Michael C. Taylor's Blog, page 12

March 24, 2020

We Will All Be Received In Mexico

My 9 year-old and I traveled in February to Mexico City for a brief visit. On our first day, during a two-hour walk touring our center-city neighborhood, I was pleased to hear her say “If my school was here, and my friends were here, I’d like to live here.”

My Ranch Water drink in Roma

My Ranch Water drink in RomaHer comment followed directly after her inquiry into the price of things. Our 30-minute Uber ride from the Mexico City airport cost just $7. The plane ticket itself cost just $250 on a Mexican discount airline. She realized the food we were buying – in Mexico’s most expensive city – was about half the price of food in San Antonio – one of the United States’ least expensive cities. I enjoyed watching her wrap her math-brain around exchange rates between the US dollar and the Mexican peso. I’m pretty sure in part she liked Mexico because she likes a bargain. That’s my girl!

Throughout the rest of our brief trip I thought about other financial and economic comparisons with Mexico.

Mexico is the 15th largest economy in the world, and the 11th largest when measured by purchasing power parity. (This second measure takes into account the domestic cost of living, and is considered a better measurement of poverty in a country). Eleventh in purchasing power parity ranking puts Mexico, perhaps surprisingly, ahead of Italy, Spain, and Canada.

My purpose in going to Mexico gave me anecdotal insight into the system of healthcare in Mexico. Like the United States, Mexico has a somewhat chaotic mix of public and private health care. Unlike the United States, Mexico offers some form of basic universal coverage.

I came to Mexico to visit my “host mom” from 27 years ago, in the house where I first lived in Mexico City during college. I visited because her breast cancer – in remission from 7 years ago – returned in December 2019. She had an emergency procedure to drain her lungs in January. I learned from her son that she had the option of electing to pay at a private hospital – with what they perceived as top-notch surgeons – or going to a public hospital to undergo the procedure, for free. Her son had recently received a lump sum severance from Ford Motor company, where he had worked in marketing. He decided to use that money to pay for the lung drainage procedure for his mom at the private hospital.

My traveling companion is 9 Years Old…

My traveling companion is 9 Years Old…She now gets her regular chemotherapy treatments, which would cost them around $1,000 each, for free at the public hospital. This is essential because she has no private insurance. She and her son admittedly don’t love the scene at the public hospital, which they describe as chaotic and an inconvenient hour’s drive away. On the other hand, free chemotherapy treatments.

Ever since I first met her 28 years ago, my host mom has walked on crutches from having survived polio as a child. She can’t work. She’s privately uninsurable due to the polio as well as due to her previous bout with breast cancer. But with free chemotherapy, she’s alive to fight the cancer some more, and her family is not bankrupted.

I know some form of basic universal health care coverage remains an extremely controversial subject in the United States. I did not visit the free public hospital in Mexico. I trust my host family’s report that the scene isn’t great. In the face of death and bankruptcy, however, I am grateful that Mexico offers free cancer care to all of its citizens. My host mom deserves a chance to fight cancer and live longer.

My favorite building in Mexico City

My favorite building in Mexico CityLike much of Latin America throughout history, Mexico’s income is unevenly distributed, with the top 10% of the population earning 33% of the nation’s total income. And yet, in the United States, the top 10% earns 39% of annual income. We’re more unequal in terms of income earned in this country than is Mexico these days.

Looking at wealth inequality puts us in the United States further to shame. The most common simple measurement of wealth inequality, the Gini coefficient, indicates the United States as a more unequal society than Mexico. While Mexico has wealth inequality typical of Latin American countries, the United States by contrast is a complete outlier on inequality measurements, when compared to its common peer group of wealthy countries such as Canada, Australia, and European countries.

While Mexico’s economy has grown at a slightly slower rate than the United States’ economy over the 25 years since I last lived there, the changes in wealth in Mexico are significant. This is probably most obvious in central Mexico City, where my daughter and I visited.

I remember as a college student fantasizing about retiring some day to Mexico and living simply, on a very modest amount of money. The cost of living can be very attractive in Mexico, especially in rural areas. I think my daughter began to appreciate that idea as well, even though we only visited the expensive parts of its biggest city.

I lived in Mexico long enough (back in the 1990s) to not be naive about its struggles. Struggles with poverty, violence, corruption, and the absence of the rule of law in so many areas.

Yes, in the United States we’re richer, outright and on average, than Mexico. But increasingly, we’re a harsher society.

I kept humming to myself during our trip my version of the lyrics from Paul Simon’s Graceland. “My traveling companion is nine years old. She is the child of my first marriage. I have reason to believe, we both will be received, in Me-xi-co.”

See related post:

Entrepreneurship lesson from the Let’s Go Mexico Book series

Post read (5) times.

The post We Will All Be Received In Mexico appeared first on Bankers Anonymous.

March 23, 2020

UBI is Coming This Year – Permanently

As of this week we have the results from the Democratic primaries, and we have a surprise winner. I didn’t expect to say this, but tech entrepreneur Andrew Yang has run away with the 2020 Presidential election.

Mandatory Credit: Photo by John Locher/AP/Shutterstock (10532388f)

Mandatory Credit: Photo by John Locher/AP/Shutterstock (10532388f)Democratic presidential candidate entrepreneur Andrew Yang speaks at the Charles H. MacNider Art Museum during a campaign event, in Mason City, Iowa

Election 2020 Andrew Yang, Mason City, USA – 21 Jan 2020

No, I don’t mean literally Yang becomes President next year, obviously. But his central, formerly kooky-sounding idea of Universal Basic Income (UBI) is about to become reality. With bi-partisan support. And more than that – I think it becomes permanent.

What the Trump administration and key Republicans Senators propose to pass in the next week or so – as a response to the COVID-19 crash – is an unconditional cash transfer to American adults. As of this writing, they are still debating the amounts and timing, but it all seems likely. Maybe $1,000 per adult on April 6 and May 18th, according to a Bloomberg news report.

This cash transfer represents a previously-untried-in-the-US solution to alleviating the effects of a recession. For what it’s worth, it feels to me like exactly the right thing to do right now. The traditional “lower interest rates and let it trickle down” is insufficiently targeted to the people for example who face imminent poverty because their bar, restaurant, retail store, theater, or gymnasium where they work is either forcibly closed, or effectively closed, until the virus stops passing around.

As Americans, we think we’re opposed to transfers like this. We tend to think in shorthand like “bootstraps” and “no work, no pay.” But just as there are no atheists in foxholes, there are fewer libertarians in a pandemic-induced recession. Nobody is to blame when their restaurant-employer shuts indefinitely, by order of the city. People want to work, but they can’t. The only humane response is a bit of cash to cushion the blow until normalcy returns.

So why do I think this one- or two-time cash transfer becomes permanent? For a bunch of virulogic, economic, and political reasons.

I’m not an infectious disease expert (although I am married to one!) but I can imagine scenarios where we do not have the “all clear” signal to return to public places 3 months from now. Which means severe economic pain among households continues 3 months from now.

So, now follow my train of thought. Let’s say the COVID lockdown and recession continues for not just 3 months but 6 months to 12 months. Restaurants, bars, theaters, gymnasiums, stadiums, concert halls, and retail stores have to remain basically empty, either by law or by prudent health practice, to prevent the continued spread of the virus. Every shuttered business represents people who can’t afford to pay rent, pay the mortgage, or buy groceries. The pesky thing about food and shelter is that we all have to pay for it every single month. The federal government is going to have to make another unconditional cash transfer 3 months from now.

And then, if the virus continues to circulate among the population, another month after that. Pretty soon we’re looking at a monthly, universal basic income.

Why will it become permanent? Let’s look at the example of Alaska. And then Social Security.

For Alaska residents, a basic income check known as the Alaska Permanent Fund Dividend – recently around $1,600 per year – sure is popular. Even though oil revenue has plummeted, and the state can’t necessarily afford it, Alaskan politicians would not dare eliminate the dividend. It turns out – and you’re going to have to just trust me on this one – people tend to like free money.

There was a moment in time, in the mid-1930s, when Social Security looked to some people like a radical Socialist idea. Now, only paleo-conservatives find the idea of Social Security to be un-American.

So I bet by month 6 of this recession – just before elections – that a majority of Americans will have swung around to deciding that a universal monthly basic income is a comfortable and necessary thing.

Perhaps the biggest whiplash is happening among political leaders.

How did the Republican Party suddenly become advocates for this unconditional cash transfer?

Trump undoubtedly has an instinct for what his key supporters want and need. A strong case could be made that the Rust-Belt swing state voters of Michigan, Pennsylvania, and Ohio who delivered Trump the electoral college victory in 2016 are eager for this type of economic lifeline. When you live in a manufacturing town, and manufacturing jobs are going overseas, a little monthly help goes a long way.

Trump – nominally a Republican – has an unorthodox approach to economic policy. Certainly he’s proved willing to reject the free-trade, open borders, global market approach of the Bushes and Romneys of his own party.

But then, Utah Senator Mitt Romney himself kicked off the cash transfer idea on the Republican side on March 16th by urging $1,000 be sent to every American adult.

Arkansas Senator Tom Cotton – a Republican with deep conservative bona fides – jumped in to support $1,000 payments for every American, introducing the idea that payments should be made monthly, as needed.

Embedded in Senator Cotton’s proposal, and his critique of existing measures, is the reason why conservatives might – and should – endorse cash transfers and UBI. Cotton said on Fox News that “we worry that the [already passed rescue] bill is setting up a new and complicated system relying on businesses giving paid sick leave and then getting a refundable tax credit that won’t move quickly enough and could give pressure on those businesses to lay workers off.”

The House bill sets up a complicated relief system that relies on paid sick leave & refundable tax credits.

— Tom Cotton (@SenTomCotton) March 16, 2020

That won’t move quickly enough & puts undue pressure on businesses to lay off workers.

We don’t want to see layoffs—we need cash in the hands of affected families. pic.twitter.com/64hNtYhfJO

To Cotton, and possibly other conservatives, unconditional cash transfers and the related idea of UBI have the huge advantage of simplicity. And simple means smaller government.

Charles Murray, a staunchly conservative intellectual, wrote in his book In Our Hands, A Plan To Replace The Welfare State that UBI represents a far preferable system to the patchwork of federal programs currently in place.

It does not take a massive government infrastructure to send money transfers. Traditional welfare programs for households like SNAP and EITC require giant bureaucracies. Small business tax credits are complicated, and slow moving. UBI is easier than housing subsidies or unemployment checks. Faster than rent or mortgage freezes. If you squint your ideas a bit, the idea of trusting people to use money as they personally choose, rather than nanny-stating them around food, housing, and employment status, is a deeply conservative, small-government idea.

I’m just saying, when conservatives like Cotton, moderates like Romney, and unorthodox Republicans like Trump unite around an economic idea that feels pretty lefty, you have the makings of a permanent feature of American life.

I haven’t mentioned the Democrats yet. Senate Minority Leader Chuck Schumer has already argued that the one time cash transfer does not go far enough. “This is not a time for small thinking. A single $1,000 check would help someone pay their landlord in March. But what happens after that?” he said.

New York Congresswoman Alexandra Ocasio-Cortez has weighed in with support, but not if it comes at the expense of existing social welfare programs.

At the end of the day though, if given the chance to implement a permanent UBI, would Democrats support this idea? I don’t know, what do you think? Is the Pope Catholic? They are never going to allow Republicans to get to the left of them on this idea.

The final matchup between Vice President Joe Biden and Vermont Senator Bernie Sanders has left neither candidate with a viable economic plan. Biden, because he never had any forward-looking ideas except to replace Trump. And Sanders, because his forward-looking idea of “Medicare For All” has precisely zero chance of implementation over the next twenty years. So that leaves Yang as the ultimate winner of the Presidential race, even if he’s not the one who will occupy the Oval Office next year.

“Money for Nothing” as Dire Straits used to sing.

I bet nobody is as surprised as Yang that he won the war of ideas, far more quickly than he imagined. And further, I think he won this idea permanently. You read it here first. We’re getting UBI in the United States, starting this year, and we’re never going back.

Please see related posts:

Cash is Better Than Good Intentions

Post read (19) times.

The post UBI is Coming This Year – Permanently appeared first on Bankers Anonymous.

February 17, 2020

Metals – The Short Con And the Long Con

Did you know that “Liberals are seeking to siphon money from successful Americans” and “They want to feed their grandchildren before yours!”

Depending on the strength of your reaction to that statement, I might have something to sell you for your retirement account.

That claim in quotes above is from a Facebook advertisement by precious metals company Metals.com or its affiliates. Metals.com does business under other names Chase Metals LLC, and Chase Metals Inc, Access Unlimited, and is owned by parent company TMTE.

Unfortunately for folks who responded to that pitch, the company has a history of fleecing its customers, according to actions taken by regulators in seven states.

In Texas, the State Securities Board kicked off a torrent of state regulatory action last May, with a Cease and Desist Order.

The State of Texas complaint notes the example of an 80-year old woman convinced to transfer her entire $850 thousand retirement account into another account – affiliated with Metals.com – that could hold precious metals, disregarding its appropriateness for her situation. In addition, in April 2019, the Securities Board complaint continues, the firm’s lawyer sent a threatening “Pre-Lawsuit Notice” to a 75-year old retired schoolteacher who publicly complained about investing nearly $66 thousand with Metals.com.

As part of the sales process, the Securities Board found, salespeople convince elderly prospects that their existing investments in securities are highly risky and imminently in danger. Only precious metals, the pitch went, can provide safety in retirement.

But this company does not target just any elderly prospects. An investigation by Quartz.com described their particular strategy of Facebook targeting.

The Quartz investigation details how Metals.com’s sought to exploit political biases. Specifically, Facebook advertisements targeted a demographic that identified as “very conservative,” over 59, and “interested in” Fox News’s Sean Hannity.

Further, the Facebook ads that led to Metals.com strongly implied linkages – linkages that do not exist – with Fox News. Facebook ads used Fox News logos, and unaffiliated websites like www.foxbusiness.com.co that would appear linked to the media company. Metals.com ran ads that sounded like they originated from political and governmental bodies, although they did not, with sponsors named “Republican House Committee,” “US Retirement Bureau,” and “Conservative Republican Association.”

These online ads encouraged Facebook users to sign up for more information about how silver and gold investment strategies could protect them from the Deep State and from a grasping federal government.

With an ad supposedly sponsored by an account called “Proud To Be A Deplorable,” the message asked “Is your retirement protected from the Deep State? A newly-liberal majority Congress cares more about chaos than your security!”

Commissioned salespeople would contact potential victims, initiating a conversation about politics or religion. A former salesperson for the company, interviewed by Quartz, said his instructions were “if someone says they’re liberal or they don’t like Hannity, you just hang up.”

Another opening sales line to use on prospects was “I don’t know what your religious beliefs are, but I’m Christian. Did you know there are 700 references to gold and silver in the Bible?”

The solution to everything, apparently, was gold and silver investments.

In July 2019, Metals.com agreed to an Order with the Texas State Securities Board to offer refunds, up to $10 million, to 84 customers in Texas of the full amounts they invested in precious metals with the company.

The company’s troubles are not over, however. Following Texas’ lead, at least six other states have initiated enforcement actions against Metals.com and its affiliates. The latest was a complaint in December 2019 from the Securities Division of the Secretary of the Commonwealth in Massachusetts.

That Massachusetts state filing details one couple that transferred $2.3 million from their retirement account from a Fidelity IRA to a precious metals account at the direction of a Metals.com salesperson. Due to the heavy markups employed by the company, the account suffered an immediate $1.5 million drop in value. Transactions by this couple and others described in the Massachusetts enforcement action suffered markups between 53% and 63%.

As further described in the complaint, Metals.com provided statements showing values in the precious metals had increased, despite observable prices that made those claims fraudulent.

One plausible financial lesson we could take from the Metals.com enforcement actions would be to beware pushy salespeople using scare tactics and political biases to push expensive, inappropriate investments on vulnerable people. And that’s fine advice. But that advice seems to limit the story to the unsavory tactics of a rogue boiler-room operation.

A would urge a more general lesson, one that goes far beyond the frightening Metals.com story: Never, ever, buy precious metals as an investment.

Gold, and other precious metals including silver, are always primarily a psychological trick used to prey on the financially naïve. Massive segments of the financial infotainment industrial complex dedicate themselves to selling us on the idea that gold and silver have a legitimate role in an individual investor’s portfolio.

This simply isn’t true.

So yes, beware of boiler-room operations like Metals.com, still apparently in business today, despite multi-state enforcement action against them. But also consider, if you didn’t know this already, that the entire retail-investment arm of the precious metals industry is itself a long con.

Phone calls to Metals.com went unreturned, as did an inquiry through their website.

A version of this post ran in the San Antonio Express News and Houston Chronicle.

Please see related post:

Post read (31) times.

The post Metals – The Short Con And the Long Con appeared first on Bankers Anonymous.

February 14, 2020

Parasite and Class Warfare

After Parasite won Best Picture at the Academy Awards on Sunday, I slipped into a Wednesday matinee. This is the movie we need right now

Lower class Korean family

Lower class Korean family“It’s so metaphorical” marvels the adult child of the lower class Korean family about an important prop, introduced early in the movie. The same could be said about nearly every frame in Parasite.

This is about lower class Korea at war with upper class Korea. I’m not saying we need Parasite because it solves anything. It does not neatly tie up class differences in a bow. I’m saying we have a huge communication block about everything related to class and inequality in America. I welcome art – the language of metaphors – because we can’t seem to talk about this stuff any other way.

Whenever I write about inequality – even hinting at the theme – I receive resentful emails. Some other people, I should understand, are always getting a better deal. They get money for nothing. They cut the line. I’m working so hard, and those other people have it so easy. It’s unfair. Those other people, it seems, are like parasites.

As a guy who writes about money and finance, and receives regular feedback on the subject, I sense the bottled up rage around inequality, class warfare, the haves and have-nots. Inequality is a top three problem of our time. Yet simply writing about inequality – pointing out the vast and growing gulf between upstairs and downstairs dwellers in America – feels like a deeply political act.

Nowhere is the potency of class warfare more apparent than in Presidential politics in February 2020.

President Donald Trump’s successful pitch to the electorate in 2016 was that an elite class of wealthy professionals – and their avatars Hillary Clinton and Barack Obama – snub their noses at real, down-to-earth, Americans. The upper classes laugh at those they see as “deplorables,” said Trump, who intuitively channels the resentment of people who feel looked down upon. In Parasite, the upper class family literally wrinkles its nose at the lower class family.

Meanwhile, the front-runner for the Democratic nomination, Bernie Sanders, has made demonizing the wealthy a central plank of his appeal. He’s going to redistribute what the wealthy have taken.

“We cannot afford a billionaire class whose greed and corruption has been at war with the working families of this country for 45 years,” says Sanders.

Nobody has ever made it this far in a major party nomination in America so clearly channeling class resentment. The lower class family of Parasite has no hesitation to grab what isn’t theirs from the upper class family.

Socialism has never taken root in America, said John Steinbeck, because Americans traditionally conceived of themselves as temporarily embarrassed millionaires. That myth – that achieving a rich life is just around the corner – has seemingly disappeared for lower class Americans. Is it any wonder the appeal today of Donald Trump and Bernie Sanders? The fervency of their political supporters feels stronger than anything I remember in politics in my lifetime. But also, the fear these leaders inspire from opponents feels like something stronger than anything I remember in my lifetime.

I don’t think I’m spoiling much by saying that – whether in the movies or in real life – class warfare does not end happily ever after.

One advantage of a movie like Parasite is that it’s entirely metaphorical. Could that give us some symbolic language to start a dialogue about this taboo in America?

Maybe another advantage is that Parasite feels foreign enough for us to observe Korean scenes and images without settling into our traditional American symbols of inequality. I welcome a movie – something, anything – that can give us language to communicate about this.

We need to talk about this. We need to have a difficult conversation about our debts. We need to have a difficult conversation talk about our inheritances. We need to talk about failing to “make it” in America. We need to talk about our resentments. The ones below, not working as hard as us. The ones above, not working as hard as us.

Please see related post:

Great graphical display of inequality in America

Book Review: The Upside of Inequality by Edward Conard

Kooky and good idea to address inequality

New Estate Tax Changes and Inequality

Post read (13) times.

The post Parasite and Class Warfare appeared first on Bankers Anonymous.

February 10, 2020

Savings on Auto Insurance

I conducted an experiment last week to test a long-held theory. The ubiquitous funny advertisements with the green lizard have led me to believe I could save money by calling up my automobile insurance provider and asking them to reduce my costs. (FWIW I don’t use that company. I have a different one, and I’m loyal to mine.)

Long story short, it worked. At the end of my phone conversation with my provider I’ll pay $20.07 less per month. To state some obvious math, that’s $240.84 per year.

I think my choices are prudent for me, but they are not free-lunch choices. I made a series of calculated gambles based on what I know about insurance in general, my particular car, and my personal financial situation.

This all started from a conversation over coffee with a reader two weeks ago. He mentioned that since the 1980s he’d declined to pay for collision insurance on his car, and that he calculates having saved at least $30,000 since then as a result. That got my attention. I realized I haven’t deeply studied the different components of auto insurance. Maybe you haven’t either. Now’s your chance to get a little nerdy with me.

For starters, auto insurance is required by law in every state. The required part of auto insurance is liability insurance. That’s for when you damage someone else’s body, car, or property. In Texas you’re allowed to buy a minimum of $25,000 in coverage per person or car, and $60,000 per incident. I pay to insure well over the minimum amounts and I didn’t mess with this liability part of my auto insurance policy.

The second part of auto insurance – which turns out to be optional in some cases – is collision insurance. That’s the amount you’ll receive if your car gets damaged.

Here’s where insurance theory and two other personal finance theories came into play. I’ll hit you with all three theories. First, insurance is expensive, so buy the least you can while still avoiding catastrophic financial risk. Second, don’t buy too much car. Third, try to buy so little car that you can avoid having a car loan. This third part is admittedly rarely achieved, but something to strive for. Because if you can eliminate your car loan, you have more options with collision insurance.

(Not meant as an advertisement. Just the pictures was BIG!)

(Not meant as an advertisement. Just the pictures was BIG!)If you have a car loan, your lender makes you buy collision insurance, naturally, because the car acts as collateral for your loan. A smashed up car makes for poor collateral. If you don’t have a car loan, however, you can decline collision insurance.

I don’t have a car loan. I also don’t have a valuable car. In combination, that means I’m not terribly worried about losing many thousands of dollars in value if I wreck it. During this process I looked up trade-in value [LINK to Kelly Blue Book https://www.kbb.com] for my 11 year-old Hyundai Elantra with 95,000 miles and learned it’s worth $1,800 to $2,5000. I don’t expect my insurance company to shower me with much more than that amount, in the event of a total wreck. And I’m not dropping $7,000 in repairs into this automotive beauty in that event either. Both of these factors mean I should keep my collision insurance to a minimum. I declined to pay for any collision insurance this week, because that suits my particular circumstance.

A fourth rule of personal finance came into play on the issue of comprehensive coverage. The rule is that it helps to have money in order to save money.

I saved a small amount when I upped my comprehensive coverage deductible from $500 to $1000. A few definitions might be helpful to explain what this means. Comprehensive coverage protects me if something other than another motorist hits me, such as hail damage, a tree falling, or flooding. The deductible is the amount I’m on the hook for, in the event of needed repairs. My upping the deductible is really a result of being able to handle the financial hit if a bad thing happens. If I didn’t have either savings or decent lines of credit, I wouldn’t be able to responsibly increase my deductible. But I do, so it’s cool. That’s the “it takes money to save money” thing.

A few other fine-print things I considered during my auto insurance conversation.

I continue to pay for vehicle damage if I’m hit by an uninsured motorist, although I lowered my coverage to the Texas state minimum of $25,000. As I mentioned, my car ain’t worth $25,000, so I’m probably over-covered there.

I continue to pay $1.65 per month for towing and labor. Between a history of dead batteries and flat tires, it feels like I need a tow or jump start more than once a year. So I’m getting my full money’s worth there, if history is any guide.

I also learned that our household auto insurance premiums won’t jump in six months when my eldest gets her learner’s permit. But they will jump in 1.5 years – quite a bit – when she gets her full license. I could hear the empathetic pain over the phone in the auto insurer representative’s voice when I told her my daughter’s age.

So that will be a future auto insurance cost increase. In the meantime, I was happy to squeeze out a bit in savings while I could.

Post read (10) times.

The post Savings on Auto Insurance appeared first on Bankers Anonymous.

January 27, 2020

I Hate Tesla

The most important rule for writing a business bog – at least my most inviolate rule – is to never, ever, forecast or make “market calls,” on individual stocks. I have broken this rule only once in my 5.5 years. It’s time to break my rule again. On the same damn stock.

I slather this self-rebellion in thick layers of irony. But irony with a purpose!

Some background. I last tucked my only-ever individual-stock forecast into a post in March 2015.

The point of that 2015 post was to highlight – in my contrarian way – the unpleasant fact that “sin-investing,” especially in a nasty tobacco company like Altria has been extraordinarily profitable over the past 40 years.

But that wasn’t my stock forecast. Instead, I contrasted MO with green-tech market darling Tesla the sexy electric-car company that combines virtue-signalling for reducing your carbon footprint with 0-to-60 acceleration in 1.9 seconds.

I wrote the following about Tesla in March 2015:

“Tesla Motors, to name one public company that I’m reasonably certain will be dead in five years, despite its $25 billion market cap, is an innovative company. But that doesn’t make it a good stock to own.” Then, to further metaphorically point to the bleacher seats while stepping into the batter’s box for my inevitable home run, I wrote “Would a few people mark their calendars for five years on Tesla and let me know how I did with my call? Because I AM SO RIGHT.”

Anyway, time flies. It’s five years later.

I’ll save you the hassle and let you know that Tesla stock is up 182% since then, from $200 per share at the time of my home-run call to $565 per share as I write this. The market cap has expanded from $25 billion to $102 billion. It’s up 35% just this year. Tesla will announce 4th quarter 2109 results on Wednesday January 29th.

screenshot from January 22 2020

screenshot from January 22 2020Having broken my inviolate rule five years ago of never forecasting a stock in a column, it is only right and just that I have both my hypocrisy and terrible market call publicly mocked.

But that’s not the main lesson you should take away from this shameful episode. The main lesson is that you, too, should never forecast individual stocks. You will be emotionally invested in a way that hurts your chances of building wealth. You will buy, or sell, that stock too frequently. You will let fear and then greed cloud your judgment. You will look up that stock price exactly at the moment when you should be admiring your daughter’s ballet recital. (How many times do I have to tell you to put your phone down?) You will read headlines that confirm your preconceived biases and you will discount headlines that contradict them. You can guess how I know all of these accurate things about you.

Beyond the emotional reasons, you should avoid forecasting because you will also be wrong. You will even be wrong for all the right reasons. Like me.

Like, Tesla, by all rational analysis, has always been a stupid stock. It’s been overvalued forever. But as the Wall Street phrase goes, “the market can remain irrational longer than you can remain solvent.”

I was correct about Tesla then, and I’m still even more correct, damnit! I will now double-down on all of my errors.

Unlike, say, software technology companies that enjoy infinite scalability, building an auto-manufacturer is highly expensive to scale. It takes cash. Tesla has burned billions in cash to build manufacturing plants in Nevada and Shanghai. The competition from other auto companies is intense and global. Regulation is massive. Innovation, for which Tesla is known, is expensive to implement. The company has nearly run out of money more than once in the past five years, even by the admission of their CEO/Evangelist Elon Musk.

Am considering taking Tesla private at $420. Funding secured.

— Elon Musk (@elonmusk) August 7, 2018

One of his dumbest, and the one that got him fined by the SEC.

And then there’s Musk himself. Ugh. As clearly brilliant and visionary as he is, he can’t stop himself from tweeting nonsense, earning rebukes and $40 million fines from the SEC, and lawsuits from fights he picks unnecessarily. He also employs his knack for distracting the media to change the subject, whenever they attempt to ask about Tesla’s lack of profit.

Oh yeah, and about that profit. Tesla has never turned an annual profit in nearly ten years as a public company.

A master-distractor from the missing profits

A master-distractor from the missing profitsTesla’s market cap at $102 billion is larger than car companies Ford and General Motors combined. In fact, let’s compare those companies to Tesla. Ford sold 5.9 million vehicles in 2018, for a profit of $3.8 billion. General Motors sold 8.4 million vehicles in 2018, or a profit of $1.9 billion. Tesla, which has never turned an annual profit, sold 367,500 cars in 2019.

Tesla has sold 891 thousand vehicles in its entire history. Total. In other words, Ford and General Motors sell more cars in any given month than Tesla has ever sold. I could go on, but you get the idea. Tesla is a stock that mostly exists in our collective imaginations.

It turns out, Wall Street pros mostly agree with me about Tesla. It is the most “shorted” large stock on the US stock market, meaning sophisticated investors have bet against the share price, finding it as absurd as I do.

One of Musk’s most recent distractions

One of Musk’s most recent distractionsShorting means hedge funds have sold shares at current prices in anticipation of buying back shares when they drop in the future. Shorting Tesla has been, as you can imagine, one of the most spectacularly unprofitable trades of the past few months.

Some people never learn. Like me and like you, the pros also shouldn’t be forecasting individual stocks.

Incidentally, I have no individual positions in any stock so nothing to disclose about conflicts of interest writing about Tesla. Index funds all the way, baby!

Please see related post:

Sin Investing (and a mention of TSLA)

Post read (23) times.

The post I Hate Tesla appeared first on Bankers Anonymous.

January 18, 2020

Maverick Whiskey – Small Business as a Legacy Project

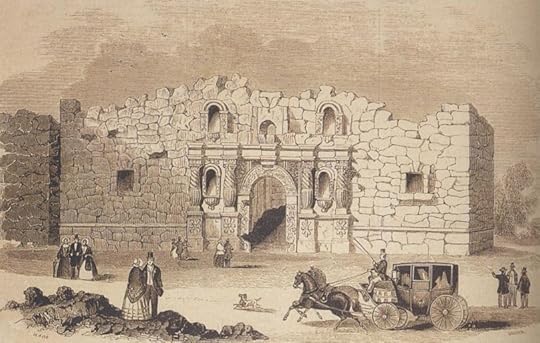

At first glance, sure, Maverick Whiskey – it’s a small startup. Founded by a couple of San Antonio physicians with three children under age 14. In 2017, they bought a building two blocks north of the Alamo, and invested heavily in distilling and brewing and kitchen equipment. They hired food and alcohol experts. They are busy building their business’ brand with the tagline: “Unbranded since 1836.”

Unbranded since 1836

Unbranded since 1836That’s a clever slogan, because we remember 19th Century land baron Sam Maverick famously didn’t brand his cattle, inspiring the word we still use today for a person unbounded by convention.

Doctors Ken and Amy Maverick celebrated their business’ official opening in July 23rd, the 216th birthday of Sam Maverick. Ken is the great great great grandson of Sam.

And so upon closer inspection, no, this is no small startup business. This is a family legacy project.

What is a legacy?

To quote my family’s favorite musical1 a legacy is “planting seeds in a garden you never get to see.”

To receive a legacy from a family member who preceded you is to have your identity shaped in ways you didn’t necessarily choose, at least initially.

Ken received a collection of old diaries and letters from his grandmother and father. Long after becoming an ophthalmologist, he became immersed in the 18th and 19th Century stories contained there.

Says Ken, “I felt compelled to preserve and help tell some of these stories and aim to pass them on to my children. Some are filled with murder, separations, and drama (like all families). Some we will keep private (per my grandmother) and some we will tell.”

Ken and Amy Maverick transformed a largely empty bank building into a distillery, brewery, high-end restaurant, and historic tour-destination, all in the service of the legacy of Sam Maverick. The walls of Maverick Whiskey are covered with the official announcements, historic pictures, documents and maps from Ken’s family legacy, as well as his research.

Texas History

Quick refresher on 19th Century Texas history: Sam Maverick left the siege of the Alamo in March 1836 to join the Texas independence convention, urging the convention to send reinforcements. We all know how that turned out. He later signed the Texas Declaration of Independence, served as mayor of San Antonio twice, then as a Texas legislator, and in the meantime accumulated vast land holdings in Texas. Those holdings were once estimated between 300,000 and a million acres. Ken says that Sam’s stated goal was to be able to ride from San Antonio to El Paso, all without leaving his own private property.

The Maverick family name continued to dominate the San Antonio scene long after Sam. His sons Sam Jr, Albert, William, and George were involved in real estate development, especially downtown on Houston Street. During the 20th Century, Maury Maverick, son of Albert and grandson of Sam Sr., served two terms in Congress and one term as mayor, as a staunch Roosevelt New Deal-supporter of the 1930s.

His son, Maury Maverick Jr. in turn, was a Texas state representative, and then became Sunday newspaper columnist for the San Antonio Express-News. Many people in the best social circles believe the latter to be the most honorable of all professions. (But I digress.)

Ken and Amy built Maverick Whiskey to answer the following question: “For adults interested in 19th Century Texas history, what’s the most fun and historic way to spend a few hours in San Antonio?”

Fun, because whiskey and beer and food. All of them very good.

I purchased and sampled bottles of their Maverick Whiskey, Maverick Light Whiskey, and Maverick Gin. I have further sampled four of their brewed beers. Plus dinner. (All of this strictly for research purposes because, you know, journalism). Rum and Tequila-style spirits are planned at the distillery as well.

Palimpsest Set In Stone

Historic, because like a palimpsest set in stone, 115 Broadway offers layer upon layer of history lessons, starting from the underground up.

The building sits in a corner of the original Sam Maverick homestead, within site of the Alamo ruins. Later 115 Broadway was the location of the Lockwood Bank, formed in 1865, which in the early 20th Century built a massive classical Greek-Revival structure that implied the bank would last forever. It lasted just a few years.

Inside, on the walls, Maverick Whiskey has preserved the optimistic bank announcements of 1929, as well as the more sobering announcements of re-opening during the Great Depression, a few years later.

The Mavericks now store and age their newly distilled whiskey in barrels in the old Lockwood bank vault underground. Underground, below the dirt of Sam Maverick’s homestead – this is where symbolism and word play converge.

Ken and Amy have literally sunk their liquid assets into an old bank vault, in the hopes that it will, over time, compound in value. Ken told me his legacy to his children may someday be that aged whiskey and his great great great grandfather’s recipe. Alcohol is one of the few physical assets – unlike cars or jewelry or even gold – which may increase in quality over time.

For physicians to take on such a huge legacy project raised questions in my mind about expected return on assets. From the seeds they have planted underground in their garden, all in the service of Sam’s legacy, how will the Mavericks realize a return on their investment?

Whiskey takes time, after all, to age.

Some new businesses decide to do one small thing. That is not at all what Ken and Amy Maverick have taken on with Maverick Whiskey. This is a historic building telling the story of a historic family that profoundly shaped early Texas and San Antonio history. It’s also part food and drink place, part event space, part tourist destination. I bought the t-shirt too.

A version of this post ran in the San Antonio Express-News.

Post read (0) times.

Lin-Manuel Miranda’s “Hamilton.” Duh ↩

The post Maverick Whiskey – Small Business as a Legacy Project appeared first on Bankers Anonymous.

January 15, 2020

The Saudi Aramco IPO Headscratcher

The world’s most profitable company listed its first public shares in the first week of December – in the largest IPO of all time – and you didn’t get your chance to buy? Don’t worry, be happy. May I offer you a much better idea?

ARAMCO

ARAMCOThe Saudi Aramco pre-IPO price guidance tells us at least one of three things. Either:

The Saudi Aramco IPO is way overpriced. Or,US energy stocks are way underpriced. Or, Both of these things are true at the same time.

If we check out the S&P 500 Energy Index (ticker symbol SPN) , made up of the 28 largest US-listed companies, they make a nice comparison with the Aramco listing. I’ll start with the math comparison, and later move on to comparing governance.

Aramco sold 1.5% of itself and priced at the IPO in December as initially worth $1.7 trillion.1 The 28 US-based companies in the SPN are currently valued by public markets, if you add them all up, at 1.1 trillion. In other words, they are valued at 35% less than where Aramco launched.

Aramco produced annual profits of just over $111 billion in 2018. Meanwhile, the SPN companies produce annual profits, if you add them all up, of $291 billion. In other words 262% more in annual profit for US energy companies than Aramco. I don’t know. 2.62 times the annual profit at 65% of the price? That’s my dumb, but also pretty good way, to look at it.

I suppose you could get into proven oil and gas reserves and more complicated analysis here on the future profitability of exploration and production companies, but I like simple, so thanks for indulging me on my simple analysis.

What other way can we understand the relative performance and value of US energy stocks? Here’s one. While the US S&P 500 Index representing all 500 of the largest US-based stocks soared 178% between 2009 and 2018, the S&P E&P Index representing the largest oil and gas companies shrunk 2% overall.

Also, the US energy sector market value, as a percentage of the S&P 500, has hit an all-time low in 2019. So investors are merely modestly valuing US-based energy companies, and valuing them relatively less than they ever have. Just interesting to note.

I think markets are rarely wrong in the long run, so what explains this US energy sector versus Aramco anomaly? In the case of Aramco at least, it’s worth remembering the stock market did not actually drived the IPO price here.

ARAMCO History

Let’s briefly recap the history of the Saudi Aramco IPO. This is Saudi Arabia’s state-owned oil company, formed after the Kingdom nationalized holdings from oil giants Exxon, Texaco and Mobile between 1973 and 1976. Aramco has been sovereign-owned since then. The current leadership of the country, Crown Prince Mohammad Bin Salman al Saud (known as ‘MbS’ to the kool kids) believes that:

1. They have the world’s single most profitable company, and

2. MbS has long thought that they could sell some of the world’s most profitable company on the global stock market, they could use the proceeds to diversify into other industries and technologies.

This makes perfect logical economic development sense for the long term prospects of the Saudi Kingdom.

The problem for the past few months, however, is that MbS wanted a $2 trillion valuation for Aramco, while large global investors gave pre-IPO feedback to Aramco’s bankers that they would value the company around $1.2 to 1.5 trillion.

Saudi Aramco’s backup plan, therefore, was to reject the international feedback, and to instead sell shares to mostly Saudi investors on the Saudi stock exchange, at a valuation of $1.7 trillion. Since they planned to sell only 1.5 percent of the company, that would – simple math tells me – raise around $25 billion.

The great thing about selling only to Saudi investors is that MbS as recently as October 2017 locked many of them and their relatives in the Ritz Carlton hotel, Riyadh for up to three months, essentially as hostages, until they coughed up money to the Kingdom, reportedly netting around $106 billion. This was described by MbS’s government as an anti-corruption campaign at the time (and who’s to say, maybe some of them are corrupt?) but there’s only the subtlest distinction between what actually happened and what a mafia shakedown would look like, if conducted entirely at the Ritz Carlton, Riyadh. MbS is also widely believed to have ordered the murder and dismemberment of Washington Post columnist Jamal Khasshogi and other dissidents, a point also surely not lost on local wealthy investors.So we’re not exactly getting, let’s say, efficient market pricing feedback from local Saudi investors here.

This listing on the Saudi exchange highlights Aramco two biggest problems – vulnerability to shocks, and governance.

US-Based Advantages

The US-based market for energy companies has the advantage of being highly competitive and diversified. This makes it flexible to respond if bad things happen.

What do I mean by “flexible,” and “bad things?”

US Oil & Gas Industry

US Oil & Gas IndustryFor example, drone attacks lobbed in by Yemeni (Iranian-backed) forces shut down for some time half of the productive capacity of Saudi Aramco back in September.

It is hard to imagine a few drone attacks stopping or slowing the productive capacity of 28 different companies that make up the entire S&P500 Energy sector.2

Another huge advantage of the US-based energy sector is governance. Not to put too fine a point on it, but the CEOs of Exxon and Chevron don’t typically gather up all the wealthy folks in the world and lock them in a hotel like hostages until they pledge to do the company’s bidding. Say what you will about them, but the US energy sector corporate leadership is considerably less stabby than MbS. For that reason alone, US energy companies should be valued by investors well above Saudi’s Aramco.

To keep local Saudi investors in line and prevent them from doing the rational thing – like selling Aramco shares and buying much more attractive alternatives like US energy companies – the local Saudi investors’ shares will be ‘locked up’ for a year after the IPO, restricted from selling.

MBS

MBSCapitalism is really great, except when it combines with command-economy authoritarian tactics that lock up investor’s money – or investors themselves – for long periods of time.

A version of this post ran in the San Antonio Express News and Houston Chronicle (a bit before the December IPO.)

Post read (6) times.

for a brief minute the company has been worth $2 trillion, but only briefly ↩ But don’t get any big ideas, Greenpeace! ↩

The post The Saudi Aramco IPO Headscratcher appeared first on Bankers Anonymous.

January 7, 2020

Book Review: Permanent Record by Edward Snowden

As the year came to a close last week, I read the most important book of 2019, Permanent Record by Edward Snowden. Although Snowden’s subject is mostly government data collection on civilians, it dovetails with what I think is the major story of 2019, the rise of private-sector data collection about our personal lives.

[image error]

Snowden is perhaps the most polarizing figure of the third millennium in the United States.1

In 2013 Snowden broke the law and his professional oath by exposing to select journalists secret documents of the US Deep State, secrets drawn from the server archives of the NSA and CIA, where he had worked as a systems engineer for seven years. He fled to Hong Kong, and later landed in Russia, where he remains in exile today. His exposure of state secrets about official surveillance methods and programs, Snowden claims, was in the interest of serving something larger than the laws of the state. He claims to serve the interests of people and the ideals of the US Constitution.

Snowden takes pains in the first 100 pages to explain his deep roots in America and his family’s history of government service. Both of his parents had top secret clearances in the course of their careers. In a latter section of the book he describes reading a hard copy – made of physical paper, glue and staples – of the US Constitution in his office cubicle, to the puzzlement of his NSA and CIA colleagues.

The first surprising fact about Permanent Record is what a good a writer Snowden is. He has a knack for anecdote and humor to leaven his clear explanation of the technical issues of surveillance, and the dramatic timeline of his treason-for-a-higher-cause.

Snowden says the failure of government checks to account for the new technology and expanded mandate of the intelligence community (IC) to collect data on citizens meant that something had fundamentally broken. He writes, “The IC had come to understand the rules of our system better than the people who had created it, and they used that knowledge to their advantage. They’d hacked the Constitution.”

Snowden uses the metaphor of Frankenstein – already familiar to IT and intelligence communities – to describe this problem of technology that creates unexpected dangers for its creators and unsuspecting civilians.

Snowden does not reason like a technologist who admires technology for its own sake. He reasons like a humanist, who understand technology enough to be very afraid for us.

A distillation of Snowden’s warning in his book is this: So vast are the powers of the US government’s spy technology that every web search, every location, every digital interaction any individual makes – down to the keystroke – can and will be monitored, recorded, and used against you. This makes a mockery of what we might think our Miranda rights are, or what we suppose our constitutional protections against unlawful search may be.

In the six years since Snowden’s disclosures, we have become increasingly aware not just of government collection of our personal secrets but also the willing donation of our personal secrets to private companies.

Snowden’s biggest warning, at the time of his secrets-exposure in 2013, was about the warrantless surveillance of the US government on private citizens through aggregated phone data collection.

Looking back on the biggest business stories of 2019, however, the issues raised by Snowden in his book clearly leaped from the government to the for-profit corporate sector. In 2019, Facebook CEO Mark Zuckerberg testified to the US Congress about the damage his network can wreak on their 2.5 billion active users. Twitter banned political ads in 2019, although we continue to struggle with the political and social implications of this new broadcast technology. Massive private data breaches, often of credit histories and personal identifying information, have become a monthly occurrence.

As Snowden says, “If government surveillance was having the effect of turning the citizen into a subject, at the mercy of state power, then corporate surveillance was turning the consumer into a product, which corporations sold to other corporations, data brokers, and advertisers.”

We who occupy the moderate Right or Left have a failure of imagination with respect to how our data is being collected, by both our own government and private industry.

Because we don’t understand communications and data technology and its development over the last 25 years, only the fringes of our political spectrum have the proper disaffection and paranoia to imagine the extent to which we are being watched. And being watched leads to being controlled, influenced.

If you can’t currently sense the NSA monitoring all of your communications via your tooth-fillings, you have not properly attached the tinfoil to your cranium. Keep pushing down harder. Yes, I’m joking, but only because it’s easier for me to laugh than cry. In all seriousness, it’s very unsettling to read Snowden’s book.

As citizens of a society, we do not have sufficient privacy protections in place, appropriate for 2020 technology. As individuals, we have not adopted the correct behavior in 2020 to protect our individual privacy from either government or corporate overlords. Frankenstein’s monster is not going back to the laboratory without a terrible fight.

After reading his book, while acknowledging how polarizing his actions have been, I am not on the fence about his role, actions, or motivations. Snowden is utterly credible. Informed. Thoughtful. Patriotic. We need to read his story and try to understand his lessons.

“America was born from an act of treason,” he reminds us.

The historical significance of his book and Snowden’s actions will only be understood in the decades ahead. Meaning, if we head his warning and build protections against surveillance technology from the private sector and government, he’ll be honored as a kind of early martyr to the cause, sacrificing his own liberty so that ours can be preserved.

If we ignore his warning – which at this point in time seems the more likely path – the very meaning of his behavior will be discarded as illegal, unpatriotic, and irrelevant. What was even the point of that guy? Who cares, we’ll say, as we scroll through the timelines on our phone, uploading our current location and faces to permanent data-storage servers, in blissful ignorance.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see all Books Reviewed By Bankers Anonymous

Post read (5) times.

I know a certain someone else just came to mind, but hear me out. ↩

The post Book Review: Permanent Record by Edward Snowden appeared first on Bankers Anonymous.

December 30, 2019

Dissatisfaction with ESG

A top-five question I hear, whenever I help someone get started investing, is “Can I do socially responsible investing with my retirement funds?”

Inevitably, my answer disappoints: “Nope!”

A booming category, but mostly disappointing

A booming category, but mostly disappointing At the beginning of the third decade of the third millennium, we still have no good way of both earning a solid “return on markets” through stocks, while simultaneously feeling good about our social consciences.

I’m not saying that because it’s a bad idea, necessarily, to accept a lower return on our investments in favor of living our values. That’s fine, very cool, it’s something we should aspire to. I have no problem with being willing to accept a lower return in order to sleep well at night, for any number of reasons. Some will even argue that sustainable investing should provide a higher return in the long run, which is a fine thing to believe, if slightly less plausible.

I’m also not saying that Wall Street is unable to provide a set of products to satisfy this wish for socially responsible investing.

On the contrary, starting a decade or two ago, Wall Street seemed to be on a solid path to providing that option for people who want to invest according to their moral values. The mutual fund category known as ESG – for Environmental, Social, and Governance – allows an easy way to identify companies that pledge to do good in the world. That category is in fact booming, following record year to date inflows to the tune of $17.6 billion through November 2019, more than triple previous annual amounts.

What I am saying instead is that it seems to me this type of investing – as currently available through the ESG filter – is extremely dissatisfying, at least for the people typically asking me this question.

Dissatisfaction starts with one important complication: If you put 5 social justice warriors in a room in front of a Bloomberg terminal, they will very likely not agree on what constitutes a socially conscious investment.

Should we eliminate weapons manufacturers, casinos, alcohol brands and tobacco purveyors? Those seem at first relatively easy to agree on. But reasonable people could disagree on whether guns and gambling are good fun, while smoking and drinking are sinful. Or vice versa.

Those are all examples of ‘negative filters,’ in the sense that a mutual fund manager could filter out any company that is involved in a forbidden industry. Eliminate a bunch of industries and there are still many left over for investing.

A separate socially-aware method would be to attempt to invest in ‘positive’ filters, such as a company that tries to promote labor safety, or one that practices corporate board diversity. If those are your priorities, it is somewhat possible to find this through the ESG filter.

Still others would find it nice to be able to select positively for companies earning profits from fair trade, renewable energy, or manufacturing bioplastics, to crowd out industries considered less good for the planet or for people. We want that ‘positive’ filter approach to social investing to exist, although it is harder to find because it tends to be done on a small scale only.

At a future, later, stage of our late-stage capitalist system, these alternate strategies and disagreements in approach will matter more.

But here’s the grim reality of where ESG is now. The billions flowing into ESG funds are going to not-very-inspiring investments. The reality falls far short of where I think social justice folks imagine it should be or that it is.

One investment firm early in the socially responsible investing space, Calvert Research and Management, boasts high rankings for its ESG-influenced approach. The top 10 holdings of their flagship Calvert Equity Fund are lovely companies that I admire and am a customer of. You’ll recognize brands like Visa, Mastercard, Dollar General, Alphabet (aka Google), and Microsoft in their top 10. But it doesn’t feel like I’m exactly saving the planet when I invest in worldwide leaders in credit card, low-end retail, and software companies.

It isn’t easy being green

It isn’t easy being greenOver at Vanguard’s FTSE Social Index Fund – “screened based on social criteria such as workplace issues, environmental issues, product safety, human rights, and corporate responsibility” – here are the top ten holdings, in order of size: Apple, Microsoft, Alphabet, Facebook, JPMorganChase, Johnson & Johnson, Visa, Proctor & Gamble, Bank of America, and Walt Disney. Again – great companies – I’ve been a customer of all of them at some time or another. But my sense is that these are not exactly appealing recipients of the capital of social justice warriors worldwide.

Search for top ESG companies and the lists are always like this: Great, profitable corporations that operate far from the fuzzy feeling I might think I’m getting from “socially responsible” investing.

In my most cynical moments, this feels to me a lot like greenwashing. Imagine you are in charge of a company that would like to attract the investment capital of ESG mutual funds. So you hire a Chief Equity Officer, or Chief Compliance Officer, and now you can be considered good enough to satisfy the ESG screen of many mutual fund companies. For a few hundred thousand dollars in salary you qualify to attract billions in capital. It’s an easy decision.

I am not the only one who finds this situation somewhat unsatisfactory. The Wall Street Journal reports that The US Securities and Exchange Commission recently began in inquiry into ESG funds.

The gist of the SEC’s inquiry is to verify whether fund criteria for investing and voting is consistent with stated ESG principles, while at the same time acknowledging that ESG principles are poorly defined.

The SEC Commissioner Hester Pierce is quoted on record saying that:

“While financial reporting benefits from uniform standards developed over centuries, many ESG factors rely on research that is far from settled.” On another occasion, she has said about ESG: “I think that should be part of the discussion, trying to figure out to what extent ESG might stand for ‘enabling stakeholder graft.’ “

I think socially responsible investing is a worthy goal, but the means as of now are pretty unsatisfactory, at least through public company investing.

Post read (20) times.

The post Dissatisfaction with ESG appeared first on Bankers Anonymous.