mistakes (forthcoming)

Post read (18) times.

The post Broken Recycling Markets – Part I appeared first on Bankers Anonymous.

September 24, 2019

Running for Benevolent Dictator

Following the Democratic presidential debates, I feel like I could have qualified for a spot among the 20 or even 10-person debate stages, if I’d only rolled out my platform sooner.

I know we can do better on the personal financial policy side. Here are my three big ideas on retirement.

Oh and by the way I’m not running as a Democratic Presidential candidate per se. Rather, I’m declaring my candidacy for National Personal Financial Benevolent Dictator – or NPFBD, which just rolls off the tongue nicely – a position that happens to also include extraordinary legislative power needed to pass my most important ideas.

My first three policy ideas deal with the crisis of retirement.

This is the crisis: About half of American households have zero net worth, and 29% of older Americans have virtually no retirement savings. The returns on Social Security savings are low, the enrollment in workplace retirement accounts is weak, and the costs of investing are too high. As NPFBD, I will solve all this.

I’m not a member of a party. Rather, as NPFBD I’m embracing “Paternalistic Capitalism” as my ideological mantle. For you fervent capitalists, very little will change under my dictatorship – you can continue to save and invest as you always have, and the program is revenue neutral. Read my lips: No new taxes. For you budding socialists, I think you will find my benevolent dictatorship addresses the problem of poverty and financial insecurity at retirement through important government interventions.

Policy #1 – Automatic enrollment in workplace retirement accounts.

About once a day I remember that not every single person with a job is enrolled in a their workplace tax-advantaged retirement account – like a 401(k) or 403(b) – and then I get heart palpitations and red in the face. Gah! Why is this still allowed?

As benevolent dictator, my fellow Americans won’t be able to make that mistake. The day you start your job is the day the HR department at work directs a portion of your paycheck to a retirement account. No ifs, ands, or buts. You’re also automatically invested in an age-appropriate investment fund. You can improve upon that fund choice later by taking charge of your investments, but the default fund will be thoughtfully chosen (by me, your NPFBD, according to your age, and adjusted annually).

Policy #2 – Private market investing of federal payroll deductions

In addition to automatic enrollment in a workplace tax-advantaged defined contribution plan, I’m going to reform the nation’s primary defined-benefit plan for retirees.

So part of every paycheck you receive will be withheld by the federal government, and you get the money back at retirement, but more. Through the decades of your working life this money will be invested by the federal government in private high-return assets, like diversified stock mutual funds.

Now, you’re probably thinking, “So, let me see here…the feds take part of every paycheck throughout my working life, and then I get my money back in retirement…Well um, that’s…that’s Social Security!…This blogger thinks he’s just invented Social Security.”

And fine, yes, there’s a resemblance. But the improvement I’m highlighting as NPFBD is that the money taken throughout our working life is actually invested, under my plan. Like, invested in stocks and mutual funds and stuff that grows in value over time.

Currently, our Social Security taxes are not invested over decades. Rather, our money is either transferred to retirees or loaned to the federal government and earns a very low rate of return. Actually investing our money over decades would, under many scenarios, grow tremendously over forty years of compounding returns. My own calculation recently was that I would have a monthly income about 2.7 times larger if my specific Social Security taxes in my lifetime had been invested, rather than simply earned a low government loan interest rate.

Ok so yeah, it’s a partial privatization of Social Security. Deal with it. You elected me to be NPFBD for a reason.

Also, In order to make this partial privatization the best deal possible, we have to roll out policy #3 at the same time.

Policy #3 – Universal access to the Thrift Savings Plan (TSP), currently only open to federal employees

Even as you read my third policy, the investment management industry (aka Wall Street) is already typing up its response to me. Something along the lines of “Shhh…Shut Up!”

Now, I sense your instinctual suspicion about expanding government-managed retirement funds like TSP. Something like “Gub’mint git yer gosh-darned hands off my mutual funds,” or whatever.

But firstly, private sector managers actually run most of the money, subcontracted by the TSP. Currently, BlackRock is the manager for the TSP stock funds. The federal government just did the important work of simplifying and driving down costs, a major part of successful investing.

Anyone who is a federal worker with access to TSP retirement accounts already knows that these funds are amazing. Amazing – not because they employ brilliant managers of money, as brilliance in money management is over-rated – but because they offer some of the lowest cost funds in the world. All I can tell you – if you haven’t experienced it – is that the TSP is a delightful program, and we should all be so lucky as to have access to it.

As my campaign for NPFBD continues to gather momentum, I will release further plans in the future. In the meantime you are welcome to send me your own crazy-but-good ideas for me to roll out, as your benevolent dictator.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related posts:

Post read (34) times.

The post Running for Benevolent Dictator appeared first on Bankers Anonymous.

August 15, 2019

Improving Retirement, Reducing Aristocracy

I’m a fan of tax-advantaged retirement accounts, like IRAs and 401(k)s. I’m also a fan of reasonable federal legislation to periodically update these accounts to make them attractive, available, and useful as retirement savings tools, while still serving society’s best interests.

SECURE Act passed the house, probably will pass the Senate

SECURE Act passed the house, probably will pass the SenateThe Democratic-controlled House passed The Setting Every Community Up For Retirement Enhancement and Savings (SECURE) Act in May 2019. It’s a bi-partisan bill, with the Republican Senate expected to approve it sometime this year, possibly with minor modifications. The Republican President is expected to sign it into law. It’s almost as if we have a real functioning government and cooperation on an important issue, people! This is exciting!

The SECURE Act provides a bunch of incremental improvements to retirement fund rules and most of the changes are investor-friendly – in the sense that they make IRA rules more generous and more advantageous for investing in one’s retirement.

I’ll list below some of the small, but good, improvements for investors below, but after that I want to highlight the only part of the proposed bill that is actually less generous to investors. The fact that it is less generous is good, in my opinion, although many of you savers and investors might disagree with me.

Incremental Improvements

But first, I’ll highlight the goodies for investors, if and when the bill passes.

You can make contributions up until any age into a Traditional IRA, rather than having to cease contributions at age 70.5.The age for starting Required Minimum Distributions (RMDs) would increase from 70.5 to 72.Small businesses could form multi-company groups to offer 401(k) plans, to share and therefore reduce administrative costs. Part-time workers could participate in 401(k) plans

These are all incremental but each increases incentives to save and invest over the long run in a tax advantaged way.

There are a few other proposed provisions – some regarding 529 accounts and others requiring disclosure on 401(k) plans about how much income could be derived from account balances if annuitized.

One of the proposals in the SECURE Act limits something called the ‘stretch IRA.’ I like the stretch IRA personally, but hate it philosophically – so limiting it strikes me in opposite ways.

On the personal side, if there’s a way to reduce taxes and build wealth, I may want to do it myself and I usually tend to tell other people about it. This is a case of: It shouldn’t exist, but since it does exist you should take advantage of it if you can. I’ve previously written about the joys and opportunities of the stretch IRA in my book on personal finance and on my blog.

On the philosophical side, however, the stretch IRA rubs me the wrong way. I mean that from a “societal good” perspective. The principle of the thing, like much of tax reform around inheritance over the last thirty-five years, tends to aggravate one of our great societal problems already: wealth inequality.

Here are the basics of a stretch IRA, which the SECURE Act, as currently passed by the House, limits.

The image that comes to mind with Trust Fund kids

The image that comes to mind with Trust Fund kidsHeirs who inherit an IRA are required to withdraw a certain amount money every year based on their own expected lifetime. They have to take out an amount calculated as the account value divided by their expected remaining life (as determined by an IRS table.) An 18 year-old, with an expected remaining life of 65 years, for example, who inherits $100,000 from Grandma’s IRA, would be required to withdraw around 1.5% of her account as income this year. Or $1,538 – because that’s $100,000 divided by 65.

Importantly for the ‘stretch’ theory, however, she could leave the remaining amount in the account to grow, tax-advantaged, into the future. Each year, the heiress would only be forced to withdraw a small amount. Based on her long remaining life and small withdrawals, her inherited stretch IRA account, under most scenarios, would grow until approximately her own retirement age. Carefully done, that’s nearly 5 decades of tax-advantaged inheritance, a growing account, and a rising annual income from the account.

I say, old chap, that sound delightfully like the good old days of the English aristocracy.

With careful planning, this could produce millions of tax-advantaged income over the young heiresses lifetime. The larger the original inheritance, obviously, the larger the advantage. The traditional key to a stretch IRA is to leave funds to young heirs, who can take advantage of the rules of required minimum distributions, based on a long ‘expected life.’

The limit proposed by the House version of the SECURE Act is that inherited IRAs would have to be fully withdrawn within 10 years, curtailing the ‘stretch’ previously enjoyed by young heirs.

Fighting the Aristocracy

So what’s my big problem with the “stretch IRA?”

Simply this: Children don’t deserve free money. Intergenerational wealth transfers merit careful limits. My particular American preference for a democratic world makes me think aristocratic societies – in which inherited wealth creates lifetime comfort for a fortunate few – are bad. The stretch IRA was one small piece of a larger intergenerational wealth-transfer industry. So I applaud the SECURE Act’s attack on it, or for limiting it to just 10 years, on these philosophical grounds.

Finally – were I a betting man about this part of the SECURE Act, I’d bet against the right thing happening. I am a complete Washington outsider, but I do have a cynic’s instinct for who funds Congressional campaigns. There’s a particularly high correlation – regardless of party – between people who fund Congressional campaigns and people who understand and can benefit from tax-advantaged intergenerational wealth transfers.

The history of tax and estate legislation regarding wealth transfers for the last 35 years – regardless of the party in Congress – appears to me an unrelenting move toward favoring the establishment of intergenerational wealth. So, I personally wouldn’t bet on this small step against the American aristocracy surviving in the Senate this year.

But, we can hope. So far, it’s still in the bill.

Please see related posts:

So I guess we all like Trust Fund Kids, right?

Post read (78) times.

The post Improving Retirement, Reducing Aristocracy appeared first on Bankers Anonymous.

August 2, 2019

Book Review: Fifty Inventions That Shaped The Modern Economy, by Tim Harford

Barbed wire…so simple, so consequential

Barbed wire…so simple, so consequentialModern Texas owes everything to the innovation and marketing genius of John Warnes Gates. Don’t worry, I hadn’t heard of him either, until this week.

In 1876 he presented a technological marvel that would revolutionize the state, in a promotional display in Military Plaza, in the heart of downtown San Antonio. Exactly where City Hall would later be built, just 15 years later.

Gates described his innovation as “lighter than air, stronger than whiskey, cheaper than dust.” A print advertisement from the year before had dubbed it “The Greatest Discovery of the Age.”

[image error]

Gates’ marketing stunt: He bet all comers that their wildest longhorns, whipped into a frenzy by his sidekick with a burning brand, couldn’t break through a flimsy-looking little wire pen he’d built in Military Plaza.

His innovation: barbed wire. It worked.

The anecdote comes from some enjoyable summer reading, Tim Harford’s 2017 book: Fifty Inventions That Shaped The Modern Economy.

In a series of 50 essays of 3-4 pages each, Harford describes the surprising results of many seemingly humble innovations.

So what revolution did barbed wire launch? Before barbed wire, the vast prairielands of Texas couldn’t be divvied up effectively into private parcels. Before barbed wire, the American prairie was effectively unbounded. Native tribes, as well as cowboy teams heading up cattle drives, thrived in this fence-less free range. Like an untame-able ocean.

Despite President Lincoln’s 1862 promise of 160 acres through the Homestead Act to anyone who could settle it and work it for 5 years – privately-held land in the state just didn’t work economically. In vast swathes of Texas it was nearly impossible to keep free-roaming cattle in – and out – of people’s property. Property lines, without an effective means of enforcement, weren’t respected.

But now with barbed wire, cheap and easy enforcement changed everything. The native tribes were doomed. The traditional cowboy-led cattle drive was doomed. Without unfenced prairie to roam – forever altering the previous regime of “the open range,” their livelihood was gone. “The devil’s rope” tamed wild Texas. Private property owners now had the cheap and effective means to invest in and develop their land.

What gives Harford’s book extra philosophical texture is his eagerness to consider technological innovations for all their consequences – for both better and worse. With new products or methods we enhance our lives in many ways, but we also suffer as well. We expand the scale at which humans can live, but we completely upend traditional ways of life. He explores who lives and who dies, who reaps astonishing benefits and who loses their livelihood.

Harford’s book is mind-expanding, easy to digest, and if you like business stories – fun. Harford raises many issues of our day that underlie conflict in our politics and society. One is the unintended consequence of disruptive technological change. From trade disputes to privacy invasions to relentless market pressure to rising inequality – it seems like every big issue of the day hinges on these unintended effects.

The invention of baby formula maybe saved millions of lives, but led us on a 100+ year detour away from the original best nutrition for babies. Birth control pills launched an education and economic revolution as a result of the first effective contraceptive that women themselves could control. The technology of music recording, and revenues from copyright, created a winner-take-all star system in entertainment, previously unimaginable just two generations ago.

Taming the Texas prairie required one simple, cheap invention

Taming the Texas prairie required one simple, cheap inventionIn essay after essay Harford shows how a smallish change in material conditions alters the entire way our society works.

The barbed wire example highlights our still unsettled attitudes towards private property. The transformation of Texas into an economic powerhouse required enforceable private real estate property rights. But clearly we are not all in agreement that this is a good thing. And depending on who we are or were – the native, the cowboy, the homesteader – a little innovation changed absolutely everything. At the core of some of our biggest political fights today – on taxation, student loan debt, health-care costs, to name a few – is a disagreement over the relative cost and benefit of private property rights enforcement. Should education be free? Should health care be affordable for all? Should we have to pay for music we download from the internet?

Harford explicitly makes the connection between barbed wire and musical copyrights. The technology needed to protect the private copyrights of music recordings is similar to the ‘stronger than whiskey, cheaper than dirt” barbed wire.

In a post-Napster world of illegal downloading and streaming, music copyrights nearly became completely unenforceable. The music industry went into an industry-long slump from about 2005 to 2015. One of the main things Disney and Netflix and YouTube do today is erect and maintain digital barbed wire around their private properties. Their effective digital barbed wire creates massive differences between winners and losers in music royalty payments. Is this a good thing?

By the way, as a recent amateur investor in music royalties myself, I newly applaud strict enforcement of these private property rights. It suddenly seems fair to me.

No doubt, however, effective private property enforcement renders many people worse off.

A few other notes on barbed-wire promoter John Warne Gates. Gates went on to build a fortune in steel production, his company eventually purchased by the early 20thCentury mega-company US Steel. He was also an early major investor and then President of a business born from the original Spindletop gusher, The Texas Company – begun in Beaumont in 1902, moved to Houston in 1903, and later renamed Texaco.

A version of this post ran in the Houston Chronicle and San Antonio Express News.

Post read (32) times.

The post Book Review: Fifty Inventions That Shaped The Modern Economy, by Tim Harford appeared first on Bankers Anonymous.

July 29, 2019

Book Review: Foolproof by Greg Ip

Did you notice the weird stock market that emerged, Gorgon-like, from the Upside Down in December 2018?

We’re living this Stranger Things market because the Federal Reserve holds all the keys. The December 2018 panic – a 15 percent peak-to-trough drop in the S&P500 – scared all the adults so much that between January and July 2019 we’ve been living the chain reaction. When I say adults – in my analogy – I mean the Federal Reserve, which sets short-term interest rate policy.

The July 30-31stmeeting of the Federal Reserve this week may (or may not!) resolve this Upside Down world. By Upside Down I mean all traditional good news for the economy is bad for stocks, because interest rates might stay the same or go up, which could in turn tank the market. Bad news for the economy, on the other hand, is good, because the Fed could cut rates and therefore juice markets further.

[image error]

Got it? It’s the Upside Down. Love is Hate, No is Yes, War is Peace. I’ll come back to that upcoming Federal Reserve meeting, but first…

I have a weakness for counter-intuitive truths, contrarian wisdom, and oxymoronic statements, especially when it comes to money and markets. This week’s summer reading was Wall Street Journal reporter and economist Greg Ip’s 2015 book Foolproof: Why Safety Can Be Dangerous and How Danger Makes Us Safe

Of course I would fall for a book with the subtitle “Why Safety Can Be Dangerous, and How Danger Makes Us Safe.”

Ip’s main point is that when we act to reduce risks in one place today, we may create greater risks for tomorrow. Or we may unknowingly create risks for other people, in unexpected ways or places. When we seek perfect stability or the absence of volatility, we create unstable systems. Ip cites mid-twentieth century economist Hyman Minsky, who summarized this big idea as “stability is destabilizing.”

A few analogies Ip employs:

Suppressing natural forest fires on national park land may, ironically, create the conditions for uncontrollable wildfires in the future. Small controlled burns, by contrast, reduce the chance of big conflagrations.The introduction of padded helmets in professional football may have increased the risk of both brain and bodily injury in players, because bigger and faster players tackle head first. Rugby players, by contrast, don’t suffer the same types of brain and spinal injuries because they don’t play with the same head-first recklessness that helmets encourage.Our reaction to catastrophic-seeming risks like airline crashes and nuclear power plant meltdowns can increase risky behavior – like driving more, or shifting to other, long-term deadlier energy sources.The Federal Reserve historically has attempted to lower the risk of big blowups by inducing smaller economic slowdowns, like setting a controlled burn to reduce the chance of a big out-of-control forest fire.

As an economist, Ip urges us to think about how seemingly risk-reducing behavior can, counter-intuitively, create greater risks in the future. The attempt to smooth over all dangers completely can make an entire whole system riskier, or create unanticipated risks later on.

To prevent this, in macroeconomic terms, the Federal Reserve often attempts to play a key role in setting a controlled fire, in order to prevent an uncontrolled wildfire. William McChesney Martin, former Federal Reserve Chairman (1951-1970) classically described this action as “take away the punch bowl just as the party gets going,” by raising rates when the economy gets too strong. This sounds good in theory, although it’s always controversial and based on guesswork when implemented in real life.

Incidentally – about that July 30-31stFederal Reserve meeting – markets clearly anticipate a rate cut. Which also strikes me as something coming from the Upside Down.

With risky asset prices (real estate, stock market indexes) at an all-time high and unemployment at a 50-year low, the traditional macroeconomic case for a Fed interest rate cut in July 2019 is – in a word – absent.

It’s difficult, but maybe necessary, to set small fires to prevent the big fires

It’s difficult, but maybe necessary, to set small fires to prevent the big firesIn the past, we’d expect a rate hike, not a rate cut, under these booming economic conditions. The Fed would seek to set a controlled burn now, in order to prevent a massive forest fire later. Interest rate cuts, by contrast, were a rarely-used emergency tool for cushioning against recession, boosting confidence in the face of tight lending or adverse shocks to the economy. None of that is apparent now.

Under similar situations of asset price inflation and low unemployment – 1991, 2000, 2006 – the discussion was always about raising interest rates. By classic standards, a rate cut at the end of this month seems insane. But what the heck do I know? It’s just what markets currently expect in our Stranger Things economy.

The Personal Investments Application of This Idea

By the way, moving from macroeconomic theory to personal investments, I think the most important application of Ip’s thesis – although he never spells it out in his book – is in our personal asset allocation choices.

Specifically, should we choose “dangerous” assets like stocks, or “safe” assets like bonds and annuities? Because the perceived riskiness or safety of these assets seems clear in the short term, but counter-intuitively flips in the long term.

The truly dangerous investment– if we’re talking about a long-term project like living comfortably in retirement – comes from “safe” seeming assets like bonds and annuities. For middle-income folks, the true investment danger is that we will outlive our money, a danger that bonds and annuities tend to aggravate rather than alleviate.

Stocks, when given decades to grow, – and diversified, of course – tend to lower our personal risk of outliving our money. In order to be safe in retirement, we need to choose risky in our investments.

Please see related posts

All Bankers Anonymous Book Reviews In One Place

Post read (76) times.

The post Book Review: Foolproof by Greg Ip appeared first on Bankers Anonymous.