Gennaro Cuofano's Blog, page 156

April 30, 2021

Gossip Protocol And Why It Matters To Understand Blockchain Business Models

A gossip protocol describes peer-to-peer (P2P) communication based on how a virus spreads during an epidemic. The Gossip Protocol favors a decentralized approach to maintaining relaxed consistency among many nodes where each node is paired with another node at random and sends data to it. This process is repeated, causing data to propagate through the system like a virus in a timely and efficient manner.

Understanding a gossip protocolSystems built on sometimes uncooperative computers can result in knowledge problems. Indeed, it can be difficult to ascertain if one node is dead or if another is alive.

It can also be difficult to make local decisions. Which node should handle a request and how are nodes assigned to a certain range of users?

Gossip protocols seek to address these issues, favoring a decentralized approach and maintaining relaxed consistency requirements among many nodes. In this approach, each node is paired with another node at random and sends data to it. This process is repeated, causing data to propagate through the system like a virus in a timely and efficient manner.

At some point, data reach every node in the system and a global map is built from less interactions.

Three main types of gossip protocolsThree main variants of gossip protocol can be utilized according to the particular needs of the organization.

1 – Dissemination (rumor-mongering) protocolsThese protocols use gossip to spread information through a network by flooding agents in a manner that produces bounded worst-case loads.

Under this type are two subtypes:

Background data dissemination protocols – where gossip about information is continuous and rapid. Propagation latency is less of a concern because of a lack of severe penalty for acting upon old data. The threat of latency is also reduced by information that tends to change very slowly.Event dissemination protocols – here, gossip is used to send data to multiple nodes simultaneously (multicasting). Events are reported but do not trigger gossip which only occurs periodically. This characteristic has the potential to increase propagation latency.2 – Aggregation protocolsThese protocols calculate a network aggregate by sampling information at the nodes and extrapolating a system-wide value.

Importantly, the aggregate must be based on fixed-size pairwise exchanges of information. Aggregation protocols keep a record of all processed data in a process known as distributed data mining. This process is used in distributed ledger technologies such as Blockchain.

3 – Anti-entropy protocolsIn this type, nodes choose a random partner with which to share data. In systems without strong consistency requirements, anti-entropy protocols “repair” data and reconcile missing records to keep nodes in sync.

Updates spread logarithmically – even in the face of host failures and message loss.

Advantages of gossip protocolsAdvantagesFault tolerance – gossip protocols are resistant to faults because nodes can distribute information with multiple other nodes in the network. Nodes with connectivity issues are compensated by other nodes that have already received the message. Put differently, there are many routes by which information can flow from origin to destination.Scalability – gossip protocols are also highly scalable because information can be efficiently spread across large networks. Individual nodes do not wait for acknowledgments, nor do they act if an acknowledgment does not arrive. This allows systems to be easily scaled to millions of processes.Robustness – no node in a network plays a specific role. As a result, a failed node will not prevent other nodes from continuing to send messages. Each node can join or leave a system without compromising integrity or quality of service.Key takeaways:Gossip protocols describe the movement of information across a peer-to-peer network akin to how a virus spreads through a population.There are three main types of gossip protocol: dissemination (rumor-mongering) protocols, aggregation protocols, and anti-entropy protocols.Gossip protocols have numerous advantages. With multiple avenues for information flow, they are resistant to system faults. They are also highly scalable and robust.Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Gossip Protocol And Why It Matters To Understand Blockchain Business Models appeared first on FourWeekMBA.

April 28, 2021

How Does Upwork Make Money? The Upwork Business Model In A Nutshell

Upwork is an American freelance platform, formerly known as Elance, Odesk, and Elance-Odesk, founded in 1998 in a Jersey City apartment by Srini Anumolu and Beerud Sheth. The company turned into a multi-billion dollar business by 2018, when it listed on the Nasdaq. Upwork makes money through service and transaction fees and clients’ memberships.

Origin StoryUpwork is an American freelance platform, formerly known as Elance, Odesk, and Elance-Odesk.

The platform was founded in 1998 in a Jersey City apartment by Srini Anumolu and Beerud Sheth. The following year, the small company of just 22 employees relocated to Silicon Valley and released the Elance Small Business Marketplace.

Operating as Elance, the company merged with similar platform Odesk late in 2013 and was later rebranded as Upwork. Today, the platform matches freelancers with individuals or businesses who require as-needed and sometimes highly specialized work. Categories include article writing, data science, accounting, and web development.

In 2018 Upwork had an IPO on the Nasdaq stock exchange, raising $187 million to be valued at $1.5 billion.

Upwork revenue generationUpwork drives revenue via two main sources.

Service and transaction feesWhen an Upwork user successfully bills a client, they are charged a service fee.

The exact amount is based on the total amount the freelancer collects per engagement relationship. That is:

A 20% rate for work totaling less than $500.A 10% rate for work totaling between $500.01 and $10,000.A 5% rate for work totaling $10.000.01 and above.It should be noted that the service fee is a sliding fee based on the lifetime earnings a freelancer receives from a specific client. In other words, incorporating all hourly and fixed-rate contracts. An agreement of $4,000 for a new project will see the freelancer billed 20% for the first $500 and 10% for the remaining $3,500.

Job supply on the platform is maintained by allowing businesses to post a job free of charge. There is also no fee to join the platform.

Upwork also charges a transaction fee of 3% for handling and then processing each transaction.

According to earnings reports, these fees account for around 90% of total company revenue. These earnings are comparable to competitors such as Fiverr that charge a flat 20% transaction fee to all freelancers.

Client membershipThis is a subscription plan for businesses looking for freelancers.

The Basic plan is free of charge and enables hiring managers to vet freelancers and use built-in collaboration tools.

For those desiring more flexibility, there is a single paid option:

Upwork Plus ($49.99/month) – for small businesses looking for ongoing work opportunities. Functionality includes access to a free Featured Job each month, more freelancer invitations per post, and partnering with a Talent Specialist. Service and transaction fees are still applicable on Upwork Plus.Key takeaways:Upwork is an American freelance platform, with former incarnations including Odesk and Elance. It was founded in 1998 by Srini Anumolu and Beerud Sheth in a Jersey City apartment.Upwork makes most of its money via service and transaction fees. Services fees are based on the dollar amount of each project while the company charges a flat transaction fee for handling the payment.Upwork Plus is a paid subscription plan for businesses who need ongoing access to talent, though it does not absolve them from paying the aforementioned service and transaction fees.Read Next: How Does Fiverr Work And Make Money, WeWork Business Model In A Nutshell, How Does Shopify Make Money, How Does PayPal Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Upwork Make Money? The Upwork Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Oracle Make Money? The Oracle Business Model In A Nutshell

Oracle is a behemoth software company, founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates. The company primarily followed the on-premise software model, but it mostly successfully transitioned to the cloud model. In fact, by 2020, cloud services represented most of its revenues. Indeed its lineup of software products comprises MySQL, Java, Middleware, Oracle Linux, and many others.

Origin StoryOracle is a multinational computer technology corporation, founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates.

Originally known as Software Development Laboratories (SDL), it was Ellison in particular who became inspired by a 1970 paper written by Edgar F. Codd on database management systems. Thirteen years later, SDL became Oracle Systems Corporation – a name in more alignment with the flagship Oracle Database product.

Oracle had early success in using the C programming language to implement its products. Its products and services were expanded following the successful acquisitions of PeopleSoft, NetSuite, and BEA Systems to name a few.

The company now sells database software and technology as well as cloud-engineered systems and enterprise software products. It currently occupies position 82 on the Fortune 500 list and employs over 136,000 people.

Glance At The Oracle Business ModelAs the company highlights in its financials:

Oracle provides products and services that address enterprise information technology (IT) environments. Our products and services include applications and infrastructure offerings that are delivered worldwide through a variety of flexible and interoperable IT deployment models. These models include on‑premise deployments, cloud‑based deployments, and hybrid deployments (an approach that combines both on-premise and cloud‑based deployment) such as our Oracle Cloud at Customer offering (an instance of Oracle Cloud in a customer’s own data center). Accordingly, we offer choice and flexibility to our customers and facilitate the product, service and deployment combinations that best suit our customers’ needs. Through our worldwide sales force and Oracle Partner Network, we sell to customers all over the world including businesses of many sizes, government agencies, educational institutions and resellers.

Oracle therefore is a behemoth which software business ranges across the old and the new way (from on-premise to cloud and a hybrid between the two).

Oracle three primary lines of business comprise:

Cloud and license: representing 83% of the company’s total revenues for 2020. This operating segment sells and delivers a broad spectrum of applications and infrastructure technologies through our cloud and license offerings.Hardware: it represented 9% of the company’s revenue in 2020 and it provides a broad selection of hardware products including Oracle Engineered System.And services: which represented 8% of the company’s revenue in 2020, primarily focused on helping customers and partners to use at the best the suite of Oracle products. Oracle revenue generation Oracle Revenue Model moves around three primary lines of business. Cloud services are either based on license and support or on-premise model. And the remaining lines of business (Hardware and Services), which represent a smaller part of the company’s revenues.

Oracle Revenue Model moves around three primary lines of business. Cloud services are either based on license and support or on-premise model. And the remaining lines of business (Hardware and Services), which represent a smaller part of the company’s revenues. Oracle makes money by designing, manufacturing, and selling hardware and software products. More specifically, revenue comes from software subscriptions, license fees, hardware fees, and service fees.

Through its numerous acquisitions, it also offers extensive complimentary services in consulting, hosting, financing, and training. Ultimately, Oracle sells enterprise-level technology to large enterprises.

Let’s take a look at some of the major products and services.

Oracle Cloud InfrastructureOracle Cloud Infrastructure (OCI) delivers high-performance, on-premise computing power for cloud-native and enterprise IT workloads. Some of the more notable organizations utilizing OCI are Zoom, 7 Eleven, and FedEx.

Given that this is an enterprise solution, prices are available on request. Alternatively, a business can estimate its potential costs using a simple unit cost model.

SoftwareCentral to the Oracle software offering is their flagship product Oracle Database 19c. This gives organizations cost-efficient access to the most reliable, scalable, and secure database technology in the industry.

Other on-premise products include:

MySQL.Java.Middleware – a cloud platform for digital businesses.Oracle Linux – guiding leveraging Linux OS to deploy enterprise applications more rapidly.Engineered Systems – designed to integrate, test, and optimize software and hardware products.GraalVM – enabling interoperability between programming languages in a shared runtime.Analytics Server – for detailed customer analytics.Oracle Autonomous Database – a product allowing enterprises to reduce operating costs by 90% through an automated, machine learning database for full lifecycle management.Prices are available by contacting an Oracle expert.

HardwareOracle Hardware is a suite of scalable and engineered systems, storage, and servers. This hardware delivers many benefits to enterprises, including lower costs, better cloud integration, optimized performance, and more robust data.

Again, prices are available upon request. Current Oracle Hardware customers include Toyo, Halliburton, and Exelon.

Key takeawaysOracle is a multinational computer technology company for large enterprises. Co-founder Larry Ellison was inspired to create Oracle after reading a paper on database management systems.Oracle makes money by selling an extensive range of products and services to large enterprises. Acquisitions of related organizations also enable it to sell complementary services in hosting, training, and consulting.Oracle is best known for selling its database management system. It also sells cloud infrastructure and scalable systems, storage, and server hardware.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Oracle Make Money? The Oracle Business Model In A Nutshell appeared first on FourWeekMBA.

April 27, 2021

Chaincode And Why It Matters To Understand Blockchain Business Models

Chaincode is essentially the business logic governing how different entities in a blockchain network interact or transact with one another.

Understanding chaincodeFrom the point of view of an app developer, a smart contract and a ledger are central to the Hyperledger Fabric blockchain framework.

Here, the ledger stores facts about the current and historical states of a set of business objects. Smart contracts define the executable logic that generates new facts which are added to the ledger.

Administrators use chaincode to group related smart contracts for deployment. Chaincode can also be used for low-level system programming of Fabric and is typically written in Go, node.js, or Java.

Chaincode terminologyIn the context of Hyperledger Fabric, many use the terms smart contract and chaincode interchangeably.

Generally speaking, however, a smart contract defines the transaction logic that in turn controls the lifecycle of a business object. This contract is then packaged into a chaincode and deployed to a blockchain network.

To make the distinction between the two terms, it is useful to think of smart contracts as governing transactions and chaincode as something which determines how those contracts are packaged for deployment.

Consider the example of a business selling vehicles to another business.

Smart contracts lay out an agreed process to transfer the ownership of each vehicle from one business to the other. A vehicle chaincode may contain smart contracts for cars, trucks, boats, and buses.

There may also be an insurance chaincode, which contains further smart contracts for policy, insurance, and vehicle registration. To reiterate a point made earlier, remember that chaincode is a technical container of a group of related smart contracts. The smart contracts themselves are simply domain-specific programs relating to specific business processes – such as selling a type of vehicle.

System chaincodeChaincode can also define low-level program code corresponding to independent system interactions. This process is unrelated to its ability to define smart contracts.

Here is a look at some common system chaincodes:

Query system chaincode (QSCC) – which runs in all peers to provide ledger APIs such as block query and transaction query.Validation system chaincode (VSCC) – this chaincode validates a transaction by verifying endorsement policy and read-write set versioning.Configuration system chaincode (CSCC) – or code that runs across every peer to handle channel configuration changes such as policy updates. Channels are private communication pathways between two or more members on a Hyperledger Fabric blockchain network. Each channel has its own transaction ledger and each specifies which members can participate in the channel and the peer nodes that can transact.Endorsement system chaincode (ESCC) – this facilitates the endorsing and cryptographic signing of transaction proposals by relevant peers.Key takeaways:Chaincode details the business logic governing the interaction of different entities on a blockchain network.

Chaincode is sometimes called smart contracts on the Hyperledger Fabric network. However, the two terms are more distinct. Chaincode determines how smart contracts are packaged for deployment.

Chaincode can also be used in low-level programming to define system interactions. These interactions include query, validation, configuration, and endorsement system chaincode.

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Chaincode And Why It Matters To Understand Blockchain Business Models appeared first on FourWeekMBA.

How Does Zomato Make Money? The Zomato Business Model In A Nutshell

Zomato is a multinational restaurant aggregator and food delivery company headquartered in Gurugram, India, founded in 2008 by Deepinder Goyal, Gaurav Gupta, and Pankaj Chaddah as Foodiebay. The trio were passionate foodies and had an idea to provide digital access to thousands of restaurant menus across India. Depending on the country where it operates Zomato makes money in various ways: via restaurant listings and advertising, delivery fees, loyalty programs, special event ticket sales, and consulting services.

Origin StoryZomato is a multinational restaurant aggregator and food delivery company headquartered in Gurugram, India.

It was founded in 2008 by Deepinder Goyal, Gaurav Gupta, and Pankaj Chaddah as Foodiebay. The trio were passionate foodies and had an idea to provide digital access to thousands of restaurant menus across India. In the early days of the company, the founders would drive around Delhi to visit each restaurant, scan the menu, and put it online. After a name change in 2010, the service quickly spread to major Indian cities including Chennai, Pune, Kolkata, Mumbai, and Bangalore.

In 2014, international expansion began with a presence established in Qatar, Sri Lanka, South Africa, and the UK to name a few. Five years later, Zomato acquired Seattle-based Urbanspoon – giving it first access to the United States and Australian markets.

The platform now offers restaurant menus and user review information for selected partners in 10,000 cities across 24 countries. Aside from delivery services, Zomato also offers live events, loyalty programs, and restaurant reservations.

Zomato revenue generationZomato has multiple, established revenue channels. The exact revenue is dependent on country-specific fees and its unique arrangements between restaurants and delivery partners.

Let’s take a look at each below.

Restaurant listings and advertisingAdvertising was one of the first sources of revenue for Zomato and remains to be a significant contributor today. The company charges for sponsored listings, allowing restaurants to increase their visibility. Zomato also offers local advertising for restaurants in much the same way as Yelp and Google do.

Restaurants can also pay to have their special events or offers promoted on the platform.

Delivery feesZomato also offers food delivery. It collects a delivery fee from the user and also earns a commission from the restaurant processing the order. This commission is then split between the company and the courier.

Ultimately, delivery commissions vary according to whether Zomato is fulfilling the order itself or using a partner.

Loyalty programsZomato Pro is an all-encompassing membership program for users. The program gives restaurant lovers access to exclusive discounts at a variety of establishments, from fast food to fine dining.

Zomato Pro members also can jump the delivery queue at selected restaurants, reducing delivery wait times by 15-20%.

Access to Zomato Pro is maintained by a monthly subscription fee, again dependent on geographic location. In most cases, users can pay for 6 months or a full year in advance.

Special event ticket salesZomato also sells tickets to festivals and one-off events such as Valentine’s Day and New Year’s Eve.

These tickets are a cleverly disguised commission that Zomato collects from restaurant owners for sending patrons their way.

Each event is promoted on the Zomato platform, earning the company another source of advertising revenue.

Consulting servicesWith access to extensive amounts of restaurant and consumer behavior data, Zomato also offers a consulting service.

This includes advice regarding the demand level for new eateries in a specific area and pre-existing competition levels.

Key takeawaysZomato is a multinational restaurant aggregator and food delivery service headquartered in India. It was created by three founders who had a passionate desire to provide better access to thousands of restaurant menus.Zomato makes the majority of revenue through advertising – one of the original revenue streams on the platform. To some extent, it has been supplemented by a delivery service where Zomato collects a fee and a commission.Zomato also charges for a loyalty program called Zomato Pro. Members can gain access to exclusive discounts and receive their food more quickly from participating restaurants. The company also offers a consultation service, helping new restaurants choose a suitable area to establish themselves.Read Next: Uber Eats Business Model, McDonald’s Business Model, OpenTable Business Model, Amazon Business Model, TripAdvisor Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Zomato Make Money? The Zomato Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Zalando Make Money? The Zalando Business Model In A Nutshell

Zalando is a multi-national eCommerce company founded in 2008 by David Schneider and Robert Gentz, created under the name Ifansho, changed to Zalando as a reference to the Italian word zalare – or “making jokes”. Zalando generates revenues by purchasing stock and then selling it for a profit. Zalando also charges brands it partners with a commission for the privilege of selling on its platform. The commission Zalando collects on each sale is undisclosed. Zalando also collects advertising revenue from ads placed on its website and app.

Origin StoryZalando is a multi-national eCommerce company headquartered in Berlin, Germany.

The company was founded in 2008 by David Schneider and Robert Gentz. Initially created under the name Ifansho, the name was changed to Zalando as a reference to the Italian word zalare – or “making jokes”.

Inspired by US retailer Zappos, Schneider and Gentz began selling footwear. After aggressive expansion across Europe, Zalando began to market itself as a digital shopping mall. Fashion and lifestyle products are now offered by retailers who can sell items using the Zalando Partner Program.

By integrating their stock into the Zalando Fashion Store, retailers get access to 17 European markets encompassing 38 million active consumers. This is underpinned by a suite of propriety technology the company uses to manage logistics, mobile shopping, customer service, and distribution.

Zalando revenue generationLike all retailers, Zalando generates the bulk of its revenue by purchasing stock and then selling it for a profit.

In part, profitability is achieved through economies of scale. With most of the European market cornered, Zalando can purchase goods in bulk and offer competitive prices to its customers.

But money is also made by enhancing the online shopping experience. Zalando seeks to make shopping on its platform inspirational. It incorporates up-to-date and extensive information on its products and also offers fashion advice in the form of a glossary and blog.

Zalando also maximizes profits by offering free delivery and returns, with the latter being particularly important in an industry where return rates can be as high as 50%. To that end, detailed size guides and product presentation reduce the likelihood a consumer will have to return an ill-fitting product.

Partner programZalando also charges brands it partners with a commission for the privilege of selling on its platform. The commission Zalando collects on each sale is undisclosed.

In the partner program, merchants get access to Zalando’s expertise and the vast amount of consumer data is collects on purchases.

The company also offers a brand solution service to merchants, enabling them to sell on the Zalando platform under their own brand name. Merchants can also select between fulfillment by Zalando or fulfillment by their brand. Depending on the level of service provided, the company collects a commission.

Advertising revenueZalando also collects advertising revenue from ads placed on its website and app.

Under the Zalando Media Solutions banner, brands and other advertisers are encouraged to place marketing content on the platform. This content can also be re-used on affiliate websites where Zalando collects a commission from each referred sale.

Zalando is a multi-national eCommerce company founded in Berlin with significant reach in the European market. It was founded in 2008 by David Schneider and Robert Gentz under the name Ifansho. Zalando primarily makes money by enhancing the traditional online retail experience and buying in bulk to increase profit margins. The company offers detailed sizing guides, fashion advice, and free returns for ill-fitting goods.Zalando also takes a commission from each sale through its Partner Program for eligible brands. It also collects advertising revenue and affiliate commissions from advertisers.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Zalando Make Money? The Zalando Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Vimeo Make Money? The Vimeo Business Model In A Nutshell

Vimeo is a video platform established in 2004 by Jack Lodwick and Zach Klein as a side-project to the humor-based website CollegeHumor which helped them create Vimeo. Vimeo is a YouTube competitor, though it runs a different business model, not based on ads but rather on memberships and OTT video services.

Origin StoryVimeo is a North American video platform headquartered in New York City.

The company was established in 2004 by Jack Lodwick and Zach Klein as a side-project to the humor-based website CollegeHumor. Lodwick and Klein received inspiration for Vimeo after noting the popularity of certain types of videos on CollegeHumor.

During the next few years, Vimeo took a back seat as the pair focused most of their efforts elsewhere. However, the Vimeo user base did begin to gradually increase through word-of-mouth advertising.

After media company IAC acquired majority ownership of CollegeHumor parent company Connected Ventures, it discovered Vimeo. Around the same time, Google had famously acquired YouTube. As a result, IAC directed Lodwick and Klein to focus on Vimeo. It became the first video sharing platform to offer high-definition content.

In recent times, Vimeo has focused on providing more support to its content creators. They can now use collaborative tools to privately share videos and receive feedback tied to individual frames in each video. Vimeo also acquired AI-backed video creation service Magisto in 2019 to help its less experienced users produce professional videos.

Vimeo revenue generationUnlike competitors such as YouTube, there is no advertising in Vimeo video content.

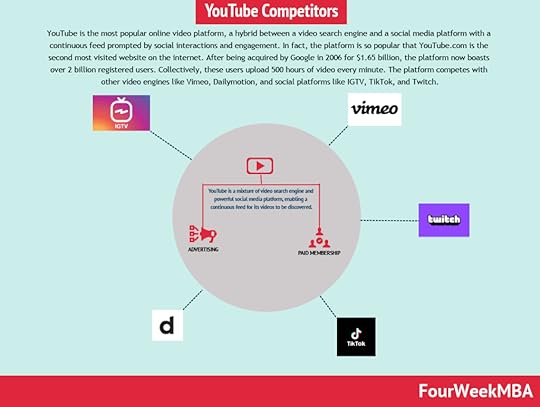

YouTube is the most popular online video platform, a hybrid between a video search engine and a social media platform with a continuous feed prompted by social interactions and engagement. In fact, the platform is so popular that YouTube.com is the second most visited website on the internet. After being acquired by Google in 2006 for $1.65 billion, the platform now boasts over 2 billion registered users. Collectively, these users upload 500 hours of video every minute. The platform competes with other video engines like Vimeo, Dailymotion, and social platforms like IGTV, TikTok, and Twitch.

YouTube is the most popular online video platform, a hybrid between a video search engine and a social media platform with a continuous feed prompted by social interactions and engagement. In fact, the platform is so popular that YouTube.com is the second most visited website on the internet. After being acquired by Google in 2006 for $1.65 billion, the platform now boasts over 2 billion registered users. Collectively, these users upload 500 hours of video every minute. The platform competes with other video engines like Vimeo, Dailymotion, and social platforms like IGTV, TikTok, and Twitch.Instead, the platform makes money in several other ways.

Vimeo creator membershipIn addition to the free plan Vimeo Basic, creators can sign up to four paid plans:

Vimeo Plus ($7/month) – with 5 GB of weekly bandwidth and 250 GB of annual storage for a single user. Features not available in Vimeo Basic include privacy controls, social distribution, and player customization.Vimeo Pro ($20/month) – with 20 GB of weekly bandwidth and 1 TB of annual storage for three users. Vimeo Pro has everything from Vimeo plus in addition to custom video templates, streaming, and the ability to publish unlimited videos. Access is also granted to unlimited use of licensed music and stock photography.Vimeo Business ($50/month) – with no weekly limits on bandwidth and 5 TB of total annual storage for 10 users. Premium comes with SEO, analytics, and lead generation tools. It also enables video creation with custom branding.Vimeo Premium ($75/month) – for unlimited live streaming and users with 7 TB of total storage for a maximum of 10 users. Features are streaming-centric and include unlimited live events, multiple destination live streams, audience chat, and live graphics and polls.OTT video serviceOver the top (OTT) describes film and television content provided via the internet and not delivered by a cable or satellite provider.

Vimeo also provides three paid plans for OTT businesses called Vimeo OTT (formerly Vimeo On Demand):

Starter – charged at $1 per subscriber per month and providing the basics for starting a web-based OTT channel. Processing fees may also apply.Growth – charged at $500/month per app and renewed annually. Bulk discounts may apply. The Growth plan includes everything in Starter plus dedicated account management, free migration, branded apps, and dedicated support.Enterprise – prices available on request. This is ideal for large enterprises who require live streaming, DRM, free-to-view registration and AVOD, and API or SDK support.Key takeaways:Vimeo is a North American video platform created by Jack Lodwick and Zach Klein. The idea for the platform came after Lodwick and Klein noticed that certain humorous videos received more views on CollegeHumor.Vimeo was the first such platform to provide high-definition video content. To differentiate itself in the market, it also offers a range of machine-backed tools to help creators edit and produce professional video content.Vimeo makes money through paid subscriptions. There are four Vimeo creator membership options with various levels of storage, bandwidth, and functionality. Vimeo OTT also allows aspiring businesses to launch their own channels.Read Next: How Does YouTube Make Money, How Does Twitch Make Money, How Does TikTok Make Money, How Does Instacart Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Vimeo Make Money? The Vimeo Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Glovo Make Money? The Glovo Business Model In A Nutshell

Glovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app. Founded in 2015 by Oscar Pierre and Sacha Michaud as a way to “uberize” local services. Glovo makes money via delivery fees, mini-supermarkets (fulfillment centers that Glovo operates in partnership with grocery store chains), and dark kitchens (enabling restaurants to increase their capacity).

Origin StoryGlovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app.

The company was founded in 2015 by Oscar Pierre and Sacha Michaud, primary in response to the uberization of local services. It is perhaps most well-known for its food delivery service, but the company has a mission to develop an urban lifestyle product.

This encompasses the delivery of pharmacy goods, groceries, jewelry, flowers, courier parcels, and desserts among other options. Indeed, Glovo markets itself as able to deliver anything. It will for example buy a customer a size 10 dress from Zara and deliver it to their doorstep.

Such is Glovo’s success that it has expanded globally with operations focused on Europe, Africa, and South America. Securing the funding that enabled the company to attain a significant market share in the very competitive delivery industry.

Glovo revenue generationGlovo drives revenue by charging its partners a fee. This fee is typically 22-30% of the total value of the food or product being delivered. The exact fee is agreed upon between Glovo and each business.

A portion of this fee is given to Glovo couriers based on the distance they cover while delivering.

Delivery feeThe user also pays a delivery fee to ensure their order reaches them. Deliveries fees are dependent on location, distance, and how quickly the customer wants to receive their order.

An average delivery fee in Europe is around 1.90€.

SuperGlovo mini-supermarketsSuperGlovo supermarkets are essentially fulfillment centers that Glovo operates in collaboration with grocery store chains.

These stores are not open to the public. Instead, they are staffed with employees who pick, purchase, and deliver customer grocery orders 24/7. This gives Glovo total control over the goods that are available to its customers.

These stores are still a relatively new concept and as such, are only offered in Madrid and Barcelona. However, the company hopes to expand its rapid delivery service by using the efficiency of a McDonald’s drive-through as inspiration. Pickers are being trained to select an entire customer order before the courier arrives to collect it.

Glovo is also targeting every day, household items to drive revenue in a relatively underserved segment. This includes items such as bread, milk, cereal, and water.

Dark kitchensGlovo also works with local restaurants that have reached peak capacity in their kitchens. These restaurants can rent one of seven dark kitchens scattered across Europe, allowing them to increase productivity and sell more food.

Again, the intent here is for Glovo to control more of the food delivery process and charge accordingly.

Key takeawaysGlovo is a Spanish on-demand courier service. Although most well-known for delivering restaurant food, the company will deliver almost anything including clothes, pharmacy goods, and jewelry.Glovo charges its customers a delivery fee and also takes a 22-30% commission from each participating business. The company gives a portion of this commission to the courier, depending on the distance covered.Glovo is also in the process of creating supermarket fulfillment stores. These stores are attended by pickers who collect orders for common household purchases and deliver them 24/7. The company also makes money by offering kitchen space to restaurants that require extra space.Read Next: Last-Mile Problem, Amazon Business Model, Grubhub Business Model, Uber Business Model, Uber Eats Business Model, How Does Postmates Make Money, How Does OpenTable Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Glovo Make Money? The Glovo Business Model In A Nutshell appeared first on FourWeekMBA.

How Does E-Trade Make Money? The E-Trade Business Model In A Nutshell

E-Trade is a trading platform, allowing investors to trade common and preferred stocks, exchange-traded funds (ETFs), options, bonds, mutual funds, and futures contracts, acquired by Morgan Stanley in 2020 for $13 billion. E-Trade makes money through interest income, order flow, margin interests, options, future and bonds trading, and through other fees and service charges.

Origin StoryE-Trade is a North American trading platform founded in 1991 by William A. Porter and Bernard A. Newcomb.

Before the internet became mainstream, E-Trade offered its trading services via CompuServe and America Online. After global expansion via many mergers and acquisitions, E-Trade expanded its product range to include student loan benefit administration, margin lending, online banking, and cash management services.

The E-Trade trading platform is also multi-faceted, allowing investors to trade common and preferred stocks, exchange-traded funds (ETFs), options, bonds, mutual funds, and futures contracts.

In popular culture, the platform is famous for its promotional campaigns featuring an infant talking about finance during high-profile events such as Super Bowl.

E-Trade was acquired by Morgan Stanley in 2020 for $13 billion.

E-Trade revenue generationIn line with other popular trading platforms, E-Trade no longer charges commissions.

Instead, it has several other ways of driving revenue.

Interest incomeE-Trade makes money on the interest that sits in user accounts, otherwise known as the float. Free trading is offered to retail investors in particular since they are less likely to actively trade.

Here, it’s important to note that interest is defined as money E-Trade generates by investing in money market funds.

Order flowWhen E-Trade receives an order from a user, it sends that order to a market maker (or another interested party) who fills it. This party then compensates the company for the order flow it sends by earning a small amount from the bid-ask spread.

Typically E-Trade makes less than 1 cent per share, which seems an insignificant amount of money. But with hundreds of thousands of trades processed daily, it grows into something substantial.

Margin interestMargin interest is also a significant source of income for E-Trade. This is collected when a customer borrows money to buy or short a stock. Rates start at 8.95% for amounts below $10,000 and decrease to 5.45% if the amount borrowed exceeds $1 million.

Options, futures, and bonds tradingE-Trade also makes money from active traders via several fees:

Options fees – $0.65 per contract, reduced to $0.50 if more than 30 contracts are traded per quarter.Futures trading charges – charged at $1.50 per futures contract.Bonds trading fees – or $1 per bond for a minimum of $10, capped at $250.Fees and service chargesE-Trade also makes money on portfolio and retirement account management.

The E-Trade Personalized Investment service offers four portfolio management options. Each offers a different level of personalized support and investment advice:

Core Portfolios – charged at 0.30% of account market value (minimum $500).Blend Portfolios – charged at 0.90% for the first $100,000 and then on a sliding scale as account value increases. A 0.65% fee is charged for balances over $1 million.Dedicated Portfolios – charged at 1.25% for the first $1 million on a similar sliding scale. Balances of $5 million or more are charged a 0.95% fee.Fixed Income Portfolios – for those interested in bond portfolios, E-Trade charges 0.75% for actively managed portfolios and 0.45% for laddered portfolios. These amounts decrease for every additional $1 million added.Key takeaways:E-Trade is an investment and financial services platform founded in 1991 by William A. Porter and Bernard A. Newcomb.E-Trade offers a free trade platform for retail investors so that it can make money on the funds sitting in their accounts.Like many similar platforms, E-Trade is also compensated for sending order flow to market makers. The company also charges a fee for options, bonds, and futures trading.Read Next: How Does Robinhood Make Money, How Does Lemonade Make Money, How Does Alipay Make Money, How Does Squarespace Make Money, How Does Compass Make Money, How Does PayPal Make Money, How Does Venmo Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does E-Trade Make Money? The E-Trade Business Model In A Nutshell appeared first on FourWeekMBA.

April 26, 2021

How Does Tinder Make Money? The Tinder Business Model In A Nutshell

Tinder is among the most popular dating apps. Initially named MatchBox, it leveraged a “double opt-in” mechanism that helped remove the initial friction of having to meet strangers. Later on, the product was renamed Tinder. The company (now parts of the Match Group) makes money via its main subscription plans and premium features like boosts and super likes.

Origin StoryTinder is a North American online networking and dating application.

The prototype for the app, named MatchBox, was created at start-up incubator Hatch Labs by Sean Rad and Justin Mateen. Rad had identified an absence of platforms allowing users to meet each other and noted that a “double opt-in” system could alleviate the stress of interacting with strangers.

Six months after creation, the prototype was renamed Tinder to match the flame logo designed by eventual CCO Chris Gulczynski. Then began an aggressive marketing campaign, which involved launching the app at multiple college campuses. By 2014, there were over 1 billion swipes per day equating to 12 million matches.

Tinder became a part of Match Group in 2017, a portfolio of popular online dating services including OkCupid, Meetic, Match.com, and PlentyOfFish. As of Q4 2020, Tinder had 6.7 million paid subscribers, with almost 1 in 5 adults in the United States having used the service.

Tinder revenue generationTinder operates on a freemium model of revenue generation.

The app is free to use, but Tinder subscribers can pay for a variety of added features and functionality. Let’s take a look at them below.

Subscription tiersIn addition to the free “plan”, users can upgrade to one of three paid plans:

Tinder Plus – starting at $9.99/month, users get unlimited likes and rewards with 5 super likes per day. Location can also be changed for those using the service while on vacation.Tinder Gold – starting at $29.99/month, users get all Tinder Plus features in addition to top picks and the ability to see who likes them.Tinder Platinum – a relatively new plan starting at around $39.99/month. Platinum users can message others before they match and see prioritized likes.Prices for each plan vary according to geographic location and market, particularly if the company is beta-testing new features. Like many subscription services, a cheaper price can be obtained by paying six-monthly or annually. For example, the cost of the Tinder Plus plan drops from $9.99 to $4.17 per month if paying yearly.

Prices are also dependent on age, which has attracted some controversy. Users over 30 years of age are generally charged much more for equivalent service than those under 30. Anecdotal evidence suggests that price is also dependent on geographic location and sexual orientation.

Tinder argues that its dynamic pricing allows the more budget-conscious younger generation to access paid subscriptions.

Premium featuresFor users who want extra functionality without signing up for a plan, they can pay for premium features on a once-off basis including:

Boosts – which increase visibility.Super Likes – which provide extra social signals of profile popularity.Again, prices are dependent on the abovementioned factors and cheaper prices can be had if purchased in bulk.

Key takeawaysTinder is an American online dating and networking application. It was created by Sean Rad and Justin Mateen at start-up incubator Hatch Labs. Originally called MatchBox, the name was changed in 2012 to reflect a previously designed logo.Tinder operates on the freemium model with three paid plans for extra functionality. Prices are highly variable and are dependent on age, geographic location, and whether plan features are being tested in new markets.Tinder also gives free users a chance to enhance their experience by purchasing Boosts and Super Likes.Read Also: How Does Bumble Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Tinder Make Money? The Tinder Business Model In A Nutshell appeared first on FourWeekMBA.